TIDMDGB

RNS Number : 1727I

Digital Barriers plc

28 May 2014

RNS

28 May 2014

Digital Barriers plc

("Digital Barriers or the "Group")

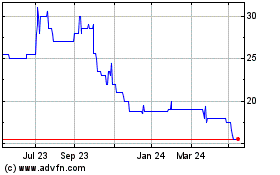

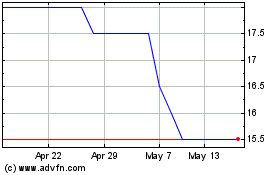

Preliminary Results for the year ended 31 March 2014

The Board of Digital Barriers plc (AIM:DGB), the specialist

provider of advanced surveillance technologies to the security and

defence sectors, announces audited results for the year ended 31

March 2014.

Key Highlights

-- Group revenues for the year were GBP19.0 million (2013: GBP23.3 million).

-- Revenues from Core Products grew 18% to GBP9.9 million (2013:

GBP8.4 million) and now account for 52% of Group revenue (2013:

36%).

-- International revenue from Core Products increased by 78% and

covered a significantly expanded geographic footprint.

-- GBP18.0 million (net of placing costs) raised through the

issue of new ordinary shares in November 2013.

-- Restructuring programme undertaken to rationalise cost base

and concentrate resources on Core Products.

-- 8 new products launched to extend and enhance our key product platforms.

-- Q4 FY14 represented our best ever sales quarter for the Group.

Commenting on the results Dr Tom Black, Executive Chairman of

Digital Barriers said:

"Looking forward, the volatile international security context

confirms that the market for security products such as ours will

continue to grow rapidly. This, combined with our new generation of

products which have been designed specifically to combat this

threat, and the sales traction which we have achieved thus far,

give me confidence that Digital Barriers is on track to become an

important player in the international security marketplace. We

therefore look forward to significant growth in revenues and

reiterate our aspiration to move towards breakeven in the current

financial year."

For further information, please contact:

Digital Barriers plc Tel: 020 7940 4740

Tom Black, Executive Chairman

Sharon Cooper, Finance Director

Investec Investment Banking Tel: 020 7597 5970

Andrew Pinder / Dominic Emery

FTI Consulting Tel: 020 7831 3113

Edward Bridges / Matt Dixon / Elodie Castagna

About Digital Barriers

Digital Barriers provides advanced surveillance technologies to

the international homeland security and defence markets,

specialising in 'edge-intelligent' solutions that are designed for

remote, hostile or complex operating environments. We work with

governments, multinational corporations and system integrators in

the defence, law enforcement, critical infrastructure,

transportation and natural resources sectors. Our surveillance

technologies have been successfully proven on some of the most

demanding operational and environmental deployments around the

world.

www.digitalbarriers.com

Chairman's Statement

This last year proved to be one of mixed fortunes for Digital

Barriers. Whilst our reported revenues are somewhat lower than

FY13, we made very significant progress in shaping the Group for

the growth which we expect in the current financial year and in

growing the contribution to revenues from our core product set.

Revenues were GBP19.0m of which 52% came from sales of our three

core product ranges TVI, RDC and ThruVision ("Core Products" (FY13:

36%).

The drop in revenues was due to three factors: a declining

contribution from legacy or non-core products, longer-than expected

customer procurement cycles and delays in bringing our new

generation of products to market. The first of these was expected

and is of little strategic importance as we focus increasingly on

Core Products. The second is an ongoing feature of our business,

although its impact will reduce as we grow. The third has been

overcome and we saw a range of new products come to market in our

fourth quarter, resulting in our best ever quarterly sales

performance, although much of this did not convert to revenues in

the year but remained as sales backlog to be fulfilled this

year.

During the year we raised a further GBP18m from shareholders to

fund the losses incurred, to strengthen the balance sheet and to

provide working capital for growth. The vast majority of this cash

remained on the balance sheet at the year-end (GBP14.2m). We also

transitioned emphatically from our acquisition phase to focus on

business rationalisation, sales team development and product

development. The rationalisation project has resulted in a lower

headcount and fewer offices, thereby reducing our cost base by some

GBP3m per annum and, equally importantly, allowing us to invest in

our sales teams and our engineering capability.

In particular, our US sales team has been significantly upgraded

and we saw the fruits of this investment towards the end of the

year with material sales of our new products into US Federal and

Defense Agencies. Elsewhere we added a range of new customers in

countries as diverse as Nigeria, Turkey and Japan. In the

commercial sector we saw the first material sales of our TVI-based

Minicam product through a major telecoms operator mostly into the

UK Local Authority marketplace. Our UK Services business navigated

a difficult year with UK budget constraints much in evidence,

although recent sales successes suggest that the current year will

see a return to modest growth in this area.

Our engineering teams worked hard through the year to bring to

market an entirely new generation of products. Our TVI video range

was extended to include High Definition and IP variants, which open

up entirely new markets for us in the US, Asia Pacific and the

Middle East. We also launched a software version of TVI which runs

on iOS devices and which was sold successfully at enterprise level

to a US Federal Agency during the year. Our RDC product, which was

launched towards the end of the previous year, achieved good market

traction during the year and forms a major part of our FY15 sales

pipeline. RDC also provides additional impetus to our TVI range as

RDC sales are almost always combined with TVI to produce our

Integrated Surveillance Platform, a compelling solution for the

protection of borders or vulnerable facilities. ThruVision, our

personnel scanning technology, was a modest contributor to revenues

but was developed significantly during the year resulting in an

important new product launch and significant sales success in the

final quarter.

Although Digital Barriers' success will be built in large part

on the quality of our products, these in turn depend on high

quality and dedicated staff. Our headcount reduced to 163 at the

date of this announcement as a result of our strategic re-focus and

rationalisation project and voluntary departures remained rare. The

tempo of the business remained high and the commitment and

professionalism demonstrated by all staff was exemplary. I would

like to extend a warm personal thanks to all of my colleagues for

their hard work and dedication. Our Board saw only one change with

the addition of Sharon Cooper as CFO who joined us in March from

Sophos and is already making a full contribution.

Looking forward, the fragile international security context

confirms that the market for security products such as ours will

continue to grow rapidly. This, combined with our new generation of

products which have been designed specifically to combat this

threat, and the sales traction which we have achieved thus far,

give me confidence that Digital Barriers is on track to become an

important player in the international security marketplace. We

therefore look forward to significant growth in revenues and

reiterate our aspiration to move towards breakeven in the current

financial year.

Operational strategic review

Since our IPO in 2010 we have made strong progress in validating

our strategy of providing advanced surveillance technologies to

governments, multinational corporations and system integrators in

the international defence, law enforcement, critical

infrastructure, transportation and natural resources sectors.

At IPO we described the three phases of our growth strategy in

the following way:

-- Phase One: to undertake acquisitions to collate core products

to drive Digital Barriers' organic growth; integration will be

limited at this early stage.

-- Phase Two: to focus on international development and

additional material acquisitions to enhance the scale of our

business. This will coincide with further integration and a

deepening of specialist prime system integrator and other channel

sales partner relationships.

-- Phase Three: to focus on further geographical and product expansion.

We are currently transitioning from Phase Two to Phase Three. No

further acquisitions were undertaken during FY14 and our internal

focus was on the final stages of integration and rationalisation as

outlined in the Chairman's Statement above. We did, however, expend

considerable effort in developing a new generation of products

across our core technologies of TVI, RDC and ThruVision and

extending our geographic reach into numerous additional countries,

including Nigeria, Turkey and Japan.

Our assessment of the growth potential that our market offers

remains unchanged. Global spending remains strong with a number of

notable trends emerging in the last year, namely:

-- Continued demand for upgrading capability in established

markets (core UK and US) for leading agencies, as well as the

adoption of UK-proven technology overseas.

-- Recovery in US Federal Government budgets and, because of

major changes to telecoms video transmission costs, major

investment in wireless video technology refresh.

-- Ongoing weekly insurgency and terrorist attacks in high-risk

countries in the Middle East, Africa and parts of Asia, continuing

to drive demand for border and wide-area surveillance, VIP and

natural resources protection, and transportation security.

-- Continued long-term trends around cross-border terrorism and

organised crime driving demand for enhanced border check-point

security measures, critical national infrastructure protection and

tactical law enforcement surveillance capability.

-- Increasing adoption of mainstream commercial solutions such

as mobile handsets, cellular and satellite networks to satisfy

demand for wide distribution of video and data.

Our new products are well positioned to address these critical

trends and we continue to position ourselves as providers, in the

first instance, of sophisticated new tactical capability.

Increasingly, however, we are being seen as credible providers of

"Enterprise-grade" technology, allowing us to access our customers'

spend on much larger programmes.

The growing international customer interest and engagement,

combined with the sales traction that we have seen in the last

year, confirms that our original strategy remains valid and we will

continue to pursue it.

Business Review

Introduction

FY14 was a year in which we focused our attention on extending

our international sales capability and developing new products in

all three of our core technology areas - TVI, RDC and ThruVision.

With 8 new products coming to market in the year across these

areas, we achieved a number of landmark sales in terms of scale and

strategic importance. These have also underpinned our three new

propositions that are driving growth in major international

customer accounts.

Sales

Headlines

We achieved a number of notable successes in terms of

international reach and successful new product launches in the last

year, including:

-- First "enterprise-grade" sale of TVI - GBP1.8m sale of 3,000

TVI iPhone licences following ongoing work with a major US law

enforcement customer. This capability will provide a range of

benefits including increased surveillance effectiveness, situation

awareness and officer safety.

-- Landmark ThruVision sale into Middle East - GBP2.0m sale via

a partner into the government of a major country in the Middle East

for the protection of key government facilities and airports, to be

delivered over the course of FY15.

-- Strategic adoption by major Asian ally for critical defence

surveillance - GBP1.0m sale after a year of extended trials, RDC

has been adopted as the core sensor as part of its national-level

strategic surveillance investment programme.

-- Launch and initial sale of new 'Safe City' camera product -

developed in partnership with the UK's largest telecoms operator,

the MiniCam was launched in March to take the UK public safety CCTV

market wireless. It offers the potential to extend our managed

service offering moving forward.

-- First sale of RDC in the Oil and Gas sector - initial sale of

our RDC solution to a multi-national oil company to help protect

key assets in a Middle Eastern country.

-- Initial sales of a range of new TVI products - our High

Definition and IP camera variants, launched in Q4, achieved initial

sales into customers in each of our regions.

-- Prestige integration services contract win - GBP2.1m sale of

security system integration services, via a major system integrator

into a major UK sporting event, to be delivered over the course of

FY15.

-- Other noteworthy sales - we announced repeat sales of GBP2.3m

and GBP0.75m to existing UK Government RDC and Asian transportation

customers, respectively.

-- Sales traction continuing - since the period end, we have

secured a further major contract in our Middle East and Africa

region, with an initial contract valued at GBP1.5 million for the

protection of key government facilities, to be delivered over the

course of FY15.

Our sales pipeline continues to build with international

interest in our three new key 'proposition' areas, namely:

-- Our "Integrated Surveillance Platform" combining our RDC

sensors with TVI, allowing unauthorized intrusions to be viewed

securely anywhere in the world. Our customers see this rapidly

deployed, covert solution as the ideal way to meet a number of

requirements, including protection of hostile borders, oil

pipelines, government buildings and remote military facilities.

-- Our "Video Distribution Platform", based on TVI and providing

our customers with the ability to wirelessly enable their legacy

fixed security video infrastructure and add the ability to send and

watch live video using smart phones and tablets. Demand is

expanding out from our traditional government security market,

through Smart City initiatives into the broader corporate

world.

-- Our "Safe Search People Screening" solution uses our

ThruVision product set to facilitate the screening of people

without the need for intrusive and time consuming physical

searches. Our customers see this "virtual pat-down" as an

efficient, repeatable and reliable procedure for looking for

weapons, contraband or stolen goods in a safe and respectful

manner.

International expansion

We continued our strategy of targeting key nations with material

defence and security budgets across the US, Asia Pacific and the

Middle East and Africa regions. With the support of the UK

government where necessary, we aim to build relationships with key

government agencies and procurement authorities and move through an

increasingly streamlined evaluation cycle. This approach, coupled

with the appointment and management of a number of local partner

companies, resulted in sales to numerous new countries as well as

repeat sales to existing ones in the last 12 months.

Our principal export market remains the US and we made very

strong progress here after the hiatus of sequestration in FY13.

With an expanded sales presence, we have established strong

positions in agencies across the Departments of Defense, Justice

and Homeland Security. With a number of market trends in our

favour, including new investment in wireless video capability,

ongoing investment in counter-insurgency and counter-IED

technology, and ongoing investment in border surveillance

technology, we are now poised for strong growth here across all of

our key technologies.

Asia Pacific is a more fragmented region and we have been

focused on a number of key countries including the Republic of

Korea, Japan, Singapore, Malaysia, Indonesia, Hong Kong and

Australia. Our focus is on a number of strategic border and

maritime surveillance initiatives and achieving further TVI

penetration into national law enforcement agencies. We have

established a permanent presence in Seoul on the strength of the

strategic interest shown by major Korean government agencies in

RDC.

In the Middle East and Africa, we are focused on a number of key

Gulf states, notably Qatar and UAE, and other key regional powers

including Turkey and Nigeria, and we have achieved early sales

successes in all of these. Given the heightened security state in

several of these countries, we see strong interest in ThruVision

for protective security, and our Integrated Surveillance Platform

for force protection, border surveillance and critical asset

protection including oil and gas.

UK market

The UK Government market has continued to see spend being

tightly controlled. We continue to focus on working closely with

the Home Office and its agencies, major law enforcement

organisations, large public sector transport operators and the

Ministry of Defence. As well as generating revenue, these close

working relationships remain vital for our broader export efforts

in terms of direct UK Government support and the implicit comfort

this gives our foreign government customers.

With our expanding product range, we are also seeing increasing

interest from the more mainstream "CCTV" market in the UK. This

interest is coming from both the local authority market, from the

security departments of commercial organisations and from large

security service providers.

With this growing domestic interest, and after a relatively weak

year for the division, we are starting to make increasing use of

our Integration Services business to sell, deploy and maintain TVI

solutions into this broader security equipment market. We also

intend using its 24/7 support and callout infrastructure as an

integral part of our post-sales support capability moving

forward.

OEMs and other commercial models

We noted twelve months ago that we were seeing interest from the

broader commercial market, principally via telecoms operators, in

TVI. This is because we are able to offer a fully mobile,

affordable and real-time video capability at a level of quality

unmatched by any competing technologies. This meets the needs of a

number of industry trends. These include the ongoing rollouts of

city-wide wifi networks and national 4G wireless infrastructure,

and the continued focus by network operators on selling "Machine to

Machine" (M2M) data plans to maintain data revenue growth.

This commercial interest represents another large, high growth

market for us, and one that is potentially less prone to slower

government sales cycles. We have invested in both sales and product

development resource over the last year to build our presence here

and exploit this leveraged sales route to market. We are now

engaged with five international telecoms providers where our TVI

technology, through its highly efficient bandwidth management, has

the potential to help better monetise cellular, wifi and satellite

communication infrastructures. We also continue to partner with the

world's largest system integrators on embedding our TVI and broader

video analytics capability into their global 'smart city' and

'mobile workforce' propositions.

Finally, we have also made very good progress with achieving

tight technical and commercial integration with other video

industry vendors, again to exploit a leveraged sales model. Most

advanced is our relationship with Axis Communications, one of the

world leaders in IP cameras. By embedding our new video analytics

product, SafeZone Edge, on Axis cameras, we both differentiate

Axis' offering and open up its distribution network in 70 countries

to our products.

Technology and Products

Introduction

Substantial effort has been invested in the last year driving

our product portfolio forward in our three core product families -

TVI, RDC and ThruVision - that now represent the key focus of the

business, representing 52% of FY14 revenues (FY13 36%). We remain

confident that all three families are highly disruptive, occupy

clearly differentiated positions in the market, are internationally

scalable and are built on class-leading intellectual property. Most

significantly, these core product families have been rounded-out

with additional capabilities to form our new propositions that are

driving international sales activity.

With a number of products being delivered to market later in Q4

than we had planned, we have now introduced a new Product

Management process to significantly improve our product development

and launch capabilities. This will ensure that we optimise the use

of finite development resource to produce differentiated products

on schedule. It will also make sure we continue to identify

significant and growing market niches and ensure our products

contain the features that our increasingly large and international

customer base demands.

We have continued the process of retiring non-core products and

technologies that do not have differentiation and scalability,

helping us sharpen our focus and increase resource in those areas

that are strategically important.

TVI

TVI represents the largest market opportunity for us. As a

proven, world-class video distribution technology, it offers large

organisations the opportunity, for the first time, to adopt video

as an affordable, core enterprise tool for a range of security

applications in the first instance, but increasingly for more

mainstream "enterprise applications" moving forward.

We have made significant progress in the last year moving TVI

from its tactical roots to focus on products for both our

specialist market (law enforcement, defence) and, increasingly, on

the wider commercial security market. This has involved embracing a

number of significant video industry technology trends and

'benchmarks', including High Definition (HD) video, IP video and

video management system compatibility (through the ONVIF

standard).

These developments, as well as meeting the needs of a rapidly

increasing number of potential customers, have also ensured we

remain very confident about our competitive positioning.

Highlights in FY14 included:

-- Launch of new HD video product - developed to meet the needs

of top-end law enforcement agencies around the world, the HD-S600

was launched in March. Combining highly efficient, wireless HD

video streaming with local recording functionality, we achieved

initial sales in a number of UK and international customers.

-- Launch of new 'Safe City' camera product - developed in

partnership with the UK's largest telecoms operator, The MiniCam

was launched in March to enter the UK public safety CCTV market

wireless.

-- Launch of new IP product series - developed as highly

cost-effective general purpose wireless video recording and

streaming devices, our one-and four-camera models support customers

migrating from analogue to IP cameras. We launched in March and

immediately sold into both the US law enforcement and UK

transportation security markets. We have since sold our TVI IP

products into customers in each of our regions.

-- Launch of new man-wearable military product - developed to

meet emerging needs of UK/US military, we launched in March and

sold to both UK and other allied military customers.

Plans for the coming year include expanding our HD range,

developing a number of team-working tools for TVI on smart phones,

scaling the server software and releasing software development kits

for use by third party developers.

RDC

RDC is our unique ground sensor for the Remote Detection and

Classification of unauthorised people or vehicles in locations

where communications and power infrastructure are limited.

Following its introduction around 18 months ago and its initial

sale to a major UK government organisation, RDC has been deployed

for a wide range of protection applications, including defence

force/bases, oil and gas pipelines and VIP locations as well as

more traditional border surveillance and control.

Our key differentiation remains the combination of seismic

sensor algorithms, with mesh radio and tight coupling to real-time

video. Taken together, these form our Integrated Surveillance

Platform and provide a cost effective way of maintaining real-time

"eyes on" coverage of large swathes of territory and we therefore

remain confident about our competitive positioning.

In the last year RDC has moved from 'pathfinder projects' and

early adopter trials to a pipeline of mature procurements and,

perhaps most encouragingly, repeat sales from existing customers.

The breadth of live opportunities across all regions provides

confidence for realising further growth in the coming year and

beyond.

Highlights include:

-- Continued development of our sensor node detection algorithm

for US government - we have broadened the range of threats that we

can detect to meet specific operational needs.

-- Continued development of node 'mesh' networking - we launched

"multi-hop" capability to our sensor nodes to allow them to operate

in long-linear arrays. This makes them ideal for protecting assets

such as oil pipelines.

Plans for the coming year include continued work on improving

the range of threats that can be detected and further tightening of

the integration with TVI.

ThruVision

ThruVision is our passive, standoff people screening technology

for protection of high-profile buildings and VIPs, the detection of

concealed contraband by Customs organisations, high-threat military

checkpoint screening and the efficient searching of employees to

reduce theft in retail and distribution environments.

Based on patented intellectual property in the field of

Terahertz scanning, the last year has seen further fundamental

improvements in both image quality and use of video processing

techniques to automatically detect concealed items of interest.

This, combined with further manufacturing improvements to reduce

the cost of production, has generated much broader market

interest.

Highlights include:

-- Assessed as 'operationally proven' following extensive

testing by UK Government - We are now embarked on a number of

operational trials with various UK agencies in a range of security

and contraband applications.

-- Launch of new "SafeSearch" proposition - bringing our new

technology advances together, we have improved system usability by

increasing the speed with which individuals can be scanned in

partnership with a major British retailer. This 'virtual pat-down'

now forms a proven new security procedure.

Plans for the coming year include the addition of a "zoom"

function to enhance detection capability, improving the software

interface to improve usability and continued work to allow future

scaling of production.

Face recognition and video analytics applications

We have concluded that the major value from the OmniPerception

acquisition is most likely to come through software implementation

of face recognition on the TVI platform, although some alternative

opportunities for the OmniPerception product set will still

occur.

Accordingly, our face recognition and video applications work

aims to ensure that, as TVI achieves increased international

traction, we can maintain our strategic differentiation by offering

mission-critical video tools running within TVI's video

distribution architecture.

With this in mind we have been investing in redeveloping our

applications from server-based systems to software that we can

embed on a range of devices including smart phones, tablets, our

own TVI products and an emerging range of high performance IP

cameras. We believe this strategy will create new markets by

offering a disruptive combination of performance, simplicity and

affordability.

Highlights include:

-- Achieved the highest level of UK Home Office "iLids" approval

for performance - Our SafeZone Edge product, an automated intrusion

detection application, achieved this internationally recognised

standard in [April 2014].

-- Adoption by Axis, the world's leading IP camera manufacturer

- we have embedded SafeZone Edge on Axis' latest range of IP

cameras and have agreed a leveraged channel sales model with Axis.

We believe this partnership will allow us to assess the potential

to exploit leveraged sales models.

-- Ongoing refinement of face recognition algorithms - we have

re-engineered our face recognition technology to operate solely in

the visible light domain (as opposed to IR) as part of our plan to

integrate face recognition within our Video Distribution

Platform.

Plans for the coming year are to maintain the good progress we

have made to integrate these applications into our Video

Distribution Platform.

Mature and Non-Strategic products

We continue to generate profitable but increasingly modest

revenues from our legacy products family (ie fixed infrastructure

video management and transmission systems). These derive

principally from the transportation and natural resources sectors,

including a number of international customers.

During the year, we have exited non-strategic products where

there is insufficient scope for differentiation or scalability. We

also decided to cease offering bespoke video R&D services to UK

customers due to the lack of scalability offered by this service

line.

Operational review

People

We continue to aim to provide exciting careers for highly

talented sales and engineering staff who, despite the

geographically distributed nature of the business, are integrating

into an increasingly recognisable culture of innovation.

In the last year, we have substantially strengthened our US team

and have recruited our first permanent Korean staff into a new

office in Seoul. We have substantially increased the size of our

TVI engineering team in Glasgow and we have strengthened our

pre-sales capability across all products.

With voluntary attrition already very low, we plan to introduce

a Save-As-You-Earn share option scheme to enable staff to benefit

from the company's growth moving forward and build long-term

careers with us.

Cost base

Through the second half of the last year, we conducted a major

strategic review of activities to ensure all our resources were

focused on the most compelling growth opportunities in a fully

integrated way. This contributed to a cost reduction programme that

has reduced our overall net cost based by GBP3.0m, and allowed

further investment in international sales and engineering. We also

started the process of centralising a number of support functions

to achieve improved service levels and better economies of

scale.

Infrastructure

We further consolidated key activities into a smaller number of

principal offices to improve effectiveness and focus. This resulted

in the closure of 5 offices around the UK.

Looking forward, we plan further expansion of our TVI

engineering office in Glasgow and investment in our Oxfordshire hub

to increase ThruVision manufacturing and broader product delivery

capacity. We are also investing in a new, secure, group-wide IT

infrastructure to allow more efficient working for our staff around

the world, while also better securing our core intellectual

property.

Performance Indicators

We monitor a number of metrics, both financial and

non-financial, on a monthly basis. The most important of these are

as follows:

-- Revenue: GBP19.0million for the year under review (2013: GBP23.3 million);

-- International revenues: 26% of total (2013: 29%);

-- Gross margin: 45.8% for the year under review (2013: 42.8%);

-- Sales & Marketing costs: GBP5.4 million for the year (2013: GBP3.8 million);

-- Corporate overheads: GBP4.7 million for the year (2013: GBP3.1 million);

-- Number of employees: 193 at 31 March 2014 (2013: 212); and

-- Cash: GBP14.2 million at 31 March 2013 (2013: GBP5.5 million).

Financial review

For the year ended 31 March 2014, Digital Barriers delivered

revenue of GBP19.0 million (2013: GBP23.3 million) generating an

adjusted loss before tax of GBP12.0 million (2013 loss: GBP7.6

million) and adjusted loss per share of 21.49 pence (2013 loss:

16.45 pence). On an unadjusted basis, the loss before tax was

GBP15.1 million (2013 loss: GBP10.8 million) and loss per share was

25.87 pence (2013 loss: 21.78 pence).

Revenue and margins

Of the GBP19.0 million of revenue in the year, GBP14.5 million

was delivered from Product revenue streams, with GBP4.5 million

from the Services Division.

The decrease in revenue over the prior year was due to three

factors: a declining contribution from legacy or non-core products,

longer-than expected customer procurement cycles and delays in

bringing our new generation of products to market, now addressed.

There were no acquisitions in the year.

Results by division are discussed below:

Reported 2014 Reported 2013

Revenue GBP'000 GBP'000

--------------------- -------------- --------------

Services 4,527 6,289

--------------------- -------------- --------------

Products:

--------------------- -------------- --------------

Core Products(i) 9,927 8,421

--------------------- -------------- --------------

Mature(ii) 2,497 4,705

--------------------- -------------- --------------

Non-strategic(iii) 2,091 3,857

--------------------- -------------- --------------

14,515 16,983

--------------------- -------------- --------------

19,042 23,272

--------------------- -------------- --------------

(i) Core Products: greatest strategic opportunity for growth.

(ii) Mature products: established in the market and capable of

steady on-going profitable revenue.

(iii) Non-strategic products: underlying IP being transferred into Core product families.

Revenue from the Services division declined GBP(1.8) million

(28%) on the prior year, reflecting a difficult year with UK budget

constraints. This contraction in revenues led to a GBP(0.8) million

fall from GBP0.7 million segmental operating profit to a GBP(0.1)

million operating loss.

Products division revenue declined GBP(2.5) million (15%) on the

prior year, with all the reduction in Mature and Non-Strategic

categories. Core Products increased GBP1.5 million (18%), primarily

driven by TVI growth, with International Core Products revenues up

78% and UK revenues down 2%. The operating loss associated with the

Products division increased GBP(0.4) million in the year to

GBP(1.9)m as a result of reduced revenues.

Services Products Total

2014 2014 2014

GBP'000 GBP'000 GBP'000

-------------------------------- --------- --------- ---------

Revenue 4,527 14,515 19,042

-------------------------------- --------- --------- ---------

Segment loss (97) (1,854) (1,951)

-------------------------------- --------- --------- ---------

Corporate overheads (10,074)

-------------------------------- --------- --------- ---------

Adjusted group operating loss (12,025)

-------------------------------- --------- --------- ---------

Interest 32

-------------------------------- --------- --------- ---------

Adjusted group loss before tax (11,993)

-------------------------------- --------- --------- ---------

Revenue in the year was split 76%: 24% (2013: 73%: 27%) between

Products and Services respectively. The continuing trend towards

products reflects the on-going strategic focus of the Group and

drives the improvement in gross margin, increasing from 42.8% to

45.8%.

The Services gross margin decreased to 19.1% in the year (2013:

29.0%), driven by the reduction in revenues and a higher proportion

of lower margin project work, with higher product costs elements

compared to the prior year. The Products gross margin was 54.2%

(2013: 47.9%). This increase is largely associated with sales mix

with a marked increase in software sales in the year, alongside a

reduction in product hardware sales with a lower gross margin.

Adjusted loss

An adjusted loss before tax figure is presented as the Directors

believe that this is a more relevant measure of the Group's

underlying performance. For the year this was GBP12.0 million

(2013: GBP7.6 million) and is detailed in the table below:

2014 2013

GBP'000 GBP'000

----------------------------------------------------------------- --------- ---------

Loss before tax (15,067) (10,756)

----------------------------------------------------------------- --------- ---------

Add back:

----------------------------------------------------------------- --------- ---------

Amortisation of intangibles initially recognised on acquisition 1,733 2,029

----------------------------------------------------------------- --------- ---------

Acquisition costs - 369

----------------------------------------------------------------- --------- ---------

Adjustments to deferred consideration(i) (679) (1,384)

----------------------------------------------------------------- --------- ---------

Reorganisation costs(ii) 1,860 769

----------------------------------------------------------------- --------- ---------

Impairment of intangibles(iii) 160 1,336

----------------------------------------------------------------- --------- ---------

Adjusted loss before tax (11,993) (7,637)

----------------------------------------------------------------- --------- ---------

(i) Relates to the release of deferred consideration payable

against the Zimiti and Visimetrics acquisitions plus reassessment

of the remaining Visimetrics deferred consideration balance to

zero, partly offset by the unwind of discount.

(ii) Relates to a restructuring programme to rationalize the

Group's cost base and concentrate its resources on Core Products.

As the expenditure relates to transforming the divisions for the

future these costs are not directly related to current

operations.

(iii) Relates to certain intangibles acquired with Visimetrics

and LMW which are no longer seen as core to the business and

generate returns below the level used to determine the value of the

assets initially recognised on acquisition.

The increased year on year adjusted loss has been driven by

three key factors:

-- continued investment in sales and marketing required to drive international expansion;

-- investments in operations, particularly in new product

releases to address customer demand; and

-- lower group revenues (referred to above)

Central overheads are broken down as follows:

2014 2013

GBP'000 GBP'000

-------------------------------------------------------------------- --------- ---------

Sales and marketing 5,403 3,824

-------------------------------------------------------------------- --------- ---------

Other corporate overheads:

-------------------------------------------------------------------- --------- ---------

Central costs, including board, operations, finance and facilities 4,147 2,726

-------------------------------------------------------------------- --------- ---------

LTIP charge 524 336

-------------------------------------------------------------------- --------- ---------

4,671 3,062

-------------------------------------------------------------------- --------- ---------

Total 10,074 6,886

-------------------------------------------------------------------- --------- ---------

Sales and marketing costs have increased GBP1.6 million to

GBP5.4 million (2013: GBP3.8 million) as existing regional sales

teams have been expanded and strengthened, and investments have

been made into new sales and marketing teams internationally. These

investments enable a greater level of engagement in both

established and high-potential markets, building customer

relationships and pipeline to drive sales growth.

The operations teams have also been strengthened in the year to

further support product development and customer procurement

processes. This, along with investment in the IT infrastructure,

are the key drivers of the GBP1.4 million increase to GBP4.1

million (2013: GBP2.7 million) in central overheads.

Taxation

As a result of losses acquired through acquisitions and central

overheads we do not expect to pay the full rate of UK corporation

tax for a number of years. The Income Statement tax credit for the

year of GBP0.5 million (2013: GBP0.8 million) principally relates

to R&D tax credits. At 31 March 2014, the Group had unutilised

tax losses carried forward of approximately GBP44.0 million (2013:

GBP26.4 million). Given the varying degrees of uncertainty as to

the timescale of utilisation of these losses, the Group has not

recognised GBP8.5 million (2013: GBP5.6 million) of potential

deferred tax assets associated with GBP42.3 million (2013: GBP23.7

million) of these losses.

At 31 March 2014, the Group's net deferred tax liability stood

at GBP0.2 million (2013: GBP0.4 million), relating to acquired

intangible assets of GBP0.6 million (2013: GBP1.0 million), offset

by GBP0.4 million (2013: GBP0.6 million) relating to tax

losses.

Loss per share

The reported loss per share is 25.87 pence (2013 loss: 21.78

pence). The adjusted Loss per share is 21.49 pence (2013 loss:

16.45 pence).

Cash and treasury

The Group ended the year with a cash balance of GBP14.2 million

(2013: GBP5.5 million).

The GBP8.7 million year on year increase in net cash consists of

GBP18.0 million (net of placing costs) proceeds from an equity fund

raise less GBP(8.5) million (2013: GBP(14.1)million outflow)

outflow from operating activities and GBP(0.8)million

(2013:GBP(5.7) million) investing spend. No new businesses were

acquired during the year.

The GBP(8.5) million (2013:GBP(14.1) million)outflow from

operating activities included a GBP2.3 million net working capital

inflow / reduction (2013: GBP(6.9) million outflow), largely as a

result of lower fourth quarter revenues than in the prior year,

partially offset by an inventory increase. The balancing GBP(10.8)

million outflow from operating activities (2013: GBP(7.2) million

outflow) relates principally to the "cash" operating loss

(operating loss excluding non-cash items).

Investing spend included GBP(0.6) million of capital

expenditure, mainly demonstration stock, and a GBP(0.2) million

payment made to e-Tech in relation to a deferred consideration earn

out due.

Dividends

The Board is not recommending the payment of a dividend (2013:

GBPnil).

Consolidated income statement

for the year ended 31 March 2014

Year ended 31 March 2014 Year ended 31 March 2013

Note GBP'000 GBP'000

--------------------------------------------------------- ----- ------------------------- -------------------------

Revenue 19,042 23,272

--------------------------------------------------------- ----- ------------------------- -------------------------

Cost of sales (10,319) (13,322)

--------------------------------------------------------- ----- ------------------------- -------------------------

Gross profit 8,723 9,950

--------------------------------------------------------- ----- ------------------------- -------------------------

Administration costs (24,341) (20,823)

--------------------------------------------------------- ----- ------------------------- -------------------------

Other income 706 1,484

--------------------------------------------------------- ----- ------------------------- -------------------------

Other costs (160) (1,336)

--------------------------------------------------------- ----- ------------------------- -------------------------

Operating loss (15,072) (10,725)

--------------------------------------------------------- ----- ------------------------- -------------------------

Finance revenue 32 69

--------------------------------------------------------- ----- ------------------------- -------------------------

Finance costs (27) (100)

--------------------------------------------------------- ----- ------------------------- -------------------------

Loss before tax (15,067) (10,756)

--------------------------------------------------------- ----- ------------------------- -------------------------

Income tax 458 840

--------------------------------------------------------- ----- ------------------------- -------------------------

Loss after tax attributable to owners of the parent (14,609) (9,916)

--------------------------------------------------------- ----- ------------------------- -------------------------

Adjusted loss: 2

--------------------------------------------------------- ----- ------------------------- -------------------------

Loss before tax (15,067) (10,756)

--------------------------------------------------------- ----- ------------------------- -------------------------

Amortisation of intangibles initially recognised on

acquisition 1,733 2,029

--------------------------------------------------------- ----- ------------------------- -------------------------

Acquisition costs - 369

--------------------------------------------------------- ----- ------------------------- -------------------------

Adjustments to deferred consideration (679) (1,384)

--------------------------------------------------------- ----- ------------------------- -------------------------

Reorganisation costs 1,860 769

--------------------------------------------------------- ----- ------------------------- -------------------------

Impairment of intangibles 160 1,336

--------------------------------------------------------- ----- ------------------------- -------------------------

Adjusted loss before tax for the year (11,993) (7,637)

--------------------------------------------------------- ----- ------------------------- -------------------------

(Loss) per share - basic 4 (25.87p) (21.78p)

--------------------------------------------------------- ----- ------------------------- -------------------------

(Loss) per share - diluted 4 (25.87p) (21.78p)

--------------------------------------------------------- ----- ------------------------- -------------------------

(Loss) per share - adjusted 4 (21.49p) (16.45p)

--------------------------------------------------------- ----- ------------------------- -------------------------

(Loss) per share - adjusted diluted 4 (21.49p) (16.45p)

--------------------------------------------------------- ----- ------------------------- -------------------------

The results for the year and the prior year are derived from

continuing activities.

Consolidated statement of comprehensive income

for the year ended 31 March 2014

Year Year

ended ended

31 March 31 March

2014 2013

GBP'000 GBP'000

--------------------------------------------------- ---------- ----------

Loss for the year (14,609) (9,916)

--------------------------------------------------- ---------- ----------

Other comprehensive income

--------------------------------------------------- ---------- ----------

Other comprehensive income that may be

subsequently reclassified to profit and

loss:

--------------------------------------------------- ---------- ----------

Exchange differences on retranslation

of foreign operations 9 25

--------------------------------------------------- ---------- ----------

Net other comprehensive income to be reclassified

to profit or loss in subsequent years 9 25

--------------------------------------------------- ---------- ----------

Total comprehensive loss attributable

to owners of the parent (14,600) (9,891)

--------------------------------------------------- ---------- ----------

Consolidated balance sheet

at 31 March 2014

31 March 31 March

2014 2013

Note GBP'000 GBP'000

---------------------------------------------- ----- --------- ---------

Assets

---------------------------------------------- ----- --------- ---------

Non-current assets

---------------------------------------------- ----- --------- ---------

Property, plant and equipment 1,108 1,370

---------------------------------------------- ----- --------- ---------

Goodwill 24,802 24,802

---------------------------------------------- ----- --------- ---------

Other intangible assets 3,857 5,828

---------------------------------------------- ----- --------- ---------

29,767 32,000

---------------------------------------------- ----- --------- ---------

Current assets

---------------------------------------------- ----- --------- ---------

Inventories 3,895 1,779

---------------------------------------------- ----- --------- ---------

Trade and other receivables 5 7,706 13,084

---------------------------------------------- ----- --------- ---------

Current tax recoverable 826 972

---------------------------------------------- ----- --------- ---------

Cash and cash equivalents 14,246 5,544

---------------------------------------------- ----- --------- ---------

26,673 21,379

---------------------------------------------- ----- --------- ---------

Total assets 56,440 53,379

---------------------------------------------- ----- --------- ---------

Equity and liabilities

---------------------------------------------- ----- --------- ---------

Attributable to equity holders of the Parent

---------------------------------------------- ----- --------- ---------

Equity share capital 646 510

---------------------------------------------- ----- --------- ---------

Share premium 75,879 57,989

---------------------------------------------- ----- --------- ---------

Capital redemption reserve 4,786 4,735

---------------------------------------------- ----- --------- ---------

Merger reserve 454 454

---------------------------------------------- ----- --------- ---------

Translation reserve (212) (221)

---------------------------------------------- ----- --------- ---------

Other reserves (307) (307)

---------------------------------------------- ----- --------- ---------

Retained earnings (31,352) (17,267)

---------------------------------------------- ----- --------- ---------

Total equity 49,894 45,893

---------------------------------------------- ----- --------- ---------

Non-current liabilities

---------------------------------------------- ----- --------- ---------

Deferred tax liabilities 194 363

---------------------------------------------- ----- --------- ---------

Financial liabilities 7 - 202

---------------------------------------------- ----- --------- ---------

Provisions 161 -

---------------------------------------------- ----- --------- ---------

355 565

---------------------------------------------- ----- --------- ---------

Current liabilities

---------------------------------------------- ----- --------- ---------

Trade and other payables 6 5,608 6,038

---------------------------------------------- ----- --------- ---------

Financial liabilities 7 163 883

---------------------------------------------- ----- --------- ---------

Provisions 420 -

---------------------------------------------- ----- --------- ---------

6,191 6,921

---------------------------------------------- ----- --------- ---------

Total liabilities 6,546 7,486

---------------------------------------------- ----- --------- ---------

Total equity and liabilities 56,440 53,379

---------------------------------------------- ----- --------- ---------

Consolidated statement of changes in equity

for the year ended 31 March 2014

Profit

Share Capital and

Share premium redemption Merger Translation Other loss Total

capital account reserve reserve reserve reserves reserve equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------- --------- --------- ------------ --------- ------------ ---------- --------- ---------

At 31 March 2012 437 48,012 4,735 348 (246) (307) (7,687) 45,292

----------------------- --------- --------- ------------ --------- ------------ ---------- --------- ---------

Total comprehensive

income / (loss) - - - - 25 - (9,916) (9,891)

----------------------- --------- --------- ------------ --------- ------------ ---------- --------- ---------

Share-based payment

credit - - - - - - 336 336

----------------------- --------- --------- ------------ --------- ------------ ---------- --------- ---------

Share placement 72 10,328 - - - - - 10,400

----------------------- --------- --------- ------------ --------- ------------ ---------- --------- ---------

Share issue cost - (351) - - - - - (351)

----------------------- --------- --------- ------------ --------- ------------ ---------- --------- ---------

Issue of shares

regarding the

acquisition

of Keeneo 1 - - 106 - - - 107

----------------------- --------- --------- ------------ --------- ------------ ---------- --------- ---------

At 31 March 2013 510 57,989 4,735 454 (221) (307) (17,267) 45,893

----------------------- --------- --------- ------------ --------- ------------ ---------- --------- ---------

Share placement 133 18,567 - - - - - 18,700

----------------------- --------- --------- ------------ --------- ------------ ---------- --------- ---------

Share issue costs - (677) - - - - - (677)

----------------------- --------- --------- ------------ --------- ------------ ---------- --------- ---------

Incentive share

conversion 3 - 51 - - - - 54

----------------------- --------- --------- ------------ --------- ------------ ---------- --------- ---------

Share based payment

credit - - - - - - 524 524

----------------------- --------- --------- ------------ --------- ------------ ---------- --------- ---------

Loss for the year - - - - - - (14,609) (14,609)

----------------------- --------- --------- ------------ --------- ------------ ---------- --------- ---------

Other comprehensive

loss - - - - 9 - - 9

----------------------- --------- --------- ------------ --------- ------------ ---------- --------- ---------

At 31 March 2014 646 75,879 4,786 454 (212) (307) (31,352) 49,894

----------------------- --------- --------- ------------ --------- ------------ ---------- --------- ---------

Consolidated statement of cash flows

for the year ended 31 March 2014

Year Year

ended ended

31 March 31 March

2014 2013

GBP'000 GBP'000

---------------------------------------------------------- ---------- ----------

Operating activities

---------------------------------------------------------- ---------- ----------

Loss before tax (15,067) (10,756)

---------------------------------------------------------- ---------- ----------

Non-cash adjustment to reconcile loss before

tax to net cash flows

---------------------------------------------------------- ---------- ----------

Depreciation of property, plant and equipment 739 771

---------------------------------------------------------- ---------- ----------

Amortisation of intangible assets 1,819 2,102

---------------------------------------------------------- ---------- ----------

Impairment of intangible assets 160 1,336

---------------------------------------------------------- ---------- ----------

Share-based payment transaction expense 524 336

---------------------------------------------------------- ---------- ----------

Release of deferred consideration (494) (678)

---------------------------------------------------------- ---------- ----------

Reassessment of deferred consideration (212) (805)

---------------------------------------------------------- ---------- ----------

Disposal of fixed assets 178 226

---------------------------------------------------------- ---------- ----------

Finance income (32) (69)

---------------------------------------------------------- ---------- ----------

Finance costs 27 100

---------------------------------------------------------- ---------- ----------

Working capital adjustments:

---------------------------------------------------------- ---------- ----------

Decrease/ (increase) in trade and other receivables 5,353 (6,096)

---------------------------------------------------------- ---------- ----------

(Increase)/ decrease in inventories (2,116) 351

---------------------------------------------------------- ---------- ----------

(Decrease)/ increase in trade and other payables (919) (1,163)

---------------------------------------------------------- ---------- ----------

Increase in deferred revenue 704 -

---------------------------------------------------------- ---------- ----------

Increase in provisions 581 -

---------------------------------------------------------- ---------- ----------

Cash utilised in operations (8,755) (14,345)

---------------------------------------------------------- ---------- ----------

Tax received 220 275

---------------------------------------------------------- ---------- ----------

Net cash flow from operating activities (8,535) (14,070)

---------------------------------------------------------- ---------- ----------

Investing activities

---------------------------------------------------------- ---------- ----------

Purchase of property, plant and equipment (624) (1,453)

---------------------------------------------------------- ---------- ----------

Expenditure on intangible assets (8) (97)

---------------------------------------------------------- ---------- ----------

Acquisition of subsidiaries - (3,349)

---------------------------------------------------------- ---------- ----------

Payment of deferred consideration (188) (822)

---------------------------------------------------------- ---------- ----------

Acquisition of cash and cash equivalents of subsidiaries - (41)

---------------------------------------------------------- ---------- ----------

Interest received 32 69

---------------------------------------------------------- ---------- ----------

Net cash flow utilised in investing activities (788) (5,693)

---------------------------------------------------------- ---------- ----------

Financing activities

---------------------------------------------------------- ---------- ----------

Proceeds from issue of shares 18,700 10,400

---------------------------------------------------------- ---------- ----------

Share issue costs (677) (351)

---------------------------------------------------------- ---------- ----------

Interest paid - -

---------------------------------------------------------- ---------- ----------

Net cash flow from financing activities 18,023 10,049

---------------------------------------------------------- ---------- ----------

Net increase/(decrease) in cash and cash equivalents 8,700 (9,714)

---------------------------------------------------------- ---------- ----------

Cash and cash equivalents at beginning of year 5,544 15,289

---------------------------------------------------------- ---------- ----------

Effect of foreign exchange rate changes on cash

and cash equivalents 2 (31)

---------------------------------------------------------- ---------- ----------

Cash and cash equivalents at end of year 14,246 5,544

---------------------------------------------------------- ---------- ----------

1. Accounting policies

Basis of preparation

The consolidated financial statements for the year include those

of Digital Barriers plc and all of its subsidiary undertakings

(together 'the Group') drawn up at 31 March 2014. The Financial

Statements were authorised for issue by the Board of Directors on

27 May 2014 and the Balance sheet was signed on the Board's behalf

by Colin Evans and Sharon Cooper.

Subsidiary undertakings are those entities controlled directly

or indirectly by the Company. Control arises when the Group has the

power to govern the financial and operating policies of an entity

so as to obtain benefits from its activities. Subsidiaries are

consolidated from the date of their acquisition, being the date on

which the Group obtains control, and continue to be consolidated

until the date that such control ceases. Subsidiaries are

consolidated using the Group's accounting policies. Business

combinations are accounted for using the acquisition method of

accounting except for the acquisition of Digital Barriers Services

Limited by Digital Barriers plc which has been accounted for using

the pooling of interests method. All inter-company balances and

transactions, including unrealised profits arising from them, are

eliminated on consolidation.

All values are rounded to GBP'000 except where otherwise

stated.

The Company is a public limited company incorporated and

domiciled in England and Wales and whose shares are quoted on AIM,

a market operated by the London Stock Exchange.

The Group's financial statements have been prepared in

accordance with International Financial Reporting Standards

('IFRSs') as adopted by the European Union as they apply to the

financial statements of the Group for the year ended 31 March 2014

and applied in accordance with the Companies Act 2006. The

accounting policies which apply in preparing the financial

statements for the period are set out below.

The Group's financial statements have been prepared on a going

concern basis. Forecasts and projections, taking into account

reasonably possible changes in trading performance, show that the

Group will be able to operate within the level of current funding

resources. Given this and in view of the cash reserves of GBP14.2

million held on the balance sheet, the Directors are satisfied that

the Group has adequate resources to continue operating for the

foreseeable future. For this reason they have adopted the going

concern basis in preparing the accounts.

2. Adjusted loss before tax

An adjusted loss before tax measure has been presented as the

Directors believe that this is a more relevant measure of the

Group's underlying performance. Adjusted loss is not defined under

IFRS and has been shown as the Directors consider this to be

helpful for a better understanding of the performance of the

Group's underlying business. It may not be comparable with

similarly titled measurements reported by other companies and is

not intended to be a substitute for, or superior to, IFRS measures

of profit. The net adjustments to loss before tax are summarised

below:

2014 2013

GBP'000 GBP'000

----------------------------------------------------------------- --------- ---------

Amortisation of intangibles initially recognised on acquisition 1,733 2,029

----------------------------------------------------------------- --------- ---------

Acquisition costs - 369

----------------------------------------------------------------- --------- ---------

Adjustments to deferred consideration (i) (ii) (679) (1,384)

----------------------------------------------------------------- --------- ---------

Reorganisation costs 1,860 769

----------------------------------------------------------------- --------- ---------

Impairment of intangible assets (iii) 160 1,336

----------------------------------------------------------------- --------- ---------

Total adjustments 3,074 3,119

----------------------------------------------------------------- --------- ---------

(i) Adjustments to deferred consideration in the current year

comprise releases of GBP494,000 and reassessments of GBP212,000

partly offset by the unwind of discount on deferred consideration

balances of GBP27,000. In relation to the e-Tech acquisition

deferred consideration of GBP188,000 was paid in the year clearing

the remaining balance. The remaining GBP260,000 balance at Zimiti

was released in the year as the target was not achieved. At

Visimetrics GBP234,000 was released and the remaining GBP212,000

balance has all been reassessed. The releases and reassessments of

deferred consideration totalling GBP706,000 have been separately

disclosed within Other Income in the Consolidated Income

Statement.

(ii) Adjustments to deferred consideration in the prior year

comprise releases of GBP678,000 and reassessments of GBP805,000

partly offset by the unwind of discount on deferred consideration

balances of GBP99,000. In relation to the LMW acquisition deferred

consideration of GBP60,000 was paid in the year and the remaining

balance of GBP30,000 was released. An interim time-constrained

financial target was not met in relation to the Zimiti acquisition,

resulting in the release of GBP617,000 of deferred consideration;

the remaining balance held in respect of Zimiti has been reassessed

and reduced by GBP805,000 to GBP253,000. In relation to the E-Tech

acquisition deferred consideration of GBP12,000 was paid in the

year with a further GBP188,000 paid after year-end in April 2013;

the remaining balance of GBP31,000 was released. The releases and

reassessments of deferred consideration totalling GBP1,484,000 have

been separately disclosed within Other Income in the Consolidated

Income Statement.

(iii) The restructuring programme has resulted in an impairment

in the year of customer relationships and intellectual property in

relation to the LMW and Visimetrics acquired businesses. The total

impairment of GBP160,000 has been separately disclosed within Other

Costs in the Consolidated Income Statement.

In the prior year the performance of the Keeneo, Waterfall and

Codestuff entities were below the level used to determine the

intangible assets initially recognised on acquisition. The carrying

value of the intangible assets has been re-evaluated using a value

in use model, with discount rates of between 10.8% and 11.7%. As a

result the intangible assets of each entity have been impaired by

GBP577,000, GBP630,000 and GBP129,000 respectively. The total

impairment of GBP1,336,000 has been separately disclosed within

Other Costs in the Consolidated Income Statement.

3. Reorganisation costs

2014 2013

GBP'000 GBP'000

------------------------ --------- ---------

Redundancy and related 1,167 657

------------------------ --------- ---------

Office closure 466 -

------------------------ --------- ---------

Other 227 112

------------------------ --------- ---------

Total pre-tax charge 1,860 769

------------------------ --------- ---------

During the year the Group recognised GBP1,860,000 of pre-tax

reorganisation costs in relation to a restructuring programme to

rationalise its cost base and concentrate resources on its

strategic products. Office closure relates to five properties and

covers rent, rates and dilapidation costs. Other primarily relates

to stock write-down.

Reorganisation costs in the prior year relate to the

rationalisation of the organisational and geographical design,

information systems and support functions within both the Services

and Products Divisions. As the expenditure relates to transforming

the divisions for the future these costs are not directly related

to current operations.

4. Loss per share

Unadjusted loss per share

Weighted Weighted

Loss average Loss average

after number Loss after number Loss

taxation of shares per share taxation of shares per share

2014 2014 2014 2013 2013 2013

GBP'000 No. Pence GBP'000 No. Pence

------------------------ ---------- ----------- ----------- ---------- ----------- -----------

Basic loss per share (14,609) 56,472,084 (25.87) (9,916) 45,530,712 (21.78)

------------------------ ---------- ----------- ----------- ---------- ----------- -----------

Diluted loss per share (14,609) 56,472,084 (25.87) (9,916) 45,530,712 (21.78)

------------------------ ---------- ----------- ----------- ---------- ----------- -----------

5. Adjusted loss per share

Weighted Weighted

Loss average Loss average

after number after number Loss

taxation of shares Loss per taxation of shares per share

2014 2014 share 2013 2013 2013

GBP'000 No. 2014 Pence GBP'000 No. Pence

--------------------------------------- ---------- ----------- ------------ ---------- ----------- -----------

Loss attributable to ordinary

shareholders (14,609) 56,472,084 (25.87) (9,916) 45,530,712 (21.78)

--------------------------------------- ---------- ----------- ------------ ---------- ----------- -----------

Add back:

--------------------------------------- ---------- ----------- ------------ ---------- ----------- -----------

Amortisation of acquired

intangible assets, net of

tax 1,559 - 2.76 1,658 - 3.64

--------------------------------------- ---------- ----------- ------------ ---------- ----------- -----------

IPO, placing costs and acquisition

costs - - - 369 - 0.81

--------------------------------------- ---------- ----------- ------------ ---------- ----------- -----------

Adjustments to deferred consideration (679) - (1.20) (1,384) - 3.04)

--------------------------------------- ---------- ----------- ------------ ---------- ----------- -----------

Reorganisation costs 1,432 - 2.54 769 - 1.69

--------------------------------------- ---------- ----------- ------------ ---------- ----------- -----------

Impairment of acquired intangibles 160 - 0.28 1,015 - 2.23

--------------------------------------- ---------- ----------- ------------ ---------- ----------- -----------

Basic adjusted loss per share (12,137) 56,472,084 (21.49) (7,489) 45,530,712 (16.45)

--------------------------------------- ---------- ----------- ------------ ---------- ----------- -----------

Diluted adjusted loss per

share (12,137) 56,472,084 (21.49) (7,489) 45,530,712 (16.45)

--------------------------------------- ---------- ----------- ------------ ---------- ----------- -----------

The Directors consider that adjusted loss per share better

reflects the underlying performance of the Group.

The inclusion of potential Ordinary Shares arising from LTIPs

and Incentive Shares would be anti-dilutive. Basic and diluted loss

per share has therefore been calculated using the same weighted

number of shares. If the Incentive Shares had become convertible on

31 March 2014 and based on the share price of GBP0.875 (2013:

GBP1.850) on that day, no (2013: 1,540,401) Ordinary Shares would

have been issued in respect of the Incentive Share conversion. Full

details of the basis of calculation is given in the Admission

Document available on the Company's website. The Incentive Shares

will immediately vest on change of control of the Company.

6. Trade and other receivables

Gross Gross

carrying Provision Net carrying carrying Provision Net carrying

amounts for impairment amounts amounts for impairment amounts

2014 2014 2014 2013 2013 2013

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ ---------- ---------------- ------------- ---------- ---------------- -------------

Trade receivables 6,562 (499) 6,063 9,344 (34) 9,310

------------------------ ---------- ---------------- ------------- ---------- ---------------- -------------

Prepayments 430 - 430 733 - 733

------------------------ ---------- ---------------- ------------- ---------- ---------------- -------------

Accrued income 119 - 119 2,273 - 2273

------------------------ ---------- ---------------- ------------- ---------- ---------------- -------------

Amounts recoverable on

contracts 692 - 692 718 - 718

------------------------ ---------- ---------------- ------------- ---------- ---------------- -------------

Other receivables 402 - 402 50 - 50

------------------------ ---------- ---------------- ------------- ---------- ---------------- -------------

8,205 (499) 7,706 13,118 (34) 13,084

------------------------ ---------- ---------------- ------------- ---------- ---------------- -------------

The Group's credit risk on trade and other receivables is

primarily attributable to trade receivables and amounts recoverable

on contracts. One customer represents GBP1,103,000 (2013:

GBP2,426,000) of the Group's trade receivables at 31 March 2014.

There is no other significant concentration of credit risk.

In the prior year fair values of the assets and liabilities

arising from the Visimetrics acquisition were provisional.

Acquisition accounting allows for a review of these values within a

12 month period post acquisition. This has resulted in a GBP155,000

reduction in the fair value of trade receivables and consequent

equal increase in goodwill in the prior year.

7. Trade and other payables

2014 2013

GBP'000 GBP'000

--------------------------------- --------- ---------

Current

--------------------------------- --------- ---------

Trade payables 3,096 3,892

--------------------------------- --------- ---------

Accruals 1,173 887

--------------------------------- --------- ---------

Deferred income 704 190

--------------------------------- --------- ---------

Social security and other taxes 520 861

--------------------------------- --------- ---------

Other payables 115 208

--------------------------------- --------- ---------

5,608 6,038