TIDMTHRU

RNS Number : 0389T

Thruvision Group PLC

22 November 2021

22 November 2021

Thruvision Group plc

(" Thruvision " or the " Group ")

Interim Results for the six months ended 30 September 2021

Thruvision (AIM: THRU), the specialist provider of 'safe

distance' people-screening technology to the international security

market, announces its unaudited results for the six months ended 30

September 2021 .

Key Highlights

-- Revenue for the six months ended 30 September 2021 was GBP2.0

million (H1 2021: GBP4.7 million).

-- Trading since 30 September has strengthened significantly and

confidence about H2 trading is strong.

-- Profit Protection revenue grew by 50% to GBP1.0 million in

the first half (H1 2021: GBP0.65 million) and a further GBP1.7

million of orders have since been received.

-- Since the end of H1 we have received a major order from Tesco,

the leading UK retailer, following its decision to deploy Thruvision

at scale across its UK distribution network.

-- Last year's large H1 sale to US Customs and Border Protection

(CBP) was not repeated this year but strong engagement during

H1 supports confidence of expected order-flow in H2.

-- Transportation Security Administration (TSA) accreditation

testing continued after the Covid-19 hiatus.

-- The Group's EBITDA loss was GBP1.6 million (H1 2021: breakeven

) and gross margin of 49% (H1 2021: 48%)

-- Cash balance at 30 September 2021 was GBP4.1 million (31 March

2021: GBP7.3 million), with cash at 19 November 2021 of GBP4.0

million.

Commenting on the results, Colin Evans, Chief Executive of

Thruvision, said:

"We have seen steadily building momentum since the spring, with

continued strong performance in our Profit Protection market in

particular. We are delighted to add Tesco to our growing list of

major users and are pleased with the increasing traction we are

seeing with retailers in Europe and the US. We have been very

active helping US Customs and Border Protection (CBP) respond to

the rapid increase in immigration levels on the southern border and

anticipate future orders as a result . We are increasingly

confident that both Profit Protection and CBP can deliver strong

growth over the short to medium term, and that we are well

positioned to benefit from the ongoing recovery in the global

aviation sector. As a result, we remain confident of achieving

growth in full year revenue and an improvement in our cash position

in H2."

For further information please contact:

Thruvision Group plc +44 (0)1235 425 400

Tom Black, Executive Chairman

Colin Evans, Chief Executive

Investec Bank plc +44 (0)20 7597 5970

Patrick Robb / James Rudd / Sebastian Lawrence

FTI Consulting LLP +44 (0)20 3727 1000

Matt Dixon / Tom Blundell

About Thruvision

Thruvision is the leading provider of safe distance, people

security screening technology. Using patented passive terahertz

technology, Thruvision is uniquely capable of detecting metallic

and non-metallic threats including weapons, explosives and

contraband items that are hidden under clothing, at distances

between 3m and 10m. Addressing the growing need for safe, fast and

effective security, Thruvision completely removes the need for

physical "pat-downs" and has been vetted and approved by the US

Transportation Security Administration for surface transportation.

Operationally deployed in 20 countries around the world, Thruvision

is used for aviation and transportation security, retail supply

chain loss prevention, facilities and public area protection and

customs and border control. The company has offices near Oxford and

Washington DC.

www.thruvision.com

Half year report

for the six months ended 30 September 2021

Chairman's Statement

The Group's trading momentum has continued to build strongly

this financial year, particularly in Profit Protection, although

first half revenue of GBP2.0 million (H1 2021: GBP4.7 million, H2

2021: GBP2.0 million) was reduced due to sales slipping into early

H2 as described in the Trading Update of 7 October. Last year's H1

comparator included material revenue of GBP2.9 million from a US

CBP order which was not repeated in H1 this year although we do

anticipate further order flow from this customer in H2.

Encouragingly, we have already added a further GBP1.7 million of

Profit Protection orders since the end of September.

Profit Protection revenue grew by 50% over H1 and, as with

previous periods, this growth continues to come from both existing

customers, including ASOS, JD Sports and Next as they open new

distribution centre capacity, and from new customers attracted by

our success at existing installations. We are particularly pleased

that since the end of H1, Tesco has become the latest major UK

retailer to invest in a substantial rollout following a pilot

programme that demonstrated a strong return on investment. We are

encouraged by progress in both the US and Europe where we have

invested in further sales capacity in the last six months. This

progress has convinced us that our Profit Protection revenues are

now set on a long-term growth path.

In our Customs segment, the absence of CBP orders in H1 reduced

our headline revenue, but we are increasingly confident about the

scale of the opportunity with this important customer. With growing

immigration pressure on the US southern border, many of our

existing installed units have been redeployed to meet this

challenge and we have worked closely with CBP to effect this. This

close engagement has revealed the significant value our solution

provides, and we are increasingly confident of a further

significant expansion of Thruvision deployments by CBP over the

next year.

In our third key market, Aviation, traffic levels are starting

to recover, and we continue to progress through the TSA

accreditation process. Although this has been a slow and often

frustrating process, contactless security remains a priority for

the global aviation industry, and we remain well placed to meet

this need when accredited and as the global aviation industry

recovers.

Thanks to the hard work and determination of our staff, the

business has come through the pandemic well, albeit with our growth

trajectory delayed, and we are now confident that the worst effects

of Covid-19 are behind us. Our other major recent concern relates

to the well-publicised supply chain issues disrupting much of

industry and our team has worked hard to mitigate its impact on our

business. I am pleased to report that our supplies of essential

components have been largely protected and that our key supplier

relationships remain very strong.

Outlook

With Profit Protection performing strongly, growing confidence

about our strategic prospects with CBP and continued improvements

in broader international market conditions, we remain confident of

achieving growth in full year revenue and an improvement in our

cash position in H2 as the business returns to its pre-pandemic

growth trajectory .

Strategic Update

Thruvision addresses the growing international need to safely,

quickly and comprehensively security screen individuals for

weapons, contraband or other illicit items that might be concealed

in their clothing. As reported previously, the pandemic has seen

many organisations look to replace metal detectors and airport body

scanners given they both require physical contact between security

guards and individuals to resolve alarms. By operating at a

physically distant range of several metres, Thruvision cameras

completely remove the need for physical searches.

With this important differentiator and our growing flagship

customer list, we believe we have now established ourselves in the

mainstream international security market. Our Profit Protection

market in the UK, US and Europe is recovering strongly from

Covid-19, international customs agencies are very active again as

borders reopen, and the recovery of the global aviation industry is

now underway.

Business Review

Profit Protection

Our Profit Protection market continues to be driven by the rapid

growth in online retailing and home delivery services. Theft by

employees in distribution centres of easy-to-conceal, high value

items such as fashion apparel, cosmetics, electronics, alcohol and

tobacco continues to be a significant problem which many retailers

struggle to address.

Order-flow has steadily picked up since the end of the spring

lockdown in the UK. Against full year Profit Protection revenue of

GBP2.0 million in FY 2021, we recorded GBP1.0 million of revenue in

the first half and have added GBP1.7 million of new orders since

the end of September. This performance has come from a number of

customers including Next, Boots, JD Sports, ASOS, THG, Clipper and

CEVA either adding units to new or upgraded distribution centres or

upgrading old Thruvision models to our latest LPC product family,

designed specifically for the Profit Protection market. We are

particularly pleased that since the end of H1 Tesco has become the

latest major UK retailer to invest in a substantial rollout

following an initial pilot programme that demonstrated a strong

return on investment.

In addition to the UK, we have installed units in The

Netherlands, Germany, Ireland, Poland and the US in the period and

our new sales teams covering Eastern Europe, Western Europe and the

US are making excellent progress in building the broader sales

pipeline.

Half year report (continued)

for the six months ended 30 September 2021

Customs

This is a well-established Thruvision market, where our ability

to detect predominantly non-metallic, prohibited items such as cash

and drugs at all types of border checkpoint means we have no direct

competition. We have equipment in service with nine international

customs agencies, but CBP represents, by some distance, our single

largest opportunity in this market.

Although we did not receive any orders from CBP in the first

half (H1 2021: CBP order value GBP3.8 million), the Chief Privacy

Officer for US Department of Homeland Security approved

Thruvision's operational use by CBP and we have trained over 700

officers in the last few months. We have partnered with one of

CBP's major equipment providers and as a result have made the

Thruvision product range available for purchase via the US

Government Services Administration (GSA) purchasing portal. Given

the mounting pressure on the southern border with Mexico in

particular, we are seeing strong operational demand for further

units, and we are increasingly confident that we will see further

significant order-flow from CBP, via our chosen partner in this

area, in H2 and beyond.

Our interactions with a number of other customs agencies in

Asia, the Gulf, and UK Border Force have increased as borders have

re-opened, and we therefore foresee a growing opportunity in the

broader customs market beyond CBP.

Aviation

Global aviation is starting to recover as governments and

airline operators establish various Covid-19 management protocols,

with the reopening of UK / US travel the latest example. Our

primary focus remains moving through the TSA accreditation process

where slow but positive progress has been made. We are seeing a

pick-up in enquiry rates from airlines and airports both in the US

and the UK where our contactless detection capability is recognised

as a key differentiator. We expect "Detection at Range" (as

described by TSA) to become a formalised equipment category,

alongside existing airport body scanners and metal detections, in

due course.

Other

The entrance security and surface transportation markets remain

a lower priority for us at this time. Nevertheless, a number of

recent, fatal workplace shootings in the US have resulted in some

of our retail customer prospects also expressing interest in our

products enabling "dual-use" deployments covering both outgoing

theft and incoming firearms detection.

We have also seen increasing interest and some early sales into

two new niche markets. In the Prisons market, we have sold units to

both Australia and The Netherlands where authorities are aiming to

use our technology to disrupt the flow of contraband within

prisons. Within the natural resources sector, we are seeing

interest from mining and mineral processing businesses which are

concerned about the theft of a range of items including precious

metals and blasting explosives. In both these markets, no other

technology provides the detection performance and flexibility of

deployment that Thruvision can achieve.

Product Range

We launched fully our extended product range during the early

part of H1. Using our modular hardware architecture, we are now

using different software functionality to meet the specific needs

of each of our different markets. We have recently launched our

AI-based "Dynamic Detection" algorithm, developed to meet aviation

accreditation requirements, to the Profit Protection market. This

will enable faster employee screening which will, in many cases,

strengthen the business case to invest in Thruvision

technology.

Manufacturing

Our manufacturing capability remains robust, and our principal

suppliers have traded well through the pandemic. We are only seeing

supply-chain issues in generic components such as power supplies

and PCs, which we have been able to manage effectively to date. It

remains our intention to assemble products for the US market in

that country and, with modest further investment in manufacturing

capacity, we expect to complete the outsourcing of US assembly and

test of our cameras to our Florida-based partner in the remainder

of this year. This will have the added benefit of scaling-up our

production capacity and our business resilience.

People

Overall headcount remained constant at 42 during the period as

the Group reduced administrative support but strengthened its US

team and grew the Profit Protection sales team in Europe. We also

added a new VP Software to continue to develop our product range

through further software innovation.

Half year report (continued)

for the six months ended 30 September 2021

Financial review

Financial results

During the six months ended 30 September 2021, revenues were

GBP2.0 million (H1 2021: GBP4.7 million, FY 2021: GBP6.7 million).

H1 2021 contained a single order from US Customs and Border

Protection (CBP) resulting in revenue of GBP2.9 million in the

period which did not recur in H1 2022, although further orders from

CBP are anticipated in H2 2022 Gross margin increased slightly from

the prior period to 49% (H1 2021: 48%, FY 2021: 48%), where the mix

of units sold, and unit pricing were similar.

The Group EBITDA loss was GBP1.6 million (H1 2021: breakeven, FY

2021 loss of GBP1.5 million). Operating loss in the period was

GBP2.0 million (H1 2021: loss of GBP0.5 million), FY 2021: loss of

GBP2.8 million).

Cash at 30 September 2021 was GBP4.1 million (31 March 2021:

GBP7.3 million), with cash at 19 November 2021 of GBP4.0 million.

Some GBP0.8 million of this reduction in cash during H1 relates to

increases in our stock balance to support expected orders in

H2.

Financial summary

6 months 6 months 12 months

ended ended ended

30-Sep-21 30-Sep-20 31-Mar-21

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

-------------------------------------------- ---------- ---------- ----------

Revenue 1,962 4,653 6,700

Cost of sales (1,001) (2,397) (3,486)

-------------------------------------------- ---------- ---------- ----------

Gross Profit 961 2,256 3,214

-------------------------------------------- ---------- ---------- ----------

EBITDA (1,580) 12 (1,501)

-------------------------------------------- ---------- ---------- ----------

Depreciation and amortisation (285) (245) (518)

Share based payments (LTIP) (138) (177) (409)

FX gains/(losses) (1) (92) (329)

(2,757

Operating profit / (loss) (2,004) (502) )

-------------------------------------------- ---------- ---------- ----------

Finance revenue 10 11 22

Finance costs (7) (11) (21)

-------------------------------------------- ---------- ---------- ----------

Profit / (Loss) before tax (2,001) (502) (2,756)

-------------------------------------------- ---------- ---------- ----------

Income tax 87 108 266

-------------------------------------------- ---------- ---------- ----------

Profit / (Loss) for the period / year from

continuing operations (1,914) (394) (2,490)

-------------------------------------------- ---------- ---------- ----------

Discontinued operations

-------------------------------------------- ---------- ---------- ----------

Profit/(loss) from discontinued operations

(net of tax) (33) 41 2

-------------------------------------------- ---------- ---------- ----------

Profit / (Loss) for the period / year (1,947) (353) (2,488)

-------------------------------------------- ---------- ---------- ----------

Half year report (continued)

for the six months ended 30 September 2021

Key Performance Indicators ("KPIs")

The Group considers the following to be the relevant KPIs which

track the trading performance and position of the business.

6 months 6 months 12 months

ended ended ended

Financial KPIs 30-Sep-21 30-Sep-20 31-Mar-21

GBP'000 GBP'000 GBP'000

--------------------------------- ---------- ---------- ----------

Revenue 1,962 4,653 6,700

--------------------------------- ---------- ---------- ----------

Average revenue per unit sold * 73 72 67

--------------------------------- ---------- ---------- ----------

Gross Profit 961 2,256 3,214

--------------------------------- ---------- ---------- ----------

Gross Margin 49% 48% 48 %

--------------------------------- ---------- ---------- ----------

Overheads ** (2,827) (2,538) (5,282)

--------------------------------- ---------- ---------- ----------

(1,501

EBITDA profit / (loss) (1,580) 12 )

--------------------------------- ---------- ---------- ----------

* Average revenue per unit has been recalculated from the

figures presented in previous financial periods. The above

comparative data now excludes warranty and support revenue which is

separately analysed out below.

** Overheads exclude the share-based payment charge as well as

foreign exchange gains and losses. See Overheads table on page 6

for further detail.

Non-financial KPIs 6 months 6 months 12 months

30-Sep-21 30-Sep-20 31-Mar-21

---------------------------------- ----------- ----------- -----------

No of units sold 22 58 84

Number of staff at end of period 42 39 42

---------------------------------- ----------- ----------- -----------

Revenue

Thruvision revenues were GBP2.0 million in the six months to 30

September 2021 (H1 2021: GBP4.7 million, FY 2021: GBP6.7 million).

Revenues has been split between our three principle activities

(unit sales, warranty and support revenue and research and

development revenues) as below.

Unit volumes of 22 (H1 2021: 58 units, FY 2021: 84 units) were

achieved in the period despite challenges presented by Coronavirus

and the continuing weakness in the Aviation and Customs sectors. 19

of these units were in Profit Protection (H1 2021: 11 units, FY

2021: 36 units).

Revenue 6 months 6 months 12 months

30-Sep-21 30-Sep-20 31-Mar-21

GBP'000 GBP'000 GBP'000

---------------------- ---------- ---------- ----------

Units 1,607 4,149 5,666

Warranty and support 300 349 836

Development 55 155 198

----------------------- ---------- ---------- ----------

Total 1,962 4,653 6,700

The principal growth driver for the business is unit sales and,

while we expect to continue to be awarded customer funded

development contracts, we do not expect this to form a material

proportion of revenues in the future.

Half year report (continued)

for the six months ended 30 September 2021

Gross Profit Margin

Gross margin increased marginally to 49% in the year (H1 2021:

48%, FY 2021: 48%) principally due to warranty and support revenue

making up a higher proportion of total revenue than in the

comparative periods.

Gross Margin 6 months 6 months 12 months

30-Sep-21 30-Sep-20 31-Mar-21

GBP'000 GBP'000 GBP'000

---------------- ---------- ---------- ----------

Revenue 1,962 4,653 6,700

Gross Profit 961 2,256 3,214

----------------- ---------- ---------- ----------

Gross margin % 49% 48% 48%

----------------- ---------- ---------- ----------

Administrative expenses

Overheads increased by 11.4% to GBP2.8 million compared to the

corresponding period in FY21. This was mainly due to investment to

drive growth in the US and Europe Profit Protection markets which

was partly offset by reduced international travel as a result of

the lockdown.

Sales and marketing expenditure increased by GBP163k to target

growth in our European and US profit protection markets.

Engineering costs include Manufacturing and R&D costs which

have increased as a result of additional recruitment in our

software department as we look to scale up and increase our product

offerings going forwards.

Administrative expenses 6 months 6 months 12 months

30-Sep-21 30-Sep-20 31-Mar-21

GBP'000 GBP'000 GBP'000

------------------------------- ---------- ---------- ----------

Engineering 756 688 1,403

Sales and marketing 983 820 1,718

Property and administration 224 220 469

Management 338 321 642

PLC costs 241 244 532

Depreciation and amortisation 285 245 518

------------------------------- ---------- ---------- ----------

Overheads 2,827 2,538 5,282

------------------------------- ---------- ---------- ----------

Share based payments

(LTIP) 138 177 409

Foreign exchange losses/(gains) 1 92 329

Total administration

costs 2,966 2,807 6,020

--------------------------------- ----- ----- -----

Loss from continuing operations

Losses from continuing operations in the period were (GBP1.9

million) (H1 2021: (GBP0.4 million), FY 2021: (GBP2.5 million))

including share-based payments.

Thruvision continues to invest in sales and marketing

activities, developing new markets and segments, whilst further

investing in our engineering and manufacturing capacity including

R&D.

Half year report (continued)

for the six months ended 30 September 2021.

Cash Flows

Cash and cash equivalents at 30 September 2021 were GBP4.1

million (H1 2021: GBP5.0 million, FY 2021: GBP7.3 million), with

the principal movements in the period being the loss recorded in

the period as well as the net GBP1.6 million working capital

movements as per the cashflow statement on page 12.

Movements in working capital were as follows:

-- GBP0.8 million of the reduction in cash since the start of

the period relates to increases in our stock balance to support

expected orders in Q3 2022.

-- GBP0.5 million relates to a reduction in deferred revenue balances

during the period, as revenues deferred as at 31 March 2021

was recognised as income in the period.

-- A further net GBP0.4 million relates to a net decrease in trade

payables, accruals and other creditors as well as provision

balances. Trade creditors reduced due to the timing of stock

purchases in the period.

-- A reduction in Trade receivables offset the above, showing

a decrease of GBP0.1 million in the period.

Consolidated income statement

for the six months ended 30 September 2021

6 months 6 months Year ended

ended ended

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

---------------------------- ----- ------------- ------------- ----------------

Revenue 2 1,962 4,653 6,700

Cost of sales (1,001) (2,397) (3,486)

---------------------------- ----- ------------- ------------- ----------------

Gross profit 961 2,256 3,214

Administration costs (2,966) (2,807) (6,020)

Other income 1 49 49

Operating loss (2,004) (502) (2,757)

Finance revenue 10 11 22

Finance costs (7) (11) (21)

---------------------------- ----- ------------- ------------- ----------------

Loss before tax (2,001) (502) (2,756)

Income tax 87 108 266

---------------------------- ----- ------------- ------------- ----------------

Loss for the period /

year from continuing

operations (1,914) (394) (2,490)

---------------------------- ----- ------------- ------------- ----------------

Discontinued operations

(Loss)/profit from discontinued

operation (net of tax) (33) 41 2

Loss for the period /

year (1,947) (353) (2,488)

Adjusted loss: 3

Loss before tax from continuing

operations (2,001) (502) (2,756)

Share-based payment 138 177 409

Adjusted loss before

tax for the period /

year from continuing

operations (1,863) (325) (2,347)

----- ------------- -------------

Consolidated statement of comprehensive income

for the six months ended 30 September 2021

6 months 6 months Year ended

ended ended

30 September 30 September 31 March 2021

2021 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

--------------------------------------- ------------- ------------- --------------

Loss for the period / year

from continuing operations (1,914) (394) (2,490)

Profit/(loss) for the period

/ year from discontinued operations (33) 41 2

---------------------------------------- ------------- ------------- --------------

Loss for the period /

year attributable to

owners of the parent (1,947) (353) (2,488)

Other comprehensive income/(expense)

from continuing operations

---------------------------------------- ------------- ------------- --------------

Other comprehensive income

that may be

subsequently reclassified

to profit and loss:

Exchange differences

on retranslation

of foreign operations 2 - (48)

Total comprehensive loss attributable

to owners of the parent (1,945) (353) (2,536)

---------------------------------------- ------------- ------------- --------------

Consolidated statement of financial position

at 30 September 2021

30 September 30 September 31 March 2021

2021 2020

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

------------------------------ ----- ------------- ------------- --------------

Assets

Non-current assets

Property, plant and

equipment 910 1,069 1,103

Other intangible assets 42 55 48

------------------------------ ----- ------------- ------------- --------------

952 1,124 1,151

Current assets

Inventories 5,257 3,513 4,419

Trade and other receivables 1,316 7,479 1,442

Current tax recoverable 270 219 378

Cash and cash equivalents 4,097 5,016 7,268

------------------------------ ----- ------------- ------------- --------------

10,940 16,227 13,507

------------------------------ ----- ------------- ------------- --------------

Total assets 11,892 17,351 14,658

Equity and liabilities

Attributable to owners

of the parent

Equity share capital 5 1,458 1,455 1,458

Share Premium 47 - 47

Capital redemption

reserve 163 163 163

Translation reserve 69 115 67

Retained earnings 7,769 11,476 9,578

------------------------------ ----- ------------- ------------- --------------

Total equity 9,506 13,209 11,313

------------------------------ ----- ------------- ------------- --------------

Non-current liabilities

Other payables 259 202 643

Provisions 38 38 38

297 240 681

------------------------------ ----- ------------- ------------- --------------

Current liabilities

Trade and other payables 1,849 3,733 2,489

Provisions 240 169 175

2,089 3,902 2,664

------------------------------ ----- ------------- ------------- --------------

Total liabilities 2,386 4,142 3,345

------------------------------ ----- ------------- ------------- --------------

Total equity and liabilities 11,892 17,351 14,658

------------------------------ ----- ------------- ------------- --------------

Consolidated statement of changes in equity

for the six months ended 30 September 2021

Ordinary Share Capital Translation Retained Total

share premium redemption reserve earnings equity

capital GBP'000 reserve GBP'000 GBP'000 GBP'000

GBP'000 GBP'000

---------------------- --------- --------- ------------ --------------- ------------ -----------------

At 31 March 2020 1,455 - 163 115 11,652 13,385

---------------------- --------- --------- ------------ --------------- ------------ -----------------

Share-based payment

credit - - - - 177 177

---------------------- --------- --------- ------------ --------------- ------------ -----------------

Transactions with

shareholders - - - - 177 177

---------------------- --------- --------- ------------ --------------- ------------ -----------------

Loss for the period - - - - (353) (353)

Other comprehensive - - - - - -

income

---------------------- --------- --------- ------------ --------------- ------------ -----------------

Total comprehensive

loss - - - - (353) (353)

---------------------- --------- --------- ------------ --------------- ------------ -----------------

At 30 September 2020 1,455 - 163 115 11,476 13,209

---------------------- --------- --------- ------------ --------------- ------------ -----------------

Shares issued 3 47 - - - 50

Share-based payment

credit - - - - 237 237

---------------------- --------- --------- ------------ --------------- ------------ -----------------

Transactions with

shareholders 3 47 - - 237 287

---------------------- --------- --------- ------------ --------------- ------------ -----------------

Loss for the period - - - - (2,135) (2,135)

Other comprehensive

expense - - - (48) - (48)

---------------------- --------- --------- ------------ --------------- ------------ -----------------

Total comprehensive

loss - - - (48) (2,135) (2,183)

---------------------- --------- --------- ------------ --------------- ------------ -----------------

At 31 March 2021 1,458 47 163 67 9,578 11,313

---------------------- --------- --------- ------------ --------------- ------------ -----------------

Share-based payment

credit - - - - 138 138

---------------------- --------- --------- ------------ --------------- ------------ -----------------

Transactions with

shareholders - - - - 138 138

---------------------- --------- --------- ------------ --------------- ------------ -----------------

Loss for the period - - - - (1,947) (1,947)

Other comprehensive

income - - - 2 - 2

---------------------- --------- --------- ------------ --------------- ------------ -----------------

Total comprehensive

income/(loss) - - - 2 (1,947) (1,945)

---------------------- --------- --------- ------------ --------------- ------------ -----------------

At 30 September 2021 1,458 47 163 69 7,769 9,506

---------------------- --------- --------- ------------ --------------- ------------ -----------------

Consolidated statement of cash flows

for the six months ended 30 September 2021

6 months 6 months Year ended

ended ended

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

---------------------------------------- ------------- ------------- -----------

Operating activities

Loss before tax from continuing

operations (2,001) (502) (2,756)

Profit/(loss) before tax from

discontinued operations (33) 41 2

---------------------------------------- ------------- ------------- -----------

Loss before tax (2,034) (461) (2,754)

Non-cash adjustment to reconcile loss before

tax to net cash flows

Depreciation of property,

plant and equipment 278 238 504

Amortisation of intangible

assets 7 7 14

Share-based payment transaction

expense 138 177 409

Unrealised (losses) / gains

on foreign exchange (5) 11 5

Disposals of property, plant

& equipment 25 8 103

Finance income (10) (11) (22)

Finance costs 7 11 21

Working capital adjustments:

Decrease / (increase) in trade

and other receivables 126 (5,316) 956

Decrease / (increase) in inventories (838) 158 (748)

Increase / (decrease) in trade

and other payables (479) 110 24

Increase / (decrease) in provisions 65 - (175)

Increase / (decrease) in deferred

revenue (460) 1,380 891

Cash utilised in operations (3,180) (3,688) (772)

Tax received 197 179 179

---------------------------------------- ------------- ------------- -----------

Net cash flow from operating

activities (2,983) (3,509) (593)

---------------------------------------- ------------- ------------- -----------

Investing activities

Purchase of property, plant &

equipment (111) (78) (491)

Disposal of fixed assets - - 20

Interest received 10 11 22

Deferred consideration from disposal

of Video Business - 63 63

Net cash flow from investing

activities (101) (4) (386)

---------------------------------------- ------------- ------------- -----------

Financing activities

Proceeds from issues of shares - - 50

Lease obligation repayments (89) (86) (186)

Net cash flow from financing

activities (89) (86) (136)

---------------------------------------- ------------- ------------- -----------

Net (decrease) in cash and cash

equivalents (3,173) (3,599) (1,115)

Cash and cash equivalents at

beginning of period / year 7,268 8,431 8,431

Effect of foreign exchange rate

changes on cash and cash equivalents 2 184 (48)

---------------------------------------- ------------- ------------- -----------

Cash and cash equivalents at

end of period / year 4,097 5,016 7,268

---------------------------------------- ------------- ------------- -----------

Notes to the financial statements

for the six months ended 30 September 2021

1. Accounting policies

Basis of preparation

The consolidated interim financial statements include those of

Thruvision Group plc and all of its subsidiary undertakings

(together "the Group") drawn up at 30 September 2021 and have been

prepared in accordance with International Accounting Standard 34,

"Interim Financial Reporting" ("IAS 34") as adopted for use in the

European Union ("EU"). The consolidated interim financial

statements have been prepared using accounting policies and methods

of computation consistent with those applied in the consolidated

financial statements for the period ended 31 March 2021.

The Group is a public limited company incorporated and domiciled

in England & Wales and whose shares are quoted on AIM, a market

operated by The London Stock Exchange.

All values are rounded to GBP'000 except where otherwise

stated.

Accounting policies

The annual consolidated financial statements of the Group are

prepared on the basis of International Financial Reporting

Standards ("IFRS"). The consolidated interim financial statements

are presented on a condensed basis as permitted by IAS 34 and

therefore do not include all the disclosures that would otherwise

be required in a full set of financial statements and should be

read in conjunction with the most recent Annual Report and Accounts

which were approved by the Board of Directors on 9 July 2021 and

have been filed with Companies House. The condensed interim

financial statements do not constitute statutory accounts as

defined in Section 435 of the Companies Act 2006 and are unaudited

for all periods presented. The financial information for the

12-month period ended 31 March 2021 is extracted from the financial

statements for that period. The auditors' report on those financial

statements was unqualified and did not contain an emphasis of

matter reference and did not contain a statement under section

498(2) or (3) of the Companies Act 2006 .

The half year results for the current period to 30 September

2021 have not been audited or reviewed by auditors pursuant to the

Auditing Practices Board guidance of Review of Interim Financial

Information.

Adoption of new and revised International Financial Reporting

Standards

The Group's accounting policies have been prepared in accordance

with IFRS effective as at its reporting date of 30 September

2021.

Standards Issued

The standards and interpretations that are issued up to the date

of issuance of the Group's interim financial statements are

disclosed below. The Group has adopted these standards, if

applicable, when these became effective. Further details are

disclosed in the 31 March 2021 Annual Report available on the

Group's website: thruvision.com

Accounting developments - new standards, amendments and

interpretations issued and adopted

There were no new accounting standards or amendments requiring

disclosure in the period.

Going concern

The Group's loss before tax from continuing operations for the

period was GBP2.0 million (H1 2021: GBP0.5 million, FY 2021 GBP2.8

million). As at 30 September 2021 the Group had net current assets

of GBP8.9 million (H1 2021: GBP12.3 million, FY 2021: GBP10.8

million) and net cash reserves of GBP4.1 million (H1 2021: GBP5.0

million, FY 2021: GBP7.3 million). Additionally net cash reserves

were GBP4.0 million as at 19 November 2021.

The Board has reviewed cash flow forecasts for the period up to

and including 30 November 2022. These forecasts and projections

take into account reasonably possible changes in trading

performance and show that the Group will be able to react as

required in order to operate within the level of current funding

resources, and no need for the Group to take on any debt. In order

to stress test the adoption of the going concern basis, a cashflow

forecast was also produced which looked at the highly unlikely

scenario in which no further sales took place and certain

non-discretionary areas of cash expenditure were reduced. This

showed that even under this extreme condition, the Group would

still have positive cash reserves as at 30 November 2022 with no

need to take on external debt. The Directors therefore believe

there is sufficient cash available to the Group to manage through

these requirements.

As with all businesses, there are particular times of the year

where the Group's working capital requirements are at their peak.

However, the Group is well placed to manage business risk

effectively and the Board reviews the Group's performance against

budgets and forecasts on a regular basis to ensure action is taken

where needed.

The Directors therefore are satisfied that the Group has

adequate resources to continue operating for a period of at least

12 months from the approval of these accounts. For this reason,

they have adopted the going concern basis in preparing the

financial statements.

Notes to the financial statements (continued)

for the six months ended 30 September 2021

2. Segmental information

The Directors do not split the business into segments in order

to internally analyse the business performance. The Directors

believe that allocating overheads by department provides a suitable

level of business insight. The overhead department cost centres

comprise of Engineering (manufacturing and R&D), sales and

marketing, property and administration, Management and PLC costs,

with the split of costs as shown in the Half Year Report on page

6.

Analysis of revenue by customer

There have been three (H1 2021: one, FY 2021: one) individually

material customer/s (each comprising in excess of 10% of revenue)

during the period. These customers individually represented

GBP359k, GBP206k and GBP200k of revenue (H1 2021: GBP2,917k, FY

2021: GBP3,094k).

The Group's revenue by customer's geographical location is

detailed below:

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------ ------------- ------------- ------------

UK 941 467 1,045

Americas 693 3,599 4,501

Asia Pacific 85 100 140

Europe 92 37 428

Middle East and Africa 151 450 586

1,962 4,653 6,700

------------------------ ------------- ------------- ------------

The Group's Revenue by type is detailed below:

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

---------------------------------- ------------- ------------- ------------

Revenue recognised at point of

delivery 1,662 4,304 5,864

Revenue recognised over time

- extended warranty and support

revenue 300 349 836

1,962 4,653 6,700

---------------------------------- ------------- ------------- ------------

The Group's non-current assets by geography are detailed

below:

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

---------- ------------- ------------- ------------

UK 828 977 1,001

Americas 124 147 150

952 1,124 1,151

---------- ------------- ------------- ------------

3. Adjusted loss before tax

An adjusted loss before tax measure has been presented as the

Directors believe that this is a more relevant measure of the

Group's underlying performance. Adjusted loss is not defined under

IFRS and has been shown as the Directors consider this to be

helpful for a better understanding of the performance of the

Group's underlying business. It may not be comparable with

similarly titled measurements reported by other companies and is

not intended to be a substitute for, or superior to, IFRS measures

of profit.

The net adjustments to loss before tax from continuing

operations are summarised below:

6 months 6 months Year ended

ended ended

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

---------------------------- ------------- ------------- ------------

Share-based payment (LTIP) 138 177 409

Total adjustments 138 177 409

---------------------------- ------------- ------------- ------------

4. Loss per share

The following reflects the loss and share data used in the basic

and diluted loss per share calculations:

Unadjusted loss per share 6 months 6 months Year ended

ended ended

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

---------------------------------------- ------------- ------------- ----------------

Loss from continuing operations

attributable to ordinary shareholders (1,914) (394) (2,490)

---------------------------------------- ------------- ------------- ----------------

Loss from continuing and discontinued

operations attributable to ordinary

shareholders (1,947) (353) (2,488)

Weighted average number of shares 145,779,118 145,454,118 145,515,022

---------------------------------------- ------------- ------------- ----------------

Basic and diluted loss per share

- continuing operations (1.31p) (0.27p) (1.71p)

---------------------------------------- ------------- ------------- ----------------

Basic and diluted loss per share

- continuing and discontinued

operations (1.34p) (0.24p) (1.71p)

---------------------------------------- ------------- ------------- ----------------

Adjusted loss per share 6 months 6 months Year ended

ended ended

30 September 30 September 31 March

2021 2020 2021

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------------ ------------- ------------- ----------------

Loss from continuing operations

attributable to ordinary shareholders (1,914) (394) (2,490)

------------------------------------------ ------------- ------------- ----------------

Share-based payment 138 177 409

Adjusted (loss)/profit after

tax (1,776) (217) (2,081)

------------------------------------------ ------------- ------------- ----------------

Weighted average number of shares 145,779,118 145,454,118 145,515,022

------------------------------------------ ------------- ------------- ----------------

Basic and diluted loss per share (1.31p) (0.27p) (1.71p)

------------------------------------------ ------------- ------------- ----------------

Basic and diluted adjusted (loss)/profit

per share (1.22p) (0.15p) (1.43p)

------------------------------------------ ------------- ------------- ----------------

The inclusion of potential Ordinary Shares arising from Share

based payments (LTIP awards and EMI Options) would be

anti-dilutive. Basic and diluted loss per share has therefore been

calculated using the same weighted number of shares.

Notes to the financial statements (continued)

for the six months ended 30 September 2021

5. Issued share capital

As at 30 September 2021, there were 145,779,118 Ordinary Shares

in issue (H1 2021: 145,454,118, FY 2021 145,779,118).

6. Share options

The following share awards were granted in the six-month period

ended 30 September 2021:

EMI Approved

Options

Grant date 4 August

2021

-------------

Number granted 200,000

-------------

Exercise price 24.40p

-------------

Vesting period (years) 3.0

-------------

The share-based payment charge in the period amounts to GBP138k

(H1 2021: GBP177k, FY 2021: GBP409k), with the fair value charge

attributable to new awards in the period determined using a Black

Scholes calculation.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VKLFFFFLEFBZ

(END) Dow Jones Newswires

November 22, 2021 02:00 ET (07:00 GMT)

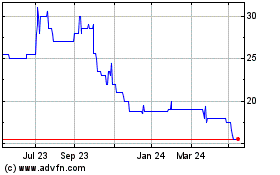

Thruvision (LSE:THRU)

Historical Stock Chart

From Jun 2024 to Jul 2024

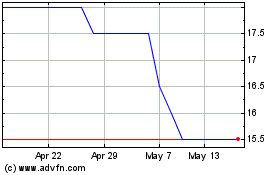

Thruvision (LSE:THRU)

Historical Stock Chart

From Jul 2023 to Jul 2024