Filed by

Emerson Electric Co.

(Commission

File No.: 001-00278)

Pursuant to

Rule 425 of the Securities Act of 1933

and deemed filed

pursuant to Rule 14a-12

of the Securities

Exchange Act of 1934

Subject Company:

Rockwell Automation, Inc.

(Commission

File No.: 001-12383)

The

following slides were made available on Emerson’s internal website:

1 Emerson + Rockwell Automation: A Compelling Value Creation Opportunity for Shareholders November 16, 2017

2 Important Information for Investors and Stockholders This presentation relates to a proposal which Emerson has made for an acquisition of Rockwell. In furtherance of this proposa l a nd subject to future developments, Emerson (and, if a negotiated transaction is agreed, Rockwell) may file one or more registration statements, pr oxy statements, tender offer statements or other documents with the Securities and Exchange Commission (“SEC”). This presentation is not a substitut e f or any proxy statement, registration statement, tender offer statement or other document Emerson and/or Rockwell may file with the SEC in con nection with the proposed transaction. Investors and security holders of Emerson and Rockwell are urged to read the proxy statement(s), registration statement, tend er offer statement and/or other documents filed with the SEC carefully in their entirety if and when they become available as they will contain importa nt information about the proposed transaction. Any definitive proxy statement(s) (if and when available) will be mailed to stockholders of Emerson and /or Rockwell, as applicable. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other docume nts filed with the SEC by Emerson through the website maintained by the SEC at http://www.sec.gov . This presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall ther e b e any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the sec uri ties laws of any jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Secur iti es Act of 1933, as amended. This presentation is neither a solicitation of a proxy nor a substitute for any proxy statement or other filing that may be m ade with the SEC. Nonetheless, Emerson and its directors and certain of its executive officers may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Emerson is set forth in its Annual Report on Form 10 - K fo r the year ended September 30, 2016, which was filed with the SEC on November 16, 2016, its proxy statement for its 2017 annual meeting of sha reh olders, which was filed with the SEC on December 9, 2016, and its Current Reports on Form 8 - K, which were filed with the SEC on May 2, 2017, May 1 9, 2017 and November 14, 2017. Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be fil ed with the SEC when they become available. Any information concerning Rockwell contained in this filing has been taken from, or based upon, publicly available informati on. Although Emerson does not have any information that would indicate that any information contained in this filing that has been taken from such docu men ts is inaccurate or incomplete, Emerson does not take any responsibility for the accuracy or completeness of such information. To date, Emerson h as not had access to the books and records of Rockwell. Cautionary Statement Regarding Forward - Looking Statements Statements in this presentation that are not strictly historical may be "forward - looking" statements, which involve risks and un certainties, and Emerson undertakes no obligation to update any such statements to reflect later developments. These risks and uncertainties include t he Company's ability to successfully complete on the terms and conditions contemplated (including the possibility that Rockwell will reject the propo sed transaction with Emerson), and the financial impact of, the proposed acquisition of Rockwell, Emerson’s ability to achieve the synergies and v alu e creation contemplated by the proposed acquisition, Emerson’s ability to promptly and effectively integrate Rockwell’s businesses, the diversion of man agement time on acquisition - related issues, as well as economic and currency conditions, market demand, pricing, protection of intellectual prop erty, and competitive and technological factors, among others, as set forth in Emerson's most recent Annual Report on Form 10 - K and subsequent reports fi led with the SEC.

3 Highly Strategic & Complementary Combination Enhanced Offering for Global Growth Expanded End Market Solutions Clear, Achievable Synergies Complementary Cultures ▪ Creates a global automation leader; #1 in Process and Hybrid automation and joint leader in Discrete automation ▪ Positioned for accelerated growth given b roadest and deepest automation product set with full technology suite in developed markets plus unique positioning in emerging markets ▪ Creates the leader in attacking the IT/OT convergence across all automation applications with enhanced investment, scale and strategic relevance given ability to combine automation and enterprise software layers more effectively ▪ Clear and achievable cost synergies and significant sales synergies which should continue to grow over time as product technologies further converge ▪ Commitment to a “best of both” approach bringing together two organizations with shared values of consistent performance , operational excellence and continuous improvement Bringing Together Two Great Automation Companies to Drive Long - Term Value Creation Better Solutions for Customers ▪ Fulfills customer demand for an integrated solution – not a single platform – that combines the best devices at the plant level with controls and software that work effectively together ▪ Immediate attractive value for Rockwell shareholders plus opportunity for all shareholders to participate in value creation through synergies and enhanced growth, profits and cash flow Compelling Shareholder Value

4 4 Overview of the Revised Proposal Seeking to Engage with Rockwell and Work Toward a Value - Creating Transaction • $225/share consisting of $135/share in cash and $90/share in Emerson shares • 30% premium to Rockwell Automation’s 90 - day undisturbed VWAP Proposed Offer Value Creation • Over $8B total value creation representing $62/share for Rockwell Automation’s shareholders which represents 36% total premium including the upfront cash and continued ownership • $6B in estimated capitalized value of identified synergies to be shared • Accretive to adjusted EPS (1) and free cash flow in year one Capital Structure • Commitment to maintaining investment grade rating with strong cash generation and deleveraging • Commitment to returning capital to shareholders with a strong and growing dividend Leadership and Governance • Combined company to be named “Emerson Rockwell” and Rockwell to have board representation • “ Best of both” management philosophy with significant roles for Rockwell Automation’s management and creation of automation center of excellence in Milwaukee (1) Excludes transaction - related amortization and fees, repatriation taxes and costs to achieve synergies

5 5 Emerson Strength Rockwell Strength Automation Represents a Large, Growing Global Opportunity W ith Diverse Exposure to Many Industries Discrete – PLC Control Process – DCS Control Printing Electronics / Electrical Auto / Tire Textiles Food / Bev Cement & Glass Pulp & Paper Metals & Mining Life Science Chemicals Refining Power Water / Wastewater Oil and Gas Material Handling $100B $61B $41B Hybrid DCS & PLC Control Packaging Emerson + Rockwell Is A Highly Complementary Combination With Leadership Capabilities Across A $202B Global Industry Source: ARC, Frost & Sullivan, RSR, public company reports and presentations, and internal estimates.

6 6 Competition is Consolidating to Secure Positions Across Industries and Strengthen Product Offerings Combination Enhances Emerson and Rockwell’s Competitive Position in the Global Automation Industry Process Hybrid Discrete Customers’ demands and needs are extending across the entire automation spectrum

7 7 Process Hybrid Discrete IIoT Instrumentation Valves & Regulators DCS Systems (w/ Integrated Safety) Skid Control MAC Capabilities Level 3 Software Instrumentation (Incl. Hygienic) Valves (incl. Hygienic) DCS Systems PLC + HMI Systems Level 3 Software Sensors / Instrumentation Fluid Control I/O & Networking PLC + HMI Systems Specialty & Robotics Level 3 Software IIoT Technologies Consulting Emerson + Rockwell Emerson + Rockwell Differentiated by Both Scale and Scope of its Automation Offering Emerson + Rockwell Creates a Comprehensive Product and Technology Portfolio For All of Industrial Automation Strong Limited No Offering Moderate

8 Clear Benefits for Customers and Complementary Channel Dynamics ▪ Customers use Rockwell as primary PLC and software supplier for factory floor applications; use Emerson for select device needs ▪ Customers use best - in - class Emerson DCS and integrate with non - native PLCs; or customers use less advanced Rockwell DCS and integrate with native PLCs ▪ Customers use best - in - class Emerson DCS for process control and as main automation contractor providing engineering capabilities and a full suite of field devices ▪ Customers serviced by Rockwell distributors, Emerson distributors, local business partners and integrators ▪ Different approaches used in each market; Emerson has established presence in all major markets; Rockwell strong in select markets and building presence more broadly ▪ Customers will continue to use Rockwell PLCs; will be new cross - selling opportunity of Rockwell products for Emerson discrete customers ▪ Customers get best of both: best - in - class Emerson DCS and native integration with Rockwell PLC’s – leading to lower project cost and superior performance ▪ For Emerson DCS customers, the ability to integrate with native Rockwell PLC’s on “skids” for discrete applications, connecting these at the software level into one control interface for the user ▪ Pursue channel relationships based on customer preferences; consistent approach used with previous Emerson automation acquisition integrations ▪ Opportunities to combine each company’s complementary global channels with a particular opportunity to expand on Emerson presence in China Discrete Customers Hybrid Customers Process Customers North American Channel International Channels Today Emerson + Rockwell Future

9 9 Identified $6B Capitalized Synergy Opportunity Synergies Are Focused on Growth and Efficiency - Value Derives From Having a Better Company, not Just Elimination of Duplication Revenue Synergies Cost Synergies Global Acceleration and Hybrid Offerings Partnershi p Replaceme nt MAC, MAC - MEC and Other 1/3 of Value • Sales acceleration across key geographies • Hybrid growth Cost Synergies Overview Sales Synergies Overview • Partner product replacement • Rockwell channel pull through • Increased MAC win rate • Incremental MAC - MEC opportunity SG&A Manufactur ing & Materials Corpora te & Other 2/3 of Value • Duplicative SG&A functions • R&D overlap • Materials cost • Manufacturing cost optimization • Project services • Reliability solutions • Corporate and public company costs • SG&A and channel efficiencies • Materials cost • Manufacturing cost optimization • More effective research, development and engineering costs across larger base Sales Synergies (~1/3 of Value) Cost Synergies (~2/3 of Value) • Increased win rate in large projects (main automation contractor or main electrical contractor role) • More comprehensive in - house product offering (retain value vs. using partnerships) • Complementary products for cross selling opportunities and channel pull through Synergies Overview Key Opportunities

10 10 Combined Company Has Stronger Financial Profile Combination Positioned to Deliver Strong Financial Performance and Drive Value for All Shareholders 2018 sales of ~$ 23B + x Increased scale across key end markets and geographies ~20% x Driven by synergies and enhanced operating efficiencies Double Digit x Accelerated topline, synergy realization, deleveraging and overall earnings potential ~$3B+ growing rapidly x High conversion and attractive free cash flow generation Scale Pro Forma Metric Operating Margin (1) EPS Growth (1) Free Cash Flow Transaction Benefit (1) Excludes transaction - related amortization and fees, repatriation taxes and costs to achieve synergies

11 $23B $18B $31B $12B $1B Value Creation to Rockwell Automation Shareholders Offer of $225 / share with 60% cash / 40% stock consideration Rockwell Automation undisturbed equity value (1) Rockwell Automation synergies ownership (2) + Source: Analysis based on company filings, equity research, Emerson management estimates and market data as of undisturbed date (10/30/2017) (1) Rockwell Automation share price and equity value based on 90 - Day VWAP as of undisturbed date (10/30/2017) (2) Based on Emerson 30 - Day VWAP as of undisturbed date (10/30/2017) Total value to Rockwell Automation = $235 / share $ 173 / share Cash consideration Stock consideration (2) $135 / share $90 / share + $235 value per share ~$8B total value creation + 3 6 % premium + $ 62/share increase ~22% ownership $10 / share Per Share Offer Value Total Value ($B)

12 Summary: A Winning Transaction on All Dimensions to Create Long - Term Value for All Shareholders Enhanced Financial Profile Strong Balance Sheet and Cash Flow Meets all Investment Objectives Compelling Strategic Logic x Strengthened product, technology and competitive positioning x Better positioned for delivering integrated hardware and software solutions x Improved scale supports investment in technology x Acceleration of top and bottom line growth x Highly attractive margins x Committed to investment grade credit rating and rapid deleveraging x Cash flow supports ongoing return of capital as well as investment x A ccretive to adjusted EPS and free cash flow in year one x $6bn of capitalized synergy value x Drive sustainable long - term returns

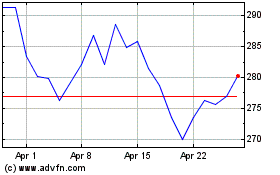

Rockwell Automation (NYSE:ROK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rockwell Automation (NYSE:ROK)

Historical Stock Chart

From Apr 2023 to Apr 2024