TIDMDGB

RNS Number : 6169H

Digital Barriers plc

01 June 2011

1 June 2011

Digital Barriers plc

("Digital Barriers" or the "Company")

Preliminary Results for the thirteen months ended 31 March

2011

Digital Barriers plc (LSE AIM: DGB), the specialist provider of

products and services to the international homeland security

market, announces audited results for the thirteen months ended 31

March 2011.

The Board is pleased to report that it has made good strategic

progress since IPO in March 2010, the highlights of which are:

Key Highlights

-- Revenue of GBP6.6 million, Loss before tax of GBP4.6 million,

Adjusted loss before tax of GBP2.7 million*

-- Raising a total of GBP55.0 million (before expenses) through

Executive Director contribution, the IPO in March 2010 and a share

placing in December 2010;

-- Completing five acquisitions since IPO, on which integration

is effectively complete, and with a good pipeline of potential

target companies for further acquisition;

-- Acquiring world-class IP into the group which is generating

significant traction from a growing number of overseas governments

and commercial organisations - we already have trial deployments

underway in the US, Middle East and Asia-Pacific. Our acquisition

pipeline should bring additional world-class IP into the Group;

-- Establishing a London Headquarters which provides leadership,

governance, strategic direction as well as sales and brand

management across the Group;

-- Developing an international presence. We now have operations

within each of our target regions, with offices in London,

Singapore and Washington, DC. Our presence in the Middle East is

expected to be in place later this year. In addition, we have

experienced considerable sales success in South Korea; and

-- Developing relationships with major prime system integrators.

We have entered into formal contractual arrangements with Singapore

Technologies and we are working with Boeing to provide expertise in

risk and vulnerability assessments. In addition we have on-going

sales collaboration with several other major integrators across

each of our target regions.

* Before amortisation of acquired intangibles of GBP0.7 million,

the unwinding of the discount on deferred consideration of GBP0.1

million, IPO and placing costs of GBP0.2 million and deal costs of

GBP0.9 million.

Commenting on the results Dr Tom Black, Executive Chairman of

Digital Barriers plc said:

"With our strategy now validated, and with strong sales interest

across each of our target regions, we continue to see the

opportunity for Digital Barriers as very compelling over the medium

to long term. We also have a good pipeline of potential

acquisitions which gives us additional confidence in the future of

the Group."

For further information please contact:

Digital Barriers plc +44 (0)20 7940

4740

Tom Black, Executive Chairman

Colin Evans, Managing Director

Investec Investment Banking +44 (0)20 7597

5970

Andrew Pinder

Financial Dynamics +44 (0)20 7831

3113

Edward Bridges / Matt Dixon

About Digital Barriers plc:

Founded by the leadership team behind Detica Group plc, Digital

Barriers is focused on the provision of specialist products and

services to the international homeland security market, where

counter-terrorism, the protection of critical computer systems and

networks, and support for counter-insurgency operations overseas

represent a compelling commercial opportunity. Over time, the

Company aims to become a leading specialist, working directly with

end-customers and through key partner organisations, providing

focused, proportionate and effective solutions across the Secure

Government, Border Protection, Defence, Transportation, Energy and

Utilities sectors, as well as with organisations responsible for

safeguarding crowded public spaces and nationally symbolic

locations.

www.digitalbarriers.com

Chairman's Statement

Introduction and highlights

This has been a very good first year for Digital Barriers and we

have seen significant momentum in the development of the Company.

At the time of our IPO in March 2010, we stated that we aimed to

provide specialist products and services to an international

homeland security market now worth $178.0 billion a year and

growing (Source: Visiongain: 'Global Homeland Security 2010-2020,

July 2010). This aim remains unaltered. Since then, the evolving

threats of international terrorism against civilian targets,

highly-organised criminal networks sponsoring the trafficking of

drugs and people, economic fraud and identity theft, attacks on

high-profile computer systems, and specialist military operations

overseas, have continued to dominate the headlines both in the UK

and internationally.

Our strategy is to provide specialist solutions to the major

government departments and commercial organisations responsible for

combating these threats in the most significant homeland security

regions, specifically the UK and Mainland Europe, the United

States, the Middle East and Asia-Pacific. Our progress and momentum

through the last year has validated this strategy through the

strong interest we have received from major customers and partners

across each of these territories.

The major highlights are as follows:

-- Revenue of GBP6.6 million, Loss before tax of GBP4.6 million,

Adjusted loss before tax of GBP2.7 million*

-- Raising a total of GBP55.0 million (before expenses) through

Executive Director contribution, the IPO in March 2010 and a share

placing in December 2010;

-- Completing five acquisitions since IPO, on which integration

is effectively complete, and with a good pipeline of potential

target companies for further acquisition;

-- Acquiring world-class IP into the group which is generating

significant traction from a growing number of overseas governments

and commercial organisations - we already have trial deployments

underway in the US, Middle East and Asia-Pacific. Our acquisition

pipeline should bring additional world-class IP into the Group;

-- Establishing a London Headquarters which provides leadership,

governance, strategic direction as well as sales and brand

management across the Group;

-- Developing an international presence. We now have operations

within each of our target regions, with regional offices in London,

Singapore and Washington, DC. Our presence in the Middle East is

expected to be in place later this year. In addition, we have

experienced considerable sales success in South Korea; and

-- Developing relationships with major prime system integrators.

We have entered into formal contractual arrangements with Singapore

Technologies and we are working with Boeing to provide expertise in

risk and vulnerability assessments. In addition we have on-going

sales collaboration with several other major integrators across

each of our target regions.

* Before amortisation of acquired intangibles of GBP0.7 million,

the unwinding of the discount on deferred consideration of GBP0.1

million, IPO and placing costs of GBP0.2 million and deal costs of

GBP0.9 million.

Results

The results for the period reflect the phased acquisitions by

the Group during the period and ongoing corporate overheads. As

such they are not representative of the current trading of the

business.

Revenues in the period were GBP6.6 million. The Group's loss

before tax was GBP4.6 million. We recorded an adjusted loss before

tax of GBP2.7 million, after adding back amortisation of acquired

intangibles of GBP0.7 million, the unwinding of the discount on

deferred consideration of GBP0.1 million, IPO and placing costs of

GBP0.2 million and acquisition costs of GBP0.9 million.

Consideration for acquisitions in the period totalled GBP20.2

million, with GBP16.5 million of this paid in cash in the period.

The cash balance at the end of the period was GBP33.5 million.

People

Our people include world-class technologists and experienced

homeland security and specialist defence practitioners who help our

customers and partners both in the UK and overseas. We bring

together a unique mix of skills to provide real-world solutions

that make a tangible difference on the ground.

In our first year we have assembled a very experienced HQ

management and sales team, and have made good progress in

developing our broader regional presence. We have also established

a Strategic Advisors Group comprising four senior former government

officials from the UK and US. This group brings deep operational

expertise and a strong network of international relationships.

Outlook

Having validated our strategy, with world-class IP in the Group,

and with strong interest across each of our regions, we remain

confident that the opportunity for Digital Barriers is very

compelling over the medium to long term.

The Group's initial set-up phase is complete and the focus is

now on international sales, with our specialist sales team taking

solutions based on our world-class IP to target customers and

partners in each of our regions. We will also continue to identify

and secure additional target companies with compelling technology;

we expect these to be broadly similar in size and profile to

previous acquisitions.

We will continue to develop the Digital Barriers brand in the

minds of customers and partners, and remain confident that we are

continuing to make good progress in establishing the Group as a

leading international homeland security specialist over the coming

years.

Business Review

Introduction

We have made very good progress in establishing a platform for

Digital Barriers since the IPO in March 2010. In addition to

establishing our Headquarters and international sales functions, we

have also put in place two operating divisions, Services and

Products, into which we have integrated the five acquisitions made

to date.

With this platform now established, we are confident we can

drive strong organic growth by exploiting our regional sales

capability, and continue adding further capability via

acquisition.

Services Division

A key part of our strategy is to use the strong credentials

provided by our experience with the UK Government to support our

international business development initiatives. Our Services

Division is focused on the UK market and, in our first year, we saw

Digital Barriers establish itself with a number of key UK

Government organisations in the secure government, law enforcement

and transportation sectors. This has been achieved through the

acquisition and subsequent development of Security Applications and

Overtis Solutions (now known as Digital Barriers Integration

Services), which together, despite difficult market conditions,

delivered good results.

This division generally implements solutions based on third

party technology although we are starting to deliver our own

technology into our UK Services clients. We plan to develop our

Services business primarily organically and will maintain our

current focus on the very high security areas of the UK Government

market.

Outside the UK Government market we have been further encouraged

by the support received so far from the Government's UK Trade and

Investment organisation, where staff in London and embassies in key

countries have provided us with invaluable advice and

introductions.

Products Division

Our Products Division operates internationally and currently

comprises COE, Waterfall Solutions and Essential Viewing Systems.

Collectively, these businesses have sold to customers in the UK,

Asia-Pacific and the US in the period.

Waterfall Solutions and Essential Viewing Systems have traded

very well post-acquisition and have both helped broaden and deepen

our UK Government relationships. COE brought with it both its

existing infrastructure and customer base in Singapore, upon which

we have continued to build as well as a broader Asia-Pacific market

position, particularly in the transportation sector. We have

implemented a number of planned changes to align COE better with

the Digital Barriers operating model.

Technology capability

Our Products Division now owns industry leading intellectual

property focused on the advanced visual surveillance market. This

covers image capture, a range of image processing and enhancement

techniques (for example, thermal image processing, image

stabilisation, and enhancing low light performance), and a range of

video analysis techniques. In addition, we have world class secure

and bandwidth-efficient wireless transmission technology.

We have been successful in generating good interest with a

number of highly differentiated products and have trials underway

with new government customers in the US, Middle East and

Asia-Pacific. In particular:

-- Essential Viewing's wireless video transmission system,

"LiteStream" - utilising a patented software algorithm originating

from the University of Strathclyde, the E300 is designed to stream

high quality video over very poor quality wireless communications

links, such as the poor coverage areas of a mobile phone network.

With a military heritage, this technology is creating significant

interest from traditional military customers, police forces and,

under Digital Barriers' ownership, mass transport operators worried

about terrorist and serious crime risks.

-- Waterfall's dual-band imaging and processing system

"Fuzer"(TM)- with roots in advanced military image processing, this

system intelligently fuses images from multiple cameras, including

visual and infrared sensors, into a single, integrated and enhanced

image. This unique system is capable of fusing imagery from

zoom-enabled cameras. This provides excellent performance in

difficult surveillance environments and is in trial with a number

of mainly military customers.

International progress

In Asia-Pacific, our initial focus has been on Singapore, both

as an important international customer itself, and as a regional

hub. We have been encouraged by the response of the Singapore

Government, the key regional partner Singapore Technologies and

customers such as Port of Singapore Authority and Singapore Mass

Transit System to our full range of capability. We expect to see a

broadening and deepening of these relationships in the coming year.

From a broader Asian perspective, we have achieved good progress in

South Korea and are now actively broadening our reach to other

countries in the region.

Our Essential Viewing acquisition has brought us a number of US

Government opportunities. We have established a sales presence in a

Washington, DC. office to take these opportunities forward and to

develop our US market presence. In this large and highly

competitive market, we are working with a small number of key US

prime system integrators to gain traction.

In the Middle East, we have initiated relationship and

brand-building activities with the support of the UK Government.

With an initial focus on the United Arab Emirates, Qatar, Kuwait

and the Kingdom of Saudi Arabia, we are again working closely with

major prime system integrators such as Boeing, who are well

established in the region and that have good market knowledge and

relationships.

Sales approach

Since IPO, we have established an international sales capability

utilising our regional office infrastructure. We are currently

focusing primarily on direct sales to end-government customers to

gain market traction and build credibility internationally. Given

our consulting-led approach, we are confident that once initial

sales are complete, we can go on to develop enduring relationships

with these international customers.

We are also positioning ourselves as key partners with prime

system integrators on very large programmes, specifically in the US

and Middle East. These are at various stages of the procurement

cycle but represent substantial opportunities for us over time.

Governance

Digital Barriers is committed to maintaining high standards of

Corporate Governance. Whilst the Group is not bound by the

provisions of section 1 of the 2008 Combined Code on Corporate

Governance ('the Combined Code') the Board endeavors, so far as is

practical, to comply with the Combined Code. During the period

under review the Board has developed the internal controls and

processes to ensure as far as possible compliance with the Combined

Code.

Performance Indicators

We monitor a number of metrics, both financial and

non-financial, on a monthly basis. The most important of these are

as follows:

-- Revenue: GBP6.6 million for period under review;

-- Corporate overhead GBP2.7 million for period under

review;

-- Number of employees: 110 at 31 March 2011; and

-- Cash: GBP33.5 million at 31 March 2011.

The Board is satisfied with the status of the above performance

indicators given the current stage of the Group's development.

Although not particularly relevant for the period under review

the Board will in future also monitor organic revenue growth,

operating margin, tax rate and cash conversion.

Financial Review

Digital Barriers has delivered solid performance in its first

accounting period since incorporation in February 2010, with

revenue of GBP6.6 million generating an adjusted loss before tax of

GBP2.7 million and adjusted loss per share of 9.21 pence. On an

unadjusted basis, the loss before tax was GBP4.6 million and loss

per share was 15.38 pence.

Revenue and margins

Digital Barriers delivered GBP6.6 million of revenue driven by

the acquisition of five businesses at various points in the

reporting period as detailed below.

Date of acquisition

Security Applications Limited (trading as 23 March 2010

D Ford Associates)

Overtis Solutions (now known as Digital Barriers 23 July 2010

Integration Services)

Coe Group plc 20 August 2010

Waterfall Solutions Limited 20 October

2010

Essential Viewing Systems Limited 11 March 2011

These acquired businesses have been integrated into one of two

divisions. Results by division are shown below. The Products

Divisional loss is the result of a number of planned changes

post-acquisition to align COE better with Digital Barriers'

operating model.

The Group's adjusted loss before tax for the period was GBP2.7

million. The table below summarises the Group's revenue and

operating results by these segments.

Services Products Total

2011 2011 2011

GBPm GBPm GBPm

Revenue 4.3 2.3 6.6

Segment profit / (loss) 0.3 (0.4) (0.1)

Segment margin 7.1% - -

Corporate overheads (2.7)

Adjusted Group operating loss (2.8)

Interest 0.1

Adjusted Group loss before tax (2.7)

Revenues earned by the Group in the period were split 64% and

36% between Services and Products respectively.

The Corporate overheads are broken down as follows:

GBP000

Board and plc operating costs 999

Sales and marketing 732

Operations, finance and facilities 973

LTIP charge 43

Total 2,747

Taxation

As a result of losses acquired through acquisitions and

corporate overheads we do not expect to pay the full rate of UK

corporation tax for a number of years. The tax credit for the

period of GBP0.3 million principally relates to the unwinding of

deferred tax liabilities on acquired intangibles and R&D tax

credits.

At 31 March the Group hadunutilised tax losses carried forward

of approximately GBP11.2 million. Given the varying degrees of

uncertainty as to the timescale ofutilisation of these losses, the

Group has not recognised GBP2.2 million of potential deferred tax

assets associated with GBP8.3 million of these losses.

At 31 March the Group's net deferred tax liability stood at

GBP0.5 million, relating to intangibles on acquisitions made in the

period of GBP1.3 million, offset by GBP0.8 million relating to tax

losses.

Loss Per Share

The reported Loss per share is 15.38 pence.

The adjusted Loss per share of 9.21 pence is detailed in the

table below as the Directors believe that this is a more relevant

measure of the Group's underlying performance.

Loss

Loss after per

Taxation share

2011 2011

GBP'000 Pence

Loss attributable to ordinary shareholders (4,348) (15.38)

Add back:

Amortisation of acquired intangible

assets, net of tax 529 1.87

IPO and Placing costs 233 0.82

Deal costs 892 3.15

Unwind of discount on deferred consideration 89 0.32

Basic adjusted loss per share (2,605) (9.21)

Cash and treasury

We ended the period with a cash balance of GBP33.5 million.

During the course of the period the Group raised a total of

GBP55.0 million (before expenses). The Executive Directors

contributed GBP5.0 million through Digital Barriers Services Ltd,

GBP20.0 million was raised via the IPO in March 2010 and GBP30.0

million from a Placing in December 2010. After taking into account

the maximum deferred consideration payable in respect of

acquisitions made to date of GBP4.0 million, and assuming these are

paid in full, the balance of cash would be GBP29.5 million. This

cash balance remains available to the business to fund future

acquisitions and working capital.

Financing costs included a charge of GBP0.1 million in respect

of the discounting of the deferred consideration for Security

Applications Limited, Waterfall Solutions Limited and Essential

Viewing Systems Limited, which will be paid out over the next two

years.

Dividends

The Board is not recommending the payment of a dividend.

DIGITAL BARRIERS PLC

Consolidated statement of comprehensive income

for the thirteen months ended 31 March 2011

13 Months

ended

31 March

2011

Note GBP'000

Revenue 6,555

Cost of sales (4,021)

----------

Gross profit 2,534

Administration costs (7,141)

----------

Operating Loss (4,607)

Finance Revenue 98

Finance Costs (96)

----------

Loss before Tax (4,605)

Income Tax 257

----------

Loss after tax and total comprehensive

loss

attributable to owners of the parent (4,348)

----------

Adjusted loss:

Loss before Tax (4,605)

Amortisation of acquired intangible

assets 668

IPO and Placing costs 233

Deal costs 892

Unwind of discount on deferred consideration 89

----------

Adjusted loss before tax for the period (2,723)

----------

(Loss) per share - basic 2 (15.38p)

(Loss) per share - diluted 2 (15.38p)

(Loss) per share - adjusted 2 (9.21p)

(Loss) per share - adjusted diluted 2 (9.21p)

The results for the period are derived from continuing

activities

DIGITAL BARRIERS PLC

Consolidated balance sheet

at 31 March 2011

31 March

11

Note GBP'000

ASSETS

Non current assets

Property, plant and equipment 389

Goodwill 12,966

Other intangible assets 5,912

19,267

Current assets

Inventories 589

Trade and other receivables 3 3,243

Current tax recoverable 163

Cash and cash equivalents 33,524

37,519

TOTAL ASSETS 56,786

---------

EQUITY AND LIABILITIES

Attributable to equity holders of the

parent

Equity share capital 436

Share premium 48,012

Capital redemption reserve 4,735

Other reserves (307)

Retained earnings (4,305)

TOTAL EQUITY 48,571

Non current liabilities

Deferred tax liabilities 507

Financial liabilities 5 673

1,180

Current liabilities

Trade and other payables 4 3,680

Financial liabilities 5 3,355

---------

7,035

TOTAL LIABILITIES 8,215

---------

TOTAL EQUITY AND LIABILITIES 56,786

---------

DIGITAL BARRIERS PLC

Consolidated statement of changes in equity

for the thirteen months ended 31 March 2011

Profit

Share Capital and

Share Premium redemption Other loss Total

capital account reserve reserves reserve Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 8 February

2010 - - - - - -

Issue of

shares in

exchange for

shares in

Digital

Barriers

Services Ltd 4,783 - - - - 4,783

Arising on

pooling of

interest

transaction - - - (307) - (307)

Redemption of

deferred

shares (4,735) - 4,735 - - -

Shares issued

to market -

IPO 200 19,800 - - - 20,000

Share issue

costs - IPO - (700) - - - (700)

Shares issued

to market -

placing 188 29,812 - - - 30,000

Share issue

costs -

placing - (900) - - - (900)

Share based

payment

credit - - - - 43 43

Total

comprehensive

loss - loss

for the year - - - - (4,348) (4,348)

-------- -------- ----------- --------- -------- --------

At 31 March

2011 436 48,012 4,735 (307) (4,305) 48,571

-------- -------- ----------- --------- -------- --------

DIGITAL BARRIERS PLC

Consolidated statement of cash flows

for the thirteen months ended 31 March 2011

13 Months ended

31 March 11

GBP'000

Operating activities

Loss before tax (4,605)

Non-cash adjustment to reconcile loss before

tax to net cash flows

Depreciation of property, plant and equipment 90

Amortisation of acquired intangible assets 668

Share-based payment transaction expense 43

Finance income (98)

Finance costs 96

Working capital adjustments:

Increase in trade and other receivables (1,163)

Increase in trade and other payables 691

----------------

Cash generated from operations (4,278)

Income tax paid (121)

Net cash flow from operating activities (4,399)

----------------

Investing activities

Purchase of property, plant & equipment (126)

Acquisition of subsidiaries (16,525)

Acquisition of cash and cash equivalents of subsidiaries 1,410

Cash and cash equivalents arising on pooling

of interest transaction 4,680

Interest received 88

Net cash flow generated in investing activities (10,473)

----------------

Financing activities

Proceeds from issue of shares 50,000

Share issue costs (1,600)

Interest paid (4)

Net cash flow from financing activities 48,396

----------------

Net increase in cash and cash equivalents 33,524

Cash and cash equivalents at 8 February 2010 -

Cash and cash equivalents at 31 March 2011 33,524

================

1. Accounting policies

Basis of preparation

The preliminary results of the period 8 February 2010 to 31

March 2011 have been extracted from audited accounts which have not

yet been delivered to the Registrar of Companies. The Financial

Statements set out in this announcement do not constitute statutory

accounts for the period ended 31 March 2011. The report of the

auditors on the statutory accounts for the period ended 31 March

2011 was unqualified and did not contain a statement under Section

498 of the Companies Act 2006. The Financial Statements for the

period ended 31 March 2011 included in this announcement were

authorised for issue in accordance with a resolution of the Board

of Directors on 31 May 2011.

Subsidiary undertakings are those entities controlled directly

or indirectly by the Company. Control arises when the Group has the

power to govern the financial and operating policies of an entity

so as to obtain benefits from its activities. Subsidiaries are

consolidated from the date of their acquisition, being the date on

which the Group obtains control, and continue to be consolidated

until the date that such control ceases. Subsidiaries are

consolidated using the Group's accounting policies. Business

combinations are accounted for using the acquisition method of

accounting except for the acquisition of Digital Barriers Services

Limited by Digital Barriers plc which has been accounted for using

the pooling method. All inter-company balances and transactions,

including unrealised profits arising from them, are eliminated on

consolidation.

The Company is a limited liability company incorporated and

domiciled in England & Wales and whose shares are quoted on

AIM, a market operated by The London Stock Exchange.

The Group's financial statements have been prepared in

accordance with International Financial Reporting Standards

("IFRS") as adopted by the European Union as they apply to the

financial statements of the Group for the period ended 31 March

2011 and applied in accordance with the Companies Act 2006.

New holding company

On 8 February 2010, Digital Barriers plc was incorporated as a

new holding company and parent company of the Group. On 22 February

2010 the former shareholders of Digital Barriers Services Limited

("DBSL") were issued new shares in Digital Barriers plc in a share

for share exchange. Immediately following the share for share

exchange the former shareholders of DBSL held the same economic

interest in Digital Barriers plc as they held in DBSL immediately

prior to the exchange.

The acquisition of DBSL by Digital Barriers plc falls outside

the scope of IFRS 3R "Business Combinations" and has been accounted

for in these financial statements using the pooling of interests

method which reflects the economic substance of the transaction. In

accordance with the requirements of the pooling of interests

method, the assets and liabilities of Digital Barriers plc and DBSL

are recognised and measured in these financial statements at their

pre-combination carrying amounts.

2. Loss per share

Basic loss per share

Weighted

average

number Loss

Loss after of per

taxation shares share

2011 2011 2011

GBP'000 No. Pence

Basic loss per share (4,348) 28,279,011 (15.38)

Diluted loss per share (4,348) 28,279,011 (15.38)

Adjusted loss per share

Weighted

average

number Loss

Loss after of per

Taxation shares share

2011 2011 2011

GBP'000 No. Pence

Loss attributable to ordinary

shareholders (4,348) 28,279,011 (15.38)

Add back:

Amortisation of acquired intangible

assets, net of tax 529 - 1.87

IPO and Placing costs 233 - 0.82

Deal costs 892 - 3.15

Unwind of discount on deferred

consideration 89 - 0.32

Basic adjusted loss per share (2,605) 28,279,011 (9.21)

Diluted adjusted loss per share (2,605) 28,279,011 (9.21)

The Directors consider that adjusted EPS better reflects the

underlying performance of the Group.

The inclusion of potential ordinary shares arising from LTIPs

and Incentive shares would be anti-dilutive. Basic and diluted loss

per share has therefore been calculated using the same weighted

number of shares. If the Incentive shares had become convertible on

31 March 2011 and based on the share price of GBP2.05 on that day,

2,679,206 ordinary shares would have been issued in respect of the

Incentive Share conversion. Full details as to the basis of

calculation is given in the placing document available on the

Company's website. The Incentive shares will immediately vest on

change of control of the Company.

The weighted average number of shares excludes any shares held

by employee share ownership plan (ESOP) trusts, which are treated

as cancelled.

3. Trade and other receivables

Gross Provision Net

Carrying For carrying

amounts impairment amounts

2011 2011 2011

GBP'000 GBP'000 GBP'000

Trade receivables 3,169 (355) 2,814

Prepayments and accrued income 167 - 167

Amounts recoverable on contracts 233 - 233

Other receivables 29 - 29

3,598 (355) 3,243

4. Trade and other payables

2011

GBP'000

Current

Trade payables 2,030

Accruals 1,024

Payments received on account 220

Social security and other taxes 400

Other payables 6

3,680

5. Financial liabilities

2011

GBP'000

Current

Incentive shares 218

Deferred consideration 3,137

3,355

Non-current

Deferred consideration 673

673

6. Business combinations

Details of the acquisitions made by the Group in the period are

set out below.

6a. Digital Barriers Services Limited

On 22 February 2010, Digital Barriers plc acquired 100% of the

shares of Digital Barriers Services Limited ("DBSL") to form the

Digital Barriers group via a share for share exchange. Digital

Barriers plc issued 4,782,500 GBP1 ordinary shares and 217,500

Incentive shares at GBP1 to acquire 100% of the share capital of

DBSL. This transaction has been accounted for using the pooling of

interests method.

6b. Security Applications Limited

On 23 March 2010, the Group acquired the entire issued share

capital of Security Applications Ltd ("SAL"), (trading as D Ford

Associates). for GBP2.0m in cash and up to GBP0.85m in deferred

cash consideration.

SAL is a UK-based specialist supplier, installer and integrator

of thermal imaging equipment for perimeter surveillance, law

enforcement and the protection of high-profile target locations.

SAL supplies customised equipment and associated installation and

maintenance services on a project-by-project basis to a

highly-concentrated customer base through a framework agreement

with a major UK Government department. SAL is part of the Group's

Services division.

At present, the most significant threat to UK security comes not

from state-to-state conflict, but from international and domestic

terrorism. To effectively protect potential target locations such

as crowded public spaces, high-profile targets and critical

national infrastructure, they must appear hostile to potential

terrorist activity. The Company believes that SAL will be

instrumental in helping it achieve its strategic aim of working

directly with end-customers and through key partner organisations,

both in the UK and abroad, to provide focused, proportionate and

effective solutions which will help protect these target locations

from attack.

6c. Overtis Solutions (now known as Digital Barriers Integration

Services)

On 23 July 2010 the Group acquired the business and assets of

the Solutions division of Overtis Group ("Overtis Solutions") for

GBP3.2m in cash.

Overtis Solutions is a UK-based specialist provider of

integrated security solutions used in the protection of high value

physical, human and information assets on a global basis held by

high risk government departments, public sector bodies and major

corporations. Overtis is part of the Group's Services division.

Overtis Solutions is considered by the Board to be highly

complementary to the activities of Security Applications Limited

("SAL"), which Digital Barriers acquired on 23 March 2010. The

Board of Digital Barriers believes that the activities of Overtis

Solutions combined with those of SAL will enable the Company to

take a further step forward in its strategic ambition to build a

specialist mid-market business that can work directly with

end-customers and through key partner organisations both at home

and abroad to provide focused, proportionate and effective

solutions which help protect key assets from attack.

6d. COE Group plc

On 20 August 2010 the Group's recommended cash offer for the

issued share capital of COE Plc ("COE") for GBP3.3m in cash became

unconditional, and the Group took control of Coe Group plc.

COE's focus has been to specialise in bringing innovative

products to the video surveillance market. This has culminated in

the successful development of COE's product range which offer high

levels of video quality and technological integration for

surveillance activities across IP, fibre and hybrid networks. The

Board believes that the acquisition of COE will provide Digital

Barriers with the next step in the development and execution of its

strategy to build a leading mid-market business in the homeland

security space. Coe is part of the Group's Products division.

6e. Waterfall Solutions Limited

On 20 October 2010, the Group acquired the entire share capital

of Waterfall Solutions Limited ("Waterfall Solutions") for a

maximum consideration of GBP5.5 million in cash and loan notes on a

cash and debt free basis. Cash consideration was an initial GBP3.9

million paid upon completion and another GBP0.5 million paid before

the period end for the excess working capital acquired. The initial

consideration of GBP3.9 million was paid in cash. Deferred

consideration of up to GBP0.75 million is payable in cash and loan

notes based on the year ended 30 September 2011, and an additional

sum of up to GBP0.75 million is payable in cash and loan notes

based on the year ended 30 September 2012, based on revenue and

profit targets. A further GBP0.1 million is payable shortly after

the year ended 30 September 2011 and is contingent on the vendors

continuing to be employed by the Group at that date. This amount is

treated as remuneration for services to Waterfall Solutions and

will be recognised within administrative expenses over the period

to 30 September 2011.

Waterfall Solutions is a UK-based provider of advanced

technology solutions and related consulting services, specialising

in the areas of image processing, data fusion, modelling and

simulation, and fits neatly with Digital Barriers existing acquired

assets. Waterfall works directly with government and commercial

clients in the defence and security sectors as well as through

strategies partnerships and prime systems integrators. Waterfall is

part of the Group's Products division.

6f. Essential Viewing Systems Limited

On 11 March 2011, the Group acquired the entire share capital of

Essential Viewing Systems Limited ("EVS") for a maximum

consideration of GBP4.85 million in cash on a cash-free, debt-free

basis. Cash consideration was an initial GBP3.4 million paid upon

completion and another GBP0.2 million paid before the period end

for the excess working capital acquired. A further payment of

GBP0.2 million for the balance of excess working capital is payable

after the period end. Deferred consideration of up to GBP1.45

million is payable in cash upon the completion of EVS' current

financial year, ending on 31 December 2011 and subject to revenue

and profit targets. Up to GBP0.35 million of this deferred

consideration is payable at the end of the first half of EVS'

current financial year, ending on 30 June 2011, again subject to

revenue and profit targets.

EVS is a UK-based provider of surveillance products that are

capable of streaming real-time video and related data over cellular

and other wireless networks where bandwidth limitations can

seriously compromise video quality and equipment control. EVS'

products can be rapidly deployed and are especially well suited to

covert surveillance, specialist areas of defence and law

enforcement, public safety including transportation security, and

deployment within remote or hostile environments. EVS is part of

the Group's Products division.

EVS' products, its end markets and the high quality nature of

its solutions complement Digital Barriers' existing technology

portfolio and stated growth strategy, as does EVS' current network

of partners, distributors and integrators.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SDDEFFFFSEDI

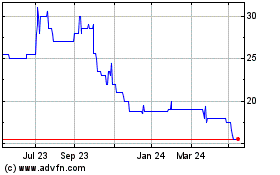

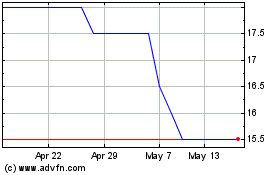

Thruvision (LSE:THRU)

Historical Stock Chart

From Jun 2024 to Jul 2024

Thruvision (LSE:THRU)

Historical Stock Chart

From Jul 2023 to Jul 2024