TIDMTIDE

RNS Number : 4804K

Crimson Tide PLC

22 September 2016

Crimson Tide plc

("Crimson Tide" or "the Company")

Interim Results for the six months ended 30 June 2016

Crimson Tide, a leading service provider of mobile data

solutions for business (AIM: TIDE.L) announces its unaudited

interim results for the six months ended 30 June 2016.

Highlights

-- Profit Before Tax doubled to GBP122k (1H 2015: GBP60k);

-- Revenues 25% up on 1H 2015 (GBP845k vs. GBP673k)

-- More significant customers added

-- Balance Sheet reconstruction completed

Barrie Whipp, Executive Chairman, commented,

"We have continued to build and grow mpro5 into, in our opinion,

the leading full service mobility service for organisations. We are

expanding our team and our footprint and commencing an investment

programme for further growth, both in our existing markets and

overseas."

Enquiries:

Crimson Tide plc Barrie

Whipp / Steve Goodwin 01892 542444

WH Ireland Limited James

Joyce / James Bavister 020 7220 1666

Chairman's Statement

I am very pleased to report on the Company's progress for the

first half of 2016. Once again, we exceeded all of our key

indicators and of particular note, Profit after Tax for the period

increased by 100% to GBP122k on increased turnover. We have

achieved record subscriber numbers but our most recent contract

wins are enterprise level agreements which place less relevance on

user numbers and more on net revenues.

We have consolidated agreements with leading facilities

management groups and can report that mpro5 is used in over 15,000

sites in the UK and Ireland. Our long term revenue has continued to

increase and is underpinned by significant contracts. Our retail

implementations have gone well and there is more opportunity in

this sector, where we are offering new solutions to our

clients.

Our growth is reflected not only in profitability but also in

terms of cash where we are well placed. Lombard Technical Services

continue to support our contracts where devices are required and we

remain confident of our ability to fulfil contract wins.

We are now starting to invest in expansion of our sales channels

in the UK and overseas with confidence. We expect this strategy to

start to bear more fruit late in the second half and the coming

year and is focused upon four or five areas where we believe that

mpro5 can fulfil demand.

I am encouraged by our activities with Vodafone in Ireland and

we are hopeful of expanding this relationship in the UK and

overseas.

Technically mpro5 is in extremely good shape. We have added

modules to the service based upon customer demand and have an

extremely high satisfaction rating. We are currently working on a

significant platform change for the mobile application investing in

the latest Angular 2 framework. We are also adding Internet of

Things capabilities into mpro5 and have a new proprietary alerting

platform, which has replaced a third party product, thereby

increasing margins further.

In the healthcare world, we are progressing with a range of

transactions and are hopeful of further news soon. There is little

doubt that pharma offers enormous opportunities for mpro5.

Our capital reorganisation was successful and allows the

Directors to recommend a dividend when appropriate.

The board is extremely pleased with the Company's progress. The

positive decision to invest in further growth opportunities is

designed to grow our top line revenues which, with our high

margins, should see bottom line improvements after absorbing short

term increases in sales and marketing overhead. For the first time

we will see Crimson Tide with sales channels outside the UK &

Ireland. We are excited for the future.

Barrie Whipp

Executive Chairman

22 September 2016

Operating and Financial Review

I am pleased to review our operating and financial performance

over the first half of 2016 and comment on our results for the six

months to 30 June 2016.

Operating Review

The year commenced on a very positive note following the earlier

than expected full rollout of the Company's mpro5 solution with one

of the country's leading retailers. This highlighted two factors;

one, the ease with which we were able to organise and install our

mpro5 solution nationwide and two, the value placed on mpro5 by our

customers, immediately allowing them to reap the operational and

financial benefits from adopting the solution. mpro5 has since

started to be implemented elsewhere in the retail sector and we

announced in July 2016 a new pilot with another retailer to monitor

store safety, cleanliness and security.

The flexibility of our mpro5 solution means it is able to

generate value across a wide range of different markets. Elsewhere,

in healthcare, we remain very encouraged by the number of

opportunities we are working on including a pilot project for the

serialisation and verification of pharmaceutical products. Here,

mpro5 provides barcode scanning and cloud--based synchronisation

services via Microsoft Azure, which enables real--time information

to be uploaded, quickly verified and communicated to users. Job

scheduling, tracking, bespoke dashboards, all add value ensuring

mobile users are able to work most efficiently. Our investment in

mpro5 continues and we aim to make sure it remains a leading

solution as technological advances continue apace.

The nature of some of our business is moving to bigger,

enterprise solutions. The customer's commitment is unchanged,

signing a subscriber agreement for typically an initial thirty-six

month term. However, our pricing in these cases reflects the large

numbers of users expected. Furthermore, we are finding more

opportunities abroad and as mentioned in the Chairman's statement,

we are investing in overseas sales resources and related marketing

to be able to progress these most effectively. The positive

cashflows we are generating together with the security of funding

available from Lombard Technical Services to finance devices

provided as part of our solution, means the Company's directors are

comfortable with this increased expenditure. There may as a result

be some short term impact on our rate of profitability growth but

we expect over the medium term to generate additional revenues and

greater profits.

Financial Review

Turnover for the six months to 30 June 2016 increased to

GBP845k, up 25% on the same period in 2015. With gross profit

margins still over 90% and operating margins before depreciation,

amortisation and interest of 33%, up from 29% in 1H 2015, the

additional investments previously made in staff have been more than

compensated for by increased profitability.

After depreciation, amortisation and interest costs, the Group

achieved a profit of GBP122k in the first half 2016 (1H 2015:

GBP60k).

There have been no changes to Crimson Tide's accounting policies

which can be found in the notes to the published 2015 Consolidated

Financial Statements available on our website,

www.crimsontide.co.uk.

It should be noted, however, that early in 2016, the Company

completed its capital reconstruction and now has positive retained

earnings in the Balance Sheet to allow the Company to, if

appropriate, pay dividends in the future. Shareholders also

approved future share buy-backs at the General Meeting, again if

thought by the directors to be appropriate. This exercise together

with the positive cashflows generated by the Group means the

financial position of Crimson Tide looks favourable at the half

year and has further improved since as net funds have continued to

increase.

Future Prospects

The outlook for the business remains very positive. Our mpro5

solution has continually proved a sound investment for our

customers even as these customers have become more sizable and/or

more geographically spread. The Board and team at Crimson Tide are

working hard on behalf of shareholders to ensure that our

reputation and success continue to advance.

Stephen Goodwin

Finance Director

22 September 2016

Crimson Tide plc

Unaudited Consolidated Income Statement for the 6 months to 30

June 2016

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

ended ended ended

30 June 30 June 31

2016 2015 December

2015

GBP000 GBP000 GBP000

Revenue 845 673 1,402

Cost of Sales (71) (62) (104)

Gross Profit 774 611 1,298

Overhead expenses (493) (413) (868)

Earnings before interest,

tax, depreciation & amortisation 281 198 430

Depreciation & Amortisation (142) (132) (245)

Profit from operations 139 66 185

Interest income - - -

Interest payable and similar

charges (17) (6) (17)

---------- ---------- -----------

Profit before taxation 122 60 168

Taxation - - -

---------- ---------- -----------

Profit for the year attributable

to equity holders of the

parent 122 60 168

========== ========== ===========

Earnings per share Unaudited Unaudited Audited

6 Months 6 Months 12 Months

ended ended ended

30 June 30 June 31

2016 2015 December

2015

Basic and diluted earnings

per Ordinary Share 0.03p 0.01p 0.04p

(see Note 2)

Unaudited Consolidated Statement of Comprehensive Income

for the 6 months to 30 June 2016

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

ended ended ended

30 June 30 June 31

2016 2015 December

2015

GBP000 GBP000 GBP000

Profit for the period 122 60 168

Other comprehensive income/(loss)

for period:

Exchange differences on

translating foreign operations 1 (5) (5)

Total comprehensive profit

recognised in the period

and attributable to equity

holders of parent 123 55 163

========== ========== ===========

Unaudited Consolidated Statement of Financial Position at 30

June 2016

Unaudited Unaudited Audited

As at As at As at

30 June 30 June 31 December

2016 2015 2015

GBP000 GBP000 GBP000

Fixed Assets

Intangible assets 1,452 1,308 1,373

Equipment, fixtures & fittings 458 390 527

1,910 1,698 1,900

Current Assets

Inventories 14 11 15

Trade and other receivables 495 346 634

Cash and cash equivalents 661 499 539

Total current assets 1,170 856 1,188

Total assets 3,080 2,554 3,088

Equity and liabilities

Equity

Share capital 447 7,335 7,335

Capital redemption reserve - 49 49

Share premium 28 1,090 1,090

Other reserves 422 421 421

Reverse acquisition reserve (5,244) (5,244) (5,244)

Retained earnings 6,533 (1,726) (1,618)

Total Equity 2,186 1,925 2,033

Creditors

Amounts falling due within

one year 638 513 806

Creditors

Amounts falling due after

more than one year 256 116 249

Total liabilities 894 629 1,055

Total equity and liabilities 3,080 2,554 3,088

Unaudited Consolidated Statement of Changes In Equity at 30 June

2016

Capital Reverse

redemp-tion acquisi-tion

Share reserve Share Other reserve Retained

capital premium reserves earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Balance

at 31 December

2014 7,335 49 1,090 426 (5,244) (1,786) 1,870

Profit for

the period - - - - - 60 60

Translation

movement - - - (5) - - (5)

Balance

at

30 June

2015 7,335 49 1,090 421 (5,244) (1,726) 1,925

Balance

at 31 December

2015 7,335 49 1,090 421 (5,244) (1,618) 2,033

Profit for

the period - - - - - 122 122

Capital

reconstruction

(*) (6,890) (49) (1,090) - - 8,029 -

Share options

exercised 2 - 28 - - - 30

Translation

movement - - - 1 - - 1

Balance

at

30 June

2016 447 - 28 422 (5,244) 6,533 2,186

---------- ------------- ---------- ----------- -------------- ----------- --------

(*) At the Company's General Meeting on 26 January 2016

shareholders approved plans to undertake a capital reconstruction,

the purpose of which was to create positive retained earnings in

the Balance Sheet to allow the Company to, if appropriate, pay

dividends in the future. Shareholders also approved future share

buy-backs. Following a court hearing on 24 February 2016 the court

confirmed the reduction of capital of the Company. The nominal

value of each Ordinary Share in the Company reduced from one penny

to 0.1 pence per share and the Company's Deferred Shares of 19

pence each, Share Premium Account and Capital Redemption Reserve

were cancelled. Trading in the shares with a nominal value of 0.1

pence commenced on 25 February 2016.

Unaudited Consolidated Statement of Cashflows for the 6 months

to 30 June 2016

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

ended ended ended

30 June 30 June 31 December

2016 2015 2015

GBP000 GBP000 GBP000

Cash flows from operating

activities

Profit before tax 122 60 168

Adjustments for:

Amortisation of Intangible

Assets 48 52 90

Depreciation of equipment,

fixtures and fittings 94 80 155

Profit on Sale of Assets - - -

Net Interest 17 6 17

Operating cash flows before

movement in working capital

and provisions 281 198 430

Decrease in inventories 1 19 15

Decrease/(increase) in

trade and other receivables 134 217 (71)

(Decrease)/increase in

trade and other payables (204) (73) 147

Cash generated from operations 212 361 521

Taxes paid - - -

Net cash generated in operating

activities 212 361 521

--------- --------- ------------

Cash flows used in investing

activities

Purchase of fixed assets (150) (230) (552)

Sale of fixed assets - - -

Interest received - - -

Net cash used in investing

activities (150) (230) (552)

--------- --------- ------------

Cash flows from financing

activities

Net proceeds from issues

of shares 30 - -

Interest paid (17) (6) (17)

Net increase in borrowings 48 135 347

Net cash from/(used in)

financing activities 61 129 330

--------- --------- ------------

Net increase in cash and

cash equivalents 123 260 299

Net cash and cash equivalents

at beginning of period 538 239 239

--------- --------- ------------

Net cash and cash equivalents

at end of period 661 499 538

--------- --------- ------------

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

ended ended ended

30 June 30 June 31 December

2016 2015 2015

GBP000 GBP000 GBP000

Analysis of net funds:

Cash and cash equivalents 667 499 539

Bank overdraft (6) - (1)

661 499 538

Other borrowings due within

one year (198) (78) (157)

Borrowings due after one

year (256) (116) (249)

Net funds 207 305 132

Crimson Tide Plc

Notes to the Unaudited Interim Results for the 6 months ended 30

June 2016

1. Basis of preparation of interim report

The information for the period ended 30 June 2016 does not

constitute statutory accounts as defined in section 434 of the

Companies Act 2006. It has been prepared in accordance with the

accounting policies set out in, and is consistent with, the audited

financial statements for the twelve months ended 31 December 2015.

A copy of the statutory accounts for that period has been delivered

to the Registrar of Companies. The auditor's report on those

accounts was unqualified and did not contain statements under

Section 498 (2) or (3) of the Companies Act 2006.

2. Earnings per share

The calculation of the basic earnings per share is based on the

profit attributable to ordinary shareholders and the weighted

average number of ordinary shares in issue during the period.

The calculation of the diluted earnings per share is based on

the profit per share attributable to ordinary shareholders and the

weighted average number of ordinary shares that would be in issue,

assuming conversion of all dilutive potential ordinary shares into

ordinary shares.

Reconciliations of the profit and weighted average number of

ordinary shares used in the calculation are set out below:

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

ended ended ended 31

30 June 30 June December

2016 2015 2015

Basic and diluted earnings

per share

Reported profit (GBP000) 122 60 168

Reported profit per

share (pence) 0.03 0.01 0.04

Unaudited Unaudited Audited

6 Months 6 Months 12 Months

ended ended ended 31

30 June 30 June December

2016 2015 2015

No. 000 No. 000 No. 000

Weighted average number

of ordinary shares:

Shares in issue at

start of period 445,486 445,486 445,486

Effect of shares issued 197 - -

during the period

------------ ------------ ------------

Weighted average number

of ordinary shares 445,683 445,486 445,486

------------ ------------ ------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UAOSRNSAKUAR

(END) Dow Jones Newswires

September 22, 2016 02:00 ET (06:00 GMT)

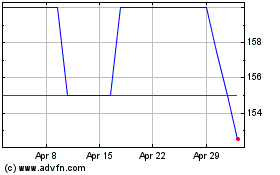

Crimson Tide (LSE:TIDE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Crimson Tide (LSE:TIDE)

Historical Stock Chart

From Apr 2023 to Apr 2024