Visa Introduces the Visa Tokenized Asset Platform

October 03 2024 - 8:00AM

Business Wire

Visa Tokenized Asset Platform (VTAP) is a new product that helps

banks issue fiat-backed tokens. BBVA will use VTAP to create tokens

on the public Ethereum blockchain with expected live pilots in

2025.

Visa (NYSE: V), a global leader in digital payments, is helping

to bridge existing fiat currencies with blockchains through the

Visa Tokenized Asset Platform (VTAP), a new product designed to

help financial institutions issue and manage fiat-backed tokens on

blockchain networks. The VTAP solution is available on the Visa

Developer Platform for participating financial institution

partners, to create and experiment with their own fiat-backed

tokens in a VTAP sandbox.

Visa has a global network of more than 15,000 financial

institutions and helps facilitate seamless transactions of fiat

currencies across more than 200 countries and territories. Now,

Visa is applying its expertise in new technologies, such as smart

contracts, to enable banks to issue and transfer fiat-backed tokens

over blockchain networks.

“Visa has been at the forefront of digital payments for nearly

sixty years, and with the introduction of VTAP, we are once again

setting the pace for the industry,” said Vanessa Colella, Global

Head of Innovation and Digital Partnerships, Visa. “We're excited

to leverage our experience with tokenization to help banks

integrate blockchain technologies into their operations.”

Benefits of VTAP

VTAP is a cutting-edge solution developed by Visa’s in-house

blockchain experts. The platform is a b2b solution designed to

enable banks to bring fiat currencies onchain in a safe, seamless,

and efficient manner. Key benefits include:

- Easy integration: VTAP provides a platform for banks to

mint, burn and transfer fiat-backed tokens, such as tokenized

deposits and stablecoins, and experiment with use cases. This is

available in a test environment with plans to support live programs

in 2025 and when participating banks are ready to launch with end

customers. VTAP requires minimal technical integration, as

participating banks can access the complete suite of VTAP services

via APIs designed to help enhance existing financial infrastructure

to be always on and more efficient.

- Programmability: VTAP is designed to enable banks to use

their fiat-backed tokens within smart contracts. This could help

digitize and automate existing workflows and power the future

exchange of new types of real-world assets. For example, a bank

could automate processes like administering complex lines of credit

using smart contracts and use fiat-backed tokens to release

payments when payment terms are met. A bank could also enable their

customers to use a fiat-backed token to purchase tokenized

commodities or tokenized treasuries with near-real time settlement

onchain.

- Interoperability: There is a growing ecosystem where

tokenized real-world assets are being issued across multiple

permissioned and public blockchain networks. Visa’s vision is to

enable interoperability across different blockchains for banks

utilizing the VTAP platform. With a single API connection to VTAP,

in the future, banks can enable multiple use cases and interact

with partners and clients on both permissioned and public

blockchains. To support the broad ecosystem adoption of tokenized

assets, Visa is committed to enabling safe and secure cross-chain

exchanges of tokenized real world assets using fiat-backed

tokens.

Partnering for the future

BBVA has been working in the VTAP sandbox throughout this year

and has been testing core VTAP sandbox functionalities including

the issuance, transfer and redemption of a bank token on a testnet

blockchain, as well as interactions of the token with smart

contracts with the goal of launching an initial live pilot with

select customers in 2025 on the public Ethereum blockchain.

“We are proud to continue spearheading the exploration of

tokenized solutions with Visa through its VTAP platform,” said

Francisco Maroto, Head of Blockchain and Digital Assets, BBVA.

“This collaboration marks a significant milestone in our

exploration of the potential of blockchain technology and will

ultimately help enable us to broaden our banking services and

expand the market with new financial solutions.”

Visa is committed to working with financial institutions and

fintechs to develop standards and capabilities that can enable the

growth of these new payment flows in a secure, reliable, and

compliant manner.

About Visa

Visa (NYSE: V) is a world leader in digital payments,

facilitating transactions between consumers, merchants, financial

institutions and government entities across more than 200 countries

and territories. Our mission is to connect the world through the

most innovative, convenient, reliable and secure payments network,

enabling individuals, businesses and economies to thrive. We

believe that economies that include everyone everywhere, uplift

everyone everywhere and see access as foundational to the future of

money movement. Learn more at Visa.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241003550660/en/

Jackie Dresch - jdresch@visa.com

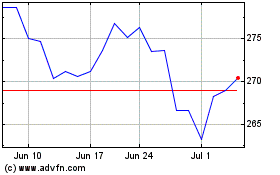

Visa (NYSE:V)

Historical Stock Chart

From Oct 2024 to Nov 2024

Visa (NYSE:V)

Historical Stock Chart

From Nov 2023 to Nov 2024