Travis Perkins: Q3 trading update (1745833)

October 11 2023 - 2:00AM

UK Regulatory

Travis Perkins (TPK)

Travis Perkins: Q3 trading update

11-Oct-2023 / 07:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

11 October 2023

Dissemination of a Regulatory Announcement that contains inside information according to REGULATION (EU) No 596/2014

(MAR)

Travis Perkins plc Q3 2023 trading update for the three months to 30 September 2023

Challenging market conditions persist with significant commodity product deflation impacting on margins; full year

adjusted operating profit now expected to be in the range of GBP175m to GBP195m

Business Performance

The Group has continued to experience challenging market conditions with the pronounced slowdown in new build housing

and domestic RMI activity persisting into the third quarter. As a result, Group revenue declined by (1.8)% in the

period with like-for-like sales also down (1.8)%.

Whilst third quarter trading started as expected in the Merchanting segment, September saw a notable deterioration in

market activity and sentiment. Q3 revenue was (3.4)% lower year-on-year, a modest improvement on the first half,

however the drivers of revenue have shifted markedly. Pricing declined by (3.1)%, resulting primarily from strong

deflationary pressures on commodity products which have significantly impacted on gross profit and margins, including

the impact of selling through existing stocks at lower market prices.

All merchant businesses have been focused on driving volume by delivering great service and competitive prices for

customers. This has resulted in a positive response from customers and, as a consequence, volume performance improved

to flat year-on-year in the quarter.

Toolstation continues to see good growth across both the UK and Europe, benefitting from network maturity. Toolstation

UK delivered revenue growth of 7% in the third quarter whilst Toolstation Europe saw revenue growth of 9%.

Whilst overhead inflation remains elevated, the Group remains focused on actions to minimise the impact on

profitability. Working capital and capital expenditure continue to be tightly managed to reflect near term market

conditions.

Outlook

The Group's businesses will continue to focus on meeting customers' needs on pricing and service in order to be well

positioned when market conditions improve. With commodity deflation expected to continue and the exit rate from the

third quarter indicating further challenging conditions for the balance of the year, the Group now expects to deliver

an adjusted operating profit in the range of GBP175m to GBP195m for the full year.

Nick Roberts, Chief Executive, commented:

"Market conditions remain challenging with continued weakness across new build housing and domestic RMI. Deflation on

commodity products has also been greater than we had anticipated. In this environment, our priority has been to ensure

that we deliver for our customers, both on service and pricing, as we seek to retain and grow our customer base for the

medium to long term.

This is the right approach, demonstrated by our ability to maintain volumes in this difficult market. However, this has

impacted on our trading margins and is reflected in today's revised guidance.

With a strong balance sheet and leading customer propositions, we remain confident in our future prospects and work

continues to position the Group to benefit from the long-term structural drivers across our end markets, particularly

with the need to decarbonise the built environment and to build more homes in the UK becoming ever more pressing."

Q3 2023 Merchanting Toolstation Group

Volume (0.3)% 2.5% 0.0%

Price and mix (3.1)% 4.8% (1.8)%

Total revenue growth* (3.4)% 7.3% (1.8)%

Like-for-like revenue growth (2.9)% 4.4% (1.8)%

YTD 2023 Merchanting Toolstation Group

Volume* (6.4)% 2.6% (5.3)%

Price and mix 2.4% 6.0% 3.1%

Total revenue growth* (4.0)% 8.6% (2.2)%

Like-for-like revenue growth (4.1)% 5.0% (2.7)%

* Trading day adjusted

Travis Perkins Management team will be hosting a call for

analysts and investors at 8.00am BST. Details of the call are below

with participants requested to join 10 minutes before the scheduled

start time;

Guest dial in: +44 (0) 33 0551 0200

Please quote "Travis Perkins" when prompted by the operator

The person responsible for making this announcement is Alan

Williams, Chief Financial Officer.

Enquiries:

Travis Perkins FGS Global

Matt Worster Faeth Birch / Jenny Davey / James Gray

+44 (0) 7990 088548 +44 (0) 207 251 3801

matt.worster@travisperkins.co.uk TravisPerkins@fgsglobal.com

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement, transmitted by EQS

Group. The issuer is solely responsible for the content of this

announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BK9RKT01

Category Code: MSCH

TIDM: TPK

LEI Code: 2138001I27OUBAF22K83

OAM Categories: 2.2. Inside information

Sequence No.: 277150

EQS News ID: 1745833

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1745833&application_name=news

(END) Dow Jones Newswires

October 11, 2023 02:00 ET (06:00 GMT)

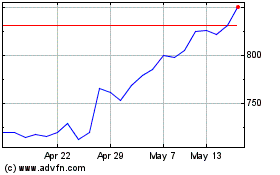

Travis Perkins (LSE:TPK)

Historical Stock Chart

From Apr 2024 to May 2024

Travis Perkins (LSE:TPK)

Historical Stock Chart

From May 2023 to May 2024