Microsoft Earnings: What to Watch

April 26 2018 - 5:59AM

Dow Jones News

By Jay Greene

Microsoft Corp. is scheduled to report fiscal third-quarter

earnings after the market closes Thursday. Here's what to

expect.

EARNINGS FORECAST: Analysts surveyed by S&P Global Market

Intelligence expect Microsoft to report earnings of 85 cents a

share. Microsoft no longer reports adjusted figures, reflecting

accounting changes it adopted at the start of the fiscal year.

REVENUE FORECAST: Analysts expect revenue of $25.78 billion, up

from $23.21 billion a year earlier. The year-ago figure reflects

the new accounting standard.

WHAT TO WATCH:

AZURE'S RISE: Microsoft's financial reports the past few years

have had a familiar refrain: the surge of the company's Azure

cloud-infrastructure services and Office 365 online-productivity

service for businesses. Those increasingly important pieces of its

operations have helped the software giant leap the chasm from being

a once-dominant vendor of legacy software to an emerging power in

cloud-computing era. Morgan Stanley analyst Keith Weiss expects

Azure to grow 97% in the quarter, and commercial Office 365 sales

to climb 38% in the period. Microsoft doesn't disclose revenue for

those businesses, but in the fiscal second quarter it said Azure

jumped 98% and commercial Office 365 grew 41%.

HYBRID HYPE: Much of Microsoft's success in cloud computing is

tied to its focus on the so-called hybrid cloud, in which customers

mix cloud services with software running on servers in their own

data centers. While rivals, including cloud-infrastructure market

leader Amazon.com Inc., also offer hybrid services, Microsoft has

capitalized on its legacy as a seller of server software. Last

fall, Microsoft debuted Azure Stack, a technology that allows

developers to write programs that span private data centers and the

cloud. "Early checks cite 'pretty good' demand and pent-up interest

as Microsoft's hybrid-cloud message -- that customers don't need to

re-engineer and move their workloads and can keep running them

on-premise with an Azure-like experience -- is resonating,"

Deutsche Bank analyst Karl Keirstead wrote in a recent report.

MARKET CAP TUSSLE: The rise of Microsoft's cloud-computing

business has fueled its value as a publicly traded company. Its

stock has doubled in the past 2 1/2 years, and now jockeys daily

with Alphabet Inc. and Amazon to be the No. 2 stock globally

measured by market capitalization, behind Apple Inc. In recent

periods, the company's shares have surged on surprisingly strong

quarterly results and upbeat guidance.

SUPPORTING ROLE FOR WINDOWS: A month ago, Microsoft split the

engineering group that develops products under the Windows banner

among two separate divisions. Stifel Nicolaus & Co. analyst

Brad Reback expects Microsoft to address the change on its call

with investors. The move "sends a strong signal of the supporting,

and not leading, role Windows will likely take in coming years and

we like the continued emphasis on hybrid cloud and AI," he wrote in

a research note. In the quarter, Mr. Reback expects the More

Personal Computing unit, which includes the Windows business, grew

5% to $9.2 billion, amid flat personal-computer sales. The unit

likely benefited from corporate customers continuing to upgrade to

Windows 10, which launched in 2015, he said.

Write to Jay Greene at Jay.Greene@wsj.com

(END) Dow Jones Newswires

April 26, 2018 05:44 ET (09:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

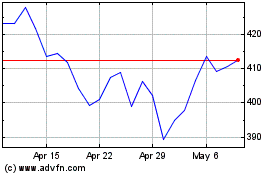

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Microsoft (NASDAQ:MSFT)

Historical Stock Chart

From Apr 2023 to Apr 2024