TUI AG (TUI)

TUI AG: Quarterly Statement 1 October 2020 - 31 December 2020

09-Feb-2021 / 08:00 CET/CEST

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

=----------------------------------------------------------------------------------------------------------------------

Quarterly Statement 1 October 2020 - 31 December 2020

? Completion of third support package for EUR1.8bn including fully subscribed rights issue

? Liquidity bridged to Summer 2021 travel recovery

? Q1 result reflects minimal operations due to extended travel restrictions

? Proven delivery of safe holidays - 2.5m customers since restart, 7-day incidence rate1 averages 0.54 per 100k

guests

? 2.8m customers booked for Summer 2021 season - 80% capacity maintained

? Early redemption of EUR300m Senior Notes (due Oct 2021) announced post balance sheet date on 15 January 2021,

ensuring extension of major debt maturity to July 2022

1 Incidence rate calculated as cases / guests x 100,000 / number of calendar days x 7

TUI Group - financial highlights

EUR million Q1 2021 Q1 2020 adjusted Var. % Var. % at constant currency

Revenue 468.1 3,850.8 - 87.8 - 87.6

Underlying EBIT1

Hotels & Resorts - 95.6 35.3 n. a. n. a.

Cruises - 98.4 48.8 n. a. n. a.

TUI Musement - 32.6 - 8.9 - 267.0 - 274.2

Holiday Experiences - 226.6 75.2 n. a. n. a.

Northern Region - 224.7 - 105.8 - 112.5 - 119.8

Central Region - 145.8 - 28.9 - 403.8 - 404.5

Western Region - 75.4 - 63.2 - 19.2 - 18.0

Markets & Airlines - 445.9 - 197.9 - 125.3 - 128.9

All other segments - 26.0 - 24.0 - 8.3 - 9.2

Underlying EBIT - 698.6 - 146.7 - 376.1 - 383.4

EBIT1 - 720.9 - 77.9 - 825.8

Underlying EBITDA - 480.4 111.5 n. a.

EBITDA2 - 497.6 189.8 n. a.

Group loss - 813.1 - 105.4 - 671.6

Earnings per share EUR - 1.36 - 0.22 - 518.2

Net capex and investment - 47.1 60.7 n. a.

Equity ratio (31 Dec)3 % - 5.0 21.7 - 26.7

Net financial position (31 Dec) - 7,177.0 - 5,072.2 - 41.5

Employees (31 Dec) 37,081 56,448 - 34.3

Differences may occur due to rounding.

This Quarterly Statement of the TUI Group was prepared for the

reporting period Q1 FY 2021 from 1 October 2020 to 31 December

2020.

1 We define the EBIT in underlying EBIT as earnings before

interest, income taxes and result of the measurement of the Group's

interest hedges. For further details please see page xx.

2 EBITDA is defined as earnings before interest, income taxes,

goodwill impairment and amortisation and write-downs of other

intangible assets, depreciation and write-downs of property, plant

and equipment, investments and current assets.

3 Equity divided by balance sheet total in %, variance is given

in percentage points.

Q1 Summary1 ? Group revenue of EUR479m1, down 88 % as a result

of extended travel restrictions across our key European markets

during November and December 2020. ? Within Hotels &

Resorts, 116 hotels were open at end of the quarter (versus 229

open hotels in Q1 FY 2020)

reflecting the usual winter seasonality and limited operations

from travel restrictions. We saw good operational

performance in both Greece and the Caribbean, but operations

were limited in our other winter destinations such as

Canaries and Maldives. ? TUI Cruises and Hapag-Lloyd Cruises

operated five ships, offering itineraries to the Baltic Sea and

Canary Islands,

with TUI Cruises the only European cruise operator to

continuously sail throughout the Winter. ? Group underlying EBIT

loss of EUR709m1 reflects our strong cost discipline and

contribution from operational

opportunities, helping to reduce average monthly underlying EBIT

loss to EUR230m per month. ? Completion of third support package

for EUR1.8bn including EUR500m fully subscribed rights issue. ? Pro

forma cash and available facilities of EUR2.1bn as at 3 February

2021, liquidity bridged to Summer 2021 travel

recovery. ? 2.8m customers booked for Summer 2021 season -

capacity plans maintained at 80% (of Summer 2019), with scope

to

flex as demand evolves. ? Global Realignment Programme on track

to target cost savings of EUR400m p.a by FY 2023. ? Early

redemption of EUR300m Senior Notes (due Oct 2021) announced post

balance sheet date on 15 January 2021,

ensuring extension of major debt maturity to July 2022.

1 Comments based on key figures at constant currency

Completion of Third Support Package

Our third support package as announced on 2 December 2020

amounting to EUR1.8bn, agreed with our shareholders, a syndicate of

underwriting banks, KfW and the German Economic Support Fund

(Wirtschaftsstabilisierungsfonds - WSF) was successfully concluded

in the period, consisting of the following components: ? a capital

increase with subscription rights in excess of EUR500m; ? a silent

participation, convertible into shares by the WSF of EUR420m; ? a

non-convertible silent participation by the WSF of EUR671m; ? an

additional credit facility by KfW of EUR200m

Liquidity

Pro forma cash and available facilities as at 3 February 2021,

including third support package, would amount to EUR2.1bn (post

EUR300m senior notes redemption).

Our assumption for Q2 FY 2021, is for working capital

development to correlate with vaccine programme rollout and lifting

of travel restrictions, with significant upside anticipated should

travel restrictions be lifted ahead of Easter (early April 2020).

We anticipate net cash fixed costs outflow to be in the range of

EUR250m to EUR300m per month.

For Q3 FY 2021, we assume significant positive working capital

inflow and net costs moving towards cash break-even as both

operations and bookings begin to normalise.

Trading update ? Winter 2020/21 bookings2 down 89% as a result

of extended travel restrictions across our key European markets

during November and December 2020. ? Summer 2021 bookings2

including amendments and voucher rebookings, down 44% versus Summer

2019 (undistorted by

COVID-19) ? 2.8m customers are currently booked for our Summer

2021 programme, and we continue to plan to operate 80% capacity

(of Summer 2019) for Summer 2021 ? Summer 2021 ASP2 is up 20%,

driven by both pricing and mix, with a higher level of packaged

holidays booked versus

prior year ? TUI shares the industry expectation of delayed

bookings whilst vaccine programmes are underway, the rollout of

which will support the lifting of extensive travel restrictions

? Average daily bookings in January are up 70% compared to

December, with an expectation of peak booking period

still to come

2 Bookings up to 31 January 2021 compared to 2019 programmes

(undistorted by COVID-19) and relate to all customers whether risk

or non-risk

Integrated model provides capacity flexibility and a safe &

enjoyable customer experience

TUI's integrated business model continues to be considered a

success factor for the long term and remains a core element of our

strategy. It enables us to: ? Flexibly adapt our programme as we

gain more visibility; ? Maximise asset utilisation and yield in our

airlines, hotels and cruise ships; ? Ensure our customers have a

safe and enjoyable holiday.

Our focus on the end-to-end delivery of safe holidays already

resulted in the successful partial recommencement of operations

during Summer 2020. Destinations have recognised this strength of

TUI's, as the governments of Greece and the Balearics selected TUI

to implement pilot programmes in Summer 2020 aimed at restarting

tourism in their regions.

Our strong customer base and scale gives us an advantage in

terms of brand awareness and distribution, securing attractive

terms from suppliers, and in gaining greater insight into customer

behaviour. In addition, selling into a range of source markets

helps to diversify our customer base, meaning we are not reliant on

a single market.

Flying capacity

The combination of in-house and committed and variable

third-party flying capacity provides agility in destination

planning and marketing, enabling us to swiftly and flexibly respond

to changing travel restrictions and customer demand, whilst

guaranteeing the delivery of our core programme. We expect third

party flying to be widely available, enabling us to meet excess

demand. Additionally, aircraft lease expiries in excess of incoming

deliveries, negotiated as part of our Boeing compensation

agreement, allow for a temporary reduction in our fleet, should

recovery be slower than expected. We can also extend our current

lease expiries with our various lessor partners and increase our

flying capacity beyond the 80% currently planned for Summer

2021.

Hotel capacity

One of the key advantages of our integration is the ability to

leverage our Markets & Airline distribution power by funnelling

customers (FY 2019: 21m) to own and 3rd party committed capacity,

allowing us to better optimise capacity utilisation and yield for

our Group hotels and hotel partners.

Another key advantage is our diversified portfolio, with hotels

across the Western and Eastern Mediterranean, the Caribbean, North

Africa & Asia. This diversification helps to mitigate the risks

associated with single destinations. In addition, our integration

means we are able to coordinate and restart operations sooner than

competitors who rely on third parties across the supply chain.

Finally, our significant control of our core brands and influence

over exclusive hotel concepts and global partner hotels means we

have been able to ensure the implementation of strict COVID-19

health & safety protocols, reinforcing the recognition of the

TUI brand for safety and service quality.

Cruise capacity

TUI Cruises was the only European cruise operator sailing

throughout the Winter. Our own capacity has also enabled us to

control and swiftly implement rigorous COVID-19 preventative

protocols, in addition to the already comprehensive hygiene

measures on board.

Our unique integrated model enables a high level of direct

distribution, enhancing occupancy and yield. We also expect to

benefit from the reduction in global supply.

Boeing 737 max update

The recertification of the Boeing 737 Max was approved by EASA

and the UK CAA on 27 January 2021, allowing for the resumption of

commercial operations. Final stages of implementing regulators'

updates and improvements, as well as pilot retraining are in

progress.

Global Realignment Programme

The main projects of our global realignment programme are on

track to achieve our targeted savings of EUR400m per annum by FY

2023. The programme, as one of our self-help measures to address

group-wide costs, targets to permanently reduce our annual cost

base by 30% with full benefits to be achieved by FY 2023. Projects

announced and underway across core functions, Markets &

Airlines and TUI Musement (formerly Destination Experiences) are on

track. Of the 8,000 roles potentially impacted as part of the

programme, we have to date reduced 5,000 FTEs.

FY 2021 Expected development

In light of the ongoing and significant uncertainties relating

to the further development of the pandemic, the measures launched

to curb the virus, in particular to the removal of travel

restrictions, the TUI AG Executive Board refrains from issuing a

guidance for the financial year 2021.

Consolidated earnings

Revenue

EUR million Q1 2021 Q1 2020 Var. %

Hotels & Resorts 56.5 166.2 - 66.0

Cruises 0.6 238.4 - 99.7

TUI Musement 10.5 216.7 - 95.2

Holiday Experiences 67.5 621.4 - 89.1

Northern Region 107.0 1,220.3 - 91.2

Central Region 213.2 1,354.6 - 84.3

Western Region 74.1 594.8 - 87.5

Markets & Airlines 394.3 3,169.8 - 87.6

All other segments 6.3 59.6 - 89.4

TUI Group 468.1 3,850.8 - 87.8

TUI Group (at constant currency) 478.5 3,850.8 - 87.6

Underlying EBIT

EUR million Q1 2021 Q1 2020 Var. %

adjusted

Hotels & Resorts - 95.6 35.3 n. a.

Cruises - 98.4 48.8 n. a.

TUI Musement - 32.6 - 8.9 - 266.3

Holiday Experiences - 226.6 75.2 n. a.

Northern Region - 224.7 - 105.8 - 112.4

Central Region - 145.8 - 28.9 - 404.5

Western Region - 75.4 - 63.2 - 19.3

Markets & Airlines - 445.9 - 197.9 - 125.3

All other segments - 26.0 - 24.0 - 8.3

TUI Group - 698.6 - 146.7 - 376.2

EBIT

EUR million Q1 2021 Q1 2020 Var. %

adjusted

Hotels & Resorts - 95.7 35.3 n. a.

Cruises - 98.4 48.8 n. a.

TUI Musement - 34.3 - 13.6 - 152.2

Holiday Experiences - 228.4 70.5 n. a.

Northern Region - 228.7 - 109.9 - 108.1

Central Region - 156.3 54.4 n. a.

Western Region - 78.4 - 66.4 - 18.1

Markets & Airlines - 463.4 - 121.8 - 280.5

All other segments - 29.1 - 26.5 - 9.8

TUI Group - 720.9 - 77.9 - 825.4

Segmental performance*

Holiday Experiences

EUR million Q1 2021 Q1 2020 Var. %

adjusted

Revenue 67.5 621.4 - 89.1

Underlying EBIT - 226.6 75.2 n. a.

Underlying EBIT at constant currency - 230.1 75.2 n. a.

Hotels & Resorts

EUR million Q1 2021 Q1 2020 Var. %

Total revenue 93.6 328.6 - 71.5

Revenue 56.5 166.2 - 66.0

Underlying EBIT - 95.6 35.3 n. a.

Underlying EBIT at constant currency - 96.9 35.3 n. a.

Capacity hotels total1 ('000) 5,176 9,526 - 45.7

Riu 2,496 4,390 - 43.1

Robinson 364 741 - 50.9

Blue Diamond 873 1,150 - 24.1

Occupancy rate hotels total2 43 77 - 34

(in %, variance in % points)

Riu 46 83 - 37

Robinson 48 72 - 24

Blue Diamond 42 76 - 34

Average revenue per bed hotels total3 60 68 - 11.5

(in EUR)

Riu 53 66 - 20.5

Robinson 89 93 - 3.6

Blue Diamond 91 112 - 18.7

Revenue includes fully consolidated companies, all other KPIs incl. companies measured at equity.

1 Group owned or leased hotel beds multiplied by opening days per quarter

2 Occupied beds divided by capacity

3 Arrangement revenue divided by occupied beds

116 hotels were open as at the end of the quarter (33% of Group

hotel portfolio), reflecting both the winter seasonality and travel

restrictions currently in place. (Q1 FY 2020: 229 hotels open).

Demonstrating the benefit of our integration and diversified

destinations, our Greek and Turkish hotels remained open into

October, helping to drive further revenue and contribution

opportunities beyond the normal Markets & Airlines Summer

programme timing. The most popular destinations for our Winter

programme were the Caribbean, the Canaries, Eastern Mediterranean,

Maldives, Zanzibar and North Africa.

Occupancy rate declined 34%pts to 43% across our operating

portfolio, reflecting the impact of travel restrictions from

November onwards. Average daily rate declined by 12% to EUR60.

Our Greek hotels, which ran an extended programme into October,

delivered occupancy rates of 67%. Our Caribbean hotels saw

occupancy rates of 57%, largely driven by an increase in our

third-party distribution as well as reduced travel restrictions

from our North American markets.

Underlying EBIT loss of EUR97m*, down EUR132m versus prior year

reflects the limited capacity operated over the period as a result

of travel restrictions, partially offset by cost saving

actions.

* commentary based on underlying EBIT at constant currency

Cruises

EUR million Q1 2021 Q1 2020 Var. %

adjusted

Revenue1 0.6 238.4 - 99.7

Underlying EBIT - 98.4 48.8 n. a.

Underlying EBIT at constant currency - 99.8 48.8 n. a.

Occupancy (in %, variance in % points)

TUI Cruises 35 98 - 63

Marella Cruises - 98 n. a.

Hapag-Lloyd Cruises2 37 76 - 39

Passenger days ('000)

TUI Cruises 177 1,598 - 88.9

Marella Cruises - 781 n. a.

Hapag-Lloyd Cruises 13 88 - 85.1

Average daily rates3 (in EUR)

TUI Cruises 118 144 - 17.9

Marella Cruises4 (in GBP) - 143 n. a.

Hapag-Lloyd Cruises2 434 619 - 29.9

1 No revenue is carried for TUI Cruises and Hapag-Lloyd Cruises as the joint venture is consolidated at equity

2 Hapag-Lloyd Cruises prior year KPIs restated to align to TUI Cruises methodology

3 Per day and passenger

4 Inclusive of transfers, flights and hotels due to the integrated nature of Marella Cruises, in GBP

Extended travel restrictions announced from November 2020

through to the end of the quarter by the German government limited

the operations of our two German cruise brands, TUI Cruises and

Hapag-Lloyd Cruises.

TUI Cruises operated three ships (Mein Schiff 1, 2 and 6) in the

quarter, offering short "Blue Cruises" around the Baltic Sea, Greek

and Canary Islands. Average daily rate of the operated fleet was

EUR118, down 18% versus prior year (Q1 FY 2020: EUR144) reflecting

the shorter average duration and more local routes of "Blue

Cruises". Occupancy of our operated fleet was 35%, reflecting a

more subdued environment for departures as a result of travel

restrictions as well as adherence to COVID-19 government safety

advice capping the numbers of passengers on board.

Hapag-Lloyd Cruises operated two ships during the quarter, the

Europa 2 and Hanseatic inspiration, which offered sailings to the

Baltic and Canaries. Average daily rate for the operated fleet was

EUR434, down 30% versus prior year (Q1 FY 2020: EUR619)2,

reflecting pricing of shorter and more local itineraries. Occupancy

of the operated fleet was 37% (Q1 FY 2020: 76%)2.

Marella Cruises (our UK cruise brand) remained suspended

throughout the first quarter, in line with UK government travel

advice.

Underlying EBIT loss of EUR100m*, down EUR149m versus prior

year, reflects the limited capacity operated over the period as a

result of travel restrictions, including a EUR19m impairment charge

relating to Mein Schiff Herz, partially offset by cost saving

measures across all three brands. Prior year includes 100% result

of Hapag-Lloyd Cruises (Q1 FY 2020: underlying EBIT of EUR6m) which

is now consolidated at equity within the TUI Cruises joint

venture.

TUI Musement (formerly Destination Experiences)

EUR million Q1 2021 Q1 2020 Var. %

Total revenue 15.6 305.5 - 94.9

Revenue 10.5 216.7 - 95.2

Underlying EBIT - 32.6 - 8.9 - 266.3

Underlying EBIT at constant currency - 33.3 - 8.9 - 274.2

75k excursions and activities sold, down 95% versus prior year,

reflecting the limited operations during the quarter, driving an

underlying loss of EUR33m*, down EUR24m on prior year.

Online distribution was 47% increasing from 16% in Q1 prior

year, reflecting the successful integration and adoption of our

online TUI Musement app, having launched across all our source

markets.

Markets & Airlines

EUR million Q1 2021 Q1 2020 Var. %

Revenue 394.3 3,169.8 - 87.6

Underlying EBIT - 445.9 - 197.9 - 125.3

Underlying EBIT at constant currency - 452.9 - 197.9 - 128.9

Direct distribution mix1,3 77 72 + 5

(in %, variance in % points)

Online mix2,3 56 48 + 8

(in %, variance in % points)

Customers ('000)3 525 3,776 - 86

1 Share of sales via own channels (retail and online)

2 Share of online sales

As covered above, due to the latest lockdown measures across

many of our key source markets, operations have been highly limited

from November. A total of 525k customers departed in the quarter,

down 86% versus prior year, with around two thirds departing in

October.

Underlying loss of EUR453m* reflects the limited capacity

operated over the period and includes EUR10m net costs from hedging

ineffectiveness. The overall loss has been mitigated by strict cost

discipline across all markets and the year-on-year comparison is

improved by non-recurring Boeing 737 Max costs of EUR45m.

Northern Region

EUR million Q1 2021 Q1 2020 Var. %

Revenue 107.0 1,220.3 - 91.2

Underlying EBIT - 224.7 - 105.8 - 112.4

Underlying EBIT at constant currency - 232.5 - 105.8 - 119.8

Direct distribution mix1 93 91 + 2

(in %, variance in % points)

Online mix2 76 65 + 11

(in %, variance in % points)

Customers ('000) 114 1,269 - 91.0

1 Share of sales via own channels (retail and online)

2 Share of online sales

Underlying loss of EUR232m*, down EUR127m versus prior year.

114k customers departed in the quarter, down 91% versus prior

year.

Central Region

EUR million Q1 2021 Q1 2020 Var. %

Revenue 213.2 1,354.6 - 84.3

Underlying EBIT - 145.8 - 28.9 - 404.5

Underlying EBIT at constant currency - 145.8 - 28.9 - 404.5

Direct distribution mix1,3 64 51 + 13

(in %, variance in % points)

Online mix2,3 37 21 + 16

(in %, variance in % points)

Customers3 ('000) 246 1,423 - 82.7

1 Share of sales via own channels (retail and online)

2 Share of online sales

Underlying loss of EUR146m*, down EUR117m versus prior year.

246k customers departed in the quarter, down 83% versus prior

year.

Western Region

EUR million Q1 2021 Q1 2020 Var. %

adjusted

Revenue 74.1 594.8 - 87.5

Underlying EBIT - 75.4 - 63.2 - 19.3

Underlying EBIT at constant currency - 74.6 - 63.2 - 18.0

Direct distribution mix1 85 77 + 8

(in %, variance in % points)

Online mix2 69 61 + 8

(in %, variance in % points)

Customers ('000) 166 1,084 - 84.7

1 Share of sales via own channels (retail and online)

2 Share of online sales

Underlying loss of EUR75m*, down EUR11m versus prior year. 166k

customers departed in the quarter, down 85% versus prior year.

All other segments

EUR million Q1 2021 Q1 2020 Var. %

Revenue 6.3 59.6 - 89.4

Underlying EBIT - 26.0 - 24.0 - 8.3

Underlying EBIT at constant currency) - 26.2 - 24.0 - 9.2

Underlying EBIT loss was EUR26m*, broadly in line with prior

year.

Cash Flow / Net capex and investments / Net debt

The TUI Group's operating cash flow was also impacted by the

travel restrictions imposed by COVID-19 in March 2020.

Due to the lower business volume in the 2020 Summer season, the

cash outflow for supplier payments in Q1 FY 2021 was significantly

below prior-year. At EUR736.5m, the cash outflow from operating

activities decreased by EUR644.6m year-on-year.

The net debt as of 31 December 2020 increased by EUR2,104.8m to

EUR7,177.0m.

Net debt

31 Dec 2020 31 Dec 2019 Var. %

Financial debt 5,167.3 2,035.7 + 153.8

Finance lease liabilities 3,275.1 3,917.5 - 16.4

Cash and cash equivalents 1,250.5 866.1 + 44.4

Short-term interest-bearing investments 14.8 14.9 - 0.7

Net debt -7,177.0 -5,072.2 - 41.5

Net capex and investments

EUR million Q1 2021 Q1 2020 Var. %

Cash gross capex

Hotels & Resorts 33.7 72.7 - 53.6

Cruises 7.9 39.3 - 79.9

TUI Musement 2.8 3.5 - 20.0

Holiday Experiences 44.4 115.4 - 61.5

Northern Region 5.9 15.7 - 62.4

Central Region 0.9 6.4 - 85.9

Western Region 2.0 8.0 - 75.0

Markets & Airlines* 12.0 31.5 - 61.9

All other segments 12.9 17.7 - 27.1

TUI Group 69.3 164.6 - 57.9

Net pre delivery payments on aircraft 0.3 - 60.0 n. a.

Financial investments 0.5 10.0 - 95.0

Divestments - 117.2 - 53.8 - 117.8

Net capex and investments - 47.1 60.7 n. a.

* Including EUR3.2m for Q1 2021 (previous year EUR1.4m) cash

gross capex of the aircraft leasing companies, which are allocated

to Markets & Airlines as a whole, but not to the individual

segments Northern Region, Central Region and Western Region.

Cash gross capex in Q1 FY 2021 was 57.9 % lower year-on-year,

reflecting our disciplined capex management. Net capex and

investments declined by EUR107.8m. The divestments related mainly

to the sale of Hapag-Lloyd Kreuzfahrten to our joint venture TUI

Cruises and the sale and lease back of spares and aircraft.

Previous year's divestments included the sale of two German

specialist tour operators.

Income statement

Income statement of TUI Group for the period from 1 Oct 2020 to 31 Dec 2020

EUR million Q1 2021 Q1 2020 Var. %

adjusted

Revenue 468.1 3,850.8 - 87.8

Cost of sales 902.9 3,771.0 - 76.1

Gross loss / profit - 434.8 79.8 n. a.

Administrative expenses 193.1 282.5 - 31.6

Other income 5.8 93.5 - 93.8

Other expenses 6.0 5.3 +13.2

Impairment of financial assets - 9.6 4.4 n. a.

Financial income 36.1 19.9 +81.4

Financial expenses 143.5 69.8 +105.6

Share of result of joint ventures and associates - 103.9 38.7 n. a.

Earnings before income taxes - 829.7 - 130.1 - 537.7

Income taxes (expense (+), income (-)) - 16.6 - 24.7 +32.8

Group loss - 813.1 - 105.4 - 671.4

Group loss attributable to shareholders of TUI AG - 802.9 - 128.6 - 524.3

Group loss / profit attributable to non-controlling interest - 10.1 23.2 n. a.

Consolidated turnover in Q1 FY 2021 declined by 87.8 %

year-on-year to EUR0.5bn. On a constant currency basis, turnover

fell by 87.6 % year-on-year. This decline reflects the suspension

of our tour operator, airline, hotel and cruise business due to the

worldwide travel restrictions imposed to stem the spread of

COVID-19 from mid-March 2020 onwards.

Cash flow statement

Condensed cash flow statement of TUI Group for the period 1 Oct 2020 to 31 Dec 2020

EUR million Q1 2021 Q1 2020

Cash outflow from operating activities - 736.5 - 1,381.1

Cash outflow / cash inflow from investing activities 48.0 - 41.9

Cash inflow from financing activities 715.5 492.4

Net change in cash and cash equivalents 27.1 - 930.7

Change in cash and cash equivalents due to exchange rate fluctuation - 9.6 51.7

Cash and cash equivalents at beginning of period 1,233.1 1,747.6

Cash and cash equivalents at end of period 1,250.5 868.7

of which included in the balance sheet as assets held for sale - 2.6

Statement of financial position

Statement of financial position of TUI Group as at 31 Dec 2020

EUR million 31 Dec 2020 30 Sep 2020

Assets

Goodwill 2,934.7 2,914.5

Other intangible assets 540.8 553.5

Property, plant and equipment 3,375.3 3,462.5

Right-of-use assets 3,130.8 3,227.9

Investments in joint ventures and associates 1,056.9 1,186.7

Trade and other receivables 231.9 402.4

Derivative financial instruments 6.0 7.4

Other financial assets 10.2 10.6

Touristic payments on account 154.6 149.9

Other non-financial assets 383.2 423.2

Income tax assets 9.6 9.6

Deferred tax assets 250.0 299.6

Non-current assets 12,084.1 12,647.8

Inventories 68.4 73.2

Trade and other receivables 375.9 486.3

Derivative financial instruments 40.2 88.9

Other financial assets 14.8 14.9

Touristic payments on account 489.6 555.5

Other non-financial assets 110.9 113.4

Income tax assets 72.3 70.9

Cash and cash equivalents 1,250.5 1,233.1

Assets held for sale 12.8 57.2

Current assets 2,435.4 2,693.4

Total assets 14,519.6 15,341.1

Statement of financial position of TUI Group as at 31 Dec 2020

EUR million 31 Dec 2020 30 Sep 2020

Equity and liabilities

Subscribed capital 1,509.4 1,509.4

Capital reserves 4,245.6 4,211.0

Revenue reserves - 7,146.7 - 6,168.8

Equity before non-controlling interest - 1,391.8 - 448.4

Non-controlling interest 662.7 666.5

Equity - 729.0 218.1

Pension provisions and similar obligations 1,133.7 983.6

Other provisions 841.2 912.1

Non-current provisions 1,974.9 1,895.7

Financial liabilities 4,254.8 3,691.7

Lease liabilities 2,569.6 2,712.6

Derivative financial instruments 40.8 44.0

Other financial liabilities 5.5 7.2

Other non-financial liabilities 198.2 198.4

Income tax liabilities 80.4 61.3

Deferred tax liabilities 70.3 192.7

Non-current liabilities 7,219.7 6,908.1

Non-current provisions and liabilities 9,194.5 8,803.7

Pension provisions and similar obligations 30.8 31.4

Other provisions 395.8 390.3

Current provisions 426.6 421.6

Financial liabilities 912.5 577.3

Lease liabilities 705.4 687.3

Trade payables 1,347.1 1,611.5

Derivative financial instruments 210.4 274.8

Other financial liabilities 305.2 422.0

Touristic advance payments received 1,669.1 1,770.1

Other non-financial liabilities 409.9 447.8

Income tax liabilities 67.8 82.4

Current liabilities 5,627.4 5,873.2

Liabilities related to assets held for sale - 24.5

Current provisions and liabilities 6,054.1 6,319.3

Total equity, liabilities and provisions 14,519.6 15,341.1

Alternative performance measures

From FY 2020, we use underlying EBIT for our management system.

We define the EBIT in underlying EBIT as earnings before interest,

taxes and result of the measurement of the Group's interest

hedges.

One-off items carried here include adjustments for income and

expense items that reflect amounts and frequencies of occurrence

rendering an evaluation of the operating profitability of the

segments and the Group more difficult or causing distortions. These

items include gains on disposal of financial investments,

significant gains and losses from the sale of assets as well as

significant restructuring and integration expenses. Any effects

from purchase price allocations, ancillary acquisition costs and

conditional purchase price payments are adjusted. Also, any

goodwill impairments would be adjusted in the reconciliation to

underlying EBIT.

Reconciliation to underlying EBIT

Q1 2021 Q1 2020 Var. %

EUR million adjusted

Earnings before income taxes - 829.7 - 130.1 - 537.7

pluss: Net interest expense (excluding expense / income from measurement of interest 102.2 52.0 96.5

hedges)

plus: Expense (income) from measurement of interest hedges 6.6 0.1 n. a.

EBIT - 720.9 - 77.9 - 825.4

Adjustments:

plus / less: Separately disclosed items 14.2 - 79.4 n. a.

plus: Expense from purchase price allocation 8.1 10.5 - 22.9

Underlying EBIT - 698.6 - 146.7 - 376.2

In Q1 FY 2021, separately disclosed items mainly relate to

restructuring expenses in the Central and Eastern Europe region and

a disposal loss from the sale of Corsair.

In the previous year's period, separately disclosed items

included a gain of disposal of EUR91.4m of the German specialist

tour operators partly offset by restructuring costs in TUI

Musement, Central Region and Western Region.

The TUI Group's operating loss adjusted for special items

increased by EUR551.9m to EUR698.6m in the first quarter FY

2021.

Key figures of income statement

Q1 2021 Q1 2020 Var. %

adjusted

EBITDAR - 495.2 210.6 n. a.

Operating rental expenses - 2.4 - 20.8 + 88.5

EBITDA - 497.6 189.8 n. a.

Depreciation/amortisation less reversals of depreciation* - 223.3 - 267.7 + 16.6

EBIT - 720.9 - 77.9 - 825.4

Expense from the meaurement of interest hedges 6.6 0.1 n. a.

Net interest expense 102.2 52.0 + 96.5

EBT - 829.7 - 130.1 - 537.7

* on property, plant and equipment, intangible assets, financial and other assets

Other segment indicators

Underlying EBITDA

EUR million Q1 2021 Q1 2020 Var. %

Hotels & Resorts - 41.5 83.8 n. a.

Cruises - 83.6 79.0 n. a.

TUI Musement - 26.8 - 2.7 - 892.6

Holiday Experiences - 152.0 160.1 n. a.

Northern Region - 148.2 - 25.6 - 478.9

Central Region - 116.2 6.7 n. a.

Western Region - 39.3 - 17.5 - 124.6

Markets & Airlines - 303.8 - 36.4 - 734.6

All other segments - 24.7 - 12.2 - 102.5

TUI Group - 480.4 111.5 n. a.

EBITDA

EUR million Q1 2021 Q1 2020 Var. %

Hotels & Resorts - 41.6 83.8 n. a.

Cruises - 83.7 79.0 n. a.

TUI Musement - 26.5 - 4.5 - 488.9

Holiday Experiences - 151.8 158.2 n. a.

Northern Region - 151.2 - 26.5 - 470.6

Central Region - 126.3 90.8 n. a.

Western Region - 40.6 - 18.1 - 124.3

Markets & Airlines - 318.1 46.2 n. a.

All other segments - 27.8 - 14.6 - 90.4

TUI Group - 497.6 189.8 n. a.

Employees

31 Dec 2020 31 Dec 2019 Var. %

Hotels & Resorts 9,297 19,433 - 52.2

Cruises* 57 344 - 83.4

TUI Musement 3,362 6,733 - 50.1

Holiday Experiences 12,716 26,510 - 52.0

Northern Region 8,877 11,333 - 21.7

Central Region 8,336 10,130 - 17.7

Western Region 4,795 6,053 - 20.8

Markets & Airlines 22,008 27,516 - 20.0

All other segments 2,357 2,422 - 2.7

Total 37,081 56,448 - 34.3

* Excludes TUI Cruises (JV) employees. Cruises employees are primarily hired by external crew management agencies.

Analyst and investor enquiries

Mathias Kiep

Group Director Controlling, Corporate Finance & Investor

Relations

Tel.: + 44 1293 645 925 /

+ 49 511 566-1425

Nicola Gehrt

Director, Head of Group Investor Relations

Tel.: + 49 511 566-1435

Contacts for analysts and investor in UK, Ireland and

Americas

Hazel Chung

Senior Investor Relations Manager

Tel.: +44 (0)1293 645 823

Contacts for analysts and investor in Continental Europa, Middle

East and Asia

Ina Klose

Senior Investor Relations Manager

Tel.: +49 (0)511 566 1318

Jessica Blinne

Junior Investor Relations Manager

Tel.: +49 (0)511 566 1442

TUI AG

Karl-Wiechert-Allee 4

30625 Hanover, Germany

Tel.: + 49 511 566-00

www.tuigroup.com

This Quarterly Statement, the presentation slides and the video

webcast for Q1 FY 2021 (published on 9 February 2021) are available

at the following link:

www.tuigroup.com/en-en/investors

Financial Calendar

Date

Half-Year Financial Report 2021 12 May 2021

Quarterly Statement Q3 2021 August 2021

Annual Report 2021 December 2021 -----------------------------------------------------------------------------------------------------------------------

ISIN: DE000TUAG000

Category Code: QRF

TIDM: TUI

LEI Code: 529900SL2WSPV293B552

OAM Categories: 3.1. Additional regulated information required to be disclosed under the laws of a Member State

Sequence No.: 93190

EQS News ID: 1166829

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

(END) Dow Jones Newswires

February 09, 2021 02:01 ET (07:01 GMT)

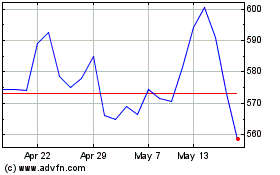

Tui (LSE:TUI)

Historical Stock Chart

From Jun 2024 to Jul 2024

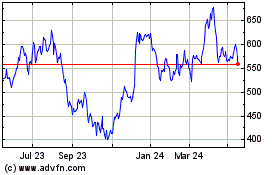

Tui (LSE:TUI)

Historical Stock Chart

From Jul 2023 to Jul 2024