Company Raises 2017 Guidance

Nomad Foods Limited (NYSE: NOMD), today reported financial

results for the three and nine month periods ended

September 30, 2017. Key operating highlights and financial

performance for the third quarter 2017, when compared to the third

quarter 2016, include:

- Reported revenue increased 4.4% to

€459 million

- Organic revenue growth of

5.9%

- Reported Profit for the period of

€42 million

- Adjusted EBITDA decreased 8% to €79

million

- Reported EPS of €0.24; Adjusted EPS

increased 9% to €0.24

- Company raises 2017 Adjusted EBITDA

guidance to approximately €325 to €327 million

Management Comments

Stéfan Descheemaeker, Nomad Foods’ Chief Executive Officer,

stated, “We experienced strong growth in the third quarter with

revenue, gross margin and adjusted EBITDA exceeding our

expectation. Results, including 5.9% organic revenue growth,

reflect favorable category performance coupled with market share

gains. We are pleased by the momentum in the business, with Q3

representing a third consecutive quarter of organic revenue growth

and market share expansion. Based on our year-to-date performance,

we are raising our 2017 guidance.”

Noam Gottesman, Nomad Foods’ Co-Chairman and Founder, commented,

“Third quarter results reflect another quarter of solid execution

and further validation of our growth strategy. Our momentum is

underpinned by a strong balance sheet and a portfolio of iconic,

market leading brands. As a result, we continue to be encouraged by

our growth prospects within European frozen and beyond."

Third Quarter of 2017 results compared to the Third Quarter

of 2016

- Revenue increased 4.4% to €459

million. Organic revenue growth of 5.9% was driven by 4.1%

growth in volume/mix and 1.8% growth in price.

- Gross profit increased 8.6% to

€139 million. Gross margin expanded 120 basis points to 30.3%

driven by positive mix and improved pricing and promotional

efficiency.

- Adjusted Operating expense

increased 27% to €71 million. Advertising and promotion expense

increased 3% to €23 million. Indirect expense increased 43% to €49

million as the quarterly bonus accrual in the current period

compared to the reversal of the year-to-date bonus accrual in the

prior year period.

- Adjusted EBITDA decreased 8% to

€79 million due to the aforementioned factors. Foreign exchange

currency translation adversely affected adjusted EBITDA by €1

million.

- Adjusted Profit after tax

increased 2% to €42 million reflecting interest rate savings and

lower depreciation and amortization. Adjusted EPS increased

9% to €0.24, reflecting Adjusted Profit growth and a lower share

count.

First Nine Months of 2017 results compared to the First Nine

Months of 2016

- Revenue increased 0.4% to €1,448

million. Organic revenue growth of 3.3% was driven by 2.6%

growth in volume/mix and 0.7% growth in price.

- Gross profit increased 1.0% to

€439 million. Gross margin expanded 10 basis points to 30.3% as

positive mix and improved pricing and promotional efficiencies were

offset by currency driven inflation. Foreign exchange currency

translation adversely impacted gross margin by 20 basis

points.

- Adjusted Operating expense

increased 7% to €225 million. Advertising and promotion expense

increased 3% to €78 million. Indirect expense increased 10% to €147

million as the bonus accrual in the current period compared to the

reversal of the year-to-date bonus accrual in the prior year

period.

- Adjusted EBITDA decreased 6% to

€247 million due to the aforementioned factors. Foreign exchange

currency translation adversely affected adjusted EBITDA by €9

million.

- Adjusted Profit after tax

decreased 1% to €130 million. Adjusted EPS was unchanged at

€0.72 reflecting Adjusted Profit decline and a lower share

count.

2017 GuidanceThe Company raises its 2017 Adjusted EBITDA

outlook to a range of approximately €325 to €327 million versus the

prior expectation of approximately €320 to €325 million. Full year

guidance now assumes organic revenue growth of approximately 3%

versus the prior expectation of growth at a low-single digit

percentage rate.

Conference Call and WebcastThe Company will host a

conference call with members of the executive management team to

discuss these results today, Tuesday, November 28, 2017 at 1:30

p.m. GMT time (8:30 a.m. Eastern time). Investors interested in

participating in the live call can dial +1-888-778-9064 from the

U.S. International callers can dial +1-719-325-4870.

In addition, the call will be broadcast live over the internet

hosted at the “Investor Relations” section of the Company’s website

at http://www.nomadfoods.com. The webcast will be archived

for 30 days. A replay of the conference call will be available on

the Company website for two weeks following the event and can be

accessed by listeners in North America by dialing +1-844-512-2921

and by international listeners by dialing +1-412-317-6671; the

replay pin number is 7162444.

About Nomad FoodsNomad Foods (NYSE: NOMD) is a leading

frozen foods company building a global portfolio of best-in-class

food companies and brands within the frozen category and across the

broader food sector. Nomad Foods produces, markets and distributes

brands in 17 countries and has the leading market share in Western

Europe. The Company’s portfolio of leading frozen food brands

includes Birds Eye, Iglo, and Findus. More information on Nomad

Foods Limited is available at http://www.nomadfoods.com.

Non-IFRS Financial InformationNomad Foods is presenting

Adjusted and Organic financial information, which is considered

non-IFRS financial information, for the three and nine months ended

September 30, 2017 and for comparative purposes, the three and

nine months ended September 30, 2016.

Adjusted financial information for the three and nine months

ended September 30, 2017 and 2016 presented in this press

release reflects the historical reported financial statements of

Nomad Foods, adjusted primarily for share based payment charges,

exceptional items and foreign currency exchange charges/gains.

EBITDA is profit or loss for the period before taxation, net

financing costs, depreciation and amortization. Adjusted EBITDA is

EBITDA adjusted to exclude (when they occur) exited markets,

trading day impacts, chart of account (“CoA”) alignments and

exceptional items such as restructuring charges, goodwill and

intangible asset impairment charges, the impact of share based

payment charges, charges relating to the Founders Preferred Shares

Annual Dividend Amount, charges relating to the redemption of

warrants and other unusual or non-recurring items. The Company

believes Adjusted EBITDA provides important comparability of

underlying operating results, allowing investors and management to

assess operating performance on a consistent basis.

Adjusted EBITDA should not be considered as an alternative to

profit/(loss) for the period, determined in accordance with IFRS,

as an indicator of the Company’s operating performance.

Adjusted EPS is defined as basic earnings per share excluding,

when they occur, the impacts of exited markets, trading day

impacts, chart of account (“CoA”) alignments and exceptional items

such as restructuring charges, goodwill and intangible asset

impairment charges, share based compensation expense, unissued

preferred share dividends, and other non-operating items as well as

certain other items considered unusual or non-recurring in nature.

The Company believes Adjusted EPS provides important comparability

of underlying operating results, allowing investors and management

to assess operating performance on a consistent basis.

Organic revenue for the three and nine months ended

September 30, 2017 and 2016 presented in this press release

reflects reported revenue adjusted for currency translation and

non-comparable trading items such as expansion, acquisitions,

disposals, closures, chart of account (“CoA”) alignments, trading

day impacts or any other event that artificially impact the

comparability of our results.

Adjustments for currency translation are calculated by

translating data of the current and comparative periods using a

budget foreign exchange rate that is set once a year as part of the

Company's internal annual forecast process.

Adjusted and Organic non-IFRS financial information should be

read in conjunction with the unaudited financial statements of

Nomad Foods included in this press release as well as the

historical financial statements of the Company previously filed

with the SEC.

Nomad Foods believe its non-IFRS financial measures provide an

important additional measure with which to monitor and evaluate the

Company’s ongoing financial results, as well as to reflect its

acquisitions. Nomad Foods’ calculation of these financial measures

may be different from the calculations used by other companies and

comparability may therefore be limited. The Adjusted and Organic

financial information presented herein is based upon certain

assumptions that Nomad Foods believes to be reasonable and is

presented for informational purposes only and is not necessarily

indicative of any anticipated financial position or future results

of operations that the Company will experience. You should not

consider the Company’s non-IFRS financial measures an alternative

or substitute for the Company’s reported results and are cautioned

not to place undue reliance on these results and information as

they may not be representative of our actual or future results as a

Company.

Please see on pages 8 to 16, the non-IFRS reconciliation tables

attached hereto and the schedules accompanying this release for an

explanation and reconciliation of the Adjusted and Organic

financial information to the most directly comparable IFRS

measure.

Nomad Foods Limited As Reported Statements of

Profit or Loss (unaudited) Three months ended September 30,

2017 and September 30, 2016

Three months endedSeptember 30,

2017

Three months endedSeptember 30,

2016

€ millions € millions Revenue 459.0 439.5 Cost of

sales (320.0 ) (311.5 )

Gross profit 139.0

128.0 Other operating expenses (71.4 ) (56.1 ) Exceptional

items (5.4 ) (34.1 )

Operating profit 62.2

37.8 Finance income 3.9 5.6 Finance costs (12.5 ) (21.9 )

Net financing costs (8.6 ) (16.3

) Profit before tax 53.6 21.5 Taxation

(11.7 ) (17.9 )

Profit for the period 41.9

3.6 Basic earnings per share Profit for the

period in € millions 41.9 3.6 Weighted average shares outstanding

in millions 172.4 183.6

Basic earnings per share in €

0.24 0.02 Diluted earnings per share Profit

for the period in € millions 41.9 3.6 Weighted average shares

outstanding in millions 172.4 183.6

Diluted earnings per share

in € 0.24 0.02 Nomad Foods

Limited As Reported Statements of Profit or Loss

(unaudited) Nine months ended September 30, 2017 and

September 30, 2016

Nine months endedSeptember 30,

2017

Nine months endedSeptember 30,

2016

€ millions € millions Revenue 1,448.4 1,442.5 Cost of

sales (1,009.0 ) (1,007.4 )

Gross profit 439.4

435.1 Other operating expenses (227.6 ) (210.9 ) Exceptional

items (16.8 ) (112.3 )

Operating profit 195.0

111.9 Finance income 9.2 24.8 Finance costs (66.2 ) (64.7 )

Net financing costs (57.0 ) (39.9

) Profit before tax 138.0 72.0 Taxation

(28.8 ) (33.5 )

Profit for the period 109.2

38.5 Basic earnings per share Profit for the

period in € millions 109.2 38.5 Weighted average shares outstanding

in millions 179.2 183.4

Basic earnings per share in €

0.61 0.21 Diluted earnings per share Profit

for the period in € millions 109.2 38.5 Weighted average shares

outstanding in millions 179.2 183.4

Diluted earnings per share

in € 0.61 0.21 Nomad Foods

Limited As Reported Statements of Financial Position

As at September 30, 2017 (unaudited) and December 31, 2016

(audited) As at September 30,

2017 As at December 31, 2016 € millions €

millions Non-current assets Goodwill 1,745.6 1,745.6

Intangibles 1,723.4 1,726.6 Property, plant and equipment 293.6

298.2 Other receivables 1.3 0.4 Derivative financial instruments

18.7 — Deferred tax assets 68.0 64.9

Total

non-current assets 3,850.6 3,835.7

Current assets Cash and cash equivalents 178.1 329.5

Inventories 330.6 325.0 Trade and other receivables 142.3 135.7

Indemnification assets 73.8 65.5 Capitalized borrowing costs — 5.0

Derivative financial instruments 6.0 13.1

Total

current assets 730.8 873.8 Total

assets 4,581.4 4,709.5 Current

liabilities Trade and other payables 459.2 472.7 Current tax

payable 158.3 162.3 Provisions 78.8 116.7 Current portion of loans

and borrowings 4.1 — Derivative financial instruments 11.7

1.4

Total current liabilities 712.1

753.1 Non-current liabilities Loans and

borrowings 1,403.8 1,451.8 Employee benefits 187.8 190.9 Trade and

other payables 1.8 1.0 Provisions 74.8 77.0 Derivative financial

instruments 54.8 — Deferred tax liabilities 327.5 333.2

Total non-current liabilities 2,050.5

2,053.9 Total liabilities 2,762.6

2,807.0 Net assets 1,818.8

1,902.5 Equity attributable to equity

holders Share capital — — Capital reserve 1,623.7 1,800.7 Share

based compensation reserve 2.7 1.0 Founder Preferred Share Dividend

reserve 493.4 493.4 Translation reserve 80.1 84.0 Cash flow hedging

reserve (7.9 ) 8.4 Accumulated deficit (373.2 ) (485.0 )

Total

equity 1,818.8 1,902.5

Nomad Foods Limited As Reported Statements of Cash

Flows (unaudited) For the nine months ended September 30,

2017 and the nine months ended September 30, 2016

For the nine months

endedSeptember 30, 2017

For the nine months

endedSeptember 30, 2016

€ millions € millions Cash flows from operating

activities Profit for the period 109.2

38.5 Adjustments for: Exceptional items 16.8 112.3 Share

based payment expense 2.4 0.8 Depreciation and amortization 32.4

37.8 Loss on disposal of property, plant and equipment 0.2 0.4

Finance costs 66.2 64.7 Finance income (9.2 ) (24.8 ) Taxation 28.8

33.5

Operating cash flow before changes in working

capital, provisions and exceptional items 246.8

263.2 Increase in inventories (9.0 ) (25.0 ) Increase in

trade and other receivables (8.1 ) (9.9 ) (Decrease)/increase in

trade and other payables (7.7 ) 6.6 Increase/(decrease) in employee

benefits and other provisions 2.0 (2.5 )

Cash generated

from operations before tax and exceptional items 224.0

232.4 Cash flows relating to exceptional items (71.3 ) (40.7

) Tax paid (32.2 ) (7.7 )

Net cash generated from operating

activities 120.5 184.0 Cash

flows from investing activities Contingent consideration for

purchase of Frudesa brand — (8.0 ) Purchase of property, plant and

equipment (26.0 ) (17.7 ) Purchase of intangibles (2.5 ) (0.5 )

Cash used in investing activities (28.5 )

(26.2 ) Cash flows from financing activities

Repurchase of ordinary shares (177.6 ) — Issuance of new loan

principal 1,470.5 — Repayment of loan principal (1,469.5 ) —

Payment of finance leases (1.6 ) (0.6 ) Loss on settlement of

derivatives (2.4 ) (3.4 ) Payment of financing fees (13.6 ) —

Interest paid (32.9 ) (53.2 ) Interest received 0.3 8.4

Net cash used in financing activities (226.8

) (48.8 ) Net (decrease)/increase in cash

and cash equivalents (134.8 ) 109.0

Cash and cash equivalents at beginning of period

329.5 186.1 Effect of exchange rate fluctuations

(16.6 ) (26.3 )

Cash and cash equivalents at end of

period(a) 178.1 268.8

(a) Cash and cash equivalents comprise cash at bank of €178.1

million (September 30, 2016: cash at bank of €271.0 million

less bank overdrafts of €2.2 million).

Nomad Foods LimitedAdjusted Financial

Information(In € millions, except per share data)

The following table reconciles Adjusted financial information

for the three months ended September 30, 2017 to the reported

results of Nomad Foods for such period.

Adjusted Statements of Profit or Loss (unaudited)

Three Months Ended September 30, 2017

€ in millions, except per share data

As reported for thethree months

endedSeptember 30, 2017

Adjustments

As Adjusted for thethree months

endedSeptember 30, 2017

Revenue 459.0 — 459.0

Cost of sales

(320.0 ) — (320.0 )

Gross profit 139.0

— 139.0 Other operating expenses (71.4 ) 0.3 (a)

(71.1 ) Exceptional items (5.4 ) 5.4 (b) —

Operating profit 62.2 5.7 67.9 Finance

income 3.9 (3.8 ) 0.1 Finance costs (12.5 ) (0.9 ) (13.4 )

Net

financing costs (8.6 ) (4.7 ) (c)

(13.3 ) Profit before tax 53.6

1.0 54.6 Taxation (11.7 ) (0.9 ) (d) (12.6 )

Profit for the period 41.9 0.1

42.0 Weighted average shares outstanding in millions

- basic 172.4 172.4

Basic earnings per share 0.24

0.24 Weighted average shares outstanding in millions -

diluted 172.4 172.4

Diluted earnings per share 0.24

0.24

(a) Adjustment to add back share based payment charge.(b)

Adjustment to add back exceptional items which management believes

are non-recurring and do not have a continuing impact. See

table ‘EBITDA and Adjusted EBITDA (unaudited) three months ended

September 30, 2017’ for a detailed list of exceptional items.(c)

Adjustment to eliminate €0.3 million of non-cash foreign exchange

translation gains and €4.4 million of foreign exchange gains on

derivatives.(d) Adjustment to reflect the tax impact of the above

at the applicable tax rate for each adjustment, determined by the

nature of the item and the jurisdiction in which it arises.

Nomad Foods LimitedAdjusted Financial

Information(In € millions)

The following table reconciles EBITDA and Adjusted EBITDA for

the three months ended September 30, 2017 to the reported results

of Nomad Foods for such period.

EBITDA and Adjusted EBITDA (unaudited) Three

Months Ended September 30, 2017 € in millions

Three months endedSeptember 30,

2017

Profit for the period 41.9 Taxation 11.7 Net

financing costs 8.6 Depreciation 8.6 Amortization 2.0

EBITDA 72.8 Exceptional items: Investigation and

implementation of strategic opportunities and other items 3.1 (a)

Findus Group integration costs 2.3 (b) Other Adjustments: Share

based payment charge 0.3 (c)

Adjusted EBITDA(d)

78.5

(a) Elimination of costs incurred in relation to investigation

and implementation of strategic opportunities and other items

considered non-recurring for the combined group following

acquisitions by the Company. These costs include commercial

reorganization of the combined businesses and settlements.(b)

Elimination of non-recurring costs related to the integration of

the Findus Group, primarily relating to the rollout of the Nomad

ERP system.(c) Elimination of share based payment charge.(d)

Adjusted EBITDA margin of 17.1% for the three months ended

September 30, 2017 is calculated by dividing Adjusted EBITDA by

Adjusted revenue of €459.0 million per page 8.

Nomad Foods LimitedAdjusted Financial

Information(In € millions, except per share data)

The following table reconciles Adjusted financial information

for the three months ended September 30, 2016 to the reported

results of Nomad Foods for such period.

Adjusted Statements of Profit or Loss

(unaudited)

Three Months Ended September 30,

2016

€ in millions, except per share data

As reported for thethree months

endedSeptember 30, 2016

Adjustments

As Adjusted for thethree months

endedSeptember 30, 2016

Revenue 439.5 — 439.5 Cost of sales (311.5 ) — (311.5 )

Gross profit 128.0 — 128.0 Other

operating expenses (56.1 ) 0.2 (a) (55.9 ) Exceptional items (34.1

) 34.1 (b) —

Operating profit 37.8

34.3 72.1 Finance income 5.6 (4.0 ) 1.6 Finance costs

(21.9 ) 1.2 (20.7 )

Net financing costs (16.3

) (2.8 ) (c)

(19.1 ) Profit

before tax 21.5 31.5 53.0 Taxation (17.9 )

6.1 (d) (11.8 )

Profit for the period 3.6

37.6 41.2 Weighted average

shares outstanding in millions - basic 183.6 183.6

Basic

earnings per share 0.02 0.22 Weighted average

shares outstanding in millions - diluted 183.6 183.6

Diluted

earnings per share 0.02 0.22

(a) Adjustment to add back share based payment charge(b)

Adjustment to add back exceptional items which management believes

do not have a continuing impact. See table ‘EBITDA and Adjusted

EBITDA (unaudited) three months ended September 30, 2016’ for a

detailed list of exceptional items.(c) Adjustment to eliminate €4.0

million of non-cash foreign exchange translation gains and €1.2

million foreign exchange loss on derivatives.(d) Adjustment to

reflect the tax impact of the above at the applicable tax rate for

each exceptional item, determined by the nature of the item and the

jurisdiction in which it arises.

Nomad Foods LimitedAdjusted Financial

Information(In € millions)

The following table reconciles EBITDA and Adjusted EBITDA for

the three months ended September 30, 2016 to the reported results

of Nomad Foods for such period.

EBITDA and Adjusted EBITDA

(unaudited)

Three Months Ended September 30,

2016

€ in millions

Three months endedSeptember 30,

2016

Profit for the period 3.6 Taxation 17.9 Net financing

costs 16.3 Depreciation 11.3 Amortization 1.7

EBITDA

50.8 Exceptional items: Costs related to transactions 1.3

(a) Cisterna fire costs 0.1 (b) Investigation and implementation of

strategic opportunities and other items 1.8 (c) Supply chain

reconfiguration 35.2 (d) Other restructuring costs 0.8 (e) Findus

Group integration costs 12.5 (f) Remeasurement of indemnification

assets (17.6 ) (g) Other Adjustments: Share based payment charge

0.2 (h)

Adjusted EBITDA(i) 85.1

(a) Elimination of costs incurred in relation to completed

acquisitions.(b) Adjustment to add back incremental costs incurred

as a result of an August 2014 fire in the Iglo Group’s Italian

production facility.(c) Elimination of costs incurred in relation

to investigation and implementation of strategic opportunities and

other items considered non-recurring for the combined group

following acquisitions by the Company. These costs include

commercial reorganization of the combined businesses and

professional fees on pre-existing tax audits.(d) Elimination of

supply chain reconfiguration costs, namely the closure of the Bjuv

factory.(e) Elimination of other restructuring costs associated

with operating locations.(f) Elimination of costs recognized by

Nomad Foods relating to the integration of the Findus Group.(g)

Adjustment to reflect the remeasurement of the indemnification

assets recognized on the acquisition of the Findus Group, which is

capped at the value of shares held in escrow at the share price as

at June 30, 2016.(h) Elimination of share based payment charge.(i)

Adjusted EBITDA margin 19.4% for the three months ended September

30, 2016 is calculated by dividing Adjusted EBITDA by Adjusted

revenue of €439.5 million per page 10.

Nomad Foods LimitedAdjusted Financial

Information(In € millions, except per share data)

The following table reconciles Adjusted financial information

for the nine months ended September 30, 2017 to the reported

results of Nomad Foods for such period.

Adjusted Statements of Profit or Loss (unaudited)

Nine Months Ended September 30, 2017 € in

millions, except per share data

As reported for thenine months

endedSeptember 30, 2017

Adjustments

As Adjusted for thenine months

endedSeptember 30, 2017

Revenue 1,448.4 — 1,448.4 Cost of sales (1,009.0 ) —

(1,009.0 )

Gross profit 439.4 — 439.4

Other operating expenses (227.6 ) 2.4 (a) (225.2 ) Exceptional

items (16.8 ) 16.8 (b) —

Operating profit

195.0 19.2 214.2 Finance income 9.2 (8.9 ) 0.3

Finance costs (66.2 ) 20.2 (46.0 )

Net financing

costs (57.0 ) 11.3 (c)

(45.7

) Profit before tax 138.0 30.5

168.5 Taxation (28.8 ) (10.0 ) (d) (38.8 )

Profit for the

period 109.2 20.5 129.7

Weighted average shares outstanding in millions - basic

179.2 179.2

Basic earnings per share 0.61 0.72

Weighted average shares outstanding in millions - diluted 179.2

179.2

Diluted earnings per share 0.61 0.72

(a) Adjustment to add back share based payment charge.(b)

Adjustment to eliminate exceptional items which management believes

are non-recurring and do not have a continuing impact. See

table ‘EBITDA and Adjusted EBITDA (unaudited) nine months ended

September 30, 2017’ for a detailed list of exceptional items.(c)

Adjustment to eliminate €19.5 million of costs incurred as part of

the refinancing on the May 3, 2017, €2.2 million of foreign

exchange translation losses and €10.4 million of foreign currency

gains on derivatives.(d) Adjustment to reflect the tax impact of

the above at the applicable tax rate for each adjustment,

determined by the nature of the item and the jurisdiction in which

it arises.

Nomad Foods LimitedAdjusted Financial

Information(In € millions)

The following table reconciles EBITDA and Adjusted EBITDA for

the nine months ended September 30, 2017 to the reported results of

Nomad Foods for such period:

EBITDA and Adjusted EBITDA

(unaudited)

Nine Months Ended September 30,

2017

€ in millions

Nine months endedSeptember 30,

2017

Profit for the period 109.2 Taxation 28.8 Net

financing costs 57.0 Depreciation 26.6 Amortization 5.8

EBITDA 227.4 Exceptional items: Costs related to

transactions 2.5 (a) Investigation and implementation of strategic

opportunities and other items 14.6 (b) Findus Group integration

costs 8.0 (c) Remeasurement of indemnification assets (8.3 ) (d)

Other Adjustments: Share based payment charge 2.4 (e)

Adjusted EBITDA(f) 246.6

(a) Elimination of costs incurred in relation to completed and

potential acquisitions and one-off compliance costs incurred as a

result of listing on the New York Stock Exchange.(b) Elimination of

costs incurred in relation to investigation and implementation of

strategic opportunities and other items considered non-recurring

for the combined group following acquisitions by the Company. These

costs include commercial reorganization of the combined businesses

and settlements of pre-existing tax audits.(c) Elimination of

non-recurring costs related to the integration of the Findus Group,

primarily relating to the rollout of the Nomad ERP system.(d)

Adjustments to reflect the remeasurement of the indemnification

assets recognized on the acquisition of the Findus Group, which is

capped at the value of shares held in escrow at the share price as

at September 30, 2017. Offsetting are the release of

indemnification assets associated with final settlement of

indemnity claims against an affiliate of Permira Advisors LLP,

which are legacy tax matters that predate the Company's acquisition

of Iglo Group in 2015.(e) Elimination of share based payment

charge.(f) Adjusted EBITDA margin of 17.0% for the nine months

ended September 30, 2017 is calculated by dividing Adjusted EBITDA

by Adjusted revenue of €1,448.4 million per page 12.

Nomad Foods LimitedAdjusted Financial

Information(In € millions, except per share data)

The following table reconciles Adjusted financial information

for the nine months ended September 30, 2016 to the reported

results of Nomad Foods for such period:

Adjusted Statements of Profit or Loss (unaudited)

Nine Months Ended September 30, 2016 € in

millions, except per share data

As reported for thenine months

endedSeptember 30, 2016

Adjustments

As Adjusted for thenine months

endedSeptember 30, 2016

Revenue 1,442.5 — 1,442.5

Cost of sales

(1,007.4 ) — (1,007.4 )

Gross profit 435.1

— 435.1 Other operating expenses (210.9 ) 0.8 (a)

(210.1 ) Exceptional items (112.3 ) 112.3 (b) —

Operating profit 111.9 113.1 225.0

Finance income 24.8 (18.5 ) 6.3 Finance costs (64.7 ) 3.4

(61.3 )

Net financing costs (39.9 )

(15.1 ) (c)

(55.0 ) Profit before

tax 72.0 98.0 170.0 Taxation (33.5 ) (5.2

) (d) (38.7 )

Profit for the period 38.5

92.8 131.3 Weighted average shares

outstanding in millions - basic 183.4 183.4

Basic earnings per

share 0.21 0.72 Weighted average shares

outstanding in millions - diluted 183.4 183.4

Diluted earnings

per share 0.21 0.72

(a) Adjustment to add back share based payment charge(b)

Adjustment to add back exceptional items which management believes

do not have a continuing impact. See table ‘EBITDA and Adjusted

EBITDA (unaudited) nine months ended September 30, 2016’ for a

detailed list of exceptional items.(c) Adjustment to eliminate

€18.5 million of non-cash foreign exchange translation gains and

€3.4 million foreign exchange loss on derivatives.(d) Adjustment to

reflect the tax impact of the above at the applicable tax rate for

each adjustment, determined by the nature of the item and the

jurisdiction in which it arises.

Nomad Foods LimitedAdjusted Financial

Information(In € millions)

The following table reconciles EBITDA and Adjusted EBITDA for

the nine months ended September 30, 2016 to the reported results of

Nomad Foods for such period:

EBITDA and Adjusted EBITDA (unaudited) Nine Months

Ended September 30, 2016 € in millions

Nine months endedSeptember 30,

2016

Profit for the period 38.5 Taxation 33.5 Net

financing costs 39.9 Depreciation 32.8 Amortization 5.0

EBITDA 149.7 Exceptional items: Costs related to

transactions 3.0 (a) Costs related to management incentive plans

1.9 (b) Investigation and implementation of strategic opportunities

and other items 7.2 (c) Cisterna fire costs 0.4 (d) Supply chain

reconfiguration 74.9 (e) Other restructuring costs (0.1 ) (f)

Findus Group integration costs 25.0 (g) Remeasurement of

indemnification assets — (h) Other Adjustments: Share based payment

charge 0.8 (i)

Adjusted EBITDA(j) 262.8

(a) Elimination of costs incurred in relation to completed and

potential acquisitions.(b) Adjustment to eliminate long term

management incentive scheme costs from prior ownership.(c)

Elimination of costs incurred in relation to investigation and

implementation of strategic opportunities and other items

considered non-recurring for the combined group following

acquisitions by the Company. These costs include commercial

reorganization of the combined businesses and professional fees on

pre-existing tax audits.(d) Adjustment to add back incremental

costs incurred as a result of an August 2014 fire in the Iglo

Group’s Italian production facility.(e) Elimination of supply chain

reconfiguration costs, namely the closure of the Bjuv factory.(f)

Elimination of other restructuring costs associated with operating

locations.(g) Elimination of costs recognized by Nomad Foods

relating to the integration of the Findus Group.(h) Adjustment to

reflect the remeasurement of the indemnification assets recognized

on the acquisition of the Findus Group, which is capped at the

value of shares held in escrow at the share price as at June 30,

2016.(i) Elimination of share based payment charge.(j) Adjusted

EBITDA margin 18.2% for the nine months ended September 30, 2016 is

calculated by dividing Adjusted EBITDA by Adjusted revenue of

€1,442.5 million per page 14.

Nomad Foods LimitedAdjusted Financial Information

(continued)

Appendix 1: Reconciliation from reported to organic

revenue growth

Year on Year Growth - Three and nine months

September 30, 2017 compared with September 30,

2016:

Three Months EndedSeptember 30,

2017

Nine Months EndedSeptember 30,

2017

YoY Growth YoY Growth Reported Revenue Growth

4.4 % 0.4 % Trading Day Impact — % 0.7

% Translational FX (a) 1.5 % 2.2 %

Organic Revenue Growth

5.9 % 3.3 %

(a) Translational FX is calculated by translating data of the

current and comparative periods using a budget foreign exchange

rate that is set once a year as part of the Company's internal

annual forecast process.

Forward-Looking

Statements

Forward-Looking Statements and Disclaimers

Certain statements in this announcement are forward-looking

statements which are based on the Company’s expectations,

intentions and projections regarding its future performance,

anticipated events or trends and other matters that are not

historical facts, including expectations regarding (i) the

Company’s ability to expand its presence in the frozen foods

market; (ii) the success of the Company’s strategic initiatives;

(iii) completion of successful acquisitions in the same and

adjacent categories; (iv) the future operating and financial

performance of the Company including our guidance with respect to

Adjusted EBITDA; and (v) synergies from combining the Findus and

Iglo businesses. These statements are not guarantees of future

performance and are subject to known and unknown risks,

uncertainties and other factors that could cause actual results to

differ materially from those expressed or implied by such

forward-looking statements, including (i) economic conditions,

competition and other risks that may affect the Company’s future

performance; (ii) the risk that securities markets will react

negatively to actions by the Company; (iii) the ability to

recognize the anticipated benefits to the Company of strategic

initiatives; (iv) the successful completion of strategic

acquisitions; (v) changes in applicable laws or regulations; and

(vi) the other risks and uncertainties disclosed in the Company’s

public filings and any other public disclosures by the Company.

Given these risks and uncertainties, prospective investors are

cautioned not to place undue reliance on forward-looking

statements. Forward-looking statements speak only as of the date of

such statements and, except as required by applicable law, the

Company does not undertake any obligation to update or revise

publicly any forward-looking statements, whether as a result of new

information, future events or otherwise.

No Offer or Solicitation

This release and referenced conference call is provided for

informational purposes only and does not constitute an offer to

sell, or an invitation to subscribe for, purchase or exchange, any

securities or the solicitation of any vote or approval in any

jurisdiction, nor shall there be any sale, issuance, exchange or

transfer of the securities referred to in this press release in any

jurisdiction in contravention of applicable law.

The release, publication or distribution of this announcement in

certain jurisdictions may be restricted by law and therefore

persons in such jurisdictions into which this announcement is

released, published or distributed should inform themselves about

and observe such restrictions.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171128005187/en/

Nomad Foods ContactsInvestor Relations

ContactsNomad Foods LimitedTaposh Bari,

+1-718-290-7950CFAorICRJohn Mills, +1-646-277-1254PartnerorMedia

ContactWeber ShandwickLiz Cohen, +1-212-445-8044

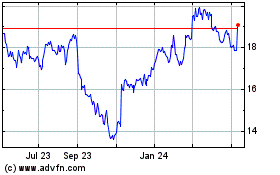

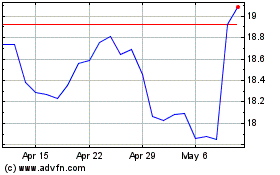

Nomad Foods (NYSE:NOMD)

Historical Stock Chart

From Aug 2024 to Sep 2024

Nomad Foods (NYSE:NOMD)

Historical Stock Chart

From Sep 2023 to Sep 2024