UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. __)

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

|

|

|

|

|

|

☐ |

|

Preliminary Proxy Statement |

☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

|

Definitive Proxy Statement |

☐ |

|

Definitive Additional Materials |

☐ |

|

Soliciting Material Pursuant to §240.14a-12 |

S&W SEED COMPANY

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

|

|

|

|

|

|

|

|

|

☒ |

|

No fee required |

☐ |

|

Fee paid previously with preliminary materials |

☐ |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

September 10, 2024

To our Stockholders:

We are pleased to invite you to attend a special meeting of stockholders of S&W Seed Company to be held virtually via live audio-only webcast on Thursday, September 26, 2024 at 2:30 p.m. Mountain Time. To participate in the special meeting virtually via the Internet, please visit www.proxydocs.com/SANW.

In order to attend the special meeting, you must register in advance at www.proxydocs.com/SANW prior to 3:00 p.m. Mountain Time on Tuesday, September 24, 2024. Upon completion of your registration, you will receive further instructions via email, including a unique link that will allow you to access the meeting, vote at the meeting and submit questions during the meeting. Stockholders will not be able to attend the special meeting in person.

Details regarding the business to be conducted are described in the accompanying Notice of Special Meeting of Stockholders and the Proxy Statement.

Important Notice Regarding the Availability of Proxy Materials for a Special Meeting of Stockholders to be Held Virtually on Thursday, September 26, 2024 via Live Audio-only Webcast.

The proxy materials are available free of charge at: www.proxydocs.com/SANW.

Your vote is very important. Whether or not you attend the special meeting virtually, we hope you will vote promptly. You can cast your ballot by telephone, via the Internet or by mailing the proxy card or, if you attend the special meeting virtually, you may submit an electronic ballot during the meeting.

Please review the instructions included in the Proxy Statement.

Thank you for your ongoing support and continued interest in S&W Seed Company. We look forward to your participation at the special meeting.

Sincerely,

|

/s/ Alan Willits |

Alan D. Willits |

Chairman of the Board |

2101 Ken Pratt Blvd., Suite 201

Longmont, Colorado 80501

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON THURSDAY SEPTEMBER 26, 2024

To the Stockholders of S&W Seed Company:

The special meeting of stockholders (the “Special Meeting”) of S&W Seed Company, a Nevada corporation (the “Company”), will be held virtually via live audio-only webcast on Thursday, September 26, 2024 at 2:30 p.m. Mountain Time. To participate in the Special Meeting virtually via the Internet, please visit www.proxydocs.com/SANW.

The Special Meeting will be held for the following purposes:

1.to approve, pursuant to Nevada Revised Statutes 78.2055, a reverse stock split of our common stock at a ratio in the range of 1-for-5 to 1-for-20, with such ratio to be determined in the discretion of the Board of Directors of the Company (the “Board”) and with such reverse stock split to be effected at such time and date as determined by the Board in its sole discretion (but in no event later than January 31, 2025); and

2.to conduct such other business as may properly come before the Special Meeting and any adjournment or postponement thereof.

These items of business are more fully described in the Proxy Statement accompanying this Notice of Special Meeting of Stockholders. Any action on the items of business described above may be considered at the time and on the date specified above or at any other time and date to which the Special Meeting may be properly adjourned or postponed.

The record date for the Special Meeting is September 3, 2024. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

Important Notice Regarding the Availability of Proxy Materials for a Special Meeting of Stockholders to be Held Virtually on Thursday, September 26, 2024 via Live Audio-only Webcast.

The proxy materials are available free of charge at: www.proxydocs.com/SANW.

|

|

By Order of the Board of Directors |

|

/s/ Mark Herrmann |

Mark Herrmann |

President and Chief Executive Officer |

Longmont, Colorado |

September 10, 2024 |

You are cordially invited to attend the Special Meeting. The Special Meeting will be a completely virtual meeting. There will be no physical meeting location. The meeting will only be conducted via live audio-only webcast. In order to attend, you must register in advance at www.proxydocs.com/SANW and enter the control number included in your proxy card prior to the deadline of Tuesday, September 24, 2024 at 3:00 p.m. Mountain Time. Upon completing your registration, you will receive further instructions via email, including your unique link that will allow you access to the Special Meeting, and you will have the ability to vote and submit questions during the Special Meeting.

Whether or not you expect to attend the Special Meeting, please vote as promptly as possible in order to ensure your representation at the Special Meeting. You can cast your ballot by telephone, via the Internet or by completing and returning the enclosed proxy card. Even if you have voted by proxy, you may still cast a ballot if you attend the Special Meeting virtually. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Special Meeting, you must obtain a proxy issued in your name from that record holder.

S&W SEED COMPANY

PROXY STATEMENT

FOR THE 2024 SPECIAL MEETING OF STOCKHOLDERS

To Be Held On Thursday, September 26, 2024 at 2:30 p.m. Mountain Time

The enclosed proxy is solicited by the Board of Directors (the “Board”) of S&W Seed Company, a Nevada corporation (the “Company,” “S&W,” “we” or “our”), for use in voting at the 2024 Special Meeting of Stockholders (the “Special Meeting”) to be held virtually via live audio-only webcast on Thursday, September 26, 2024 at 2:30 p.m. Mountain Time and at any adjournment(s) or postponement(s) thereof, for the purposes set forth in the accompanying Notice of Special Meeting of Stockholders (the "Notice"). We intend to first mail these proxy materials on or about September 10, 2024 to all stockholders of record entitled to vote at the Special Meeting.

TABLE OF CONTENTS

QUESTIONS AND ANSWERS ABOUT THE SPECIAL MEETING

Why am I receiving these materials?

We have prepared these materials for the Special Meeting to be held virtually via live audio-only webcast on Thursday, September 26, 2024 at 2:30 p.m. Mountain Time. The Board is soliciting your proxy to vote at the Special Meeting, including any postponements or adjournments thereof.

The Special Meeting will be held in a virtual meeting format only, via the Internet, with no physical in-person meeting.

To participate in the Special Meeting virtually via the Internet, please visit www.proxydocs.com/SANW. In order to attend the Special Meeting, you must register in advance at www.proxydocs.com/SANW and enter the control number included in your proxy card prior to 3:00 p.m. Mountain Time on Tuesday, September 24, 2024. Upon completion of your registration, you will receive further instructions via email, including a unique link that will allow you to access the Special Meeting, vote at the Special Meeting and submit questions during the Special Meeting. Stockholders will not be able to attend the Special Meeting in person.

You are invited to attend the Special Meeting virtually via the Internet and requested to vote on the proposal described in this Proxy Statement (the “Proxy Statement”). However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions below to submit your proxy over the phone or through the internet.

We intend to first mail these proxy materials on or about September 10, 2024 to all stockholders of record entitled to vote at the Special Meeting.

What is included in these proxy materials?

•This Proxy Statement; and

•The enclosed proxy card.

What items will be voted on at the Special Meeting?

There is one item scheduled for a vote at the Special Meeting:

•to approve, pursuant to Nevada Revised Statutes 78.2055, a reverse stock split of our common stock at a ratio in the range of 1-for-5 to 1-for-20, with such ratio to be determined in the discretion of the Board and with such reverse stock split to be effected at such time and date as determined by the Board in its sole discretion (but in no event later than January 31, 2025) (“Proposal No. 1”).

Will any other business be conducted at the meeting?

Other than the proposal referred to in this Proxy Statement, S&W knows of no other matters to be submitted to the stockholders for consideration at the Special Meeting. If any other matters properly come before the stockholders at the Special Meeting, it is the intention of the persons named in the enclosed proxy card to vote upon such matters in accordance with their best judgment.

What are the Board’s voting recommendations?

The Board recommends that you vote your shares “FOR” Proposal No. 1.

May the Special Meeting be adjourned or postponed?

Any action on the items of business described above may be considered at the Special Meeting at the time and on the date specified above or at any time and date to which the Special Meeting may be properly adjourned or postponed. Under Nevada law, we are not required to give any notice of an adjourned meeting or of the business to be transacted at an adjourned meeting, other than by announcement at the meeting at which the adjournment is taken, unless the Board fixes, or is required to fix, a new record date for the adjourned meeting. If the meeting date is postponed or adjourned to a date more than 60 days later than the date set for the original meeting, Nevada law requires that a new record date must be fixed and notice given.

Who may vote at the Special Meeting?

Only stockholders of record as of the close of business on September 3, 2024 (the “Record Date”) are entitled to receive notice of, to attend, and to vote at the Special Meeting. In addition to the stockholders of record of S&W’s common stock, beneficial owners of shares held in street name as of the Record Date can vote using the methods described below. Each share of S&W’s common stock entitles the holder thereof to one vote on each matter. As of the Record Date, there were 43,372,815 shares outstanding and entitled to vote at the Special Meeting.

What is the difference between a stockholder of record and a beneficial owner of shares held in street name?

•Stockholder of Record. If your shares are registered directly in your name with S&W’s transfer agent, Transfer Online, Inc., you are the stockholder of record with respect to those shares, and the Notice and Proxy Statement was sent directly to you by S&W.

•Beneficial Owner of Shares Held in Street Name. If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the “beneficial owner” of shares held in “street name,” and the Notice and Proxy Statement was forwarded to you by that organization. As a beneficial owner, you have the right to instruct your broker, bank, trustee, or nominee how to vote your shares.

If I am a stockholder of record of S&W’s shares, how do I vote?

If you are a stockholder of record, there are four ways to vote:

•At the Special Meeting. You may vote online during the Special Meeting by submitting an electronic ballot. Please visit www.proxydocs.com/SANW and enter the control number included in your proxy card to register for the Special Meeting. Upon completing your registration to attend the Special Meeting, you will receive further instructions via email, including a unique link that will allow you access to the meeting.

•Via the Internet. You may vote by proxy via the Internet by visiting www.proxypush.com/SANW and following the on-screen instructions to complete an electronic proxy card. You will be asked to provide the control number from the enclosed proxy card.

•By Telephone. You may vote by proxy by calling the toll-free number found in the enclosed proxy card and following the recorded instructions. You will be asked to provide the control number from the enclosed proxy card.

•By Mail. You may vote by proxy by filling out the enclosed proxy card and returning it in the envelope provided.

•Internet and telephone voting facilities for stockholders of record will be available for 24 hours a day and will close at approximately 2:30 p.m. Mountain Time on Thursday, September 26, 2024.

If I am a beneficial owner of shares held in street name, how do I vote?

If you are a beneficial owner of shares registered in the name of your broker, bank, or other nominee, you should have received a Notice containing voting instructions from that organization rather than from S&W. Simply follow the voting instructions in the Notice to ensure that your vote is counted. To cast a ballot at the Special Meeting, you must obtain a valid proxy from your broker, bank or other nominee. Follow the instructions from your broker, bank or other nominee included with these proxy materials, or contact your broker, bank or other nominee to request a proxy form.

If you are a beneficial owner of shares held in street name, there are three ways to vote:

•At the Special Meeting. If you are a beneficial owner of shares held in street name and wish to cast a ballot at the Special Meeting, you must obtain a “legal proxy” from the organization that holds your shares. A legal proxy is a written document that authorizes you to vote your shares held in street name at the Special Meeting. Please contact the organization that holds your shares for instructions regarding obtaining a legal proxy.

•Via the Internet. You will receive a voting instruction form from the organization that holds your shares and you may vote by proxy via the Internet by following instructions on the voting instruction form. The availability of Internet voting may depend on the voting process of the organization that holds your shares.

•By Telephone. You will receive a voting instruction form from the organization that holds your shares and you may vote by proxy by calling the toll-free number found on the voting instruction form. The availability of telephone voting may depend on the voting process of the organization that holds your shares.

•If you are a beneficial owner of shares held in street name, and you do not plan to attend the Special Meeting, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other nominee by the deadline provided in the materials you receive from your broker, bank or other nominee.

What is the quorum requirement for the Special Meeting?

The holders of a majority of the shares entitled to vote at the Special Meeting must be present at the Special Meeting virtually or represented by proxy for the transaction of business. This is called a quorum. Your shares will be counted for purposes of determining if there is a quorum if you:

•are entitled to vote and you are present at the Special Meeting virtually; or

•have properly voted by proxy via the Internet, by telephone or by submitting a proxy card or voting instruction form by mail.

Under Nevada law, unless the articles of incorporation or bylaws provide otherwise, a quorum is calculated based on the voting power present in person (or virtually) or represented by proxy, regardless of whether the proxy has authority to vote on any matter. Consequently, broker non-votes (as described below), and shares represented by proxies indicating abstentions, will be counted towards the presence of a quorum for holding the Special Meeting.

The holders of a majority of the shares entitled to vote at the Special Meeting must be present at the Special Meeting virtually or represented by proxy in order to have a quorum and conduct the Special Meeting. If a quorum is not present, the chairperson of the Special Meeting, or the holders of a majority of the shares entitled to vote thereat who are present, virtually or by proxy, at the Special Meeting may adjourn the Special Meeting to solicit additional proxies.

How are proxies voted?

All shares represented by valid proxies received prior to the taking of the vote at the Special Meeting will be voted and, where a stockholder specifies by means of the proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the stockholder’s instructions.

What happens if I do not vote or give specific voting instructions?

Stockholders of Record. If you are a stockholder of record and do not cast your ballot by telephone, via the Internet, by mailing the proxy card or by submitting an electronic ballot during the Special Meeting, your shares will not be voted. If you are a stockholder of record and you:

•indicate when voting via the Internet or by telephone that you wish to vote as recommended by the Board, or

•sign and return a proxy card without giving specific voting instructions,

then the persons named as proxy holders, Mark Herrmann and Vanessa Baughman, will vote your shares in the manner recommended by the Board on all matters presented in this Proxy Statement and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Special Meeting.

Beneficial Owners of Shares Held in Street Name. If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions then, under applicable rules, the organization that holds your shares may generally vote your shares in their discretion on “routine” matters but cannot vote on “non-routine” matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, that organization will inform the inspector of election that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.”

What is the voting requirement to approve Proposal No. 1?

Approval of Proposal No. 1 requires the affirmative vote of a majority of the stock having voting power present at the Special Meeting virtually or represented by proxy at the Special Meeting. Abstentions and broker non-votes on Proposal No. 1 will have the effect of votes “against” such proposal.

How are broker non-votes and abstentions treated?

Abstentions and broker non-votes are counted as present for the purpose of determining the presence or absence of a quorum for the transaction of business at the Special Meeting. Abstentions and broker non-votes will have the effect of votes “against” Proposal No. 1. We expect Proposal No. 1 will be considered

routine under applicable rules. A broker, bank or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected in connection with Proposal No. 1. Any failure by a broker, bank or other nominee to vote on Proposal No. 1 will be deemed an abstention with respect to such proposal.

May I change my vote after I have voted?

You may revoke your proxy and change your vote at any time before the taking of the vote at the Special Meeting. Prior to the applicable cutoff time, you may change your vote via the Internet or by the telephone methods described above, in which case only your latest Internet or telephone proxy submitted prior to the Special Meeting will be counted. You may also revoke your proxy and change your vote by signing and returning a new proxy card or voting instruction form dated as of a later date, or by virtually attending the Special Meeting and voting online. However, your attendance at the Special Meeting will not automatically revoke your proxy unless you properly vote at the Special Meeting or specifically request that your prior proxy be revoked by delivering a written notice of revocation to S&W’s Corporate Secretary at 2101 Ken Pratt Blvd., Suite 201, Longmont, Colorado 80501, prior to the Special Meeting.

If you are a beneficial owner, please contact your organization for specific instructions for changing your vote and make sure that you plan for sufficient time for your organization to meet the time deadline for delivering your revised votes or your original votes will stand.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner intended to protect your voting privacy. Your vote will not be disclosed either within S&W or to third parties, except:

•to allow for the tabulation and certification of votes;

•to facilitate a successful proxy solicitation; and

•as necessary to meet applicable legal requirements or to assert or defend claims for or against S&W.

If you write comments on your proxy card or ballot, the proxy card or ballot may be forwarded to S&W’s management and the Board to review your comments.

Who will serve as the inspector of election?

A representative from BetaNXT will serve as the inspector of election.

Where may I find the voting results of the Special Meeting?

Preliminary voting results will be announced at the Special Meeting. Final voting results will be tallied by the inspector of election after the taking of the vote at the Special Meeting. S&W will publish the final voting results in a Current Report on Form 8-K within four business days following the Special Meeting.

Who is paying the costs of this proxy solicitation?

S&W is paying for the entire cost of soliciting proxies. In addition to these proxy materials, S&W’s directors, officers and employees, without additional compensation, may also solicit proxies on S&W’s behalf by telephone or other means of communication. S&W will also reimburse brokerage firms, banks

and other nominees representing beneficial owners certain fees associated with forwarding proxy materials to beneficial owners and obtaining their voting instructions.

Where are S&W’s principal executive offices located and what is S&W’s main telephone number?

S&W’s principal executive offices are located at 2101 Ken Pratt Blvd., Suite 201, Longmont, Colorado 80501. S&W’s main telephone number is (720) 506-9191.

How can I attend the Special Meeting?

The Special Meeting will be a completely virtual meeting. There will be no physical meeting location. The meeting will only be conducted via live audio-only webcast. In order to attend, you must register in advance at www.proxydocs.com/SANW and enter the control number included in your proxy card prior to the deadline of Tuesday, September 24, 2024 at 3:00 p.m. Mountain Time. Upon completing your registration, you will receive further instructions via email, including a unique link that will allow you access to the meeting. Even if you plan on attending the Special Meeting virtually, we encourage you to vote your shares in advance using one of the methods outlined in this Proxy Statement to ensure that your vote will be represented at the Special Meeting.

What if during the Special Meeting I have technical difficulties or trouble accessing the live webcast of the Special Meeting?

On the day of the Special Meeting, if you encounter any difficulties accessing the live webcast of the Special Meeting or during the Special Meeting, please call the technical support number that will be posted on the log-in page for our virtual Special Meeting for assistance.

May I propose actions for consideration at the next annual meeting of stockholders or nominate individuals to serve as directors?

You may present proposals (including nominations for election of directors) to be considered for inclusion in the proxy materials for our next annual meeting or for action at a future annual meeting only if you comply with the requirements of the proxy rules established by the SEC and our bylaws, as applicable.

To be considered for inclusion in the proxy materials for our next annual meeting, your proposal must have been submitted in writing to our Corporate Secretary by July 6, 2024.

For nominations or other business to be properly brought before the next annual meeting of stockholders, you must have given timely notice in proper written form to our Corporate Secretary and any such proposed business must constitute a proper matter for stockholder action under our Articles of Incorporation, as amended, our bylaws and applicable law. To be timely, your notice must be delivered to our principal executive offices in Longmont, Colorado between August 15, 2024 and September 14, 2024; provided, however, that in the event that the date of the next Annual Meeting of Stockholders is more than 30 days before or more than 60 days after December 13, 2024, your notice must be so delivered not earlier than the close of business on the 120th day prior to the next annual meeting of stockholders and not later than the close of business on the later of the 90th day prior to such annual meeting or the 10th day following the day on which public announcement of the date of such meeting is first made by us.

Our bylaws require that certain information and acknowledgments with respect to the proposal or the nominee and the stockholder making the proposal or nomination be set forth in the notice. Our bylaws have been publicly filed with the SEC and can also be provided upon request, addressed to our Corporate Secretary, as noted below.

In addition to satisfying the requirements under our bylaws, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than Company nominees must provide notice that sets forth the information required by Rule 14a-19 under the Securities Exchange Act of 1934, as amended.

Where should I send proposals and director nominations for the next annual meeting of stockholders?

Proposals and director nominations for the next annual meeting of stockholders should be sent to S&W’s principal executive offices, located at 2101 Ken Pratt Blvd., Suite 201, Longmont, Colorado 80501.

PROPOSAL NO. 1 –APPROVAL, PURSUant to nevada revised statutes 78.2055, OF A REVERSE STOCK SPLIT OF OUR COMMON STOCK AT A RATIO IN THE RANGE OF 1-FOR-5 TO 1-FOR-20, WITH SUCH RATIO TO BE DETERMINED IN THE DISCRETION OF THE BOARD AND WITH SUCH REVERSE STOCK SPLIT TO BE EFFECTED AT SUCH TIME AND DATE AS DETERMINED BY THE BOARD IN ITS SOLE DISCRETION (BUT IN NO EVENT LATER THAN JANUARY 31, 2025)

Background

Our Board has unanimously approved a reverse stock split of all issued and outstanding shares of our common stock, at a ratio ranging from 1-for-5 to 1-for-20, inclusive (the “Reverse Stock Split”), pursuant to Nevada Revised Statutes (“NRS”) 78.2055.

Effecting the Reverse Stock Split would reduce the number of outstanding shares of our common stock. The determination to effect a Reverse Stock Split, including the ratio and the effective date and time of any such Reverse Stock Split, will be determined by our Board within a reasonable time following the Special Meeting. Our Board has recommended that the proposed Reverse Stock Split be presented to, and approved by, our stockholders.

Pursuant to Proposal No. 1, our stockholders are being asked to approve a Reverse Stock Split of our common stock at a ratio in the range of 1-for-5 to 1-for-20, and to grant authorization to our Board to determine, in its sole discretion, whether to implement a Reverse Stock Split, including its specific timing and ratio within the specified range.

Should we receive the required stockholder approval for Proposal No. 1, our Board will have the sole authority to determine, and without the need for any further action on the part of our stockholders, whether to effect the Reverse Stock Split and the number of whole shares of our common stock, between and including 5 and 20, that will be combined into one share of our common stock.

By approving Proposal No. 1, our stockholders will: (a) approve a Reverse Stock Split of our common stock pursuant to which any whole number of outstanding shares of common stock between and including 5 and 20 will be combined into one share of common stock; and (b) authorize our Board to determine, at its option, whether to effect and the specific timing and ratio of the Reverse Stock Split within the specified range.

In addition, under NRS 78.207, a corporation that desires to change the number of shares of a class of its authorized stock by increasing or decreasing the number of authorized shares of the class and correspondingly increasing or decreasing the number of issued and outstanding shares of the same class held by each stockholder of record at the effective date and time of the change, may, except in certain limited circumstances, do so by a resolution adopted by the Board, without obtaining the approval of the stockholders. In the event that our stockholders do not approve this Proposal No. 1, our Board may take action to effect a reverse split of our common stock without stockholder approval pursuant to NRS 78.207 if required to comply with The Nasdaq Stock Market (“Nasdaq”) minimum bid price requirement described more fully below and if the Board deems such a reverse stock split without stockholder approval to be in the interests of the Company.

In the event any reverse stock split of our common stock is implemented, whether the Reverse Stock Split (if approved by our stockholders pursuant to this Proposal No. 1 and implemented by our Board), or a reverse stock split effectuated by our Board without stockholder approval pursuant to NRS 78.207, any fractional shares of our common stock that would otherwise result from such reverse stock split, will be rounded up to the next whole share.

Approval of Reverse Stock Split of our Common Stock (Proposal No. 1)

Our Board has approved and is recommending that our stockholders approve a Reverse Stock Split of our common stock at a ratio in the range of 1-for-5 to 1-for-20. We are proposing that our Board has the discretion to select the Reverse Stock Split ratio from within such range, rather than proposing that stockholders approve a specific ratio at this time, in order to give our Board the flexibility to implement a Reverse Stock Split at a ratio that reflects the Board’s then-current assessment of the factors described below under “Criteria to be Used for Determining Whether to Implement the Reverse Stock Split.” If the Board decides to implement a Reverse Stock Split, the Board will do so within a reasonable time following the Special Meeting by resolution (but in no event later than January 31, 2025), which will include the specific timing and ratio of the Reverse Stock Split. Except for adjustments that may result from the treatment of fractional shares as described below, each of our stockholders will hold the same percentage of our outstanding common stock immediately following the Reverse Stock Split as such stockholder holds immediately prior to the Reverse Stock Split.

Reasons for Reverse Stock Split

To Maintain Our Listing on The Nasdaq Capital Market. By potentially having the effect of increasing our stock price, the Reverse Stock Split would reduce the risk that our common stock could be delisted from The Nasdaq Capital Market. To continue our listing on The Nasdaq Capital Market, we must comply with Nasdaq Marketplace Rules, which requirements include a minimum bid price of $1.00 per share.

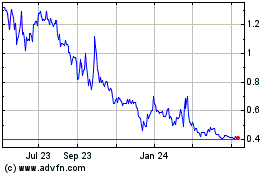

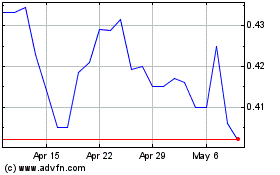

On November 14, 2023, we received a notice (“Notice”), from Nasdaq advising the Company that for 30 consecutive trading days preceding the date of the Notice, the bid price of the Company’s common stock had closed below the $1.00 per share minimum required for continued listing on The Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(a)(2) (“Minimum Bid Price Requirement”). The Company subsequently requested an extension of time to regain compliance with the Minimum Bid Price Requirement and submitted to Nasdaq a plan to regain compliance. On May 14, 2024, Nasdaq informed the Company that the request for extension was granted. As a result of the extension, the Company has until November 11, 2024, to provide evidence that it has regained compliance with the Minimum Bid Price Requirement.

If we do not regain compliance with the Minimum Bid Price Requirement, our common stock will be subject to delisting. The Board has considered the potential harm to us and our stockholders should Nasdaq delist our common stock from The Nasdaq Capital Market. The delisting of our common stock by Nasdaq could adversely affect the liquidity of our common stock, create increased volatility in our common stock, and result in a loss of current or future coverage by certain sell-side analysts and/or a diminution of institutional investor interest. Delisting could also cause a loss of confidence of our collaborators, vendors and employees, which could harm our business and future prospects. If our common stock is delisted by Nasdaq, our common stock may be eligible to trade on the OTC Bulletin Board, OTC-QB or another over-the-counter market, which alternatives are generally considered to be less efficient markets. Any such alternative would likely result in it being more difficult for us to raise additional capital through the public or private sale of equity securities and for investors to dispose of or obtain accurate quotations as to the market value of our common stock. Moreover, if our common stock is delisted, it may come within the definition of “penny stock” under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which imposes additional sales practice requirements on broker-dealers who sell securities to persons other than established customers and accredited investors. These requirements may reduce trading activity in the secondary market for our common stock and may impact the ability or willingness of broker-dealers to sell our securities which could limit the ability of stockholders to sell their securities in the public market and limit our ability to attract and retain qualified employees or raise additional capital in the future.

The Board believes that the proposed Reverse Stock Split is a potentially effective means for us to maintain compliance with the $1.00 minimum bid requirement and to avoid, or at least mitigate, the likely adverse consequences of our common stock being delisted from The Nasdaq Capital Market by producing the immediate effect of increasing the bid price of our common stock.

The Board believes that maintaining the current number of authorized shares of our common stock, irrespective of the Reverse Stock Split, is desirable to provide us with the flexibility to act in the future with respect to raising additional financing, potential strategic collaborations and other corporate purposes without the delay and expense associated with obtaining special stockholder approval each time an opportunity requiring the issuance of shares of common stock may arise. Such a delay might deny us the flexibility that our Board views as important and in the interests of the Company and its stockholders.

To Potentially Improve the Marketability and Liquidity of Our Common Stock. Our Board believes that the increased market price of our common stock expected as a result of implementing a Reverse Stock Split could improve the marketability and liquidity of our common stock and encourage interest and trading in our common stock.

•Stock Price Requirements. We understand that many brokerage houses, institutional investors and funds have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers or by restricting or limiting the ability to purchase such stocks on margin. Additionally, a Reverse Stock Split could help increase analyst and broker interest in our common stock, as their internal policies might discourage them from following or recommending companies with low stock prices.

•Stock Price Volatility. Because of the trading volatility often associated with low-priced stocks, many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. Some of those policies and practices may make the processing of trades in low-priced stocks economically unattractive to brokers.

•Transaction Costs. Investors may be dissuaded from purchasing stocks below certain prices because brokers’ commissions, as a percentage of the total transaction value, can be higher for low-priced stocks.

Criteria to be Used for Determining Whether to Implement Reverse Stock Split

In determining whether to implement the Reverse Stock Split and which Reverse Stock Split ratio to implement, our Board may consider, among other things, various factors, such as:

•the historical trading price and trading volume of our common stock;

•the then-prevailing trading price and trading volume of our common stock and the expected impact of the Reverse Stock Split on the trading market for our common stock in the short- and long-term;

•our ability to maintain our listing on The Nasdaq Capital Market;

•which Reverse Stock Split ratio would result in the least administrative cost to us;

•prevailing general market and economic conditions; and

•if our stockholders approve this Proposal No. 1, the additional authorized but unissued shares of common stock that will result from the implementation of a Reverse Stock Split, which will be available to provide flexibility to use our common stock for business and/or financial purposes.

Certain Risks and Potential Disadvantages Associated with Reverse Stock Split

We cannot assure you that the proposed Reverse Stock Split will increase our stock price and have the desired effect of maintaining compliance with Nasdaq Marketplace Rules. We expect that the Reverse Stock Split will increase the market price of our common stock so that we may be able to regain and maintain compliance with the Nasdaq $1.00 minimum bid price requirement. However, the effect of the Reverse Stock Split upon the market price of our common stock cannot be predicted with any certainty, and the history of similar reverse stock splits for companies in like circumstances is varied, particularly since some investors may view a reverse stock split negatively. It is possible that the per share price of our common stock after the Reverse Stock Split will not rise in proportion to the reduction in the number of shares of our common stock outstanding resulting from the Reverse Stock Split, and the market price per post-Reverse Stock Split share may not exceed or remain in excess of the $1.00 minimum bid price for a sustained period of time, and the Reverse Stock Split may not result in a per share price that would attract brokers and investors who do not trade in lower priced stocks. In addition, although we believe the Reverse Stock Split may enhance the desirability of our common stock to certain potential investors, it is possible that, if implemented, our common stock may not become more attractive to institutional and other long term investors. Even if we implement the Reverse Stock Split, the market price of our common stock may decrease due to factors unrelated to the Reverse Stock Split. In any case, the market price of our common stock may also be based on other factors which may be unrelated to the number of shares outstanding, including our future performance. If the Reverse Stock Split is consummated and the trading price of the common stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of the Reverse Stock Split. Even if the market price per post-Reverse Stock Split share of our common stock remains in excess of $1.00 per share, we may be delisted due to a failure to meet other continued listing requirements, including Nasdaq requirements related to the minimum stockholder equity requirement, the minimum number of shares that must be in the public float, the minimum market value of the public float and the minimum number of “round lot” holders.

The proposed Reverse Stock Split may decrease the liquidity of our common stock and result in higher transaction costs. The liquidity of our common stock may be negatively impacted by a Reverse Stock Split, given the reduced number of shares that would be outstanding after the Reverse Stock Split, particularly if the stock price does not increase as a result of the Reverse Stock Split. In addition, if a Reverse Stock Split is implemented, it will increase the number of our stockholders who own “odd lots” of fewer than 100 shares of common stock. Brokerage commission and other costs of transactions in odd lots are generally higher than the costs of transactions of more than 100 shares of common stock. Accordingly, a Reverse Stock Split may not achieve the desired results of increasing marketability and liquidity of our common stock described above.

If our stockholders approve this Proposal No. 1, the effective increase in the authorized number of shares of our common stock as a result of the Reverse Stock Split could have anti-takeover implications. If our stockholders approve this Proposal No. 1, the implementation of a Reverse Stock Split will result in an effective increase in the authorized number of shares of our common stock available for issuance (as our authorized number of shares of common stock will remain at 75,000,000 shares), which could, under certain circumstances, have anti-takeover implications. The additional shares of common stock that would become available for issuance if this Proposal No. 1 is approved and a Reverse Stock Split is implemented could be used by us to oppose a hostile takeover attempt or to delay or prevent changes in control or our management. For example, without further stockholder approval, the Board could adopt a “poison pill” which would, under certain circumstances related to an acquisition of our securities that is not approved by the Board, give certain holders the right to acquire additional shares of our common stock at a low price. The Board also could strategically sell shares of common stock in a private transaction to purchasers who would oppose a takeover or favor the current Board. Although this Proposal No. 1 has been prompted by business and

financial considerations and not by the threat of any hostile takeover attempt (nor is the Board currently aware of any such attempts directed at us), stockholders should be aware that approval of this Proposal No. 1 could facilitate future efforts by us to deter or prevent changes in control, including transactions in which the stockholders might otherwise receive a premium for their shares over then current market prices.

Effects of Reverse Stock Split

After the effective time of a Reverse Stock Split (if approved by the stockholders and implemented by our Board), each stockholder will own a reduced number of shares of common stock as compared to immediately prior to the effective time of the Reverse Stock Split. However, any Reverse Stock Split that is implemented by our Board would affect all of our stockholders uniformly and would not affect any stockholder’s percentage ownership interests in the Company, except for adjustments that may result from the treatment of fractional shares as described below. Voting rights and other rights and preferences of the holders of our common stock will not be affected by a Reverse Stock Split (other than for adjustments that may result from the treatment of fractional shares as described below). For example, a holder of 2% of the voting power of the outstanding shares of our common stock immediately prior to a Reverse Stock Split would continue to hold 2% (assuming there is no impact as a result of the treatment of fractional shares as described below) of the voting power of the outstanding shares of our common stock immediately after such Reverse Stock Split. The number of stockholders of record will not be affected by a Reverse Stock Split.

The principal effects of a Reverse Stock Split that is implemented by our Board will be that:

•depending on the Reverse Stock Split ratio selected by the Board, each 5 to 20 shares of our common stock owned by a stockholder will be combined into one post-split share of our common stock;

•no fractional shares of common stock will be issued in connection with any Reverse Stock Split; instead, holders of common stock who would otherwise hold a fractional share of common stock after giving effect to the Reverse Stock Split will hold one whole post-split share as explained more fully below;

•the total number of authorized shares of our common stock will remain at 75,000,000 shares, resulting in an effective increase in the authorized number of shares of our common stock available for issuance; provided that if this Proposal No. 1 does not receive stockholder approval and the Board effects a reverse split of our common stock without stockholder approval, as permitted under NRS 78.207, the total number of authorized shares of our common stock will be correspondingly and proportionately reduced by the Reverse Stock Split ratio selected by the Board;

•based upon the Reverse Stock Split ratio selected by the Board, proportionate adjustments will be made to the per share exercise price and/or the number of shares issuable upon the exercise or vesting of all then outstanding stock options, restricted stock units (“RSUs”) and warrants, which will result in a proportional decrease in the number of shares of our common stock reserved for issuance upon exercise or vesting of such stock options, RSUs and warrants, and, in the case of stock options and warrants, a proportional increase in the exercise price of all such stock options and warrants;

•based upon the Reverse Stock Split ratio selected by the Board, a proportionate adjustment will be made to the conversion price of our Series B Redeemable Convertible Non-Voting Preferred Stock, which will result in a proportional decrease in the number of shares of our common stock reserved for issuance upon such conversion; and

•the number of shares then reserved for issuance under our equity compensation plans will be reduced proportionately based upon the Reverse Stock Split ratio selected by the Board.

The following table contains approximate information, based on share information as of September 3, 2024, relating to our outstanding common stock based on the proposed Reverse Stock Split ratios (without giving effect to the treatment of fractional shares):

|

|

|

|

|

|

|

|

|

|

|

|

|

Status |

|

Number of Shares of Common Stock Authorized (1) |

|

|

Number of Shares of Common Stock Issued and Outstanding |

|

|

Number of Shares of Common Stock Authorized but Unissued |

|

Pre-Reverse Stock Split |

|

|

75,000,000 |

|

|

|

43,372,815 |

|

|

|

31,627,185 |

|

Post-Reverse Stock Split 1:5 |

|

|

75,000,000 |

|

|

|

8,674,563 |

|

|

|

66,325,437 |

|

Post-Reverse Stock Split 1:10 |

|

|

75,000,000 |

|

|

|

4,337,282 |

|

|

|

70,662,718 |

|

Post-Reverse Stock Split 1:15 |

|

|

75,000,000 |

|

|

|

2,891,521 |

|

|

|

72,108,479 |

|

Post-Reverse Stock Split 1:20 |

|

|

75,000,000 |

|

|

|

2,168,641 |

|

|

|

72,831,359 |

|

(1) Note that if this Proposal No. 1 does not receive stockholder approval and the Board effects a reverse split of our common stock without stockholder approval, as permitted under NRS 78.207, the total number of authorized shares of our common stock will be correspondingly and proportionately reduced by the Reverse Stock Split ratio selected by the Board.

After the effective time of any Reverse Stock Split that our Board elects to implement, our common stock would have a new committee on uniform securities identification procedures, or CUSIP number, a number used to identify our common stock.

Our common stock is currently registered under Section 12(b) of the Exchange Act, and we are subject to the periodic reporting and other requirements of the Exchange Act. The implementation of any proposed Reverse Stock Split will not affect the registration of our common stock under the Exchange Act. Our common stock would continue to be listed on The Nasdaq Capital Market under the symbol “SANW” immediately following the Reverse Stock Split, although it is likely that Nasdaq would add the letter “D” to the end of the trading symbol for a period of twenty trading days after the effective date of the Reverse Stock Split to indicate that the Reverse Stock Split had occurred.

Effective Time

The proposed Reverse Stock Split would become effective as of the date and time determined by our Board and specified in the resolutions approving the actual Reverse Stock Split, which time we refer to in this Proposal No. 1 as the “Effective Time.” Effective as of the Effective Time, shares of common stock issued and outstanding immediately prior thereto will be combined, automatically and without any action on the part of us or our stockholders, into a lesser number of new shares of our common stock in accordance with the Reverse Stock Split ratio determined by our Board within the limits set forth in this Proposal No. 1. See “Share Issuance In Lieu of Fractional Shares” below regarding the treatment of any fractional shares.

Share Issuance In Lieu of Fractional Shares

No fractional shares of common stock will be issued as a result of any reverse stock split of our common stock, whether the Reverse Stock Split (if approved by our stockholders pursuant to this Proposal No. 1 and implemented by our Board), or a reverse stock split effectuated by our Board without stockholder approval pursuant to NRS 78.207. Instead, in lieu of any fractional shares to which a stockholder of record would otherwise be entitled as a result of the Reverse Stock Split, pursuant to NRS 78.205(2)(b), we will issue to such stockholder such additional fraction of a share as is necessary to increase such resulting fractional share to a full share of common stock. For example, if as a result of a reverse stock split a record stockholder would otherwise be entitled to hold 15.3 shares of our common stock after giving effect to the Reverse Stock Split, such stockholder would instead hold 16 shares of our common stock.

Record and Beneficial Stockholders

If this Proposal No. 1 is approved by our stockholders and our Board elects to implement a Reverse Stock Split, or our Board otherwise elects to implement a reverse split of our common stock without stockholder approval, as permitted under NRS 78.207, stockholders of record holding all of their shares of our common stock electronically in book-entry form under the direct registration system for securities will be automatically exchanged by the exchange agent and will receive a transaction statement at their address of record indicating the number of new post-split shares of our common stock they hold after the Reverse Stock Split. Non-registered stockholders holding common stock through a bank, broker or other nominee should note that such banks, brokers or other nominees may have different procedures for processing the Reverse Stock Split than those that would be put in place by us for registered stockholders. If you hold your shares with such a bank, broker or other nominee and if you have questions in this regard, you are encouraged to contact your nominee.

If this Proposal No. 1 is approved by our stockholders and our Board elects to implement a Reverse Stock Split or our Board otherwise elects to implement a reverse split of our common stock without stockholder approval, as permitted under NRS 78.207, stockholders of record holding some or all of their shares in certificate form will receive a letter of transmittal from the Company or its exchange agent, as soon as practicable after the effective time of the Reverse Stock Split. Our transfer agent is expected to act as “exchange agent” for the purpose of implementing the exchange of stock certificates. Holders of pre-Reverse Stock Split shares will be asked to surrender to the exchange agent certificates representing pre-Reverse Stock Split shares in exchange for post-Reverse Stock Split shares in accordance with the procedures to be set forth in the letter of transmittal. No new post-Reverse Stock Split share certificates will be issued to a stockholder until such stockholder has surrendered such stockholder’s outstanding certificate(s) together with the properly completed and executed letter of transmittal to the exchange agent.

STOCKHOLDERS SHOULD NOT DESTROY ANY PRE-SPLIT STOCK CERTIFICATE AND SHOULD NOT SUBMIT ANY CERTIFICATES UNLESS AND UNTIL THEY ARE REQUESTED TO DO SO.

Accounting Consequences

The par value per share of our common stock would remain unchanged at $0.001 per share after any Reverse Stock Split. As a result, on the Effective Time, the stated capital on our balance sheet attributable to the common stock would be reduced proportionally, based on the actual Reverse Stock Split ratio, from its present amount, and the additional paid-in capital account would be credited with the amount by which the stated capital would be reduced. The net income or loss per share of common stock would be increased because there would be fewer shares of common stock outstanding. The Reverse Stock Split would be reflected retroactively and prospectively in our consolidated financial statements. We do not anticipate that any other accounting consequences would arise as a result of any Reverse Stock Split.

No Dissenter’s or Appraisal Rights

Our stockholders are not entitled to dissenter’s or appraisal rights under the NRS with respect to the proposed Reverse Stock Split.

Material Federal Income Tax Consequences of the Reverse Stock Split to U.S. Holders

The following is a summary of certain material U.S. federal income tax consequences of the Reverse Stock Split that are generally expected to be applicable to U.S. Holders (as defined below) of our common stock who hold their common shares as capital assets within the meaning of Section 1221 of the Internal Revenue Code of 1986, as amended (the “Code”) (generally property held for investment). The summary is based on the Code, applicable Treasury Regulations promulgated thereunder, current administrative rulings and

practices and judicial authorities as in effect on the date of this proxy statement. Changes to the laws could alter the tax consequences described below, possibly with retroactive effect. We have not sought and will not seek an opinion of counsel or a ruling from the Internal Revenue Service regarding the federal income tax consequences of the Reverse Stock Split. This discussion is for general information only and does not discuss the tax consequences that may apply to U.S. Holders in light of their particular circumstances or to U.S. Holders that may be subject to special rules, including without limitation banks, financial institutions or insurance companies; brokers, dealers or traders in securities, commodities or currencies; tax-exempt entities or organizations; regulated investment companies or real estate investment trusts, pension funds or retirement plans; certain former citizens or long-term residents of the United States; persons that received shares of our common stock in connection with the exercise of employee stock options or otherwise as compensation for the performance of services; persons that hold shares of our common stock as part of a “hedging,” “integrated” or “conversion” transaction or as a position in a “straddle” for U.S. federal income tax purposes; partnerships (including entities or arrangements classified as partnerships for U.S. federal income tax purposes) or other pass-through entities, or holders that hold shares of our common stock through such an entity; persons who hold our common stock as “qualified small business stock” within the meaning of Section 1202 of the Code or Section 1244 stock for purposes of Section 1244 of the Code; persons who acquired their stock in a transaction subject to the gain rollover provisions of Section 1045 of the Code, or persons whose “functional currency” is not the U.S. dollar. Moreover, this summary does not address (i) the tax consequences of the Reverse Stock Split arising under any under any state, local or non-U.S. tax laws, or any U.S. federal tax laws other than U.S. federal income tax laws (such as estate, gift tax laws), (ii) the alternative minimum tax, the Medicare contribution tax on net investment income, or the special accounting rules under Section 451(b) of the Code, (iii) the tax consequences of transactions effectuated before, after or at the same time as the Reverse Stock Split, whether or not they are in connection with the Reverse Stock Split, or (iv) the tax consequences to holders of options, warrants or similar rights to acquire our common stock. Stockholders are urged to consult their own tax advisors to determine the particular consequences to them of the Reverse Stock Split.

As used in this discussion, the term “U.S. Holder” means a beneficial owner of shares of our common stock that is, for U.S. federal income tax purposes, (i) an individual who is a citizen or individual resident of the United States; (ii) a corporation, or other entity taxable as a corporation, created or organized in or under the laws of the United States, any state thereof or the District of Columbia; (iii) an estate, the income of which is subject to U.S. federal income taxation regardless of its source; or (iv) a trust, if (A) a court within the United States is able to exercise primary jurisdiction over administration of the trust and one or more United States persons have authority to control all substantial decisions of the trust or (B) it has a valid election in effect to be treated as a United States person.

The Reverse Stock Split is intended to be treated as a recapitalization for U.S. federal income tax purposes that is not part of a plan to increase periodically a stockholder’s proportionate interest in our assets or earnings and profits, and that, taken together with other relevant transactions, if any, will not have the effect of the receipt of money or other property by some stockholders and an increase in the proportionate interest of other stockholders in our assets or earnings and profits. Assuming that is the case, a U.S. Holder that receives a reduced number of shares of common stock will not recognize income, gain or loss. In the aggregate, such a stockholder’s basis in the reduced number of shares of common stock will equal the stockholder’s basis in its shares of common stock held immediately prior to the Reverse Stock Split, and such stockholder’s holding period in the reduced number of shares will include the holding period in its shares held immediately prior to the Reverse Stock Split. The tax treatment of the increase of a fractional share of our common stock to a whole share is not certain. We intend to treat the issuance of such a whole share as a non-recognition event, but there can be no assurances that the Internal Revenue Service or a court would not successfully assert otherwise. Treasury Regulations provide detailed rules for allocating the tax basis and holding period of the shares of common stock surrendered to the shares of common stock received in a recapitalization pursuant to the Reverse Stock Split. U.S. Holders should consult their tax advisors as

to application of the foregoing rules where shares of common stock were acquired at different times or at different prices. Stockholders should consult their own tax advisors regarding the tax consequences to them of the Reverse Stock Split.

THE PRECEDING DISCUSSION IS INTENDED ONLY AS A SUMMARY OF CERTAIN MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT TO U.S. HOLDERS. IT IS NOT A COMPLETE ANALYSIS OR DISCUSSION OF ALL POTENTIAL TAX EFFECTS THAT MAY BE IMPORTANT TO A PARTICULAR HOLDER. ALL HOLDERS OF OUR COMMON STOCK SHOULD CONSULT THEIR OWN TAX ADVISORS AS TO THE SPECIFIC TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT TO THEM, INCLUDING RECORD RETENTION AND TAX-REPORTING REQUIREMENTS, AND THE APPLICABILITY AND EFFECT OF ANY U.S. FEDERAL, STATE, LOCAL AND NON-U.S. TAX LAWS.

Vote Required

The Reverse Stock Split would be effectuated pursuant to NRS 78.2055. Pursuant to NRS 78.2055 and in accordance with our third amended and restated bylaws, an affirmative vote of the holders of a majority of the stock having voting power present virtually or represented by proxy at the Special Meeting is required to approve the Reverse Stock Split. Abstentions and broker non-votes will the effect of votes “against” this proposal.

As noted above, in the event that our stockholders do not approve this Proposal No. 1, our Board may take action in accordance with NRS 78.207 to effect a reverse split of our common stock without stockholder approval if required to comply with the Nasdaq minimum bid price requirement and if deemed to be in the interest of the Company.

The Board recommends that you vote “FOR” approval of a Reverse Stock Split to be determined in the discretion of the Board, as set forth in Proposal No. 1.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table presents information concerning the beneficial ownership of the shares of our common stock as of July 31, 2024 by:

•each person we know to be the beneficial owner of 5% of more of the outstanding shares of our common stock;

•each of our named executive officers;

•each of our current directors; and

•all of our current executive officers and directors as a group.

Except as otherwise indicated below, the address of each beneficial owner listed in the table is c/o S&W Seed Company, 2101 Ken Pratt Blvd., Suite 201, Longmont, Colorado 80501.

We have determined beneficial ownership in accordance with the rules of the SEC. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the persons and entities named in the table below have sole voting and investment power with respect to all shares of common stock that they beneficially own, subject to applicable community property laws.

Applicable percentage ownership is based on 43,372,815 shares of common stock outstanding on July 31, 2024. In computing the number of shares of common stock beneficially owned by a person and the percentage ownership of that person, we deemed as outstanding shares of common stock subject to options held by that person that are currently exercisable or exercisable within 60 days of July 31, 2024 (September 29, 2024). We did not deem these exercisable shares outstanding, however, for the purpose of computing the percentage ownership of any other person. The applicable footnotes are an integral part of the table and should be carefully read in order to understand the actual ownership of our securities, particularly by the 5% stockholders listed in the table.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of Shares |

|

|

Number of Shares

Subject to Options,

RSUs and Warrants

Exercisable by |

|

|

Total Shares

Beneficially Owned |

|

Name of Beneficial Owners |

|

Beneficially Held |

|

|

September 29, 2024 |

|

|

Number |

|

|

Percent |

|

5% Stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

MFP Partners, L.P. (1) |

|

|

17,448,226 |

|

|

|

5,086,979 |

|

(2) |

|

22,535,205 |

|

|

|

46.5 |

% |

Wynnefield Capital Management LLC and Related Entities (3) |

|

|

4,112,950 |

|

|

|

— |

|

|

|

4,112,950 |

|

|

|

9.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Directors and Named Executive Officers |

|

|

|

|

|

|

|

|

|

|

|

|

Mark Herrmann, Chief Executive Officer |

|

|

40,311 |

|

|

|

100,000 |

|

(4) |

|

140,311 |

|

|

* |

|

Vanessa Baughman, Chief Financial Officer |

|

|

11,984 |

|

|

|

32,454 |

|

(5) |

|

44,438 |

|

|

* |

|

Mark J. Harvey, Director |

|

|

239,401 |

|

(6) |

|

7,000 |

|

(7) |

|

246,401 |

|

|

* |

|

Elizabeth Horton, Director |

|

|

63,519 |

|

|

|

205,068 |

|

(8) |

|

268,587 |

|

|

* |

|

Alexander C. Matina, Director |

|

|

175,260 |

|

|

|

42,026 |

|

(9) |

|

217,286 |

|

|

* |

|

Jeffrey Rona, Director |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

* |

|

Alan D. Willits, Director |

|

|

567,142 |

|

|

|

16,648 |

|

(10) |

|

583,790 |

|

|

|

1.3 |

% |

Mark W. Wong, Director |

|

|

323,089 |

|

|

|

2,600,951 |

|

(11) |

|

2,924,040 |

|

|

|

6.4 |

% |

All executive officers and directors as a group (8 persons) |

|

|

1,420,706 |

|

|

|

3,004,147 |

|

(12) |

|

4,424,853 |

|

|

|

9.5 |

% |

* Less than 1 percent of the class.

(1)Based solely upon the most recent Schedule 13D/A filed with the SEC on March 22, 2023 by MFP Investors LLC. MFP Investors LLC is the general partner of MFP Partners, L.P. (“MFP”). Jennifer Cook Price is the managing director of MFP and the managing member of MFP Investors, LLC. The address

for MFP is 909 Third Avenue, 33rd Floor, New York, NY 10022. Alexander C. Matina, a member of our Board of Directors, is Vice President, Investments of MFP.

(2)Includes (i) 3,192,750 shares issuable upon exercise of warrants, and (ii) 1,894,229 shares issuable upon conversion of 1,695 shares of the Company’s Series B Redeemable Convertible Non-Voting Preferred Stock.

(3)Based upon the most recent Form 4 filed with the SEC on February 9, 2023 by Wynnefield Partners Small Cap Value, L.P. and the latest Schedule 13G filed with the SEC on February 16, 2023. The address for Wynnefield Capital Management, LLC and related entities is 450 Seventh Avenue, Suite 509, New York, NY 10123. Of the shares indicated, 1,336,741 shares are beneficially owned by Wynnefield Partners Small Cap Value, L.P. (“Partners”), 2,104,556 shares are beneficially owned by Wynnefield Partners Small Cap Value, L.P. I (“Partners I”), 542,418 shares are beneficially owned by Wynnefield Small Cap Value Offshore Fund, Ltd. (the “Fund”) and 129,235 shares are beneficially owned by Wynnefield Capital, Inc. Profit Sharing Plan (the “Plan”). Wynnefield Capital Management, LLC has an indirect beneficial interest in the shares held by Partners and Partners I. Wynnefield Capital, Inc. has an indirect beneficial interest in the shares held by the Fund. Nelson Obus may be deemed to hold an indirect beneficial interest in the shares held by Partners, Partners I, the Fund and the Plan because he is the co-managing member of Wynnefield Capital Management, LLC, a principal executive officer of Wynnefield Capital, Inc. (the investment manager of the Fund) and a co-trustee of Wynnefield Capital, Inc. Profit Sharing Plan (having power to vote and dispose of investments in securities). Joshua Landes may be deemed to hold an indirect beneficial interest in the shares held by Partners, Partners I, the Fund and the Plan because he is the co-managing member of Wynnefield Capital Management, LLC, a principal executive officer of Wynnefield Capital, Inc. (the investment manager of the Fund) and a co-trustee of Wynnefield Capital, Inc. Profit Sharing Plan (having power to vote and dispose of investments in securities). Mr. Obus and Mr. Landes both disclaim any beneficial ownership of the shares of common stock reported in this report.

(4)Includes 100,000 shares issuable upon exercise of options.

(5)Includes 32,454 shares issuable upon exercise of options.

(6)Includes 220,666 shares held in a retirement fund directed by Mr. Harvey and as to which he is a beneficiary.

(7)Includes 7,000 shares issuable upon exercise of options.

(8)Includes 205,068 shares issuable upon exercise of options.

(9)Includes 42,026 shares issuable upon exercise of options.

(10)Includes 16,648 shares issuable upon exercise of options.

(11)Includes 2,600,951 shares issuable upon exercise of options.

(12)Includes shares issuable upon exercise of options and shares issuable upon settlement of RSUs by September 29, 2024 that are beneficially owned by our executive officers and directors.

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Policies and Procedures for Related Party Transactions

Our Audit Committee is responsible for reviewing and approving, in advance, any transactions between us and any related parties. Related parties include any of our directors or executive officers, certain of our stockholders and their immediate family members. This obligation is set forth in writing in the Audit Committee charter. A copy of the Audit Committee charter is available on our website at www.swseedco.com in the Investors section under “Corporate Governance.” This website address is included for reference only. The information contained on S&W’s website is not incorporated by reference into this Proxy Statement. Each year, our Audit Committee, assisted by our legal counsel, works with our directors, executive officers and certain stockholders to identify any transactions with us in which the executive officer or director or their family members have an interest. We review related party transactions due to the potential for a conflict of interest. A conflict of interest occurs when an individual’s private interest interferes, or appears to interfere, with our interests.

MFP Loan Agreement

On September 22, 2022, MFP Partners, L.P., or MFP, our largest stockholder, provided a letter of credit issued by JPMorgan Chase Bank, N.A. for the account of MFP, with an initial face amount of $9.0 million, or the MFP Letter of Credit, for the benefit of CIBC, as additional collateral to support the Company’s obligations under the CIBC Loan Agreement. The MFP Letter of Credit initially matured on January 23, 2023, one month after the maturity date of the existing CIBC Loan Agreement. Concurrently, on September 22, 2022, the Company entered into a Subordinate Loan and Security Agreement, or the MFP Loan Agreement, with MFP, pursuant to which any draw CIBC may make on the MFP Letter of Credit will be deemed to be a term loan advance made by MFP to the Company. The MFP Loan Agreement initially provided for up to $9.0 million of term loan advances.

Concurrent with the October 28, 2022, amendment to the CIBC Loan Agreement, MFP amended the MFP Letter of Credit to increase the face amount from $9.0 million to $12.0 million, and the MFP Loan Agreement was amended to increase the maximum amount of term loan advances available to the Company from $9.0 million to $12.0 million. In connection with the December 23, 2022 amendment to the CIBC Loan Agreement, MFP amended the MFP Letter of Credit, extending the maturity date from January 23, 2023 to April 30, 2023. In connection with the Company’s March 22, 2023 amendment to the CIBC Loan Agreement, MFP further amended the MFP Letter of Credit to increase the maximum amount of term loan advances to $13.0 million and extend the maturity date to September 30, 2024. Following the July 3, 2024 amendment to the CIBC Loan Agreement, which extended the maturity date to October 31, 2024 amongst other items, the Company entered into a Fourth Amendment to Subordinate Loan and Security Agreement with MFP, dated July 16, 2024, which extended the maturity date of the MFP Letter of Credit to November 30, 2024 and also extended the maturity date of the MFP Loan Agreement to May 31, 2025.

Pursuant to the MFP Loan Agreement, the Company initially accrued a cash fee to be paid to MFP equal to 3.50% per annum on all amounts remaining undrawn under the MFP Letter of Credit. In the event any term advances are deemed made under the MFP Loan Agreement, such advances will bear interest at a rate per annum equal to term SOFR (with a floor of 1.25%) plus 9.25%, 50% of which will be payable in cash on the last day of each fiscal quarter and 50% of which will accrue as payment in kind interest payable on the maturity date, unless, with respect to any quarterly payment date, the Company elects to pay such interest in cash. This was subsequently amended on March 22, 2023 to, amongst other things, increase the cash fee payable to MFP on all amounts remaining undrawn under the MFP Letter of Credit from 3.50% to 4.25% per annum.

The MFP Loan Agreement is secured by substantially all of our assets and is subordinated to the CIBC Loan Agreement. Upon the occurrence and during the continuance of an event of default, MFP may declare all outstanding obligations under the MFP Loan Agreement immediately due and payable and take such other actions as set forth in the MFP Loan Agreement.

MFP Warrants

On September 22, 2022, the Company entered into a Subordinate Loan and Security Agreement, or the MFP Loan Agreement, with MFP, pursuant to which any draw CIBC may make on the MFP Letter of Credit will be deemed to be a term loan advance made by MFP to the Company. Pursuant to the terms and conditions of the MFP Loan agreement, on September 22, 2022, the Company issued to MFP a warrant, or Initial Warrant, to purchase up to 500,000 shares of the Company’s common stock, or Initial Warrant Shares, at $1.60 per share. The Initial Warrant expires five years from its issue date, or September 22, 2027.

In connection with the October 28, 2022 and December 22, 2022 amendments to the MFP Letter of Credit, the Company issued to MFP additional warrants to purchase 166,700 and 666,700 shares of the Company’s common stock, respectively, at an exercise price of $1.60 per warrant share. The warrants will each expire five years from the date of issuance.

In connection with the March 22, 2024 amendment to the MFP Letter of Credit, the Company issued to MFP a warrant to purchase 1,300,000 shares of the Company’s common stock at an exercise price of $2.15 per MFP warrant share. The warrants will expire five years from the date of issuance.

In total, warrants to purchase 2,633,400 shares of the Company’s common stock were issued to MFP in connection with the MFP Loan Agreement, or MFP Warrants, during the year ended June 30, 2023. The stated purchase prices of all of the MFP Warrants are subject to adjustment in connection with any stock dividends and splits, distributions with respect to common stock and certain fundamental transactions as described in the MFP Warrant. The MFP Warrants were valued using the Black-Scholes-Merton model as of the respective issue dates and recorded as financial commitment assets within Prepaid expenses and other current asset on the consolidated balance sheets. The MFP Warrants financial commitment assets are amortized on a straight-line basis over the period from their initial issue dates through the end of the related MFP Letter of Credit commitment periods. During the years ended June 30, 2024 and 2023, an aggregate value of $0.0 million and $1.9 million was capitalized, respectively, of which, $0.8 million and $0.9 million, respectively, was amortized as interest expense.

Alexander C. Matina, a member of our Board, was Portfolio Manager of MFP Investments LLC, the general partner of MFP, until December 31, 2023, at which point he transitioned to an advisor role for MFP Investors LLC. MFP is our largest stockholder.

Indemnification