Aldrin Partners With Take-Over Target Fission Energy

February 10 2015 - 8:15AM

If it is true that you are known by the company you keep, Aldrin

Resources (ALN-TSX.V) social status just made a quantum leap

upward.

On February 5, 2015 Aldrin announced an agreement to purchase

50% of Fission 3.0 (FUU-TSX.V) Key Lake Uranium Package for $6.9

million staged expenditure. Four days later Dev Randhawa, Chairman

and CEO of Fission 3.0, joined the board of Aldrin.

Mr. Randhawa is a messiah in the uranium space. He is the

founding CEO of Fission Uranium Corp. (FCU-TSX.V) -- a $435m market

cap uranium exploration company that owns the Triple R deposit at

PLS in the Athabasca Basin. Mr. Randhawa was also the founding CEO

of Fission Energy Corp.

"I am looking forward to helping Aldrin's team progress their

projects in Saskatchewan," stated Randhawa, "including the recently

announced joint venture between Aldrin and Fission 3.0 on the

highly prospective Key Lake property package."

The Key Lake package contains five separate properties

comprising 61 mineral claims covering about 18,000 hectares. The

claims are sitting in the same group of basement rocks that host

the major uranium deposits on the eastern side of the Athabasca

Basin. A near-by Key Lake open pit uranium operation produced

209.8 million pounds from 1983 to 2002.

"In the last 24 months we've executed a successful drill program

on our Triple M Property in the Athabasca Basin," states Aldrin CEO

Johnathan More in an exclusive interview with Financial Press. "But

the addition of the Key Lake Property creates a new horizon for our

shareholders."

Northern Miner Magazine's 2013 'Mining Person of the Year',

Randhawa has recently resigned from another junior

explorer. After a careful look at the players in this basin,

he appears to be placing his bet on Aldrin.

"Mr. Randhawa knows the basin, he knows uranium, and he knows

the Aldrin team," confirmed More. "It's a strategic partnership

that I believe is going to deliver significant dividends."

"As a project generator, we identify and acquire properties that

have the potential to host high-grade uranium," stated Randhawa.

"Our JV partners provide the financing, while our technical team,

led by COO and Chief Geologist Ross McElroy, operates the

project."

Having discovered two major deposits in four years, Fission's

technical team has developed a proprietary model for finding

uranium through airborne radiometrics, radon gas surveys and

geophysics.

"Key Lake has the potential for near-surface, high-grade

mineralization in basement rock," stated McElroy. "We are going to

utilize the in-house skills and techniques we've developed in

recent years when we begin exploration this year."

Although the uranium sector has been caught in a downdraft since

the 2011 Fukushima Power Plant malfunction, global energy usage

trends indicate that demand will sky rocket.

According to the World Nuclear Association there are currently

435 nuclear reactors connected into national grids, 67 are under

construction, 164 on order and 317 proposed.

"The Athabasca basin will be the biggest source of uranium for

the whole world," predicted Energy Guru Thomas Drolet in a

Financial Press Interview. "Aldrin is distinguished by its

location, size and the geological indicators which suggest there is

a strong potential for an economic uranium mine."

Location, location, location. Key Lake is in the vicinity

of the 2012 Patterson Lake discovery on the western side of the

Athabasca Basin.

Patterson Lake is a shallow deposit, amenable to an open pit,

located in basement rock that is typically easy to

mine. Analysts unanimously agree that Fission's PLS discovery

is one of the most significant uranium finds in decades.

The deposit contains an estimated 80 million pounds of

'indicated' uranium and about 25 million pounds of 'inferred'. More

than 50% of the resource sits in a high-grade zone that can be

mined at low cost.

In a recent communication, Dundee Capital Markets analyst David

Talbot called the Fission resource numbers 'truly phenomenal.'

Fission buy-out rumours involving Rio Tinto and Teck Resources

have now reached deafening levels, but Randhawa has stated that he

is in no rush to do a deal as Fission continues to expand its

resource.

"We don't control if someone comes and makes a run at us,"

stated Randhawa. "But we are ready for it if someone does."

This backdrop is significant for Aldrin shareholders because

explorers like Randhawa and McElroy will shift their focus quickly

after a buyout and the Key Lake Property is geographically and

geologically positioned to take center stage.

Aldrin is trading at .20 with a market cap of $4 million.

Legal Disclaimer/Disclosure: This document is not and should not

be construed as an offer to sell or the solicitation of an offer to

purchase or subscribe for any investment. Financial Press makes no

guarantee, representation or warranty and a fee has been paid for

the production and distribution of this Report.

CONTACT: Aldrin Resource Corp.

Johnathan More

604-687-7741

604-681-0796

info@aldrinresourcecorp.com

www.aldrinresourcecorp.com

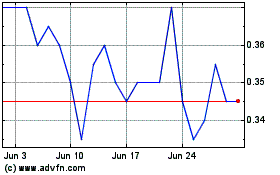

F3 Uranium (TSXV:FUU)

Historical Stock Chart

From Mar 2024 to Apr 2024

F3 Uranium (TSXV:FUU)

Historical Stock Chart

From Apr 2023 to Apr 2024