Current Report Filing (8-k)

July 18 2017 - 6:05AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

FORM 8-K

_____________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 17, 2017

_____________________________

Medtronic Public Limited Company

(Exact name of Registrant as Specified in its Charter)

_____________________________

|

|

|

|

|

|

|

|

|

Ireland

|

|

1-36820

|

|

98-1183488

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

20 On Hatch, Lower Hatch Street

Dublin 2, Ireland

|

|

(Address of principal executive offices)

|

(Registrant’s telephone number, including area code):

+353 1 438-1700

_____________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 7.01. Regulation FD Disclosure.

Medtronic Clarifies Certain Information Contained in News Articles

Medtronic plc (the “Company”) is furnishing this Form 8-K to clarify certain information contained in articles published July 17, 2017, regarding the Company’s first quarter and full fiscal year 2018 financial expectations.

|

|

|

|

•

|

In June of 2017 the Company experienced a disruption in its information technology systems. In its Form 10-K filed with the Securities and Exchange Commission on June 27, 2017, the Company reported that its information technology systems had been fully restored, and that the Company did not believe its fiscal year 2018 results of operations or financial condition would be materially affected by the incident.

|

|

|

|

|

•

|

In an interview conducted and published with Bloomberg News, Karen Parkhill, Executive Vice President and Chief Financial Officer, confirmed that the Company continues to believe there will be no material impact from the disruption. The Company continues to do a root cause analysis and believes this was an internal technical infrastructure issue. The Company feels good about its first quarter and the full fiscal year ahead and remains pleased with its robust pipeline and the reception from customers to its innovative products.

|

|

|

|

|

•

|

The Company reiterates its prior guidance range for both the fiscal first quarter and full year revenue growth on a constant currency basis in the range of 4-5%. Given the IT disruption and strong new product demand in the Diabetes Group against a temporarily limited supply of sensors, the Company expects growth at the lower end of the range in the first quarter.

|

|

|

|

|

•

|

The Company reiterates its prior guidance range for its adjusted diluted EPS growth for the first fiscal quarter of 2018 at the upper end of the high-single digit range on a constant currency basis, due to the underlying strength of its businesses as well as additional tax benefits the Company expects to receive in the first quarter, which ends July 28, 2017.

|

|

|

|

|

•

|

For fiscal year 2018, the Company reiterates its expectation that its constant currency revenue growth will be in the range of 4 to 5 percent and that its adjusted diluted EPS growth will be in the range of 9 to 10 percent on a constant currency basis.

|

In addition, the Company notes that this fiscal year 2018 outlook and guidance does not include the impact of the previously announced divestiture of a portion of its Patient Monitoring and Recovery division to Cardinal Health, which the Company continues to expect to close in the second fiscal quarter. The Company intends to update its guidance following the closing of the transaction.

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements related to the Company’s expectations regarding its operations, sustainability of growth, timing of the consummation of certain transactions, and the Company’s future results of operations, each of which are subject to risks and uncertainties, such as competitive factors, difficulties and delays inherent in the development, manufacturing, marketing and sale of medical products, challenges with respect to third-party collaborations and integration of acquired businesses, disruptions or interruptions of information technology or similar systems, effectiveness of growth and restructuring strategies, challenges relating to the Company’s worldwide operations, challenges or unforeseen risks in implementing the Company’s growth strategies, government regulation, fluctuations in foreign currency exchange rates, future revenue and earnings growth, and general economic conditions and other risks and uncertainties described in the Company’s periodic reports and other filings with the U.S. Securities and Exchange Commission (the “SEC”). In some cases, you can identify these statements by forward-looking words, such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “intend,” “looking ahead,” “may,” “plan,” “possible,” “potential,” “project,” “should,” “will,” and similar words or expressions, the negative or plural of such words or expressions and other comparable terminology. Anticipated results only reflect information available to the Company at this time and may differ materially from actual results. The Company does not undertake to update its forward-looking statements or any of the information contained in this Current Report on Form 8-K.

Forward Looking Non-GAAP Measures

Medtronic calculates forward-looking non-GAAP financial measures based on internal forecasts that omit certain amounts that would be included in GAAP financial measures. For instance, forward-looking revenue growth and EPS projections exclude the impact of foreign currency exchange fluctuations. Forward-looking non-GAAP EPS guidance also excludes other potential charges or gains that would be recorded as non-GAAP adjustments to earnings during the fiscal year, such as amortization of intangible assets and acquisition-related, certain tax and litigation, and restructuring charges or gains. Medtronic does not attempt to provide reconciliations of forward-looking non-GAAP EPS guidance to projected GAAP EPS guidance because the combined impact and timing of recognition of these potential charges or gains is inherently uncertain and difficult to predict and is unavailable without unreasonable efforts. In addition, we believe such reconciliations would imply a degree of precision and certainty that could be confusing to investors. Such items could have a substantial impact on GAAP measures of financial performance

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

MEDTRONIC PUBLIC LIMITED COMPANY

|

|

|

|

|

|

|

|

|

By

|

/s/ Karen L. Parkhill

|

|

Date: July 17, 2017

|

|

|

Karen L. Parkhill

|

|

|

|

|

Executive Vice President and Chief Financial Officer

|

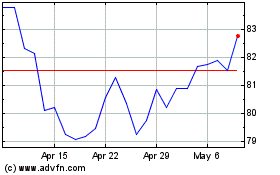

Medtronic (NYSE:MDT)

Historical Stock Chart

From Aug 2024 to Sep 2024

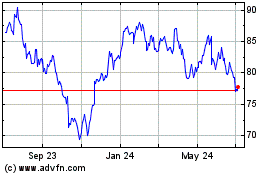

Medtronic (NYSE:MDT)

Historical Stock Chart

From Sep 2023 to Sep 2024