Report of Foreign Issuer (6-k)

February 07 2018 - 4:20PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2018

Commission file number:

|

Ehave, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Canada

|

|

7371

|

|

Not Applicable

|

|

(State or other jurisdiction

of incorporation)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification No.)

|

203-277 Lakeshore Road East

Oakville, ON L6J 6J3

Canada

(905) 362-1499

(Name, address, including zip code, and

telephone number, including area code, of agent for service)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F

x

Form 40-F

¨

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

On January 31, 2018, Ehave, Inc. (the “Company”)

completed the first tranche of a private placement to raise up to CDN$1,500,000 in gross proceeds (the “Secured Private Placement”)

by the issuance of secured convertible debentures (the “Secured Debentures”) and common share purchase warrants (the

“Secured Debenture Warrants”). The gross proceeds of the first tranche were equal to CDN$750,000. The Secured Debentures

are secured against the assets of the Company.

In connection with the closing of the first

tranche of the Secured Private Placement, the Company also closed the first tranche of a private placement to raise up to CDN$1,500,000

of unsecured convertible debentures (together with the Secured Debentures, the “Debentures”) and common share purchase

warrants (the “Unsecured Debenture Warrants”) for gross proceeds of CDN$409,000 (together with the Secured Private

Placement, the “Private Placements”).

The Debentures will bear interest at a

rate of 10% per annum and mature on the date that is 24 months from the date of issuance (the “Maturity Date”). In

connection with the Private Placements, the Company has agreed to use commercially reasonable efforts to complete a subsequent

financing for aggregate gross proceeds to the Company of at least CDN$2,000,000 (a “Qualified Financing”) and be approved

for trading on a recognized stock exchange in Canada. The issue price of the securities issued by the Company in connection with

the Qualified Financing shall be the “Qualified Financing Price”.

The principal amount of each Debenture

shall be convertible into common shares of the Company (“Common Shares”) at the option of the holder thereof at any

time following the completion of a Qualified Financing and prior to the close of business on the Maturity Date, at a conversion

price per Common Share equal to 0.75 multiplied by the Qualified Financing Price (the “Conversion Price”).

For each CDN$1,000 of principal of Secured

Debentures purchased, the holder thereof received Secured Debenture Warrants exercisable to acquire that number of Common Shares

as equal to the quotient of CDN$1,000 divided by the Conversion Price. Following the completion of a Qualified Financing, each

Secured Debenture Warrant entitles the holder thereof to acquire one Common Share for an exercise price equal to the Qualified

Financing Price at any time up to 5 years following the date of issuance (subject to adjustment in certain customary events).

For each CDN$1,000 of principal of Unsecured

Debentures purchased, the holder thereof received Unsecured Debenture Warrants exercisable to acquire that number of Common Shares

as equal to the quotient of CDN$1,200 divided by the Conversion Price. Following the completion of a Qualified Financing, each

Warrant entitles the holder thereof to acquire one Common Share for an exercise price equal to the Qualified Financing Price at

any time up to 5 years following the date of issuance (subject to adjustment in certain customary events).

Proceeds from the Private

Placements will be used for general working capital purposes as the Company continues to develop and market its novel health informatics

platform, Ehave Connect.

This Report on Form 6-K shall not constitute

an offer to sell, the solicitation of an offer to buy, nor shall there be any sale of these securities in any state or jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of

any such state or jurisdiction.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

Registrant:

Ehave, Inc.

|

|

|

|

|

|

February 07, 2018

|

By:

|

/

s/ “

Prateek Dwivedi

”

|

|

|

|

Prateek Dwivedi

|

|

|

|

President and Chief Executive Officer

|

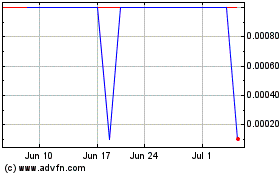

Ehave (CE) (USOTC:EHVVF)

Historical Stock Chart

From Apr 2024 to May 2024

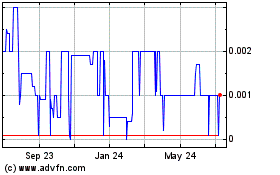

Ehave (CE) (USOTC:EHVVF)

Historical Stock Chart

From May 2023 to May 2024