Current Report Filing (8-k)

June 13 2018 - 4:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 13, 2018

Flotek Industries, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-13270

|

|

90-0023731

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

10603 W. Sam Houston Pkwy N., Suite 300

Houston, Texas

|

|

77064

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (713) 849-9911

Not applicable

(Former

name or former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On June 13, 2018, Flotek Industries,

Inc. (the “Company”) and its affiliates entered into the Eleventh Amendment to Amended and Restated Revolving Credit, Term Loan and Security Agreement, dated as of May 10, 2013, as amended to date (the “Credit Agreement”)

with PNC Bank, National Association as agent for the lenders thereto (the “Agent”), to be effective as of June 13, 2018 (the “Amendment”).

Pursuant to the Amendment, among other things, (i) the maximum revolving advance amount remains at $75 million, but the borrowing base

can be reduced by an amount of up to $10 million (the “Collateral Block”); (ii) the Collateral Block is equal to $10 million less the amount of any collateral value in excess of $75 million and, to the extent not duplicated, the

amount of any inventory collateral value in excess of $52 million; (iii) the Company’s compliance with the fixed charge coverage ratio and the leverage ratio is suspended through December 31, 2018, so long as the undrawn availability

is not less than $15 million on the last day of any month through December 2018. If the undrawn availability is less than $15 million on the last day of any month through December 2018, the Company will be required to comply with the fixed charge

coverage ratio and the leverage ratio at the following quarter end, and for any remaining quarters in 2018; and (iv) compliance with the fixed charge coverage ratio and leverage ratio will be required beginning with the first quarter of 2019

ending on March 31, 2019. The fixed charge coverage ratio and the leverage ratio requirements have not been modified, except that such ratios will be for annualized periods of quarterly results in 2019.

The Company also agreed to pay fees and expenses of the Agent in connection with the Amendment. The description of the Amendment is qualified

in its entirety by reference to the copy thereof filed as Exhibit 10.1 to this Form 8-K, which is incorporated by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

FLOTEK INDUSTRIES, INC.

|

|

|

|

|

|

Date: June 13, 2018

|

|

|

|

/s/ Matthew B. Marietta

|

|

|

|

|

|

Matthew B. Marietta

|

|

|

|

|

|

Executive Vice President of Finance and Corporate Development

|

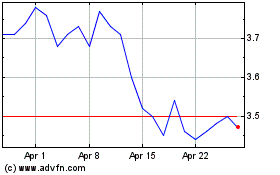

Flotek Industries (NYSE:FTK)

Historical Stock Chart

From Mar 2024 to Apr 2024

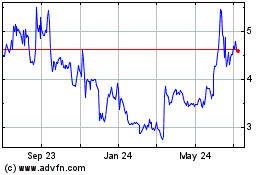

Flotek Industries (NYSE:FTK)

Historical Stock Chart

From Apr 2023 to Apr 2024