RNS Number : 0059W

Vp PLC

05 June 2008

Press Release 5 June 2008

Vp plc

("Vp" or "the Group")

Final Results

Vp plc, the equipment rental specialist, today announces its Final Results for the year ended 31 March 2008.

Highlights

� Revenues ahead 23% to �149.3 million (2007: �121.6 million)

� Profit before tax and amortisation rose 39% to �20.2 million (2007: �14.5

million)

� Basic earnings per share up 48% to 36.09p (2007: 24.40p)

� Proposed final dividend of 7.7p per share, increases the total dividend

for the year by 27% to 10.50p per share (2007: 8.25p)

� Significant capital investment of �43 million in rental fleet; eight

acquisitions completed for an aggregate consideration of a further �11

million

� Solid balance sheet with strong operational cashflows

Jeremy Pilkington, Chairman, commented:

"This is another year of record results reflecting the underlying strength of the Group, and the successful implementation of our

strategy to build a resilient business with diversified market exposure and leading market positions. We look forward to the future with

confidence."

- Ends -

Enquiries:

Vp plc

Jeremy Pilkington, Chairman Tel: +44 (0) 1423 533 405

jeremypilkington@vpplc.com

Neil Stothard, Group Managing Director Tel: +44 (0) 1423 533 445

neil.stothard@vpplc.com

Mike Holt, Group Finance Director Tel: +44 (0) 1423 533 445

mike.holt@vpplc.com www.vpplc.com

Media enquiries:

Abchurch Communications

Sarah Hollins/ Ariane Comstive Tel: +44 (0) 20 7398 7705

ariane.comstive@abchurch-group.com www.abchurch-group.com

CHAIRMAN'S STATEMENT

I am delighted to report another year of significant growth and record profits for the Group.

Profits before tax and amortisation rose 39% to �20.2m on revenues ahead by 23% to �149.3m. Earnings per share rose 48% to 36.09p.

Although we have been relatively acquisitive this year, 82% of this profit growth came from underlying organic business performance. Trading

results are discussed in the business review.

During the year we invested �43 million into the rental fleet and made a total of eight acquisitions for our Hire Station, Groundforce

and Torrent Trackside businesses at an aggregate consideration of a further �11 million. Notwithstanding these levels of expenditure, year

end gearing stood at just 51%. This financial strength gives the Group the flexibility to take advantage of further investment and

acquisition opportunities as they arise whilst also providing a strong position from which to confront any uncertainties in the broader

economy. Interest cover was 7.5 times.

In view of this excellent performance the Board is recommending a final dividend of 7.7p per share, making a total for the year of

10.5p, an increase of 27%. Subject to shareholder approval at the Annual General Meeting on the 9 September 2008 the dividend will be paid

on 1 October 2008 to shareholders registered as at 5 September 2008.

The Vp business model calls for market leading positions in specialist sectors with value adding opportunities, increasingly outside of

mainstream construction. Energy, infrastructure, environmental quality, health and safety legislation and the continuing trend to

outsourcing are all key drivers in the Vp business mix. The changing economic climate will undoubtedly present challenges to growth but as

yet we have not seen any significant impact on our markets, with the exception of UK residential construction. New housing starts have

clearly slowed but we believe that any softness here will be more than offset by buoyancy elsewhere, particularly within the oil and gas and

electricity transmission sectors.

We will remain alert to the early identification of market trends which could adversely affect prospects for the Group but we believe

that our mix of businesses contains diversity and resilience which will stand us in good stead. We look forward to future progress in the

year ahead.

It remains my pleasurable duty to thank all our employees for their contribution to this outstanding result.

Jeremy Pilkington

Chairman

5 June 2008

BUSINESS REVIEW

OVERVIEW

Vp plc is an equipment rental specialist providing the rental and sale of products and services to a diverse range of markets including

construction, civil engineering, rail, oil and gas exploration, events and industrial markets.

The Group's development over the last few years has been focused around a number of key attributes and goals. We seek to provide value

added, specialist services to a wide customer base, and to develop market leading capabilities for our businesses measured by range of

product and service, expertise of employees and our ability to innovate. We constantly seek to improve our delivery to customers and provide

solutions to changes in market conditions. These aspirations for the business were delivered in the year under review to great effect as

described further in the individual business reviews below. We continue to develop the Group in this way to ensure that the future growth

ambitions of the business can be achieved.

The year ended 31 March 2008 was one of further excellent progress with the business delivering substantial increases in profitability,

return on capital employed, margin and revenue.

Operating profits pre-amortisation increased 43% on prior year to �23.3 million, on revenues of �149.3 million, 23% ahead of last year.

Whilst the Group has benefited from a strong flow of acquisitions this year, the majority of the profit increase has come from organic

growth.

The market environment in the year under review has been largely supportive, with particularly strong demand from general construction,

water, oil and gas, and events. The rail market however, was weak throughout the year. Since the start of 2008 we have seen little change in

market behaviour other than in the transmission sector which has picked up well and housebuilding, which represents less than 10% of Group

revenues, where the market is quieter than last year.

GROUNDFORCE

Excavation Support Systems, Specialist Solutions and Trenchless Technology.

Revenue �35.0 million (2007: �28.1 million)

Operating Profit before amortisation �8.7 million (2007: �6.4 million)

Investment in Rental Fleet �7.6 million (2007: �5.4 million)

Groundforce continued its consistent record of delivering growth with revenues up 25% to �35.0 million, producing excellent operating

profits of �8.7 million, 36% ahead of the previous year.

During the year, the business was able to capitalise on healthy market drivers, which included a full year of AMP4 contract releases,

sustained infrastructure spend and strong general construction and civil engineering work. This strong work base was further enhanced by its

class leading position in major excavation propping, developed during the previous year, which allowed a number of key projects to be

secured. Notably the second phase of the tunnel under the River Shannon, Birmingham Railway Station and Leeds University, were all

successfully completed and provided Groundforce with the expertise to win two significant contracts for the early enabling work on the 2012

Olympics.

Piletec and Easiform delivered results above expectation, benefiting from the cross selling across the divisional customer base and

leveraging the associated relationships.

During the year, Groundforce also increased its geographic footprint by establishing an operational facility in Port Laoise, 40 miles

west of Dublin. This presence was augmented, in November 2007, by the acquisition of two Irish businesses, Underground Safety Services and

Pipe Testing Accessories which have provided Groundforce with a strong initial market position in Ireland, an experienced team and critical

mass for further growth.

At the end of the fiscal year, U Mole, based in Cambridge, market leaders in trenchless technology, was acquired for �4.5 million.

Specialising in pipe rehabilitation for the Gas and Water Industries, we anticipate good growth both from existing activities and the added

opportunity to expand the business geographically using our depot network.

Shortly after the year end, Redding Hire was acquired for �2.9 million. Operating from Wellingborough, this shoring rental business

gives the division improved distribution into East Anglia and Cambridgeshire.

The division has grown both organically and by acquisition and in doing so has widened its scope of activity. Each of the business

elements holds further aspirations to expand, both geographically and in products and services. We believe the prospects for Groundforce's

core markets remain positive.

UK FORKS

Rough terrain material handling equipment for industry, residential and general construction.

Revenue �16.1 million (2007: �13.9 million)

Operating Profit before amortisation �3.2 million (2007: �1.4 million)

Investment in Rental Fleet �7.8 million (2007: �3.4 million)

UK Forks delivered an excellent result reporting operating profits of �3.2 million, more than double that of the previous year.

Revenues, which increased by 16% to �16.1 million, were underpinned by a number of successes within general construction. Some progress

was also achieved in the housebuild sector although this was delivered predominantly in the first half of the year when market conditions

were more favourable. Growing markets other than housebuild has been a strategic objective for a number of years, and by the year end

revenues derived from domestic housing development had reduced to 50%, the lowest since the division was established in 2000.

Significant investment was made in the fleet, primarily replacement, but with some selective growth. In total 400 machines were acquired

with the hire fleet growing by over 10% to 1,350 telehandlers. This programme enabled us to improve product mix in response to the changing

needs of the market and meant that disposal activity was also high. However residual values were robust, partly influenced by extended

manufacturer lead times for new products last year.

We provide many of our customers with a wide range of key performance indicators allowing them to compare performance levels both to

their expectations and to our peers. With market conditions keener than ever, this has become an important differentiator for UK Forks.

Whilst prospectively we expect that elements of the market will be more challenging, with the business fundamentals unchanged and a

reduced dependency on the housebuild sector, we remain confident that the UK Forks business model will provide opportunity and resilience in

the year ahead.

AIRPAC BUKOM OILFIELD SERVICES

Equipment and service providers to the international oil and gas markets.

Revenue �13.1 million (2007: �10.0 million)

Operating Profit before amortisation �3.3 million (2007: �2.4 million)

Investment in Rental Fleet �9.8 million (2007: �2.5 million)

Our oilfield services division progressed well against the backdrop of a buoyant oil & gas sector with a consequent high demand for its

range of services. Airpac Bukom posted a 38% increase in profits to �3.3 million on revenues up 31% at �13.1 million.

The sustained period of double digit investment by oil and gas companies worldwide continued in 2007, driven by further strong rises in

oil and gas demand and the confidence provided by high oil prices.

The major capital investment programme initiated by the business in 2006 to expand the range and depth of its equipment offering

continued in the year under review. This programme delivered substantial growth in core products such as air compressors and steam

generators and a doubling of holdings of complementary specialist equipment such as sand filters and heat exchangers. In addition, new

products are being added in anticipation of growing opportunities in deep water operations.

During the year the business expanded its servicing and distribution network with the opening of new satellite facilities in Western

Australia, the Middle East and South America.

These facilities will absorb much of the recent, new capital investment and provide a unique network to provide more immediate support

to our global customers throughout the forty or more countries in which we operate.

Our primary market, serving the well testing sector, has again seen good activity in diverse international markets. The repair and

maintenance market has also been strong including some projects centred on modification of the existing North Sea platform infrastructure to

facilitate field life extension.

Our high pressure markets also contributed significantly in the period, with equipment and operational personnel being utilised on

various pipeline dewatering projects internationally. Our equipment has been employed in the testing of process pipe-work systems on major

liquefied natural gas (LNG) plant construction projects and we continue to identify fresh applications for our products in both upstream and

downstream oil and gas segments.

The robustness in the oil price, the growth in energy demand and the confidence of our customers for a prolonged up cycle give a

positive outlook for the oilfield services sector and Airpac Bukom is well placed to contribute and benefit.

TORRENT TRACKSIDE

Railway infrastructure equipment and services.

Revenue �14.0 million (2007: �13.1 million)

Operating Profit before amortisation �0.9 million (2007: �2.0 million)

Investment in Rental Fleet �1.8 million (2007: �3.2 million)

As anticipated the rail market was slow during the year and as a result Torrent's profitability fell to �0.9 million on revenues

marginally ahead at �14.0 million.

Two particular market factors were significant to Torrent in the year. During 2007 Network Rail reduced their major renewals and

projects contractors from six to four, and this process resulted in a significant interruption to contract releases. Additionally the

placing of the Metronet consortium into receivership in July 2007 partially halted the flow of work from the London Underground for a

considerable part of the year. This has been a very challenging year for all rail industry suppliers and we believe Torrent has performed

commendably in these difficult trading conditions.

In October 2007, Torrent purchased the rail portable plant assets of First Engineering in conjunction with a three year preferred

supplier agreement which will be of particular benefit to our activities in Scotland and North West England.

Despite the quieter market, Torrent has retained its market leading position and remains well placed to benefit from improved market

stability in the year ahead.

TPA

Portable roadway systems, bridging, fencing and barriers.

Revenue �14.0 million (2007: �11.4 million)

Operating Profit before amortisation �1.2 million (2007: �1.0 million)

Investment in Rental Fleet �3.5 million (2007: �4.7 million)

The TPA division delivered a 20% increase in operating profits to �1.2 million on revenues of �14.0 million. After a relatively quiet

first quarter, demand for temporary roadway systems in the summer period was very strong, particularly from the outdoor events market, where

the extreme weather conditions pushed demand even higher. Growth in transmission was below expectations but activity in this market did

increase during the final quarter.

In the period, the barriers business in Croydon was reorganised and rebranded to fall within the TPA Site Services operation which

provides barriers, fencing, portable toilets and traffic management solutions to complement the roadway systems customer base.

Further investment of over �3.5 million was made in hire stocks in the year. In part, this investment supported continued expansion in

Europe via the German subsidiary, TPA GmbH, where both revenues and profits exceeded expectations. TPA has continued to innovate in product

design, and the new MD40 lightweight roll out roadway and fencing system has proved to be a major success and is currently in use at various

sites throughout the UK and Europe.

The markets within which TPA operate remain broadly supportive. The five year programme announced by the National Grid in October 2006

is in its second year and workloads are now beginning to run at expected levels. The outdoor events market in the UK remains buoyant and we

anticipate a further period of strong demand from this sector.

HIRE STATION

Small tools and specialist equipment for industry and construction.

Revenue �57.1 million (2007: �44.9 million)

Operating Profit before amortisation �5.9 million (2007: �3.1 million)

Investment in Rental Fleet �12.0 million (2007: �8.4 million)

Hire Station had an excellent year with all its business units delivering strong growth. Revenues were up 27% and with costs relatively

stable the business generated operating profits of �5.9m, nearly double those in 2007. Return on capital employed now exceeds 15% and net

trading margins improved further to over 10%, an increase of nearly 50% on prior year.

Over two thirds of the revenue growth was delivered organically, with the balance coming from the acquisitions of ET Hire, Able Safety,

Northern Site Supplies (NSS) and a full year contribution from Cool Customers. Markets have been supportive during the year and we were also

actively involved in satisfying the requirements of the remediation companies during the summer floods.

The tools business made further solid progress during the year and delivered excellent profit growth. Strong capital investment in our

core hire fleet helped drive revenues forward with stock availability once again being a key differentiator from our many competitors. The

National Call centre in Manchester continued to grow its transaction levels as more customers chose to use this route for order placement.

The call centre also proved crucial to the securing of some long term trading partnerships with customers new to tool hire.

Our depot infrastructure has been further strengthened during the year with the opening of green field sites in Hull, Exeter and

Skipton, together with the three new locations in Scotland from the ET Hire acquisition. In 2008/09, we plan to open a small number of

additional green field locations. The specialist lifting business, Lifting Point delivered good revenue growth and now operates satellites

in all of our tool branches.

Our safety rental business, ESS Safeforce had another excellent year in a broadly supportive market delivering revenues ahead of

expectation and opened four additional training centres in the year. In November 2007, we purchased Able Safety, a long established business

in Yorkshire with a strong local customer base and a thriving confined space training business.

Our penetration of the industrial market place was further boosted in February with the acquisition of NSS, based in Teesside. NSS are

suppliers of specialist explosion proof lighting and site electrics into the petrochem sectors with established relationships at the Wilton

plant in Middlesbrough. We intend to roll out this offering elsewhere in the UK.

MEP added new locations in the year and now trades out of Heathrow, Manchester and Port Laoise in Ireland in addition to their original

site in Glasgow. Investment in additional fleet and resource has enabled this business to deliver excellent revenue and profits growth. The

pipefitting market in the UK and Ireland is experiencing strong growth as customers move away from traditional threading methods, which will

continue to fuel demand for the more modern alternatives that MEP offers.

The Climate Hire & Sales business had an extremely busy year. The Summer weather proved disappointing for the core air conditioning

products but the unprecedented flooding in Yorkshire and the South West created dramatic demand for remediation products. The business

model, based on high stock availability, meant that we were the first port of call in the majority of cases and enjoyed excellent rental and

sales revenues.

Since the year end, Hire Station has completed two further acquisitions: DJ Tool Hire, a long established business based in the North

East adding 3 new locations and in early April, Climate Hire and Sales completed the acquisition of Arcotherm, a sales and rental heating

specialist with locations in Stoke and Oxford. Overall trading has remained positive for Hire Station into the new financial year and the

work load of the customer base remains broadly unchanged.

PROSPECTS

We have over the last seven years established a resilient business model for Vp, which is designed to deliver consistent and progressive

performance across the group as a whole. We believe that the diversity of markets within which we operate should compensate for any

volatility we might experience from a particular sector.

Whilst we continue to be alert to possible changes in market conditions, we remain confident that our growth ambitions for the business

are deliverable and that we will continue to build on the excellent results that we are reporting for the year.

Neil Stothard

Group Managing Director

5 June 2008 Consolidated Income Statement

For the year ended 31 March 2008

Note 2008 2007

(

Restated

�000 )

�000

Revenue 1 149,269 121,607

Cost of sales (104,856) (84,956)

Gross profit 44,413 36,651

Administrative expenses (21,437) (20,459)

Operating profit before amortisation and other 1 23,271 16,276

income

Amortisation (295) (84)

Operating profit before other income 22,976 16,192

Other income - property profit - 257

Operating profit 22,976 16,449

Financial income 88 125

Financial expense (3,207) (2,154)

Profit before amortisation and taxation 20,152 14,504

Amortisation (295) (84)

Profit before taxation 19,857 14,420

Taxation 5 (4,462) (3,981)

Net profit for the year 15,395 10,439

Pence Pence

Basic earnings per share 2 36.09 24.40

Diluted earnings per share 2 34.26 23.24

Dividend per share paid and proposed 6 10.50 8.25

The restatement of prior year figures relates solely to the amortisation of intangibles and associated deferred tax credits following

hindsight adjustments to prior year acquisitions.

Consolidated Statement of Recognised Income and Expense

For the year ended 31 March 2008

Note 2008 2007

(Restated)

�000 �000

Actuarial (losses)/gains on defined benefit (419) 411

pension schemes

Tax on items taken directly to equity 126 (123)

Impact of change in tax rate on items taken (65) -

directly to equity

Effective portion of changes in fair value of

cash flow

hedges (729) 366

Foreign exchange translation difference 238 (1)

Net income recognised direct to equity (849) 653

Profit for the year 15,395 10,439

Total recognised income and expense for the year 3 14,546 11,092

Consolidated Balance Sheet

As at 31 March 2008

Note 2008 2007

(

Restated

)

�000 �000

ASSETS

Non-current assets

Property, plant and equipment 100,901 76,797

Intangible assets 41,220 36,257

Total non-current assets 142,121 113,054

Current assets

Inventories 4,794 4,814

Trade and other receivables 32,779 30,112

Cash and cash equivalents 4 4,987 6,662

Total current assets 42,560 41,588

Total assets 184,681 154,642

LIABILITIES

Current liabilities

Interest bearing loans and borrowings 4 (9,757) (7,535)

Income tax payable (2,560) (1,500)

Trade and other payables (40,632) (31,696)

Total current liabilities (52,949) (40,731)

Non-current liabilities

Interest bearing loans and borrowings 4 (48,679) (35,677)

Employee benefits (1,433) (2,048)

Other payables - (4,240)

Deferred tax liabilities (7,826) (6,396)

Total non-current liabilities (57,938) (48,361)

Total liabilities (110,887) (89,092)

Net assets 73,794 65,550

EQUITY

Issued share capital 2,309 2,309

Share premium account 16,192 16,192

Hedging reserve (452) 277

Retained earnings 55,718 46,745

Total equity attributable to equity holders of the parent 73,767 65,523

Minority interests 27 27

Total equity 3 73,794 65,550

The restatement of the prior year figures relates solely to the amortisation of intangibles and associated deferred tax credits

following hindsight adjustments to prior year acquisitions. Consolidated Statement of Cash Flows

For the year ended 31 March 2008

Note 2008 2007

(Restated)

�000 �000

Cash flow from operating activities

Profit before taxation 19,857 14,420

Pension fund contributions in excess of service (1,034) (435)

cost

Share based payment charge 1,355 1,000

Depreciation 1 17,810 14,093

Amortisation of intangibles 295 84

Financial expense 3,207 2,154

Financial income (88) (125)

Profit on sale of property, plant and equipment (3,373) (3,307)

Operating cashflow before changes in working 38,029 27,884

capital

Decrease/(increase) in inventories 467 (1,458)

Increase in trade and other receivables (1,957) (1,131)

Increase in trade and other payables 5,498 4,599

Cash generated from operations 42,037 29,894

Interest paid (3,031) (1,930)

Interest element of finance lease rental (158) (155)

payments

Interest received 88 125

Income tax paid (3,611) (2,890)

Net cash flow from operating activities 35,325 25,044

Cash flow from investing activities

Disposal of property, plant and equipment 10,284 8,966

Purchase of property, plant and equipment (45,470) (26,746)

Acquisition of businesses (net of cash and (9,556) (4,375)

overdrafts)

Net cash flow from investing activities (44,742) (22,155)

Cash flow from financing activities

Purchase of own shares by Employee Trust (3,489) (3,671)

Repayment of borrowings - (156)

Repayment of loan notes (70) (941)

Proceeds from new loans 16,000 7,000

Proceeds from new finance lease 29 -

Capital element of hire purchase/finance lease (1,205) (1,105)

agreements

Dividends paid (3,761) (2,932)

Net cash flow from financing activities 7,504 (1,805)

(Decrease)/increase in cash and cash (1,913) 1,084

equivalents

Effect of exchange rate fluctuations on cash 238 -

held

Cash and cash equivalents at the beginning of 6,662 5,578

the year

Cash and cash equivalents at the end of the 4,987 6,662

year

NOTES

The final results have been prepared on the basis of the accounting policies which are to be set out in Vp plc's annual report and

accounts for the year ended 31 March 2008.

EU Law (IAS Regulation EC1606/2002) requires that the consolidated accounts of the group for the year ended 31 March 2008 be prepared in

accordance with International Financial Reporting Standards ("IFRSs") as adopted for use in the EU ('adopted IFRSs').

The financial information set out above does not constitute the Company's statutory accounts for the years ended 31 March 2008 or 2007.

The statutory accounts for 2007 have been delivered to the Registrar of Companies and those for 2008 will be delivered following the

Company's Annual General Meeting. The auditors have reported on these accounts; their reports were unqualified and did not contain a

statement under section 237 (2) or (3) of the Companies Act 1985.

The financial statements were approved by the board of directors on 4 June 2008.

1. Business Segments

Revenue Depreciation Operating profit

before

amortisation

and other income

2008 2007 2008 2007 2008 2007

(Restated) (Restated)

�000 �000 �000 �000 �000 �000

Groundforce 35,035 28,119 3,076 2,485 8,740 6,409

UK Forks 16,066 13,933 2,601 2,347 3,186 1,407

Airpac Bukom 13,112 10,033 1,879 1,324 3,335 2,360

Hire Station 57,055 44,931 6,439 4,584 5,914 3,121

Torrent Trackside 14,010 13,149 2,017 1,686 886 1,954

TPA 13,991 11,442 1,481 1,272 1,210 1,025

Group - - 317 395 - -

Total 149,269 121,607 17,810 14,093 23,271 16,276

2. Earnings Per Share

Basic earnings per share

The calculation of basic earnings per share of 36.09 pence (2007: 24.40 pence) is based on the profit attributable to equity holders of

the parent of �15,395,000 (2007: �10,439,000) and a weighted average number of ordinary shares outstanding during the year ended 31 March

2008 of 42,658,000 (2007: 42,780,000), calculated as follows:

2008 2007

Shares Shares

000's 000's

Issued ordinary shares 46,185 46,185

Effect of own shares held (3,527) (3,405)

Weighted average number of ordinary shares 42,658 42,780

Basic earnings per share before the amortisation of intangibles was 36.64 pence (2007: 24.56 pence) and is based on an after tax add

back of �234,000 (2007: �67,000) in respect of the amortisation of intangibles.

Diluted earnings per share

The calculation of diluted earnings per share of 34.26 pence (2007: 23.24 pence) is based on profit attributable to equity holders of

the parent of �15,395,000 (2007: �10,439,000) and a weighted average number of ordinary shares outstanding during the year ended 31 March

2008 of 44,939,000 (2007: 44,913,000), calculated as follows:

2008 2007

Shares Shares

000's 000's

Weighted average number of ordinary shares 42,658 42,780

Effect of share options in issue 2,281 2,133

Weighted average number of ordinary shares (diluted) 44,939 44,913

There are additional options which are not currently dilutive, but may become dilutive in the future. Diluted earnings per share before

the amortisation of intangibles was 34.78 pence (2007: 23.39 pence).

3. Consolidated Statement of Changes in Equity

2008 2007

(

Restate

d)

�000 �000

Total recognised income and expense for the year 14,546 11,092

Dividends paid (3,761) (2,932)

Net movement in shares held by Vp Employee Trust at cost (3,489) (3,671)

Share option charge in the year 1,355 1,000

Gains/(losses) on disposal of shares 64 (240)

Tax movements on equity (451) (22)

Effect of tax rate change (20) -

Change in Equity 8,244 5,227

Equity at start of year 65,550 60,323

Equity at end of year 73,794 65,550

4. Analysis of Debt

At At

31 1 April

March 2007

2008 �000

�000

Cash and cash equivalents (4,987) (6,662)

Current debt 9,757 7,535

Non current debt 48,679 35,677

Net debt 53,449 36,550

Year end gearing (calculated as net debt expressed as a percentage of shareholders' funds) stands at 72% (2007: 56%). Excluding

investment in own shares of �10.6 million (2007: �7.1 million), underlying gearing for business activities was 51% (2007: 41%).

5. Taxation

The charge for taxation for the year represents an effective tax rate of 22.5% (2007: 27.6%). The effective tax rate excluding

adjustments in respect of prior years is 27.4% (2007: 29.4%).

6. Dividend

The Board has proposed a final dividend of 7.70 pence per share to be paid on 1 October 2008 to shareholders on the register at 5

September 2008. This, together with the interim dividend of 2.80 pence per share paid on 4 January 2008 makes a total dividend for the year

of 10.50 pence per share (2007: 8.25 pence per share).

7. Annual Report and Accounts

The Annual Report and Accounts for the year ended 31 March 2008 will be posted to shareholders on or about 25 July 2008.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR EAKKLEEAPEFE

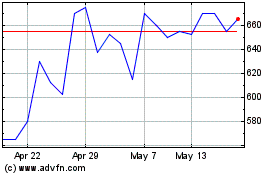

Vp (LSE:VP.)

Historical Stock Chart

From Jul 2024 to Aug 2024

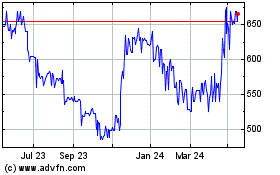

Vp (LSE:VP.)

Historical Stock Chart

From Aug 2023 to Aug 2024