TIDMDGB

RNS Number : 2283W

Digital Barriers plc

16 November 2010

16 November 2010

Digital Barriers plc

("Digital Barriers" or the "Company")

Interim Results for the seven months ending 30 September 2010

Digital Barriers plc (LSE AIM: DGB), the specialist provider of products and

services to the homeland security market, announces unaudited results for the

seven months ending 30 September 2010.

Key Highlights

· Successful AIM IPO in March 2010, raising GBP20.0 million before expenses

· Strong early progress made towards our strategic aim of building a

leading specialist in the homeland security sector

· Four acquisitions in the Surveillance, Imaging and Recognition area

completed to-date, three in the period, with integration of these businesses now

well underway

· Office established in Singapore

· Strategy validated by ongoing international terrorist activity and

counter-terrorism response, and by UK budget announcements

Commenting on the results Dr Tom Black, Executive Chairman of Digital Barriers

plc said:

"I am pleased with the progress that Digital Barriers has made since its IPO in

March. We came to market with a plan to build a new leading player in the

homeland security market and we have wasted no time in getting to work.

Homeland security remains a large, growing and dynamic global market place.

Whilst these are still early days, I believe that the four acquisitions we have

made so far this year create a solid base on which we can continue to extend the

scope and capabilities of our business in the months and years ahead."

For further information please contact:

+-----------------------------------+---------------+

| Digital Barriers plc | +44 (0)20 |

| | 7940 4740 |

+-----------------------------------+---------------+

| Tom Black, Executive Chairman | |

+-----------------------------------+---------------+

| Colin Evans, Managing Director | |

| | |

+-----------------------------------+---------------+

| | |

+-----------------------------------+---------------+

| Investec Investment Banking | +44 (0)20 |

| | 7597 5970 |

+-----------------------------------+---------------+

| Andrew Pinder | |

| | |

+-----------------------------------+---------------+

| | |

+-----------------------------------+---------------+

| Financial Dynamics | +44 (0)20 |

| | 7831 3113 |

+-----------------------------------+---------------+

| Edward Bridges / Matt Dixon | |

+-----------------------------------+---------------+

About Digital Barriers plc:

Founded by the leadership team behind Detica Group plc, Digital Barriers is

focused on the provision of specialist products and services to the

international homeland security market, where counter-terrorism, the protection

of critical computer systems and networks, and support for counter-insurgency

operations overseas represent a compelling commercial opportunity. Over time,

the Company aims to become a leading specialist, working directly with

end-customers and through key partner organisations, providing focused,

proportionate and effective solutions across the Secure Government, Border

Protection, Defence, Transportation, Energy and Utilities sectors, as well as

with organisations responsible for safeguarding crowded public spaces and

nationally symbolic locations.

www.digitalbarriers.com

Chairman's Statement

Introduction

Digital Barriers was established earlier this year to provide specialist

products and services to the international homeland security market, which is

assessed to be approximately $140 billion a year and growing1. The global

security context has evolved in recent years, with the most significant threats

now coming from international terrorism against civilian targets, attacks on

high-profile computer systems, and asymmetric military operations overseas. This

market represents a compelling opportunity to develop a leading international

business, working directly with end-customers and through key partner

organisations.

Since our IPO on AIM in March this year, these evolving threats have continued

to dominate the headlines, with terrorist and cyber attacks against high-profile

targets in different countries around the world. In our domestic market, this

has resulted in the UK's National Security Strategy, and in budget commitments

for counter-terrorism and new funding for cyber security as set out in the

Defence and Security Review and the Comprehensive Spending Review. The incoming

UK Government is also strongly supporting the export of leading technology and

capabilities through UK Trade and Investment initiatives. This has the potential

to benefit Digital Barriers as we engage with potential customers in key markets

around the world where we have already identified significant demand for

specialist homeland security products and services.

1 Source: Visiongain: 'Global Homeland Security 2009-2019', June 2009

Our strategy

Digital Barriers' strategy is to combine consulting and system integration

services with IP-rich solutions that address specific client requirements across

the international homeland security and defence sectors. We focus on

counter-terrorism, cyber security and specialist areas of defence, helping our

clients select, design and deploy effective and proportionate solutions to

enhance the physical and electronic security of high profile, high value

targets.

Digital Barriers provides consulting services, integration services and

specialist solutions. We work directly with government departments and

commercial organisations, and also through prime system integration partners.

Our consultants, operational security practitioners, technologists and systems

engineers are adept at complex problem solving, and have often played a leading

role on national-level programmes.

Our plan is to work with clients around the world through hub offices in key

locations, the first of which has been established in Singapore. Through our

acquisitions, we have international reference installations that enable us to

transfer capabilities and experiences from complex security programmes,

including major international airports, large metropolitan transportation

networks and high-security government locations.

Progress in period

We have made good progress since raising GBP20 million through our IPO. In

particular, we have:

· acquired four businesses, three in the period, which have secured key,

referenceable UK and overseas client relationships and an office in Singapore,

· established a central sales function to extend the reach of the

capabilities we acquire and to manage relationships with key partner

organisations, this function also manages our relationships with key strategic

advisers,

· put in place a central services function to focus on strategy, programme

delivery, acquisition and integration, and financial governance,

· invested in an organic consulting and pre-sales service through the

hiring of subject matter experts and the development of specific offerings, and,

· taken steps towards establishing the embryonic Digital Barriers brand as

a premium player in the mid-market sector.

Financials

These interim results reflect the phased acquisitions by the Company during the

period and ongoing central costs. As such, they are not representative of the

current trading performance of the Company.

Revenues in the period were GBP1.32 million. We recorded an adjusted loss before

tax of GBP1.18 million, after adding back amortisation of acquired intangibles

of GBP0.15 million, IPO costs of GBP0.19 million, and acquisition costs of

GBP0.5 million. Consideration for acquisitions in the period totalled GBP9.22

million, with GBP8.52 million of this paid in cash in the period. The cash

balance at the end of the period was GBP13.95 million, before the acquisition of

Waterfall Solutions Limited in October 2010.

Acquisitions

· Security Applications Limited (trading as DFA), acquired in March 2010, a

specialist installer and integrator of thermal imaging for high-profile targets.

· Overtis Solutions (now trading as Integration Services), acquired in July

2010, a specialist provider of integrated security solutions for the protection

of high-value assets.

· COE Group plc, acquired in September 2010, an innovative provider of

high-end video surveillance products and solutions for complex operating

environments across the homeland security market.

· Waterfall Solutions Limited, acquired after the period-end in October

2010, a specialist in advanced image processing and data and image fusion for

defence and homeland security.

Integration of these businesses under the Digital Barriers brand and operating

model is now well underway.

Outlook

We see the opportunity for Digital Barriers as very compelling over the medium

to long term. To capitalise on this, we intend to acquire additional

capabilities, establish regional overseas hubs for our services and solutions,

build our central sales and services functions, and develop strong relationships

with key partner organisations.

Given the current global preoccupation with counter-terrorism and cyber

security, we believe that our strategy has been validated during our first few

months of operation, and that our access to clients, to potential acquisition

targets, and to high-quality people will enable us to execute it successfully.

We anticipate making further strategic acquisitions to secure technologies and

capabilities that fall within our areas of focus; primarily businesses with

revenues of up to GBP10 million. In parallel, we will integrate our

acquisitions, continue to develop our UK and Singapore locations, and establish

the demand for our services and capabilities in the US and the Middle East.

It is important that we continue to develop the Digital Barriers brand in the

minds of our clients and partners to ensure that we become a globally recognised

and respected homeland security and defence specialist. We are pleased with the

progress made since our IPO, and remain confident about the prospects for

developing the Company as a leading specialist over the coming years.

DIGITAL BARRIERS PLC

Consolidated Statement of Comprehensive Income

for the seven months ended 30 September 2010

+----------------------------------------+------+-+-----------+

| | | | 7 |

| | | | Months |

| | | | ended |

+----------------------------------------+------+-+-----------+

| | | | 30 Sept |

| | | | 10 |

+----------------------------------------+------+-+-----------+

| | | | Unaudited |

+----------------------------------------+------+-+-----------+

| |Note | | GBP'000 |

+----------------------------------------+------+-+-----------+

| | | | |

+----------------------------------------+------+-+-----------+

| Revenue | 2 | | 1,322 |

+----------------------------------------+------+-+-----------+

| | | | |

+----------------------------------------+------+-+-----------+

| Cost of sales | | | (901) |

+----------------------------------------+------+-+-----------+

| | | | |

+----------------------------------------+------+-+-----------+

| Gross profit | | | 421 |

+----------------------------------------+------+-+-----------+

| | | | |

+----------------------------------------+------+-+-----------+

| Administration costs | | | (2,425) |

+----------------------------------------+------+-+-----------+

| | | | |

+----------------------------------------+------+-+-----------+

| Operating Loss | | | (2,004) |

+----------------------------------------+------+-+-----------+

| | | | |

+----------------------------------------+------+-+-----------+

| Finance Revenue | | | 44 |

+----------------------------------------+------+-+-----------+

| Finance Costs | | | (60) |

+----------------------------------------+------+-+-----------+

| | | | |

+----------------------------------------+------+-+-----------+

| Loss before Tax | | | (2,020) |

+----------------------------------------+------+-+-----------+

| | | | |

+----------------------------------------+------+-+-----------+

| Income Tax | 4 | | 27 |

+----------------------------------------+------+-+-----------+

| | | | |

+----------------------------------------+------+-+-----------+

| Loss for the Period | | | (1,993) |

+----------------------------------------+------+-+-----------+

| | | | |

+----------------------------------------+------+-+-----------+

| | | | |

+----------------------------------------+------+-+-----------+

| Adjusted loss: | 3 | | |

+----------------------------------------+------+-+-----------+

| | | | |

+----------------------------------------+------+-+-----------+

| Loss before Tax | | | (2,020) |

+----------------------------------------+------+-+-----------+

| Amortisation of acquired intangibles | | | 151 |

+----------------------------------------+------+-+-----------+

| IPO and deal costs | | | 685 |

+----------------------------------------+------+-+-----------+

| | | | |

+----------------------------------------+------+-+-----------+

| Adjusted loss for the period | | | (1,184) |

+----------------------------------------+------+-+-----------+

| | | | |

+----------------------------------------+------+-+-----------+

| | | | |

+----------------------------------------+------+-+-----------+

| Loss per share - basic (pence) | 5 | | 0.0898 |

+----------------------------------------+------+-+-----------+

| Loss per share - diluted (pence) | 5 | | 0.0898 |

+----------------------------------------+------+-+-----------+

| Loss per share - adjusted (pence) | 5 | | 0.0534 |

+----------------------------------------+------+-+-----------+

| Loss per share - adjusted diluted | 5 | | 0.0534 |

| (pence) | | | |

+----------------------------------------+------+-+-----------+

The results for the period are derived from continuing activities

DIGITAL BARRIERS PLC

Consolidated Balance Sheet

at 30 September 2010

+----------------------------------------+------+----------+-----------+

| | | | 30 Sept |

| | | | 10 |

+----------------------------------------+------+----------+-----------+

| | | | Unaudited |

+----------------------------------------+------+----------+-----------+

| |Note | | GBP'000 |

+----------------------------------------+------+----------+-----------+

| ASSETS | | | |

+----------------------------------------+------+----------+-----------+

| | | | |

+----------------------------------------+------+----------+-----------+

| Non current assets | | | |

+----------------------------------------+------+----------+-----------+

| | | | |

+----------------------------------------+------+----------+-----------+

| Property, plant and equipment | | | 331 |

+----------------------------------------+------+----------+-----------+

| Goodwill | 6 | | 6,065 |

+----------------------------------------+------+----------+-----------+

| Other intangible assets | 6 | | 3,036 |

+----------------------------------------+------+----------+-----------+

| | | | 9,432 |

+----------------------------------------+------+----------+-----------+

| | | | |

+----------------------------------------+------+----------+-----------+

| Current assets | | | |

+----------------------------------------+------+----------+-----------+

| | | | |

+----------------------------------------+------+----------+-----------+

| Trade and other receivables | | | 1,276 |

+----------------------------------------+------+----------+-----------+

| Inventories | | | 483 |

+----------------------------------------+------+----------+-----------+

| Cash and cash equivalents | | | 13,954 |

+----------------------------------------+------+----------+-----------+

| | | | 15,713 |

+----------------------------------------+------+----------+-----------+

| | | | |

+----------------------------------------+------+----------+-----------+

| TOTAL ASSETS | | | 25,145 |

+----------------------------------------+------+----------+-----------+

| | | | |

+----------------------------------------+------+----------+-----------+

| EQUITY AND LIABILITIES | | | |

+----------------------------------------+------+----------+-----------+

| Attributable to equity holders of the | | | |

| parent | | | |

+----------------------------------------+------+----------+-----------+

| | | | |

+----------------------------------------+------+----------+-----------+

| Equity share capital | 7 | | 248 |

+----------------------------------------+------+----------+-----------+

| Share premium | 7 | | 19,100 |

+----------------------------------------+------+----------+-----------+

| Capital redemption reserve | | | 4,735 |

+----------------------------------------+------+----------+-----------+

| Other reserves | | | (307) |

+----------------------------------------+------+----------+-----------+

| Retained earnings | | | (1,968) |

+----------------------------------------+------+----------+-----------+

| TOTAL EQUITY | | | 21,808 |

+----------------------------------------+------+----------+-----------+

| | | | |

+----------------------------------------+------+----------+-----------+

| Non current liabilities | | | |

+----------------------------------------+------+----------+-----------+

| | | | |

+----------------------------------------+------+----------+-----------+

| Deferred tax liabilities | | | 274 |

+----------------------------------------+------+----------+-----------+

| | | | 274 |

+----------------------------------------+------+----------+-----------+

| | | | |

+----------------------------------------+------+----------+-----------+

| Current liabilities | | | |

+----------------------------------------+------+----------+-----------+

| | | | |

+----------------------------------------+------+----------+-----------+

| Trade and other payables | | | 2,082 |

+----------------------------------------+------+----------+-----------+

| Income tax payable | | | 10 |

+----------------------------------------+------+----------+-----------+

| Incentive Shares | | | 217 |

+----------------------------------------+------+----------+-----------+

| Deferred consideration | | | 754 |

+----------------------------------------+------+----------+-----------+

| | | | 3,063 |

+----------------------------------------+------+----------+-----------+

| | | | |

+----------------------------------------+------+----------+-----------+

| TOTAL LIABILITIES | | | 3,337 |

+----------------------------------------+------+----------+-----------+

| | | | |

+----------------------------------------+------+----------+-----------+

| TOTAL EQUITY AND LIABILITIES | | | 25,145 |

+----------------------------------------+------+----------+-----------+

DIGITAL BARRIERS PLC

Consolidated statement of changes in equity

at 30 September 2010

+-----------------------------+---------+---------+------------+----------+----------+---------+

| | | | Capital | | | |

+-----------------------------+---------+---------+------------+----------+----------+---------+

| | Share | Share | Redemption | Retained | Other | Total |

+-----------------------------+---------+---------+------------+----------+----------+---------+

| | Capital | Premium | Reserve | Deficit | Reserves | equity |

+-----------------------------+---------+---------+------------+----------+----------+---------+

| | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 | GBP'000 |

+-----------------------------+---------+---------+------------+----------+----------+---------+

| | | | | | | |

+-----------------------------+---------+---------+------------+----------+----------+---------+

| | | | | | | |

+-----------------------------+---------+---------+------------+----------+----------+---------+

| As at 1 March 2010 | 0 | 0 | 0 | 0 | 0 | 0 |

+-----------------------------+---------+---------+------------+----------+----------+---------+

| | | | | | | |

+-----------------------------+---------+---------+------------+----------+----------+---------+

| Total comprehensive income | 0 | 0 | 0 | (1,993) | 0 | (1,993) |

| - loss for the period | | | | | | |

+-----------------------------+---------+---------+------------+----------+----------+---------+

| | | | | | | |

+-----------------------------+---------+---------+------------+----------+----------+---------+

| Shares issued to market | 200 | 19,800 | 0 | 0 | 0 | 20,000 |

+-----------------------------+---------+---------+------------+----------+----------+---------+

| | | | | | | |

+-----------------------------+---------+---------+------------+----------+----------+---------+

| Share issue costs | 0 | (700) | 0 | 0 | 0 | (700) |

+-----------------------------+---------+---------+------------+----------+----------+---------+

| | | | | | | |

+-----------------------------+---------+---------+------------+----------+----------+---------+

| Issue of shares in exchange | 4,783 | 0 | 0 | 0 | 0 | 4,783 |

| for shares in Digital | | | | | | |

| Barriers Services Ltd | | | | | | |

+-----------------------------+---------+---------+------------+----------+----------+---------+

| | | | | | | |

+-----------------------------+---------+---------+------------+----------+----------+---------+

| Redemption of deferred | (4,735) | 0 | 4,735 | 0 | 0 | 0 |

| shares | | | | | | |

+-----------------------------+---------+---------+------------+----------+----------+---------+

| | | | | | | |

+-----------------------------+---------+---------+------------+----------+----------+---------+

| Arising on pooling of | 0 | 0 | 0 | 0 | (307) | (307) |

| interest transaction | | | | | | |

+-----------------------------+---------+---------+------------+----------+----------+---------+

| | | | | | | |

+-----------------------------+---------+---------+------------+----------+----------+---------+

| Share based incentive | 0 | 0 | 0 | 25 | 0 | 25 |

| charge | | | | | | |

+-----------------------------+---------+---------+------------+----------+----------+---------+

| | | | | | | |

+-----------------------------+---------+---------+------------+----------+----------+---------+

| BALANCE AS AT 30 SEPTEMBER | 248 | 19,100 | 4,735 | (1,968) | (307) | 21,808 |

| 2010 | | | | | | |

+-----------------------------+---------+---------+------------+----------+----------+---------+

DIGITAL BARRIERS PLC

Consolidated statement of cash flows

for the period to 30 September 2010

+--+------------------------------------------+-----------+

| | 7 Months |

| | ended |

+---------------------------------------------+-----------+

| | 30 Sept |

| | 10 |

+---------------------------------------------+-----------+

| | Unaudited |

+---------------------------------------------+-----------+

| | GBP'000 |

+---------------------------------------------+-----------+

| Operating activities | |

+---------------------------------------------+-----------+

| Loss before tax | (2,020) |

+---------------------------------------------+-----------+

| Non-cash adjustment to reconcile loss | |

| before tax to net cash flows | |

+---------------------------------------------+-----------+

| | Depreciation of property, plant and | 33 |

| | equipment | |

+--+------------------------------------------+-----------+

| | Amortisation of intangible assets | 151 |

+--+------------------------------------------+-----------+

| | Share-based payment transaction expense | 25 |

+--+------------------------------------------+-----------+

| | Finance income | (44) |

+--+------------------------------------------+-----------+

| | Finance costs | 60 |

+--+------------------------------------------+-----------+

| Working capital adjustments: | |

+---------------------------------------------+-----------+

| | Decrease in trade and other receivables | 218 |

+--+------------------------------------------+-----------+

| | Decrease in inventories | 61 |

+--+------------------------------------------+-----------+

| | Decrease in trade and other payables | (355) |

+--+------------------------------------------+-----------+

| | |

+---------------------------------------------+-----------+

| Interest received | 44 |

+---------------------------------------------+-----------+

| Income tax paid | (80) |

+---------------------------------------------+-----------+

| Net cash flows from operating activities | (1,907) |

+---------------------------------------------+-----------+

| | |

+---------------------------------------------+-----------+

| Investing activities | |

+---------------------------------------------+-----------+

| Purchase of property, plant & equipment | (85) |

+---------------------------------------------+-----------+

| Acquisition of subsidiaries | (8,520) |

+---------------------------------------------+-----------+

| Acquisition of cash and cash equivalents of | 488 |

| subsidiaries | |

+---------------------------------------------+-----------+

| Cash and cash equivalents recognised under | 4,680 |

| pooling arrangements | |

+---------------------------------------------+-----------+

| Net cashflows generated in investing | (3,437) |

| activities | |

+---------------------------------------------+-----------+

| | |

+---------------------------------------------+-----------+

| Financing activities | |

+---------------------------------------------+-----------+

| Proceeds from issue of shares | 20,000 |

+---------------------------------------------+-----------+

| Share issue costs | (700) |

+---------------------------------------------+-----------+

| Interest paid | (2) |

+---------------------------------------------+-----------+

| Net cash flows from financing activities | 19,298 |

+---------------------------------------------+-----------+

| Net increase in cash and cash equivalents | 13,954 |

+---------------------------------------------+-----------+

| Cash and cash equivalents at 1 March | 0 |

+---------------------------------------------+-----------+

| Cash and cash equivalents at 30th September | 13,954 |

+--+------------------------------------------+-----------+

DIGITAL BARRIERS PLC

Notes to the financial statements

for the period to 30 September 2010

1. Accounting policies

Basis of preparation

The consolidated interim financial statements include those of Digital Barriers

plc and all of its subsidiary undertakings (together "the Group") drawn up at 30

September 2010. Subsidiary undertakings are those entities controlled directly

or indirectly by the Company. Control arises when the Group has the power to

govern the financial and operating policies of an entity so as to obtain

benefits from its activities. Subsidiaries are consolidated from the date of

their acquisition, being the date on which the Group obtains control, and

continue to be consolidated until the date that such control ceases.

Subsidiaries are consolidated using the Group's accounting policies. Business

combinations are accounted for using the acquisition method of accounting except

for the acquisition of Digital Barriers Services Limited by Digital Barriers plc

which has been accounted for using the pooling method. All inter-company

balances and transactions, including unrealised profits arising from them, are

eliminated on consolidation.

The company is a limited liability company incorporated and domiciled in England

& Wales and whose shares are quoted on AIM, a market operated by The London

Stock Exchange.

The financial statements have been prepared in accordance with the recognition

and measurement criteria of International Financial Reporting Standards as

adopted by the European Union ('IFRS') and are consistent with those which will

be adopted in the annual statutory financial statements for the year ended 31st

March 2011.

While the financial information included has been prepared in accordance with

the recognition and measurement criteria of International Financial Reporting

Standards as adopted by the European Union (EU), this announcement does not in

itself contain sufficient information to comply with IFRS's.

New holding company

On 8 February 2010, Digital Barriers plc was incorporated as a new holding

company and parent company of the Group. On 22 February 2010 the former

shareholders of Digital Barriers Services Limited ("DBSL") were issued new

shares in Digital Barriers plc in a share for share exchange. Immediately

following the share for share exchange the former shareholders of DBSL held the

same economic interest in Digital Barriers plc as they held in DBSL immediately

prior to the exchange.

The acquisition of DBSL by Digital Barriers plc falls outside the scope of

IFRS3R "Business Combinations" and has been accounted for in these financial

statements using the pooling of interests method which reflects the economic

substance of the transaction. In accordance with the requirements of the pooling

of interests method, the assets and liabilities of Digital Barriers plc and DBSL

are recognized and measured in these financial statements at their

pre-combination carrying amounts.

Business combinations and goodwill

Business combinations are accounted for using the acquisition method. The cost

of an acquisition is measured as the aggregate of the consideration transferred,

measured at acquisition date fair value and the amount of any non-controlling

interest in the acquiree. For each business combination, the acquirer measures

the non-controlling interest in the acquiree either at fair value or at the

proportionate share of the acquiree's identifiable net assets. Acquisition costs

incurred are expensed and included in administrative expenses.

When the Group acquires a business, it assesses the financial assets and

liabilities assumed for appropriate classification and designation in accordance

with the contractual terms, economic circumstances and pertinent conditions as

at the acquisition date. This includes the separation of embedded derivatives in

host contracts by the acquiree.

If the business combination is achieved in stages, the acquisition date fair

value of the acquirer's previously held equity interest in the acquiree is

remeasured to fair value at the acquisition date through profit or loss.

Any contingent consideration to be transferred by the acquirer will be

recognised at fair value at the acquisition date. Subsequent changes to the fair

value of the contingent consideration which is deemed to be an asset or

liability, will be recognised in accordance with IAS 39 either in profit or loss

or as a change to other comprehensive income. If the contingent consideration is

classified as equity, it should not be remeasured until it is finally settled

within equity.

Goodwill is initially measured at cost being the excess of the aggregate of the

consideration transferred and the amount recognised for non-controlling interest

over the net identifiable assets acquired and liabilities assumed. If this

consideration is lower than the fair value of the net assets of the subsidiary

acquired, the difference is recognised in profit or loss.

After initial recognition, goodwill is measured at cost less any accumulated

impairment losses. For the purpose of impairment testing, goodwill acquired in a

business combination is, from the acquisition date, allocated to each of the

Group's cash-generating units that are expected to benefit from the combination,

irrespective of whether other assets or liabilities of the acquiree are assigned

to those units.

Where goodwill forms part of a cash-generating unit and part of the operation

within that unit is disposed of, the goodwill associated with the operation

disposed of is included in the carrying amount of the operation when determining

the gain or loss on disposal of the operation. Goodwill disposed of in this

circumstance is measured based on the relative values of the operation disposed

of and the portion of the cash-generating unit retained.

Impairment of Goodwill

The determination of whether or not goodwill has been impaired requires an

estimate to be made of the value in use of the cash-generating units to which

goodwill has been allocated. The value in use calculation includes estimates

about the future financial performance of the cash-generating units, including

management's estimates of long-term operating margins and long-term growth

rates.

Intangible Assets

In accordance with IFRS 3 "Business combinations" goodwill arising on the

acquisition of subsidiaries is capitalised and included in intangible assets.

IFRS 3 also requires the identification of other intangible assets acquired. The

method used to value intangible assets is the "income approach" The Income

Approach indicates the fair value of an asset based on the value of the cash

flows that the asset mightreasonably be expected to generate.

Other intangible assets

Intangible assets acquired from a business combination are capitalised at fair

value as at the date of acquisition and amortised over their estimated useful

economic life. An intangible asset acquired as part of a business combination is

recognised outside goodwill if the asset is separable or arises from contractual

or other legal rights and if its fair value can be measured reliably. The

estimated useful lives of the intangible assets are as follows: Customer

relationships and order book 3-5 years, Intellectual Property 1-7 years and

trademarks 10 years. Intangible assets, other than development costs, created

within the business are not capitalised and expenditure thereon is charged to

the income statement in the period in which the expenditure is incurred.

The carrying value of other intangible assets is reviewed for impairment when

events or changes in circumstance indicate that it may be impaired. If any such

indication exists, the recoverable amount of the asset is estimated in order to

determine the extent of the impairment loss. The asset's recoverable amount is

the higher of the asset's fair value less costs to sell and its value in use.

Where it is not possible to estimate the recoverable amount of an individual

asset, the Group estimates the recoverable amount of the cash-generating unit to

which it belongs.

Revenue and Profit Recognition

Revenue is recognised to the extent that it is probable that the economic

benefits will flow to the Group and the revenue can be reliably measured.

Revenue is measured at the fair value of the consideration received, excluding

discounts, rebates, VAT and other sales taxes. Revenue derived from professional

fees billed to clients on a time and materials or fixed-price basis represents

the value of work completed, including attributable profit, based on the stage

of completion achieved on each project. For time and materials projects, revenue

is recognised as services are performed. For fixed-price projects, revenue is

recognised according to the stage of completion which is determined using the

percentage-of-completion method based on the Directors' assessment of progress

against key project milestones and risks, and the ratio of costs incurred to

total estimated project costs. Revenue from support contracts is spread evenly

over the period of the support contract. Revenue from the sale of products is

recognised at the point at which goods are supplied to the client. Revenue from

recharging to clients the cost of specialist managed subcontractors and the

purchase of software or hardware for client assignments, together with

associated mark-up, is recognised as these costs are incurred. Where the Group

acts as agent in the transaction, only the mark up is recognised as Group

revenue. The cumulative impact of any revisions to the estimate of

percentage-of-completion of any fixed-price contracts is reflected in the period

in which such impact becomes known. Licence income is recognised in accordance

with the substance of the agreement. Revenue from licence agreements which have

no significant remaining performance obligations is recognised where there is

persuasive evidence that an arrangement exists, delivery has occurred, the fee

is fixed or determinable and collectability is probable.

Revenue recognised in this interim period arises largely from the sale of

products.

Amounts recoverable on contracts

Amounts recoverable on contracts represent revenue recognised to date less

amounts invoiced to clients. Full provision is made for known or anticipated

project losses.

Payments Received on Account

Payments received on account represent amounts invoiced to clients in excess of

revenue recognised to date.

Trade and other receivables

Trade receivables are recognised and measured at their original invoiced amount

less provision for any uncollectible amounts. An estimate for doubtful debts is

made when the collection of the full amount is no longer probable. Bad debts are

written off to the income statement when they are identified.

Provisions

Provisions are recognised in the balance sheet when there is a present legal or

constructive obligation as a result of a past event, and it is probable that an

outflow of economic benefits will be required to settle the obligation and a

reliable estimate can be made of the obligation.

Income taxes

Current tax assets and liabilities are measured at the amount expected to be

recovered from or paid to the taxation authorities, based on tax rates and laws

that are enacted or substantively enacted by the balance sheet date.

Deferred income tax is recognised on all temporary differences arising between

the tax bases of assets and liabilities and their carrying amounts in the

financial statements, with the following exceptions:

- where the temporary difference arises from the initial recognition of goodwill

- or of an asset or liability in a transaction that is not a business

combination that at the time of the transaction affects neither accounting nor

taxable profit or loss;

- in respect of taxable temporary differences associated with investments in

subsidiaries, associates and joint ventures, where the timing of the reversal of

the temporary differences can be controlled and it is probable that the

temporary differences will not reverse in the foreseeable future; and

- deferred income tax assets are recognised only to the extent that it is

probable that taxable profit will be available against which the deductible

temporary differences, carried forward tax credits or tax losses can be

utilised.

Deferred income tax assets and liabilities are measured on an undiscounted basis

at the tax rates that are expected to apply when the related asset is realised

or liability is settled, based on tax rates and laws enacted or substantively

enacted at the balance sheet date.

The carrying amount of deferred income tax assets is reviewed at each balance

sheet date. Deferred income tax assets and liabilities are offset, only if a

legally enforcement right exists to set off current tax assets against current

tax liabilities, the deferred income taxes relate to the same taxation authority

and that authority permits the group to make a single net payment.

Income tax is charged or credited to other comprehensive income if it relates to

items that are charged or credited to other comprehensive income. Similarly,

income tax is charged or credited directly to equity if it relates to items that

are credited or charged directly to equity. Otherwise income tax is recognised

in the income statement.

Equity

Equity comprises the following: Share capital represents the nominal value of

equity shares. Share premium represents the excess over nominal value of the

fair value of consideration received for equity shares, net of expenses of the

share issue. Profit and loss reserve represents retained profits.

Research and Development Costs

Research expenditure is charged to income in the year in which it is incurred.

Expenditure incurred in the development of software and hardware products for

use or sale by the business, and their related intellectual property rights, is

capitalised as an intangible asset only when:

- Technical feasibility has been demonstrated;

- Adequate technical, financial and other resources exist to complete the

development, which the Group intends to complete and use;

- Future economic benefits expected to arise are deemed probable; and

- The costs can be reliably measured.

Development costs not meeting these criteria are expensed in the income

statement as incurred. When capitalised, development costs are amortised on a

straight-line basis over their useful economic lives once the related software

and hardware products are available to use. During the period of development

the asset is tested for impairment annually. No research and development costs

have been capitalised in the period.

Property, plant and equipment

Property, plant and equipment is stated at cost less accumulated depreciation

and accumulated impairment losses. Depreciation is charged on the following

bases to reduce the cost of the Company's property, plant, and equipment to

their residual values over their expected useful lives at the following rates:

Leasehold improvements - 20% straight line,

Office furniture and equipment - 20% straight line,

Computer equipment - 33% straight line,

Demonstration Stock - 14% to 20% straight line.

The carrying value of property, plant and equipment is reviewed for impairment

when events or changes in circumstances indicate the carrying value may be

impaired.

Inventories

Inventories are valued at the lower of cost and net realisable value on a first

in first out basis. In the case of finished goods, cost includes all direct

expenditure and production overheads based on the normal level of activity.

Where necessary, an appropriate allowance is made for obsolete, slow-moving and

defective inventories. In certain instances stock items are used for

Demonstration purposes, in this case the stock item is classified as a fixed

asset and depreciated in line with the group depreciation policy.

Trade and other payables

Trade and other payables are initially recognised at fair value. Subsequent to

initial recognition, they are measured at amortised cost.

Cash Equivalents

Cash and cash equivalents in the balance sheet comprise cash at bank and in hand

and short-term deposits with an original maturity of three months or less.

Deferred Income

Deferred income represents amounts received in advance from clients less

turnover recognised to date.

Financial Instruments

The Group classifies financial instruments, or their component parts, on initial

recognition as a financial asset, a financial liability or an equity instrument

in accordance with the substance of the contractual arrangement.

Foreign Currency Translation

The functional and presentation currency of the Group is Sterling. Transactions

denominated in foreign currencies are translated into Sterling at the rates of

exchange ruling on the date of the transaction. Monetary assets and liabilities

are translated into Sterling at the rate of exchange ruling at the balance sheet

dates. All other exchange differences are dealt with through the income

statement.

Retirement benefits

The Group operates defined contribution pension schemes for certain employees,

and makes contributions to a Group personal pension plan for the majority of

employees. Pension costs are calculated annually and charged to the income

statement as they arise.

Share Based Payments

Certain employees of the Group receive remuneration in the form of share-based

payment transactions, whereby employees render services in exchange for rights

over shares under the Long-Term Incentive Plan ("LTIPs"). The LTIP performance

and service conditions are all non-market conditions. The total amount to be

expensed over the vesting period of the options and LTIPs is determined by

reference to the fair value at the date at which the options or LTIPs are

granted and the number of awards that are expected to vest. The fair value is

determined using a Black Scholes model. The assumptions underlying the number of

options expected to vest are adjusted to reflect conditions prevailing at the

balance sheet date. At the vesting date, the cumulative expense recognised in

the income statement is adjusted to take account of the awards that actually

vest.

The executive directors have subscribed an aggregate of GBP217,500 for incentive

shares. The incentive shares only reward participants if shareholder value is

created, thereby aligning the interests of the executive directors with those of

shareholders. The incentive shares carry the right to 12.5 percent of any

increase in the value of the company in excess of the retail prices index after

1 February 2010. The incentive shares do not carry any voting or dividend rights

and are not transferable except in limited circumstances. The total amount to be

expensed over the vesting period of the incentive shares is determined by

reference to the fair value at the date at which the incentive shares were

acquired. The fair value is determined using a stochastic model. The cash

subscribed for the incentive shares has been recognised as a current liability

on the balance sheet as it becomes repayable if the executive directors leave

office. The fair value of the incentive shares has been determined to be

equivalent to the amount subscribed and hence no share based payment charge has

been recognised.

Employee Benefit Trust

The Digital Barriers Group Employee Benefit Trust (the "Trust"), which purchases

and holds ordinary shares of the Company in connection with employee share

schemes, is consolidated in the Group financial statements. Any consideration

paid or received by the Trust for the purchase or sale of the Company's own

shares is shown as a movement in shareholders' equity.

Lease commitments and hire purchase contracts

Assets acquired under finance leases and hire purchase contracts are capitalised

and disclosed under property, plant and equipment at their estimated fair value,

or, if lower, the present value of the minimum lease payments on the inception

of each lease or contract and depreciated over their estimated useful lives. The

capital element of the future payments is treated as a liability and the total

finance charge is allocated over the period of the lease or contract in such a

way as to give a constant charge on the outstanding liability.

Leases in which a significant proportion of the risk and rewards of ownership

are retained by the lessor are classified as operating leases. Operating lease

rentals payable or receivable are charged or credited to the income statement on

a straight-line basis over the lease term.

Dividends

Dividends proposed by the Directors and unpaid at the year end are not

recognised in the financial statements until they have been approved by

shareholders at a general meeting of the Company. Interim dividends are

recognised when they are paid.

Adoption of new and revised International Financial Reporting Standards

The Group's accounting policies have been prepared in accordance with IFRS

effective as for its reporting date of 31 March 2011.

2. Segmental information

At this stage of the Group's development, the directors are of the opinion that

there is only one reportable segment within the activities of the Group relating

to the provision of specialist Digital Security and Surveillance Technology and

Services. This is the business segment used for internal reporting purposes and

reviewed by the Directors to assess performance and allocate resources.

3. Adjusted loss

An adjusted loss measure has been presented which excludes the amortisation of

intangibles (GBP151,000), the cost of the initial public offering (GBP185,000)

and the costs of acquisitions (GBP500,000) as the directors believe that this is

a more relevant measure of the group's underlying performance.

4. Taxation on ordinary activities

It is anticipated that there will be no charge to United Kingdom corporation tax

for the period to 31st March 2011. The tax credit recognised in the interim

period arises from the unwinding of the deferred tax liability recognised on

acquisition.

5. Loss per share

The loss per share is calculated on the loss after tax of GBP1,993,000 and the

average number of shares in issue during the period of 22,183,000.

Diluted earnings per share are calculated as above as the inclusion of potential

ordinary shares arising from share options in issue would be anti-dilutive.

The adjusted loss per share is calculated on the adjusted loss before tax of

GBP1,184,000 and the average number of shares in issue during the period of

22,183,000.

Diluted adjusted earnings per share is calculated as above as the inclusion of

potential ordinary shares arising from share options in issue would be

anti-dilutive.

6. Acquisitions

Digital Barriers Services Limited

On 22nd February 2010, Digital Barriers plc acquired 100% of the shares of

Digital Barriers Services Limited to form the Digital Barriers group via a share

for share exchange. Digital Barriers plc issued 4,782,500 GBP1 ordinary shares

and 217,500 incentive shares at GBP1 to acquire 100% of the share capital of

Digital Barriers Services Limited. This transaction has been accounted for using

the pooling of interests method. Digital Barriers Services Limited is the main

operating business of the group.

The carrying value of the assets and liabilities of Digital Barriers Services

Limited at the transaction date are set out below.

+---------------------------------------------------+----------+

| GBP'000 | Carrying |

| | Value |

+---------------------------------------------------+----------+

| Non-current assets | |

+---------------------------------------------------+----------+

| Tangible Fixed Assets | 51 |

+---------------------------------------------------+----------+

| Total Non-current Assets | 51 |

+---------------------------------------------------+----------+

| | |

+---------------------------------------------------+----------+

| Current Assets | |

+---------------------------------------------------+----------+

| Trade & other receivables | 28 |

+---------------------------------------------------+----------+

| Cash and cash equivalents | 4,680 |

+---------------------------------------------------+----------+

| Total Current Assets | 4,708 |

+---------------------------------------------------+----------+

| | |

+---------------------------------------------------+----------+

| Total Assets | 4,759 |

+---------------------------------------------------+----------+

| | |

+---------------------------------------------------+----------+

| Current liabilities | |

+---------------------------------------------------+----------+

| Trade & other payables | 66 |

+---------------------------------------------------+----------+

| Total current liabilities | 66 |

+---------------------------------------------------+----------+

| | |

+---------------------------------------------------+----------+

| Net Assets Acquired | 4,693 |

+---------------------------------------------------+----------+

The difference of GBP307,000 between the carrying value of the net assets

acquired and the GBP5,000,000 of shares issued in consideration has been

recognised in reserves on consolidation.

Security Applications Limited

On 23rd March 2010, the group acquired the entire issued share capital of

Security Applications Ltd (SAL), (trading as D Ford Associates).

SAL is a UK-based specialist supplier, installer and integrator of thermal

imaging equipment for perimeter surveillance, law enforcement and the protection

of high-profile target locations. SAL supplies customised equipment and

associated installation and maintenance services on a project-by-project basis

to a highly-concentrated customer base through a framework agreement with a

major UK Government department.

+--------------------------------+----------+-------------+---------+

| GBP'000 | Carrying | Adjustments | Fair |

| | Value | | Value |

+--------------------------------+----------+-------------+---------+

| Non-current assets | | | |

+--------------------------------+----------+-------------+---------+

| Tangible Fixed Assets | 136 | - | 136 |

+--------------------------------+----------+-------------+---------+

| Customer relationships - | - | 778 | 778 |

| intangible | | | |

+--------------------------------+----------+-------------+---------+

| Intellectual Property - | - | 256 | 256 |

| intangible | | | |

+--------------------------------+----------+-------------+---------+

| Total Non-current Assets | 136 | | 1,170 |

+--------------------------------+----------+-------------+---------+

| | | | |

+--------------------------------+----------+-------------+---------+

| Current Assets | | | |

+--------------------------------+----------+-------------+---------+

| Trade & other receivables | 732 | - | 732 |

+--------------------------------+----------+-------------+---------+

| Inventories | 124 | - | 124 |

+--------------------------------+----------+-------------+---------+

| Cash and cash equivalents | 238 | - | 238 |

+--------------------------------+----------+-------------+---------+

| Total Current Assets | 1,094 | | 1,094 |

+--------------------------------+----------+-------------+---------+

| | | | |

+--------------------------------+----------+-------------+---------+

| Total Assets | 1,230 | | 2,264 |

+--------------------------------+----------+-------------+---------+

| | | | |

+--------------------------------+----------+-------------+---------+

| Current liabilities | | | |

+--------------------------------+----------+-------------+---------+

| Trade & other payables | 580 | - | 580 |

+--------------------------------+----------+-------------+---------+

| Income tax payable | 89 | - | 89 |

+--------------------------------+----------+-------------+---------+

| Total current liabilities | 669 | | 669 |

+--------------------------------+----------+-------------+---------+

| | | | |

+--------------------------------+----------+-------------+---------+

| Non-current liabilities | | | |

+--------------------------------+----------+-------------+---------+

| Deferred tax liabilities | 21 | 281 | 302 |

+--------------------------------+----------+-------------+---------+

| Total Non-current Liabilities | 21 | | 302 |

+--------------------------------+----------+-------------+---------+

| | | | |

+--------------------------------+----------+-------------+---------+

| Total liabilities | 690 | | 971 |

+--------------------------------+----------+-------------+---------+

| | | | |

+--------------------------------+----------+-------------+---------+

| Net Assets Acquired | 540 | | 1,293 |

+--------------------------------+----------+-------------+---------+

| | | | |

+--------------------------------+----------+-------------+---------+

| | | | GBP'000 |

+--------------------------------+----------+-------------+---------+

| Consideration paid in cash | | | 2,013 |

+--------------------------------+----------+-------------+---------+

| Deferred payments | | | 697 |

+--------------------------------+----------+-------------+---------+

| Total consideration | | | 2,710 |

+--------------------------------+----------+-------------+---------+

| | | | |

+--------------------------------+----------+-------------+---------+

| Goodwill arising from | | | 1,417 |

| Acquisition | | | |

+--------------------------------+----------+-------------+---------+

The provisional fair value of the identifiable assets and liabilities of SAL at

acquisition date are set out below.

The goodwill of GBP1,417,000 comprises the value of expected synergies arising

from the acquisition and the workforce, which is not separately recognised. None

of the goodwill recognised is expected to be deductible for income tax purposes.

The deferred consideration represents an earn-out based on revenue and profit

targets for the period ending 31 July 2011.

Overtis Solutions

On 23rd July 2010 the group acquired the business and assets of the Solutions

division of Overtis Group for GBP3.20m in cash.

Overtis Solutions is a UK-based specialist provider of integrated security

solutions used in the protection of high value physical, human and information

assets on a global basis held by high risk government departments, public sector

bodies and major corporations.

The provisional fair value of the identifiable assets and liabilities of Overtis

Solutions at acquisition date are set out below.

+--------------------------------+----------+-------------+---------+

| GBP'000 | Carrying | Adjustments | Fair |

| | Value | | Value |

+--------------------------------+----------+-------------+---------+

| Non-current assets | | | |

+--------------------------------+----------+-------------+---------+

| Tangible Fixed Assets | 79 | - | 79 |

+--------------------------------+----------+-------------+---------+

| Customer relationships - | - | 1,197 | 1,197 |

| intangible | | | |

+--------------------------------+----------+-------------+---------+

| Total Non-current Assets | 79 | | 1,276 |

+--------------------------------+----------+-------------+---------+

| | | | |

+--------------------------------+----------+-------------+---------+

| Current Assets | | | |

+--------------------------------+----------+-------------+---------+

| Inventories | 99 | - | 99 |

+--------------------------------+----------+-------------+---------+

| Total Current Assets | 99 | | 99 |

+--------------------------------+----------+-------------+---------+

| | | | |

+--------------------------------+----------+-------------+---------+

| Net Assets Acquired | 178 | | 1,375 |

+--------------------------------+----------+-------------+---------+

| | | | |

+--------------------------------+----------+-------------+---------+

| | | | GBP'000 |

+--------------------------------+----------+-------------+---------+

| Consideration paid in cash | | | 3,200 |

+--------------------------------+----------+-------------+---------+

| | | | |

+--------------------------------+----------+-------------+---------+

| Goodwill arising from | | | 1,825 |

| Acquisition | | | |

+--------------------------------+----------+-------------+---------+

The goodwill of GBP1,825,000 comprises the value of expected synergies arising

from the acquisition and the workforce, which is not separately recognised. All

of the goodwill recognised is expected to be deductible for income tax purposes.

COE Group plc

On the 20th of August 2010 the groups recommended cash offer for the issued

share capital of COE Plc for GBP3.3m in cash became unconditional, and the group

took control of Coe Group plc.

COE's focus has been to specialise in bringing innovative products to the video

surveillance market. This has culminated in the successful development of COE's

product range which offer high levels of video quality and technological

integration for surveillance activities across IP, fibre and hybrid networks.

The provisional fair value of the identifiable assets and liabilities of COE

Group plc at acquisition date are set out below.

+--------------------------------+----------+-------------+---------+

| GBP'000 | Carrying | Adjustments | Fair |

| | Value | | Value |

+--------------------------------+----------+-------------+---------+

| Non-current assets | | | |

+--------------------------------+----------+-------------+---------+

| Tangible Fixed Assets | 14 | - | 14 |

+--------------------------------+----------+-------------+---------+

| Customer relationships - | - | 715 | 715 |

| intangible | | | |

+--------------------------------+----------+-------------+---------+

| Intellectual Property - | - | 138 | 138 |

| intangible | | | |

+--------------------------------+----------+-------------+---------+

| Trademark - Intangible | - | 103 | 103 |

+--------------------------------+----------+-------------+---------+

| Total Non-current Assets | 14 | | 970 |

+--------------------------------+----------+-------------+---------+

| | | | |

+--------------------------------+----------+-------------+---------+

| Current Assets | | | |

+--------------------------------+----------+-------------+---------+

| Trade & other receivables | 734 | - | 734 |

+--------------------------------+----------+-------------+---------+

| Inventories | 321 | | 321 |

+--------------------------------+----------+-------------+---------+

| Cash and cash equivalents | 250 | - | 250 |

+--------------------------------+----------+-------------+---------+

| Total Current Assets | 1,305 | | 1,305 |

+--------------------------------+----------+-------------+---------+

| | | | |

+--------------------------------+----------+-------------+---------+

| Total Assets | 1,319 | | 2,275 |

+--------------------------------+----------+-------------+---------+

| | | | |

+--------------------------------+----------+-------------+---------+

| Current liabilities | | | |

+--------------------------------+----------+-------------+---------+

| Trade & other payables | 1,763 | - | 1,763 |

+--------------------------------+----------+-------------+---------+

| Total current liabilities | 1,763 | | 1,763 |

+--------------------------------+----------+-------------+---------+

| | | | |

+--------------------------------+----------+-------------+---------+

| Non-current liabilities | | | |

+--------------------------------+----------+-------------+---------+

| Trade & other payables | 28 | - | 28 |

+--------------------------------+----------+-------------+---------+

| Total Non-current Liabilities | 28 | | 28 |

+--------------------------------+----------+-------------+---------+

| | | | |

+--------------------------------+----------+-------------+---------+

| Total liabilities | 1,791 | | 1,791 |

+--------------------------------+----------+-------------+---------+

| | | | |

+--------------------------------+----------+-------------+---------+

| Net Assets Acquired | (472) | | 484 |

+--------------------------------+----------+-------------+---------+

| | | | |

+--------------------------------+----------+-------------+---------+

| | | | GBP'000 |

+--------------------------------+----------+-------------+---------+

| Consideration paid in cash | | | 3,307 |

+--------------------------------+----------+-------------+---------+

| | | | |

+--------------------------------+----------+-------------+---------+

| Goodwill arising from | | | 2,823 |

| Acquisition | | | |

+--------------------------------+----------+-------------+---------+

The goodwill of GBP2,823,000 comprises the value of expected synergies arising

from the acquisition and the workforce, which is not separately recognised. None

of the goodwill recognised is expected to be deductible for income tax purposes.

7. Issued capital and reserves

On 22nd February 2010 the Company issued 4,782,500 Ordinary Shares of GBP1 each

in a share for share exchange to acquire Digital Barriers Services Ltd. These

shares were subsequently sub-divided into 4,782,500 shares of GBP0.01 each and

4,782,500 Deferred Shares of GBP0.99 each. The Deferred Shares were bought back

by the Company for a total consideration of GBP1 from the proceeds of the IPO,

resulting in a capital redemption reserve of GBP4,735,000.

On 4th March 2010 the Company issued 20,000,000 GBP0.01 Ordinary shares for a

total consideration of GBP20,000,000.

8. Post Balance Sheet Events

On the 20th October 2010, Digital Barriers acquired the entire share capital of

Waterfall Solutions Limited for a maximum consideration of GBP5.5m in cash and

loan notes. The initial consideration of GBP3.9m was paid in cash. Deferred

consideration of up to GBP0.85 million is payable in cash and loan notes on

completion of Waterfall's current financial year, ending 30 September 2011, and

an additional sum of GBP0.75 million is payable in cash and loan notes on

completion of the subsequent financial year, ending on 30 September 2012,

subject to the satisfaction of certain performance conditions.

Waterfall is as UK-based provider of advanced technology solutions and related

consulting services, specialising in the areas of image processing, data fusion,

modelling and simulation, and fits neatly with Digital Barriers existing

acquired assets. Waterfall works directly with government and commercial clients

in the defence and security sectors as well as through strategies partnerships

and prime systems integrators.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BELLFBFFBFBX

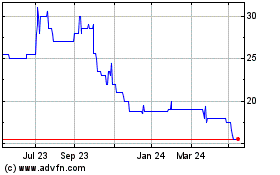

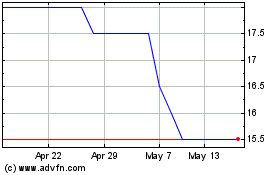

Thruvision (LSE:THRU)

Historical Stock Chart

From Jun 2024 to Jul 2024

Thruvision (LSE:THRU)

Historical Stock Chart

From Jul 2023 to Jul 2024