Report of Foreign Issuer (6-k)

August 04 2017 - 11:07AM

Edgar (US Regulatory)

FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to rule 13a-16 or 15d-16 of

The Securities Exchange Act of 1934

For the month of August

, 2017

National Bank of Greece S.A.

(Translation of registrant’s name into English)

86 Eolou Street, 10232 Athens, Greece

(Address of principal executive offices)

[Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.]

Form 20-F

x

Form 40-F

o

[Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to rule 12g3-2(b) under the Securities Exchange Act of 1934.]

Yes

o

No

x

[If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- ]

NATIONAL BANK OF GREECE

S.A.

Athens — 4 August 2017

AGREEMENT BETWEEN NBG SA AND OTP SERBIA FOR THE SALE OF VOJVODJANSKA BANKA AD AND NBG LEASING DOO

National Bank of Greece S.A. (“NBG”) announces the signing of a definitive agreement with

OTP Banka Srbija a.d. Novi Sad (“OTP Serbia”) for the divestment to OTP Serbia of its 100% stake in its Serbian subsidiaries Vojvodjanska Banka AD (“VOBAN”) and NBG Leasing doo (“NBG Leasing”) and of a portfolio of Serbian-risk corporate loans (together the “Transaction”).

The agreed consideration for the share

capital of VOBAN and NBG Leasing amounts to €125 million, representing a Transaction multiple of c. 0.75x P/TBV(1). The Transaction is expected to increase NBG’s CET1 Ratio by c.30 bps(2) and, taking into account the repayment of the intra-group debt, strengthen its liquidity position by c.€280 million.

Leonidas Fragkiadakis, NBG CEO said: “After

over 15 years of successful presence in Serbia, NBG divests from its Serbian operations to deliver on its commitments to the European Authorities under the Restructuring Plan. The Transaction further strengthens NBG’s position in terms of capital and liquidity, allowing for the redeployment of resources to support the Greek economic recovery”.

Closing of the transaction is subject to approval from the National Bank of Hungary, the National Bank of Serbia, the General Council of the Hellenic Financial Stability Fund and anti-trust approvals.

Credit Suisse International is acting as exclusive financial advisor to NBG. Freshfields Bruckhaus Deringer is acting as international legal counsel and Bojovic & Partners as local legal counsel to NBG.

Note 1:

Based on the Tangible Book Value of 31.12.2016

Note 2

: Impact on CET 1 ratio as of 31.03.2017

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

National Bank of Greece S.A.

|

|

|

|

|

|

|

|

|

/s/ Ioannis Kyriakopoulos

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

Date: August 4

th

, 2017

|

|

|

|

|

|

|

Chief Financial Officer

|

|

|

|

|

|

/s/ George Angelides

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

Date: August 4

th

, 2017

|

|

|

|

|

|

|

Director, Financial Division

|

3

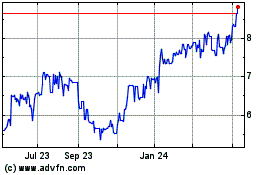

National Bank of Greece (PK) (USOTC:NBGIF)

Historical Stock Chart

From Mar 2024 to Apr 2024

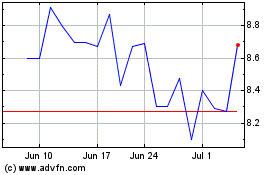

National Bank of Greece (PK) (USOTC:NBGIF)

Historical Stock Chart

From Apr 2023 to Apr 2024