TRIVEST VCT PLC

PRELIMINARY RESULTS FOR THE YEAR ENDED 30 SEPTEMBER 2006

CHAIRMAN'S STATEMENT

I am pleased to present the preliminary results of the Company for the year

ended 30 September 2006.

Despite the slight fall in the net asset value per share during the year,

largely due to a slightly disappointing technology sector, the performance of

the portfolio continues to provide encouragement. This year capital gains have

again been realised which has resulted in the Board proposing to pay to

Shareholders an interim capital distribution of 3.00 pence per share in respect

of the year ending 30 September 2007. The Board expects to be able to pay a

similar capital distribution at the end of the current financial year. Future

capital distributions will depend on a number of factors including the level of

realisations from the portfolio. This capital distribution is in addition to

the proposed final dividend for the year ended 30 September 2006 of 0.75 pence

per share to be paid from income.

Economic background

During the last six months, the FTSE 100 Index rose by 1.63% and the FTSE

All-Share Index rose by 1.74% whilst the FTSE AIM Index fell by 14.9%. During

this same period, the AIM new issue market has been largely dormant with many

IPO prices being substantially lower at the end of the period compared with the

beginning of the year.

On the investment side there is no shortage of equity and debt providers

looking for good propositions, and competition to finance such situations

continues to remain strong. However, the dormancy in the AIM new issue market

has inevitably made divestment for portfolios, such as TriVest, more difficult

at this time. Looking ahead in the short term, it appears that the markets may

have temporarily learned to live with the current global security position, the

prospect of continuing high energy prices and the possibility of a return to

higher inflation and interest rates.

Net asset value

At 30 September, 2006, the Company's Net Asset Value (NAV) per share was 112.89

pence (2005: 122.53 pence as restated). The Company, including the proposed

final income dividend of 0.75 pence per share and the proposed capital

distribution of 3.00 pence per share referred to above, will have distributed

dividends of 12.45 pence per share since the Company's launch. This total

return since launch (including these dividends) of 121.59 pence compares with

the initial NAV (after the launch expenses of the issue) of 94.5 pence per

share.

TriVest's portfolio

At present, Matrix Private Equity Partners LLP (MPEP) manage some 52% of the

portfolio with Foresight Venture Partners (Foresight) managing 41% and Nova

Capital Management Limited (Nova) the balance. By market sector, the portfolio

is dominated by investments in technology companies at 47%, with manufacturing

companies at 24%, media at 12%, construction and building materials at 9% and

the balance in a variety of other sectors. When the portfolio is considered by

stage of development, it comprises 51% invested in MBO / MBI situations, 32% in

AIM quoted stocks, 16% in development capital companies and 1% in early stage

investments.

The last year has been a relatively quiet period for the Foresight portfolio,

probably reflecting the state of activity in the AIM market, although the

underlying investments in the portfolio continue to work hard to create value.

Wire-e (held in the books with a value of �500,000) was sold in May 2006 for �

120,000 cash, together with an equity investment in Rapide Communication (the

new vehicle for the Wire-e business) representing 6.7% of the business and

valued at �80,000 at the time of the sale. In Monactive, Administrators were

appointed on 16 June 2006 and the company's assets were sold to Centennial

Software Limited.

Within the MPEP portfolio, in April 2006 new investments of �361,000 and �

389,000 were made respectively into Blaze Signs, a signwriter, and VSI, a group

of associated businesses that specialises in developing and marketing 3D

software. In June 2006 new investments of �500,000 were made into British

International, a supplier of helicopter services, and �292,000 into PastaKing,

a food and equipment supplier to the food service and educational markets. In

May 2006 a further investment of �126,000 was made into BBI. Importantly, in

September 2006 Secure Mail Services was sold to Candover Partners Limited for

initial proceeds of �4.1 million as part of a deal valuing SMS at �40 million.

This has resulted in an uplift to the Interim valuation of �1.0 million and a

capital gain to the portfolio of �2.9 million. The Hunter Rubber Company, which

had previously been written down to nil, went into Administration on 10 April

2006. There remains some expectation of receiving a small payment from the

Administrators in due course. After the year-end, Brookerpaks has redeemed in

full its unsecured loan of �445,000.

Within the Nova portfolio, NexxtDrive continues to move ahead with the

development of its fuel efficiency products while it waits for an opportune

moment to seek a public listing.

Capital account

The element of return due to capital movements for the year in the Profit and

Loss Account has contributed a loss of �3,115,302 (2005: profit of �16,826,289

as restated). This is attributable to three main factors. First, the portfolios

suffered net unrealised losses in the year of �4,074,141 (2005: profit of �

16,221,200 as restated), due to some substantial declines in the value of

several quoted investments, most notably Sarantel and Oxonica, and several

unquoted investments, particularly Aquasium Technology. It should be noted that

these three had been major contributors to last year's unrealised gains.

However, these losses were mitigated by some healthy unrealised gains in other

unquoted investments, principally Youngman Group, Original Additions (Beauty

Products) and Image Source Group, where strong trading performance warranted

increased valuations.

Secondly, and partly off-setting these losses, realised gains of �1,583,855

(2005: �1,080,192 as restated) were achieved principally from the sale of

Secure Mail Services, which generated further gains in the year of �1,532,032,

and realised a total gain of �2,892,250 over original cost.

A full analysis of all unrealised gains and losses by investment for the year

is shown in the Investment Portfolio Summary below.

Finally, 75% of the fund management fees were deducted from capital returns,

which, after tax relief, were �597,945 (2005: �475,103) due to the higher

levels of net assets managed this year.

Revenue account

The revenue return after tax for the year rose by �17,223 from last year to �

342,931. As a result, revenue return per share is 0.86 (2005: 0.80) of a penny

per share, thereby remaining broadly constant.

Total income fell by �27,893, caused by three principal factors. First, the

further investment in qualifying holdings this year consequently reduced the

income from the OEIC money market funds (used to hold the Company's liquidity

until invested in qualifying investments) by �159,054. Against this, there has

been an increase of �85,888 in loan stock interest receivable, itself

reflecting further loan stock investments of �2.7 million made by the MPEP

portfolio over the past year. Finally, dividends from qualifying holdings also

rose by �32,582.

Dividends

The Company's revenue return per Ordinary Share was 0.86 pence per share (2005:

0.80 pence per share as re-stated). As noted above, your Board will be

recommending a final dividend of 0.75 pence per Ordinary Share in respect of

the year under review at the Annual General Meeting to be held on 31 January

2007. The Board also proposes to pay an interim capital dividend of 3.00 pence

per Ordinary Share in respect of the year ending 30 September 2007. The

dividends will be paid on 15 February 2007 to shareholders on the Register on

12 January 2007.

Dividend Investment Scheme

We are again offering Shareholders the opportunity to re-invest these dividends

into shares of the Company at the NAV per share as at 31 December 2006

(adjusted for the income and capital dividends totalling 3.75 pence per share).

Board members have once again indicated that they will be doing so to the

extent of their full entitlement. Shareholders who have not yet joined the

scheme and who wish to receive the proposed dividends as shares should complete

the form to be circulated with the Full Annual Report or the Summary Annual

Report as appropriate. Shareholders should return the Form to Capita Registrars

at the address given on the form so as to arrive by 31 January 2007 to ensure

that they qualify to participate in the Scheme in respect of these dividends.

Copies of the rules relating to the scheme are available on request from the

Company Secretary or can be downloaded from the Company's website:

www.trivestvct.co.uk.

Valuation policy

The Company has adopted several new Financial Reporting Standards. These

include FRS 25 (Financial Instruments: Disclosure and Presentation) and FRS 26

(Financial Instruments: Measurement), which require that investments are stated

at fair value and impact the Company's valuation policy. To this end, the

Company has applied the International Private Equity Venture Capital Valuation

(IPEVCV) guidelines for the first time, which are broadly similar to the

previously applied British Venture Capital Association guidelines in respect of

unquoted investments. However, these guidelines also require that quoted stocks

are valued at closing bid price, rather than mid-market price as applied

previously, which has caused a reduction in the opening net asset value as

restated of �483,352. Last year's figures have been restated for this change as

required by FRS 26.

Share buy-backs

During the year ended 30 September 2006, the Company continued to implement its

buy-back policy and, accordingly, bought back 1,100,000 Ordinary Shares

(representing 2.8%) of the shares in issue at the period end) at a total cost

of �1,033,750 (net of expenses). These shares were subsequently cancelled by

the Company.

Investor Allstars 2006 Awards

At the recent Investor Allstars 2006 Awards ceremony, I am delighted to inform

you that MPEP won the award for the second year running for the Venture Capital

Trust Manager of the Year based in no small measure upon the performance of

TriVest. The judging panel commented "Matrix is one of the few VCs that has

successfully defended its title**What differentiated Matrix (from other

finalists) was the quality of the exits they achieved." Foresight Venture

Partners, another of our Investment Managers, was also a finalist in this

category.

This has been another busy and positive year for the Board. The Board is

pleased with the progress that the portfolio overall has made to date and looks

forward to its continued development. Once again I would like to take this

opportunity to thank Shareholders for their continued support.

Colin Hook

Chairman

UNAUDITED PROFIT AND LOSS ACCOUNT

for the year ended 30 September 2006

30 September 2006 (Unaudited) 30 September 2005 (restated)

Revenue Capital Total Revenue Capital Total

� � � � � �

Net unrealised - (4,074,141) (4,074,141) - 16,221,200 16,221,200

(losses)/gains on

investments

Net gains on - 1,583,855 1,583,855 - 1,080,192 1,080,192

realisation of

investments

Costs of investment - (27,071) (27,071) - - -

transactions

Income 1,135,895 - 1,135,895 1,163,788 - 1,163,788

Investment (233,097) (699,292) (932,389) (193,717) (581,150) (774,867)

management fees

Other expenses (458,520) - (458,520) (537,493) - (537,493)

------------- --------------- --------------- ------------- --------------- ---------------

Profit on ordinary 444,278 (3,216,649) (2,772,371) 432,578 16,720,242 17,152,820

activities before

taxation

Tax on ordinary (101,347) 101,347 - (106,870) 106,047 (823)

activities

Profit on ordinary 342,931 (3,115,302) (2,772,371) 325,708 16,826,289 17,151,997

activities after

taxation for the

financial year

------------ --------------- --------------- ------------ --------------- ---------------

Basic and diluted 0.86p (7.84)p (6.98)p 0.80p 41.25p 42.05p

return per share:

Dividends paid

Final dividend for - - - 515,996 - 515,996

the year ended 30

September 2004

Final dividend for 300,780 - 300,780 - - -

the year ended 30

September 2005

Interim dividend - 1,003,852 1,003,852 - - -

for the year ended

30 September 2006

300,780 1,003,852 1,304,632 515,996 - 515,996

All revenue and capital items in the above statement derive from continuing

operations.

No operations were acquired or discontinued in the period.

UNAUDITED STATEMENT OF TOTAL RECOGNISED GAINS AND LOSSES

for the year ended 30 September 2006

30 September 2006 (Unaudited) 30 September 2005 (restated)

Total Total

� �

(Loss)/profit on (2,772,371) 17,151,997

ordinary activities

after taxation

=========

Effect of changes (483,352)

in accounting

policy arising from

the introduction of

FRS 26

---------------

Total recognised (3,255,723) 17,151,997

(losses)/gains

since last annual

report

========= =========

UNAUDITED NOTE OF HISTORICAL COST PROFITS AND LOSSES

for the year ended 30 September 2006

30 September 2006 (Unaudited) 30 September 2005 (restated)

Total Total

� �

(Loss)/profit on (2,772,371) 17,152,820

ordinary

activities before

taxation

Add/(less) 4,074,141 (16,221,200)

unrealised losses/

(gains) on

investments

(Less)/add (4,059,632) 350,156

realisation of

revaluation

(losses)/gains of

previous years

--------------- --------------

Historical cost (2,757,862) 1,281,776

(loss)/profit on

ordinary

activities before

taxation

--------------- ------------

Historical cost (4,062,494) 765,780

(loss)/profit for

the year after

taxation and

dividends

UNAUDITED BALANCE SHEET

as at 30 September 2006

30 September 2006 (Unaudited) 30 September 2005 (restated)

� � � � � �

Non-current assets

Investments at fair 35,405,032 38,740,570

value

Current assets

Debtors and 936,772 1,386,381

prepayments

Current investments 5,969,440 6,345,873

Cash at bank 2,027,094 2,926,233

------------- ---------------

8,933,306 10,658,487

Creditors: amounts

falling due within

one year

Other creditors 43,064 34,617

Accruals 144,996 159,721

------------- ---------------

(188,060) (194,338)

------------- ---------------

Net current assets 8,745,246 10,464,149

========= =========

Net assets 44,150,278 49,204,719

========= =========

Capital and reserves

Called up share 391,099 401,574

capital

Share premium 60,974 -

account

Capital redemption 27,441 16,441

reserve

Special reserve 25,025,881 32,211,804

Capital reserve - 12,618,828 12,633,337

unrealised

Capital reserve - 5,298,692 3,410,294

realised

Revenue reserves 727,363 531,269

========= =========

44,150,278 49,204,719

========= =========

Net asset value per Ordinary 112.89p 122.53p

Share basic and diluted

UNAUDITED RECONCILIATION OF MOVEMENTS IN SHAREHOLDERS' FUNDS

for the year ended 30 September 2006

2006 2005

(Unaudited)

� �

Opening shareholders' funds 49,204,719 33,445,230

(previously �49,386,890 before

prior year adjustment of �

182,171 )

Net share capital bought back in (1,038,937) (878,317)

the year

Net share capital subscribed for 61,499 -

in the year

(Loss)/profit for the year (2,772,371) 17,151,997

Dividends paid in the year (1,304,632) (514,191)

--------------- ---------------

Closing shareholders' funds 44,150,278 49,204,719

======== ========

UNAUDITED CASH FLOW STATEMENT

for the year ended 30 September 2006

Year ended 30 September Year ended 30 September 2005

2006

(Unaudited)

Operating activities � � � �

Investment income 972,767 1,105,903

received

Other income received 7,812 -

Investment management (932,389) (774,866)

fees paid

Other cash payments (488,253) (426,129)

------------- ------------

Net cash outflow from (440,063) (95,092)

operating activities

Taxation

UK Corporation tax paid - (25,279)

Investing activities

Acquisition of (2,410,773) (3,660,979)

investments

Disposal of investments 3,857,334 2,885,804

-------------- --------------

1,446,561 (775,175)

Equity Dividends

Payment of equity (1,304,632) (514,191)

dividends

--------------- -------------

Cash outflow before (298,134) (1,409,737)

financing and liquid

resource management

Management of liquid

resources

Decrease in monies held 376,433 581,068

pending investment

Financing

Issue of Ordinary 61,499 -

shares

Purchase of own shares (1,038,937) (878,317)

------------- -------------

(977,438) (878,317)

Decrease in cash for (899,139) (1,706,986)

the year

======== =========

INVESTMENT PORTFOLIO SUMMARY

as at 30 September 2006

Investment Portfolio Summary

% of

Cost at Valuation Valuation portfolio

at at

30-Sep-06 30-Sep-05 30-Sep-06 by value

Foresight Venture Partners

Oxonica plc 2,136,763 8,780,297 7,245,512 20.46%

Specialist in the design,

manipulation and engineering of

properties of materials at the

nano-scale

SmartFOCUS Group plc 700,000 1,899,292 1,856,969 5.24%

Provider of analytic software to

support targeting and execution of

marketing campaigns

Camwood Limited 1,028,181 1,780,937 1,669,520 4.72%

Provider of software repackaging

services

Aquasium Technology Limited 700,000 2,067,997 1,059,610 2.99%

Business engaged in the design,

manufacturing and marketing of

bespoke electron beam welding and

vacuum furnace equipment

Sarantel plc 1,670,252 3,729,170 798,621 2.26%

Developer and manufacturer of

antennae for mobile phones and

other wireless devices

Alaric Systems Limited 595,803 595,763 595,763 1.68%

Software developer and provider of

support services in the credit/

debit card authorisation and

payments market

ANT plc 462,816 472,749 393,958 1.11%

Provider of embedded browser/email

software for consumer electronics

and Internet appliances

Aigis Engineering Solutions 272,120 333,320 333,320 0.94%

Limited

Specialist blast containment

materials company

DCG Datapoint Group Limited 312,074 312,074 311,853 0.88%

Design, supply and integration of

data storage solutions

Mondas plc 1 600,000 450,183 238,255 0.67%

Provider of e-business

technologies

Rapide Communication Limited 2 379,983 250,000 66,667 0.19%

Mobile phone software company

Monactive Limited (in 339,285 160,667 0 0.00%

administration)

Provider of software management

tools that monitor usage of

software versus licences held

Other investments in the portfolio 0 15,000 Nil 0.00%

3

9,197,277 20,847,449 14,570,048 41.14%

Matrix Private Equity Partners LLP

HWA Limited (trading as Holloway 69,105 3,219,023 3,348,323 9.47%

White Allom)

Refurbishment, restoration and

construction of notable public

buildings and top-end residential

dwellings in and around London

Image Source Group Limited 1,000,000 2,618,253 3,232,667 9.13%

Royalty free picture library

Original Additions (Beauty 1,000,000 2,301,687 3,127,944 8.83%

Products) Limited

Manufacturer and distributor of

beauty products

Youngman Group Limited 1,000,000 0 2,368,418 6.69%

Manufacturer of ladders and access

towers

BBI Holdings plc 496,119 731,910 1,227,231 3.47%

Manufacturer of gold conjugate for

the medical diagnostics industry

Tottel Publishing Limited 514,800 514,800 759,048 2.14%

Publisher of specialist legal and

taxation titles

Letraset Limited 1,000,000 487,737 622,737 1.76%

Manufacturer and worldwide

distributor of graphic art

products

Brookerpaks Limited 500,000 1,033,058 621,555 1.76%

Importer and distributor of garlic

and vacuum-packed vegetables to

supermarkets and the wholesale

trade

Ministry of Cake Limited 721,280 721,280 556,169 1.57%

Manufacturer of desserts and cakes

for the food service industry

British International Holdings 500,000 n/a 500,000 1.41%

Limited

Helicopter service operators

VSI Limited 388,842 0 388,842 1.10%

Provider of software for CAD and

CAM vendors

Blaze Signs Holdings Limited 360,969 n/a 360,969 1.02%

Manufacturer and installer of

signs

Campden Media Limited 334,880 n/a 334,880 0.95%

Magazine publisher and conference

organiser

PastaKing Holdings Limited 292,405 0 292,405 0.83%

Manufacturer and supplier of fresh

pasta meals

Vectair Holdings Limited 215,914 0 215,914 0.61%

Designer and distributor of

washroom products

SectorGuard plc 150,000 128,571 150,000 0.42%

Provider of manned guarding,

mobile patrols and alarm response

services

B G Consulting Group Limited/ 1,153,976 125,000 128,344 0.36%

Duncary 4 Limited

Technical training business

Inca Interiors Limited 350,000 300,562 50,000 0.14%

Design, supply and installation of

quality kitchens to house

developers

FH Ingredients Limited 403,303 403,303 0 0.00%

Processor of frozen herbs for the

food manufacturing industry

Secure Mail Services Limited 0 2,590,494 0 0.00%

Specialist, secure credit card

delivery business

Other investments in the portfolio 1,316,482 Nil Nil 0.00%

3

11,768,075 15,175,678 18,285,446 51.66%

Nova Capital Management Limited

Tikit Group plc 500,000 882,607 960,868 2.71%

Provider of consultancy, services

and software solutions for law

firms

Biomer Technology Limited 137,170 753,836 753,837 2.14%

Developer of biomaterials for

medical devices

NexxtDrive Limited 600,000 412,500 468,750 1.32%

Developer of transmissions

technologies for applications in

the automotive, construction and

industrial sectors

I-DOX plc 737,625 668,500 366,083 1.03%

Provider of document storage

systems

1,974,795 2,717,443 2,549,538 7.20%

Total 22,940,147 38,740,570 35,405,032 100.00%

1 Data for Mondas includes Blue Curve Limited, acquired during the year.

2 Data for Rapide Communication includes Wire-e Limited, acquired during the

year.

3 Other investments in the portfolio comprises The Hunter Rubber Company

Limited (in administration) and Stortext-FM Limited/Stortext (DO) Limited in

the MPEP portfolio and Broadreach Networks Limited, in the Foresight portfolio

which have all been valued at nil.

Notes

1. In accordance with the policy statement published under "Management and

Administration" in the Company's Prospectus dated 13 October 2000, the

Directors have charged 75% of the investment management expenses to capital

reserve.

2. With effect from 1 October 2005, the Company has adopted the following

Financial Reporting Standards (FRS):

FRS 21 (Events after the Balance Sheet Date) - Interim dividends paid by the

Company are accounted for in the period in which they are paid and final

dividends are accounted for when approved by shareholders. Previously, the

Company accrued dividends in the period in which the net income, to which those

dividends related, was accounted for.

FRS 25 (Financial Instruments: Disclosure and Presentation) and FRS 26

(Financial Instruments: Measurement) -The Company has designated its

investments as being measured at "fair value through profit and loss". The fair

value of quoted investments is deemed to be the bid value of these investments

at the close of business on the relevant date.

The corresponding amounts in this announcement are restated in accordance with

these new policies.

Non-current investments which are not quoted are stated at Directors' best

estimate of fair value, in accordance with IPEVCV guidelines.

The Company has also adopted FRS 22 (Earnings per Share), FRS 23 (The effects

of changes in foreign exchange rates) and FRS 28 (Corresponding amounts), none

of which give rise to prior year adjustments.

The Company has chosen not to adopt the accounting requirements of FRS 20

(accounting for share based payments), as the incentive agreement with the

Investment Managers existed before the date from which FRS 20 became

applicable.

3. The basic revenue return per Ordinary Share is based on the net revenue from

ordinary activities after taxation of �342,931 (2005: �325,708) and on

39,694,960 (2005: 40,786,094) Ordinary Shares, being the weighted average

number of Ordinary Shares in issue during the year.

4. The basic capital return per Ordinary Share is based on net realised and

unrealised capital losses of �2,490,286 (2005: �17,301,392 as restated) and net

capital costs (including investment management fees) of �625,016 (2005: �

475,103) and on 39,694,960 (2005: 40,786,094) Ordinary Shares, being the

weighted average number of Ordinary Shares in issue during the year.

5. The above financial information comprises non-statutory accounts within the

meaning of section 240 of the Companies Act 1985. The financial information for

the year ended 30 September 2005 has been extracted from published accounts

(except as restated) for the year ended 30 September 2005 that have been

delivered to the Registrar of Companies and on which the report of the auditors

was unqualified.

6. The Company revoked its investment company status on 30 November 2005 which

means that it is now able to make capital distributions from realised profits

when previously it could only pay dividends from income.

7. The Company proposes to pay a final dividend from income of 0.75 pence

(2005: 0.75 pence) per share in respect of the year ended 30 September 2006.

The Board also intends to pay an interim capital dividend of 3.00 pence per

Ordinary Share in respect of the year ending 30 September 2007. The dividends

will be paid on 15 February 2007 to Shareholders on the Register on 12 January

2007.

8. The Annual General Meeting will be held at 11.00 am on 31 January 2007 at

One Jermyn Street, London SW1Y 4UH.

END

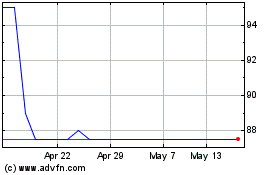

Touchstar (LSE:TST)

Historical Stock Chart

From Jun 2024 to Jul 2024

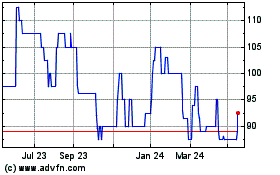

Touchstar (LSE:TST)

Historical Stock Chart

From Jul 2023 to Jul 2024