First Quarter of Fiscal 2018 Net Income up

59% on Operating Income Increase of 23% and Net Sales Increase of

18%

HEICO Corporation (NYSE:HEI.A) (NYSE:HEI) today reported that

net income increased 59% to a record $65.2 million, or

60 cents per diluted share, in the first quarter of fiscal

2018, up from $40.9 million, or 38 cents per diluted share, in

the first quarter of fiscal 2017.

Operating income increased 23% to $79.6 million in the first

quarter of fiscal 2018, up from $64.6 million in the first quarter

of fiscal 2017. The Company's consolidated operating margin

improved to 19.7% in the first quarter of fiscal 2018, up from

18.8% in the first quarter of fiscal 2017.

In the first quarter of fiscal 2018, the United States (U.S.)

government enacted significant changes to existing tax law,

including a reduction in the U.S. corporate tax rate. The Company’s

first quarter of fiscal 2018 effective tax rate was 4.7%, down from

26.6% in the first quarter of fiscal 2017. Net income was favorably

impacted by approximately $16.5 million, or 15 cents per diluted

earnings per share, as a result of the lower federal tax rate and

is inclusive of approximately $11.9 million, or 11 cents per

diluted earnings per share, as a result of one-time tax benefits

principally due to the remeasurement of the Company's net deferred

tax liabilities.

All share and per share information has been adjusted

retrospectively to reflect 5-for-4 stock splits distributed by the

Company in April 2017 and January 2018.

Net sales increased 18% to $404.4 million in the first quarter

of fiscal 2018, up from $343.4 million in the first quarter of

fiscal 2017.

Consolidated Results

Laurans A. Mendelson, HEICO’s Chairman and CEO, commented on the

Company's first quarter results stating, "We are pleased to report

strong first quarter year-over-year increases in net sales and

operating income within both our Electronic Technologies Group and

Flight Support Group. These results principally reflect the

excellent performance of our well-managed and profitable fiscal

2017 and 2018 acquisitions, as well as consolidated organic growth

of 5%.

Our total debt to shareholders' equity ratio decreased to 50.3%

as of January 31, 2018, down from 54.0% as of October 31, 2017. Our

net debt (total debt less cash and cash equivalents) of $603.3

million as of January 31, 2018 to shareholders’ equity ratio

decreased to 45.4% as of January 31, 2018, down from 49.8% as of

October 31, 2017. Our net debt to EBITDA ratio was 1.54x as of

January 31, 2018 compared to 1.67x as of October 31, 2017. During

fiscal 2018, we have successfully completed two acquisitions and we

have completed five acquisitions over the past year. We have no

significant debt maturities until fiscal 2023 and plan to utilize

our financial flexibility to aggressively pursue high quality

acquisitions to accelerate growth and maximize shareholder

returns.

Cash flow provided by operating activities remained strong,

totaling $45.0 million in the first quarter of fiscal 2018. We

continue to forecast record cash flow from operations for fiscal

2018.

As we look ahead to the remainder of fiscal 2018, we anticipate

continued net sales growth within the Flight Support Group's

commercial aviation and defense product lines. We also anticipate

growth within the Electronic Technologies Group, principally driven

by demand for the majority of our products. During the remainder of

fiscal 2018, we will continue our commitments to developing new

products and services, further market penetration, and an

aggressive acquisition strategy, while maintaining our financial

strength and flexibility.

Based on our current economic visibility, we are increasing our

estimated consolidated fiscal 2018 year-over-year growth in net

sales to 12% - 14% and in net income to 30% - 32%, up from prior

growth estimates in net sales and net income of 10% - 12%. The

increased net income guidance reflects the impact of a lower

federal income tax rate and the continued improvements in our

consolidated operating results. Additionally, we now anticipate our

consolidated operating margin to approximate 20% - 21%, up from our

prior estimate of 20%, and cash flow from operations to approximate

$310 million, up from our prior estimate of $290 million. Further,

we continue to anticipate depreciation and amortization expense to

approximate $75 million and capital expenditures to approximate $50

million. These estimates include our recent acquisition of Sensor

Technology Engineering, Inc., but exclude additional acquired

businesses, if any."

Flight Support Group

Eric A. Mendelson, HEICO's Co-President and President of HEICO's

Flight Support Group, commented on the Flight Support Group's first

quarter results stating, "Our year-over-year net sales and

operating income increase in the first quarter of fiscal 2018 was

driven by recent acquisitions and continued organic growth within

our aftermarket replacement parts and repair and overhaul parts and

services product lines.

The Flight Support Group's net sales increased 15% to $254.7

million in the first quarter of fiscal 2018, up from $220.9 million

in the first quarter of fiscal 2017. The increase is attributable

to the impact from our recent profitable acquisitions as well as 4%

organic growth. The organic growth in the Flight Support Group

mainly reflects higher demand and new product offerings within our

aftermarket replacement parts, as well as repair and overhaul parts

and services product lines, partially offset by lower demand for

certain defense components within our specialty products product

line. Excluding the net sales decrease in our specialty products

product line, the Flight Support Group experienced 6% organic

growth in the first quarter of fiscal 2018, principally in our

aftermarket replacement parts product line.

The Flight Support Group's operating income increased 11% to

$45.9 million in the first quarter of fiscal 2018, up from $41.4

million in the first quarter of fiscal 2017. The increase

principally reflects the previously mentioned net sales growth

partially offset by higher performance-based compensation expense

and an increase in intangible asset amortization expense mainly

resulting from the fiscal 2017 acquisitions.

The Flight Support Group's operating margin was 18.0% and 18.7%

in the first quarters of fiscal 2018 and 2017, respectively. The

decrease principally reflects the previously mentioned higher

performance-based compensation expense and increase in intangible

asset amortization expense.

With respect to the remainder of fiscal 2018, we continue to

estimate full year net sales growth of approximately 10% over the

prior year and the full year Flight Support Group operating margin

to approximate 18.0% - 18.5%. Further, we continue to estimate that

approximately half our fiscal 2018 net sales growth will be

generated organically. These estimates exclude additional acquired

businesses, if any.”

Electronic Technologies Group

Victor H. Mendelson, HEICO's Co-President and President of

HEICO’s Electronic Technologies Group, commented on the Electronic

Technologies Group's first quarter results stating, "Our strong

performance was driven principally by the impact of recent

acquisitions, as well as continued favorable organic growth.

The Electronic Technologies Group's net sales increased 23% to

$155.7 million in the first quarter of fiscal 2018, up from $126.2

million in the first quarter of fiscal 2017. The increase resulted

from the contribution by our profitable fiscal 2017 and 2018

acquisitions, as well as 6% organic growth, principally from

increased demand for our space and defense products.

The Electronic Technologies Group's operating income increased

49% to $43.2 million in the first quarter of fiscal 2018, up from

$29.1 million in the first quarter of fiscal 2017. The increase

principally reflects the previously mentioned net sales growth and

an improved gross profit margin impact mainly attributed to higher

net sales and a more favorable product mix for certain defense

products.

The Electronic Technologies Group's operating margin improved to

27.8% in the first quarter of fiscal 2018, up from 23.1% in the

first quarter of fiscal 2017. The increase is principally

attributed to the previously mentioned improved gross profit

margin.

With respect to the remainder of fiscal 2018, we now estimate

full year net sales growth of approximately 15% - 17% over the

prior year, up from the prior estimate of 12%, and anticipate the

full year Electronic Technologies Group's operating margin to

approximate 27% - 28%, up from the prior estimate of 27%. Further,

we estimate the Electronic Technologies Group’s organic net sales

growth rate to be in the mid- to high-single digits. These

estimates include the recently announced acquisition of Sensor

Technology Engineering, Inc., but exclude additional acquired

businesses, if any.”

(NOTE: HEICO has two classes of common stock traded on

the NYSE. Both classes, the Class A Common Stock (HEI.A) and

the Common Stock (HEI), are virtually identical in all economic

respects. The only difference between the share classes is

the voting rights. The Class A Common Stock (HEI.A) has 1/10

vote per share and the Common Stock (HEI) has one vote per

share.)

There are currently approximately 63.5 million shares of HEICO's

Class A Common Stock (HEI.A) outstanding and 42.2 million shares of

HEICO's Common Stock (HEI) outstanding. The stock symbols for

HEICO’s two classes of common stock on most websites are HEI.A and

HEI. However, some websites change HEICO's Class A Common Stock

trading symbol (HEI.A) to HEI/A or HEIa.

As previously announced, HEICO will hold a conference call on

Wednesday, February 28, 2018 at 9:00 a.m. Eastern Standard

Time to discuss its first quarter results. Individuals wishing to

participate in the conference call should dial: U.S. and Canada

(877) 586-4323, International (706) 679-0934, wait for the

conference operator and provide the operator with the Conference ID

4496699. A digital replay will be available two hours after the

completion of the conference for 14 days. To access, dial: (404)

537-3406, and enter the Conference ID 4496699.

HEICO Corporation is engaged primarily in the design,

production, servicing and distribution of products and services to

certain niche segments of the aviation, defense, space, medical,

telecommunications and electronics industries through its

Hollywood, Florida-based Flight Support Group and its Miami,

Florida-based Electronic Technologies Group. HEICO's customers

include a majority of the world's airlines and overhaul shops, as

well as numerous defense and space contractors and military

agencies worldwide, in addition to medical, telecommunications and

electronics equipment manufacturers. For more information about

HEICO, please visit our website at http://www.heico.com.

Certain statements in this press release constitute

forward-looking statements, which are subject to risks,

uncertainties and contingencies. HEICO's actual results may differ

materially from those expressed in or implied by those

forward-looking statements as a result of factors including: lower

demand for commercial air travel or airline fleet changes or

airline purchasing decisions, which could cause lower demand for

our goods and services; product specification costs and

requirements, which could cause an increase to our costs to

complete contracts; governmental and regulatory demands, export

policies and restrictions, reductions in defense, space or homeland

security spending by U.S. and/or foreign customers or competition

from existing and new competitors, which could reduce our sales;

our ability to introduce new products and services at profitable

pricing levels, which could reduce our sales or sales growth;

product development or manufacturing difficulties, which could

increase our product development costs and delay sales; our ability

to make acquisitions and achieve operating synergies from acquired

businesses; customer credit risk; interest, foreign currency

exchange and income tax rates; economic conditions within and

outside of the aviation, defense, space, medical,

telecommunications and electronics industries, which could

negatively impact our costs and revenues; and defense spending or

budget cuts, which could reduce our defense-related revenue.

Parties receiving this material are encouraged to review all of

HEICO's filings with the Securities and Exchange Commission,

including, but not limited to filings on Form 10-K, Form 10-Q and

Form 8-K. We undertake no obligation to publicly update or revise

any forward-looking statement, whether as a result of new

information, future events or otherwise, except to the extent

required by applicable law.

HEICO CORPORATION

Condensed Consolidated Statements of

Operations (Unaudited)

(in thousands, except per share data)

Three Months Ended January 31, 2018

2017 Net sales $404,410 $343,432 Cost of sales 249,619

218,015 Selling, general and administrative expenses 75,231 60,867

Operating income 79,560 64,550 Interest expense (4,725 ) (1,969)

Other income 360 484 Income before income taxes and noncontrolling

interests 75,195 63,065 Income tax expense 3,500 (b) 16,800 Net

income from consolidated operations 71,695 46,265 Less: Net income

attributable to noncontrolling interests 6,543 5,338 Net income

attributable to HEICO $65,152 (b) $40,927 Net income per

share attributable to HEICO shareholders: (a) Basic $.62 (b) $.39

Diluted $.60 (b) $.38 Weighted average number of common

shares outstanding: (a) Basic 105,639 105,178 Diluted 109,112

108,005

Three Months Ended January 31, 2018

2017 Operating segment information: Net sales: Flight

Support Group $254,721 $220,901 Electronic Technologies Group

155,658 126,165 Intersegment sales (5,969) (3,634) $404,410

$343,432 Operating income: Flight Support Group $45,869

$41,363 Electronic Technologies Group 43,220 29,084 Other,

primarily corporate (9,529) (5,897) $79,560 $64,550

HEICO CORPORATION

Footnotes to Condensed Consolidated

Statements of Operations (Unaudited)

(a) All share and per share information

has been adjusted retrospectively to reflect 5-for-4 stock

splits effected in April 2017 and January

2018.

(b) In the first quarter of fiscal 2018,

the United States (U.S.) government enacted significant

changes to existing tax law resulting in

the Company recording a provisional discrete tax

benefit from remeasuring its U.S. federal

net deferred tax liabilities partially offset by a

provisional discrete tax expense related

to a one-time transition tax on the unremitted

earnings of the Company's foreign

subsidiaries. The net impact of these provisional

amounts increased net income attributable

to HEICO by $11.9 million, or $.11 per basic and

diluted share.

HEICO CORPORATION

Condensed Consolidated Balance

Sheets (Unaudited)

(in thousands)

January 31, 2018 October 31,

2017 Cash and cash equivalents $65,688 $52,066 Accounts

receivable, net 210,278 222,456 Inventories, net 367,395 343,628

Prepaid expenses and other current assets 19,071 13,742 Total

current assets 662,432 631,892 Property, plant and equipment, net

133,115 129,883 Goodwill 1,090,864 1,081,306 Intangible assets, net

530,987 538,081 Other assets 153,044 131,269 Total assets

$2,570,442 $2,512,431 Current maturities of long-term debt

$485 $451 Other current liabilities 228,571 248,986 Total current

liabilities 229,056 249,437 Long-term debt, net of current

maturities 668,527 673,528 Deferred income taxes 42,526 59,026

Other long-term liabilities 167,964 151,025 Total liabilities

1,108,073 1,133,016 Redeemable noncontrolling interests 132,355

131,123 Shareholders’ equity 1,330,014 1,248,292 Total liabilities

and equity $2,570,442 $2,512,431

HEICO CORPORATION

Condensed Consolidated Statements of

Cash Flows (Unaudited)

(in thousands)

Three Months Ended January 31, 2018

2017 Operating Activities: Net income from consolidated

operations $71,695 $46,265 Depreciation and amortization 19,024

15,248 Employer contributions to HEICO Savings and Investment Plan

1,860 1,714 Share-based compensation expense 2,168 1,451 (Decrease)

increase in accrued contingent consideration (3,195 ) 537 Foreign

currency transaction adjustments, net 75 (956 ) Deferred income tax

benefit (17,292 ) (346 ) Decrease in accounts receivable 14,463

25,998 Increase in inventories (18,301 ) (14,989 ) Decrease in

current liabilities, net (20,581 ) (18,000 ) Other (4,911 ) (947 )

Net cash provided by operating activities 45,005 55,975

Investing Activities: Capital expenditures (7,577 )

(6,422 ) Acquisitions, net of cash acquired (6,126 ) — Other (2,790

) 419 Net cash used in investing activities (16,493 ) (6,003

) Financing Activities: Payments on revolving credit

facility (5,000 ) (40,000 ) Cash dividends paid (7,395 ) (6,059 )

Revolving credit facility issuance costs (4,067 ) — Distributions

to noncontrolling interests (1,882 ) (1,986 ) Payment of contingent

consideration (300 ) — Proceeds from stock option exercises 1,425

1,230 Other (114 ) (108 ) Net cash used in financing activities

(17,333 ) (46,923 ) Effect of exchange rate changes on cash

2,443 (99 ) Net increase in cash and cash equivalents

13,622 2,950 Cash and cash equivalents at beginning of year 52,066

42,955 Cash and cash equivalents at end of period

$65,688 $45,905

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180227006585/en/

HEICO CorporationVictor H. Mendelson, 305-374-1745 Ext.

7590orCarlos L. Macau, Jr., 954-987-4000 Ext. 7570

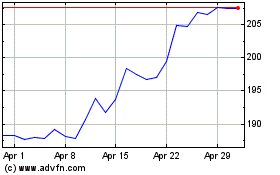

HEICO (NYSE:HEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

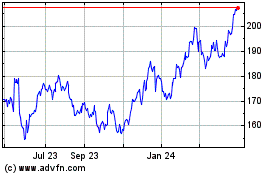

HEICO (NYSE:HEI)

Historical Stock Chart

From Apr 2023 to Apr 2024