NewtekOne, Inc. (Nasdaq: NEWT) reports its financial and operating

results for the three and twelve months ended December 31, 2024.

NewtekOne Financial Highlights for the Three Months

Ended December 31, 2024

- Net income was $18.3 million and earnings per share (“EPS”) was

$0.70 per basic and $0.69 per diluted common share, for the three

months ended December 31, 2024; a 55.6% increase, on a per share

basis, compared to $11.9 million and $0.45 per basic and diluted

common share for the three months ended September 30, 2024, and a

62.8% increase, on a per share basis, compared to $10.8 million and

$0.43 per basic and diluted common share for the three months ended

December 31, 2023.

- Net interest income was $11.3 million for the three months

ended December 31, 2024; an increase of 2.7% over $11.0 million for

the three months ended September 30, 2024, and an increase of 36.1%

over $8.3 million for the three months ended December 31,

2023.

- Total assets were $2.1 billion at December 31 2024; an increase

of 50.0% from $1.4 billion at December 31, 2023.

- Loans held for investment were $991.4 million at December 31,

2024; an increase of 23.0% over $806.1 million at December 31,

2023.

- Total borrowings were $708.0 million at December 31, 2024; an

increase of 9.9% from $644.1 million at December 31, 2023.

- Net interest margin2 was 2.80% for the three months ended

December 31, 2024; a decrease of 9.1% compared to 3.08% for the

three months ended September 30, 2024, and an increase of 1.4% over

2.76% for the three months ended December 31, 2023.

- Return on Tangible Common Equity (“ROTCE”)1 of 31.8% for the

three months ended December 31, 2024; an increase of 49.3% over

21.3% for the three months ended September 30, 2024, and an

increase of 20.5% over 26.4% for the three months ended December

31, 2023.

- Return on Average Assets (“ROAA”)1,2 of 4.1% for the three

months ended December 31, 2024; an increase of 41.4% over 2.9% for

the three months ended September 30, 2024, and an increase of 28.1%

over 3.2% for the three months ended December 31, 2023.

- Efficiency ratio2 of 55.9% for the three months ended December

31, 2024; an improvement of 9.5% compared to 61.8% for the three

months ended September 30, 2024, and an improvement of 16.1%

compared to 66.6% for the three months ended December 31,

2023.

- Total risk-based capital ratio2 was 19.7% at December 31, 2024;

an increase of 3.1% over 19.1% at December 31, 2023.

- Tier-1 leverage ratio2 was 13.3% at December 31, 2024; a

decrease of 2.2% compared to 13.6% at December 31, 2023.

- Alternative Loan Program ("ALP") loan closings were $91.4

million for the three months ended December 31, 2024; an increase

of 199.0% over $30.5 million ALP loan closings for the three months

ended December 31, 2023.

- The Newtek Payments segment, which includes Newtek Merchant

Solutions ("NMS") and Mobil Money, had pretax income of $3.5

million for the three months ended December 31, 2024; a 2.9%

increase over the three months ended December 31, 2023.

Post Fourth Quarter 2024 Highlights

- The Company raises its 2025 annual EPS forecast range to $2.10

to $2.50 per basic and diluted common share, from its previous full

year 2025 EPS forecast range of $2.00 to $2.25 per basic and

diluted common share.

- On January 2, 2025, the Company closed on the sale of its

wholly owned subsidiary Newtek Technology Solutions, Inc. ("NTS")

to Intelligent Protection Management Corp. (Nasdaq: IPM).

- On January 13, 2025, the Company paid a quarterly cash dividend

of $0.19 per share on its outstanding common shares.

- On February 18, 2025, the Company announced that the Newtek

Advantage® now integrates with Intuit QuickBooks®, providing

independent business owners with a real-time snapshot into their

finances directly through the Newtek Advantage connecting real-time

accounting data with real-time banking data.

NewtekOne Financial Highlights for the Twelve Months

Ended December 31, 2024

- Net income was $50.9 million and EPS was $1.97 per basic and

$1.96 per diluted common share for the twelve months ended December

31, 2024, compared to $47.3 million and $1.89 per basic and $1.88

per diluted common share for the twelve months ended December 31,

2023. Excluding the positive impact of an income tax benefit of

$14.2 million, or $0.59 per basic and $0.58 per diluted share in

2023, EPS for the twelve months ended December 31, 2023, would have

been $1.30 per basic and diluted share.1

- Net interest income was $40.3 million for the twelve months

ended December 30, 2024; an increase of 51.5% over $26.6 million

for the twelve months ended December 31, 2023.

- Net interest margin2 was 2.87% for the twelve months ended

December 31, 2024; an increase of 21.1% over 2.37% for the twelve

months ended December 31, 2023.

- ROTCE1 of 24.1% for the twelve months ended December 31, 2024;

a decrease of 13.9% compared to 28.0% for the twelve months ended

December 31, 2023. ROTCE for the twelve months ended December 31,

2023, was positively impacted by the income tax benefit in the

first quarter of 2023.

- ROAA1,2 of 3.2% for the twelve months ended December 31, 2024;

a decrease of 11.1% compared to 3.6% for the twelve months ended

December 31, 2023. ROAA for the twelve months ended December 31,

2023, was positively impacted by the income tax benefit in the

first quarter of 2023.

- Efficiency ratio2 of 63.2% for the twelve months ended December

31, 2024; an improvement of 12.1% compared to 71.9% for the twelve

months ended December 31, 2023.

- ALP loan closings were $269.6 million for the twelve months

ended December 31, 2024; an increase of 224.9% over $83.0 million

of ALP loan closings for the twelve months ended December 31,

2023.

- The Newtek Payments segment, which includes NMS and Mobil

Money, had pretax income of $16.2 million for the twelve months

ended December 31, 2024; a 33.1% increase over the twelve months

ended December 31, 2023.

- On September 16, 2024, the Company completed a registered

public offering of $75.0 million aggregate principal amount of its

8.625% Fixed Rate Senior Notes due 2029 (Nasdaq: NEWTH), which were

rated BBB+ by Egan-Jones Ratings Company with a positive

outlook.

- On July 23, 2024, NewtekOne's joint venture, Newtek-TSO II

Conventional Credit Partners, LP, closed a $154.3 million

alternative business loan backed securitization rated by

Morningstar DBRS.

Newtek Bank, N.A. Financial Highlights

- Total deposits3 were $1.04 billion at December 31, 2024; an

increase of 39.5% over $745.7 million at September 30, 2024 and an

increase of 100.3% over $519.1 million in deposits at December 31,

2023.

- Insured deposits represented approximately 80.3% of total

deposits at December 31, 2024.

- Net interest margin was 4.84% for the twelve months ended

December 31, 2024; an increase of 33.3% over 3.63% for the twelve

months ended December 31, 2023.

- ROTCE1 of 48.8% for the twelve months ended December 31, 2024;

an increase of 36.3% compared to 35.8% for the twelve months ended

December 31, 2023.

- ROAA1 of 6.3% for the twelve months ended December 31, 2024; an

increase of 10.5% compared to 5.7% for the twelve months ended

December 31, 2023.

- Efficiency ratio1 of 43.6% for the twelve months ended December

31, 2024; an improvement of 12.6% from 49.9% for the twelve months

ended December 31, 2023.

- Total risk-based capital ratio was 15.4% at December 31, 2024;

a decrease of 32.5% from 22.8% at December 31, 2023.

- Tier-1 leverage ratio was 11.9% at December 31, 2024; a

decrease of 28.3% from 16.6% at December 31, 2023.

Lending Highlights for the Twelve Months Ended December

31, 2024

- SBA 7(a) loan closings of $954.3 million for the twelve months

ended December 31, 2024; an increase of 15.2% over $828.1 million

of SBA 7(a) loan closings for the twelve months ended December 31,

2023, surpassing the 2024 forecast of $935 million in total SBA

7(a) loan closings.

- The Company forecasts $1.0 billion in total SBA 7(a) loan

closings for 2025, which would represent a 6.0% increase over

2024.

- SBA 504 loan closings of $129.8 million for the twelve months

ended December 31, 2024; a decrease of 9.2% from $142.9 million SBA

504 loans closed for the twelve months ended December 31,

2023.

- Newtek Bank and the Company’s non-bank lending subsidiaries

closed $1.5 billion of loans across all loan products for the

twelve months ended December 31, 2024; a 33.1% increase over $1.1

billion of loans closed for the same period in 2023.

Barry Sloane, CEO, President and Chairman said, “Having

completed two full years since our January 6, 2023 acquisition of

Newtek Bank (formerly known as the National Bank of New York City)

and transitioning from a Business Development Company to a

financial holding company owning a nationally chartered bank, we

could not be more pleased with our ability to achieve our key

metrics and milestones. We are a technology-based organization that

is innovative and blanketed in a bank holding company wrapper.

Since the acquisition, we have faced and successfully overcome many

hurdles, including: demonstrating that we can raise deposits;

transitioning loan originations and growth into Newtek Bank; and

successfully operating as a financial holding company. For example,

deposits on December 31, 2022, when we acquired Newtek Bank, were

$142 million, and we have grown Newtek Bank's deposits3 by more

than 600% to $1.04 billion on December 31, 2024, representing

phenomenal growth in just two years. Additionally, Newtek Bank's

loan portfolio grew by more than 360% from $167 million on December

31, 2022, to $774 million on December 31, 2024. During this

two-year period, our business plan and model remained centered on

our strategy of deposit growth, loan growth, and the development of

the Newtek Advantage®. As an example of this development, we

announced last week that the Newtek Advantage now integrates with

Intuit QuickBooks®, providing independent business owners with a

real-time snapshot into their finances. Specifically, this

integration allows business owners using the Newtek Advantage and

QuickBooks to access and display essential financial data from

QuickBooks, including revenue, gross profits, net profits, account

balances, invoices (with aging), and bills. This financial data is

viewable in real time, with filtering options by day, month, or

year, enabling customers to stay informed and make timely decisions

with confidence. This feature complements the existing components

of the Newtek Advantage, which includes real-time credit card

payment tracking for batches and settlements, access to Newtek

Bank, Newtek payroll services, free unlimited document storage, and

free website analytics. Together, these tools provide a

comprehensive 360-degree financial solution that gives independent

business owners unparalleled control and visibility into their

operations. Furthermore, our management team has done an excellent

job of growing Newtek Bank’s assets, liabilities, and profits while

maintaining what we believe are appropriate levels of capital and

loan loss reserves, and achieving strong profitability. We believe

that as we strive to continue to achieve our performance metrics

and demonstrate our ability to earn outsized returns on equity and

assets, market opportunities will continue to come our way. For the

full year 2024, NewtekOne's ROTCE, and ROAA were 24.1% and 3.2%,

respectively, which we believe are leading metrics in the bank and

bank holding company space. Achieving these results while

simultaneously being able to manage a portfolio of loans with a

higher risk and reward profile, is something that we, as an

organization, are familiar with, as this has been our business

model for over two decades.”

Mr. Sloane added, “During our conference call tomorrow morning,

we will focus on metrics such as pre-provision net revenue, as well

as our percentage of non-interest income as a percentage of total

income, which we believe can demonstrate how we are one of the top

performers in the market regarding these metrics. We will also

provide a more in-depth explanation regarding the loss default

curves, both at the holding company and in Newtek Bank, which we

believe are unique to our SBA 7(a) portfolio. This data will

illustrate that we have an appropriate amount of loss reserves in

our provisions, and that our returns can be less sensitive to

credit deterioration compared to the banks and bank holding

companies in our space. Slide 12 in our earnings conference call

presentation will demonstrate the net increase in non accruals

before charge offs peaked in the second quarter of 2024 and the

subsequent decline of almost 50% in the fourth quarter of 2024. It

is also important to highlight that we made progress in the fourth

quarter of 2024 to diversify our Newtek Bank loan portfolio with

lower margin, less risky, conforming, commercial, and industrial

business loans as well as current vintage multi-tenanted commercial

real estate loans. We believe we can continue to diversify the loan

portfolio at Newtek Bank and can do this going forward without

sacrificing our ability to generate what we view as industry

leading ROTCE and ROAA. We will also discuss how we intend to grow

Newtek Bank's conforming CRE and C&I loans, and SBA 504 loans

at a faster rate than our SBA 7(a) loans in 2025. NewtekOne's full

year 2025 EPS forecast incorporates an expectation of generating

$500 million of new originations in the ALP loan portfolio, another

important and growing segment of our business model. We anticipate

our third ALP securitization will occur during the first half of

2025.”

Mr. Sloane further commented, “We believe that an investor in

NewtekOne should look beyond the typical bank and bank holding

company narrow focus on credit, provisions for credit losses,

charge offs, and deposit rates of interest. Indeed, for over two

decades, we have chosen not to avoid credit risk, but rather to

seek to effectively manage a portfolio of loans and the risk

associated with them and earn outsized returns. We believe we have

demonstrated over the two years of owning Newtek Bank that our

higher levels of provisions and charge offs are in our business

plan and are included in our 2025 expectations, and further, should

be measured against the high rewards we believe we can achieve as a

result of having developed an expertise in the area of providing

financing to independent business owners. After two full years of

operations and financial results, including metrics such as our

credit loss reserves, charge offs, well-capitalized balance sheet,

and returns on equity and assets, we continue to believe in our

ability to generate profits. We believe that our business model,

with higher margins and lower operating expenses, has the ability

to generate an attractive risk and reward scenario for all of our

stakeholders with the capability to continue to grow our earnings

on a go-forward basis."

Mr. Sloane concluded, “During our conference call tomorrow, we

look forward to further elaborating on our unique and attractive

business model, which we believe can address the bank holding

company and bank industry issues of high-quality asset originations

with razor-thin margins, as well as expensive infrastructure to

acquire customers, using traditional bankers, branches, brokers,

and business development officers. Newtek Bank is a true

technology-enabled bank. During our two-decade history of using our

patented NewTracker® system and alliance partner model, through

which we receive an average of 600 to 900 unique business referrals

daily, we have been able to operate below industry-level efficiency

ratios of 43.6% for Newtek Bank, and 63.2% for NewtekOne in 2024.

Moreover, the industry’s business model is predicated on raising

deposits at 2% to 3% below the risk-free treasury rate without

offering depositors anything special for the inexpensive

liabilities, or non-interest-bearing accounts, especially given

today's market where deposits can be moved with the click of a

mouse or the finger movement on a smartphone. We believe our

business model can overcome obstacles in a compliant and

frictionless manner that is highly attractive to our independent

business owner client base due to, among other things, the Newtek

Advantage. The Newtek Advantage can give independent business owner

clientele true value by offering things like free document storage,

free updated web tracking, analytics, payment processing in the

business portal, data in the business portal, ability to make

payroll in the business portal, integration with QuickBooks, and

other benefits which can enable us to acquire and grow our business

deposit clientele, particularly with the integration of payment

processing and payroll with our Bank's checking accounts. We are

pleased we were able to grow our business accounts significantly in

2024 and anticipate further growth in 2025 due to, among other

things, the capabilities of the Newtek Advantage. We are raising

our full year 2025 EPS forecast range to $2.10 to $2.50 per basic

and diluted common share, from our previous full year 2025 EPS

forecast range of $2.00 to $2.25 per basic and diluted common

share, which we believe represents attractive, measurable growth

over our full year 2024 EPS of $1.97 per basic and $1.96 per

diluted common share for the twelve months ended December 31, 2024.

In addition, our objective is to maintain the current dividend

payout. Our current dividend yield has been tracking between 5% and

6%, which we believe represents an attractive opportunity for a

company that is growing its earnings and has a unique and, in many

metrics, industry-leading performance model.”

Fourth Quarter and Full Year 2024 Conference Call and

Webcast

A conference call to discuss the fourth quarter and full year

2024 financial and operating results will be hosted by Barry

Sloane, Chief Executive Officer, President and Chairman and M.

Scott Price, Chief Financial Officer, tomorrow, Thursday, February

27, 2025, 8:30 a.m. ET.

Please note, to attend the conference call or webcast,

participants should register online at NewtekOne, Inc. Fourth

Quarter and Full Year 2024 Financial Results Conference Call. To

receive a dial-in number, participants are requested to register at

a minimum 15 minutes before the start of the call. The

corresponding presentation will be available in the ‘Events &

Presentations’ section of the Investor Relations portion of

NewtekOne's website at NewtekOne, Inc. Fourth Quarter and Full Year

2024 Financial Results Conference Call. A replay of the call with

the corresponding presentation will be available on NewtekOne's

website shortly following the live presentation and will be

available for a period of one year.

Note Regarding Dividend Payments

Amount and timing of dividends, if any, remain subject to the

discretion of the Company's Board of Directors.

About NewtekOne, Inc.

NewtekOne®, Your Business Solutions Company®, is a financial

holding company, which along with its bank and non-bank

consolidated subsidiaries (collectively, “NewtekOne”), provides a

wide range of business and financial solutions under the Newtek®

brand to independent business owners. Since 1999, NewtekOne has

provided state-of-the-art, cost-efficient products and services and

efficient business strategies to independent business owners across

all 50 states to help them grow their sales, control their

expenses, and reduce their risk.

NewtekOne’s and its subsidiaries’ business and financial

solutions include: banking (Newtek Bank, N.A.), Business Lending,

SBA Lending Solutions, Electronic Payment Processing, Accounts

Receivable Financing & Inventory Financing, Insurance Solutions

and Payroll and Benefits Solutions. In addition, NewtekOne offers

its clients the Technology Solutions (Cloud Computing, Data Backup,

Storage and Retrieval, IT Consulting and Web Services) provided by

Intelligent Protection Management Corp. (IPM.com)

Newtek®, NewtekOne®, Newtek Bank®, National Association, Your

Business Solutions Company®, One Solution for All Your Business

Needs® and Newtek Advantage® are registered trademarks of

NewtekOne, Inc.

Note Regarding Forward-Looking

StatementsCertain statements in this press release are

“forward-looking statements” within the meaning of the rules and

regulations of the Private Securities Litigation and Reform Act of

1995. Information regarding the Company’s assets under supervision,

capital ratios, risk-weighted assets, supplementary leverage ratio

and balance sheet data consists of preliminary estimates and are

subject to change with our filings with regulatory agencies and the

filing of the Company's Form 10-K for the year ended December 31,

2024. These statements and other forward-looking statements herein

are based on the current beliefs and expectations of NewtekOne's

management and are subject to significant risks and uncertainties.

Actual results may differ materially from those set forth in the

forward-looking statements. In addition, earnings per share

guidance reflects risks, uncertainties and assumptions with respect

to facts and circumstances that are beyond our control, in

particular concerning interest rates, monetary policy and

prevailing economic conditions during the relevant periods, any of

which may differ significantly from our assumptions about the

applicable period, causing our actual operating results, including

our earnings per share, to differ materially from the stated

guidance. See “Note Regarding Forward-Looking Statements” and the

sections entitled “Risk Factors” in our filings with the Securities

and Exchange Commission which are available on NewtekOne's website

(https://investor.newtekbusinessservices.com/sec-filings) and on

the Securities and Exchange Commission’s website (www.sec.gov). Any

forward-looking statements made by or on behalf of NewtekOne speak

only as to the date they are made, and NewtekOne does not undertake

to update forward-looking statements to reflect the impact of

circumstances or events that arise after the date the

forward-looking statements were made.

SOURCE: NewtekOne, Inc.

Investor Relations & Public

RelationsContact: Jayne Cavuoto Telephone: (212) 273-8179

/ jcavuoto@newtekone.com

|

NEWTEKONE, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF FINANCIAL

CONDITION(In Thousands, except for Per Share

Data) |

|

|

|

|

|

|

|

|

|

December 31, 2024 |

|

December 31, 2023 |

|

ASSETS |

|

(unaudited) |

|

|

|

Cash and due from banks |

|

$ |

6,941 |

|

|

$ |

15,398 |

|

|

Restricted cash |

|

|

28,226 |

|

|

|

30,919 |

|

|

Interest bearing deposits in banks |

|

|

346,207 |

|

|

|

137,689 |

|

|

Total cash and cash equivalents |

|

|

381,374 |

|

|

|

184,006 |

|

|

Debt securities available-for-sale, at fair value |

|

|

23,916 |

|

|

|

32,171 |

|

|

Loans held for sale, at fair value |

|

|

372,286 |

|

|

|

118,867 |

|

|

Loans held for sale, at LCM |

|

|

58,803 |

|

|

|

56,607 |

|

|

Loans held for investment, at fair value |

|

|

369,746 |

|

|

|

469,801 |

|

|

Loans held for investment, at amortized cost, net of deferred fees

and costs |

|

|

621,651 |

|

|

|

336,305 |

|

|

Allowance for credit losses |

|

|

(30,233 |

) |

|

|

(12,574 |

) |

|

Loans held for investment, at amortized cost, net |

|

|

591,418 |

|

|

|

323,731 |

|

|

Federal Home Loan Bank and Federal Reserve Bank stock |

|

|

3,585 |

|

|

|

3,635 |

|

|

Settlement receivable |

|

|

52,465 |

|

|

|

62,230 |

|

|

Joint ventures and non-control investments, at fair value (cost of

$44,039 and $38,660), respectively |

|

|

57,678 |

|

|

|

41,587 |

|

|

Goodwill and intangibles |

|

|

14,752 |

|

|

|

30,120 |

|

|

Right of use assets |

|

|

5,688 |

|

|

|

5,701 |

|

|

Deferred tax asset, net |

|

|

— |

|

|

|

5,230 |

|

|

Servicing assets |

|

|

46,257 |

|

|

|

39,725 |

|

|

Other assets |

|

|

60,636 |

|

|

|

56,102 |

|

|

Assets held for sale |

|

|

21,308 |

|

|

|

— |

|

|

Total assets |

|

$ |

2,059,912 |

|

|

$ |

1,429,513 |

|

| |

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

| Liabilities: |

|

|

|

|

|

Deposits: |

|

|

|

|

|

Noninterest-bearing |

|

$ |

11,142 |

|

|

$ |

10,053 |

|

|

Interest-bearing |

|

|

961,910 |

|

|

|

453,452 |

|

|

Total deposits |

|

|

973,052 |

|

|

|

463,505 |

|

|

Borrowings |

|

|

708,041 |

|

|

|

644,122 |

|

|

Dividends payable |

|

|

5,233 |

|

|

|

4,792 |

|

|

Lease liabilities |

|

|

6,498 |

|

|

|

6,952 |

|

|

Deferred tax liabilities, net |

|

|

2,244 |

|

|

|

— |

|

|

Due to participants |

|

|

21,532 |

|

|

|

23,796 |

|

|

Accounts payable, accrued expenses and other liabilities |

|

|

40,806 |

|

|

|

37,300 |

|

|

Liabilities directly associated with assets held for sale |

|

|

6,224 |

|

|

|

— |

|

|

Total liabilities |

|

|

1,763,630 |

|

|

|

1,180,467 |

|

| |

|

|

|

|

|

Shareholders' Equity: |

|

|

|

|

|

Preferred stock (par value $0.02 per share; authorized 20 shares,

20 shares issued and outstanding) |

|

|

19,738 |

|

|

|

19,738 |

|

|

Common stock (par value $0.02 per share; authorized 199,980 shares,

26,291 and 24,680 issued and outstanding, respectively) |

|

|

526 |

|

|

|

492 |

|

|

Additional paid-in capital |

|

|

218,266 |

|

|

|

200,913 |

|

|

Retained earnings |

|

|

57,773 |

|

|

|

28,051 |

|

|

Accumulated other comprehensive income (loss), net of income

taxes |

|

|

(21 |

) |

|

|

(148 |

) |

|

Total shareholders' equity |

|

|

296,282 |

|

|

|

249,046 |

|

|

Total liabilities and shareholders' equity |

|

$ |

2,059,912 |

|

|

$ |

1,429,513 |

|

|

|

|

NEWTEKONE, INC. AND SUBSIDIARIES |

|

CONSOLIDATED STATEMENTS OF INCOME |

|

(In Thousands, except for Per Share Data) |

|

|

| |

|

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

Financial Holding Company |

|

Financial Holding Company |

|

Investment Company |

|

Financial Holding Company |

|

Financial Holding Company |

|

Investment Company |

| |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

|

|

|

| Interest

income |

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt securities available-for-sale |

|

$ |

314 |

|

|

$ |

435 |

|

|

$ |

— |

|

|

$ |

1,482 |

|

|

$ |

1,518 |

|

|

$ |

— |

|

|

Loans and fees on loans |

|

|

30,546 |

|

|

|

23,660 |

|

|

|

11,781 |

|

|

|

110,892 |

|

|

|

84,001 |

|

|

|

35,696 |

|

|

Interest from affiliates |

|

|

— |

|

|

|

— |

|

|

|

834 |

|

|

|

— |

|

|

|

— |

|

|

|

2,921 |

|

|

Other interest earning assets |

|

|

2,867 |

|

|

|

2,274 |

|

|

|

— |

|

|

|

9,044 |

|

|

|

8,854 |

|

|

|

— |

|

|

Total interest income |

|

|

33,727 |

|

|

|

26,369 |

|

|

|

12,615 |

|

|

|

121,418 |

|

|

|

94,373 |

|

|

|

38,617 |

|

| Interest

expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

|

|

8,935 |

|

|

|

5,111 |

|

|

|

— |

|

|

|

28,690 |

|

|

|

15,849 |

|

|

|

— |

|

|

Notes and securitizations |

|

|

12,027 |

|

|

|

11,411 |

|

|

|

7,348 |

|

|

|

45,454 |

|

|

|

40,217 |

|

|

|

21,780 |

|

|

Bank and FHLB borrowings |

|

|

1,473 |

|

|

|

1,546 |

|

|

|

1,303 |

|

|

|

6,969 |

|

|

|

11,673 |

|

|

|

3,998 |

|

|

Notes payable related party |

|

|

— |

|

|

|

— |

|

|

|

262 |

|

|

|

— |

|

|

|

— |

|

|

|

547 |

|

|

Total interest expense |

|

|

22,435 |

|

|

|

18,068 |

|

|

|

8,913 |

|

|

|

81,113 |

|

|

|

67,739 |

|

|

|

26,325 |

|

|

Net interest income |

|

|

11,292 |

|

|

|

8,301 |

|

|

|

3,702 |

|

|

|

40,305 |

|

|

|

26,634 |

|

|

|

12,292 |

|

|

Provision for credit losses |

|

|

9,474 |

|

|

|

4,365 |

|

|

|

— |

|

|

|

26,216 |

|

|

|

11,704 |

|

|

|

— |

|

|

Net interest income after provision for credit losses |

|

|

1,818 |

|

|

|

3,936 |

|

|

|

3,702 |

|

|

|

14,089 |

|

|

|

14,930 |

|

|

|

12,292 |

|

| Noninterest

income |

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividend income |

|

|

391 |

|

|

|

360 |

|

|

|

4,606 |

|

|

|

1,519 |

|

|

|

1,757 |

|

|

|

24,657 |

|

|

Net gain (loss) on loan servicing assets |

|

|

(7,282 |

) |

|

|

(1,983 |

) |

|

|

(6,131 |

) |

|

|

(12,665 |

) |

|

|

8,970 |

|

|

|

2,259 |

|

|

Servicing income |

|

|

5,165 |

|

|

|

4,985 |

|

|

|

3,767 |

|

|

|

20,087 |

|

|

|

18,289 |

|

|

|

13,698 |

|

|

Net gains on sales of loans |

|

|

28,652 |

|

|

|

17,252 |

|

|

|

6,948 |

|

|

|

97,183 |

|

|

|

38,215 |

|

|

|

44,547 |

|

|

Net gain (loss) on loans under the fair value option |

|

|

9,381 |

|

|

|

5,420 |

|

|

|

(14,089 |

) |

|

|

5,200 |

|

|

|

18,008 |

|

|

|

(26,504 |

) |

|

Technology and IT support income |

|

|

5,388 |

|

|

|

6,460 |

|

|

|

— |

|

|

|

19,643 |

|

|

|

24,916 |

|

|

|

— |

|

|

Electronic payment processing income |

|

|

10,640 |

|

|

|

10,659 |

|

|

|

— |

|

|

|

46,049 |

|

|

|

42,855 |

|

|

|

— |

|

|

Other noninterest income |

|

|

11,739 |

|

|

|

5,954 |

|

|

|

24,840 |

|

|

|

40,296 |

|

|

|

23,762 |

|

|

|

34,221 |

|

|

Total noninterest income |

|

|

64,074 |

|

|

|

49,107 |

|

|

|

19,941 |

|

|

|

217,312 |

|

|

|

176,772 |

|

|

|

92,878 |

|

| Noninterest

expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits expense |

|

|

17,486 |

|

|

|

14,535 |

|

|

|

5,806 |

|

|

|

77,931 |

|

|

|

65,708 |

|

|

|

20,186 |

|

|

Technology services expense |

|

|

3,637 |

|

|

|

4,265 |

|

|

|

— |

|

|

|

12,261 |

|

|

|

14,272 |

|

|

|

— |

|

|

Electronic payment processing expense |

|

|

4,901 |

|

|

|

4,168 |

|

|

|

— |

|

|

|

19,878 |

|

|

|

18,327 |

|

|

|

— |

|

|

Professional services expense |

|

|

4,576 |

|

|

|

3,311 |

|

|

|

2,812 |

|

|

|

15,813 |

|

|

|

13,077 |

|

|

|

7,134 |

|

|

Other loan origination and maintenance expense |

|

|

4,379 |

|

|

|

2,503 |

|

|

|

8,846 |

|

|

|

13,770 |

|

|

|

9,433 |

|

|

|

30,746 |

|

|

Depreciation and amortization |

|

|

214 |

|

|

|

613 |

|

|

|

58 |

|

|

|

1,784 |

|

|

|

2,884 |

|

|

|

239 |

|

|

Loss on extinguishment of debt |

|

|

— |

|

|

|

271 |

|

|

|

— |

|

|

|

— |

|

|

|

271 |

|

|

|

417 |

|

|

Other general and administrative costs |

|

|

6,946 |

|

|

|

8,543 |

|

|

|

2,054 |

|

|

|

21,272 |

|

|

|

22,357 |

|

|

|

7,673 |

|

|

Total noninterest expense |

|

|

42,139 |

|

|

|

38,209 |

|

|

|

19,576 |

|

|

|

162,709 |

|

|

|

146,329 |

|

|

|

66,395 |

|

| Net income before

taxes |

|

|

23,753 |

|

|

|

14,834 |

|

|

|

4,067 |

|

|

|

68,692 |

|

|

|

45,373 |

|

|

|

38,775 |

|

| Income tax expense

(benefit) |

|

|

5,429 |

|

|

|

3,985 |

|

|

|

6,289 |

|

|

|

17,839 |

|

|

|

(1,956 |

) |

|

|

6,464 |

|

|

Net income |

|

|

18,324 |

|

|

|

10,849 |

|

|

|

(2,222 |

) |

|

|

50,853 |

|

|

|

47,329 |

|

|

|

32,311 |

|

| Dividends to preferred

shareholders |

|

|

(400 |

) |

|

|

(405 |

) |

|

|

— |

|

|

|

(1,600 |

) |

|

|

(1,454 |

) |

|

|

— |

|

| Net income available to common

shareholders |

|

$ |

17,924 |

|

|

$ |

10,444 |

|

|

$ |

(2,222 |

) |

|

$ |

49,253 |

|

|

$ |

45,875 |

|

|

$ |

32,311 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.70 |

|

|

$ |

0.43 |

|

|

$ |

(0.09 |

) |

|

$ |

1.97 |

|

|

$ |

1.89 |

|

|

$ |

1.34 |

|

| Diluted |

|

$ |

0.69 |

|

|

$ |

0.43 |

|

|

$ |

(0.09 |

) |

|

$ |

1.96 |

|

|

$ |

1.88 |

|

|

$ |

1.34 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of GAAP to Non-GAAP Financial Measures

(unaudited)The information provided below presents a

reconciliation of each of our non-GAAP financial measures to the

most directly comparable GAAP financial measure. Ratios for three

month periods ended have been annualized based on calendar

days.

Reconciliation of Newtek Bank and NewtekOne Inc.

Non-GAAP Measures:

| Newtek Bank,

NA |

|

As of and for the year ended December

31, |

|

(in thousands) |

|

2024 |

|

2023 |

| Return on Average

Tangible Common Equity |

|

|

|

|

| Net Income (GAAP) |

|

$51,994 |

|

$28,125 |

| Tax-adjusted amortization of

intangibles |

|

130 |

|

142 |

| Numerator: Adjusted net

income |

|

52,124 |

|

28,267 |

| Average Total Shareholders'

Equity1 |

|

107,896 |

|

81,049 |

| Deduct: Average Goodwill and

Intangibles1 |

|

1,031 |

|

2,099 |

| Denominator: Tangible Average

Common Equity1 |

|

$106,865 |

|

$78,950 |

| Return on Average Tangible

Common Equity1 |

|

48.8% |

|

35.8% |

| |

|

|

|

|

| Return on Average

Assets |

|

|

|

|

| Numerator: Net Income

(GAAP) |

|

$51,994 |

|

$28,125 |

| Denominator: Average

Assets1 |

|

827,220 |

|

490,606 |

| Return on Average Assets1 |

|

6.3% |

|

5.7% |

| |

|

|

|

|

| Efficiency

Ratio |

|

|

|

|

| Numerator: Non-Interest

Expense (GAAP) |

|

$70,803 |

|

$51,378 |

| Net Interest Income

(GAAP) |

|

39,721 |

|

17,461 |

| Non-Interest Income

(GAAP) |

|

122,904 |

|

85,579 |

| Denominator: Total Income |

|

$162,625 |

|

$103,040 |

| Efficiency Ratio1 |

|

43.6% |

|

49.9% |

| |

|

|

|

|

| Net Interest

Margin |

|

|

|

|

| Net interest income

(GAAP) |

|

39,721 |

|

17,461 |

| Average interest-earning

assets |

|

820,337 |

|

481,722 |

| Net Interest Margin1 |

|

4.84% |

|

3.63% |

| |

|

|

|

|

| NewtekOne,

Inc. |

|

As of and for the three months

ended |

As of and for the year ended December

31, |

|

(dollars and number of shares in thousands) |

|

December 31, 2024 |

|

September 30, 2024 |

|

December 31, 2023 |

|

2024 |

|

2023 |

| Return on Average

Tangible Common Equity |

|

|

|

|

|

|

|

|

|

|

|

Numerator: Net Income (GAAP) |

|

$18,324 |

|

$11,934 |

|

$10,849 |

|

$50,853 |

|

$47,329 |

|

Tax-adjusted amortization of intangibles |

|

55 |

|

141 |

|

141 |

|

491 |

|

1,057 |

| Numerator: Adjusted net

income |

|

18,379 |

|

12,075 |

|

10,990 |

|

51,344 |

|

48,386 |

| Average Total Shareholders'

Equity1 |

|

279,853 |

|

274,888 |

|

218,387 |

|

262,805 |

|

224,052 |

| Deduct: Preferred Stock

(GAAP) |

|

19,738 |

|

19,738 |

|

19,738 |

|

19,738 |

|

19,738 |

| Average Common Shareholders'

Equity1 |

|

260,115 |

|

255,150 |

|

198,649 |

|

243,067 |

|

204,314 |

| Deduct: Average Goodwill and

Intangibles1 |

|

29,939 |

|

29,729 |

|

31,250 |

|

29,902 |

|

31,706 |

| Denominator: Average Tangible

Common Equity1 |

|

$230,176 |

|

$225,421 |

|

$167,399 |

|

$213,165 |

|

$172,608 |

| Return on Average Tangible

Common Equity1 |

|

31.8% |

|

21.3% |

|

26.4% |

|

24.1% |

|

28.0% |

| |

|

|

|

|

|

|

|

|

|

|

| Return on Average

Assets |

|

|

|

|

|

|

|

|

|

|

| Numerator: Net Income

(GAAP) |

|

$18,324 |

|

$11,934 |

|

$10,849 |

|

$50,853 |

|

$47,329 |

| Denominator: Average

Assets1 |

|

1,787,859 |

|

1,610,849 |

|

1,382,690 |

|

1,588,282 |

|

1,316,923 |

| Return on Average Assets1 |

|

4.1% |

|

2.9% |

|

3.2% |

|

3.2% |

|

3.6% |

| |

|

|

|

|

|

|

|

|

|

|

| Efficiency

Ratio |

|

|

|

|

|

|

|

|

|

|

| Numerator: Non-Interest

Expense (GAAP) |

|

$42,139 |

|

$38,847 |

|

$38,209 |

|

$162,709 |

|

$146,329 |

| Net Interest Income

(GAAP) |

|

11,292 |

|

10,981 |

|

8,301 |

|

40,305 |

|

26,634 |

| Non-Interest Income

(GAAP) |

|

64,074 |

|

51,851 |

|

49,107 |

|

217,312 |

|

176,772 |

| Denominator: Total Income |

|

$75,366 |

|

$62,832 |

|

$57,408 |

|

$257,617 |

|

$203,406 |

| Efficiency Ratio1 |

|

55.9% |

|

61.8% |

|

66.6% |

|

63.2% |

|

71.9% |

| |

|

|

|

|

|

|

|

|

|

|

| Net Interest

Margin |

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

11,288 |

|

10,981 |

|

8,301 |

|

40,309 |

|

26,634 |

| Average interest-earning

assets |

|

1,603,858 |

|

1,416,568 |

|

1,194,463 |

|

1,402,491 |

|

1,122,930 |

| Net Interest Margin1 |

|

2.80% |

|

3.08% |

|

2.76% |

|

2.87% |

|

2.37% |

|

|

Reconciliation of NewtekOne, Inc. Tangible Book

Value:

| |

|

As of December 31, |

|

NewtekOne, Inc. |

|

2024 |

|

2023 |

| Tangible Book Value

Per Share |

|

|

|

|

| Total Shareholders' Equity

(GAAP) |

|

$296,282 |

|

$281,785 |

| Deduct: Goodwill and

Intangibles (GAAP) |

|

29,581 |

|

30,120 |

| Numerator: Total Tangible Book

Value1 |

|

$266,701 |

|

$251,665 |

| Denominator: Total Number of

Shares Outstanding |

|

26,291 |

|

26,018 |

| Tangible Book Value Per

Share1 |

|

$10.14 |

|

$9.67 |

| |

|

|

|

|

| Tangible Book Value

Per Common Share |

|

|

|

|

| Total Tangible Book

Value1 |

|

$266,701 |

|

$251,665 |

| Deduct: Preferred Stock

(GAAP) |

|

19,738 |

|

19,738 |

| Numerator: Tangible Book Value

Per Common Share1 |

|

$246,963 |

|

$231,927 |

| Denominator: Total Number of

Shares Outstanding |

|

26,291 |

|

26,018 |

| Tangible Book Value Per Common

Share1 |

|

$9.39 |

|

$8.91 |

| 1 Non-GAAP |

|

|

|

|

Reconciliation of Core EPS to GAAP EPS:

| |

|

Year Ended December 31, 2024 |

|

Year Ended December 31, 2023 |

| |

|

GAAP EPS |

|

Adjustments |

|

Core EPS |

|

GAAP EPS |

|

Adjustments |

|

Core EPS |

| |

|

Based on Net Income |

|

Discrete Tax Benefits on Reorg |

|

Based on Adjusted Net Income |

|

Based on Net Income |

|

Discrete Tax Benefits on Reorg |

|

Based on Adjusted Net Income |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income before taxes |

|

$ |

68,692 |

|

|

$ |

— |

|

$ |

68,692 |

|

|

$ |

45,373 |

|

|

$ |

— |

|

|

$ |

45,373 |

|

| Income tax expense

(benefit) |

|

|

17,839 |

|

|

|

— |

|

|

17,839 |

|

|

|

(1,956 |

) |

|

|

14,244 |

|

|

|

12,288 |

|

|

Net income |

|

|

50,853 |

|

|

|

— |

|

|

50,853 |

|

|

|

47,329 |

|

|

|

(14,244 |

) |

|

|

33,085 |

|

| Preferred dividends |

|

|

(1,600 |

) |

|

|

— |

|

|

(1,600 |

) |

|

|

(1,454 |

) |

|

|

— |

|

|

|

(1,454 |

) |

| Net income available to common

shareholders |

|

$ |

49,253 |

|

|

$ |

— |

|

$ |

49,253 |

|

|

$ |

45,875 |

|

|

$ |

(14,244 |

) |

|

$ |

31,631 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic: |

|

|

|

|

|

|

|

|

|

|

|

|

| Income available to common

shareholders |

|

$ |

49,253 |

|

|

$ |

— |

|

$ |

49,253 |

|

|

$ |

45,875 |

|

|

$ |

(14,244 |

) |

|

$ |

31,631 |

|

| Weighted-average basic shares

outstanding |

|

|

24,945 |

|

|

|

— |

|

|

24,945 |

|

|

|

24,263 |

|

|

|

— |

|

|

|

24,263 |

|

|

Basic |

|

$ |

1.97 |

|

|

$ |

— |

|

$ |

1.97 |

|

|

$ |

1.89 |

|

|

$ |

0.59 |

|

|

$ |

1.30 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted: |

|

|

|

|

|

|

|

|

|

|

|

|

| Income available to common

shareholders |

|

$ |

49,253 |

|

|

$ |

— |

|

$ |

49,253 |

|

|

$ |

45,875 |

|

|

$ |

(14,244 |

) |

|

$ |

31,631 |

|

| Total weighted-average diluted

shares outstanding |

|

|

25,186 |

|

|

|

— |

|

|

25,186 |

|

|

|

24,348 |

|

|

|

— |

|

|

|

24,348 |

|

|

Diluted |

|

$ |

1.96 |

|

|

$ |

— |

|

$ |

1.96 |

|

|

$ |

1.88 |

|

|

$ |

0.58 |

|

|

$ |

1.30 |

|

1 Non-GAAP; reconciliations of non-GAAP financial measures to

the most comparable GAAP measures are set forth on the last page of

the financial information accompanying this press release.2 Assets

under supervision, capital ratios, risk-weighted assets and

supplementary leverage ratio are preliminary data and subject to

change with the filing of our Form 10-K for the period ended

December 31, 2024.3 Total deposits as reported include $69.9

million, $96.3 million, and $55.6 million in deposits from

affiliates held at Newtek Bank as of December 31, 2024, September

30, 2024, and December 31, 2023, respectively, which are eliminated

through consolidation on NewtekOne's consolidated financial

statements.

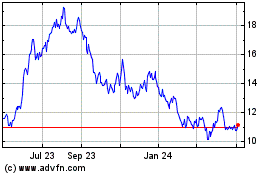

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Feb 2025 to Mar 2025

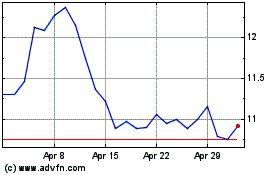

NewtekOne (NASDAQ:NEWT)

Historical Stock Chart

From Mar 2024 to Mar 2025