UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant

x

Check the appropriate box:

¨

Preliminary Proxy Statement

¨

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x

Definitive Proxy Statement

¨

Definitive Additional Materials

¨

Soliciting Material under Rule 14a-12

RGC RESOURCES, INC.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

x

No fee required.

¨

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

(1) Title of each class of securities to which transaction applies:

_________________________________________________________________________________

(2) Aggregate number of securities to which transaction applies:

_________________________________________________________________________________

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

_________________________________________________________________________________

(4) Proposed maximum aggregate value of transaction:

_________________________________________________________________________________

(5) Total fee paid:

_________________________________________________________________________________

¨

Fee paid previously with preliminary materials.

¨

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

_________________________________________________________________________________

(2) Form, Schedule or Registration Statement No.:

_________________________________________________________________________________

(3) Filing Party:

_________________________________________________________________________________

(4) Date Filed:

_________________________________________________________________________________

RGC RESOURCES, INC.

519 Kimball Avenue, N.E.

Roanoke, Virginia 24016

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD FEBRUARY 5, 2018

NOTICE is hereby given that, pursuant to its Bylaws and call of its Directors, the Annual Meeting of the Shareholders of RGC Resources, Inc. will be held at The Hotel Roanoke and Conference Center, 110 Shenandoah Avenue, Roanoke, Virginia 24016, on Monday, February 5, 2018, at 9:00 a.m., for the purposes of:

1. Electing three Class C directors.

|

|

|

|

2.

|

Ratifying the selection of Brown, Edwards & Company, L.L.P. as the independent registered public accounting firm.

|

|

|

|

|

3.

|

Approving, on an advisory basis, the compensation of our named executive officers.

|

|

|

|

|

4.

|

Acting on such other business as may properly come before the Annual Meeting.

|

Your attention is directed to the Proxy Statement accompanying this Notice for a more complete statement regarding matters proposed to be acted upon at the meeting. Only those shareholders of record as of the close of business on November 24, 2017 shall be entitled to vote at the meeting. Admission to the meeting will be limited to invited guests, persons who are listed on RGC Resources' records as shareholders as of the Record Date, or persons who bring documentation to the meeting that demonstrates their beneficial ownership of RGC Resources common stock through a broker, bank or other nominee as of the Record Date.

If you plan to attend the meeting, please contact Sherry Shaw at (540) 777-3972 or by emailing Ms. Shaw at Sherry_Shaw@RoanokeGas.com.

By Order of the Board of Directors,

John B. Williamson, III

Chairman

December 15, 2017

YOUR VOTE IS IMPORTANT. Even if you plan to be present at the Annual Meeting, please make sure to vote. You may vote by one of the following methods: (1) on-line at www.proxyvote.com, (2) completing, signing and returning the enclosed proxy in the postage paid envelope provided, (3) telephonically by calling (800) 690-6903, or (4) in person, even if you have previously sent in your proxy or voted on-line. Please note that the method by which you vote last will be the vote the Company counts. If your shares are held by a broker, bank or nominee, it is important that you provide them with your voting instructions.

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS TO BE HELD FEBRUARY 5, 2018

This Proxy Statement is furnished in connection with the solicitation of proxies to be used at the Annual Meeting of Shareholders of RGC Resources, Inc. ("we", "Resources" or the "Company") to be held on Monday, February 5, 2018, at 9:00 a.m. at The Hotel Roanoke and Conference Center, 110 Shenandoah Avenue, Roanoke, Virginia 24016 (the “Annual Meeting”).

Record Date and Voting Securities

Notice of the Company's Annual Meeting was mailed on or about December 15, 2017 to all shareholders of record. Only shareholders of record at the close of business on November 24, 2017, the record date, are entitled to vote at the Annual Meeting. A list of shareholders entitled to vote at the Annual Meeting will be open to the examination by any shareholder, for any purpose germane to the meeting, during ordinary business hours at the Company’s offices at 519 Kimball Avenue, N.E., Roanoke, Virginia 24016, and at the time and place of the meeting.

As of the record date,

7,250,093 c

ommon shares were issued and outstanding. Each common share is entitled to one vote. A majority of the common shares outstanding entitled to vote on the record date, or at least

3,625,047 comm

on shares, whether present in person or represented by proxy, will constitute a quorum for the transaction of business at the Annual Meeting.

Proxies in the form enclosed herewith are solicited by management at the direction of the Company’s Board of Directors.

Voting Procedures

Shareholders of record may vote in person at the Annual Meeting, on-line at www.proxyvote.com, by mailing the proxy card or by telephone by calling (800) 690-6903. Votes cast at the Annual Meeting will be tabulated by an Inspector of Elections, appointed by the Company. All proxy materials are available on the Company's website at www.rgcresources.com.

If your shares are held in a stock

brokerage account by a bank, broker, trustee, or other nominee, you are considered the beneficial owner of shares held in "street name." You should have received a voting instruction form with these proxy materials from that organization rather than from the Company. As a beneficial owner, you have the right to direct your broker or other nominee regarding how to vote the shares in your account by following these voting instructions. If you are a beneficial owner and do not instruct your broker or nominee how to vote your shares, the brokers and nominees can use their discretion to vote “uninstructed” shares with respect to Proposal No. 2 regarding the ratification of our independent registered public accounting firm, which for other matters is considered a "broker non-vote".

Abstentions and broker non-votes are counted as shares present and entitled to vote for the purpose of determining a quorum. Abstentions will be counted towards the vote total for Proposal Nos. 2 and 3 and will have the same effect as AGAINST votes.

If you return a signed and dated proxy card without marking voting selections or providing different instructions on the proxy card, your shares will be voted at the meeting FOR the election of the three director nominees listed in Proposal No. 1, FOR the ratification of the appointment of our independent registered public accounting firm in Proposal No. 2 and FOR the advisory approval of executive compensation in Proposal No. 3. With respect to any other business that may properly come before the Annual Meeting and be submitted to a vote of shareholders, proxies will be voted in accordance with the best judgment of the designated proxy holders. We do not know of any matters to be presented at the Annual Meeting other than those described in this proxy statement.

The director nominees listed in Proposal No. 1 will be elected by a plurality of the votes of the shares present or represented by proxy at the Annual Meeting and entitled to vote on the election of directors. The three nominees receiving the most FOR votes will be elected.

The appointment of our independent registered public accounting firm listed in Proposal No. 2 will be ratified if a majority of shares present or represented by proxy at the Annual Meeting and entitled to vote thereon vote FOR such proposal.

Proposal No. 3, advisory approval of the compensation of the Company’s named executive officers, will be considered to be approved if it receives FOR votes from the holders of a majority of shares either present or represented by proxy and entitled to vote.

Revoking a Proxy

A shareholder of record may revoke a proxy at any time before it is actually voted at the Annual Meeting either by signing and submitting a new proxy card with a later date or by attending the Annual Meeting and voting in person. A shareholder of record may also send timely written notice of revocation to Corporate Secretary, RGC Resources, Inc., P.O. Box 13007, Roanoke, VA 24030. If you hold shares through a bank or brokerage firm, you should have received a proxy card and voting instructions with these proxy materials, and you must contact the bank or brokerage firm directly to revoke any prior voting instructions.

PROPOSAL 1: ELECTION OF DIRECTORS OF RESOURCES

The Company’s Board of Directors consists of nine members and is divided into three classes (A, B, and C) with staggered three-year terms. The current term of office of the Class C directors expires at the Annual Meeting. The terms of Class A and B directors expire in 2019 and 2020, respectively. Each of the Company’s current directors and nominees for election are independent directors, as determined under the Company’s independence standards adopted in accordance with the applicable rules of the Securities and Exchange Commission (the “SEC”) and the NASDAQ Stock Market, except John S. D’Orazio and John B. Williamson, III.

There are three nominees for Class C directors: T. Joe Crawford, John S. D'Orazio, and Maryellen F. Goodlatte. After 15 years of distinguished service, George W. Logan will be retiring from the Board, effective with the 2018 Annual Meeting, and will not stand for re-election. The Board has nominated Mr. Crawford for Class C Director to fill the vacancy resulting from Mr. Logan's retirement. The Governance and Nominating Committee and the Board of Directors have selected and endorsed each of these candidates because each brings unique talents and business experience to the Board.

T. Joe Crawford

is Vice-President and General Manager of Steel Dynamics Roanoke Bar Division. Steel Dynamics, a publicly traded company, is one of the largest domestic steel producers and recyclers in the United States. The Roanoke Bar Division is a leading manufacturer of merchant steel products and billets. Mr. Crawford assumed his current position when Steel Dynamics acquired Roanoke Electric Steel Corporation in 2006. Prior to 2006, Mr. Crawford was President and Chief Operating Officer of Roanoke Electric Steel Corporation. Mr. Crawford has served on numerous boards of community organizations. Mr. Crawford holds a finance degree from Virginia Tech.

We believe that Mr. Crawford’s business and leadership experiences as well as his knowledge of the economic and political environment in the Company’s service area make him a valuable candidate for our Board.

John S. D'Orazio

is the Company's President and Chief Executive Officer. Appointed to his current role in February 2014, he was formerly President and Chief Executive Officer of Roanoke Gas Company, our largest subsidiary, from 2012 to 2014. Mr. D'Orazio joined the Company in 1993 and has served in a variety of executive and management positions. Prior to joining the Company, Mr. D'Orazio held various senior engineering positions at Virginia Natural Gas and Baltimore Gas and Electric. Mr. D'Orazio holds a civil engineering degree from Virginia Tech.

Mr. D'Orazio currently serves on the board of directors of the American Gas Association as well as the Roanoke Regional Chamber of Commerce, United Way of the Roanoke Valley, Total Action for Progress (TAP) and VA811.

We believe Mr. D'Orazio, as the Company's CEO, provides in-depth knowledge of the Company's operation, business strategy, risk and economic climate. This, coupled with his extensive utility industry experience, make him a valuable member of our Board.

Maryellen F. Goodlatte

is a principal at Glenn Feldmann Darby and Goodlatte, a leading regional law firm, and has been a director of the Company since 2001. Mrs. Goodlatte, holder of the prestigious Martindale-Hubbell AV Preeminent Rating, has practiced law for over 30 years, with an emphasis in land use and development. Mrs. Goodlatte holds an undergraduate degree from Bates College and a law degree from the Washington & Lee University School of Law.

We believe that Mrs. Goodlatte's professional experiences, her knowledge of the economic and political environment in the Company’s service area, her involvement in the community and her leadership as chair of the Governance and Nominating committee, make her a valuable Board member.

Your Board of Directors recommends a vote FOR each of the nominees for Class C Director.

PROPOSAL 2: RATIFICATION OF BROWN, EDWARDS & COMPANY, L.L.P. AS THE

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Upon recommendation and selection by the Audit Committee, the Board of Directors approved Brown, Edwards & Company, L.L.P. (“Brown Edwards”) as the independent registered public accounting firm to audit the financial statements of the Company for the year ending September 30, 2017. Brown Edwards has served as our independent registered public accounting firm since 2006. The Audit Committee has reappointed Brown Edwards as the independent registered public accounting firm to audit our consolidated financial statements as of and for the fiscal year ending September 30, 2018 and to audit our internal controls over financial reporting. A representative of Brown Edwards is expected to attend the meeting.

The Company’s Audit Committee is solely responsible for selecting the Company’s independent registered public accounting firm for the fiscal year ending September 30, 2018. Although shareholder ratification of the appointment of Brown Edwards is not required by the Company's bylaws, the Board of Directors believes that it is desirable to do so. If the shareholders do not ratify the appointment of Brown Edwards, the Audit Committee will consider whether to engage another independent registered public accounting firm. If the appointment of Brown Edwards is ratified by shareholders, the Audit Committee may change the appointment at any time if it determines a change would be in the best interest of the Company and its shareholders.

Your Board of Directors recommends a vote FOR the ratification of Brown, Edwards & Company, L.L.P.

PROPOSAL 3: NON-BINDING SHAREHOLDER ADVISORY VOTE ON EXECUTIVE COMPENSATION

At the 2017 Annual Meeting, our shareholders voted to continue the annual shareholder review of executive compensation. We believe that our executive compensation program is competitive within the industry and strongly aligned with the long-term interests of our shareholders. This program has been designed to promote a performance-based culture and ensure a philosophy of long-term value creation by aligning the interests of the executive officers with those of our shareholders by linking a meaningful portion of their compensation to the Company’s performance. The program is also designed to meet short-term objectives and to attract and retain highly-talented executive officers who are critical to the successful execution of the Company’s strategic business plan.

We also believe that both the Company and shareholders benefit from constructive and consistent dialogue. The proposal set forth above is intended to give you the opportunity to endorse or not endorse the compensation we paid to our named executive officers for fiscal 2017 and the proposed compensation for fiscal 2018.

The Compensation Committee has overseen the development of the executive compensation program, as described more fully in the Compensation, Discussion and Analysis section of this Proxy Statement.

Please note that your vote is advisory and will not be binding upon the Company or the Board of Directors. However, the Board of Directors and Compensation Committee value the opinions that our shareholders express in their votes and in any additional dialogue. Consequently, the Compensation Committee intends to take into account the outcome of the vote when considering future executive compensation decisions for our executive officers.

Your Board of Directors recommends a vote FOR approval, on an advisory basis, the named executive officers compensation as disclosed in this proxy statement.

BOARD OF DIRECTORS AND COMMITTEES OF THE BOARD OF DIRECTORS

The Company’s Board of Directors (the "Board") consists of nine directors and is divided equally into three classes, with staggered three-year terms. The Board has separate persons serving as its Chair and as the President and Chief Executive Officer ("CEO") of the Company, which, as discussed below under "The Board's Role in Risk Oversight" section, we believe is the most appropriate leadership structure at this time for the Company.

The Board met nine times during the 2017 fiscal year. All Board members attended at least 75 percent of Board and committee meetings in fiscal year 2017. Consistent with NASDAQ rules, a majority of the Company’s non-management directors met at least once each quarter without management present. All of the directors serving on the Board at the time attended the 2017 Annual Meeting of shareholders. The present principal occupation and employment during the past five years, and the office held with the Company, if any, of each director:

|

|

|

|

|

|

|

|

Name and Age

|

Year In Which First Elected As Director

|

Business Experience

|

Year in Which Assumed Principal Occupation

|

|

CLASS C DIRECTORS

(Currently serving until 2018 Annual Meeting)

|

|

John S. D'Orazio

Age 57

|

2014

|

See disclosure in Proposal No. 1 above.

|

2014

|

|

Maryellen F. Goodlatte

Age 65

|

2001

|

See disclosure in Proposal No. 1 above.

|

1983

|

|

George W. Logan

Age 72

|

2002

|

Principal, Pine Street Partners, LLC; Faculty, University of Virginia Darden Graduate School of Business, 1993-2017. Mr. Logan's board governance and financial expertise as well as his professional business experiences make him a valuable Board member.

|

1993

|

|

CLASS A DIRECTORS

(Serving until the 2019 Annual Meeting)

|

|

Abney S. Boxley, III

Age 59

|

1994

|

President and CEO of Boxley Materials Company; Director, Pinnacle Bank; Director, Carilion Clinic. Mr. Boxley's financial and business background, as well as his knowledge of construction and economic development opportunities in the Company's service area, make him a valuable member of our Board.

|

1988

|

|

S. Frank Smith

Age 69

|

1990

|

Consultant, Alpha Coal Sales Company, LLC; Vice President - Industrial Sales, Alpha Coal Sales Company, LLC, 2009 - 2014. Mr. Smith's in-depth knowledge of the competitive and regulatory landscape of energy markets, along with his leadership as chair of the Compensation Committee, make him a valuable member of our Board.

|

2014

|

|

John B. Williamson, III

Age 63

|

1998

|

Chairman of the Board, RGC Resources, Inc.; Director, Bank of Botetourt, Inc.; Director, Optical Cable Corporation; Director, Luna Innovations Inc.; Director, Corning Natural Gas Holding Corporation. President and CEO, RGC Resources, Inc. 1998-2014. Mr. Williamson's utility industry experience, understanding of the changing natural gas business and in-depth knowledge of the operational, financial and regulatory aspects of the Company, make him a valuable member of our Board.

|

2014

|

|

CLASS B DIRECTORS

(Serving until the 2020 Annual Meeting)

|

|

Nancy Howell Agee

Age 65

|

2005

|

President, CEO & Director, Carilion Clinic; President & COO Carilion Clinic 2010-2011; COO & Executive Vice President, Carilion Clinic 2007-2010; Director, Healthcare Realty Trust Inc.; Director, Hometown Bank; Director, Virginia Tech Carilion School of Medicine. As the CEO of the largest employer in the Company's service area and her active leadership and participation in the community, Mrs. Agee is a valuable Board member.

|

2011

|

|

J. Allen Layman

Age 65

|

1991

|

Private Investor. A former CEO, Mr. Layman's utility and regulatory experience makes him a valuable Board member.

|

2003

|

|

Raymond D. Smoot, Jr.

Age 70

|

2005

|

Chairman, Union Bankshares Corporation; Senior Fellow, Virginia Tech Foundation, Inc. 2012-2017; CEO & Secretary, Virginia Tech Foundation, Inc. 2003-2012; Director, Carilion Clinic. Dr. Smoot's professional experience and public company board experience make him a valuable Board member.

|

2017

|

The Board has standing Compensation, Audit, and Governance and Nominating committees. The Board has affirmatively determined that each of the Company’s current directors are considered independent directors in respect to each committee on which he or she serves, as determined under the Company’s independence standards adopted in accordance with the applicable rules of the SEC and the NASDAQ Stock Market, Inc. In addition, the Board has determined that Abney S. Boxley III, George W. Logan and Raymond D. Smoot, Jr. are audit committee financial experts under applicable SEC rules. The following table summarizes each committee.

|

|

|

|

|

|

|

|

Committee

|

Members

|

Responsibilities

|

Independence

|

|

Compensation

|

S. Frank Smith, Chair

|

Assists the Board in fulfilling its oversight responsibilities relating to the compensation of the Company's directors and executive officers.

|

Each Member is Independent

|

|

|

Nancy Howell Agee

|

|

|

Abney S. Boxley, III

|

|

|

J. Allen Layman

|

|

|

|

|

|

|

Audit

|

Raymond D. Smoot, Jr., Chair

|

Reviews and assesses the Company’s processes to manage financial reporting risk and to manage investment, tax, and other financial risks. It also reviews the Company’s policies for risk assessment and steps management has taken to control significant risks, except those delegated by the Board to other committees.

|

Each Member is Independent

|

|

|

Abney S. Boxley, III

|

|

|

George W. Logan

|

|

|

S. Frank Smith

|

|

|

|

|

|

|

Governance

|

Maryellen F. Goodlatte, Chair

|

Responsible for the oversight of a broad range of issues surrounding the composition and operation of the Board, including identifying individuals qualified to become Board members, recommending nominees for Board election, and recommending to the Board governance principles. It also provides assistance to the Board in the areas of committee member selection and rotation practices, evaluation of the overall effectiveness of the Board, and consideration of developments in corporate governance practices.

|

Each Member is Independent

|

|

and Nominating

|

Nancy Howell Agee

|

|

|

J. Allen Layman

|

|

|

George W. Logan

|

|

|

|

|

|

|

|

|

The Board's Role in Risk Oversight

The Board and management have distinct roles in the identification, assessment, and management of risks that could affect the Company. The Board exercises its responsibility for risk directly and through its three standing committees. In Board or committee meetings, management provides periodic reports to provide guidance on risk assessment and mitigation. Each committee charged with risk oversight reports up to the Board on those matters.

The Board believes that its current leadership structure facilitates its oversight of risk by combining independent leadership, through independent board committees and majority independent board composition, with an experienced Chairman and a CEO who have intimate knowledge of the business, history, and the complex challenges the Company faces. The Chairman and CEO both have in-depth understanding of these matters, and the CEO has direct involvement in the day-to-day management of the Company, uniquely positioning him to promptly identify and raise key business risks to the Board.

Director Nominations

The Governance and Nominating Committee establishes the process by which candidates are selected for possible inclusion in the recommended slate of director nominees. The Governance and Nominating Committee has a charter, which is available on the Company's website at www.rgcresources.com. The Governance and Nominating Committee will take into account the Company’s current needs and the qualities needed for Board service, including experience and achievement in business, finance, technology or other areas relevant to the Company’s activities; reputation, ethical character and maturity of judgment; diversity of viewpoints, backgrounds and experiences; absence of conflicts of interest that might impede the proper performance of director responsibilities; independence under SEC and NASDAQ rules; service on other boards of directors; sufficient time to devote to Board matters; and the ability to work effectively with other Board members. In the case of incumbent directors whose terms of office are set to expire, the Governance and Nominating Committee will review such directors’ overall service to the Company during their term, including the number of meetings attended, level of participation and quality of performance. For those potential new director candidates who appear upon first consideration to meet the Board’s selection criteria, the Governance and Nominating Committee will conduct appropriate inquiries into their background and qualifications and, depending on the result of such inquiries, arrange for in-person meetings with the potential candidates.

The Governance and Nominating Committee may use multiple sources for identifying director candidates, including its own contacts and referrals from other directors, members of management, the Company’s advisers, and executive search firms. The

Committee will consider director candidates recommended by shareholders and will evaluate such director candidates in the same manner in which it evaluates candidates recommended by other sources.

Any director candidates to be recommended by shareholders should be described in writing to Corporate Secretary, RGC Resources, Inc., P.O. Box 13007, Roanoke, VA 24030. This recommendation must be sent no later than 120 days prior to the anniversary of the expected mailing date of this proxy statement, in order to be considered for inclusion in the proxy statement for the 2019 annual meeting of shareholders.

Transactions with Related Persons

The Board follows certain policies and procedures for the approval of transactions with related persons that are required to be reported under applicable SEC rules. The policy generally requires Audit Committee approval or ratification of transactions that involve more than $120,000 in which the Company is a participant and in which a Company director, nominee for director, executive officer, greater than 5% shareholder, or an immediate family member of any of the foregoing persons has a direct or indirect material interest, with various other qualifications and exclusions for reportable related party transactions set forth in applicable SEC rules, such as a transaction where the tariff gas service is at a rate approved by the Virginia State Corporation Commission or certain banking transactions. In reviewing a reportable related party transaction, the Audit Committee will, after reviewing all material information regarding the transaction, take into account, among other factors it deems appropriate, whether the transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances and the extent of the related person’s interest in the transaction.

The Company contracted with Boxley Materials Company in fiscal 2017 for approximately $274,000 of paving services and related construction materials. Mr. Boxley, one of our directors, is President and CEO of Boxley Materials. These goods and services were obtained at arms-length pricing and terms and conditions. The Audit Committee has approved the transactions between the Company and Boxley Materials.

The Company has no other related party transactions to report for fiscal 2017.

Compensation of Directors

Directors' fees are set by the Compensation Committee and approved by the Board of Directors after the Committee considers the competitive market for directors and fee levels provided by comparable companies both within the utility industry and in the Company's geographic area. Beginning January 2018, the Company has increased its annual retainers and ceased paying directors for meeting attendance. Mr. D’Orazio is not compensated for attendance at Board and committee meetings and does not receive the annual retainer for service as a Board member. The 2018 schedule of fees paid to directors is as follows:

|

|

|

|

|

|

|

|

Annual Director Retainer

|

$

|

42,000

|

|

|

Additional Annual Retainer - Board Chair

|

15,000

|

|

|

Additional Annual Retainer - Audit Committee Chair

|

10,000

|

|

|

Additional Annual Retainer - Other Committee Chair

|

7,000

|

|

|

Additional Annual Retainer - Audit Committee

|

8,000

|

|

|

Additional Annual Retainer - Other Committee

|

2,000

|

|

Restricted Stock Plan for Outside Directors.

Under the Company's Amended and Restated Restricted Stock Plan for Outside Directors (the "Director Restricted Plan"), originally adopted January 27, 1997, as amended on March 28, 2016 and effective October 1, 2016, a minimum of 40% of the annual retainer fee paid to each non-employee director of the Company on a monthly basis is paid in shares of Company common stock restricted under the terms of the Director Restricted Plan ("Director Restricted Stock"). If the director owns more than 10,000 shares of Resources stock, the minimum requirement is waived. The number of shares of Director Restricted Stock is calculated each month based on the closing sales price on the first business day of the month of Resources’ common shares on the NASDAQ Global Market. A participant can, subject to approval of the Compensation Committee, elect to receive up to 100% of the retainer fee in Director Restricted Stock. Such election cannot be revoked or amended during the fiscal year.

The shares of Director Restricted Stock will vest only in the case of a participant’s death, disability, retirement (including not standing for reelection to the Board), or in the event of a change in control of Resources. There is no option to take cash in lieu of stock upon vesting of shares under this Plan. The Director Restricted Stock may not be sold, transferred, assigned or pledged by the participant until the shares have vested under the terms of this Plan. The shares of Director Restricted Stock will be forfeited to Resources by a participant’s voluntary resignation during his or her term on the Board or removal for cause as a director.

Fiscal Year 2017 Director Fees and Restricted Stock Holdings

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

Fees paid in cash

|

Fees paid in Restricted Stock

1

|

Total Fees

|

|

Shares of Restricted Stock as of 9/30/17

|

|

Nancy Howell Agee

|

$ 13,100

|

$ 18,667

|

$ 31,767

|

|

19,216

|

|

Abney S. Boxley, III

|

19,800

|

|

18,667

|

|

38,467

|

|

|

18,523

|

|

Maryellen F. Goodlatte

|

28,333

|

|

11,833

|

|

40,166

|

|

|

15,793

|

|

J. Allen Layman

|

29,300

|

|

7,467

|

|

36,767

|

|

|

36,985

|

|

George W. Logan

|

19,800

|

|

18,667

|

|

38,467

|

|

|

28,117

|

|

S. Frank Smith

|

33,333

|

|

11,833

|

|

45,166

|

|

|

21,792

|

|

Raymond D. Smoot, Jr.

|

47,233

|

|

—

|

|

47,233

|

|

|

20,486

|

|

John B. Williamson, III

|

34,900

|

|

12,267

|

|

47,167

|

|

|

2,258

|

Note 1: 40% of the annual retainer fees paid to non-employee directors must be paid in the form of

Director Restricted Stock, unless a participant owns at least 10,000 shares of Company stock. This

column also includes any additional portion of fees paid to directors in the form of Director Restricted

Stock pursuant to the election of the director.

The following table shows directors who elected to receive a higher percentage of their fees as Director Restricted Stock in fiscal 2017:

|

|

|

|

|

|

Name

|

Percent if Greater than 40%

|

|

Nancy Howell Agee

|

100%

|

|

Abney S. Boxley, III

|

100%

|

|

Maryellen F. Goodlatte

|

50%

|

|

George W. Logan

|

100%

|

|

S. Frank Smith

|

50%

|

Section 16(a) Beneficial Ownership Reporting Compliance

Based on the Company's review of the copies of forms related to Section 16(a) of the Securities Exchange Act of 1934 regarding beneficial ownership reporting and representations from certain reporting persons, no other reports are required

and two Form 4s, covering an option exercise and related stock purchase by an officer, were filed late in fiscal 2017.

EXECUTIVE OFFICERS

|

|

|

|

|

|

|

Name and Age

|

Period Position Held

|

Position and Experience

|

|

John S. D'Orazio, 57

|

February 2014 to present

|

President & CEO - Resources, Roanoke Gas

|

|

|

October 2012 to February 2014

|

President & CEO - Roanoke Gas

|

|

|

|

|

|

Paul W. Nester, 43

|

February 2015 to present

|

Vice President, Treasurer, Secretary & CFO

|

|

|

May 2012 to January 2015

|

Vice President, Treasurer & CFO

|

|

|

|

|

|

Carl J. Shockley, Jr., 52

|

October 2012 to present

|

Vice President, Operations - Roanoke Gas

|

|

|

May 2012 to September 2012

|

Director, Operations - Roanoke Gas

|

|

|

|

|

|

Robert L. Wells, II, 53

|

February 2005 to present

|

Vice President, Information Technology

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth, as of November 24, 2017, certain information regarding the beneficial ownership of the common shares of the Company by all directors and nominees, named executive officers, any holders of more than 5% of common shares and certain beneficial owners as a group. Unless otherwise noted in the footnotes to the table, the named persons have sole voting and investment power with respect to all outstanding common shares shown as beneficially owned by them. The address of each beneficial owner listed in the table below is c/o RGC Resources, Inc., P.O. Box 13007, Roanoke, Virginia 24030.

|

|

|

|

|

|

|

Name of Beneficial Owner

|

Common Shares

Beneficially Owned as of 11/24/17

1

|

Percent of Class

|

|

Nancy Howell Agee

2

|

28,769

|

<1%

|

|

Abney S. Boxley, III

5

|

34,903

|

<1%

|

|

T. Joe Crawford

|

4,500

|

<1%

|

|

John S. D’Orazio

3

|

67,469

|

<1%

|

|

Maryellen F. Goodlatte

|

24,588

|

<1%

|

|

J. Allen Layman

|

62,772

|

<1%

|

|

George W. Logan

|

88,373

|

1.2%

|

|

Paul W. Nester

3

|

39,984

|

<1%

|

|

Carl J. Shockley, Jr.

3

|

22,248

|

<1%

|

|

S. Frank Smith

|

85,560

|

1.2%

|

|

Raymond D. Smoot, Jr.

4

|

35,673

|

<1%

|

|

Robert L. Wells, II

3

|

25,523

|

<1%

|

|

John B. Williamson, III

|

131,099

|

1.8%

|

|

All current directors and executive officers

aaa

(as a Group - 13 Persons)

|

651,461

|

8.9%

|

Note 1: Includes Director Restricted Plan shares issued to outside directors still subject to vesting.

Note 2: Includes 24,489 shares owned in trust and 4,280 shares owned in spousal trust.

Note 3: Includes stock options shown in the Outstanding Equity Awards at Fiscal Year End section on page 13. All are

exercisable and included as shares beneficially owned.

Note 4: Includes 375 shares owned by spouse.

Note 5: Includes 1,125 shares owned by children in minor trust.

COMPENSATION DISCUSSION AND ANALYSIS

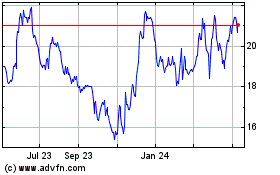

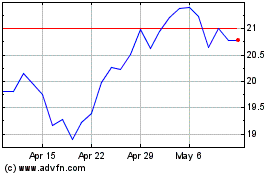

We are committed to creating shareholder value. In 2017, we achieved our third consecutive year of record earnings. Net Income was $6.2 million, or $0.86 per share, compared to $5.8 million, or $0.81 per share, in 2016. Also in 2017, the Board approved a 7.4% annual cash dividend increase to $0.58 per share and approved 3-for-2 stock dividend that was effective March 1, 2017. The Board has increased the cash dividend every year since 2004. For the first time in its history, the Company was added to the Russell 2000 index in June 2017. Total 2017 shareholder return, including dividends and stock price appreciation, was 62%. Total shareholder return for the 5 years ended 2017 was 172%.

Our compensation philosophy is designed to incentivize management to create shareholder value, by attracting and retaining talent, rewarding performance and instilling an ownership culture. Our adoption of the Restricted Stock Plan this past year is intended to advance those goals, by further aligning senior management with our shareholders. As described below, starting with our incentive bonuses to our executive officers for fiscal 2017, we will pay a portion of the bonuses in the form of restricted stock, based on earnings targets. This section will provide an overview of our executive compensation philosophy and why we believe it is appropriate for the Company and its shareholders.

We also discuss the Compensation Committee’s methodology for determining appropriate and competitive levels of compensation for the named executive officers. Details of compensation paid to the named executive officers can be found in the tables that follow.

Compensation Philosophy and Objectives

Who are the named executive officers for fiscal year 2017?

The named executive officers for fiscal year 2017 are John S. D’Orazio, Paul W. Nester, Carl J. Shockley, Jr., and Robert L. Wells, II.

What person or group is responsible for determining the compensation levels of named executive officers?

The Compensation Committee has a charter, pursuant to which it reviews and recommends to the Board the compensation, including base salary and annual incentive compensation, of the Company’s CEO and the other named executive officers.

The CEO is actively involved in the executive compensation process. The CEO reviews the performance of each of the named executive officers, other than his own, and, within the defined program parameters, recommends to the Compensation Committee base salary increases and incentive awards for such individuals. He provides the Compensation Committee with financial performance goals for the Company that are used to link pay with performance. The CEO also provides his review to the Compensation Committee with respect to the executive compensation program’s ability to attract, retain and motivate the level of executive talent necessary to achieve the Company’s business goals. The CEO attends the meetings of the Compensation Committee but does not participate in the Committee executive sessions.

The Compensation Committee did not utilize an outside consultant in fiscal year 2017.

What are the Company’s executive compensation principles and objectives?

The Company’s overall executive compensation philosophy is that pay should be competitive with the relevant market for executive talent, be performance based, vary with the attainment of specific objectives, and be aligned with the interests of the Company’s shareholders. The core principles of the Company’s executive compensation program include the following:

Pay competitively.

The Compensation Committee believes in positioning executive compensation at levels necessary to attract and retain exceptional leadership talent. An individual’s performance and importance to the Company can result in total compensation being higher or lower than the target market position.

Pay-for-performance.

The Compensation Committee structures executive compensation programs to balance annual and long-term corporate objectives, including specific measures which focus on operational and financial performance through incentive bonuses and the goal of fostering shareholder value creation through restricted stock grants.

Create an ownership culture.

The Compensation Committee believes that using compensation to instill an ownership culture effectively aligns the interests of executive officers and the shareholders. A significant portion of our incentive compensation awarded to executive officers is in the form of restricted common stock. The restrictions are intended to promote stock ownership. In addition, the Committee oversees a modest stock option plan intended to encourage stock ownership.

The CEO and the Compensation Committee periodically review the executive compensation philosophy. No recent changes have been made to the compensation philosophy; however, programmatic changes have been implemented at various times to enhance the effectiveness of the various compensation elements.

How do we determine executive pay?

The Compensation Committee benchmarks base salary, annual incentive bonus, other forms of incentive compensation and the Company's financial performance to a comparison group consisting of publicly traded gas utilities and local companies. The Compensation Committee believes this is the best way to determine whether such compensation is competitive. The comparison group is selected based on six criteria:

|

|

|

|

1.

|

Companies that an outsider, with no knowledge of the Company’s internal deliberations on the topic, would agree offer reasonable comparisons for pay and performance purposes;

|

|

|

|

|

2.

|

Companies that may overlap in the labor market for talent;

|

|

|

|

|

3.

|

Companies with revenue and market capitalizations reasonable for comparison;

|

|

|

|

|

4.

|

Companies whose business models, characteristics, growth potential, and human capital are similar but not necessarily identical to those of the Company;

|

|

|

|

|

5.

|

Public companies based in the United States where compensation and financial data are available in proxy statements and Form 10-K filings; and

|

|

|

|

|

6.

|

Companies large enough to have similar executive positions to ensure statistical significance.

|

Based on these criteria, the comparison group consists of:

Chesapeake Utilities Corporation NW Natural, Inc.

Corning Natural Gas Holding Corporation Unitil Corporation

Delta Natural Gas Company, Inc. Spire, Inc.

Hometown Bank, Inc.

In addition to the comparison group, the Compensation Committee utilizes market compensation data from Salary.com and CompAnalyst, a benefits and compensation consulting firm, for each of its executive positions. This data provides benchmark information for both base pay and total compensation for energy and utility companies in the $40 million to $3.0 billion size range. While the Compensation Committee has not established a specific target for each executive officer position, the Committee uses the comparison group and salary benchmark data to help ensure compensation is reasonably competitive in the industry and local job market.

How do we consider the results of the most recent shareholder advisory vote on executive compensation?

Annually, we ask our shareholders for a non-binding advisory vote on our overall executive compensation. The Board reviews and considers the voting results. In 2017, 96% of votes cast were in favor of the proposal. Since a substantial majority of our shareholders voted in favor of our executive compensation philosophy and program, the Board determined that we did not need to consider changing our overall approach to executive compensation.

Compensation Elements

Base Salary.

Base salary is fixed compensation and is necessary to attract and retain talent. Base salaries are the only non-variable element of the Company’s total compensation program. Base salaries are set to reflect each named executive officer’s responsibilities, the impact of each named executive officer’s position, and the contribution each named executive officer delivers to the Company. Salaries are determined after analyzing competitive levels in the market, using the Company’s comparison group and the Salary.com and CompAnalyst compensation data for executives with comparable responsibilities and job scope. The Compensation Committee also considers internal equities among employees within the Company. Salary increases, if any, are based on individual performance, Company performance and market conditions. To gauge market conditions, the Compensation Committee evaluated the comparison group and market data and established recommended salary levels based on the named executive’s experience, tenure, performance and potential. Based in part on the executive compensation benchmarking and the target levels for base salary set forth above, the Board, acting on the recommendation of Compensation Committee set the named executive officers’ base salaries for 2017.

Performance Incentive Plan Compensation.

The Performance Incentive Plan provides for a bonus based on the achievement of (1) certain qualitative goals for each named executive officer, which may be individual in nature or for the Company as a whole, and (2) targets for fiscal year earnings per share of the Company. For fiscal 2016 and 2017 performance, the plan did not set a percentage amount by which the achievement of qualitative goals, on the one hand, and earnings targets, on the other hand, contribute towards the bonus amount. The Board, upon the recommendation of the Compensation Committee, made a determination on such relative contributions. For the fiscal 2016 bonus, the percentage contribution towards the bonus amount of the achievement of qualitative goals ranged approximately from 34% to 57% among the named executive officers, versus approximately 66% to 43% in respect of the achievement of the earnings targets. For the fiscal 2017 bonus, the percentage contribution towards the cash bonus amount of the achievement of qualitative goals ranged approximately from 42% to 43% among the named executive officers, versus approximately 58% to 57% in respect of the achievement of the earnings targets. For fiscal 2018 performance, the plan will base 50% of the cash bonus on qualitative goals and 50% on earnings targets. The Compensation Committee evaluates achievement by each named executive officer of his or her qualitative goals and then recommends to the Board an amount of bonus to be awarded in respect of such achievement. The plan sets forth minimum, target and maximum earnings per share that may be achieved. After the adoption of our Restricted Stock Plan in 2017, the Company is paying a portion of the bonuses, based on the earnings targets, in the form of restricted stock for fiscal 2017 and also plans to do so for fiscal 2018.

RGC Resources, Inc. Restricted Stock Plan.

The Company has an Restricted Stock Plan which is intended to provide equity incentives to our key employees and be the successor to the Company's (i) Key Employee Stock Option Plan and (ii) Stock Bonus Plan. The Officer's Restricted Stock Plan provides for a stock award based on the achievement of targets for fiscal year earnings per share of the Company. The plan sets forth minimum, target and maximum earnings per share that may be achieved.

Each restricted stock award will be evidenced by an agreement with the recipient. The agreement shall set forth the "Vesting Period" and "Restriction Period" for the award and any other conditions or restrictions that the Compensation Committee deems advisable, including requirements established pursuant to the Securities Act, the Exchange Act, the Internal Revenue Code and any securities trading system or stock exchange upon which such restricted shares are listed.

The "Vesting Period" for an award represents substantial risk of forfeiture until certain dates, at which time such shares or a portion of such shares shall begin to "vest" over time and no longer be subject to a substantial risk of forfeiture. The default Vesting Period for an award shall be three years with one-third of the shares vesting on the first, second and third anniversaries of the effective date of the award, respectively, unless the Compensation Committee establishes otherwise. If a recipient resigns or is otherwise terminated from employment with the Company prior to the end of the Vesting Period, he or she will forfeit all interest to his or her unvested shares of restricted stock granted in an award. Unless otherwise established in an award agreement by the Compensation Committee, in the event of a recipient's death, disability or normal retirement (as considered under our defined benefit pension plan), all of the awarded shares shall vest and no longer be subject to a substantial risk of forfeiture. Likewise, all awarded shares shall vest in the event of a change in control, as defined in the recipient's agreement with the Company that relates to recipient's compensation and benefits upon the occurrence of a change in ownership of the Company or similar event (i.e., our Change-in-Control Agreement).

The "Restricted Period" for an award represents a period during which the recipient may not transfer, sell, pledge, assign, or otherwise alienate or hypothecate shares of restricted stock, and all cash dividends on such shares must be re-invested in our common stock. Unless the Compensation Committee otherwise determines, the Restricted Period shall apply so long as shares of restricted stock are unvested and thereafter apply to 75% of such vested shares unless the recipient satisfies the following minimum levels of our common stock:

President, CEO 300% of annual base salary

CFO, COO 200% of annual base salary

Vice President 150% of annual base salary

The Compensation Committee will use its discretion to determine when and how such minimum levels are measured. Once a recipient satisfies the minimum level of ownership or once a recipient is no longer employed by the Company, the Restricted Period will no longer be applicable to vested shares. A change in control will not affect the Restricted Period.

Key Employee Stock Option Plan of RGC Resources, Inc.

The Company has a Key Employee Stock Option Plan, which is intended to provide the Company’s executive officers and other key employees with long-term incentives and future rewards tied to the price of Resources’ common shares over time.

This Plan requires each option’s exercise price per share to equal the fair value of the Company’s common shares as of the date of the grant. Under the terms of this Plan, the options become exercisable six months from the grant date and expire ten years subsequent to the grant date. There were 25,500 shares granted in December 2016 to the named officers based on each officer's level of responsibility and the Compensation Committee's ongoing decision to link a portion of officer compensation directly to long-term corporate performance. The Compensation Committee did not use specific performance metrics in making these grants. Beginning with fiscal 2018, the Key Employee Stock Option Plan will continue in force in respect of previously granted options with 36,000 options available for issue. We do not anticipate stock options being a significant part of our future compensation structure.

RGC Resources, Inc. Stock Bonus Plan.

The Company has not made awards under the Stock Bonus Plan in recent years to the named executive officers. The plan, however, contains a policy that executive officers are encouraged to own a position in the Company’s common shares equal to at least 50% of the value of their annual salary. Therefore, any officer with a stock ownership position less than 50% must use a minimum of 50% of the amount of any cash bonus (e.g., under the Performance Incentive Plan) to purchase common shares directly from the Company under the Stock Bonus Plan. Beginning with fiscal 2018, the Stock Bonus Plan has been replaced by the RGC Resources, Inc. Restricted Stock Plan.

Discussion and Analysis of Summary Compensation

The changes in salary for our named executive officers primarily reflect their increasing responsibilities and significant contributions to the success of the Company in fiscal 2016. The Committee also considered competitive market forces and the comparison group in setting the 2017 salary levels. The significant decrease in pension values are directly attributable to the impact of higher discount rates on the actuarially calculated benefit.

Summary Compensation Table

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

Year

|

Salary

|

Bonus

1

|

Stock Awards

2

|

Option

Awards

3

|

Change in Pension Value

4

|

All Other Compensation

|

Total

|

|

John S. D'Orazio

|

2017

|

$ 391,084

|

$ 135,600

|

$ 156,000

|

$ 28,210

|

$ 51,389

|

$ 53,257

|

$ 815,540

|

|

President & CEO

|

2016

|

363,300

|

|

159,400

|

|

—

|

|

22,220

|

|

263,681

|

|

34,323

|

|

842,924

|

|

|

|

2015

|

325,353

|

|

84,500

|

|

—

|

|

24,600

|

|

106,405

|

|

36,418

|

|

577,276

|

|

|

|

|

|

|

|

|

|

|

|

|

Paul W. Nester

|

2017

|

221,511

|

|

64,688

|

|

58,500

|

|

21,700

|

|

28,799

|

|

48,563

|

|

443,761

|

|

|

VP, Treasurer,

|

2016

|

207,353

|

|

66,000

|

|

—

|

|

20,200

|

|

41,494

|

|

33,410

|

|

368,457

|

|

|

Secretary & CFO

|

2015

|

184,867

|

|

39,000

|

|

—

|

|

19,680

|

|

17,370

|

|

28,862

|

|

289,779

|

|

|

|

|

|

|

|

|

|

|

|

|

Robert L. Wells, II

|

2017

|

182,240

|

|

40,940

|

|

34,710

|

|

10,850

|

|

64,063

|

|

39,990

|

|

372,793

|

|

|

VP, Information

|

2016

|

171,010

|

|

49,000

|

|

—

|

|

10,100

|

|

189,255

|

|

37,698

|

|

457,063

|

|

|

Technology

|

2015

|

161,957

|

|

30,000

|

|

—

|

|

12,300

|

|

77,973

|

|

33,766

|

|

315,996

|

|

|

|

|

|

|

|

|

|

|

|

|

Carl J. Shockley, Jr.

|

2017

|

189,267

|

|

42,036

|

|

36,270

|

|

13,020

|

|

127,783

|

|

104,693

|

|

513,069

|

|

|

VP - Operations,

|

2016

|

172,566

|

|

48,000

|

|

—

|

|

12,120

|

|

181,826

|

|

32,312

|

|

446,824

|

|

|

Roanoke Gas Co.

|

2015

|

148,743

|

|

30,500

|

|

—

|

|

14,760

|

|

74,310

|

|

29,887

|

|

298,200

|

|

Note 1: Bonus amounts were earned in the respective year and paid in the following year.

Note 2: In October 2017, in respect of fiscal 2017 performance, the Company approved a total of 10,101 shares of restricted stock

to be issued to our named executive officers effective January 2, 2018. Mr. D'Orazio received 5,200 shares which is equal

to $156,000 based on the closing price of $28.26 as reported on the NASDAQ Global Market on October 30, 2017.

Mr. Nester received 2,070 shares, which is equal to $58,500 based on such closing price. Mr. Wells received 1,228 shares,

which is equal to $34,710 based on such closing price. Mr. Shockley received 1,283 shares, which is equal to $36,270

|

|

|

|

|

based on such closing price.

|

Note 3: The 2017 Option Awards values are based on 9,750 shares for Mr. D'Orazio, 7,500 shares for Mr. Nester, 4,500 shares for Mr. Shockley and 3,750 shares for Mr. Wells. The 2016 Option Awards values are based on 8,250 shares for Mr. D’Orazio, 7,500 shares for Mr. Nester, 4,500 shares for Mr. Shockley and 3,750 shares for Mr. Wells. The 2015 Option Awards values are based on 7,500 shares for Mr. D’Orazio, 6,000 shares for Mr. Nester, 4,500 shares for Mr. Shockley and 3,750 shares for Mr. Wells.

Note 4: The Change in Pension Value is an actuarial calculation and was not realized as compensation.

Fiscal 2016 Bonus Table

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

Metric

|

Minimum

|

Target

|

Maximum

|

Paid

1

|

% of Target

|

|

John S. D’Orazio

|

Performance Achievements

|

$

|

—

|

|

$ 108,000

|

$ 210,000

|

$ 159,400

|

147.6

|

|

Paul W. Nester

|

Performance Achievements

|

—

|

|

52,000

|

|

74,000

|

|

66,000

|

|

126.9

|

|

Robert L. Wells, II

|

Performance Achievements

|

—

|

|

39,000

|

|

55,000

|

|

49,000

|

|

125.6

|

|

Carl J. Shockley, Jr.

|

Performance Achievements

|

—

|

|

41,000

|

|

57,000

|

|

48,000

|

|

117.1

|

Note 1: The Board approved and paid the above bonus in 2017 for fiscal year 2016 performance.

Fiscal 2017 Incentive Compensation Table

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

Type

|

Metric

|

Minimum

|

Target

|

Maximum

|

Awarded

1

|

% of Target

|

|

John S. D’Orazio

|

Cash

|

Performance Achievements

|

$

|

—

|

|

$ 120,000

|

$ 150,000

|

$ 135,600

|

113.0

|

|

|

Equity

|

Earnings

|

—

|

|

120,000

|

|

180,000

|

|

156,000

|

|

130.0

|

|

Paul W. Nester

|

Cash

|

Performance Achievements

|

—

|

|

56,250

|

|

70,313

|

|

64,688

|

|

115.0

|

|

|

Equity

|

Earnings

|

—

|

|

45,000

|

|

67,500

|

|

58,500

|

|

130.0

|

|

Robert L. Wells, II

|

Cash

|

Performance Achievements

|

—

|

|

35,600

|

|

44,500

|

|

40,940

|

|

115.0

|

|

|

Equity

|

Earnings

|

—

|

|

26,700

|

|

40,050

|

|

34,710

|

|

130.0

|

|

Carl J. Shockley, Jr.

|

Cash

|

Performance Achievements

|

—

|

|

37,200

|

|

46,500

|

|

42,036

|

|

113.0

|

|

|

Equity

|

Earnings

|

—

|

|

27,900

|

|

41,850

|

|

36,270

|

|

130.0

|

Note 1: The Board approved the above bonus for fiscal year 2017 performance to be paid in 2018.

Other Compensation Table

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

Year

|

401(K) matching contribution

|

Insurance Premiums

|

Medical Benefits

|

Post Retirement Medical & Life Insurance Benefits

|

Stock Option Exercise

|

Total

|

|

John S. D'Orazio

|

2017

|

$ 13,500

|

$ 1,296

|

$ 18,861

|

$

|

—

|

|

$ 19,600

|

$

|

53,257

|

|

|

|

2016

|

13,250

|

|

1,342

|

|

17,019

|

|

—

|

|

2,712

|

|

34,323

|

|

|

|

2015

|

13,541

|

|

1,299

|

|

16,584

|

|

690

|

|

4,304

|

|

36,418

|

|

|

|

|

|

|

|

|

|

|

|

Paul W. Nester

|

2017

|

13,606

|

|

1,644

|

|

19,420

|

|

—

|

|

13,893

|

|

48,563

|

|

|

|

2016

|

12,428

|

|

1,494

|

|

17,282

|

|

—

|

|

2,206

|

|

33,410

|

|

|

|

2015

|

10,743

|

|

1,393

|

|

16,726

|

|

—

|

|

—

|

|

28,862

|

|

|

|

|

|

|

|

|

|

|

|

Robert L. Wells, II

|

2017

|

11,636

|

|

1,198

|

|

19,330

|

|

6,338

|

|

1,488

|

|

39,990

|

|

|

|

2016

|

10,226

|

|

1,185

|

|

16,952

|

|

5,835

|

|

3,500

|

|

37,698

|

|

|

|

2015

|

9,514

|

|

1,098

|

|

16,546

|

|

5,288

|

|

1,320

|

|

33,766

|

|

|

|

|

|

|

|

|

|

|

|

Carl J. Shockley, Jr.

|

2017

|

12,711

|

|

1,227

|

|

19,420

|

|

6,386

|

|

64,949

|

|

104,693

|

|

|

|

2016

|

8,628

|

|

1,185

|

|

17,282

|

|

5,217

|

|

—

|

|

32,312

|

|

|

|

2015

|

7,437

|

|

1,034

|

|

16,726

|

|

4,690

|

|

—

|

|

29,887

|

|

Option Exercises

|

|

|

|

|

|

|

|

Name

|

Number of Shares Acquired on Exercise

|

Value Realized Upon Exercise

|

|

John S. D‘Orazio

|

3,450

|

$ 19,600

|

|

Paul W. Nester

|

2,900

|

13,893

|

|

|

Robert L. Wells, II

|

375

|

1,488

|

|

|

Carl J. Shockley, Jr.

|

4,500

|

64,948

|

|

Outstanding Equity Awards at Fiscal Year End

The outstanding equity awards for the named executives at the end of the fiscal year had an intrinsic value of $1,448,338. The following table shows all outstanding unexercised stock options held by our named executive officers as of September 30, 2017. All stock options are vested and exercisable.

|

|

|

|

|

|

|

|

|

Name

|

Number of Unexercised Options

|

Option Exercise Price

|

Option Expiration Date

|

|

John S. D‘Orazio

|

9,750

|

$ 16.37

|

Dec 8, 2026

|

|

|

8,250

|

14.15

|

|

Dec 3, 2025

|

|

|

7,500

|

14.40

|

|

Dec 4, 2024

|

|

|

7,500

|

12.63

|

|

Dec 6, 2023

|

|

|

3,600

|

12.67

|

|

Apr 1, 2023

|

|

|

|

|

|

|

Paul W. Nester

|

7,500

|

16.37

|

|

Dec 8, 2026

|

|

|

7,500

|

14.15

|

|

Dec 3, 2025

|

|

|

6,000

|

14.40

|

|

Dec 4, 2024

|

|

|

6,000

|

12.63

|

|

Dec 6, 2023

|

|

|

3,850

|

12.67

|

|

Apr 1, 2023

|

|

|

|

|

|

|

Robert L. Wells, II

|

3,750

|

16.37

|

|

Dec 8, 2026

|

|

|

3,750

|

14.15

|

|

Dec 3, 2025

|

|

|

3,750

|

14.40

|

|

Dec 4, 2024

|

|

|

375

|

12.63

|

|

Dec 6, 2023

|

|

|

4,500

|

12.67

|

|

Apr 1, 2023

|

|

|

|

|

|

|

Carl J. Shockley, Jr.

|

4,500

|

16.37

|

|

Dec 8, 2026

|

|

|

4,500

|

14.15

|

|

Dec 3, 2025

|

|

|

4,500

|

14.40

|

|

Dec 4, 2024

|

|

|

4,500

|

12.63

|

|

Dec 6, 2023

|

Pension Benefits

The following table shows the accumulated benefits related to the RGC Resources, Inc. Employee Pension Plan (the "Pension Plan") for the named executive officers as of September 30, 2017:

|

|

|

|

|

|

|

|

|

|

Name

|

Years of Credited Service

1

|

Present Value of Accumulated Benefit

2

|

Payment During Last Fiscal Year

|

|

John S. D’Orazio

|

25

|

$ 1,070,287

|

$

|

—

|

|

|

Paul W. Nester

|

6

|

117,037

|

—

|

|

|

Robert L. Wells, II

|

30

|

802,647

|

—

|

|

|

Carl J. Shockley, Jr.

|

30

|

696,007

|

—

|

|

Note 1: The Years of Credited Service represent the years that each named executive officer has

been a participant in the Plan as of September 30, 2017, up to a maximum of 30 years.

Note 2: The Present Value of the Accumulated Benefit presented in the table above is based on a

3.72% discount rate, 4% annual compensation increase and retirement at 65 years of age.

The cost of benefits under the Plan, which are borne by Resources, are computed actuarially and defrayed by earnings from the Pension Plan's investments and/or Resources’ annual contributions. The Pension Plan generally provides for the monthly payment, at normal retirement age 65, of the greater of (a) the participant's accrued benefit as of December 31, 1988 under the formula then in effect or (b) the sum of one‑twelfth of (1) plus (2) minus (3) as follows:

|

|

|

|

(1)

|

1.2% of the participant's average compensation for the highest consecutive sixty months of service multiplied by years of credited service up to thirty years,

|

|

|

|

|

(2)

|

0.65% of the participant's average compensation for the highest consecutive sixty months of service in excess of covered compensation (generally defined as the average of Social Security wage bases over a participant's assumed working lifetime) multiplied by years of credited service up to thirty years, and

|

|

|

|

|

(3)

|

the participant's balance, if any, from the Company's former profit sharing plan.

|

Early retirement with reduced monthly benefits is available at age 55 after ten years of service. Provisions also are made for vesting of benefits after five years of service and for disability and death benefits. All employees who have completed one year of service to the Company and are credited with at least 1,000 hours of service in a Pension Plan year are eligible to participate in the Pension Plan. At age 65, for Pension Plan purposes, Mr. D’Orazio, Mr. Shockley, and Mr. Wells will have the maximum 30 credited years of service while Mr. Nester will have 27.

The compensation covered by the Plan includes the total of all amounts paid to a participant by the Company for personal services reported on the participant's federal income tax withholding statement (Form W-2), up to certain statutory limits

.

For plan years beginning January 1, 2017 and 2018 these earnings are limited to $270,000 and $275,000, respectively.

2018 Compensation and Performance Incentive Plan

The Compensation Committee is committed to pay-for-performance, paying competitively and creating an ownership culture. It has recommended salary increases that are consistent with the Company's performance in fiscal 2017 and that reasonably compare with our peers. It has also set the 2018 Performance Incentive Plan metrics to reward the achievement of the Company's objectives and personal performance and thereby drive shareholder return.

The Board approved the Compensation Committee's recommended annual base salaries beginning January 1, 2018, as shown below:

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

2018 Salary

|

Change

|

2017 Salary

|

Change

|

2016 Salary

|

|

John S. D‘Orazio

|

$ 425,000

|

6.3%

|

$ 400,000

|

6.7%

|

$ 375,000

|

|

Paul W. Nester

|

265,000

|

|

17.8%

|

225,000

|

|

4.7%

|

215,000

|

|

|

Robert L. Wells, II

|

183,000

|

|

2.8%

|

178,000

|

|

4.7%

|

170,000

|

|

|

Carl J. Shockley, Jr.

|

192,000

|

|

3.2%

|

186,000

|

|

6.3%

|

175,000

|

|

The Board approved the Compensation Committee's Performance Incentive Plan for the fiscal year ending September 30, 2018. The cash incentive bonus for each officer is based 50% on the individual's performance with respect to corporate objectives and 50% on a range of earnings results for fiscal 2018. The equity incentive bonus for each officer is based on a range of earnings results for fiscal 2018. The potential range of incentive bonuses for each officer is provided below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

Type

|

Metric

|

Minimum

|

Target

|

Maximum

|

|

John S. D’Orazio

|

Cash

|

Performance Achievements

|

$

|

—

|

|

$ 148,750

|

$ 185,938

|

|

|