Exchange traded funds (ETFs) have come a long way since January

1993--when the first ETF was introduced to the market. The ETF

world has grown exponentially since then and currently there are

more than 1400 U.S. listed products with about $1.3 trillion in

assets under management. And there are more than 900 products

in registration, currently awaiting clearance from the SEC.

With their low-cost, efficiency, flexibility and transparency,

the ETFs have grown in popularity and number and types of products

has surged. ETFs opened doors to investing in the new areas

in the markets (asset class, style, currencies, commodities or

geography) that were earlier inaccessible to regular investors.

(Three Biggest Mistakes of ETF Investing)

ETFs are popular not only with the retail investors but also

with institutional investors like pension funds, foundations and

asset managers. Retail investors love the ETFs because among

others, they also do not impose any minimum investment limits,

unlike some of the index funds. Many investors both individual as

well as institutional use the ETFs for strategic asset allocation,

tactical trading strategies or risk management.

But there are certain ETF products that are pioneer in the

investing world since they changed the way we invest. Thanksgiving

week may be the right time to be thankful for such ETFs.

SPDR S&P 500 (SPY)

It all started with a spider. The ETF that started the

ETF revolution still remains most popular with the investors, with

about $101 billion in AUM. The ETF tracks the S&P 500 index and

is a proxy for the broader U.S. stock market.

For investors who do not believe in or do not want to spend a

lot of time in sector or stock picking and still want to remain

exposed to the U.S. equities, this ETF is a low-cost and convenient

choice. (Three Excellent ETFs with more than 4% Yields)

SPY has exposure to almost all important sectors with

Information Technology, Financials, Healthcare and Consumer

Discretionary being the top four sectors. In terms of

individual holdings, Apple Inc. occupies the top spot, followed by

Exxon Mobil, Microsoft, IBM and General Electric, AT&T.

The fund is well diversified one, with top ten holdings

accounting for just about 20% of the portfolio. The expense

ratio is extremely low at 9 basis points, but this is not the

cheapest large-cap blend ETF choice available to the investors now.

It pays out a dividend yield of 2.09% currently.

SPY has excellent liquidity and trades in high volumes, and thus

it is an ideal choice for large trades but retail investors have

two other slightly cheaper alternatives available in iShares Core

S&P 500 ETF (IVV) and Vanguard S&P 500 ETF (VOO). IVV and

VOO charge seven and five basis points respectively for annual

expenses.

SPDR Gold

Trust (GLD)

Gold has attracted investors’ attention for a very long time,

not only due to its status as store of value and inflation-hedge,

but also due to excellent diversification that it provides to the

portfolio.

Many investors avoided investing in gold earlier just due to

high trading costs and inconvenience associated with buying and

storing the bullion. GLD, launched in 2004 provided an innovative,

cost-efficient and secure way to invest in the metal to such

investors.

Thus it’s no surprise that GLD is the second most popular ETF

with about $75 billion in assets under management. (Shine and

Protect your portfolio with Gold ETFs)

It seeks to replicate the performance of the gold bullion and is

backed by physical holding of gold bullion in London vaults. It

charges 40 basis points for annual expenses.

While GLD is the largest, most liquid and widely traded gold

ETF, iShares Gold Trust (IAU) presents a much cheaper option to GLD

with its expense ratio at 0.25% per year. GLD trades in higher

volumes and has slightly lower bid-ask spreads, compared with IAU,

which may result in some benefit for very large trades. But for

most retail investors, IAU is a more cost-effective option.

PIMCO Total Return ETF

(BOND)

BOND is the ETF version of PIMCO’s flagship blockbuster mutual

fund--the PIMCO Total Return Institutional Fund.

BOND is a very popular product since it provides the opportunity

of getting the portfolio management expertise of Bill Gross, one of

the most respected investment managers in the world. The ETF

has become the second-most-successful exchange-traded-product

launch since GLD’s launch in 2004.

The ETF currently has $3.7 billion in AUM and charges an expense

ratio of 55 basis points per annum. Though the ETF does not

use swaps or other similar derivative instruments which are in the

mutual fund versions of the product (due to SEC rules), it has been

outperforming its mutual fund counterpart since inception in March

this year.

The ETF has returned 10.1% since its inception and it pays out a

decent yield of 2.5%. The portfolio currently holds 873

securities with an effective maturity of 7.6 years and effective

duration of 4.8 years.

According to some industry experts actively managed bond ETFs

are likely to become popular in future and further with time-proven

success of PIMCO Total Return strategy, we expect this ETF to be an

outperformer in the fixed income world.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

PIMCO-TOT RETRN (BOND): ETF Research Reports

SPDR-GOLD TRUST (GLD): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

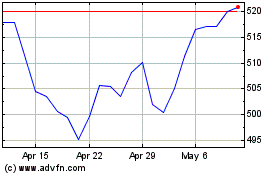

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Jun 2024 to Jul 2024

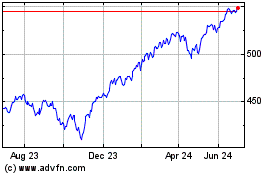

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Jul 2023 to Jul 2024