| |

| |

|

| |

|

| |

| |

I’m sending you this Special Situations

Buy-Alert on Fireweed Zinc (FWZ)

and the timing could not be any more critical.

The company just released a very impressive resource update on its

Macmillan Pass zinc project in the Yukon to the tune of 6.5

billion pounds of zinc, 3.3 billion pounds of lead, and 55 million

ounces of silver. A strategic buy-window on FWZ has now

opened up ahead of the company’s forthcoming Preliminary Economic

Assessment (PEA)…due out in a matter of days. I urge you to read

this report in full and then conduct your own due diligence —

but you need to act quickly!

Fireweed Zinc is a company with a lot going on and a lot to say…and

I think we all need to be paying attention. |

|

|

| |

|

| |

| |

Here’s how the

incredible FWZ story came together…

As you’ll recall, back in 2015, the resource market was entrenched

in a deep bear cycle many of us metal heads thought would

never end. Fortunately, for each and every one of us—it did!

Yet, in the midst of that dismal multi-year slump, a small,

dedicated group of savvy industry players had their collective eye

on one of the most important base metals in the world:

ZINC!

These players – who would later become Fireweed’s founders

– were honing in on zinc’s emerging supply and demand fundamentals

while others continued to lament a flatlining gold price.

They foresaw a developing supply shortage for the metal that was

both large and unmistakable. And they were

right! Shortly thereafter, the zinc price began

racking up impressive double-digit gains—once again pushing the

metal back into the forefront of investor consciousness.

With zinc on the rise, as predicted, the next step for the Fireweed

team was simply... How Best to Play

It!

| |

| |

They knew exactly what they

wanted...

A large zinc resource, with the

potential to get exponentially bigger, in a politically safe

jurisdiction with a history of approving mining

projects. |

| |

|

|

| |

| |

Let’s break that

down:

| • |

|

A large resource, if purchased at a favorable price, allows

management to price early financings at a non-dilutive level – IF

the resource looks potentially economic. |

| • |

|

The ability to grow the resource is also critical. It means

positive news flow and a reason to rerate the stock (and the

company’s value) upon each successive resource expansion. |

| • |

|

The importance of jurisdiction cannot be overstated. In order

to maximize the potential impact of exploration and development

news, the project MUST lie in a favorable jurisdiction. After all,

prospective shareholders, as well as any potential acquirer of the

company, will have little interest in a project that holds poor

odds of getting permitted. |

|

| |

|

|

|

|

| |

| |

|

DON’T

FORGET… to add your email to our complimentary

HRA Profit

Advisory! |

|

|

|

| |

| |

| |

| Naturally, my HRA Journal

& Alert subscribers always see the best ideas first. After

that, members of my complimentary HRA Profit

Advisory list have priority. Right now, we’re researching

another profit-stock opportunity with similar potential to Fireweed

Zinc. When the timing is right, YOU will receive this advisory

along with a selection of our best trading ideas! |

| |

|

|

|

|

| |

| |

Simply CLICK to add your email…and you’re all set for profits

with HRA!

|

| |

|

|

|

|

| |

|

|

|

| |

Remember, all of this strategizing was happening way back in 2015

BEFORE the zinc price commenced its dramatic upside move. After

reviewing numerous opportunities, the Fireweed group zeroed in on

the Macmillan Pass (“MacPass”) Project in Canada’s

Yukon. At that time, the owner of the project, HudBay, had shifted

focus to large-scale copper projects and was henceforth willing to

listen to offers on MacPass.

A distinct advantage Fireweed held over other potential suitors was

the vast experience and credibility of its management team.

Fireweed’s management group includes a chairman who previously

served as chairman of the most successful resource developer active

in the Yukon in recent memory, Kaminak Gold – and a CEO who was,

literally, born in the closest town to the Macmillan Pass Project.

Fireweed’s management group benefits from credibility, not only in

the capital markets but also with stakeholder groups critical to

MacPass eventually being permitted.

A deal for MacPass was negotiated in late-2015—and a good one at

that. While the official paperwork wasn’t completed until months

later, HudBay displayed a great deal of class in sticking to their

original “handshake deal” made with Fireweed prior to zinc’s price

escalation.

I’ve no doubt that the brass at HudBay are more than comfortable

knowing the project is now in very capable hands…as is their large

shareholding in Fireweed Zinc (FWZ). |

|

|

| |

|

| |

| |

A Major

Score that just keeps getting BIGGER

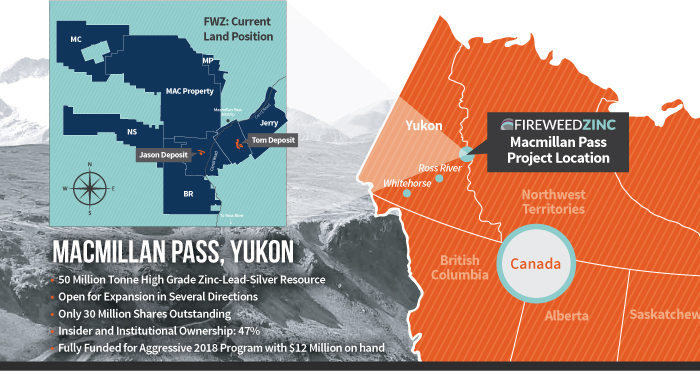

Fireweed’s acquisition of the Macmillan Pass Project is proving to

be a major score indeed. The project covers two separate zinc

discoveries, Tom and Jason, about five kilometers

apart. Both have developed into sizeable high-grade

zinc-lead-silver resources! Having two separate resource areas

is a distinct advantage for reasons I’ll outline below.

MacPass boasted a historic resource (Indicated plus Inferred) of

almost 31 million tonnes at a grade of 10.6% zinc equivalent when

the deal was struck.

|

| In other words, upon closing the deal with

HudBay, Fireweed was starting with one of the largest zinc

resources in the world not controlled by a major mining

company. |

Yet, Fireweed didn’t stop there.

Fireweed’s management, and the brokers who helped finance the deal,

were adamant that the company be set up differently from what most

traders are normally accustomed to. That meant a few key items of

interest:

- Founder’s shares to be locked-up (7.8 million shares subject to

3 year escrow agreement)

- Placement ahead of the IPO only large enough to cover necessary

expenses

- IPO shares going only to committed shareholders

- NO “unit placements” that include warrants

I’ve been well acquainted with Fireweed’s management and most of

its board for years, and all of this was laid out to me before

Fireweed went public. These are serious guys with a serious

set of goals in mind: Rapidly building one of the world’s

largest high-grade zinc resources – systematically proving its

economic viability to the market – then working toward development

of the project or a takeover by a larger company—whichever comes

first.

Let me just say, I was impressed then and I’m even more impressed

now. Fireweed Zinc (FWZ)

is the successful culmination of the right team, the right project,

and a remarkably tight share structure built to maximize

shareholder leverage.

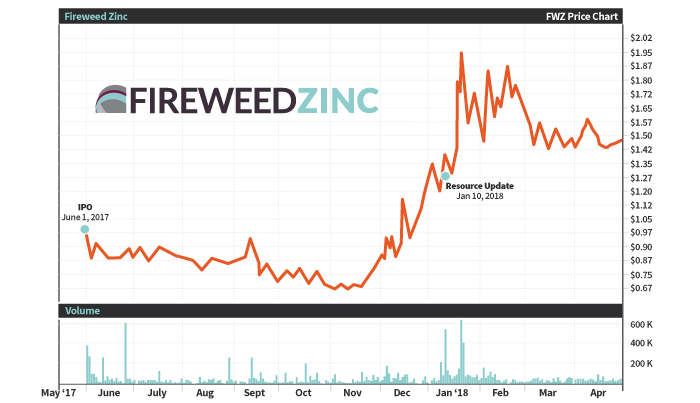

Take a look at the company’s impressive stock chart below…and then

take it directly from me: We’re now being presented with an

advantageous buy-window prior to the release of the company’s PEA

of the Macmillan Pass Project. Do not miss this

window. |

|

|

| |

|

| |

|

| |

To date, Fireweed has completed just three placements open to

outsiders. I’ve personally purchased shares in all of them. And,

I’ve been recommending FWZ to my HRA subscribers from day

one.

FWZ listed just eleven months ago via a massively oversubscribed 50

cent IPO. Confident they’d get results allowing for a higher priced

financing later on, the company raised just enough IPO cash to

carry out its 2017 field program and to complete payments for the

MacPass property.

That confidence quickly proved to be well-founded.

In late-2017, Fireweed reported a number of very good step-out

drill intercepts confirming and expanding upon historic drill

results from the Tom and Jason properties. A number of holes

intersected notably higher grades and wider zones

than projected from historic data. The total area of the project

was also quadrupled to 21,939 Ha with an option for the adjacent

MAC claims.

Fireweed CEO Brandon Macdonald noted in a press release dated

December 27th, 2017, “These are excellent year-end results and

demonstrate how far Fireweed has come since our IPO in May. In

those short seven months we have quickly moved the MacMillan

Project forward with some major achievements including a number of

very wide and high-grade drill holes to verify and step out from

the known deposits, airborne geophysics to define critical geology,

and surface field work toward defining exploration targets and

potential new discoveries.”

The company’s stock – which has never traded less than 40%

above its IPO price – rallied significantly into year-end as

the market began to anticipate a solid resource estimate update.

The market was right!

2018: Major

Resource Expansion ahead of PEA

As mentioned, I’ve been following Fireweed in HRA since

before its IPO. As results of last year’s drill program were

released, I became even more positive about what FWZ’s resource

update would reveal.

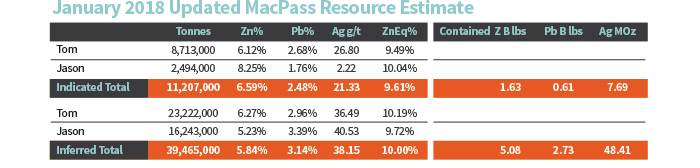

That update is detailed in the table below. Not only is it both

very large and exceptionally high-grade—it by far surpassed my

already lofty expectations.

| |

| |

| This new resource, published in January of

this year, contains over 6.5 billion pounds of zinc, 3.3

billion pounds of lead, and 55 million ounces of silver in

both the Indicated and Inferred categories. |

| |

|

|

Even better, the weighted average zinc equivalent grade of the

resource is 9.9%. That’s $300/tonne rock at

current zinc prices. And yes, we’re talking about 50 million tonnes

of it! |

|

|

| |

|

|

| |

| HRA Journal provides you with in-depth analysis of

the companies on our active coverage list along with insightful

commentary on the metals and equities markets. As a recipient of

this Special Situations report, please click the SUBSCRIBE button

to access your exclusive savings. —Eric |

|

|

| |

| |

Subscribe to

HRA Journal

Now & Save 50%

|

| |

|

|

|

|

| |

|

|

|

| |

|

| |

This

table provides separate totals for higher confidence (based on

closer drill hole spacing) Indicated and lower

confidence Inferred for the Tom and Jason

zinc-lead-silver resources. Tom and Jason are located five

kilometers from each other. The current TOTAL resource for the

MacPass project of 50 million tonnes is calculated by adding

together the Inferred and Indicated tonnage for both the Tom and

Jason resources.

Not surprisingly, the announcement of the updated resource kicked

off the next leg-up in Fireweed’s stock leading to new analyst

coverage and a large, and mostly institutional, financing.

With the enviable resource and cash position Fireweed now has, and

with the first economic study on MacMillan Pass just ahead of us, I

expect the list of analysts covering the company will grow

dramatically this year.

On the back of the new resource, Fireweed announced, then quickly

closed, another massively oversubscribed financing. The financing

was intended to be $10 million but was raised to $12.5 million in a

matter of hours due to heavy demand.

Worth mentioning is that the bulk of the financing came from a

single institutional investor, Resource Capital

Funds—a group well-known for engaging in heavy due

diligence prior to making an investment decision. That should tell

you a lot.

Now cashed up, Fireweed is busy designing an aggressive exploration

program for this year to upgrade and expand the resource yet again

while also looking for new deposits on the greatly enlarged

project.

Even with the large cash injection, FWZ remains an extraordinarily

tight stock. At present, there are only 30 million shares

outstanding with almost half of those held by Resource Capital,

HudBay, and management.

Remember earlier when I told you how the Fireweed team was

purposeful in setting up the company differently from what most

traders are used to seeing? Well, I think you’re beginning to

understand just how special this company is from an investment

standpoint.

So… how

does FWZ

stack up against its

peers?

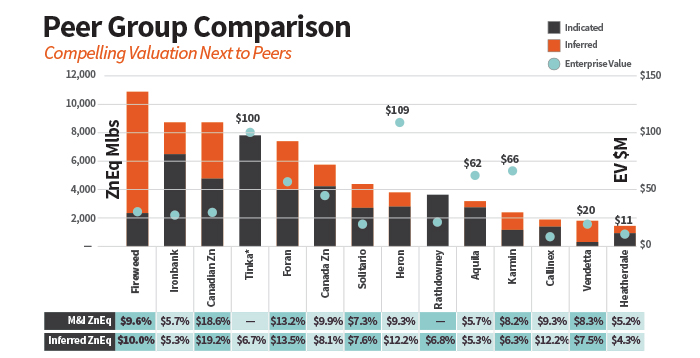

The table below compares Fireweed to several companies in its peer

group utilizing current resources and

enterprise value (market value minus working

capital) as measures. As you can readily see, Fireweed stands out

as having by far the largest combined zinc-lead resource on the

list. |

|

|

| |

|

| |

This

table compares Fireweed to a number of companies in its peer group,

based on reported zinc equivalent resources (zinc equivalent is

calculated by adding the value of zinc, lead, and silver resources

and dividing by the zinc price) and Enterprise Value. The height of

the vertical bar for each company is based on the size of its

Indicated (dark portion) and Inferred (orange portion) resources,

added together, with the scale shown on the left. The light blue

dot indicates Enterprise Value, calculated by taking the market

value and subtracting cash on hand and adding any debt on hand,

with the scale on the right. The lines below the table display the

average Measured & Indicated “M&I” and Inferred zinc

equivalent grade for the company’s resource.

Companies with smaller and/or lower grade resources are carrying

far larger market values than Fireweed. If you ask me, the main

reason for this discount (and it’s also the primary reason

you’re receiving this time-sensitive report) is the current

lack of economic studies on the MacPass Project. Think about

it. Companies that have projects with demonstrated positive

economics are carrying market values two to three times higher

than Fireweed despite the fact that MacPass holds resources that

are far larger and, in many cases, higher grade.

I believe that’s about to change. The first 43-101 compliant

economic study EVER to be produced on Macmillan Pass, a maiden PEA

(Preliminary Economic Assessment), is just around the corner. In

fact, I expect it to be published as soon as next week.

Once Fireweed publishes economics on MacPass – positive

economics that is – we should see another rerating to the

upside. And that’s just the start of the story…but I’ll save talk

of exploration and expansion

potential for our next report.

|

|

|

| |

|

| |

For now, here are a few key reasons to expect a positive PEA that

will drive Fireweed’s market valuation higher:

| 1) |

|

Size and grade: Obvious advantages that have

already been discussed in detail yet important not to forget! At 50

million tonnes and an overall zinc equivalent grade near 10%,

there’s a lot of room for profit built into the current $300/tonne

value. |

| 2) |

|

Geometry: This one is vital. Tom and Jason,

which are physically separate resources, are close to vertical with

impressive thicknesses starting close to surface near ridge tops.

This should make both Tom and Jason ideal candidates for ramp

access and efficient underground mining methods. With the potential

for both areas to be worked simultaneously, the engineers should be

able to utilize a production rate high enough to generate solid

economies of scale. |

| 3) |

|

Easily Accessible High-Grade to Boost Returns and

Shorten Payback: In addition to being a very large and

very high-grade deposit, MacPass benefits from some particularly

high-grade areas that should be accessible early in the underground

mine-life which could turbocharge returns. |

|

|

|

| |

|

| |

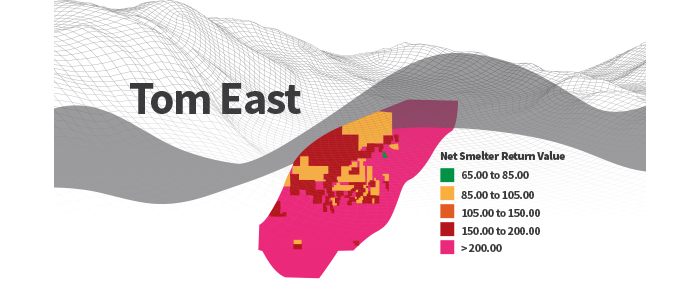

This

diagram shows a 3D version of the “resource blocks” that make up

the Tom East resource. The blocks are colored to correspond to

different NSR (net smelter returns) for each block based on

calculated grades. Net smelter return values were calculated by

taking the gross value per tonne of the zinc, lead, and silver

(adjusted to reflect the metallurgical recoveries for each metal) –

treatment charges levied by a third-party smelter that treats the

zinc and lead concentrates MacPass would produce – and the cost of

shipping the concentrate to the smelter.

| |

|

One particularly attractive area is the Tom East zone. Tom East

contains 800,000 tonnes of Indicated resources grading 20.3%

zinc-equivalent and nearly 1.7 million tonnes of Inferred resources

grading 27.3% zinc equivalent. These near surface resources

should be easily ramp accessible making them an optimum place to

start mining. Using a $1.10/lb zinc price, these zones represent a

gross metal value of over US$1.5 billion. Assuming

a mining rate of, say, 5,000 tonnes per day, this amount of

material could potentially be mined in the first couple years of

production, providing a solid front-end load to revenues that will

speed payback and increase the Net Present Value of MacPass. |

| 4) |

|

Longevity: While we don’t yet know what mining

rate the engineers will use for the MacPass PEA, I expect it to be

in the range of 5,000 tonnes per day. The geometry and thickness of

the Tom and Jason zones should allow for this sort of underground

production. Even before Fireweed works to grow the zones further

with this year’s drill program, there is enough tonnage at MacPass

to sustain a very long mine-life.

This is important. Large mining companies entering a new area to

build a greenfield mining operation want to know they will be there

for a long time. MacPass has the sort of scale that should

attract large miners, and Fireweed has assembled a huge

amount of exploration ground surrounding MacPass. “Sedex”

(sedimentary exhalative) deposits are often found in camps that

contain several separate occurrences. Most of the exploration

ground around MacPass has never received a serious exploration

effort…and that’s about to change as well. |

|

|

| |

| |

|

DON’T

FORGET… to add your email to our complimentary

HRA Profit

Advisory! |

|

|

|

| |

| Naturally, my HRA Journal

& Alert subscribers always see the best ideas first. After

that, members of my complimentary HRA Profit Advisory list have

priority. Right now, we’re researching another profit-stock

opportunity with similar potential to Fireweed Zinc. When the

timing is right, YOU will receive this advisory along with a

selection of our best trading ideas! |

|

|

| |

| |

Simply CLICK to add your email…and you’re all set for profits

with HRA!

|

| |

|

|

|

|

| |

|

|

|

| |

| |

| |

| |

| |

Late Breaking

News

After quadrupling the size of the MacPass project last year,

Fireweed has doubled the size of the project AGAIN with two new

property deals. Fireweed now controls a property exceeding 46,000

hectares or over 180 square miles of premier exploration ground.

Lots of room for new discovery! |

| |

|

|

| 5) |

|

Road Access: While the Canol Road will need to

be upgraded for production, do not underestimate the advantage of

having an existing permitted road all the way into the site.

Fireweed didn’t need to use helicopters at all for its drill

program last year. The road will represent these same advantages

during development and production. |

| 6) |

|

Power Costs: This is an issue everywhere in

the Yukon but recent advances in using LNG (liquified natural gas)

generator sets should lead to substantial power savings compared to

traditional diesel-power. This method of power generation has been

successfully deployed at other recent mine start-ups in the region.

BC and Alberta, to the south of the Yukon, are swimming in natural

gas, and prices are likely to stay cheap for the foreseeable

future. |

A Quiet

Confidence Surrounds Fireweed Zinc

Before Fireweed’s recent resource update, I’m certain anyone who

had the opportunity to talk with management would have been struck

by their quiet confidence. I’m pretty sure these guys KNEW

the resource estimate would blow away market expectations. And

while they certainly couldn’t say that at the time to analysts such

as myself, it was clear they were not even slightly concerned about

the potential for a negative resource estimate outcome.

Why does that matter? It matters because

management’s confident tone did not change as they shifted their

focus from resource estimate to the upcoming PEA.

Those who missed the clues before FWZ’s most recent resource update

missed out on some big gains. While base metals have been on a bit

of a mediocre ride of late, some of them, particularly zinc, are

catching a bid again. This hasn’t translated to Fireweed’s share

price as of yet—but it will. The current dip in price provides an

excellent entry point ahead of the MacPass PEA which I expect will

be released very soon.

But be cautioned—this is a window I believe is set to close fast.

I’m anticipating a big rerating to the upside upon the PEA’s

release. And, I am expecting this to be followed by continued

strength as Fireweed lays out plans for an aggressive, already

funded, summer resource expansion and upgrading campaign in and

around the main resource area.

From my experienced vantage point, you don’t have much time

to take advantage of this profit opportunity. Act quickly.

I will produce an update on FWZ once the PEA is released. Adding

yourself to the HRA Profit Advisory list, if you’re not

already on it, will ensure your timely receipt of that

update!

Sincerely,

Eric Coffin, editor

Hard Rock Analyst

|

|

|

| |

|

|

| |

| |

| |

| HRA Journal provides you with in-depth analysis of

the companies on our active coverage list along with insightful

commentary on the metals and equities markets. As a recipient of

this Special Situations report, please click the SUBSCRIBE button

to access your exclusive savings. —Eric |

| |

|

|

|

|

| |

| |

Subscribe to HRA

Journal

Now & Save 50%

|

| |

|

|

|

|

| |

|

|

|

| |

| |

HRA Special Delivery Alert

and the HRA Journal are independent subscriber-supported

publications produced and distributed by Stockwork Consulting Ltd.,

which is committed to providing timely and factual analysis of

junior mining and resource exploration companies. Companies are

chosen based on speculative potential for significant upside gains

resulting from asset and resource expansion and/or new discoveries.

These are high-risk securities, and opinions contained herein are

time and market sensitive. No statement or expression of opinion,

or any other matter herein, directly or indirectly, is an offer,

solicitation or recommendation to buy or sell any securities

mentioned. While we believe all sources of information to be

factual and reliable we in no way represent or guarantee the

accuracy thereof, nor of the statements made herein. We do not

receive or request compensation in any form whatsoever to feature

companies in HRA publications. The HRA Journal and HRA

Special Delivery Alert services are only distributed to paying

subscribers. On rare occasions, HRA agrees to assist companies by

producing Special Situation reports which it then

distributes to the HRA Free List and other lists that are chosen

and rented by HRA on behalf of the sponsoring company. HRA will

ONLY consider assisting with one of these campaigns for companies

that are already under active coverage in HRA publications.

Stockwork Consulting is compensated for these campaigns to cover

added expenses involved in producing the reports, renting third

party email lists and distributing the reports. HRA maintains

complete editorial control of the contents of Special

Situation reports, just as it does with its other

publications. Management of companies profiled in HRA Special

Situation reports do not have access to or ability to edit the

report prior to its publication. Fireweed and Stockwork have agreed

to a budget of US$75,000. This compensates Stockwork for writing

and producing two reports — one before and one after the release of

the Fireweed PEA — as well as covering outside copywriting,

graphics, html coding and the rental of outside email lists for

reports to be issued before and after the release of a PEA by

Fireweed. No representation or warranty, expressed or implied, is

given by or on behalf of Fireweed, its directors or officers as to

the accuracy or completeness of the information or opinions

contained in the reports; and no liability whatsoever is accepted

by the Company, its directors or officers or any other person for

any loss howsoever arising, directly or indirectly, from any use of

such information or opinions or otherwise arising in connection

therewith. We may, or may not, own securities or warrants to

acquire securities of the company mentioned herein. I do “eat my

own cooking” and tell shareholders if I have taken part in

placements of companies I follow in the newsletter, which I often

do. As noted in the body of this report, in the case of Fireweed

Zinc I have taken part in the last three placements and continue to

be a significant shareholder. This placement participation was NOT

tied to or incumbent on Fireweed undertaking this campaign.

Fireweed and Stockwork had not agreed a campaign would be

undertaken at the time I purchased shares in the placements. I pay

for stocks I buy in company placements out of my own pocket, just

like you. You should never invest in a speculative — or any other —

stock without doing your own rigorous due diligence and consulting

with an independent third-party investment professional. This

document is protected by the copyright laws of Canada and the U.S.

and may not be reproduced in any form for other than personal use

without the prior written consent of the publisher. This document

may be quoted, in context, provided proper credit is given. ©2018

Stockwork Consulting Ltd. All Rights Reserved. Published by

Stockwork Consulting Ltd. Box 85909, Phoenix AZ, 85071 |

|

|

| |

|

| |

|