NewtekOne, Inc. Closes Private Offering of Senior Unsecured Notes

March 20 2025 - 8:30AM

NewtekOne, Inc. (the “Company”) (NASDAQ: NEWT) has completed an

exempt offering of $30.0 million aggregate principal amount of its

8.375% notes due 2030 (the “Notes” and the "Offering"). The

Offering was consummated pursuant to the terms of a purchase

agreement (the “Purchase Agreement”) dated March 19, 2025 between

the Company and eleven institutional accredited investors (the

“Purchasers”). The Purchase Agreement provided for the Notes to be

issued to the Purchasers in a private placement in reliance on

Section 4(a)(2) of the Securities Act of 1933, as amended (the

“Securities Act”). The Notes have not been registered under the

Securities Act and may not be offered or sold in the United States

absent registration or an applicable exemption from registration.

The Notes will mature on April 1, 2030.

Net proceeds from the sale of the Notes were approximately

$29.250 million, after deducting estimated offering expenses

payable by the Company. The Company intends to use the net proceeds

from the sale of the Notes to refinance existing indebtedness, with

remaining proceeds, if any, for general corporate purposes

(including payment of expenses incurred in connection with the

issuance of the Notes, providing capital to Newtek Bank, National

Association, and other working capital purposes).

Keefe, Bruyette & Woods, Inc., A Stifel Company and Raymond

James & Associates, Inc. acted as placement agents for the

Company.

In addition, Egan-Jones Ratings Company ("Egan-Jones") recently

upgraded the Company’s credit rating from “BBB+” to "A- ". The

rating upgrade applies to the Company and its outstanding senior

unsecured notes including the Company’s Nasdaq listed notes: NEWTZ,

NEWTI, NEWTG, and NEWTH. Egan-Jones noted the upgrade was based on,

among other things, the Company’s healthy shareholders equity to

asset ratio, strong tier 1 capital ratio and improvement in

efficiency ratio. According to Egan-Jones public disclosures, a

rating in the “A” category suggests a “high level of

creditworthiness with low sensitivity to evolving credit

conditions.”*

Barry Sloane, Chief Executive Officer and President, said, "We

are extremely pleased to have received an upgraded rating from a

nationally recognized organization such as Egan-Jones. We believe

that the rating upgrade reflects the strength of our earnings

stream, our well-capitalized balanced sheet, the depth and breadth

of our product offerings geared to independent business owners, and

our loan portfolio that is diversified by geography and

industry."

Egan-Jones is a Nationally Recognized Statistical Rating

Organization and is recognized by the National Association of

Insurance Commissioners as a Credit Rating Provider. Egan-Jones is

also certified by the European Securities and Markets

Authority.

* Egan-Jones Ratings Company (“EJR”) credit-related and other

analyses, including ratings, statements in the Ratings letter are

statements of opinion as of the date they are expressed and are not

statements of fact. EJR’s opinions and analyses are not

recommendations to purchase, hold, or sell any securities or to

make any investment decisions, and do not address the suitability

of any security. EJR may receive compensation for its ratings and

certain analyses, normally from issuers or underwriters of

securities, or from obligors.

Note: A securities rating is not a

recommendation to buy, sell or hold securities and may be subject

to revision or withdrawal at any time. An explanation of the

significance of ratings may be obtained from the rating

agencies.

About NewtekOne, Inc.

NewtekOne®, Your Business Solutions Company®, is a financial

holding company, which along with its bank and non-bank

consolidated subsidiaries (collectively, “NewtekOne”), provides a

wide range of business and financial solutions under the Newtek®

brand to independent business owners. Since 1999, NewtekOne

has provided state-of-the-art, cost-efficient products and services

and efficient business strategies to independent business owners

across all 50 states to help them grow their sales, control their

expenses, and reduce their risk.

NewtekOne’s and its subsidiaries’ business and financial

solutions include: banking (Newtek Bank, N.A.), Business Lending,

SBA Lending Solutions, Electronic Payment Processing, Accounts

Receivable Financing & Inventory Financing, Insurance Solutions

and Payroll and Benefits Solutions. In addition, NewtekOne offers

its clients the Technology Solutions (Cloud Computing, Data Backup,

Storage and Retrieval, IT Consulting and Web Services) provided by

Intelligent Protection Management Corp. (IPM.com).

Newtek®, NewtekOne®, Newtek Bank®, National Association, Your

Business Solutions Company®, One Solution for All Your Business

Needs® and Newtek Advantage are registered trademarks of NewtekOne,

Inc.

Note Regarding Forward-Looking StatementsCertain statements in

this press release are “forward-looking statements” within the

meaning of the rules and regulations of the Private Securities

Litigation and Reform Act of 1995 are based on the current beliefs

and expectations of NewtekOne's management and are subject to

significant risks and uncertainties. Actual results may differ

materially from those set forth in the forward-looking statements.

See “Note Regarding Forward-Looking Statements” and the sections

entitled “Risk Factors” in our filings with the Securities and

Exchange Commission which are available on NewtekOne's website

(https://investor.newtekbusinessservices.com/sec-filings) and on

the Securities and Exchange Commission’s website (www.sec.gov). Any

forward-looking statements made by or on behalf of NewtekOne speak

only as to the date they are made, and NewtekOne does not undertake

to update forward-looking statements to reflect the impact of

circumstances or events that arise after the date the

forward-looking statements were made.

SOURCE: NewtekOne, Inc.

Investor Relations & Public

RelationsContact: Bryce Rowe Telephone: (212) 273-8292 /

browe@newtekone.com

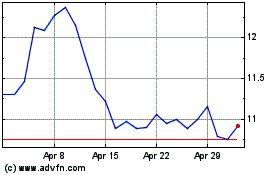

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Mar 2025 to Mar 2025

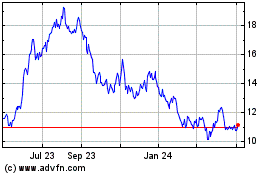

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Mar 2024 to Mar 2025