International Business Machines (NYSE:IBM) –

According to the South China Morning Post, IBM has closed its

R&D operations in China, laying off over 1,000 employees due to

geopolitical tensions. The company shut down its labs in Beijing,

Shanghai, and Dalian but stated that it will continue to support

customers in the region. IBM’s sales in China dropped 19.6% in

2023. Shares rose 0.8% in pre-market trading.

Uber Technologies (NYSE:UBER) – Uber was fined

$324 million in the Netherlands for transferring European drivers’

personal data to the U.S., violating EU rules, according to the

DPA. Uber, which has ceased this practice, called the fine unfair

and plans to appeal, citing GDPR compliance. Shares rose 0.7% in

pre-market trading.

Boeing (NYSE:BA) – NASA will return Boeing’s

Starliner capsule, which had defects, to Earth without astronauts

Butch Wilmore and Suni Williams. They will return early next year

on a SpaceX spacecraft. The Starliner, which launched its first

astronauts in June, faced leaks and thruster failures, delaying the

mission. Shares fell 0.7% in pre-market trading.

Intel Corp. (NASDAQ:INTC) – Intel has hired

consultants, including Morgan Stanley, to prepare against potential

activist investor pressures, as reported by CNBC. Shares rose 0.8%

in pre-market trading.

Apple (NASDAQ:AAPL) – Apple plans its biggest

launch event of the year on September 10, where it will unveil new

iPhones, watches, and AirPods, according to Bloomberg. While the

date is not yet confirmed, the products are expected to be

available by September 20. The company is betting on AI upgrades to

attract buyers, despite declining sales in China. According to

Reuters, billionaire Daniel Loeb believes Apple’s stock has the

potential to rise further, especially if the company leverages

artificial intelligence in its iOS operating system. Loeb, whose

Third Point acquired Apple shares in April, sees AI as a

significant opportunity that could boost revenue and profits in the

coming years. He highlights that demand for new iPhones is expected

to grow, as AI features won’t be compatible with previous versions,

and Apple’s App Store could become the leading platform for new AI

applications. Shares rose 0.2% in pre-market trading.

Microsoft (NASDAQ:MSFT),

CrowdStrike (NASDAQ:CRWD) – Microsoft plans to

meet in September with cybersecurity firms, including CrowdStrike,

to discuss how to prevent a repeat of the global July failure that

crippled Windows systems. The meeting, in Seattle, will address

best practices for system updates and access to the Windows kernel,

with government representatives in attendance. Microsoft’s shares

rose 0.2% in pre-market trading, while CrowdStrike’s shares rose

0.7%.

Nvidia (NASDAQ:NVDA) – Nvidia is set to

announce another surge in profits, with revenue doubling due to the

growing adoption of generative AI. Shares have risen more than 160%

this year. Second-quarter revenue is expected to grow 109%,

reaching $28.6 billion, while operating profits could reach $18.7

billion. Investors await updates on AI chips and forecasts for the

rest of the year. Shares rose 0.8% in pre-market trading.

Alphabet (NASDAQ:GOOGL) – A report by Eko

revealed that YouTube’s automated systems are displaying ads from

major brands alongside videos promoting controversial policies from

Project 2025 and election misinformation. Researchers analyzed 11

videos, which included ads from more than 60 global brands, many

with public commitments to diversity. Although some videos may

violate YouTube’s guidelines, the platform only removed ads from

specific videos. YouTube defends its guidelines and claims to offer

advertisers control over where their ads are shown. Shares rose

0.4% in pre-market trading.

Paramount Global (NASDAQ:PARA) – Edgar Bronfman

Jr. is willing to have Shari Redstone remain involved with

Paramount Global if his consortium succeeds in buying the company’s

controlling entity, National Amusements. Bronfman has offered $6

billion to take over Paramount, challenging a planned acquisition

by David Ellison and Skydance Media. The final decision on

Redstone’s role at the company will be up to her. Additionally,

Bronfman plans partnerships with companies like Amazon and Apple to

strengthen Paramount Global’s streaming business, according to

Bloomberg. Shares rose 0.5% in pre-market trading.

Meta Platforms (NASDAQ:META) – Meta canceled

plans to launch a premium mixed reality headset that would have

competed with Apple’s Vision Pro, as reported by The Information.

The device, codenamed La Jolla, was scheduled for 2027 but was

halted after a product review. Despite losses in its Reality Labs

division, responsible for the Quest headsets, CEO Mark Zuckerberg

still bets on the future of augmented and virtual reality. Meta had

also previously halted production of the Quest Pro due to weak

sales and negative reviews. In addition, OpenAI has hired Irina

Kofman, a former Meta executive, to lead strategic initiatives,

strengthening its team with veterans from major tech companies.

Kofman, now reporting to CTO Mira Murati, will initially focus on

safety and preparation. Before joining OpenAI, Kofman was senior

director of product management for generative AI at Meta. Shares

rose 0.3% in pre-market trading.

Spotify (NYSE:SPOT) – Mark Zuckerberg, CEO of

Meta, and Daniel Ek, CEO of Spotify, criticized European

regulations on open-source artificial intelligence (AI), warning

that complex rules could make Europe fall behind. Although Europe

has many open-source developers, fragmented regulation is slowing

innovation. They advocate for clearer and harmonized rules to

support AI growth and prevent Europe from missing a unique

opportunity.

Fox Corp (NASDAQ:FOX) – Prominent Democrats

like Gavin Newsom and Pete Buttigieg are making appearances on Fox

News to reach a broader audience and increase visibility ahead of

elections. According to Bloomberg, Fox is seeking to balance its

image and boost its ratings with the presence of politicians from

different parties.

Starbucks (NASDAQ:SBUX) – After two fires at a

Starbucks construction site in Taos, New Mexico, a builder is once

again trying to construct the city’s first drive-through café,

known for its resistance to large corporations. Local residents

oppose the project, reflecting a history of revolt against outside

influences. Security at the site has been increased, and the

investigation into the fires is ongoing. Shares rose 0.2% in

pre-market trading.

Walmart (NYSE:WMT), JD.com

(NASDAQ:JD) – JD.com faces the challenge of proving its relevance

to investors amid a slowdown in e-commerce in China, intense price

wars, and the exit of Walmart, its largest shareholder. Walmart

sold its $3.74 billion stake, causing JD.com’s shares to drop and

raising concerns about its ability to adapt to these changes.

Walmart’s shares rose 0.1% in pre-market trading, while JD.com’s

shares rose 0.6%.

Halliburton (NYSE:HAL) – Halliburton, a leader

in U.S. oilfield services, suffered a cyberattack and is working

with authorities to assess the impact. The company has shut down

some systems as a precaution and is investigating whether the

incident will affect its business. The attack compromised

operations in Houston but did not affect energy services.

Woodside Energy (NYSE:WDS) – Woodside Energy,

Australia’s largest independent gas producer, will release its

first-half results on August 27. According to Visible Alpha, the

company is expected to face a decline in profits, estimated at

$1.11 billion for the first half, compared to $1.90 billion in the

previous year. Uncertainty over future mergers, after the collapse

of a $52 billion merger with Santos, raises concerns about its

growth strategy.

Rivian Automotive (NASDAQ:RIVN) – A fire

occurred in a parking lot at Rivian’s factory in Normal, Illinois,

damaging several electric vehicles. No injuries were reported, and

the cause is under investigation. The assembly plant was not

affected, and Rivian has not confirmed how many vehicles were

damaged. Vehicle production continues to expand at the facility.

Shares fell 0.1% in pre-market trading.

XPeng (NYSE:XPEV) – The Chinese electric

vehicle manufacturer announced that its CEO, Xiaopeng He, acquired

more than 2 million shares of the company, according to the WSJ.

Shares rose 5.8% in pre-market trading.

Canadian National Railway (NYSE:CNI),

Canadian Pacific Kansas City (NYSE:CP) – The

Canadian Industrial Relations Board ordered an end to strikes at

the country’s largest railroads, ending a service disruption that

threatened the Canadian economy. The decision came after a standoff

between 9,000 Teamsters union members and the railroads CN and

CPKC. The union criticized the decision and plans to appeal. Rail

operations are expected to resume on Monday, but full recovery is

expected to take several weeks. In addition, a union notified

Canadian National Railway of a new imminent strike hours after

operations resumed on Friday, threatening to again paralyze supply

chains today if there was no agreement. The Canadian government

imposed mandatory arbitration to resolve disputes.

Norfolk Southern (NYSE:NSC) – Norfolk Southern

and BNSF Railway have reached provisional five-year collective

bargaining agreements with four unions, guaranteeing average annual

wage increases of 3.5%, plus vacation and health benefit

improvements. The agreements, which cover 30% of Norfolk Southern’s

unionized workforce, still need to be ratified.

Delta Air Lines (NYSE:DAL) – Delta’s Chief

Operating Officer Mike Spanos will leave the company next month to

take another position. Spanos, who joined Delta last year, is

leaving after considering new opportunities. His departure comes

weeks after flight cancellations due to cyber issues. Delta has no

plans to replace him immediately.

Citigroup (NYSE:C) – Citigroup argues that the

firing of Kathleen Martin, a former managing director suing the

bank, was due to performance issues, not her allegations of

covering up information to regulators. Martin claims she was fired

in retaliation for refusing to hide critical data, while Citigroup

maintains that performance concerns predated that. Martin’s

attorney, Valdi Licul, plans to seek depositions from top bank

executives, including CEO Jane Fraser, to prove the retaliation

claim. Shares rose 0.5% in pre-market trading.

Nomura Holdings (NYSE:NMR) – Nomura analysts

recommend reducing investments in Chinese stocks and increasing

positions in Indonesia and Malaysia. They expect these markets to

benefit more from U.S. interest rate cuts, while Chinese stocks

face difficulties due to economic instability and the real estate

crisis.

KKR & Co. (NYSE:KKR) – KKR is exploring

options for Sylvan Inc., the world’s largest mushroom seed

producer, including bringing in new investors. KKR, with the help

of an advisor, is gauging interest in a yuan continuation fund.

However, discussions are in the early stages and may not result in

transactions.

MIRA Pharmaceuticals (NASDAQ:MIRA) – MIRA

Pharmaceuticals announced that its new ketamine analog, Ketamir-2,

reduced or reversed neuropathic pain in rats. The study showed that

low doses of Ketamir-2 provided substantial relief for up to 22

days, while higher doses completely normalized neuropathic pain,

something ketamine could not achieve. Shares rose 35.1% in

pre-market trading.

Talis Biomedical (NASDAQ:TLIS) – Nasdaq warned

that Talis Biomedical could be delisted for being considered a

“shell company.” Talis suspended all R&D activities in June and

is preparing for a bankruptcy filing. The company, which develops

molecular tests for infectious diseases, has cut 90% of its staff

and reduced operations in Chicago to conserve resources.

BioAffinity Technologies (NASDAQ:BIAF) –

BioAffinity Technologies appointed Michael Edwards as interim CFO

effective September 16, after CFO Michael Dougherty announced his

resignation to pursue new opportunities. Dougherty will remain

until September 16 to ensure a smooth transition. The company will

begin the search for a permanent CFO. Edwards, who has previously

served as CFO, was hired under a consulting contract with a monthly

salary of $10,000 plus expenses.

Eli Lilly (NYSE:LLY) – Eli Lilly’s early-stage

Alzheimer’s treatment, donanemab, is expected to be blocked by the

UK’s National Health Service (NHS), according to the Telegraph. The

National Institute for Health and Care Excellence (NICE) is

expected to reject the drug, citing concerns about costs and

monitoring side effects, as it did with lecanemab. Both drugs have

already been approved in the U.S.

Johnson & Johnson (NYSE:JNJ) – Johnson

& Johnson is negotiating with plaintiff attorneys who opposed

the $6.48 billion settlement over claims that its talc caused

cancer. The company is seeking additional support to finalize the

settlement through a subsidiary’s bankruptcy, ending lawsuits and

preventing new cases.

Novo Nordisk (NYSE:NVO) – With the U.S.

government negotiating drug prices for Medicare, the 2027 list is

expected to include Novo Nordisk’s Ozempic, along with drugs from

Pfizer, GSK, Teva, and AbbVie. While these negotiations could

impact some companies, many of the drugs already have significant

discounts, limiting the financial impact. Shares fell 0.7% in

pre-market trading.

Novartis (NYSE:NVS) – Novartis sold its PET

molecular imaging division to Siemens Healthineers for more than

$224 million. The transaction includes the diagnostics arm of

Advanced Accelerator Applications, acquired by Novartis in 2017.

The deal is expected to close in the fourth quarter.

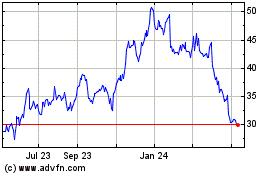

Intel (NASDAQ:INTC)

Historical Stock Chart

From Oct 2024 to Nov 2024

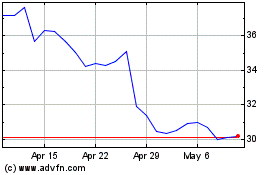

Intel (NASDAQ:INTC)

Historical Stock Chart

From Nov 2023 to Nov 2024