Posting of Offer Document

July 30 2010 - 12:22PM

UK Regulatory

TIDMDGB TIDMCOE

RNS Number : 3107Q

Digital Barriers plc

30 July 2010

Not for release, publication or distribution, in whole or in part, in, into or

from the United States, Australia, Canada or Japan or any other jurisdiction

where to do so would be unlawful

30 July 2010

RECOMMENDED CASH OFFER BY DIGITAL BARRIERS PLC ("DIGITAL BARRIERS")

FOR COE GROUP PLC ("COE")

Posting of Offer Document

Digital Barriers plc ("Digital Barriers") and COE Group Plc ("COE") announced

today that they had reached agreement on the terms of a recommended cash offer

to be made by Digital Barriers for the entire issued and to be issued ordinary

share capital of COE.

Digital Barriers now announces that the Offer Document containing, inter alia,

the terms and conditions of the Offer and details of the actions to be taken by

COE Shareholders is today being posted to all COE Shareholders.

The Offer Document and the Form of Acceptance are available for inspection at

the offices of Osborne Clarke, One London Wall, London EC2Y 5EB until the end of

the Offer Period. The Offer Document may also be obtained from the websites of

COE, www.coe.co.uk and Digital Barriers, www.digitalbarriers.com.

ENQUIRIES

+----------------------------------------------+---------------------+

| DIGITAL BARRIERS | |

+----------------------------------------------+---------------------+

| | |

+----------------------------------------------+---------------------+

| Digital Barriers plc | +44 (0) 20 7940 |

| | 4740 |

+----------------------------------------------+---------------------+

| Tom Black, Executive Chairman | |

+----------------------------------------------+---------------------+

| Colin Evans, Managing Director | |

+----------------------------------------------+---------------------+

| Zak Doffman, Strategy Director | |

+----------------------------------------------+---------------------+

| | |

+----------------------------------------------+---------------------+

| Investec, Financial Adviser and Broker to | +44 (0) 20 7597 |

| Digital Barriers | 5970 |

+----------------------------------------------+---------------------+

| Andrew Pinder | |

+----------------------------------------------+---------------------+

| Erik Anderson | |

+----------------------------------------------+---------------------+

| Dominic Emery | |

+----------------------------------------------+---------------------+

| | |

+----------------------------------------------+---------------------+

| Financial Dynamics, PR Adviser to Digital | +44 (0) 20 7831 |

| Barriers | 3113 |

+----------------------------------------------+---------------------+

| Edward Bridges | |

+----------------------------------------------+---------------------+

| Matt Dixon | |

+----------------------------------------------+---------------------+

| | |

+----------------------------------------------+---------------------+

| COE | |

+----------------------------------------------+---------------------+

| | |

+----------------------------------------------+---------------------+

| COE Group plc | +44 (0) 113 230 |

| | 8800 |

+----------------------------------------------+---------------------+

| Alison Fielding, Non-Executive Chairman | |

+----------------------------------------------+---------------------+

| Ian Jefferson, Chief Executive Officer | |

+----------------------------------------------+---------------------+

| Mark Marriage, Technical Director | |

+----------------------------------------------+---------------------+

| | |

+----------------------------------------------+---------------------+

| Zeus, Financial Adviser and Broker to COE | +44 (0) 161 831 |

| | 1512 |

+----------------------------------------------+---------------------+

| Alex Clarkson | |

+----------------------------------------------+---------------------+

| Nick Cowles | |

+----------------------------------------------+---------------------+

| Stephen Robinson | |

+----------------------------------------------+---------------------+

Capitalised terms used in this announcement have the meanings given to them in

the Offer Document.

Investec, which is authorised and regulated in the United Kingdom by the FSA, is

acting exclusively for Digital Barriers and no one else in connection with the

Offer and this announcement and will not be responsible to anyone other than

Digital Barriers for providing the protections afforded to clients of Investec

nor for providing advice in relation to the Offer or this announcement or any

other matter referred to herein.

Zeus, which is authorised and regulated in the United Kingdom by the FSA, is

acting exclusively for COE and no one else in connection with the Offer and this

announcement and will not be responsible to anyone other than COE for providing

the protections afforded to clients of Zeus nor for providing advice in relation

to the Offer or this announcement or any other matter referred to herein.

This announcement does not constitute an offer or an invitation to purchase or

subscribe for any securities. The Offer will be made solely by means of the

Offer Document and the Form of Acceptance (in respect of certificated COE

Shares), which will contain the full terms and conditions of the Offer,

including details of how the Offer may be accepted.

Unless otherwise determined by Digital Barriers and permitted by applicable law

and regulation, the Offer will not be made, directly or indirectly, in or into,

or by the use of the mails or by any means or instrumentality (including,

without limitation, telephonically or electronically) of interstate or foreign

commerce, or any facility of a national securities exchange, of a Restricted

Jurisdiction and the Offer will not be capable of acceptance by any such use,

means, instrumentality or facility or from within a Restricted Jurisdiction.

Accordingly, copies of this announcement are not being, and must not be,

directly or indirectly, mailed or otherwise forwarded, distributed or sent in or

into or from a Restricted Jurisdiction and persons receiving this announcement

(including, without limitation, custodians, nominees and trustees) must not mail

or otherwise forward, distribute or send it in or into or from a Restricted

Jurisdiction. Doing so may render invalid any purported acceptance of the

Offer. The availability of the Offer to persons who are not resident in the

United Kingdom may be affected by the laws of the relevant jurisdictions.

Persons who are not resident in the United Kingdom should inform themselves

about and observe any applicable requirements.

Dealing disclosure requirements

Under Rule 8.3(a) of the Code, any person who is interested in 1 per cent. or

more of any class of relevant securities of an offeree company or of any paper

offeror (being any offeror other than an offeror in respect of which it has been

announced that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer period and,

if later, following the announcement in which any paper offeror is first

identified. An Opening Position Disclosure must contain details of the person's

interests and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any paper offeror(s). An

Opening Position Disclosure by a person to whom Rule 8.3(a) applies must be made

by no later than 3.30 pm (London time) on the 10th business day following the

commencement of the offer period and, if appropriate, by no later than 3.30 pm

(London time) on the 10th business day following the announcement in which any

paper offeror is first identified. Relevant persons who deal in the relevant

securities of the offeree company or of a paper offeror prior to the deadline

for making an Opening Position Disclosure must instead make a Dealing

Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes, interested in 1

per cent. or more of any class of relevant securities of the offeree company or

of any paper offeror must make a Dealing Disclosure if the person deals in any

relevant securities of the offeree company or of any paper offeror. A Dealing

Disclosure must contain details of the dealing concerned and of the person's

interests and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any paper offeror, save

to the extent that these details have previously been disclosed under Rule 8. A

Dealing Disclosure by a person to whom Rule 8.3(b) applies must be made by no

later than 3.30 pm (London time) on the business day following the date of the

relevant dealing.

If two or more persons act together pursuant to an agreement or understanding,

whether formal or informal, to acquire or control an interest in relevant

securities of an offeree company or a paper offeror, they will be deemed to be a

single person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree company and by any

Offeror and Dealing Disclosures must also be made by the offeree company, by any

offeror and by any persons acting in concert with any of them (see Rules 8.1,

8.2 and 8.4).

Details of the offeree and offeror companies in respect of whose relevant

securities Opening Position Disclosures and Dealing Disclosures must be made can

be found in the Disclosure Table on the Takeover Panel's website at

www.thetakeoverpanel.org.uk, including details of the number of relevant

securities in issue, when the offer period commenced and when any offeror was

first identified. If you are in any doubt as to whether you are required to make

an Opening Position Disclosure or a Dealing Disclosure, you should contact the

Panel's Market

Surveillance Unit on +44 (0)20 7638 0129.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ODPQBLFXBDFFBBV

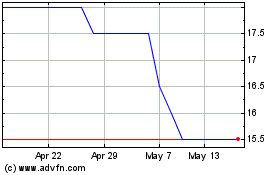

Thruvision (LSE:THRU)

Historical Stock Chart

From Jun 2024 to Jul 2024

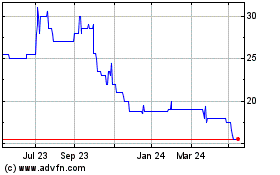

Thruvision (LSE:THRU)

Historical Stock Chart

From Jul 2023 to Jul 2024