false

0001543151

0001543151

2024-05-13

2024-05-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

_______________________________________________

FORM

8-K

_______________________________________________

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 13, 2024

_______________________________________________

UBER

TECHNOLOGIES, INC.

(Exact

name of registrant as specified in its charter)

_______________________________________________

| Delaware |

001-38902 |

45-2647441 |

| (State

or other jurisdiction of incorporation or organization) |

(Commission

File Number) |

(I.R.S.

Employer Identification No.) |

1725 Third Street

San Francisco,

California 94158

(Address

of principal executive offices, including zip code)

(415) 612-8582

(Registrant’s

telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

_______________________________________________

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common

Stock, par value $0.00001 per share |

|

UBER |

|

New

York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (17

CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company

☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On May 13, 2024, Uber Technologies, Inc. (the “Company”) issued

a press release announcing its entry into an agreement with Delivery Hero SE (“Delivery Hero”) to acquire Delivery Hero’s

Foodpanda delivery business in Taiwan for $950 million in cash on a cash and debt free basis, subject to certain adjustments. The Company

also entered into an agreement with Delivery Hero to purchase approximately $300 million in newly issued ordinary shares of Delivery Hero

at a purchase price of €33.00 per share, which is expected to close on or about May 23, 2024. A copy of the press release is attached

hereto as Exhibit 99.1 and incorporated herein by reference.

We expect the acquisition to contribute at least $150 million annualized

run-rate of Delivery Adjusted EBITDA(1), inclusive of synergies, to our business within 12 months of closing. The acquisition

of Foodpanda Taiwan is subject to regulatory approval and other customary closing conditions and is expected to close in the first half

of 2025.

(1) The

Company’s three operating and reportable segments are Mobility, Delivery and Freight, and its segment operating performance measure

is Segment Adjusted EBITDA. We define each segment’s Adjusted EBITDA as segment

revenue less the following expenses: cost of revenue, exclusive of depreciation and amortization, operations and support, sales and marketing,

and general and administrative and research and development expenses associated with our segments. Segment Adjusted EBITDA also excludes

non-cash items, certain transactions that are not indicative of ongoing segment operating performance and/or items that management does

not believe are reflective of our ongoing core operations.

The information set forth under this

Item 7.01, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it

be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any

general incorporation language in such filing, except as otherwise expressly stated in such filing.

Forward-Looking Statements

This Current Report

on Form 8-K contains forward-looking statements regarding our future business expectations which involve risks and uncertainties. Actual

results may differ materially from the results predicted, and reported results should not be considered as an indication of future performance.

Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “anticipate,”

“believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,”

“hope,” “intend,” “may,” “might,” “objective,” “ongoing,” “plan,”

“potential,” “predict,” “project,” “should,” “target,” “will,”

or “would” or similar expressions and the negatives of those terms. Forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future

results, performance or achievements expressed or implied by the forward-looking statements. These risks, uncertainties and other factors

relate to, among others: risks and uncertainties related to the pending acquisition of Foodpanda, including the failure to obtain, or

delays in obtaining, required regulatory approvals, any reverse termination fee that may be payable in connection with any failure to

close the transaction, the risk that such approvals may result in the imposition of conditions that could adversely affect us or the expected

benefits of the proposed transaction, or the failure to satisfy any of the closing conditions to the proposed transaction on a timely

basis or at all; costs, expenses or difficulties related to the acquisition of Foodpanda; failure to realize the expected benefits and

synergies of the proposed transaction in the expected timeframes or at all; the potential impact of the announcement, pendency or consummation

of the proposed transaction on relationships with the Company’s and/or Foodpanda’s employees, merchants, suppliers, delivery

partners and other business partners; the risk of litigation or regulatory actions to us, Delivery Hero and/or Foodpanda; inability to

retain key personnel; changes in legislation or government regulations affecting us, Delivery Hero or Foodpanda; the potential impact

of the acquisition on our financial results; and economic financial, social or political conditions that could adversely affect us, Delivery

Hero, Foodpanda or the proposed transaction. For additional information on other potential risks and uncertainties that could cause actual

results to differ from the results predicted, please see our Annual Report on Form 10-K for the year ended December 31, 2023 and subsequent

quarterly reports and other filings filed with the Securities and Exchange Commission from time to time. All information provided in this

release and in the attachments is as of the date of this Current Report on Form 8-K and any forward-looking statements contained herein

are based on assumptions that we believe to be reasonable as of this date. Undue reliance should not be placed on the forward-looking

statements in this Current Report on Form 8-K, which are based on information available to us on the date hereof. We undertake no duty

to update this information unless required by law.

Preliminary

Financial Information

We report our financial results in accordance with U.S.

generally accepted accounting principles. All projected financial information in this Current Report on Form 8-K is preliminary. The estimate

is not a comprehensive statement of our financial position and results of operations. There is no assurance that the Company will achieve

its forecasted results within the relevant period or otherwise. Actual results may differ materially from these estimates as a result

of actual quarter-end results, the completion of normal quarter-end accounting procedures and adjustments, including the execution of

our internal control over financial reporting, the completion of the preparation and management’s review of our financial statements

for the relevant period and the subsequent occurrence or identification of events prior to the filing of our financial results for the

relevant period with the Securities and Exchange Commission.

Item 9.01 Financial Statements and Exhibits

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

UBER

TECHNOLOGIES, INC. |

| |

|

| Date:

May 14, 2024 |

By:

/s/ Dara Khosrowshahi |

| |

Dara

Khosrowshahi |

| |

Chief

Executive Officer |

Exhibit 99.1

Uber Eats to acquire

Delivery Hero’s foodpanda delivery business in Taiwan

| |

● |

Acquisition brings together the companies’ complementary merchant, delivery partner, and consumer bases into a single app,

creating significant value |

| |

|

|

| |

● |

Deal is one of the largest-ever international acquisitions in Taiwan, highlighting its attractiveness for companies and investors |

SAN FRANCISCO and BERLIN — Uber

Technologies, Inc. (NYSE: UBER) and Delivery Hero SE have reached an agreement for Uber to acquire Delivery Hero’s foodpanda

delivery business in Taiwan for $950 million in cash. The acquisition of foodpanda Taiwan is subject to regulatory approval and

other customary closing conditions and is targeted to close in the first half of 2025. Separately, the companies have also entered

into an agreement for Uber to purchase $300 million in newly issued ordinary shares of Delivery Hero.

Until closing, Delivery Hero is dedicated

to continue operating foodpanda Taiwan as before, offering the best possible service for its customers and vendors. In the period following

closing, foodpanda’s local consumers, merchants, and delivery partners will be transitioned to Uber Eats.

Due to its existing presence in Taiwan, Uber

is best placed to build upon the significant local operations developed by Delivery Hero and foodpanda over the past years, and invest

further into an improved experience for consumers, merchants, and delivery partners.

Niklas Östberg, CEO and Co-Founder of

Delivery Hero, said: “The strength of our Taiwanese business is a testament to the hard work of many teams over the last eight years.

In order to build a world-leading service, we have come to the conclusion that we need to focus our resources on other parts of our global

footprint, where we feel we can have the largest impact for customers, vendors and riders. This deal gives foodpanda an exciting runway

in Taiwan and we wish them all the best in their next chapter.”

The deal will combine Uber’s global

expertise in operating a high-efficiency marketplace with foodpanda’s extensive coverage across Taiwan and its relationships with

beloved local brands. The deal will also give consumers greater choice across food types and price points by bringing the complementary

groups of merchants on Uber Eats and foodpanda onto a combined platform.

For example, consumers stand to benefit from

the combination of Uber’s wider selection across northern Taiwan and in major urban centers with foodpanda’s comparative strength

in southern Taiwan and in smaller cities. Better service for consumers helps drive more orders from merchants, and more orders from merchants

means more opportunities for delivery partners to earn.

Pierre-Dimitri Gore-Coty, Senior Vice President

of Delivery at Uber, said: “Bringing together our distinct customer bases, merchant selections, and geographic footprints will allow

us to deliver more choices and the best prices for consumers, stronger demand for restaurants, and more earnings opportunities for delivery

partners. Taiwan is a fiercely competitive market, where online food delivery platforms today still represent just a small part of the

food delivery landscape. We’re so excited about the opportunity to deliver even greater convenience and value that this transaction

would unlock in the years ahead.”

Once completed, this deal would be one of

the largest ever international acquisitions in Taiwan, outside of the semiconductor industry. Uber’s decision to commit to this

considerable increase in its Taiwan investment is a concrete vote of confidence in the continued long-term attractiveness of Taiwan for

international companies and investors.

###

Forward-Looking Statements

This press release contains forward-looking

statements regarding Uber’s future business expectations which involve risks and uncertainties. Actual results may differ materially

from the results predicted, and reported results should not be considered as an indication of future performance. Forward-looking statements

include all statements that are not historical facts and can be identified by terms such as “anticipate,” “believe,”

“contemplate,” “continue,” “could,” “estimate,” “expect,” “hope,”

“intend,” “may,” “might,” “objective,” “ongoing,” “plan,” “potential,”

“predict,” “project,” “should,” “target,” “will,” or “would” or

similar expressions and the negatives of those terms. Forward-looking statements involve known and unknown risks, uncertainties and other

factors that may cause Uber’s actual results, performance or achievements to be materially different from any future results, performance

or achievements expressed or implied by the forward-looking statements. These risks, uncertainties and other factors relate to, among

others: risks and uncertainties related to the pending acquisition of foodpanda, including the failure to obtain, or delays in obtaining,

required regulatory approvals, any reverse termination fee that may be payable in connection with any failure to close the transaction,

the risk that such approvals may result in the imposition of conditions that could adversely affect Uber or the expected benefits of the

proposed transaction, or the failure to satisfy any of the closing conditions to the proposed transaction on a timely basis or at all;

costs, expenses or difficulties related to the acquisition of foodpanda; failure to realize the expected benefits and synergies of the

proposed transaction in the expected timeframes or at all; the potential impact of the announcement, pendency or consummation of the proposed

transaction on relationships with Uber’s and/or foodpanda’s employees, merchants, suppliers, delivery partners and other business

partners; the risk of litigation or regulatory actions to Uber, Delivery Hero and/or foodpanda; inability to retain key personnel; changes

in legislation or government regulations affecting Uber, Delivery Hero or foodpanda; and economic financial, social or political conditions

that could adversely affect Uber, Delivery Hero, foodpanda or the proposed transaction. For additional information on other potential

risks and uncertainties that could cause actual results to differ from the results predicted, please see Uber’s most recent annual

report on Form 10-K for the year ended December 31, 2023 and subsequent quarterly reports, annual reports and other filings filed with

the Securities and Exchange Commission from time to time. All information provided in this release and in the attachments is as of the

date of this press release and any forward-looking statements contained herein are based on assumptions that Uber believes to be reasonable

as of this date. Undue reliance should not be placed on the forward-looking statements in this press release, which are based on information

available to Uber on the date hereof. Uber undertakes no duty to update this information unless required by law.

Contacts

|

For Uber:

press@uber.com |

For Delivery Hero:

press@deliveryhero.com |

About Uber

Uber’s mission is to create opportunity through movement. We

started in 2010 to solve a simple problem: how do you get access to a ride at the touch of a button? More than 49 billion trips later,

we’re building products to get people closer to where they want to be. By changing how people, food, and things move through cities, Uber

is a platform that opens up the world to new possibilities.

About Delivery Hero

Delivery Hero is the world’s leading local delivery platform,

operating its service in around 70 countries across Asia, Europe, Latin America, the Middle East and Africa. The Company started as a

food delivery service in 2011 and today runs its own delivery platform on four continents. Additionally, Delivery Hero is pioneering quick

commerce, the next generation of e-commerce, aiming to bring groceries and household goods to customers in under one hour and often in

20 to 30 minutes. Headquartered in Berlin, Germany, Delivery Hero has been listed on the Frankfurt Stock Exchange since 2017 and is part

of the MDAX stock market index. For more information, please visit www.deliveryhero.com

*Goldman Sachs & Co. LLC acted as exclusive financial advisor to

Uber and UniCredit Bank GmbH acted as financial advisor to Delivery Hero.

v3.24.1.1.u2

Cover

|

May 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 13, 2024

|

| Entity File Number |

001-38902

|

| Entity Registrant Name |

UBER

TECHNOLOGIES, INC.

|

| Entity Central Index Key |

0001543151

|

| Entity Tax Identification Number |

45-2647441

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1725 Third Street

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94158

|

| City Area Code |

(415)

|

| Local Phone Number |

612-8582

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.00001 per share

|

| Trading Symbol |

UBER

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

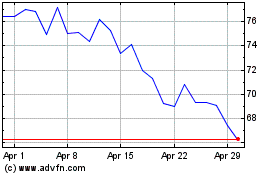

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Apr 2024 to May 2024

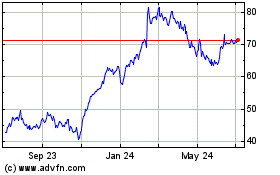

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From May 2023 to May 2024