Cardinal Health Pulls Back From China

November 15 2017 - 2:59AM

Dow Jones News

By Joanne Chiu

Cardinal Health Inc. has agreed to sell its Chinese

pharmaceutical and medical-products distribution business to a

local rival, in the latest pullback by a U.S. company in the

world's second-largest economy.

In a statement, Hong Kong-listed Shanghai Pharmaceuticals

Holding Co. said Wednesday it would acquire Cardinal Health China

for $557 million after the exclusion of debt and other accounting

adjustments. It put the "base payment" figure at $1.2 billion, the

same price tag Cardinal Health attached to the deal in a separate

release.

The Dublin, Ohio-based company said it would hold on to its

remaining operations in China, such as its heart-product division

Cordis and its recently acquired patient-recovery business.

Cardinal Health has been a distributor in China for seven years

and "we recognize that significant scale is required to be a market

leader" there, Chief Executive George Barrett said in a

statement.

The company has taken a hit from a drop in generic-drug prices

this year. Earlier this month, Cardinal Health said Mr. Barrett

would step down from the post in January. Chief Financial Officer

Mike Kaufmann is set to succeed him.

The Shanghai-based unit distributes branded and generic drugs

and operates direct-to-patient specialty pharmacies. The business

has about 2,300 employees and serves more than 10,000 customers,

Cardinal Health has said.

Shanghai Pharma said the deal was part of an effort to expand

its distribution network and build up its pharmacy operations.

Cardinal Health China operates 14 direct-sales companies and 17

distribution and operation centers with a total storage area of

around 146,000 square meters and around 7,000 square meters

cold-storage capacity, the Chinese company said.

The acquisition will "facilitate the growth of our

pharmaceutical manufacturing business, enabling us to play a

significant role in the government's 'Healthy China' initiative,"

Shanghai Pharma Chairman Zhou Jun said in a statement. The

companies said they intend to continue working together and will

look for other opportunities in the U.S. and China.

The deal comes as Chinese regulators look to tighten oversight

of the country's fast-growing pharmaceutical industry. In February,

Beijing unveiled plans to overhaul the sector, including asking

state agencies to encourage consolidation of drug manufacturers and

distributors, according to an article published by corporate law

firm Sidley Austin LLP. Five months later, Cardinal Health said it

was exploring strategic alternatives for the Chinese distribution

business.

In April, the company agreed to acquire Medtronic PLC's

medical-supplies business for $6.1 billion to bolster its portfolio

of medical products. Analysts have said proceeds from a sale of

Cardinal Health's Chinese unit could be used to pay down some debt

from the Medtronic deal.

In 2010, Cardinal extended its reach in China when it acquired

Zuellig Pharma China, the country's largest drug importer, for $470

million, including debt. Zuellig had annual sales exceeding $1

billion at the time.

Joseph Walker, Allison Prang and Anne Steele contributed to this

article.

Write to Joanne Chiu at joanne.chiu@wsj.com

(END) Dow Jones Newswires

November 15, 2017 02:44 ET (07:44 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

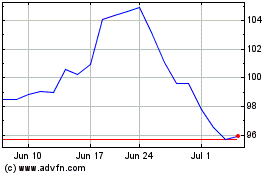

Cardinal Health (NYSE:CAH)

Historical Stock Chart

From Mar 2024 to Apr 2024

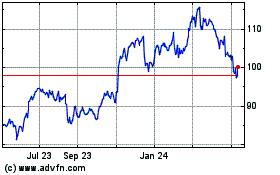

Cardinal Health (NYSE:CAH)

Historical Stock Chart

From Apr 2023 to Apr 2024