Revenue Grows 75% Year on Year

Second-Quarter Gross Profit Grows 83% Year

on Year

Shopify reports in U.S. dollars and in accordance with U.S.

GAAP

Shopify Inc. (NYSE:SHOP)(TSX:SHOP), the leading cloud-based,

multi-channel commerce platform designed for small and medium-sized

businesses, today announced strong financial results for the

quarter ended June 30, 2017.

“The fundamental shift in retail toward multi-channel and

mobile, the ongoing adoption of Shopify by larger brands, and our

continued focus on building out the market-leading platform for

sellers all contributed to the strength of our results this past

quarter,” stated Russ Jones, Shopify’s CFO. “As we have been able

to predict and capitalize on these shifts, and continue to innovate

so entrepreneurs of all sizes can take advantage of them, we feel

we are exceptionally well-positioned for the next several

years.”

Second-Quarter Financial Highlights

- Total revenue in the second quarter was

$151.7 million, a 75% increase from the comparable quarter in 2016.

Within this, Subscription Solutions revenue grew 64% to $71.6

million. The acceleration in Subscription Solutions revenue growth

was driven by the continued rapid growth in Monthly Recurring

Revenue1 (“MRR”) as another record number of merchants joined the

platform in the period. Merchant Solutions revenue grew 86% to

$80.1 million, driven primarily by the growth of Gross Merchandise

Volume2 (“GMV”).

- MRR as of June 30, 2017 was $23.7

million, up 64% compared with $14.4 million as of June 30,

2016. Shopify Plus contributed $4.3 million, or 18%, of MRR

compared with 13% of MRR as of June 30, 2016.

- GMV for the second quarter was $5.8

billion, an increase of $2.5 billion, or 74% over the second

quarter of 2016. Gross Payments Volume3 (“GPV”) grew to $2.2

billion, which accounted for 38% of GMV processed in the quarter,

versus $1.3 billion, or 38%, for the second quarter of 2016.

- Gross profit dollars grew 83% to $86.8

million as compared with the $47.5 million recorded for the second

quarter of 2016.

- Operating loss for the second quarter

of 2017 was $15.9 million, or 10% of revenue, versus $8.7 million,

or 10% of revenue, for the comparable period a year ago.

- Adjusted operating loss4 for the second

quarter of 2017 was 1.9% of revenue, or $2.9 million; adjusted

operating loss for the second quarter of 2016 was 3.7% of revenue,

or $3.2 million.

- Net loss for the second quarter of 2017

was $14.0 million, or $0.15 per share, compared with $8.4 million,

or $0.10 per share, for the second quarter of 2016.

- Adjusted net loss4 for the second

quarter of 2017 was $1.1 million, or $0.01 per share, compared with

an adjusted net loss of $3.0 million, or $0.04 per share, for the

second quarter of 2016.

- At June 30, 2017, Shopify had

$932.4 million in cash, cash equivalents and marketable securities,

compared with $392.4 million on December 31, 2016. The

increase reflects the $560 million in net proceeds from Shopify’s

offering of Class A subordinate voting shares in the second

quarter.

Business Highlights

- Shopify continues to deliver on its

strategy of providing multiple sales channels for merchants:

- In July, Shopify began shipping

pre-orders of its Chip and Swipe Reader to merchants, enhancing its

point-of-sale channel, which is its second-largest channel for GMV.

Today, we are announcing that it is now generally available and

free to new and existing merchants already on a Shopify

subscription who have not redeemed a free reader before.

- Also in July, Shopify announced the

integration of eBay as a channel for merchants. The integration

will enable Shopify merchants to surface their brand and products

to more than 169 million active eBay buyers, while managing eBay

orders, inventory and messages from within Shopify.

- In June, Shopify announced the

integration of Buzzfeed as a channel for merchants, paving a new

way for media and publishers to drive affiliate revenue. The new

channel allows merchants to easily tag products for BuzzFeed

editors to search, find, and feature in its campaigns, product

lists and onsite content for its audience of more than 200

million.

- Shopify continues to optimize features

that maximize merchants’ opportunity for success on the platform,

with several notable initiatives in the second quarter:

- Shopify Pay, a feature designed to

increase conversion at checkout by streamlining the checkout

process, especially on mobile devices, went live to all merchants

using Shopify Payments.

- Shopify Payments went live in New

Zealand, bringing the total number of countries where Shopify

Payments is available to six, including U.S., Canada, U.K,

Australia and Ireland.

- Shopify made Kit free to all merchants,

which more than doubled the number of merchants actively using the

virtual assistant to help automate online marketing.

- Mobile traffic to merchants’ stores

continued to grow, reaching 72% of traffic and 60% of orders for

the three months ended June 30, versus 69% and 59%, respectively,

exiting the first quarter of this year.

- In the second quarter, Shopify Capital

issued $37.2 million in merchant cash advances, nearly twice the

amount issued in the first quarter. Since its launch in April 2016,

Shopify Capital has grown to $86 million in cumulative cash

advanced by June 30, 2017. This figure climbed to more than $95

million by July 31, 2017.

CFO Retirement

Shopify’s Chief Financial Officer Russ Jones has informed the

Company and its Board of Directors of his decision to

retire in 2018. Russ, who joined Shopify in 2011, intends to

continue to serve as CFO until his successor is found and has

transitioned into the role, a process that is now underway and that

Shopify expects will be completed within the next 12 months.

Financial Outlook

The financial outlook that follows constitutes forward-looking

information within the meaning of applicable securities laws and is

based on a number of assumptions and subject to a number of risks.

Actual results could vary materially as a result of numerous

factors, including certain risk factors, many of which are beyond

Shopify’s control. Please see “Forward-looking Statements”

below.

In addition to the other assumptions and factors described in

this press release, Shopify’s outlook assumes the continuation of

growth trends in our industry, our ability to manage our growth

effectively and the absence of material changes in our industry or

the global economy. The following statements supersede all prior

statements made by Shopify and are based on current expectations.

As these statements are forward-looking, actual results may differ

materially.

These statements do not give effect to the potential impact of

mergers, acquisitions, divestitures or business combinations that

may be announced or closed after the date hereof. All numbers

provided in this section are approximate.

For the full year 2017, Shopify currently expects:

- Revenues in the range of $642 million

to $648 million

- GAAP operating loss in the range of $62

million to $66 million

- Adjusted operating loss4 in the range

of $7 million to $11 million, which excludes stock-based

compensation expenses and related payroll taxes of $55 million

For the third quarter of 2017, Shopify currently expects:

- Revenues in the range of $164 million

to $166 million

- GAAP operating loss in the range of $17

million to $19 million

- Adjusted operating loss4 in the range

of $2 million to $4 million, which excludes stock-based

compensation expenses and related payroll taxes of $15 million

Quarterly Conference Call

Shopify’s management team will hold a conference call to discuss

its second-quarter results today, August 1, 2017, at 8:30 a.m. ET.

The conference call will be webcast on the investor relations

section of Shopify’s website at https://investors.shopify.com/events/Events-Presentations/default.aspx.

An archived replay of the webcast will be available following the

conclusion of the call.

Shopify’s Second-Quarter 2017 Interim Unaudited Condensed

Consolidated Financial Statements and Notes and its Second-Quarter

2017 Management’s Discussion and Analysis are available on

Shopify’s website at www.shopify.com,

and will be filed on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

About Shopify

Shopify is the leading cloud-based, multi-channel commerce

platform designed for small and medium-sized businesses. Merchants

can use the software to design, set up, and manage their stores

across multiple sales channels, including web, mobile, social

media, marketplaces and physical retail locations. The platform

also provides merchants with a powerful back-office and a single

view of their business. The Shopify platform was engineered for

reliability and scale, making enterprise-level technology available

to businesses of all sizes. Shopify currently powers half a million

businesses in approximately 175 countries and is trusted by brands

such as Tesla, Nestle, GE, Red Bull, Kylie Cosmetics, and many

more.

Non-GAAP Financial Measures

To supplement its consolidated financial statements, which are

prepared and presented in accordance with United States generally

accepted accounting principles (GAAP), Shopify uses certain

non-GAAP financial measures to provide additional information in

order to assist investors in understanding its financial and

operating performance.

Adjusted operating loss, non-GAAP operating expenses, adjusted

net loss and adjusted net loss per share are non-GAAP financial

measures that exclude the effect of share-based compensation

expenses and related payroll taxes.

Management uses non-GAAP financial measures internally for

financial and operational decision-making and as a means to

evaluate period-to-period comparisons. Shopify believes that these

non-GAAP measures provide useful information about operating

results, enhance the overall understanding of past financial

performance and future prospects, and allow for greater

transparency with respect to key metrics used by management in its

financial and operational decision making. Non-GAAP financial

measures are not recognized measures for financial statement

presentation under U.S. GAAP and do not have standardized meanings,

and may not be comparable to similar measures presented by other

public companies. Such non-GAAP financial measures should be

considered as a supplement to, and not as a substitute for, or

superior to, the corresponding measures calculated in accordance

with GAAP. See the financial tables below for a reconciliation of

the non-GAAP measures.

Forward-looking Statements

This press release contains certain forward-looking statements

within the meaning of applicable securities laws, including

statements regarding Shopify’s financial outlook and future

financial performance. Words such as “expects”, “anticipates” and

“intends” or similar expressions are intended to identify

forward-looking statements.

These forward-looking statements are based on Shopify’s current

projections and expectations about future events and financial

trends that management believes might affect its financial

condition, results of operations, business strategy and financial

needs, and on certain assumptions and analysis made by Shopify in

light of the experience and perception of historical trends,

current conditions and expected future developments and other

factors management believes are appropriate. These projections,

expectations, assumptions and analyses are subject to known and

unknown risks, uncertainties, assumptions and other factors that

could cause actual results, performance, events and achievements to

differ materially from those anticipated in these forward-looking

statements. Although Shopify believes that the assumptions

underlying these forward-looking statements are reasonable, they

may prove to be incorrect, and readers cannot be assured that

actual results will be consistent with these forward-looking

statements. Actual results could differ materially from those

projected in the forward-looking statements as a result of numerous

factors, including certain risk factors, many of which are beyond

Shopify’s control, including but not limited to: (i) merchant

acquisition and retention; (ii) managing our growth; (iii) our

history of losses; (iv) our limited operating history; (v) our

ability to innovate; (vi) a disruption of service or security

breach; (vii) payments processed through Shopify Payments; (viii)

our reliance on a single supplier to provide the technology we

offer through Shopify Payments; (ix) a breach involving personally

identifiable information; (x) serious software errors or defects;

(xi) exchange rate fluctuations; (xii) achieving or maintaining

data transmission capacity; and (xiii) other one-time events and

other important factors disclosed previously and from time to time

in Shopify’s filings with the U.S. Securities and Exchange

Commission and the securities commissions or similar securities

regulatory authorities in each of the provinces or territories of

Canada. The forward-looking statements contained in this news

release represent Shopify’s expectations as of the date of this

news release, or as of the date they are otherwise stated to be

made, and subsequent events may cause these expectations to change.

Shopify undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required by law.

Shopify Inc.Condensed Consolidated

Statements of Operations and Comprehensive Loss(Expressed in US

$000’s, except share and per share amounts, unaudited)

Three months ended Six Months

Ended June 30, 2017 June 30, 2016

June 30, 2017 June 30, 2016 $

$ $ $ Revenues Subscription solutions

71,598 43,674 133,678 82,380 Merchant solutions 80,057

42,973 145,356 76,989 151,655 86,647 279,034

159,369

Cost of revenues Subscription solutions 13,688 9,098

25,942 17,330 Merchant solutions 51,127 30,026

94,011 54,431 64,815 39,124 119,953 71,761

Gross

profit 86,840 47,523 159,081 87,608

Operating

expenses Sales and marketing 54,872 29,413 100,206 57,421

Research and development 32,714 16,732 59,308 30,402 General and

administrative 15,161 10,037 29,935 18,156 Total

operating expenses 102,747 56,182 189,449 105,979

Loss from operations (15,907 ) (8,659 ) (30,368) (18,371)

Other income 1,877 220

2,740 1,003

Net loss (14,030 ) (8,439 ) (27,628)

(17,368)

Other comprehensive income (loss), net

oftax

4,631 (80 ) 6,068

141

Comprehensive loss (9,399 ) (8,519 ) (21,560) (17,227)

Basic and diluted net loss per

shareattributable to shareholders

(0.15 ) (0.10 ) (0.30 )

(0.21)

Weighted average shares used to

computebasic and diluted net loss per shareattributable to

shareholders

94,290,538 81,349,248 92,277,895 80,918,872

Shopify Inc.Condensed Consolidated

Balance Sheets(Expressed in US $000’s, except share and per

share amounts, unaudited)

As at June 30, 2017 December 31,

2016 $ $ Assets Current assets Cash

and cash equivalents 199,397 84,013 Marketable securities 733,020

308,401 Trade and other receivables 12,599 9,599 Merchant cash

advances receivable, net 32,839 11,896 Other current assets 16,382

8,989 994,237 422,898

Long-term

assets Property and equipment, net 44,235 45,719 Intangible

assets, net 18,444 6,437 Goodwill 20,317 15,504

82,996 67,660

Total assets 1,077,233

490,558

Liabilities and shareholders’ equity

Current liabilities Accounts payable and accrued liabilities

57,118 45,057 Current portion of deferred revenue 25,771 20,164

Current portion of lease incentives 1,354 1,311

84,243 66,532

Long-term liabilities Deferred

revenue 1,125 922 Lease incentives 12,728 12,628 Deferred tax

liability 1,693 — 15,546 13,550

Shareholders’ equity

Common stock, unlimited Class A

subordinate voting sharesauthorized, 85,404,395 and 77,030,952

issued and outstanding;unlimited Class B multiple voting shares

authorized, 13,122,943and 12,374,528 issued and outstanding

1,051,490 468,494 Additional paid-in capital 32,541 27,009

Accumulated other comprehensive income (loss) 4,250 (1,818 )

Accumulated deficit (110,837 ) (83,209 )

Total shareholders’

equity 977,444 410,476

Total liabilities and

shareholders’ equity 1,077,233 490,558

Shopify Inc.Condensed Consolidated

Statements of Cash Flows(Expressed in US $000’s, except share

and per share amounts, unaudited)

Six Months Ended June 30, 2017 June

30, 2016 $ $ Cash flows from operating

activities Net loss for the period (27,628) (17,368)

Adjustments to reconcile net loss to net cash provided by operating

activities: Amortization and depreciation 9,887 5,834 Stock-based

compensation 20,808 8,375 Provision for uncollectible receivables

related to merchant cash advances 1,922 441 Vesting of restricted

shares — 172 Unrealized foreign exchange gain (901) (1,161) Changes

in operating assets and liabilities: Trade and other receivables

(2,978) 1,779 Merchant cash advances receivable (22,865) (4,494)

Other current assets 348 (787) Accounts payable and accrued

liabilities 10,595 8,020 Deferred revenue 5,810 3,913 Lease

incentives 143 1,481 Net cash provided by (used in) operating

activities (4,859) 6,205

Cash flows from investing

activities Purchase of marketable securities (638,212) (81,393)

Maturity of marketable securities 213,609 49,457 Acquisitions of

property and equipment (5,290) (10,057) Acquisitions of intangible

assets (2,024) (1,256) Acquisition of businesses, net of cash

acquired (15,718) (7,969) Net cash provided by (used in) investing

activities (447,635) (51,218)

Cash flows from financing

activities Proceeds from the exercise of stock options 6,932

1,832 Proceeds from public offering, net of issuance costs 560,057

— Net cash provided by financing activities 566,989

1,832 Effect of foreign exchange on cash and cash equivalents 889

1,251

Net increase (decrease) in cash and cash equivalents

115,384 (41,930)

Cash and cash equivalents – Beginning of

Period 84,013 110,070

Cash and cash equivalents – End of

Period 199,397 68,140

Shopify Inc.Reconciliation from GAAP

to Non-GAAP Results(Expressed in US $000’s, except share and

per share amounts, unaudited)

Three months ended Six Months

Ended June 30, 2017 June 30, 2016

June 30, 2017 June 30, 2016 $

$ $ $ GAAP Gross profit 86,840 47,523 159,081

87,608 % of Revenue 57 % 55 % 57 % 55 % add: stock-based

compensation 261 129 475 234

add: payroll taxes related to

stock-basedcompensation

46 23 81 33 Non-GAAP Gross profit

87,147 47,675 159,637 87,875 % of

Revenue 57 % 55 % 57 % 55 % GAAP Sales and marketing 54,872

29,413 100,206 57,421 % of Revenue 36 % 34 % 36 % 36 % less:

stock-based compensation 2,004 942 3,485 1,506

less: payroll taxes related to

stock-basedcompensation

301 83 480 124 Non-GAAP Sales and

marketing 52,567 28,388 96,241 55,791 %

of Revenue 35 % 33 % 34 % 35 % GAAP Research and development

32,714 16,732 59,308 30,402 % of Revenue 22 % 19 % 21 % 19 % less:

stock-based compensation 7,255 3,035 13,088 5,066

less: payroll taxes related to

stock-basedcompensation

820 220 1,305 480 Non-GAAP Research and

development 24,639 13,477 44,915 24,856

% of Revenue 16 % 16 % 16 % 16 % GAAP General and

administrative 15,161 10,037 29,935 18,156 % of Revenue 10 % 12 %

11 % 11 % less: stock-based compensation 2,081 980 3,760 1,741

less: payroll taxes related to

stock-basedcompensation

201 36 442 56 Non-GAAP General and

administrative 12,879 9,021 25,733 16,359

% of Revenue 8 % 10 % 9 % 10 % GAAP Operating

expenses 102,747 56,182 189,449 105,979 % of Revenue 68 % 65 % 68 %

66 % less: stock-based compensation 11,340 4,957 20,333 8,313

less: payroll taxes related to

stock-basedcompensation

1,322 339 2,227 660 Non-GAAP Operating

Expenses 90,085 50,886 166,889 97,006 %

of Revenue 59 % 59 % 60 % 61 %

Shopify Inc.Reconciliation from GAAP

to Non-GAAP Results (continued)(Expressed in US $000’s, except

share and per share amounts, unaudited)

Three months ended Six Months

Ended June 30, 2017 June 30, 2016

June 30, 2017 June 30, 2016 $

$ $ $ GAAP Operating loss (15,907 ) (8,659 )

(30,368 ) (18,371 ) % of Revenue (10 )% (10 )% (11 )% (12 )% add:

stock-based compensation 11,601 5,086 20,808 8,547

add: payroll taxes related to

stock-basedcompensation

1,368 362 2,308 693 Adjusted Operating

loss (2,938 ) (3,211 ) (7,252 ) (9,131 ) % of Revenue (2 )% (4 )%

(3 )% (6 )% GAAP Net loss (14,030 ) (8,439 ) (27,628 )

(17,368 ) % of Revenue (9 )% (10 )% (10 )% (11 )% add: stock-based

compensation 11,601 5,086 20,808 8,547 add: payroll taxes related

to stock-based compensation 1,368 362 2,308

693 Adjusted Net loss and comprehensive loss (1,061 ) (2,991

) (4,512 ) (8,128 ) % of Revenue (1 )% (3 )% (2 )% (5 )%

GAAP net loss per share attributable to shareholders (0.15 ) (0.10

) (0.30 ) (0.21 ) add: stock-based compensation 0.12 0.06 0.23 0.11

add: payroll taxes related to stock-based compensation 0.01

— 0.03 0.01 Adjusted net loss per share

attributable to shareholders(1) (0.01 ) (0.04 ) (0.05 ) (0.10 )

Weighted average shares used to compute

GAAPand non-GAAP net loss per share attributable toshareholders

94,290,538 81,349,248 92,277,895 80,918,872

(1) Totals may not foot due to rounding differences.

1. Monthly Recurring Revenue, or MRR, is calculated by

multiplying the number of merchants by the average monthly

subscription plan fee in effect on the last day of that period and

is used by management as a directional indicator of subscription

solutions revenue going forward assuming merchants maintain their

subscription plan the following month.2. Gross Merchandise Volume,

or GMV, represents the total dollar value of orders processed on

the Shopify platform in the period, net of refunds, and inclusive

of shipping and handling, duty and value-added taxes.3. Gross

Payments Volume, or GPV, is the amount of GMV processed through

Shopify Payments.4. Please refer to "Non-GAAP Financial Measures"

in this press release.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170801005517/en/

ShopifyINVESTORS:Katie Keita, 613-241-2828 x 1024Director,

Investor RelationsIR@shopify.comorMEDIA:Sheryl So, 416-238-6705 x

302Public Relations Managerpress@shopify.com

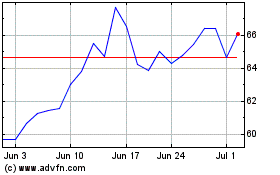

Shopify (NYSE:SHOP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Shopify (NYSE:SHOP)

Historical Stock Chart

From Apr 2023 to Apr 2024