Third-Quarter Revenue Grows 72% Year on

Year

Third-Quarter Gross Profit Grows 86% Year on

Year

Achieves Adjusted Operating Profitability

Earlier Than Expected and for First Time as a Public Company

Shopify reports in U.S. dollars and in accordance with U.S.

GAAP

Shopify Inc. (NYSE:SHOP)(TSX:SHOP), the leading cloud-based,

multi-channel commerce platform designed for small and medium-sized

businesses, today announced strong financial results for the

quarter ended September 30, 2017.

“In today’s fast-changing retail environment, merchants large

and small are hungry to leverage all that technology can do for

them,” stated Russ Jones, Shopify’s CFO. “This is why our platform

is so valuable to merchants and why they keep coming to Shopify.

Our results underscore this, with another record quarter for

merchant adds, along with a record number of store launches on

Shopify Plus in the third quarter. On the strength of these results

and our underlying business model, we are raising our forecasts for

the fourth quarter and full year 2017.”

Third-Quarter Financial Highlights

- Total revenue in the third quarter was

$171.5 million, a 72% increase from the comparable quarter in 2016.

Within this, Subscription Solutions revenue grew 65% to $82.4

million. This acceleration was driven by the continued rapid growth

in Monthly Recurring Revenue1 (“MRR”) as another record number of

merchants joined the platform in the period. Merchant Solutions

revenue grew 79% to $89.0 million, driven primarily by the growth

of Gross Merchandise Volume2 (“GMV”).

- MRR as of September 30, 2017 was

$26.8 million, up 65% compared with $16.3 million as of

September 30, 2016. Shopify Plus contributed $5.3 million, or

20%, of MRR compared with 15% of MRR as of September 30,

2016.

- GMV for the third quarter was $6.4

billion, an increase of $2.6 billion, or 69% over the third quarter

of 2016. Gross Payments Volume3 (“GPV”) grew to $2.4 billion, which

accounted for 37% of GMV processed in the quarter, versus $1.5

billion, or 39%, for the third quarter of 2016.

- Gross profit grew 86% to $100.0 million

as compared with the $53.8 million recorded for the third quarter

of 2016.

- Operating loss for the third quarter of

2017 was $12.7 million, or 7.4% of revenue, versus $9.5 million, or

9.5% of revenue, for the comparable period a year ago.

- Adjusted operating income4 for the

third quarter of 2017 was $1.7 million, or 1.0% of revenue;

adjusted operating loss for the third quarter of 2016 was $2.2

million, or 2.2% of revenue

- Net loss for the third quarter of 2017

was $9.4 million, or $0.09 per share, compared with $9.1 million or

$0.11 per share, for the third quarter of 2016.

- Adjusted net income4 for the third

quarter of 2017 was $5.0 million, or $0.05 per share, compared with

an adjusted net loss of $1.8 million, or $0.02 per share, for the

third quarter of 2016.

- At September 30, 2017, Shopify had

$926.6 million in cash, cash equivalents and marketable securities,

compared with $392.4 million on December 31, 2016.

Business Highlights

- Shopify’s pace of innovation to keep

merchants on the cutting edge of a rapidly evolving retail

environment continues, with numerous launches over the past few

months to help merchants sell and ship more products, more often,

to more places.

- Shopify’s Instagram channel was made

available in a limited release to tens of thousands of merchants

earlier this month. Merchants in categories like fashion, jewelry,

beauty, furniture, and home decor, can start tagging their posts

with products in Instagram’s apps to showcase to their over 800

million monthly active users.

- Shopify recently announced the addition

of Lyst as a channel for merchants. As the largest global fashion

search engine, Lyst leveraged Shopify’s Sales Channel SDK to

develop their channel for Shopify and enable merchants selling

fashion in the U.S., U.K., Germany, Sweden, Finland, and Austria to

reach new audiences they may not have been able to capture

before.

- In September, Shopify expanded shipping

capabilities beyond single label printing, adding bulk label

printing to Shopify Shipping; and earlier this month Shopify

integrated DHL Express as an international shipping option at

discounted rates for merchants based in the U.S.

- Shopify built an in-app Augmented

Reality feature for Magnolia, the home and lifestyle brand of Chip

and Joanna Gaines from HGTV’s Fixer Upper. Built using the Shopify

Mobile Buy SDK and Apple’s ARKit, users’ phones can now help

showcase how housewares and homegoods will look in their real-life

surroundings before buying. This is the first product of its kind

for a Shopify merchant.

- Shopify announced the addition of a

second Waterloo office, and with it, plans to expand hiring by 300

to 500 new jobs over the next 2 to 3 years. Shopify expects to open

the new space, which is steps away from its existing Waterloo

location, in the first quarter of 2018.

- Mobile traffic to merchants’ stores

continued to grow, reaching 74% of traffic and 62% of orders for

the three months ended September 30, versus 72% and 60%,

respectively, for the second quarter of 2017.

- Shopify Capital issued $44.1 million in

merchant cash advances in the third quarter of 2017, nearly five

times the $9.2 million issued in the third quarter of last year.

Shopify Capital has grown to over $130 million in cumulative cash

advanced since its launch in April 2016.

Financial Outlook

The financial outlook that follows constitutes forward-looking

information within the meaning of applicable securities laws and is

based on a number of assumptions and subject to a number of risks.

Actual results could vary materially as a result of numerous

factors, including certain risk factors, many of which are beyond

Shopify’s control. Please see “Forward-looking Statements”

below.

In addition to the other assumptions and factors described in

this press release, Shopify’s outlook assumes the continuation of

growth trends in our industry, our ability to manage our growth

effectively and the absence of material changes in our industry or

the global economy. The following statements supersede all prior

statements made by Shopify and are based on current expectations.

As these statements are forward-looking, actual results may differ

materially.

These statements do not give effect to the potential impact of

mergers, acquisitions, divestitures or business combinations that

may be announced or closed after the date hereof. All numbers

provided in this section are approximate.

For the full year 2017, Shopify currently expects:

- Revenues in the range of $656 million

to $658 million

- GAAP operating loss in the range of

$55.5 million to $57.5 million

- Adjusted operating loss4 in the range

of $1.5 million to $3.5 million, which excludes stock-based

compensation expenses and related payroll taxes of $54 million

For the fourth quarter of 2017, Shopify currently expects:

- Revenues in the range of $206 million

to $208 million

- GAAP operating loss in the range of

$12.5 million to $14.5 million

- Adjusted operating income4 in the range

of $2 million to $4 million, which excludes stock-based

compensation expenses and related payroll taxes of $16.5

million

Quarterly Conference Call

Shopify’s management team will hold a conference call to discuss

its third-quarter results today, October 31, 2017, at 8:30 a.m. ET.

The conference call will be webcast on the investor relations

section of Shopify’s website at

https://investors.shopify.com/events/Events-Presentations/default.aspx.

An archived replay of the webcast will be available following the

conclusion of the call.

Shopify’s Third-Quarter 2017 Interim Unaudited Condensed

Consolidated Financial Statements and Notes and its Third-Quarter

2017 Management’s Discussion and Analysis are available on

Shopify’s website at www.shopify.com, and will be filed on SEDAR at

www.sedar.com and on EDGAR at www.sec.gov.

About Shopify

Shopify is the leading cloud-based, multi-channel commerce

platform designed for small and medium-sized businesses. Merchants

can use the software to design, set up, and manage their stores

across multiple sales channels, including web, mobile, social

media, marketplaces, brick-and-mortar locations, and pop-up shops.

The platform also provides merchants with a powerful back-office

and a single view of their business. The Shopify platform was

engineered for reliability and scale, making enterprise-level

technology available to businesses of all sizes. Headquartered in

Ottawa, Canada, Shopify currently powers over 500,000 businesses in

approximately 175 countries and is trusted by brands such as Red

Bull, Nestle, Rebecca Minkoff, Kylie Cosmetics, and many more.

Non-GAAP Financial Measures

To supplement its consolidated financial statements, which are

prepared and presented in accordance with United States generally

accepted accounting principles (GAAP), Shopify uses certain

non-GAAP financial measures to provide additional information in

order to assist investors in understanding its financial and

operating performance.

Adjusted operating income (loss), non-GAAP operating expenses,

adjusted net loss and adjusted net loss per share are non-GAAP

financial measures that exclude the effect of share-based

compensation expenses and related payroll taxes.

Management uses non-GAAP financial measures internally for

financial and operational decision-making and as a means to

evaluate period-to-period comparisons. Shopify believes that these

non-GAAP measures provide useful information about operating

results, enhance the overall understanding of past financial

performance and future prospects, and allow for greater

transparency with respect to key metrics used by management in its

financial and operational decision making. Non-GAAP financial

measures are not recognized measures for financial statement

presentation under U.S. GAAP and do not have standardized meanings,

and may not be comparable to similar measures presented by other

public companies. Such non-GAAP financial measures should be

considered as a supplement to, and not as a substitute for, or

superior to, the corresponding measures calculated in accordance

with GAAP. See the financial tables below for a reconciliation of

the non-GAAP measures.

Forward-looking Statements

This press release contains certain forward-looking statements

within the meaning of applicable securities laws, including

statements regarding Shopify’s plans to grow its Waterloo-based

workforce and open a new office space and Shopify's financial

outlook and future financial performance. Words such as “expects”,

“anticipates”, “will”, and “intends” or similar expressions are

intended to identify forward-looking statements.

These forward-looking statements are based on Shopify’s current

projections and expectations about future events and financial

trends that management believes might affect its financial

condition, results of operations, business strategy and financial

needs, and on certain assumptions and analysis made by Shopify in

light of the experience and perception of historical trends,

current conditions and expected future developments and other

factors management believes are appropriate. These projections,

expectations, assumptions and analyses are subject to known and

unknown risks, uncertainties, assumptions and other factors that

could cause actual results, performance, events and achievements to

differ materially from those anticipated in these forward-looking

statements. Although Shopify believes that the assumptions

underlying these forward-looking statements are reasonable, they

may prove to be incorrect, and readers cannot be assured that

actual results will be consistent with these forward-looking

statements. Actual results could differ materially from those

projected in the forward-looking statements as a result of numerous

factors, including certain risk factors, many of which are beyond

Shopify’s control, including but not limited to: (i) merchant

acquisition and retention; (ii) managing our growth; (iii) our

history of losses; (iv) our limited operating history; (v) our

ability to innovate; (vi) a disruption of service or security

breach; (vii) payments processed through Shopify Payments; (viii)

our reliance on a single supplier to provide the technology we

offer through Shopify Payments; (ix) a breach involving personally

identifiable information; (x) serious software errors or defects;

(xi) exchange rate fluctuations; (xii) achieving or maintaining

data transmission capacity; and (xiii) other one-time events and

other important factors disclosed previously and from time to time

in Shopify’s filings with the U.S. Securities and Exchange

Commission and the securities commissions or similar securities

regulatory authorities in each of the provinces or territories of

Canada. The forward-looking statements contained in this news

release represent Shopify’s expectations as of the date of this

news release, or as of the date they are otherwise stated to be

made, and subsequent events may cause these expectations to change.

Shopify undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required by law.

1. Monthly Recurring Revenue, or MRR, is calculated by

multiplying the number of merchants by the average monthly

subscription plan fee in effect on the last day of that period and

is used by management as a directional indicator of subscription

solutions revenue going forward assuming merchants maintain their

subscription plan the following month.2.Gross Merchandise Volume,

or GMV, represents the total dollar value of orders processed on

the Shopify platform in the period, net of refunds, and inclusive

of shipping and handling, duty and value-added taxes.3.Gross

Payments Volume, or GPV, is the amount of GMV processed through

Shopify Payments.4. Please refer to "Non-GAAP Financial Measures"

in this press release.

Shopify Inc.Condensed

Consolidated Statements of Operations and Comprehensive

Loss(Expressed in US $000’s, except share and per share

amounts, unaudited)

Three months ended Nine months ended

September 30,2017

September 30,2016

September 30,2017

September 30,2016

$ $ $ $ Revenues Subscription

solutions 82,435 49,839 216,113 132,219 Merchant solutions 89,021

49,739 234,377 126,728 171,456

99,578 450,490 258,947

Cost of

revenues Subscription solutions 15,458 10,555 41,400 27,885

Merchant solutions 55,971 35,271 149,982

89,702 71,429 45,826 191,382

117,587

Gross profit 100,027 53,752

259,108 141,360

Operating expenses Sales and

marketing 58,314 32,777 158,520 90,198 Research and development

36,350 19,462 95,658 49,864 General and administrative 18,039

11,002 47,974 29,158 Total operating

expenses 112,703 63,241 302,152 169,220

Loss from operations (12,676 ) (9,489 ) (43,044 ) (27,860 )

Other income 3,296 369

6,036 1,372

Net loss (9,380 ) (9,120 )

(37,008 ) (26,488 )

Other comprehensive income (loss), net of

tax 2,604 (617 ) 8,672 (476 )

Comprehensive

loss (6,776 ) (9,737 ) (28,336 ) (26,964 )

Basic and diluted net loss

attributable to shareholders

(0.09 ) (0.11 )

(0.39

)

(0.32 )

Weighted average shares used to

compute

basic and diluted net loss per share

attributable to shareholders

98,777,975 84,912,757 94,502,097 82,259,884

Shopify Inc.Condensed

Consolidated Balance Sheets(Expressed in US $000’s, except

share and per share amounts, unaudited)

As at September 30, 2017 December

31, 2016 $ $ Assets Current assets

Cash and cash equivalents 119,849 84,013 Marketable securities

806,710 308,401 Trade and other receivables 17,789 9,599 Merchant

cash advances receivable, net 50,276 11,896 Other current assets

20,302 8,989 1,014,926 422,898

Long-term assets Property and equipment, net 48,605 45,719

Intangible assets, net 17,560 6,437 Goodwill 20,317 15,504

86,482 67,660

Total assets 1,101,408

490,558

Liabilities and shareholders’ equity

Current liabilities Accounts payable and accrued liabilities

65,246 45,057 Current portion of deferred revenue 28,730 20,164

Current portion of lease incentives 1,434 1,311

95,410 66,532

Long-term liabilities Deferred

revenue 1,218 922 Lease incentives 15,317 12,628 Deferred tax

liability 1,541 — 18,076 13,550

Shareholders’ equity

Common stock, unlimited Class A

subordinate voting shares

authorized, 86,169,575 and 77,030,952

issued and outstanding;

unlimited Class B multiple voting shares

authorized, 13,102,735

and 12,374,528 issued and outstanding

1,064,214 468,494 Additional paid-in capital 37,071 27,009

Accumulated other comprehensive income (loss) 6,854 (1,818 )

Accumulated deficit (120,217 ) (83,209 )

Total shareholders’

equity 987,922 410,476

Total liabilities and

shareholders’ equity 1,101,408 490,558

Shopify Inc.Condensed

Consolidated Statements of Cash Flows(Expressed in US $000’s,

except share and per share amounts, unaudited)

Nine months ended

September 30,2017

September 30,2016

$ $ Cash flows from operating activities Net

loss for the period (37,008 ) (26,488 ) Adjustments to reconcile

net loss to net cash provided by (used in) operating activities:

Amortization and depreciation 15,624 9,527 Stock-based compensation

34,185 14,834 Provision for uncollectible receivables related to

merchant cash advances 2,473 918 Vesting of restricted shares — 202

Unrealized foreign exchange gain (1,502 ) (1,087 ) Changes in

operating assets and liabilities: Trade and other receivables

(8,701 ) (688 ) Merchant cash advances receivable (40,853 ) (10,017

) Other current assets (2,179 ) (4,098 ) Accounts payable and

accrued liabilities 15,193 16,416 Deferred revenue 8,862 5,781

Lease incentives 2,812 2,002 Net cash provided by

(used in) operating activities (11,094 ) 7,302

Cash flows

from investing activities Purchase of marketable securities

(949,202 ) (223,650 ) Maturity of marketable securities 451,509

90,083 Acquisitions of property and equipment (9,258 ) (15,286 )

Acquisitions of intangible assets (2,882 ) (2,004 ) Acquisition of

businesses, net of cash acquired (15,718 ) (7,969 ) Net cash used

in investing activities (525,551 ) (158,826 )

Cash flows from

financing activities Proceeds from the exercise of stock

options 10,500 3,230 Proceeds from public offering, net of issuance

costs 560,057 224,423 Net cash provided by financing

activities 570,557 227,653 Effect of foreign exchange

on cash and cash equivalents 1,924 1,161

Net

increase in cash and cash equivalents 35,836 77,290

Cash and

cash equivalents – Beginning of Period 84,013 110,070

Cash and cash equivalents – End of Period 119,849

187,360

Shopify Inc.Reconciliation from

GAAP to Non-GAAP Results(Expressed in US $000’s, except share

and per share amounts, unaudited)

Three months ended Nine months ended

September 30,2017

September 30,2016

September 30,2017

September 30,2016

$ $ $ $ GAAP Gross profit 100,027

53,752 259,108 141,360 % of Revenue 58 % 54 % 58 % 55 % add:

stock-based compensation 318 188 794 423 add: payroll taxes related

to stock-based compensation 37 46 117 79

Non-GAAP Gross profit 100,382 53,986 260,019

141,862 % of Revenue 59 % 54 % 58 % 55 % GAAP

Sales and marketing 58,314 32,777 158,520 90,198 % of Revenue 34 %

33 % 35 % 35 % less: stock-based compensation 2,565 1,145 6,050

2,651 less: payroll taxes related to stock-based compensation 164

245 644 369 Non-GAAP Sales and

marketing 55,585 31,387 151,826 87,178

% of Revenue 32 % 32 % 34 % 34 % GAAP Research and

development 36,350 19,462 95,658 49,864 % of Revenue 21 % 20 % 21 %

19 % less: stock-based compensation 8,595 4,019 21,681 9,086 less:

payroll taxes related to stock-based compensation 729 339

2,036 816 Non-GAAP Research and development

27,026 15,104 71,941 39,962 % of

Revenue 16 % 15 % 16 % 15 % GAAP General and administrative

18,039 11,002 47,974 29,158 % of Revenue 11 % 11 % 11 % 11 % less:

stock-based compensation 1,898 1,135 5,659 2,876 less: payroll

taxes related to stock-based compensation 83 166 524

223 Non-GAAP General and administrative 16,058

9,701 41,791 26,059 % of Revenue 9 % 10 % 9 %

10 % GAAP Operating expenses 112,703 63,241 302,152 169,220

% of Revenue 66 % 64 % 67 % 65 % less: stock-based compensation

13,058 6,299 33,390 14,613 less: payroll taxes related to

stock-based compensation 976 750 3,204 1,408

Non-GAAP Operating Expenses 98,669 56,192

265,558 153,199 % of Revenue 58 % 56 % 59 % 59 %

Shopify Inc.Reconciliation from

GAAP to Non-GAAP Results (continued)(Expressed in US $000’s,

except share and per share amounts, unaudited)

Three months ended Nine months ended

September 30,2017

September 30,2016

September 30,2017

September 30,2016

$ $ $ $ GAAP Operating loss (12,676 )

(9,489 ) (43,044 ) (27,860 ) % of Revenue (7 )% (10 )% (10 )% (11

)% add: stock-based compensation 13,376 6,487 34,184 15,036 add:

payroll taxes related to stock-based compensation 1,013 796

3,321 1,487 Adjusted Operating Income (Loss)

1,713 (2,206 ) (5,539 ) (11,337 ) % of Revenue 1 % (2 )% (1

)% (4 )% GAAP Net loss (9,380 ) (9,120 ) (37,008 ) (26,488 )

% of Revenue (5 )% (9 )% (8 )% (10 )% add: stock-based compensation

13,376 6,487 34,184 15,036 add: payroll taxes related to

stock-based compensation 1,013 796 3,321 1,487

Adjusted Net Income (Loss) 5,009 (1,837 ) 497

(9,965 ) % of Revenue 3 % (2 )% — % (4 )% GAAP net loss per

share attributable to shareholders (0.09 ) (0.11 ) (0.39 ) (0.32 )

add: stock-based compensation 0.14 0.08 0.36 0.18 add: payroll

taxes related to stock-based compensation 0.01 0.01

0.04 0.02

Adjusted net income (loss) per share

attributable to

shareholders(1)

0.05 (0.02 ) 0.01 (0.12 )

Weighted average shares used to compute

GAAP

and non-GAAP net income (loss) per

share

attributable to shareholders

98,777,975 84,912,757 94,502,097 82,259,884

(1) Totals may not foot due to rounding

differences.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171031005555/en/

ShopifyINVESTORS:Katie Keita, 613-241-2828 x 1024Director,

Investor RelationsIR@shopify.comorMEDIA:Sheryl So, 416-238-6705 x

302Public Relations Managerpress@shopify.com

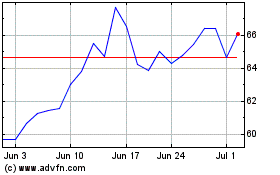

Shopify (NYSE:SHOP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Shopify (NYSE:SHOP)

Historical Stock Chart

From Apr 2023 to Apr 2024