TIDMTAM

RNS Number : 7739O

Titanium Asset Management Corp

12 March 2009

March 12, 2009

Titanium Asset Management Corp.

Full-Year 2008 Results

Chairman's Statement

It was both an honour and a pleasure to assume in 2008 the roles of Chairman and

Chief Executive Officer of Titanium Asset Management Corp., only tempered

slightly by the crisis in the global financial markets that developed during the

course of the year.

As the financial storm has swept over us, it has developed into the most serious

challenge to the stability of the global financial system in the post war years.

The crisis has had dramatic consequences already, with the collapse or forced

sale of several leading investment banks and the provision of huge sums of

public money to repair the balance sheets of commercial banks, leading in some

cases to effective or actual nationalisation.

It is too early to tell how long and how deep the consequent economic recession

will be, but its effects will be felt for a generation. The increase in

public sector debt implied by the financial rescue and fiscal stimulus packages

being announced are in some cases unsustainable in the medium term. In countries

such as the US and UK the retrenchment to an economic model based on saving and

investment rather than on debt will be painful. Equally, the beneficiaries of

debt-fuelled consumption such as China and Germany will have to rebalance their

economies too.

One implication of this is that savings rates in many developed countries will

have to rise, in part to rebuild the destruction of both individual and

institutional wealth that has occurred over the past eighteen months. Since the

financial crisis has included (as financial crisis always seem to) fraud and

theft, it will be the responsibility of the asset management industry to manage

those savings competently, transparently and at sensible fees.

In that context I am delighted with the progress that we have made in

implementing our business strategy of acquiring and integrating asset

management companies with good investment strategies, skilled professionals and

established client relationships. On March 31st 2008 we acquired National

Investment Services, Inc, with offices in Chicago and Milwaukee.On December 31st

2008 we acquired Boyd Watterson Asset Management, LLC, a firm in Cleveland that

traces its roots back to 1928. Both these excellent firms were attracted by what

we are building at Titanium and senior officers of both firms have been

given important new management roles within Titanium.

Another significant milestone is that we filed, as we committed to, a Form 10

registration statement with the Securities and Exchange Commission in July

2008 which became effective in September 2008. From that date we have been a US

public reporting company.

In the near term our efforts are focused on integrating our four businesses and

achieving efficiencies, particularly in administration and operations. We

are also reorganising, and adding to, our sales team so that we can cross-sell

to our clients and prospects the full range of our products. The following

financial statements provide more detail on the progress that we have made in

the eighteen months since our initial public offering in June 2007. We have

confidence in our business strategy and hope to be able to attract more firms

to join us at Titanium during the course of 2009.

Nigel Wightman

Forward-looking Statements

This press release contains certain statements that are "forward-looking

statements" within the meaning of the Private Securities Litigation Reform Act

of 1995. These statements are subject to a number of assumptions, risks, and

uncertainties, many of which are beyond the control of Titanium.

Any forward-looking statements made in this press release speak as of the date

made and are not guarantees of future performance. Actual results or

developments may differ materially from the expectations expressed or implied in

the forward-looking statements, and the Company undertakes no obligation to

update any such statements. Additional factors that could influence Titanium's

financial results are included in its Securities and Exchange Commission

filings, including its Form 10, Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K.

The Company's Annual Report on Form 10-K for the year ended December 31, 2008,

is expected to be filed with the Securities and Exchange Commission on or before

March 31, 2009. The Company's report and accounts will be posted to stockholders

at the same time and both will be available on the Company's website at

www.ti-am.com.

Titanium Asset Management Corp.

Consolidated Balance Sheets (Unaudited)

(in thousands except for share and per share amounts)

+-------------------------------------------------------------------------+------------+------------+

| | December | December |

| | 31, 2008 | 31, 2007 |

+-------------------------------------------------------------------------+------------+------------+

| Assets | | |

+-------------------------------------------------------------------------+------------+------------+

| Current assets | | |

+-------------------------------------------------------------------------+------------+------------+

| Cash and cash | | $ |

| equivalents | $18,753 | 19,388 |

+-------------------------------------------------------------------------+------------+------------+

| Securities available | 10,683 | - |

| for sale | | |

+-------------------------------------------------------------------------+------------+------------+

| Cash and cash | - | 55,587 |

| equivalents held in | | |

| trust | | |

+-------------------------------------------------------------------------+------------+------------+

| Accounts receivable | 4,041 | 388 |

+-------------------------------------------------------------------------+------------+------------+

| Refundable income taxes | 512 | - |

+-------------------------------------------------------------------------+------------+------------+

| Prepaid expenses and | 908 | 115 |

| other assets | | |

+-------------------------------------------------------------------------+------------+------------+

| Total | 34,897 | 75,478 |

| current | | |

| assets | | |

+-------------------------------------------------------------------------+------------+------------+

| | | |

+-------------------------------------------------------------------------+------------+------------+

| Securities available for sale | 672 | - |

+-------------------------------------------------------------------------+------------+------------+

| Property and equipment | | |

+-------------------------------------------------------------------------+------------+------------+

| Office furniture, | 543 | 19 |

| fixtures and equipment | | |

+-------------------------------------------------------------------------+------------+------------+

| Less accumulated | 87 | 16 |

| depreciation | | |

+-------------------------------------------------------------------------+------------+------------+

| Property | 456 | 3 |

| and | | |

| equipment, | | |

| net | | |

+-------------------------------------------------------------------------+------------+------------+

| Goodwill (Note 1) | 32,757 | 21,987 |

+-------------------------------------------------------------------------+------------+------------+

| Intangible assets, net (Note 1) | 32,206 | 15,340 |

+-------------------------------------------------------------------------+------------+------------+

| Deferred income taxes | 4,202 | 377 |

+-------------------------------------------------------------------------+------------+------------+

| Total | | $ |

| assets | $105,190 | 113,185 |

+-------------------------------------------------------------------------+------------+------------+

| | | |

+-------------------------------------------------------------------------+------------+------------+

| Liabilities and Stockholders' Equity | | |

+-------------------------------------------------------------------------+------------+------------+

| Current liabilities | | |

+-------------------------------------------------------------------------+------------+------------+

| Accounts payable | $663 | $ |

| | | 149 |

+-------------------------------------------------------------------------+------------+------------+

| Accrued income taxes | - | 657 |

+-------------------------------------------------------------------------+------------+------------+

| Acquisition payments | 8,145 | - |

| due | | |

+-------------------------------------------------------------------------+------------+------------+

| Deferred revenues | 273 | 218 |

+-------------------------------------------------------------------------+------------+------------+

| Other current | 1,516 | 237 |

| liabilities | | |

+-------------------------------------------------------------------------+------------+------------+

| Total current | 10,597 | 1,261 |

| liabilities | | |

+-------------------------------------------------------------------------+------------+------------+

| | | |

+-------------------------------------------------------------------------+------------+------------+

| Acquisition payments due | 1,889 | - |

+-------------------------------------------------------------------------+------------+------------+

| Commitments and contingencies | | |

+-------------------------------------------------------------------------+------------+------------+

| Common stock, subject to possible | - | 55,587 |

| conversion, 20,000,000 shares at | | |

| conversion value | | |

+-------------------------------------------------------------------------+------------+------------+

| Stockholders' equity | | |

+-------------------------------------------------------------------------+------------+------------+

| Common stock, $0.0001 | 2 | 2 |

| par value; 54,000,000 | | |

| shares authorized; | | |

| 20,464,002 and | | |

| 22,993,731 shares | | |

| issued and outstanding | | |

| at December 31, 2008 | | |

| and 2007, respectively | | |

+-------------------------------------------------------------------------+------------+------------+

| Restricted common | - | - |

| stock, $0.0001 par | | |

| value; 720,000 shares | | |

| authorized; 612,716 and | | |

| 696,160 shares issued | | |

| and outstanding at | | |

| December 31, 2008 and | | |

| 2007, respectively | | |

+-------------------------------------------------------------------------+------------+------------+

| Preferred stock, | - | - |

| $0.0001 par value; | | |

| 1,000,000 shares | | |

| authorized; none issued | | |

+-------------------------------------------------------------------------+------------+------------+

| Additional paid-in | 99,694 | 55,892 |

| capital | | |

+-------------------------------------------------------------------------+------------+------------+

| Retained earnings | (6,597) | 443 |

| (deficit) | | |

+-------------------------------------------------------------------------+------------+------------+

| Other comprehensive | (163) | - |

| income (loss) | | |

+-------------------------------------------------------------------------+------------+------------+

| Unearned compensation | (232) | - |

+-------------------------------------------------------------------------+------------+------------+

| Total | 92,704 | 56,337 |

| stockholders' | | |

| equity | | |

+-------------------------------------------------------------------------+------------+------------+

| Total | | $ |

| liabilities | $105,190 | 113,185 |

| and | | |

| stockholders' | | |

| equity | | |

+-------------------------------------------------------------------------+------------+------------+

Titanium Asset Management Corp.

Consolidated Income Statement (Unaudited)

(in thousands except for share and per share amounts)

+------------------------------------------------------+------------+-------------+

| |Year Ended | Period |

| | December | from |

| | 31, 2008 | February |

| | | 2, 2007 |

| | |(inception) |

| | | through |

| | | December |

| | | 31, 2007 |

+------------------------------------------------------+------------+-------------+

| | | |

+------------------------------------------------------+------------+-------------+

| Fee income | | $ |

| | $14,675 | 2,660 |

+------------------------------------------------------+------------+-------------+

| | | |

+------------------------------------------------------+------------+-------------+

| Operating expenses: | | |

+------------------------------------------------------+------------+-------------+

| Administrative | 16,283 | 2,490 |

+------------------------------------------------------+------------+-------------+

| Amortization of intangible assets | 4,190 | 809 |

| (Note 1) | | |

+------------------------------------------------------+------------+-------------+

| Impairment of intangible assets | 6,533 | 829 |

| (Note1) | | |

+------------------------------------------------------+------------+-------------+

| Total operating | 27,006 | 4,128 |

| expenses | | |

+------------------------------------------------------+------------+-------------+

| | | |

+------------------------------------------------------+------------+-------------+

| Operating loss | (12,331) | (1,468) |

+------------------------------------------------------+------------+-------------+

| | | |

+------------------------------------------------------+------------+-------------+

| Other income | | |

+------------------------------------------------------+------------+-------------+

| Interest income | 1,032 | 2,191 |

+------------------------------------------------------+------------+-------------+

| Interest expense | (28) | - |

+------------------------------------------------------+------------+-------------+

| | | |

+------------------------------------------------------+------------+-------------+

| Income (loss) before taxes | (11,327) | 723 |

+------------------------------------------------------+------------+-------------+

| | | |

+------------------------------------------------------+------------+-------------+

| Income tax expense (benefit) | (4,287) | 280 |

+------------------------------------------------------+------------+-------------+

| | | |

+------------------------------------------------------+------------+-------------+

| Net income (loss) | | $ |

| | $(7,040) | 443 |

+------------------------------------------------------+------------+-------------+

| Net income (loss) per share | | |

+------------------------------------------------------+------------+-------------+

| | | |

+------------------------------------------------------+------------+-------------+

| Basic | | $ |

| | $(0.34) | 0.04 |

+------------------------------------------------------+------------+-------------+

| Diluted | | $ |

| | $(0.34) | 0.03 |

+------------------------------------------------------+------------+-------------+

| | | |

+------------------------------------------------------+------------+-------------+

Titanium Asset Management Corp.

Consolidated Statement of Cash Flows (Unaudited)

(in thousands)

+------------------------------------------------------------------------------+------------+------------+

| |Year ended | Period |

| | December | from |

| | 31, 2008 | February |

| | | 2, 2007 |

| | | through |

| | | December |

| | | 31, 2007 |

+------------------------------------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------------------------------------+------------+------------+

| Cash flows from operating activities | | |

+------------------------------------------------------------------------------+------------+------------+

| Net income (loss) | $ | $ |

| | (7,040) | 443 |

+------------------------------------------------------------------------------+------------+------------+

| Adjustments to | | |

| reconcile net | | |

| income(loss) to net | | |

| cash provided by | | |

| operating activities: | | |

+------------------------------------------------------------------------------+------------+------------+

| Depreciation and | 4,262 | 825 |

| amortization | | |

+------------------------------------------------------------------------------+------------+------------+

| Impairment of | 6,533 | 829 |

| intangible assets | | |

+------------------------------------------------------------------------------+------------+------------+

| Accretion of | 26 | - |

| acquisition payments | | |

+------------------------------------------------------------------------------+------------+------------+

| Deferred income taxes | (3,823) | (377) |

+------------------------------------------------------------------------------+------------+------------+

| Changes in assets and | | |

| liabilities: | | |

+------------------------------------------------------------------------------+------------+------------+

| Decrease | (29) | (388) |

| (increase) | | |

| in | | |

| accounts | | |

| receivable | | |

+------------------------------------------------------------------------------+------------+------------+

| Decrease | (607) | (115) |

| (increase) | | |

| in other | | |

| current | | |

| assets | | |

+------------------------------------------------------------------------------+------------+------------+

| Increase | 511 | 149 |

| in | | |

| accounts | | |

| payable | | |

+------------------------------------------------------------------------------+------------+------------+

| Increase(decrease) | (1,070) | 657 |

| in taxes payable | | |

+------------------------------------------------------------------------------+------------+------------+

| Increase | 604 | 455 |

| in other | | |

| current | | |

| liabilities | | |

+------------------------------------------------------------------------------+------------+------------+

| Net cash provided by (used in) operating activities | (633) | 2,478 |

+------------------------------------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------------------------------------+------------+------------+

| Cash flows from investing activities | | |

+------------------------------------------------------------------------------+------------+------------+

| Purchases of property | (326) | (19) |

| and equipment | | |

+------------------------------------------------------------------------------+------------+------------+

| Cash and cash | 55,587 | (55,587) |

| equivalents held in | | |

| (released from) trust | | |

+------------------------------------------------------------------------------+------------+------------+

| Purchase of short-term | (10,651) | - |

| securities available | | |

| for sale | | |

+------------------------------------------------------------------------------+------------+------------+

| Purchase of securities | (968) | - |

| available for sale | | |

+------------------------------------------------------------------------------+------------+------------+

| Cash paid for | (31,627) | (33,965) |

| acquisition of | | |

| subsidiaries, net of | | |

| cash acquired | | |

+------------------------------------------------------------------------------+------------+------------+

| Net cash provided by (used in) investing activities | 12,015 | (89,571) |

+------------------------------------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------------------------------------+------------+------------+

| Cash flows from financing activities | | |

+------------------------------------------------------------------------------+------------+------------+

| Issuance of common stock units | - | 120,025 |

+------------------------------------------------------------------------------+------------+------------+

| Costs associated with share issue | - | (9,652) |

+------------------------------------------------------------------------------+------------+------------+

| Common stock redeemed | (12,017) | (3,892) |

+------------------------------------------------------------------------------+------------+------------+

| Net cash provided by (used in) financing activities | (12,017) | 106,481 |

+------------------------------------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------------------------------------+------------+------------+

| Net increase in cash and cash equivalents | (635) | 19,388 |

+------------------------------------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------------------------------------+------------+------------+

| Cash and cash equivalents: | | |

+------------------------------------------------------------------------------+------------+------------+

| Beginning | 19,388 | - |

+------------------------------------------------------------------------------+------------+------------+

| Ending | $ | $ |

| | 18,753 | 19,388 |

+------------------------------------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------------------------------------+------------+------------+

| Supplemental disclosure of cash flow information | | |

+------------------------------------------------------------------------------+------------+------------+

| Income taxes paid | $606 | $ - |

+------------------------------------------------------------------------------+------------+------------+

| | | |

+------------------------------------------------------------------------------+------------+------------+

| Supplemental disclosure of non-cash investing and | | |

| financing activities | | |

+------------------------------------------------------------------------------+------------+------------+

| Net unrealized loss on securities | $163 | $ - |

| available for sale | | |

+------------------------------------------------------------------------------+------------+------------+

| Paid-in capital | | $ - |

| attributed to common | $55,587 | |

| stock repurchase rights | | |

| not executed | | |

+------------------------------------------------------------------------------+------------+------------+

| Fair value of placement | $- | $ |

| agent warrant | | 2,091 |

+------------------------------------------------------------------------------+------------+------------+

| Guaranteed payment | $ | $ - |

| issued in connection | 10,375 | |

| with acquisition | | |

+------------------------------------------------------------------------------+------------+------------+

Note 1 - Goodwill and intangibles

During 2007 and 2008, Titanium Asset Management ("the Company") completed the

following acquisitions each of which resulted in acquired goodwill and

intangible assets. On October 1, 2007, the Company acquired all of the voting

common stock of Wood Asset Management, Inc. ("Wood") and all of the membership

interests of Sovereign Holdings, LLC ("Sovereign"), two asset management firms.

On March 31, 2008, the Company acquired all of the outstanding capital stock of

National Investment Services, Inc. ("NIS"), a third asset management firm. After

such business combinations, the Company ceased to act as a special purpose

acquisition vehicle. On December 31, 2008, the Company acquired all the

membership interests of Boyd Watterson Asset Management, LLC ("Boyd"), an asset

management firm in the equity and fixed-income markets. The Company's strategy

is to manage these operating companies as an integrated business.

The changes in goodwill for the period from February 2, 2007 to December 31,

2007 and for the year ended December 31, 2008 are as follows:

+------------------------------------------------------+------------+

| Wood acquisition | |

| | $19,865 |

+------------------------------------------------------+------------+

| Sovereign acquisition | 2,122 |

+------------------------------------------------------+------------+

| Goodwill at December 31, 2007 | 21,987 |

+------------------------------------------------------+------------+

| NIS acquisition | 7,091 |

+------------------------------------------------------+------------+

| Boyd acquisition | 3,679 |

+------------------------------------------------------+------------+

| Goodwill at December 31, 2008 | |

| | $32,757 |

+------------------------------------------------------+------------+

The Company completed its annual evaluation of its fair value and the impact of

such on its goodwill balance as of December 31, 2008. The assessment of fair

value was principally based on a discounted cash flow analysis of projected cash

flows. In preparing the cash flow projections, the Company considered the impact

that the significant decreases in the equity markets over the last half of 2008

and the loss of customer accounts over the first half of 2008 had on its assets

under management and the resulting impact on projected fee revenue over the next

several years. As a result of the fair value assessment, the Company concluded

that the value of its goodwill was recoverable.

The changes in intangible assets for the period from February 2, 2007 to

December 31, 2007 and for the year ended December 31, 2008 are as follows:

+------------------------------------------------------+------------+

| Wood acquisition | |

| | $13,299 |

+------------------------------------------------------+------------+

| Sovereign acquisition | 3,679 |

+------------------------------------------------------+------------+

| Amortization expense | (809) |

+------------------------------------------------------+------------+

| Impairment (a) | (829) |

+------------------------------------------------------+------------+

| Intangible assets at December 31, 2007 | 15,340 |

+------------------------------------------------------+------------+

| NIS acquisition | 23,089 |

+------------------------------------------------------+------------+

| Boyd acquisition | 4,500 |

+------------------------------------------------------+------------+

| Amortization expense | (4,190) |

+------------------------------------------------------+------------+

| Impairment (b) | (6,533) |

+------------------------------------------------------+------------+

| Intangible assets at December 31, 2008 | |

| | $32,206 |

+------------------------------------------------------+------------+

(a) One of the principals from Wood, with whom the Company had a non-compete

agreement, passed away in 2007. As a result, the Company wrote off the remaining

$829 balance related to that intangible asset.

(b)As a result of the principal's death in 2007, Wood lost several accounts

primarily in the second quarter of 2008. The Company determined that the loss of

these accounts impaired the original value of the Wood customer relationships

and recorded an impairment charge of $1,478 in the second quarter of 2008.

In the second quarter of 2008, Sovereign lost an institutional account that

represented approximately 19% of the assets under management at the time of the

Sovereign acquisition. As a result, the Company determined that the loss had

impaired the original value of the Sovereign customer relationships and recorded

an impairment charge of $314 in the second quarter of 2008.

As a result of the significant equity market decreases over the second half of

2008, the Company reassessed the recoverability of the customer relationship

intangible assets acquired in the Wood, Sovereign and NIS acquisitions at

December 31, 2008. The Company determined that the Wood customer relationship

asset had been further impaired and recognized a $4,540 impairment charge. The

Company also determined that the Sovereign customer relationship asset had been

further impaired and recognized a $201 impairment charge. Further, the Company

determined the carrying amount of the NIS client referral relationship was still

recoverable.

Identifiable intangible assets, net of amortization at December 31, 2008 and

2007, are as follows:

+--------------------------+----------+--------------+----------+----------+--------------+----------+

| | December 31, 2008 | December 31, 2007 |

+--------------------------+------------------------------------+------------------------------------+

| | Cost | Accumulated | Net | Cost | Accumulated | Net |

| | | Amortization | | | Amortization | |

+--------------------------+----------+--------------+----------+----------+--------------+----------+

| | | | | | | |

+--------------------------+----------+--------------+----------+----------+--------------+----------+

| Wood customer | $ | | | $ | $601 | |

| relationships | 12,026 | $8,850 | $3,176 | 12,026 | | $11,425 |

+--------------------------+----------+--------------+----------+----------+--------------+----------+

| Wood brand | 444 | 139 | 305 | 444 | 28 | 416 |

+--------------------------+----------+--------------+----------+----------+--------------+----------+

| Sovereign | 2,665 | 966 | 1,699 | 2,665 | 95 | 2,570 |

| customer | | | | | | |

| relationships | | | | | | |

+--------------------------+----------+--------------+----------+----------+--------------+----------+

| Sovereign | 833 | 347 | 486 | 833 | 70 | 763 |

| non-compete | | | | | | |

| agreement | | | | | | |

+--------------------------+----------+--------------+----------+----------+--------------+----------+

| Sovereign brand | 181 | 76 | 105 | 181 | 15 | 166 |

+--------------------------+----------+--------------+----------+----------+--------------+----------+

| NIS client | 23,089 | 1,154 | 21,935 | - | - | - |

| referral | | | | | | |

| relationship | | | | | | |

+--------------------------+----------+--------------+----------+----------+--------------+----------+

| Boyd customer | 4,500 | - | 4,500 | - | - | - |

| relationships | | | | | | |

+--------------------------+----------+--------------+----------+----------+--------------+----------+

| | | | | | | |

+--------------------------+----------+--------------+----------+----------+--------------+----------+

| Totals | | | | $ | $809 | |

| | $43,738 | $11,532 | $32,206 | 16,149 | | $15,340 |

+--------------------------+----------+--------------+----------+----------+--------------+----------+

The Company has reassessed the remaining useful lives of these assets in

connection with the recoverability tests. Amortization is based on the following

estimated remaining useful lives: Wood intangible assets - 2-3 years, Sovereign

intangible assets - 3-4 years, and NIS client referral relationship asset - 14

years.

The estimated annual amortization expense for each of the next five years is as

follows:

+------------+------------+

| Year | Amount |

+------------+------------+

| 2009 | $3,691 |

+------------+------------+

| 2010 | 3,691 |

+------------+------------+

| 2011 | 3,664 |

+------------+------------+

| 2012 | 2,436 |

+------------+------------+

| 2013 | 1,879 |

+------------+------------+

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UUOSRKNROAAR

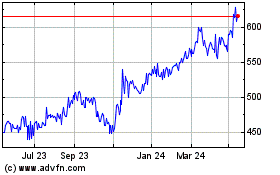

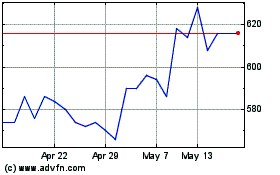

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Tatton Asset Management (LSE:TAM)

Historical Stock Chart

From Jul 2023 to Jul 2024