LPL Financial Reports Monthly Activity for November 2017

December 19 2017 - 4:05PM

Leading retail investment advisory firm and independent

broker/dealer LPL Financial LLC, a wholly owned subsidiary of LPL

Financial Holdings Inc. (NASDAQ:LPLA), today released its monthly

activity report for November 2017.

Total brokerage and advisory assets served at the end of

November were approximately $575 billion, a 1.5 percent increase

compared to the end of October 2017. Total net new assets for

November were $1.3 billion. Total client cash sweep balances at the

end of November were $27.7 billion, flat compared to October

2017.

| (End of Period $ in billions, unless

noted) |

November |

October |

% |

| 2017 |

2017 |

Change |

| Assets

Served |

|

|

|

| Brokerage Assets |

314.3 |

|

311.6 |

|

0.9 % |

| Advisory Assets |

260.7 |

|

254.8 |

|

2.3 % |

| Total Brokerage

and Advisory Assets |

575.0 |

|

566.4 |

|

1.5 % |

| |

|

|

|

| Net New Advisory

Assets |

2.3 |

|

1.7 |

|

n/m |

| Net New Brokerage

Assets |

(1.0) |

(1.1) |

n/m |

| Total Net New

Assets |

1.3 |

|

0.6 |

|

n/m |

| |

|

|

|

| Net Brokerage to

Advisory Conversions |

0.7 |

|

0.7 |

|

n/m |

| |

|

|

|

| Insured Cash Account

Balances |

21.6 |

|

21.5 |

|

0.5 % |

| Deposit Cash Account

Balances |

3.9 |

|

3.9 |

|

0.0 % |

| Money Market Account

Cash Balances |

2.2 |

|

2.3 |

|

(4.3%) |

| Total Cash

Sweep Balances |

27.7 |

|

27.7 |

|

0.0 % |

| |

|

|

|

| Market

Indices |

|

|

|

| S&P 500 (end of

period) |

2,648 |

|

2,575 |

|

2.8% |

| Fed Funds Effective

Rate (average bps) |

116 |

|

116 |

|

n/m |

For additional information regarding these and other LPL

Financial business metrics, please refer to the company’s most

recent earnings release, which is available in the Press Releases

section of investor.lpl.com. About LPL

Financial LPL Financial LLC, a wholly owned subsidiary of

LPL Financial Holdings Inc. (NASDAQ:LPLA), is a leader in the

retail financial advice market and provided service to

approximately $575 billion in brokerage and advisory assets as of

Nov. 30, 2017. LPL is one of the fastest growing RIA custodians and

the nation’s largest independent broker-dealer (based on total

revenues, Financial Planning magazine June 1996-2017), and the firm

and its financial advisors were ranked No. 1 in net customer

loyalty in a 2016 Cogent Reports™ study. The Company provides

proprietary technology, comprehensive clearing and compliance

services, practice management programs and training, and

independent research to more than 14,000 financial advisors and

over 700 financial institutions as of Sept. 30, 2017, enabling them

to provide a range of financial services including wealth

management, retirement planning, financial planning and other

investment services to help their clients turn life’s aspirations

into financial realities. As of Sept. 30, 2017, financial advisors

associated with LPL served more than 4 million client accounts

across the U.S. as well as an estimated 41,000 retirement plans

with an estimated $137 billion in retirement plan assets.

Additionally, LPL supports approximately 3,700 financial advisors

licensed and affiliated with insurance companies with customized

clearing, advisory platforms, and technology solutions. LPL

Financial and its affiliates have more than 3,500 employees with

primary offices in Boston, Charlotte, and San Diego. For more

information, visit www.lpl.com.

Securities and Advisory Services offered through LPL Financial.

A registered investment advisor, Member FINRA/SIPC.

Investor Relations – Chris Koegel, (617) 897-4574Media Relations

– Jeff Mochal, (704) 733-3589investor.lpl.com/contactus.cfm

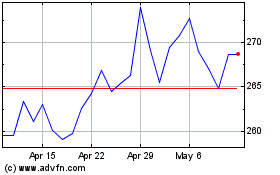

LPL Financial (NASDAQ:LPLA)

Historical Stock Chart

From Aug 2024 to Sep 2024

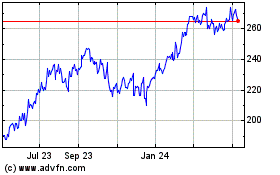

LPL Financial (NASDAQ:LPLA)

Historical Stock Chart

From Sep 2023 to Sep 2024