Current Report Filing (8-k)

October 26 2021 - 10:57AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 26, 2021

Hammer Fiber Optics Holdings Corp.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Nevada

|

000-1539680

|

98-1032170

|

|

(State or other jurisdiction

|

(Commission File Number)

|

(IRS Employer

|

|

of Incorporation)

|

|

Identification Number)

|

401 East 34th Street, Suite #N27J, New York, NY 10016

(844) 413-2600

(Address, including zip code, and telephone number, including area code,

of registrant's principal executive offices)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

FORWARD LOOKING STATEMENTS

The following discussion, in addition to the other information contained in this Current Report ("Report"), should be considered carefully in evaluating our prospects. This Report (including without limitation the following factors that may affect operating results) contains forward-looking statements regarding us and our business, financial condition, results of operations and prospects. Words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates" and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this Report. Additionally, statements concerning future matters such as revenue projections, projected profitability, growth strategies, possible changes in legislation and other statements regarding matters that are not historical are forward-looking statements.

Forward-looking statements in this Report reflect the good faith judgment of our management and the statements are based on facts and factors as we currently know them. Forward-looking statements are subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, but are not limited to, those discussed in this Report. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Report.

Item 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On October 26th, 2021, Hammer Technology Holdings, (Formally Hammer Fiber Optics Holdings Corp). a Nevada corporation (the "Company" or "HMMR") entered into a Share Exchange Agreement (the "Share Exchange Agreement") with Telecom Financial Services Ltd., a Delaware corporation ("TFS-LTD"), and the controlling stockholders of TFS-LTD (the "TFS Shareholders"). Pursuant to the Share Exchange Agreement, the Company will acquire 5,000,000 shares of common stock of TFS-LTD from the TFS shareholders (the "TFS-LTD Shares") and in exchange the Company shall issue to the TFS Shareholders 5,000,000 restricted shares of its common stock (the "HMMR Shares"). As a result of the Share Exchange Agreement, TFS-LTD shall become a wholly owned subsidiary of the Company. The Share Exchange Agreement contains customary representations, warranties and conditions to closing.

Name Change

As a result of the Share Exchange, the Company will change the name of TFS-LTD to HammerPay (USA) Ltd (the "Name Change"), effective upon approval by the Delaware Division of Corporations.

Exchange Ratio

On the effective date of the Share Exchange, the total number of shares of Common Stock held by each stockholder in the stock of TFS-LTD will be converted into an equal number of shares of Common Stock of the Company.

Non Dilution

The transactions contemplated under this Share Exchange Agreement shall be non-dilutive to the shareholders of the company as the shares of the company's common stock issued hereunder to the TFS Shareholders shall be issued out of prior reserved acquisition treasury stock of the Company

Description of Transaction

The foregoing provides only a brief descriptions of the material terms of the Share Exchange Agreement and does not purport to be a complete description of the rights and obligations of the parties thereunder, and such descriptions are qualified in their entirety by reference to the full text of the forms of the Share Exchange Agreement filed as Exhibit 99.1 to this Current Report on Form 8-K, and are incorporated herein by reference.

Item 3.02 UNREGISTERED SALES OF EQUITY SECURITIES

The shares to be issued under the Share Exchange Agreement shall qualify as a tax-free reorganization under Section 368(a)(1)(B) of the Internal Revenue Code of 1986, as amended (the "Code"); and (ii) the Share Exchange Agreement, shall be issued in reliance upon an exemption from registration afforded under Section 4(2) of the Securities Act for transactions by an issuer not involving a public offering, or Regulation D promulgated thereunder, or Regulation S for offers and sales of securities outside the United States. The Share Exchange Agreement is an exempt transaction pursuant to Section 4(2) of the Securities Act as the share exchange was a private transaction by the Company and did not involve any public offering. Additionally, we relied upon the exemption afforded by Rule 506 of Regulation D of the Securities Act which is a safe harbor for the private offering exemption of Section 4(2) of the Securities Act whereby an issuer may sell its securities to an unlimited number of accredited investors, as that term is defined in Rule 501 of Regulation D. Further, we relied upon the safe harbor provision of Rule 903 of Regulation S of the Securities Act which permits offers or sales of securities by the Company outside of the United States that are not made to "U.S. persons" or for the account or benefit of a "U.S. person", as that term is defined in Rule 902 of Regulation S.

The information disclosed under Item 1.01 is incorporated into this Item 3.02 in its entirety.

Item 9.01 FINANCIAL STATEMENTS AND EXHIBITS

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Hammer Technology Holdings (Formally Hammer Fiber Optics Holdings, Corp.)

Dated: October 26, 2021

/s/ Michael P. Cothill

By: Michael P. Cothill

Its: Executive Chairman

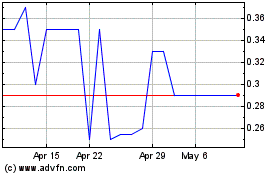

Hammer Fiber Optics (PK) (USOTC:HMMR)

Historical Stock Chart

From Apr 2024 to May 2024

Hammer Fiber Optics (PK) (USOTC:HMMR)

Historical Stock Chart

From May 2023 to May 2024