TIDMBOX

RNS Number : 4618O

Boxhill Technologies PLC

30 January 2019

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

30 January 2019

BOXHILL TECHNOLOGIES PLC

("Boxhill", the "Group" or the "Company")

Trading & Corporate Update, Return from Suspension &

Board Changes

The Board of Directors of the Company (the "Board") is pleased

to provide the following trading statement and update on recent

developments (the "Update").

Corporate Update

Boxhill is pleased to announce the publication of its audited

annual report and accounts for the year to 31 January 2018 (the

"Annual Report") both in an announcement released at 7.00 am today

(the "Announcement") and on the Company's website, in accordance

with its articles of association. Concurrent with the release of

the Update and the Announcement, the Company is also releasing the

unaudited six-month accounts for the period to 31 July 2018 (the

"Interims").

The Annual Report has variations to the unaudited preliminary

results announced on 30 July 2018. The variation is due to the

treatment of and the impact of the disposal of Emex (as announced

and defined in the announcement of 12 July 2018 and approved by

shareholders at the General Meeting held on 30 July 2018), and as

indicated in the Strategic Report section of the Annual Report, the

Board's decision not to capitalise significant expenditure relating

to the development of internal systems. This has had a material

effect on the company's performance for 2018.

In summary, for the year to 31 January 2018 the Group

performance was as follows:

-- Revenue : GBP1,367,000 (2017: GBP1,727,000)

-- Gross Profit : GBP914,000 (2017: GBP1,165,000)

-- EBITDA : Loss of GBP1,628,000 (2017: Profit of GBP38,000)

-- Depreciation & Amortisation : GBP122,000 (2017: GBP26,000)

-- (Loss)/profit before tax : Loss of GBP1,751,000 (2017: Profit of GBP2,000)

Further detail on the performance in the year to 31 January 2018

can be found in the Annual Report and the Announcement.

The Interims show an unaudited profit before tax of GBP2,793,000

for the six-month period to 31 July 2018 following the disposal of

Emex.

The Board intends to re-convene during February 2019 the

adjourned Annual General Meeting held on 31 July 2018 and lay the

accounts for the year to 31 January 2018 before shareholders (the

"AGM"). The Board also proposes to call a General Meeting, to be

held immediately after the AGM (the "GM"). The Board intends to

publish a notice of both the adjourned AGM and GM shortly.

At the GM, the Board will propose resolutions for the following

matters:

-- Prior to the suspension of the Company's ordinary shares of

0.1 pence each ("Ordinary Shares") on 1 August 2018 (the

"Suspension"), the Ordinary Shares were trading at a 55 per cent.

Discount to their nominal value. Following discussion with the

Company's financial adviser, the Board will propose a share capital

restructuring. This will consist of a sub-division of each Ordinary

Share into one new ordinary share of 0.001 pence each ("Interim

Ordinary Shares") and one deferred share of 0.099 pence each

("Deferred Shares"), followed by a consolidation of every 1,000

Interim Ordinary Shares into one consolidated new ordinary share of

1 pence each ("New Ordinary Shares"). Therefore, it will be

proposed at the GM that the existing 2,815,829,770 Ordinary Shares

will become 2,815,829 New Ordinary Shares and 2,815,829,770

Deferred Shares (the "Restructuring"). The Deferred Shares are

expected to have no value. The Board considers that having nearly

three billion shares issued has created a negative perception of

the Company and also exposes shareholders to undue volatility.

Accordingly, the Restructuring is proposed with a view to improving

the liquidity and perception of the New Ordinary Shares.

-- The Board proposes to change the name of the Company to St. James House PLC.

A further announcement will be made when the circular to

shareholders containing the above proposals and the notice of both

the adjourned AGM and GM is published.

Trading Update

Prize Provision Services Ltd. ("PPS"), which operates as an

External Lottery Manager licensed by the Gambling Commission, has

seen steady growth since July 2018 as a result of continued system

and process upgrades in conjunction with sales and account

management activity.

Sports Club Lottery, official partner of Nottinghamshire FA, has

launched new lotteries for several new sports clubs and is

providing administration services for hundreds of sports clubs

throughout Great Britain.

The lottery for the large membership organisation announced on 1

November 2018, has been through its initiation phase with the

launch of a dedicated website and completed test marketing

activities. Throughout 2019 a series of key marketing activities

tailored to appeal to the members of the organisation have been

planned and scheduled to encourage member enrolment into the

lottery.

In addition, PPS is planning new products to further increase

the capability for participating societies and charities to raise

funds. A scratch card product has recently been launched and will

be made available to all PPS clients. Expected to retail at GBP1

with a GBP1,000 top prize, the scratch-cards are expected to best

benefit those societies who regularly meet face to face with

supporters in any environment and offer an impulse purchase which a

subscription lottery does not.

Progress at Market Access Ltd., the Group's payment and foreign

exchange ("FX") business ("Market Access"), has seen the award of

an important licence in Mauritius, new banking relationships and

the soft launch of the Market Access FX platform to small number of

select clients. The feedback from those early clients is positive

and the wider roll out of the FX platform, supported by increased

sales and marketing activity begins in 2019.

The new Market Access M3 system, which incorporates the

Timegrand software (detailed in the announcement of 10 April 2017)

and brings together international payments, FX and merchant

services, is now operational. Market Access has signed contracts

for its initial low and medium risk card processing clients and the

integration process is almost complete, with meaningful revenues

expected to begin in the near future.

The ongoing commercial arrangement between Market Access and

Emex that was outlined in the announcement of 12 July 2018 has been

delayed in becoming operational due to circumstances within Emex

that have arisen after the disposal of Emex was completed on 20

July 2018, in particular:

-- Emex Technologies Ltd being placed into administration on 5 September 2018; and

-- The establishment that the historic relationship between the

Group and Net World Ltd, a company incorporated in Mauritius

("NetWorld") was one of contract rather than ownership, and thus

that as part of the Emex disposal, MDC Nominees Ltd acquired

contractual as opposed to beneficial indirect equity rights over

NetWorld.

The commencement of payments into the sinking fund outlined in

the announcement of 12 July 2018 has therefore been delayed,

however the Board remain confident that the Company will receive

the full GBP2,000,000 repayment of the Loan Note (as defined in the

announcement of 12 July 2018) within the ten-year term of the Loan

Note.

AstroKings, the all-weather soccer pitch business located in

Nottingham in which the Group holds a carried interest through its

Soccerdome Ltd subsidiary, is seeing the benefit from both

improvements to the physical infrastructure and improved marketing,

however it is not expected to make a material contribution to the

Group's finances in the short or medium term.

Return from Suspension

Following the publication of the Annual Report and the

announcement of the Interims, the Company has requested that

trading in its Ordinary Shares resumes on AIM at 7.30 am today.

Board Changes

The Company is pleased to announce the appointment to the Board

of Graeme Paton as Chief Executive Officer and Cath McCormick as

Finance Director with effect from 30 January 2019.

Graeme joined the group as part of the acquisition in 2016 of

Emex, and since then he has held the position of Chief Technology

Officer within the Payments Division of the Group. Having founded

and built an international road transport and distribution business

between 1986 and 2003, Graeme has focussed on the technology sector

for the last 15 years. Over the last two years, Graeme has overseen

the integration of the different technologies utilised within the

Group into a platform the Board believe has great potential for the

future.

Cath also joined the Group in 2016 as Financial Controller. A

Chartered Management Accountant, Cath has worked in the finance

departments of financial services companies for over 20 years,

starting her career with Cooperative Insurance Society before

moving to Arrow Global (formerly Capquest), a leader in the

secondary consumer debt purchase sector. Cath has been responsible

for the day-to-day operation of the Group's financial and

management accounting function for over two years.

Andrew Flitcroft is stepping down from the Board with effect

from 1 February 2019 but will continue to act as Company Secretary

for Boxhill.

The Company also confirms that Clive Hyman (Non-Executive

Director) and Tim Razzall (Executive Chairman) will not be seeking

re-election at the Annual General Meeting for the year to 31

January 2019, which is expected to be held in June or July 2019.

The Company will seek to recruit a Non-Executive Chairman and

Senior Independent Non-Executive Director during the intervening

period.

For further information, contact:

Boxhill Technologies PLC

Lord Razzall, Executive Chairman

Website www.boxhillplc.com 020 7493 9644

Allenby Capital Limited

(Nomad, Financial Adviser & Broker)

John Depasquale / Nick Harriss 020 3328 5656

Disclosures pursuant to Rule 17 and Schedule 2 (g) of the AIM

Rules for Companies in respect of the appointments of Graeme David

Paton and Catherine Anne McCormick are set out below:

Graeme David Paton

Age 53

Current Directorships and Partnerships

Global Wine Distributors Limited

Thisway Scot Limited

Timegrand Limited (Group company)

Former Directorships and Partnerships within the last five

years

Drumpellier and Mount Vernon Estates Limited

EmexConsult Ltd (former Group company)

Emex Technologies Limited (former Group company)

Emex (UK) Group Limited (former Group company)

Launch Digital Ltd

Nationwide Auto Enrolment Limited

Emex Technologies Limited was placed into administration on 5

September 2018. Mr Paton was a director between 12 December 2017

and 30 July 2018. Emex Technologies Limited was a subsidiary of

Boxhill from 31 January 2016 to 30 July 2018. The administration

remains in process and the final quantum of losses to creditors is

not clear at this time.

Mr Paton owns 25,000,000 Ordinary Shares in the Company

representing 0.89 per cent. of the Company's existing issued share

capital.

Catherine Ann McCormick

Previous surname - Robinson-McCormick

Age 44

Current Directorships and Partnerships

Catherine McCormick Financial Consulting Limited

St. James House Ltd (Group company)

Former Directorships and Partnerships within the last five

years

Market Access Ltd (Group company)

Ms McCormick holds options over 20,000,000 Ordinary Shares

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

SRSCKCDBOBKDADB

(END) Dow Jones Newswires

January 30, 2019 02:00 ET (07:00 GMT)

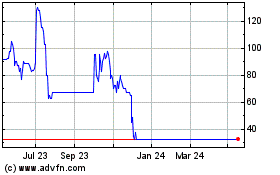

Tintra (LSE:TNT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Tintra (LSE:TNT)

Historical Stock Chart

From Nov 2023 to Nov 2024