TIDMTRX

RNS Number : 5263V

Tissue Regenix Group PLC

29 October 2014

Tissue Regenix Group plc

("Tissue Regenix" or "the Group")

Unaudited Interim Results for the six months ended 31 July

2014

YORK, 29(th) October 2014 - Tissue Regenix, the regenerative

medical devices company which uses animal or human tissue to

replace damaged or worn out parts of the human body, today

announces its unaudited interim results for the six months ended 31

July 2014.

Operational Highlights

During the period, the Group has achieved the following

milestones:

-- Wound Care

o Continued to make good progress in the execution of its

strategy to commercialise its range of regenerative medicine

products based on the dCELL(R) process, including the successful

launch of its decellularised dermal allograft product

("DermaPure(R)") in the USA. The launch of DermaPure(R) in the USA

allows Tissue Regenix to target the $1.4 billion a year market for

skin substitutes

o As a core part of the Group's marketing efforts, Tissue

Regenix USA has also developed an initial distribution network

covering in excess of 80% of the USA, currently focused on

promoting DermaPure(R)

o Received a preliminary positive decision from the Centers for

Medicare & Medicaid Services (CMS) for the assignment of a

permanent Healthcare Common Procedure Coding System (HCPCS) Q-code

for DermaPure(R), allowing for wound care centre reimbursement for

the product, expected from January 2015 onwards

o Progressed its US diabetic foot ulcer human clinical trial to

support commercial activity

-- Orthopaedics

o Gained approval from the Medicines and Healthcare Products

Regulatory Agency (MHRA) to start the first UK clinical trial of

its dCELL(R) meniscal device to aid knee repairs, a critical step

towards gaining EU clearance (and a CE Mark) to enable full

commercialisation of the dCELL(R) meniscus product

-- IP

o Received a number of patents for its global exclusive licence

portfolio covering the use of its dCELL(R) technology, including a

patent to aid meniscal repair in China, and patents for use in

bladder repair in both Europe and the USA

Financial Highlights

-- Expected loss after tax of GBP3.4m for the first half of 2014

(H1 2013: GBP2.1m) resulting from additional development

expenditure and establishing the commercial operations in the

USA

-- Cash and cash equivalents of GBP14.6m as of 31 July 2014 (H1 2013: GBP21.7m)

Antony Odell, CEO of Tissue Regenix Group plc commented: "Tissue

Regenix has achieved much in the past six months including starting

the commercial roll-out of our dCELL(R) DermaPure(R)product in the

USA; gaining approval from the MHRA for a UK clinical trial on

dCELL(R) meniscus products; progressing our diabetic foot ulcer

trial in the US and increasing our global patent portfolio.

"These milestones maintain our planned progress and build

successfully on our strategic focus on the wound care and

orthopaedic markets, following the positive data from the UK

clinical trial into dCELL(R) dermis patches, and our decision to

commercialise this product in the USA in 2013. The launch of

DermaPure(R) as our first product in the USA represents a

significant step for the Group.

"For the orthopaedic business, gaining approval to start our

human clinical trial on porcine dCELL(R) meniscus provides a

foundation for securing a CE mark in the UK. This represents a

critical step in the process to enable full commercialisation of

the dCELL(R) meniscus product and allow it to be used by clinics

and doctors to help UK and European patients."

A capital markets update presentation for analysts and investors

will be held today, Wednesday 29(th) October, between 9.30am and

11am at Jefferies International, 68 Upper Thames Street, London,

EC4V 3BJ. The presentation will contain no new material

information. If you would like to attend, please contact Deborah

Saw or Andrew Adie on +44 (0) 207 680 6550 or

TR@newgatecomms.com

For further information, please contact:

Tissue Regenix Group plc: +44 (0) 19 0443 5176

Antony Odell

Ian Jefferson

Jefferies International Ltd. +44 (0) 20 7029 8000

Simon Hardy

Harry Nicholas

Newgate Communications +44 (0) 207 680 6550

Deborah Saw

Andrew Adie

About Tissue Regenix

Tissue Regenix is a leading medical devices company in the field

of regenerative medicine. The company's patented decellularisation

('dCELL(R)') technology removes DNA and other cellular material

from animal and human tissue leaving an acellular tissue scaffold

which is not rejected by the patient's body which can then be used

to repair diseased or worn out body parts. The potential

applications of this process are diverse and address many critical

clinical needs such as vascular disease, heart valve replacement

and knee repair.

Tissue Regenix was formed in 2006 when it was spun-out from the

University of Leeds. The company commercialises academic research

conducted by our partners around the World.

In November 2012 Tissue Regenix Group plc set up a subsidiary

company in the United States - 'Tissue Regenix Wound Care Inc.', as

part of its commercialisation strategy for its dCELL(R) technology

platform.

Chairman's Statement

Overview

The first half of 2014 has arguably been the most exciting

period in the Group's short history, with the successful commercial

launch of DermaPure(R) in the USA, which allows us to target a

market worth $1.4 billion a year.

During the period we have focused heavily on developing our

marketing and sales strategy and successfully implementing these

plans in the USA. Tissue Regenix has formed an initial number of

commercial partnerships to enable distribution of the product in

the USA.

Alongside the developments in wound care, the Group has also

made steady progress in other areas of the business, including

preparations for the European trial of the dCELL(R) meniscus in

orthopaedics, and the attainment of a number of patents to protect

our unique dCELL(R) technology.

Wound care

The launch of DermaPure(R) in the USA represents a key

opportunity for the Group. Tissue Regenix's DermaPure(R) was shown

in the UK human clinical trial to be easily administered, and can

be stored at room temperature, removing the need for expensive

freezing or cryopreservation. DermaPure(R), which is processed by

our tissue bank partners Community Tissue Services ("CTS"), is

initially being aimed at helping patients with diabetic foot

ulcers, a condition which affects around 600,000 people in the USA

each year, and patients with venous leg ulcers, which currently

affect around 2.5 million people in the USA.

Tissue Regenix also received a preliminary positive decision for

an assignment of a permanent Healthcare Common Procedure Coding

System (HCPCS) "Q-code" for DermaPure(R), which from January 2015

will allow Tissue Regenix to apply for wound care centre

reimbursement of the product from local payer organisations. Payer

organisations worldwide are focused on managing the gap between

funding and medical costs, often in the context of a changing

regulatory environment. Whilst these applications will take time to

be processed the decision will allow greater access to DermaPure(R)

for clinicians and provide an advanced treatment for patients with

chronic (and potentially acute) wounds. To support this marketing

activity, the Group also progressed the human clinical trial for

diabetic foot ulcers.

In the United Kingdom, NHSBT has continued to roll out

DermaPure(R) (known as dCELL(R) Human Dermis) in the period

following its launch in January 2014.

Orthopaedics

In July 2014 the Group received approval from the Medicines and

Healthcare Products Regulatory Agency (MHRA) to start the first UK

human clinical trial of its dCELL(R) meniscal device to aid knee

repairs, expected to commence before the end of the calendar year.

The trial approval marks a key milestone towards gaining EU

clearance (and a CE Mark) which will enable full commercialisation

of the dCELL(R) meniscus product, allowing it to be used by clinics

and doctors to help UK and European patients. Meniscal injuries

affect around 1.5 million people per year in the USA and Europe,

with 61 people sustaining a meniscal tear per 100,000 population

per year in the UK alone, and the dCELL(R) meniscus potentially

addresses this substantial unmet clinical need.

IP protection

The Group's IP estate continued to develop with a number of

patents granted in the period covering the use of Tissue Regenix

technology in a range of applications. These include patents to aid

meniscal repair in China and for use in bladder repair in the USA

and Europe. Tissue Regenix will continue to apply for similar

patents worldwide to protect the Group's dCELL(R) technology.

Financial Review

As previously stated, Tissue Regenix has continued to make

investments in product development to drive growth during the

period and has maintained a robust cash position of GBP14.6m at the

end of the first half (H1 2013: GBP21.7m). As planned, we expect to

continue to use our cash resources to fund our development

programmes, and expect cash utilisation to increase over the coming

years as the programmes progress through pre-clinical and clinical

trials.

Outlook

The launch of DermaPure(R) in the USA during the first six

months of 2014 was an important milestone in Tissue Regenix's

progress from its roots as a purely development-focused company to

becoming a business with commercially available products. We are

committed to bringing our pipeline of human and animal tissue

products to market, to meet a range of clinical needs. Our focus on

accelerating the delivery of our product pipeline and the upcoming

clinical trial for the first of our orthopaedic products shows that

we have the expertise and confidence to enter competitive but

attractive global markets. The diversity and strength of the

dCELL(R) platform coupled with our strong commercial focus provides

a solid base to grow the business and the Group will continue to

aim towards the full commercial rollout of our dCELL(R) technology

across a range of target markets, including multiple applications

where we see opportunity for DermaPure(R), working towards our

ambition to become a global leader in regenerative medicine.

John Samuel

Chairman

29 October 2014

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

(UNAUDITED)

FOR THE SIX MONTHS TO 31 JULY 2014

6 months 6 months 12 months

to to to

Notes 31 July 31 July 31 Jan

2014 2013 2014

GBP'000 GBP'000 GBP'000

----------------------------------- -------- ---------- ---------- ----------

Revenue 8 3 6

Administrative expenses (3,835) (2,503) (6,583)

Operating loss (3,827) (2,500) (6,577)

Finance income 97 152 274

----------------------------------- -------- ---------- ---------- ----------

Loss before tax (3,730) (2,348) (6,303)

Taxation 3 300 200 710

----------------------------------- -------- ---------- ---------- ----------

Loss after tax attributable

to equity holders of the parent (3,430) (2,148) (5,593)

----------------------------------- -------- ---------- ---------- ----------

Other Comprehensive Income:

Foreign currency translation

differences - foreign operations - - 3

----------------------------------- -------- ---------- ---------- ----------

TOTAL COMPREHENSIVE EXPENSE

FOR THE YEAR (3,430) (2,148) (5,590)

----------------------------------- -------- ---------- ---------- ----------

Loss per share

Basic and diluted on loss from

continuing operations 4 (0.54)p (0.34)p (0.88)p

----------------------------------- -------- ---------- ---------- ----------

The loss for the period arises from the Group's continuing

operations.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

(UNAUDITED)

FOR THE SIX MONTHS TO 31 JULY 2014

Share

Reverse Reserve Based Retained

Share Share Merger Acquisition for own Payment earnings Total

Capital Premium Reserve Reserve shares Reserve deficit Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ ---------- ---------- ---------- -------------- ---------- --------- ----------- ----------

At 31 Jan

2013 3,264 31,966 10,884 (7,148) (831) 536 (14,205) 24,466

Loss and

total

comprehensive

expense

for the

period - - - - - - (2,148) (2,148)

Share based

payment - - - - - 54 - 54

At 31 July

2013 3,264 31,966 10,884 (7,148) (831) 590 (16,353) 22,372

Loss for

the period - - - - - - (3,445) (3,445)

Other

comprehensive

income - - - - - - 3 3

------------------ ---------- ---------- ---------- -------------- ---------- --------- ----------- ----------

Loss and

total

comprehensive

expense

for the

period - - - - - - (3,442) (3,442)

Exercise

of share

options 3 5 - - - - - 8

Share based

payment - - - - - 40 - 40

------------------ ---------- ---------- ---------- -------------- ---------- --------- ----------- ----------

At 31 Jan

2014 3,267 31,971 10,884 (7,148) (831) 630 (19,795) 18,978

Loss and

total

comprehensive

expense

for the

period - - - - - - (3,430) (3,430)

Exercise

of share

options 4 1 - - - - - 5

Share based

payment - - - - - 90 - 90

------------------ ---------- ---------- ---------- -------------- ---------- --------- ----------- ----------

At 31 July

2014 3,271 31,972 10,884 (7,148) (831) 720 (23,225) 15,643

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

(UNAUDITED)

AS AT 31 JULY 2014

31 July 31 July 31 Jan

Notes 2014 2013 2014

GBP'000 GBP'000 GBP'000

------------------------------- -------- --------- --------- ---------

Non-current assets

Property, plant and equipment 440 317 472

------------------------------- -------- --------- --------- ---------

Total non-current assets 440 317 472

------------------------------- -------- --------- --------- ---------

Current assets

Inventory 9 - -

Trade and other receivables 1,318 868 1,127

Cash and cash equivalent 14,578 21,671 18,483

------------------------------- -------- --------- --------- ---------

Total current assets 15,905 22,539 19,610

------------------------------- -------- --------- --------- ---------

Total assets 16,345 22,856 20,082

------------------------------- -------- --------- --------- ---------

Current liabilities

Trade and other payables (702) (484) (1,104)

------------------------------- -------- --------- --------- ---------

Total liabilities (702) (484) (1,104)

------------------------------- -------- --------- --------- ---------

Net assets 15,643 22,372 18,978

------------------------------- -------- --------- --------- ---------

Equity

Share capital 5 3,271 3,264 3,267

Share premium 5 31,972 31,966 31,971

Merger Reserve 5 10,884 10,884 10,884

Reverse acquisition reserve 5 (7,148) (7,148) (7,148)

Reserve for own shares (831) (831) (831)

Share based payment reserve 720 590 630

Retained earnings deficit 6 (23,225) (16,353) (19,795)

------------------------------- -------- --------- --------- ---------

Total equity 15,643 22,372 18,978

------------------------------- -------- --------- --------- ---------

Approved by the Board and authorised for issue on 29 October

2014

John Samuel (Executive Chairman) Ian Jefferson (Chief Financial Officer)

CONDENSED CONSOLIDATED CASH FLOW STATEMENT (UNAUDITED)

FOR THE SIX MONTHS ENDED 31 JULY 2014

6 months 6 months 12 months

to to to

Notes 31 July 31 July 31 Jan

2014 2013 2014

GBP'000 GBP'000 GBP'000

---------------------------------- --------- ---------- ---------- ----------

Operating Activities

Operating loss (3,827) (2,500) (6,577)

Adjustment for non-cash items:

Depreciation of property,

plant & equipment 76 54 124

Share based payment 90 54 94

Tax refunded - - 474

--------------------------------------------- ---------- ---------- ----------

Operating cash outflow (3,661) (2,392) (5,885)

--------------------------------------------- ---------- ---------- ----------

Increase in inventory (9) - -

Decrease/(increase) in trade

& other receivables 109 39 (184)

(Decrease)/increase in trade

& other payables (402) (201) 422

--------------------------------------------- ---------- ---------- ----------

Net cash outflow from operations (3,963) (2,554) (5,647)

--------------------------------------------- ---------- ---------- ----------

Investing activities

Interest received 97 152 274

Purchase of property, plant

& equipment (44) (133) (358)

--------------------------------------------- ---------- ---------- ----------

Net cash outflow from investing

activities 53 19 (84)

--------------------------------------------- ---------- ---------- ----------

Financing activities

Proceeds from issue of share

capital 5 - 8

Net cash inflow from financing

activities 5 - 8

--------------------------------------------- ---------- ---------- ----------

Decrease in cash and cash

equivalents (3,905) (2,535) (5,723)

Cash and cash equivalents

at start of period 18,483 24,206 24,206

--------------------------------------------- ---------- ---------- ----------

Cash and cash equivalents

at end of period 14,578 21,671 18,483

--------------------------------------------- ---------- ---------- ----------

NOTES TO THE CONDENSED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE SIX MONTHS ENDED 31 JULY 2014

1. Basis of preparation

The interim financial information set out in this statement for

the six months ended 31 July 2014 and the comparative figures for

the six months ended 31 July 2013 are unaudited. This information

does not constitute statutory accounts as defined in Section 435 of

the Companies Act 2006.

The comparative figures for the financial year ended 31 January

2014 are not the Company's statutory accounts for that financial

year. Those accounts have been reported on by the Company's

auditors and delivered to the Registrar of Companies. The report of

the auditor was (i) unqualified, (ii) did not include a reference

to any matters to which the auditor drew attention by way of

emphasis without qualifying their report, and (iii) did not contain

a statement under section 498 (2) or (3) of the Companies Act

2006.

This interim statement, which is neither audited nor reviewed,

has been prepared in accordance with the measurement and

recognition criteria of Adopted IFRSs. It does not include all the

information required for the full annual financial statements, and

should be read in conjunction with the financial statements of the

Group as at and for the year ended 31 January 2014. It does not

comply with IAS 34 "Interim Financial Reporting" as is permissible

under the rules of the AIM Market ("AIM").

The accounting policies applied in preparing these interim

financial statements are the same as those applied in the

preparation of the annual financial statements for the year ended

31 January 2014, as described in those financial statements other

than standards, amendments and interpretations which became

effective after 1 February 2014 and were adopted by the Group.

These have had no significant impact on the Group's profit for the

period or equity. The Board approved these interim financial

statements on 26 September 2014.

2. Significant accounting policies

The condensed consolidated financial statements have been

prepared under the historical cost convention in accordance with

International Financial Reporting Standards as adopted by the

European Union.

The accounting policies adopted are consistent with those

followed in the preparation of the audited financial statements of

Tissue Regenix Group Plc for the year ended 31 January 2014 and are

disclosed in those statements.

NOTES TO THE CONDENSED FINANCIAL STATEMENTS (UNAUDITED)

continued

FOR THE SIX MONTHS ENDED 31 JULY 2014

3. Taxation

6 months 6 months 12 months

to to to

31 July 31 July 31 Jan

2014 2013 2014

GBP'000 GBP'000 GBP'000

---------------------------------- --------- --------- ----------

Current Tax:

Tax credit on research and

development costs in the period 300 200 710

300 200 710

Deferred tax:

Origination and reversal of

temporary timing differences - - -

---------------------------------- --------- --------- ----------

Tax credit on loss on ordinary

activities 300 200 710

---------------------------------- --------- --------- ----------

The Group has accumulated losses available to carry forward

against future trading profits. No deferred tax asset has been

recognised in respect of tax losses.

4. Loss per share (basic and diluted)

Basic loss per share is calculated by dividing the loss

attributable to equity holders of the parent by the weighted

average number of ordinary shares in issue during the period

excluding own shares held jointly by the Tissue Regenix Employee

Share Trust and certain employees. Diluted loss per share is

calculated by adjusting the weighted average number of ordinary

shares in issue during the period to assume conversion of all

dilutive potential ordinary shares.

6 months 6 months 12 months

to to to

31 July 31 July 31 Jan

2014 2013 2014

GBP'000 GBP'000 GBP'000

---------------------------------- -------------- -------------- --------------

Total loss attributable to

the equity holders of the

parent (3,430) (2,148) (5,593)

---------------------------------- -------------- -------------- --------------

No. No. No.

---------------------------------- -------------- -------------- --------------

Weighted average number of

ordinary shares in issue during

the period 636,592,627 635,515,678 635,574,603

---------------------------------- -------------- -------------- --------------

Loss per share

Basic and diluted on loss

for the period (0.54)p (0.34)p (0.88)p

---------------------------------- -------------- -------------- --------------

The Company has issued employees options over 22,756,940

ordinary shares and there are 16,940,386 jointly owned shares which

are potentially dilutive. There is, however, no dilutive effect of

these issued options as there is a loss for each of the periods

concerned.

NOTES TO THE CONDENSED FINANCIAL STATEMENTS (UNAUDITED)

continued

FOR THE SIX MONTHS ENDED 31 JULY 2014

5. Share capital

Reverse

Share Share Merger acquisition

Capital Premium Reserve reserve Total

Number GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- -------------- ---------- ---------- ---------- ------------- ----------

Total Ordinary shares

of 0.5p each as at

31 January 2013 652,825,019 3,264 31,966 10,884 (7,148) 38,966

Issued on exercise

of share options - - - - - -

Total Ordinary shares

of 0.5p each as at

31 July 2013 652,825,019 3,264 31,966 10,884 (7,148) 38,966

Issued on exercise

of share options 662,338 3 5 - - 8

Total Ordinary shares

of 0.5p each as at

31 January 2014 653,487,357 3,267 31,971 10,884 (7,148) 38,974

Issued on exercise

of share options 635,674 4 1 - - 5

Total Ordinary shares

of 0.5p each as at

31 July 2014 654,123,031 3,271 31,972 10,884 (7,148) 38,979

6. Movement in retained earnings and reserve for own shares

Retained Reserve

Earnings For Own

Deficit Shares

GBP'000 GBP'000

--------------------- ---------- ---------

At 31 January 2013 (14,205) (831)

Loss for the period (2,148) -

--------------------- ---------- ---------

At 31 July 2013 (16,353) (831)

Loss for the period (3,445) -

Exchange movement 3 -

--------------------- ---------- ---------

At 31 January 2014 (19,795) (831)

Loss for the period (3,430) -

--------------------- ---------- ---------

At 31 July 2014 (23,225) (831)

--------------------- ---------- ---------

7. Interim financial report

A copy of this interim report will be distributed to

shareholders and is also available on the Company's website at

www.tissueregenix.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR DVLFLZBFBFBQ

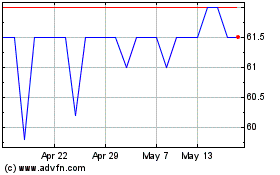

Tissue Regenix (LSE:TRX)

Historical Stock Chart

From Jul 2024 to Aug 2024

Tissue Regenix (LSE:TRX)

Historical Stock Chart

From Aug 2023 to Aug 2024