Caution Ahead Of Nvidia Earnings May Weigh On Wall Street

May 22 2024 - 9:09AM

IH Market News

The major U.S. index futures are currently pointing to a

slightly lower open on Wednesday, with stocks likely to give back

ground after ending yesterday’s choppy trading day modestly

higher.

Traders may look to cash in on recent strength in the markets

ahead of the release of quarterly results from AI darling Nvidia

(NASDAQ:NVDA).

Nvidia is scheduled to release its fiscal first quarter results

after the close of today’s trading, with analysts expecting the

company to report substantial earnings and revenue growth.

Nonetheless, traders may be reluctant to make significant moves

ahead of the release of the minutes of the Federal Reserve’s latest

monetary policy meeting this afternoon.

The minutes could have an impact on the outlook for interest

rates following recent comments from some Fed officials suggesting

rates may need to remain higher for longer than anticipated.

While the likelihood rates will be lower by September remains

high, the chances have fallen to 67.0 percent from close to 90

percent last week, according to CME Group’s FedWatch Tool.

Following the mixed performance seen in Monday’s session, stocks

showed a lack of direction throughout much of the trading day on

Tuesday. Despite the choppy trading on the day, the S&P 500 and

the Nasdaq reached new record closing highs.

The major averages spent the day bouncing back and forth across

the unchanged but moved to the upside going into the close. The

S&P 500 climbed 13.28 points or 0.3 percent to 5,321.41, the

Nasdaq rose 37.75 points or 0.2 percent to 16,832.62 and the Dow

edged up 66.22 points or 0.2 percent to 39,872.99.

The lackluster performance on Wall Street came as traders took a

step back to assess the recent strength in the markets.

Renewed confidence the Federal Reserve will lower interest rates

in the coming months has contributed to the advance, but recent

comments from Fed officials have once again created some

uncertainty.

Another quiet day on the U.S. economic front may also have kept

some traders on the sidelines ahead of the release of the minutes

of the Fed’s latest monetary policy meeting on Wednesday.

Among individual stocks, shares of Peloton Interactive

(NASDAQ:PTON) moved sharply lower after the exercise equipment and

media company announced a global refinancing that includes an

offering of $275.0 million worth of convertible senior notes due

2029.

Auto parts retailer AutoZone (NYSE:AZO) has showed a notable

move to the downside after report better than expected fiscal third

quarter earnings but weaker than expected revenues.

On the other hand, shares of XPeng (NYSE:XPEV) surged after the

Chinese electric vehicle maker reported fiscal first quarter

results that beat analyst estimates on both the top and bottom

lines.

Reflecting the lackluster performance by the broader markets,

most of the major sectors ended the day showing only modest

moves.

Airline stocks showed a significant move to the downside,

however, with the NYSE Arca Airline Index falling by 1.8

percent.

Notable weakness was also visible among networking stocks, as

reflected by the 1.2 percent loss posted by the NYSE Arca

Networking Index.

The index pulled back off its best closing level in over three

months amid a steep drop by Palo Alto Networks (NASDAQ:PANW), which

came under pressure after the cybersecurity company forecast fiscal

fourth quarter revenues and billings toward the low end of analyst

estimates.

On the other hand, tobacco and banking stocks saw some strength

on the day, driving the NYSE Arca Tobacco Index and the KBW Bank

Index up by 1.3 percent and 1.1 percent, respectively.

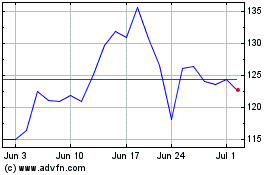

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From May 2024 to Jun 2024

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Jun 2023 to Jun 2024