Fourth Quarter 2017:

- Sales of $373 million, up 15% from

last year’s fourth quarter; Organic Sales up 10%

- Operating Margin of 13.3%; Adjusted

Operating Margin of 13.7%, down 230 bps

- GAAP EPS of ($1.10) including a

$1.79 charge for new U.S. tax legislation

- Adjusted EPS of $0.71, up 6% versus

prior year

Full Year 2017:

- Sales of $1,436 million, up 17% from

2016; Full Year Organic Sales up 11%

- Operating Margin of 14.6%; Adjusted

Operating Margin of 14.8%, down 120 bps

- GAAP EPS of $1.09 including a $1.77

charge for new U.S. tax legislation

- Adjusted EPS of $2.88, up 14% from

2016

2018 Outlook:

- 2018 Expected Sales Growth of 4% to

6%; Organic Sales Growth of 3% to 5%

- 2018 Adjusted Net Income of $2.98 to

$3.13 per Share; Up 3% to 9% from 2017 Adjusted Net Income of $2.88

per Share

Barnes Group Inc. (NYSE: B), a global provider of highly

engineered products and differentiated industrial technologies,

today reported financial results for the fourth quarter and full

year 2017.

Fourth quarter 2017 net sales of $373 million were up 15% from

$324 million in the prior year period driven by strong organic

sales growth (1) of 10%. Foreign exchange favorably impacted sales

by approximately 4% while acquisition sales contributed 1%. Net

loss for the fourth quarter was ($59.2) million, or ($1.10) per

diluted share, compared to net income of $36.7 million, or $0.67

per diluted share, a year ago. In the fourth quarter of 2017, the

Company recorded a charge of $96.7 million related to the new U.S.

tax legislation. On an adjusted basis, net income was $0.71 per

diluted share, up 6% from $0.67 last year. Adjusted net income per

diluted share in the fourth quarter of 2017 excludes a $1.79 charge

related to new U.S. tax laws and $0.02 per share related to

restructuring actions within our Industrial Segment. Fourth quarter

2016 adjusted net income per share excludes $0.03 of FOBOHA

short-term purchase accounting adjustments in our Industrial

Segment and a $0.03 benefit related to a contract termination

dispute in our Aerospace Segment.

For the full year 2017, Barnes Group generated net sales of

$1,436 million, up 17% from $1,231 million in the prior year. Full

year organic sales were up 11%, while acquisitions contributed 5%

and favorable foreign exchange provided 1%. Net income for the year

was $59.4 million, or $1.09 per diluted share, compared to $135.6

million, or $2.48 per diluted share, a year ago. On an adjusted

basis, net income was $2.88 per diluted share, up 14% from $2.53

last year. For 2017, adjusted net income per share excludes a $1.77

charge related to tax law changes, $0.03 of FOBOHA short-term

purchase accounting adjustments and a $0.01 benefit from

restructuring actions. Adjusted net income per share for 2016

excludes $0.05 of FOBOHA short-term purchase accounting adjustments

and acquisition transaction costs in our Industrial Segment and a

contract termination arbitration award which offset related charges

in our Aerospace Segment.

A table reconciling 2017 and 2016 non-GAAP adjusted results

presented in this release to the Company’s GAAP results is included

at the end of this press release.

“Barnes Group delivered a strong 2017 with double-digit organic

sales and adjusted earnings per share growth,” said Patrick J.

Dempsey, President and Chief Executive Officer of Barnes Group Inc.

“Our sustained focus on enhancing our portfolio and pipeline of

innovative products and services, advancing the Barnes Enterprise

System (“BES”), and developing a high-performing global

organization has resulted in continued progress along our

transformation journey and positions us to perform well moving

forward.”

“Accordingly, we expect 2018 to be another solid year as

generally favorable end markets coupled with our BES emphasis on

driving commercial, operational and financial excellence across our

Company are anticipated to drive revenue, margin, and earnings

growth,” added Dempsey.

Industrial

- Fourth quarter 2017 sales were $254.3

million, up 18% from $215.7 million in the prior year period.

Organic sales increased by 11%, with growth across all three

business units; Molding Solutions, Nitrogen Gas Products, and

Engineered Components. Favorable foreign exchange increased sales

by approximately $13.1 million, or 6%, while acquisition revenues

were $2.6 million, or 1%.

- Operating profit in the fourth quarter

was $26.9 million, down 11% from $30.2 million in the prior year

period, as continuing higher costs incurred on certain programs

within Engineered Components’ Associated Spring business and

incentive compensation at select SBUs were only partially offset by

the profit benefit of increased sales and the absence of $1.8

million in FOBOHA short-term purchase accounting adjustments taken

last year. The fourth quarter of 2017 includes restructuring

related costs of $1.4 million related to two previously announced

plant consolidations. Excluding this item, adjusted operating

profit was $28.3 million, down 12% from an adjusted $32.0 million a

year ago. Adjusted operating margin was 11.1%, down 370 bps, driven

by lower productivity, primarily at Engineered Components, and a

low margin contribution from the FOBOHA business.

- Full year 2017 sales were $973.9

million, up 18% from $824.2 million last year. Organic sales were

up 10%, while acquisitions contributed 7% and favorable foreign

exchange contributed 1%. Full year operating profit of $127.1

million was down 2% from $129.7 million in the prior year. On an

adjusted basis, operating profit was $129.4 million for 2017 versus

$133.2 million a year ago, a decrease of 3%. Adjusted operating

margin was 13.3%, down 290 bps from last year.

Aerospace

- Fourth quarter 2017 sales were $118.7

million, up 9% from $108.5 million in the same period last year.

Aerospace original equipment manufacturing (“OEM”) sales increased

6% due to the continuing ramp of new engine programs. Aerospace

aftermarket sales increased 17% from continuing growth in

maintenance, repair and overhaul (“MRO”), and spare parts

sales.

- Operating profit was $22.7 million for

the fourth quarter of 2017, up 7% as compared to $21.1 million in

the prior year period, reflecting the profit impact from higher

sales volumes and productivity benefits, partially offset by

scheduled price deflation. Excluding a contract termination award

of $1.4 million in the fourth quarter of 2016, adjusted operating

profit was up 15% from $19.8 million a year ago while operating

margin of 19.1% was up 90 bps from an adjusted 18.2% a year

ago.

- Full year 2017 sales were $462.6

million, up 14% from $406.5 million last year. Operating profit was

$83.2 million, up 33%, versus $62.5 million a year ago. Full year

2017 Aerospace operating profit was up 30% versus an adjusted $64.1

in the prior year. Operating margin was 18% versus an adjusted

15.8% last year, up 220 bps.

- Aerospace OEM backlog ended 2017 at

$714 million, up 14% compared to a year ago and up 1% sequentially

from the third quarter of 2017. The Company expects to ship

approximately 50% of this backlog over the next 12 months.

Additional Information

- Full year 2017 interest expense

increased $2.7 million to $14.6 million primarily as a result of a

higher average effective interest rate versus a year ago.

- Other income, net for the year

decreased $2.3 million versus a year ago primarily due to the

absence of $1.4 million of interest income related to the contract

termination arbitration award in 2016.

- The Company’s effective tax rate from

continuing operations was 69.6% in 2017 compared with 25.7% in

2016. The increase in the 2017 effective tax rate is primarily due

to a provisional $96.7 million income tax charge recorded as a

result of the Tax Cuts and Jobs Act (the Act) enacted in December

2017. Excluding the impact of the Act, the Company’s 2017 effective

tax rate would have been 20.2%. The comparable decrease from 25.7%

to 20.2% is due to the adjustment of the Swiss valuation reserves

worth $0.12 of earnings per share, the settlement of tax audits and

closure of tax years for various tax jurisdictions, and the change

in the mix of earnings. These items were partially offset by the

expiration of certain tax holidays.

2018 Outlook

Barnes Group expects 2018 total revenue growth of 4% to 6%, with

organic sales growth of 3% to 5%. Foreign exchange is anticipated

to benefit revenues by approximately 1% for the year. Operating

margin is forecasted to be in the range of 15.5% to 16.5%. Earnings

are expected to be in the range of $2.98 to $3.13 per diluted

share, up 3% to 9% from 2017’s adjusted diluted earnings per share

of $2.88. Further, the Company anticipates capital expenditures of

between $60 million to $65 million and cash conversion of greater

than 100% of net income. Based upon our forecasted geographic mix

of earnings, the effective tax rate for 2018 is expected to be

between 25% and 26%. The Company does not expect the new Revenue

Recognition standard to have a material impact on future revenues

or net income.

“2017 was a good year for Barnes Group even as we dealt with

some operational challenges within one of our Industrial

businesses. As we move beyond this in the first half of 2018, we

anticipate solid revenue growth, improved financial performance,

and good cash generation. With our supportive balance sheet, we

will continue to invest in organic growth opportunities and

strategic acquisitions that position us well for the future,” said

Christopher J. Stephens, Jr., Senior Vice President, Finance and

Chief Financial Officer, Barnes Group Inc.

Conference Call Information

Barnes Group Inc. will conduct a conference call with investors

to discuss fourth quarter and full year 2017 results at 8:30 a.m.

ET today, February 16, 2018. The public may access the conference

through a live audio webcast available on the Investor Relations

section of Barnes Group’s website at www.BGInc.com. The conference

is also available by direct dial at (866) 393-4306 in the U.S. or

(734) 385-2616 outside of the U.S.; Conference ID 3989187.

Supplemental materials will be posted to the Investor Relations

section of the Company's website prior to the conference call.

In addition, the call will be recorded and available for

playback from 12:00 p.m. (ET) on Friday, February 16, 2018 until

11:59 p.m. (ET) on Friday, February 23, 2018, by dialing (404)

537-3406; Conference ID 3989187.

Note:(1) Organic sales growth represents the total

reported sales increase within the Company’s ongoing businesses

less the impact of foreign currency translation and acquisition and

divestitures completed in the preceding twelve months.

About Barnes GroupBarnes Group Inc. (NYSE: B) is a global

provider of highly engineered products, differentiated industrial

technologies, and innovative solutions, serving a wide range of end

markets and customers. Its specialized products and services are

used in far-reaching applications including aerospace,

transportation, manufacturing, healthcare, and packaging. Barnes

Group’s skilled and dedicated employees around the globe are

committed to the highest performance standards and achieving

consistent, sustainable profitable growth. For more information,

visit www.BGInc.com.

Forward-Looking Statements

This press release contains forward-looking statements as

defined in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements often address our expected future

operating and financial performance and financial condition, and

often contain words such as "anticipate," "believe," "expect,"

"plan," "estimate," "project," and similar terms. These

forward-looking statements do not constitute guarantees of future

performance and are subject to a variety of risks and uncertainties

that may cause actual results to differ materially from those

expressed in the forward-looking statements. These include, among

others: difficulty maintaining relationships with employees,

including unionized employees, customers, distributors, suppliers,

business partners or governmental entities; failure to successfully

negotiate collective bargaining agreements or potential strikes,

work stoppages or other similar events; difficulties leveraging

market opportunities; changes in market demand for our products and

services; rapid technological and market change; the ability to

protect intellectual property rights; introduction or development

of new products or transfer of work; higher risks in global

operations and markets; the impact of intense competition; acts of

terrorism, cybersecurity attacks or intrusions that could adversely

impact our businesses; uncertainties relating to conditions in

financial markets; currency fluctuations and foreign currency

exposure; future financial performance of the industries or

customers that we serve; our dependence upon revenues and earnings

from a small number of significant customers; a major loss of

customers; inability to realize expected sales or profits from

existing backlog due to a range of factors, including changes in

customer sourcing decisions, material changes, production schedules

and volumes of specific programs; the impact of government budget

and funding decisions; the impact of new or revised tax laws and

regulations; changes in raw material or product prices and

availability; integration of acquired businesses; restructuring

costs or savings; the continuing impact of prior acquisitions and

divestitures; and any other future strategic actions, including

acquisitions, divestitures, restructurings, or strategic business

realignments, and our ability to achieve the financial and

operational targets set in connection with any such actions; the

outcome of pending and future legal, governmental, or regulatory

proceedings and contingencies and uninsured claims; product

liabilities; future repurchases of common stock; future levels of

indebtedness; and numerous other matters of a global, regional or

national scale, including those of a political, economic, business,

competitive, environmental, regulatory and public health nature;

and other risks and uncertainties described in documents filed with

or furnished to the Securities and Exchange Commission ("SEC") by

the Company, including, among others, those in the Management's

Discussion and Analysis of Financial Condition and Results of

Operations and Risk Factors sections of the Company's filings. The

Company assumes no obligation to update its forward-looking

statements.

BARNES GROUP INC. CONSOLIDATED STATEMENTS OF INCOME

(Dollars in thousands, except per share data)

(Unaudited) Three months ended December 31,

Twelve months ended December 31, 2017 2016

%Change

2017 2016

%Change

Net sales $ 373,048 $ 324,167 15.1 $ 1,436,499 $ 1,230,754

16.7 Cost of sales 246,933 208,271 18.6 939,288 790,299 18.9

Selling and administrative expenses 76,511

64,522 18.6 286,933 248,277 15.6

323,444 272,793 18.6

1,226,221 1,038,576 18.1 Operating

income 49,604 51,374 (3.4 ) 210,278 192,178 9.4 Operating

margin 13.3 % 15.8 % 14.6 % 15.6 % Interest expense 3,934

3,057 28.7 14,571 11,883 22.6 Other expense (income), net

(767 ) (2,351 ) NM 8 (2,326 ) NM

Income before income taxes 46,437 50,668 (8.4 ) 195,699 182,621 7.2

Income taxes 105,685 13,954 NM

136,284 47,020 NM Net (loss)

income $ (59,248 ) $ 36,714 NM $ 59,415 $ 135,601

(56.2 ) Common dividends $ 7,509 $ 6,991

7.4 $ 29,551 $ 27,435 7.7 Per common

share: Net (loss) income: Basic $ (1.10 ) $ 0.68 NM $ 1.10 $

2.50 (56.0 ) Diluted (1.10 ) 0.67 NM 1.09 2.48 (56.0 ) Dividends

0.14 0.13 7.7 0.55 0.51 7.8 Weighted average common shares

outstanding: Basic 53,874,164 54,133,060 (0.5 ) 54,073,407

54,191,013 (0.2 ) Diluted 53,874,164 54,574,734 (1.3 ) 54,605,298

54,631,313 (0.0 ) NM - Not Meaningful

BARNES GROUP INC.

OPERATIONS BY REPORTABLE BUSINESS

SEGMENT

(Dollars in thousands)

(Unaudited)

Three months ended December 31, Twelve months

ended December 31, 2017 2016

%Change

2017 2016

%Change

Net sales Industrial $ 254,334 $

215,682 17.9 $ 973,890 $ 824,216 18.2 Aerospace 118,718

108,486 9.4 462,617 406,541 13.8 Intersegment sales

(4 ) (1 ) (8 ) (3 ) Total net sales $

373,048 $ 324,167 15.1 $ 1,436,499 $ 1,230,754

16.7 Operating profit Industrial $ 26,899 $

30,232 (11.0 ) $ 127,056 $ 129,677 (2.0 ) Aerospace

22,705 21,142 7.4 83,222

62,501 33.2 Total operating profit $ 49,604 $

51,374 (3.4 ) $ 210,278 $ 192,178 9.4

Operating margin

Change Change Industrial 10.6

% 14.0 % (340 ) bps. 13.0 % 15.7 % (270 ) bps. Aerospace

19.1 % 19.5 % (40 ) bps. 18.0 % 15.4 %

260 bps. Total operating margin 13.3 % 15.8 % (250 ) bps.

14.6 % 15.6 % (100 ) bps.

BARNES

GROUP INC. CONSOLIDATED BALANCE SHEETS (Dollars in

thousands) (Unaudited)

December 31,2017

December 31,2016

Assets Current assets Cash and cash equivalents $ 145,290 $

66,447 Accounts receivable 348,943 287,123 Inventories 241,962

227,759 Prepaid expenses and other current assets 32,526

27,163 Total current assets 768,721 608,492

Deferred income taxes 12,161 25,433 Property, plant and

equipment, net 359,298 334,489 Goodwill 690,223 633,436 Other

intangible assets, net 507,042 522,258 Other assets 28,271

13,431 Total assets $ 2,365,716 $ 2,137,539

Liabilities and Stockholders' Equity Current liabilities

Notes and overdrafts payable $ 5,669 $ 30,825 Accounts payable

127,521 112,024 Accrued liabilities 181,241 156,967 Long-term debt

- current 1,330 2,067 Total current

liabilities 315,761 301,883 Long-term debt 525,597 468,062

Accrued retirement benefits 89,000 109,350 Deferred income taxes

73,505 66,446 Long-term tax liability 79,770 - Other liabilities

21,762 23,440 Total stockholders' equity 1,260,321

1,168,358 Total liabilities and stockholders' equity

$ 2,365,716 $ 2,137,539

BARNES GROUP

INC. CONSOLIDATED STATEMENTS OF CASH FLOWS (Dollars

in thousands) (Unaudited)

Twelve months endedDecember

31,

2017 2016 Operating activities: Net income $

59,415 $ 135,601 Adjustments to reconcile net income to net cash

provided by operating activities: Depreciation and amortization

90,150 80,154 Gain on disposition of property, plant and equipment

(246 ) (349 ) Stock compensation expense 12,279 11,493 Effect of

U.S. tax reform on deferred tax assets 4,152 - Changes in assets

and liabilities, net of the effects of acquisitions: Accounts

receivable (50,082 ) (23,057 ) Inventories (173 ) 1,989 Prepaid

expenses and other current assets (4,241 ) 569 Accounts payable

12,018 11,778 Accrued liabilities 14,439 15,825 Deferred income

taxes 3,589 (2,210 ) Long-term retirement benefits (16,349 )

(15,492 ) Long-term tax liability 79,770 - Other (801 )

1,345 Net cash provided by operating

activities 203,920 217,646

Investing activities:

Proceeds from disposition of property, plant and equipment 2,594

780 Capital expenditures (58,712 ) (47,577 ) Business acquisitions,

net of cash acquired (8,922 ) (128,613 ) Component Repair Program

payments - (4,100 ) Other (3,000 ) -

Net cash used by investing activities (68,040 ) (179,510 )

Financing activities: Net change in other borrowings (25,304

) 8,375 Payments on long-term debt (73,161 ) (321,506 ) Proceeds

from the issuance of long-term debt 129,118 303,277 Proceeds from

the issuance of common stock 2,408 4,611 Common stock repurchases

(40,791 ) (20,520 ) Dividends paid (29,551 ) (27,435 ) Withholding

taxes paid on stock issuances (5,380 ) (4,885 ) Other

(21,090 ) 4,771 Net cash used by financing

activities (63,751 ) (53,312 ) Effect of exchange rate

changes on cash flows 6,714 (2,303 )

Increase (decrease) in cash and cash equivalents 78,843 (17,479 )

Cash and cash equivalents at beginning of year 66,447

83,926 Cash and cash equivalents at end

of year $ 145,290 $ 66,447

BARNES

GROUP INC. RECONCILIATION OF NET CASH PROVIDED BY OPERATING

ACTIVITIES TO FREE CASH FLOW (Dollars in thousands)

(Unaudited)

Twelve months endedDecember

31,

2017 2016 Free cash flow: Net cash

provided by operating activities $ 203,920 $ 217,646 Capital

expenditures (58,712 ) (47,577 ) Free cash

flow(1) $ 145,208 $ 170,069

Free cash flow

to net income cash conversion ratio (as adjusted): Net

income 59,415 135,601 Effects of U.S. tax reform 96,700

- Net income (as adjusted)(2) $ 156,115

$ 135,601 Free cash flow to net income cash

conversion ratio (as adjusted)(2) 93 % 125 %

Notes:(1) The Company

defines free cash flow as net cash provided by operating activities

less capital expenditures. The Company believes that the free cash

flow metric is useful to investors and management as a measure of

cash generated by business operations that can be used to invest in

future growth, pay dividends, repurchase stock and reduce debt.

This metric can also be used to evaluate the Company's ability to

generate cash flow from business operations and the impact that

this cash flow has on the Company's liquidity.

(2) For the purpose of calculating the cash conversion ratio,

the Company has excluded the effects of U.S. tax reform, commonly

referred to as the Tax Cuts and Jobs Act, from 2017 net income.

BARNES GROUP INC. NON-GAAP FINANCIAL

MEASURE RECONCILIATION (Dollars in thousands, except per

share data) (Unaudited) Three months ended

December 31, Twelve months ended December 31,

2017 2016 % Change 2017 2016

% Change

SEGMENT

RESULTS

Operating Profit - Industrial Segment (GAAP) $ 26,899 $

30,232 (11.0 ) $ 127,056 $ 129,677 (2.0 ) Acquisition

transaction costs - (14 ) - 1,164 FOBOHA short-term purchase

accounting adjustments - 1,786 2,294 2,316 Restructuring actions

1,406 - 13 -

Operating Profit - Industrial Segment as adjusted

(Non-GAAP) (1) $ 28,305 $ 32,004 (11.6 ) $

129,363 $ 133,157 (2.8 )

Operating Margin -

Industrial Segment (GAAP) 10.6 % 14.0 % (340 ) bps. 13.0 % 15.7

% (270 ) bps.

Operating Margin - Industrial Segment as adjusted

(Non-GAAP) (1) 11.1 % 14.8 % (370 ) bps. 13.3 % 16.2 %

(290 ) bps.

Operating Profit - Aerospace Segment

(GAAP) $ 22,705 $ 21,142 7.4 $ 83,222 $ 62,501 33.2

Contract termination dispute charges - 7 - 3,005 Contract

termination arbitration award - (1,371 )

- (1,371 )

Operating Profit -

Aerospace Segment as adjusted (Non-GAAP) (1) $ 22,705

$ 19,778 14.8 $ 83,222 $ 64,135 29.8

Operating Margin - Aerospace Segment (GAAP) 19.1 %

19.5 % (40 ) bps. 18.0 % 15.4 % 260 bps.

Operating Margin -

Aerospace Segment as adjusted (Non-GAAP) (1)

19.1 % 18.2 %

90 bps.

18.0 % 15.8 %

220 bps.

CONSOLIDATED

RESULTS

Operating Income (GAAP) $ 49,604 $ 51,374 (3.4 ) $ 210,278 $

192,178 9.4 Acquisition transaction costs - (14 ) - 1,164

FOBOHA short-term purchase accounting adjustments - 1,786 2,294

2,316 Restructuring actions 1,406 - 13 - Contract termination

dispute charges - 7 - 3,005 Contract termination arbitration award

- (1,371 ) - (1,371 )

Operating Income as adjusted (Non-GAAP) (1) $

51,010 $ 51,782 (1.5 ) $ 212,585 $ 197,292

7.8

Operating Margin (GAAP) 13.3 % 15.8 % (250

) bps. 14.6 % 15.6 % (100 ) bps.

Operating Margin as adjusted

(Non-GAAP) (1) 13.7 %

16.0 % (230 )

bps. 14.8 %

16.0 % (120 ) bps.

Diluted Net (Loss) Income per Share (GAAP) $ (1.10 )

$ 0.67 NM $ 1.09 $ 2.48 (56.0 ) Acquisition transaction

costs - - - 0.02 FOBOHA short-term purchase accounting adjustments

- 0.03 0.03 0.03 Restructuring actions 0.02 - (0.01 ) - Contract

termination dispute charges - - - 0.03 Contract termination

arbitration award - (0.03 ) - (0.03 ) Effects of U.S. tax reform

1.79 - 1.77 -

Diluted Net Income per Share as adjusted

(Non-GAAP) (1) $ 0.71 $ 0.67 6.0 $ 2.88

$ 2.53 13.8

Full-Year 2018 Outlook Diluted Net Income per Share

(GAAP) $ 2.98 to $ 3.13

NM -

Not Meaningful

Notes:(1) The Company has

excluded the following from its "as adjusted" financial

measurements for 2017: 1) short-term purchase accounting

adjustments related to its FOBOHA acquisition, 2) the net loss

(gain) from restructuring actions related to the closure and

consolidation of two manufacturing facilities within the Industrial

segment and 3) the effects of U.S. tax reform commonly referred to

as the Tax Cuts and Jobs Act ($96,700). The Company has excluded

the following from its "as adjusted" financial measurements for

2016: 1) transaction costs related to its FOBOHA acquisition, 2)

short-term purchase accounting adjustments related to its FOBOHA

acquisition, 3) charges related to the contract termination dispute

and 4) operating income related to the contract termination

arbitration award and the non-operating interest income awarded.

The tax effects of these items, excluding the effects of U.S. tax

reform which impacted tax expense directly, were calculated based

on the respective tax jurisdiction of each item and range from

approximately 19% to 37%. Management believes that these

adjustments provide the Company and its investors with an

indication of our baseline performance excluding items that are not

considered to be reflective of our ongoing results. Management does

not intend results excluding the adjustments to represent results

as defined by GAAP, and the reader should not consider it as an

alternative measurement calculated in accordance with GAAP, or as

an indicator of the Company's performance. Accordingly, the

measurements have limitations depending on their use.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180216005058/en/

Barnes Group Inc.William PittsDirector, Investor

Relations860-583-7070

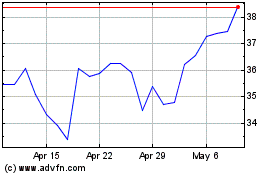

Barnes (NYSE:B)

Historical Stock Chart

From Mar 2024 to Apr 2024

Barnes (NYSE:B)

Historical Stock Chart

From Apr 2023 to Apr 2024