6.2 Upon such termination, the parties to the Placing Agreement

shall be released and discharged (except for any liability arising

before or in relation to such termination) from their respective

obligations under or pursuant to the Placing Agreement subject to

certain exceptions.

6.3 By participating in the Placing, Placees agree that the

exercise by Jefferies of any right of termination or other

discretion under the Placing Agreement shall be within Jefferies

absolute discretion and that Jefferies need not make any reference

to Placees and that it shall have no liability to Placees

whatsoever in connection with any such exercise or failure so to

exercise.

7. No prospectus

7.1 The Placing Shares are being offered to a limited number of

specifically invited persons only and will not be offered in such a

way as to require a prospectus in the UK. No offering document,

prospectus or admission document has been or will be submitted to

be approved by the FCA or submitted to the London Stock Exchange in

relation to the Placing and Placees' commitments will be made

solely on the basis of their own assessment of their own assessment

of the Company, the Placing Shares and the Placing based on the

Company's publicly available information taken together with the

information contained in this announcement (including this

Appendix), and subject to the further terms set forth in the

contract note to be provided to individual prospective Placees.

7.2 Each Placee, by accepting a participation in the Placing,

agrees that the content of this announcement (including this

Appendix) is exclusively the responsibility of the Company and

confirms that it has neither received nor relied on any other

information, representation, warranty, or statement made by or on

behalf of the Company or Jefferies or any other person and none of

Jefferies or the Company nor any other person will be liable for

any Placee's decision to participate in the Placing based on any

other information, representation, warranty or statement which the

Placees may have obtained or received. Each Placee acknowledges and

agrees that it has relied on its own investigation of the business,

financial or other position of the Company in accepting a

participation in the Placing. Nothing in this paragraph shall

exclude the liability of any person for fraudulent

misrepresentation.

8. Registration and Settlement

8.1 Settlement of transactions in the Placing Shares following

Admission will take place within the system administered by

Euroclear UK & Ireland Limited ("CREST"), subject to certain

exceptions. Jefferies and the Company reserves the right to require

settlement for and delivery of the Placing Shares (or a portion

thereof) to Placees in certificated form if, in their opinion,

delivery or settlement is not possible or practicable within the

CREST system or would not be consistent with the regulatory

requirements in the Placee's jurisdiction.

8.2 Following the close of the Bookbuild for the Placing, each

Placee to be allocated Placing Shares in the Placing will be sent a

contract note stating the number of Placing Shares allocated to it

at the Placing Price and settlement instructions. The number of

Placing Shares allocated to each Placee will be allocated in a

manner determined by Jefferies in its absolute discretion in

consultation with the Company and Placees will be notified of the

relevant allocation in the contract note.

8.3 Each Placee agrees that it will do all things necessary to

ensure that delivery and payment is completed in accordance with

the standing CREST or certificated settlement instructions that it

has in place with Jefferies.

8.4 The Company will deliver the Placing Shares to a CREST

account operated by Jefferies as agent for the Company and

Jefferies will enter its delivery instruction into the CREST

system. The input to CREST by a Placee of a matching or acceptance

instruction will then allow delivery of the relevant Placing Shares

to that Placee against payment.

8.5 It is expected that settlement in respect of the Placing

Shares will take place on 10 February 2015 on a delivery versus

payment basis.

8.6 Interest is chargeable daily on payments not received from

Placees on the due date in accordance with the arrangements set out

above at the rate of two percentage points above LIBOR as

determined by Jefferies.

8.7 Each Placee is deemed to agree that, if it does not comply

with these obligations, Jefferies may sell any or all of the

Placing Shares allocated to that Placee on such Placee's behalf and

retain from the proceeds, for Jefferies' account and benefit, an

amount equal to the aggregate amount owed by the Placee plus any

interest due. The relevant Placee will, however, remain liable for

any shortfall below the aggregate amount owed by it and may be

required to bear any stamp duty or stamp duty reserve tax (together

with any interest or penalties) which may arise upon the sale of

such Placing Shares on such Placee's behalf.

8.8 If Placing Shares are to be delivered to a custodian or

settlement agent, Placees should ensure that the trade confirmation

is copied and delivered immediately to the relevant person within

that organisation. Insofar as Placing Shares are registered in a

Placee's name or that of its nominee or in the name of any person

for whom a Placee is contracting as agent or that of a nominee for

such person, such Placing Shares should, subject as provided below,

be so registered free from any liability to UK stamp duty or stamp

duty reserve tax. Placees will not be entitled to receive any fee

or commission in connection with the Placing.

9. Representations and warranties

9.1 By participating in the Placing each Placee (and any person

acting on such Placee's behalf) irrevocably acknowledges, confirms,

undertakes, represents, warrants and agrees (as the case may be)

with Jefferies (in its capacity as bookrunner and agent of the

Company, in each case as a fundamental term of their application

for Placing Shares), the following:

9.1.4 it has read and understood this announcement in its

entirety and that its subscription of Placing Shares is subject to

and based upon all the terms, conditions, representations,

warranties, acknowledgements, agreements and undertakings and other

information contained herein;

9.1.5 that no offering document, listing particulars, prospectus

or admission document has been or will be prepared in connection

with the Placing and it has not received a prospectus, admission

document or other offering document in connection with the Placing

or the Placing Shares;

9.1.6 that the existing Ordinary Shares in the capital of the

Company are admitted to trading on AIM, and that the Company is

therefore required to publish certain business and financial

information in accordance with the rules and practices of AIM,

which includes a description of the nature of the Company's

business and its most recent balance sheet and profit and loss

account, and that it is able to obtain or access such information

and such information or comparable information concerning any other

publicly traded company, in each case without undue difficulty;

9.1.7 that neither Jefferies nor the Company nor any of their

respective affiliates nor any person acting on behalf of any of

them has provided, and none of them will provide it, with any

material regarding the Placing Shares or the Company or any other

person other than this announcement; nor has it requested

Jefferies, the Company, any of their respective affiliates or any

person acting on behalf of any of them to provide it with any such

information;

9.1.8 unless otherwise specifically agreed with Jefferies, that

neither it nor the beneficial owner of the Placing Shares is, or at

the time the Placing Shares are acquired, neither it nor the

beneficial owner of the Placing Shares will be, a resident of, or

otherwise located in, the United States, Australia, Canada, Japan

or the Republic of South Africa and it further acknowledges that

the Placing Shares have not been and will not be registered under

the securities legislation of the United States, Australia, Canada,

Japan or the Republic of South Africa and, subject to certain

exceptions, may not be offered, sold, transferred, delivered or

distributed, directly or indirectly, in or into those

jurisdictions;

9.1.9 that (i) it is not within the United States, (ii) it is

not within Australia, Canada, Japan, the Republic of South Africa

or any other jurisdiction in which it is unlawful to make or accept

an offer to acquire the Placing Shares, (iii) it is not acquiring

the Placing Shares for the account of any person who is located in

the United States, unless the instruction to acquire was received

from a person outside the United States and the person giving such

instruction has confirmed that it has the authority to give such

instruction, and that either (a) it has investment discretion over

such account or (b) it is an investment manager or investment

company and, in the case of each of (a) and (b), that it is

acquiring the Placing Shares in an "offshore transaction" (within

the meaning of Regulation S under the US Securities Act of 1933, as

amended (the "Securities Act")); and (iv) it is not acquiring the

Placing Shares with a view to the offer, sale, resale, transfer,

delivery or distribution, directly or indirectly, of any such

Placing Shares into the United States or any other jurisdiction

referred to in (ii) above;

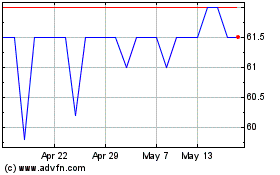

Tissue Regenix (LSE:TRX)

Historical Stock Chart

From Jul 2024 to Aug 2024

Tissue Regenix (LSE:TRX)

Historical Stock Chart

From Aug 2023 to Aug 2024