BASF

Explosion Claims Life At German Complex

FRANKFURT -- BASF SE said one person was confirmed dead, at

least six were seriously injured and another six were missing after

an explosion and resulting fires at its Ludwigshafen plant complex

on Monday, prompting the chemical company to power down 14

facilities there.

BASF said the cause of the blast was unknown, but that it took

place at 9:20 a.m. GMT during work on a pipeline system at the

factory complex in Ludwigshafen, the company's headquarters.

Firefighters remain at the scene working to douse the flames, BASF

and city officials said at a news briefing.

"There is visible smoke. Residents in the affected areas of

Ludwigshafen and Mannheim have been asked to stay indoors and to

keep doors and windows shut," BASF said.

"We deeply regret that one employee has died and several others

are injured. Our sympathies are with the victims and their

families," BASF's Ludwigshafen factory director Uwe Liebelt

said.

Earlier, BASF said it was powering down its steamcracker, and at

the briefing Mr. Liebelt said 14 production lines were shut down

"for safety reasons."

A BASF spokeswoman later said both of the complex's cracker

facilities, the starting point for production lines of various

products, were shut down. It remains unclear if the cracker

operations and productions lines can be restarted on Tuesday, she

said.

"We hope that we can finish putting out the fires this evening

so that we can resolve the uncertainty regarding the missing

employees," Peter Friedrich, Ludwigshafen's fire chief said.

BASF shares close down 1.2% at EUR78.28 ($85.86).

--Monica Houston-Waesch

COMMUNITY HEALTH

Almost Family Set To Buy Stake in Unit

Community Health Systems Inc. said it would sell 80% of its home

health and hospice business to Almost Family Inc. as it continues

to reduce its size and pay down debt.

Almost Family shares jumped 8.4% to $39.55 as Community Health

shares fell 0.5% to $9.97 in morning trading. Community Health

shares have tumbled from a high of $52.71 in June 2015.

Almost Family is buying the stake in CHS Home Health for $128

million. The unit provides skilled home health and hospice services

and currently operates 74 home health and 15 hospice locations

across 22 states.

The deal, which is expected to close in the fourth quarter, is

one of several recently announced by Community Health as it works

to pay down its multibillion-dollar debt load built up by years of

expansion.

Community Health recently came under fire from an investor over

a spinoff of a rural hospital chain. Community has been working to

salvage its $7.3 billion purchase of Health Management Associates

Inc., whose faltering hospitals Community has struggled to turn

around.

--Austen Hufford

PEARSON

LONDON -- Shares in Pearson PLC tumbled on Monday after the U.K.

educational publisher said weaker-than-expected trading in the

higher-education sector in North America weighed down on nine-month

sales.

The U.S.-focused educational-products specialist, which has

undergone a prolonged bout of restructuring including

multibillion-dollar asset sales, said revenue fell 7% in the nine

months to the end of September from the same period last year when

adjusted for changing exchange rates and mergers and

acquisitions.

The decline was just3% when currency factors, notably the

dollar's strength against the British pound, were included, the

U.K.-based Pearson said.

Weaker sales reflected "expected" declines in revenue from

student-testing contracts in the U.S. and U.K., two of its most

important markets, Pearson said. The company also recorded declines

in North American higher-education courseware, reflecting a further

draw down of inventories by retailers in July and August.

Pearson said its Penguin Random House publishing business

performed better, partly from movie-tie-in sales for books such as

"The Girl on the Train" by Paula Hawkinsin addition to best-selling

new work by authors Colson Whitehead and John Le Carré.

"Our markets have been challenging, but we are managing

discretionary costs tightly," Pearson said, with no plans to change

its earnings outlook for the full year or medium-term targets.

Investors were taken aback by the poor performance of Pearson's

North American business. The stock fell as much as 10% in morning

trading in London.

At the start of the year, the company launched cost-savings

worth half a billion dollars and released plans to ax 4,000 staff,

or 10% of its workforce world-wide after acknowledging it had

underestimated the impact of trading pressures across its key

markets.

Rapid growth in employment and increasing education regulation

in the U.S. has roiled higher-education enrollments in the company,

which has put pressure on Pearson's business even as it has sought

new sources of growth in countries like Brazil and China.

Pearson expects to report adjusted operating profit, before

restructuring costs, of between GBP580 million pounds ($706

million) and GBP620 million in 2016, and adjusted earnings a share

of share of between 50 pence and 55 pence. If current exchange

rates persist until the end of 2016, that would add 4.5 pence to

earnings a share, the company said.

Pearson, which used to own the Financial Times newspaper -- once

its flagship publishing asset -- and a stake in the publisher of

the Economist magazine, expects to report at least GBP800 million

in adjusted operating profit by 2018.

News Corp, which owns Dow Jones & Co., publisher of The Wall

Street Journal, competes with Pearson's book publishing units.

--Simon Zekaria and Razak Musah Baba

J.B. HUNT

Weak Demand Weighs on Results

J.B. Hunt Transport Services Inc. reported a drop in

third-quarter earnings as itthe freight trucking company faced

lower customer rates and weak demand.

The trucking industry has struggled for months as excess

capacity has pressured pricing. Additionally, the Arkansas-based

transportation company said bottom-line growth was weighed down by

increased driver wages and recruitment costs.

Overall for the quarter ended Sept. 30, J.B. Hunt reported a

profit of $109.4 million, or 97 cents a share, down from $115.1

million, or 99 cents a share, a year earlier. Revenue rose 6.6% to

$1.69 billion. Analysts polled by Thomson Reuters had forecast

earnings of $1.02 per share on $1.68 billion in revenue.

J.B. Hunt said intermodal revenue, its largest segment, rose 2%

to $970 million. In that segment, the number of total loads grew

7%, though revenue per load slipped 4.2%.

The dedicated contract services unit reported a 6% increase in

revenue to $394 million, helped by fewer unseated trucks and more

streamlined supply chains. Truck revenue remained flat at $97

million.

In the quarter ended in June, J.B. Hunt cut its sales guidance

for the year to 7% growth from a prior range of 9% to 12%

growth.

Shares were inactive premarket. Shares have dipped 6.2% over the

past three months.

--Imani Moise

(END) Dow Jones Newswires

October 18, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

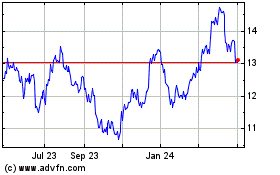

BASF (QX) (USOTC:BASFY)

Historical Stock Chart

From Apr 2024 to May 2024

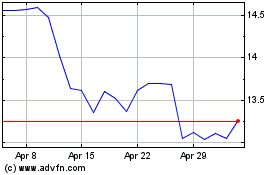

BASF (QX) (USOTC:BASFY)

Historical Stock Chart

From May 2023 to May 2024