TIDMSSTY

RNS Number : 2441L

Safestay PLC

18 April 2018

Safestay plc

("Safestay", the "Company" or the "Group)

Final Results for the Year Ended 31 December 2017

2017 Financial highlights

-- 43% growth in total revenues to GBP10.5 million (including acquisitions made in 2017)

-- 15% growth in UK revenues to GBP8.5 million showing strong underlying performance

-- Adjusted EBITDA of GBP3.2m (2016: GBP2.2 million) in line with market expectations

-- Loss before tax increased to GBP0.87m (2016: GBP0.47m) due to

increased finance costs (including leasehold properties)

-- Reflecting the strong sales growth like for like occupancy

(UK) increased by 13.5% to 74% (31 December 2016: 65%)

-- UK average bed rate stable at GBP19.80 with scope for future

increases in line with increased demand

-- Completed the refinancing of Elephant & Castle and

Edinburgh hostels raising GBP11.4 million of gross cash

proceeds

-- Agreed new GBP18.4 million 5 year secured debt facility with

HSBC to replace existing bank loan and two convertible loans and in

addition reducing significantly the cost of borrowings

Key Metrics

2017 2016

Occupancy % 73% 65%

Average Bed Rate GBP19.34 GBP19.28

Room Revenues (GBP'000) 8,971 6,058

Total Revenues (GBP'000) 10,547 7,411

Cash generated from operations (GBP'000) 1,863 2,308

Net assets per share 55p 58p

2017 Operational highlights

-- Number of beds sold increased from 297,276 to 444,480 in 2017

-- Switch from focus on bed rate to focusing on bed profitability

-- Successful integration of 5 newly acquired European

properties in key gateway city destinations

-- Leading guest scores in the markets Safestay operates

achieved by developing a strong traction with guests

-- Well advanced capex programme with key projects in Madrid,

Barcelona, and Elephant & Castle that together will add a

further 330 beds to the portfolio

-- Significant expansion of Digital Marketing capabilities

Post year end

-- Acquisition of 3rd Hostel in Barcelona for EUR3.0 million

increasing the number of beds in the city to 594 beds.

Larry Lipman commenting on the results said:

"Arguably this has been the most successful year for the Company

to date, beginning with the refinancing of the Company which

exemplified the embedded value in the business and providing the

capital to support the threefold expansion of the portfolio. This

activity came alongside a very strong trading performance from the

Group with like for like revenues up 15% driven by a particularly

strong performance from our uniquely located and Grade 1 listed

Holland Park Hostel.

2018 has started well from a trading perspective and we have

continued the portfolio's expansion with the acquisition of a third

hostel in the ever-popular city of Barcelona. We are looking

forward to benefitting from a full year's contribution from the

assets that we have acquired and completing the investment projects

we have underway."

Enquiries

Safestay plc +44 (0) 20 8815 1600

Larry Lipman

Sharon Segal

Canaccord Genuity Limited

(Nominated Adviser and Broker) +44 (0) 20 7523 8000

Chris Connors

Martin Davison

Novella +44 (0) 20 3151 7008

Tim Robertson

Toby Andrews

For more information visit: www.safestay.com

Chairman's Statement

Introduction

I am very pleased to present the results for the year to 31

December 2017 which shows the company performing strongly recording

a 43% increase in revenues alongside an increased occupancy across

our portfolio of hostels to 73%.

The business has grown rapidly, both organically and through

acquisition. The first Safestay hostel opened in London at Elephant

& Castle in 2012, with 413 beds. In 2017 the Group expanded

into key gateway European cities transforming the portfolio. Today

we have 9 hostels in the UK and Europe (plus Elephant & Castle

extension, a development site in Paris and 34 apartments under

development in Madrid), with a total of over 2,600 beds plus 34

apartments.

The concept of a youth hostel has changed substantially over the

last few years; Safestay's hostels are stylish, comfortable and

safe occupying beautiful buildings that are centrally located but

with an average bed rate of GBP20. This has led to the concept of a

premium hostel becoming more widely recognised which in turn is

increasing our existing and future customer base and opportunity as

awareness of the offer grows.

2017 was a good year for the business with the establishment of

our European platform together with growing brand recognition that

are combining to drive occupancy levels and expand our loyal

customer base.

Financial Results

Revenue

Group revenue for the financial year ended 31 December 2017

increased by 43% to GBP10.5 million (2016: GBP7.4 million). Within

this, UK achieved total sales growth of 15% to GBP8.5 million,

driven on the back of increases in occupancy to 74% (2016: 65%).

The new European acquisitions contributed GBP2.0 million to revenue

in the period.

Food & beverage sales for the Group in 2017 were GBP1.4

million. On a like for like basis, the UK grew its food &

beverage revenue by 8% to GBP1.3 million. With the added investment

and initiatives, we are making in our food and beverage offering we

expect to be able to deliver increased benefits going forward, both

in 2018 and beyond.

Total ancillary sales were GBP193k. In the UK they grew by 39%

to GBP153k. Despite being a small portion of revenue, we believe

that there is a potential to grow this side of the business.

Adjusted EBITDA

Adjusted EBITDA provides a key measure of progress made.

Adjusted EBITDA for the year to December 2017 was GBP3.2 million,

an increase of 45% on the same period last year (2016: GBP2.2

million).

Adjusted EBITDA is as follows:

2017 2016

GBP'000 GBP'000

Operating Profit 971 995

Add back:

Depreciation 1,538 901

Amortisation 161 140

Exceptional expenses 495 152

Share based payment expense 34 34

------------- --------

Adjusted EBITDA 3,199 2,222

------------- --------

There were a number of exceptional expenses, totalling GBP0.495

million which includes costs relating to the Group refinancing of

its bank debt, professional costs in relation to the property

refinancing and the acquisition costs of acquiring the U Hostel and

Equity Point Hostels in Europe.

Finance Costs

Finance costs in 2017 were GBP1.8m (2016: GBP1.5 million).

In March 2017 the Group refinanced its borrowings with a new 5

year GBP18.4m secured bank facility with HSBC. This enabled the

Group to repay all previous borrowings including two convertible

loans and, in doing so, the group significantly reduce the annual

interest costs. There were, however, early repayment penalties of

GBP118k on the previous loan.

The property refinancing for Edinburgh and Elephant & Castle

has been accounted for as a financing transaction as all

significant risks and rewards of the ownership of the two buildings

are retained by Safestay. Safestay retains operational control and

will benefit from all operating profits and also has a repurchase

option for each freehold interest.

Furthermore, our lease at Kensington Holland Park is also being

accounted for as a finance lease rather than an operating lease,

according to IAS17 (to be superseded by IFRS16 from 1 January

2019). Whilst the lease shows indicators for both finance and

operating leases it was concluded that the lease should be

classified as a finance lease on the basis that the present value

of the lease payments at a yield of 6.55% constitutes the

substantial part of the freehold valuation.

Loss Per Share

Basic loss per share for the year ended 31 December 2017 was

2.55p (2016: loss 1.49p) based on the number of shares, 34,219,134

(2016: 34,219,134) in issue during the year.

Cash flow, capital expenditure and debt

Cash generated from operations was GBP1.8 million (2016: GBP2.3

million). Cash generation has reduced during the year due to

increases in PLC and central costs, in line with the growth of the

business. The Group had cash balances of GBP4.5 million at 31

December 2017 (2016: GBP0.7million).

Gross proceeds of GBP11.4 million were received on the property

refinancing of Edinburgh and Elephant & Castle. The business

retains a long-term interest in the properties to generate future

operating cash flows and the funds generated were used to acquire

our European hostels in the Summer of 2017. The two hostels were

valued for the refinancing as leaseholds on 14 March 2017 at

GBP30.3 million.

Further capital expenditure, to improve the Group's properties,

was GBP1.1 million. For 2018 we are projecting capital expenditure

to be considerably higher due mainly to expansionary improvements.

We are undertaking the extension of the Elephant & Castle

property which will give us an additional 80 beds. The expected

build cost is GBP2.1m plus expenses. In line with the property

refinancing agreement, on completion Safestay will receive GBP1.2m

back from the landlord. The remaining amount is being financed from

internal cash resources. Other planned improvement works are at our

Madrid Hostel to provide a rooftop bar and terrace together with

the fit out of our service apartments in Madrid, due to open in the

second half of 2018. Finally, there will be some product

improvement and maintenance on our Barcelona properties and the

ongoing investment in Paris, due to open in 2019.

Outstanding bank loans from HSBC was GBP18.2 million (2016:

GBP17.4 million). This together with the finance lease obligations

of GBP21.2 million (2016: GBP10.2 million) meant debt at 31

December 2017 was GBP39.4 million (2016: GBP27.6 million).

Net asset value per share decreased to 55p (2016: 58p).

Operational Review

2017 was a year of change for the operations. With Nuno

Sacramento joining the business as COO we became more focused on

the quality of our proposition, and yield management as well as

total bed profitability, rather than average bed rate.

The UK business delivered GBP7.0 million of revenue in hostel

accommodation (+16% year on year), along with 39% growth year on

year in ancillary revenues. This excellent result was achieved by

pursuing clear segmentation, targeting 40% groups, 20% direct

business and 40% sold through Online Travel Agencies ('OTAs'). In

addition, the introduction of a yield management system has allowed

us to better flex our prices to meet demand, and this has helped

grow revenues.

Furthermore, 2017 was a year of consolidation for the UK

portfolio. Occupancy levels in all our UK properties increased.

Particularly pleasing was Kensington Holland Park where average

occupancy increased from 55.2% in 2016 to 73.40% in 2017. York

continues to grow reaching an average of 55% for the year, but

peaking at 75.3% in June, representing a good performance.

2017 was also our year of European expansion. The group acquired

two separate businesses in May. Two properties were acquired from U

Hostels in Madrid, one open with 228 beds, one under development

with 34 serviced apartments and Paris, also under development with

a further 250 beds. In addition, we acquired from Equity Point four

hostels, two in Barcelona, and one each in Prague and Lisbon. Both

these sets of acquisitions support our concept that Safestay has

the capability to apply its model to an operating business. The

European acquisitions have given us the foundation and operating

platform in Europe to expand upon further, and to deliver on our

ambition to become a leading consolidator of the hostel

segment.

Cost reduction is an ongoing consideration across our business.

We have taken a more focused approach to maximising EBITDA in order

to achieve optimum performance and hence improve bed profitability.

We have been reducing our OTA dependency. In addition, we are

removing a significant portion of costs through automation,

centralising procurement and exploring payroll efficiencies

including outsourcing, where there has been an immediate gain in

productivity. For example, we have outsourced our housekeeping in

both Elephant & Castle and Kensington Holland Park which is

proving a success.

We are also investing in line with our strategy of improving the

customer proposition and building digital and IT capabilities that

will help enable the delivery of long-term sustainable growth. We

believe this is key as we are looking to engage and talk with more

of our customers in the digital environment which in turn will lead

to increased customer loyalty translating into increased

revenues.

We believe that a well-planned capital improvements programme is

key to supporting and growing the value of our businesses. For this

reason, we are excited at the progress made in Elephant &

Castle with the extension that will yield an additional 80 beds.

The planned development of our Madrid rooftop is on track to open

for the summer months and sets the standard for our Paris opening,

in 2019, which will also have a rooftop bar. All these additions

further help enhance our brand and proposition and increase

revenue.

Safestay increased its beds sold from 297,276 to 444,480 in

2017. We believe there remains further potential to enhance

performance of the existing portfolio, through increased occupancy

as scale and distribution meets millennials' preferred travelling

profile of hop on, hop off in key European cities; groups can be

leveraged across the chain and loyalty starts to get traction

through the quality and service levels that underpin Safestay's

ethos.

Whilst we may be faced with market headwinds in 2018 with

regards to labour costs, supply chain inflation and increased

business costs we believe that our ability to focus on maximising

bed profitability, as well as keeping our brand and proposition

relevant will make us well placed to continue to grow. This will be

reinforced by the ever-increasing demand for travel in the hostel

sector across Europe).

Clear & Consistent Strategy

Safestay is targeting an increasingly diverse customer base. Our

hostels are designed to appeal to a broad community of guests from

school groups, young adults and backpackers, to families and

business travellers. Our revenue generation is driven by occupancy

and bed rate. In addition, we are also focusing our efforts on

driving additional revenue from our food & beverage offering

together with ancillary spend, including towel rental, laundry,

padlocks. This can be seen in this year's results where food &

beverage spend was 13% of total revenue, mainly in the UK (only 3%

in Europe).

Our aim is to act as a consolidator within the Hostel market,

entering new markets through the acquisition and development of

both existing operations and new sites where the potential is

identified.

The Board

There have been a number of Board changes during the year, as

well as changes to the senior executive team.

Two new non-executive directors were appointed, Michael Hirst in

May 2017 and Anson Chan in December 2017. Michael is consultant to

CBRE Hotels and is one of the world's leading hotel experts. He

also advises corporate clients in the hospitality and tourism

businesses. Michael's experience in the hospitality industry is

already providing Safestay's Board with invaluable insights and

additional operational and development support as we continue to

expand our business. Anson Chan is a respected Hong Kong

businessman who has a wealth of management and investment

experience. His experience will support Safestay through its

acquisition journey. Anson Chan is not considered to be independent

due his interest in Pyrrho Investments Limited, which is a

significant shareholder in the company.

Nuno Sacramento was appointed as Chief Operating Officer on 1

February 2017 and joined the Board in July 2017. His significant

hospitality background with Premier Inn and other international

brands and his very strong operational gives him the right

experience to take the Safestay brand to the next stage of

growth.

Sharon Segal joined the board as Finance Director and Company

Secretary on 9 October 2017. Sharon previously worked at The ONE

Group, a hospitality business operating restaurant, lounge bars and

Food & beverage in Hotels as Director of Finance, having joined

the business in 2011, in order to open the Pan-European office and

head up the European expansion.

Corporate Governance

The Remuneration Committee is chaired by Stephen Moss and its

other member is Michael Hirst. The Remuneration Committee has

responsibility for determining, within agreed terms of reference,

the Group's policy on the remuneration of senior executives and

special remuneration packages for the Executive Directors. It is

also responsible for making recommendations for performance bonus'

for Executive Directors as well as Senior Management.

The Audit Committee comprises Stephen Moss (Chairman) and

Michael Hirst. The Audit Committee meets at least twice a year and

is responsible for ensuring that the financial performance of the

Company is properly reported on and monitored, including reviews of

the annual and interim accounts, results announcements, internal

control systems and procedures and accounting policies.

Outlook

2018 has begun as expected for Safestay. The announcement on the

8 March 2018 of our acquisition of a third hostel in Barcelona,

increases our number of beds to over 2,600, and has already been

absorbed into the Safestay Group.

We have a highly experienced management team in place that will

ensure our continued growth and success. This, together with the

continued opportunity for supply chain enhancement gives us a solid

foundation to achieve our goals.

We remain committed to seeking out new opportunities in the

market; acting as a consolidator and entering new markets globally

through acquisition and acquiring new sites.

Larry Lipman

Chairman

17 April 2018

Condensed Consolidated Income Statement

Year ended 31 December 2017

Note 2017 2016

GBP'000 GBP'000

Revenue 2 10,547 7,411

Cost of sales (1,561) (1,022)

-------- --------

Gross profit 8,986 6,389

Administrative expenses (7,520) (5,242)

-------- --------

Operating profit before exceptional expenses 1,466 1,147

Exceptional expenses (495) (152)

-------- --------

Operating profit after exceptional expenses 971 995

Finance costs (1,833) (1,463)

-------- --------

Loss before tax (862) (468)

Tax (11) (43)

-------- --------

Loss for the financial year attributable

to owners of the parent company (873) (511)

======== ========

Basic and diluted loss per share 3 (2.55p) (1.49p)

Condensed Consolidated Statement of Comprehensive

Income

Year ended 31 December 2017

2017 2016

GBP'000 GBP'000

Loss for the year (873) (511)

Other comprehensive income

Items that will not be reclassified subsequently

to profit and loss

Revaluation of freehold land and buildings - 3,860

Total comprehensive (loss)/ income for

the year

attributable to owners of the parent company (873) 3,349

======== ========

Condensed

Consolidated

Statement of

Financial

Position

31 December 2017

Note 2017 2016

GBP'000 GBP'000

Non-current assets

Property, plant and equipment 4 45,971 45,771

Intangible assets 5 1,410 1,212

Goodwill 5 7,301 525

-------- --------

Total non-current assets 54,682 47,508

-------- --------

Current assets

Stock 25 23

Trade, Derivative financial instruments

and other receivables 903 504

Cash and cash equivalents 4,504 737

-------- --------

Total current assets 5,432 1,264

-------- --------

Total assets 60,114 48,772

-------- --------

Current liabilities

Loans and overdrafts 6 168 3,489

Finance lease obligations 7 49 34

Trade, Derivative financial instruments

and other payables 1,625 1,306

Current liabilities 1,842 4,829

-------- --------

Non-current liabilities

Bank loans and convertible loan notes 6 17,990 13,906

Finance lease obligations 7 21,179 10,195

Deferred tax liabilities 105 5

Total non-current liabilities 39,274 24,106

-------- --------

Total liabilities 41,116 28,935

-------- --------

Net assets 18,998 19,837

======== ========

Equity

Share capital 8 342 342

Share premium account 14,504 14,504

Merger reserve 1,772 1,772

Share based payment reserve 91 57

Revaluation reserve 4,218 4,218

Retained earnings (1,929) (1,056)

-------- --------

Total equity attributable to owners of

the parent company 18,998 19,837

======== ========

Condensed Consolidated

Statement of Changes

in Equity

31 December 2017

-------- -------- -------- -------- ----------- --------- ---------

Share Share Merger Share Revaluation Retained Total

Capital premium Reserve based Reserve earnings equity

GBP'000 account GBP'000 payment GBP'000 GBP'000 GBP'000

GBP'000 reserve

GBP'000

-------- -------- -------- -------- ----------- --------- ---------

Balance as at

1 January 2016 342 14,504 1,772 23 358 (545) 16,454

Comprehensive

income `

Loss for the

year - - - - - (511) (511)

Other comprehensive

income - - - - 3,860 - 3,860

-------- -------- -------- -------- ----------- --------- ---------

Total comprehensive

income - - - - 3,860 (511) (3,349)

-------- -------- -------- -------- ----------- --------- ---------

Transactions

with owners

Share based payment

charge for the

period - - - 34 - - 34

-------- -------- -------- -------- ----------- --------- ---------

Balance at 31

December 2016 342 14,504 1,772 57 4,218 (1,056) 19,837

-------- -------- -------- -------- ----------- --------- ---------

Comprehensive

income

Loss for the

year - - - - - (873) (873)

Other comprehensive - - - - - - -

income

-------- -------- -------- -------- ----------- --------- ---------

Total comprehensive

income - - - - - (873) (873)

-------- -------- -------- -------- ----------- --------- ---------

Transactions

with owners

Share based payment

charge for the

period - - - 34 - - 34

-------- -------- -------- -------- ----------- --------- ---------

Balance at 31

December 2017 342 14,504 1,772 91 4,218 (1,929) 18,998

======== ======== ======== ======== =========== ========= =========

Condensed Consolidated Statement of Cash

Flows

Year ended 31 December 2017

2017 2016

GBP'000 GBP'000

Operating activities

Cash generated from operations 1,911 2,308

Income tax paid (48) -

-------- --------

Net cash generated from operating activities 1,863 2,308

-------- --------

Investing activities

Purchases of property, plant and equipment (1,088) (484)

Purchases of intangible assets (48) -

Acquisition of business (note 26) (7,298) -

Net cash outflow from investing activities (8,434) (484)

-------- --------

Financing activities

Proceeds from property refinancing transaction 11,420 -

New bank loans drawn 18,400 -

Bank loans repaid (17,600) (755)

Loan and refinancing arrangement fees (375) -

Amounts paid under finance leases (916) (660)

Interest paid (591) (732)

Net cash generated / (absorbed in) from

financing activities 10,338 (2,147)

-------- --------

Net increase /(decrease) in cash and cash

equivalents 3,767 (323)

Cash and cash equivalents at beginning

of year 737 1,060

Cash and cash equivalents at end of year 4,504 737

======== ========

Basis of Preparation

On 17 April 2018, the Directors approved this preliminary

announcement for publication. Copies of this announcement are

available from the Company's registered office at la Kingsley Way,

London N2 OFW and on its website, www.safestay.com. The Annual

Report and Accounts will be sent to shareholders in due course and

will be available on the Company's website, www.safestay.com. The

financial information presented above does not constitute statutory

financial statements as defined by section 435 of the Companies Act

2006 for the year ended 31 December 2017.

The financial information for the year ended 31 December 2017 is

derived from the statutory financial statements for that year,

prepared under IFRS, under which the auditors have reported. The

audit report was unqualified, did not include references to matters

to which the auditor drew attention by way of emphasis without

qualifying their report and did not contain a statement under

section 498 (2) or (3) of the Companies Act 2006. The statutory

financial statements for the year ended 31 December 2017 will be

delivered to the Registrar of Companies following the Company's

Annual General Meeting.

The accounting policies applied in this announcement are

consistent with those of the annual financial statements for the

year ended 31 December 2016, as described in those financial

statements.

1. SIGnificant Accounting policies for the group

Business combinations

Acquisitions of subsidiaries and businesses are accounted using

the acquisition method. The consideration transferred in a business

combination is measured at fair value, which is calculated as the

sum of the acquisition-date fair values of assets transferred by

the Group, liabilities incurred by the Group to former owners of

the acquire and the equity interest issued by the Group in exchange

for control of the acquire.

At the acquisition date, the identifiable assets acquired and

liabilities assumed are recognised at their fair value at the

acquisition date.

Goodwill

Goodwill is measured as the excess of the sum of the

consideration transferred over the net of the acquisition-date

amounts of the identifiable assets acquired and the liabilities

assumed. A review of the goodwill is carried out annually.

Operating segments

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision maker.

The chief operating decision makers, who are responsible for

allocating resources and assessing performance of the operating

segments, have been identified as the executive directors.

Currently there are only operating segment, which is the operation

of hostel accommodation in the UK and Europe.

Revenue

Revenue is stated net of VAT and comprises revenues from

overnight hostel accommodation, income from the rental of student

accommodation during the academic year and the sale of ancillary

goods and services such as food & beverage and merchandise.

Accommodation and the sale of ancillary goods and services is

recognised when provided. Income from the rent of student

accommodation is recognised on a straight-line basis over the

academic year to which the rent relates.

The sale of ancillary goods comprises sales of food, beverages

and merchandise.

Deferred income comprises deposits received from customers to

guarantee future bookings of accommodation. This is recognised as

revenue once the bed has been occupied.

Leases

The Group as lessor:

Rental income from operating leases is recognised on a

straight-line basis over the term of the relevant lease.

The Group as lessee:

Assets held under finance leases are recognised as assets of the

group at the present value of the lease payments at the inception

of the lease. The corresponding liability to the lessor is included

in the balance sheet as a finance lease obligation.

Lease payments are apportioned between finance expenses and

reduction in lease obligation so as to achieve a constant rate of

interest on the remaining balance of the liability. Finance

expenses are recognised immediately in the income statement.

All other leases are classified as operating leases. Operating

leases are recognised in the income statement on a straight-line

basis over the life of the lease.

Foreign currency translation

Goodwill and fair-value adjustments arising on the acquisition

of a foreign operation are treated as the assets and liabilities of

the foreign operation and translated at the closing rate.

Property, plant and equipment

Freehold property is stated at fair value and revalued annually.

Valuation surpluses and deficits arising in the period are included

in other comprehensive income. Fixtures fittings and equipment are

stated at cost less depreciation and are depreciated over their

useful lives. The applicable useful lives are as follows:

Fixtures, fittings and equipment 3-5 years

Freehold properties 50 years

Leasehold properties 50 years or term of lease if shorter

Assets held as finance leases are depreciated over the shorter

of the lease term and their expected useful lives on the same basis

as owned assets.

Impairment of property, plant and equipment

At each statement of financial position date, the Group reviews

the carrying amounts of its property, plant and equipment to

determine whether there is any indication that those assets have

suffered an impairment loss. If any such indication exists, the

recoverable amount of the asset is estimated in order to determine

the extent of the impairment loss (if any).

Recoverable amount is the higher of fair value less costs to

sell and value in use. In assessing value in use, the estimated

future cash flows are discounted to their present value using a

pre-tax discount rate that reflects current market assessments of

the time value of money and the risks specific to the asset for

which the estimates of future cash flows have been adjusted. If the

recoverable amount of an asset (or cash-generating unit) is

estimated to be less than its carrying amount, the carrying amount

of the asset (cash-generating unit) is reduced to its recoverable

amount.

An impairment loss is recognised as an expense immediately,

unless the relevant asset is carried at a revalued amount, in which

case the impairment loss is treated as a revaluation decrease, but

a negative revaluation reserve is not created.

For revalued assets, where an impairment loss subsequently

reverses, the carrying amount of the asset (cash-generating unit)

is increased to the revised estimate of its recoverable amount, but

so that the increased carrying amount does not exceed the carrying

amount that would have been determined had no impairment loss been

recognised for the asset (cash-generating unit) in prior years. Any

remaining balance of the reversal of an impairment loss is

recognised in the income statement. For assets carried at cost, any

reversals of impairments are recognised in the income

statement.

Intangible assets

Intangible assets are initially recognised and measured at fair

market value.

Where an intangible has a determinable finite useful life, the

intangible asset is amortised on a straight-line basis over that

useful life. The applicable useful life is

10 years for the life of the interest in the head lease

13 years for tenancy sublease

3 years for website development.

(a) Goodwill

Goodwill arises on the acquisition of subsidiaries and

represents the excess of the consideration transferred over the

fair value of the identifiable net assets acquired.

For the purpose of impairment testing, goodwill acquired in a

business combination is allocated to each of the cash-generating

units (CGUs), or groups of CGUs, that is expected to benefit from

the synergies of the combination. Each unit or group of units to

which the goodwill is allocated represents the lowest level within

the entity at which the goodwill is monitored for internal

management purposes. Goodwill is monitored at the operating segment

level.

Goodwill impairment reviews are undertaken annually or more

frequently if events or changes in circumstances indicate a

potential impairment. The carrying value of the CGU containing the

goodwill is compared to the recoverable amount, which is the higher

of value in use and the fair value less costs of disposal. Any

impairment is recognised immediately as an expense and is not

subsequently reversed.

(b) Other intangible assets

Intangible assets acquired in a business combination are

recognised at fair value at the acquisition date.

Assets with a finite useful life and are carried at cost less

accumulated amortisation. Amortisation is calculated using the

straight-line method to allocate the cost of trademarks and

licences over their estimated useful lives s set out above.

Assets that are subject to amortisation are reviewed for

impairment whenever events or changes in circumstances indicate

that the carrying amount may not be recoverable. An impairment loss

is recognised for the amount by which the asset's carrying amount

exceeds its recoverable amount. The recoverable amount is the

higher of an asset's fair value less costs of disposal and value in

use. For the purposes of assessing impairment, assets are grouped

at the lowest levels for which there are largely independent cash

inflows (CGUs). Prior impairments of non-financial assets (other

than goodwill) are reviewed for possible reversal at each reporting

date.

Critical accounting judgements and key sources of estimation and

uncertainty

The fair value of the Group's property is the main area within

the financial information where the Directors have exercised

significant estimates.

-- The Holland Park lease showed indicators that it could be

treated as either a finance or operating lease. The Group's

decision to treat it as a finance lease was based on a balanced

judgment of relevant factors. Furthermore, the fair value of the

Group's finance lease asset is inherently subjective. The

methodology applies a discount rate to the future lease payments to

approximate to the fair value of the asset. Details of the

methodology of property valuations. No tax arises in these

transactions.

-- Judgements were made around the capitalised leases for

Edinburgh and Elephant & Castle. The valuations will remain

fixed going forward. The valuation of the leasehold interest was

performed by external valuers. No tax arises in these

transactions.

-- The Group has identified certain costs as exceptional in

nature in that, without separate disclosure, would distort the

reporting of the underlying business.

-- The fair-value of the assets and liabilities recognised on

the acquisition of an operation or entity is determined using both

external valuations and directors' valuations.

2. Segmental analysis

2017 2016

GBP'000 GBP'000

Hostel accommodation 8,971 6,058

Food and Beverages sales 1,383 1,243

Other income 193 110

-------- --------

10,547 7,411

-------- --------

2017 UK Europe Total

Revenue 8,496 2,051 10,547

------ ------- -------

Operating Profit 922 49 971

Depreciation & Amortisation 1,450 249 1,699

Exceptional & Share base payment expense 529 - 529

------ ------- -------

Adjusted EBITDA 2,901 298 3,199

====== ======= =======

Assets and liabilities are not analysed on a segmental

basis.

In 2016 all revenues, costs and profits and losses arising there

from related to the UK.

The above information is presented in the format of that

frequently reviewed by the Chief Operating Decision Maker (CODM),

and decisions made on the basis of adjusted segment operating

results.

3. LOSS per share

The calculation of the basic and diluted loss per share is based

on the following data:

2017 2016

GBP'000 GBP'000

Loss for the period attributable to equity holders

of the company (873) (511)

======== ========

2017 2016

'000 '000

Weighted average number of ordinary shares for

the purposes of basic loss earnings per share 34,219 34,219

Effect of dilutive potential ordinary shares 1,807 2,264

------- -------

Weighted average number of ordinary shares for

the purposes of diluted loss per share 36,026 36,483

------- -------

Basic loss per share (2.55p) (1.49p)

------- -------

Diluted loss per share (2.55p) (1.49p)

------- -------

There is no difference between the diluted loss per share and

the basic loss per share presented. Due to the loss incurred in the

year the effect of the share options in issue is anti-dilutive.

4. PROPERTY, PLANT AND EQUIPMENT

Freehold Leasehold Fixtures, Assets under Total

land and land and fittings construction GBP'000

buildings buildings and equipment GBP'000

GBP'000 GBP'000 GBP'000

Cost or valuation

Balance as at 1 January

2016 28,764 12,793 1,055 - 42,612

Transfer (267) 267 - - -

Additions 224 62 198 - 484

Revaluation 3,739 - - - 3,739

Balance as at 31 December

2016 32,460 13,122 1,253 - 46,835

Transfer (29,777) 29,777 - - -

Additions - 818 149 121 1,088

Acquired in business combination - - 598 - 598

Exchange movements - - 52 - 52

----------- --------------- -------------- ---------

At 31 December 2017 2,683 43,717 2,052 121 48,573

----------- ----------- --------------- -------------- ---------

Depreciation

Balance as at 1 January

2016 - 71 214 - 285

Charge for the period 275 262 364 - 901

Revaluation (122) - - - (122)

----------- ----------- --------------- -------------- ---------

Balance as at 31 December

2016 153 333 578 - 1,064

Charge for the year 108 698 732 - 1,538

At 31 December 2017 261 1,031 1,310 - 2,602

----------- ----------- --------------- -------------- ---------

Net book value:

At 31 December 2017 2,422 42,686 742 121 45,971

=========== =========== =============== ============== =========

At 31 December 2016 32,307 12,789 675 - 45,771

=========== =========== =============== ============== =========

The directors based their valuation of the freehold properties

using external valuations as at 14 March 2017 prepared by Cushman

and Wakefield on behalf of HSBC (the Group's bankers) as part of

the security for the Group's bank financing. Had the properties not

been revalued their historic cost carrying value would have been

GBP2.4 million.

Leasehold land and buildings additions comprise the capitalised

finance lease plus refurbishment costs incurred on the Holland Park

hostel and the Group properties transferred from freehold land and

buildings following the finance transactions in respect of its

hostels in Edinburgh and Elephant & Castle which completed on

31 March 2017.

The newly-created leaseholds for both properties were also

independently valued on 14 March 2017 at GBP30.3 million by Cushman

and Wakefield on behalf of HSBC (the Group's bankers). The Group

has accounted for the finance transactions as interest-bearing

borrowings secured on the original properties held. There were no

recognised gains or losses arising in respect of these

transactions.

Assets in the course of construction represent additional

letting rooms at one of the group's hostels. The group has a

commitment to spend GBP2.1m on this development.

5. INTANGIBLE ASSETS AND GOODWILL

Website Development Leasehold Goodwill Total

GBP'000 rights GBP'000 GBP'000

GBP'000

Cost

At 1 January 2016 and 31 December

2016 - 1,400 525 1,925

Additions 48 - - 48

Arising in business combination - 302 6,685 6,987

Exchange movements - 9 91 100

------------------- --------- -------- --------

At 31 December 2017 48 1,711 7,301 9,060

------------------- --------- -------- --------

Amortisation

At 1 January 2016 - 48 - 48

Charge for the period - 140 - 140

------------------- --------- -------- --------

At 31 December 2016 - 188 - 188

Charge for the period 4 157 - 161

------------------- ---------

At 31 December 2017 4 345 - 349

------------------- --------- -------- --------

Net book value:

At 31 December 2017 44 1,366 7,301 8,711

------------------- --------- -------- --------

At 31 December 2016 - 1,212 525 1,737

------------------- --------- -------- --------

On the acquisition of the business on Smart City hostel in

Edinburgh in 16 September 2015 the Directors identified an

intangible asset in relation the lease with the University of

Edinburgh, which terminates in 2027 and the amortisation of this

intangible asset is based on a straight-line basis until that

date.

Goodwill in 2017 arose from the acquisition of U Hostels and

Equity Point businesses.

Goodwill in 2016 arose from the acquisition of the business of

the Smart City hostel in Edinburgh, which is the relevant cash

generating unit. At 31 December 2017, an impairment review has been

performed using forecast cash flows over 5 years discounted at

appropriate discount rates to affirm its value in use. This

forecast requires the use of assumptions and estimates based on

current operating parameters and there are no reasonable

sensitivities that indicate this asset is impaired.

6. LOANS

2017 2016

GBP'000 GBP'000

At amortised cost

Bank Loan 18,400 13,794

Convertible loan - 3,800

18,400 17,594

Loan arrangement fees (242) (199)

-------- --------

18,158 17,395

======== ========

Loans repayable within one year 168 3,489

Loans repayable after more than one year 17,990 13,906

-------- --------

18,158 17,395

======== ========

7. OBLIGATIONS UNDER FINANCE LEASES

Minimum lease payments

2017 2016

GBP'000 GBP'000

Amounts payable under finance leases:

Within one year 937 660

In the second to fifth years inclusive 3,840 2,640

After five years 37,455 28,380

Less future finance charges (21,004) (21,451)

----------- -----------

Present value of future lease obligations 21,228 10,229

=========== ===========

Present value of

minimum lease payments

2017 2016

GBP'000 GBP'000

Amounts payable under finance leases:

Within one year 49 34

In the second to fifth years inclusive 223 157

After five years 20,956 10,038

------------ -----------

Present value of future lease obligations 21,228 10,229

============ ===========

The group continues to treat the Holland Park lease as a finance

lease on the basis that the present value of the lease payments

constitutes the substantial part of a theoretical freehold

valuation.

The average effective borrowing rate was 6.55%. The lease is on

a fixed repayment basis and no arrangements have been entered into

for contingent rental payments.

On 31 March 2017 the group property refinancing transactions on

its hostels in Edinburgh and Elephant & Castle, receiving gross

proceeds of GBP5.32 million and GBP6.1 million respectively. The

properties were independently valued at GBP14.3 million and GBP16.0

million; as the undervaluation matched by lease rentals is below

the full market rate, the directors have deemed the transactions as

outside the scope of IAS17 and treatment as finance leases is

considered appropriate.

The average effective rate of borrowing for the transactions was

7.74% and 7.81% respectively.

8. CALLED UP EQUITY SHARE CAPITAL

GBP'000

Allotted, issued and fully paid

34,219,134 Ordinary Shares of 1p each as at 31 December

2016 and 2017 342

=======

9. Post balance sheet events

On 8 March 2018, the Group announced the acquisition of a third

hostel in Barcelona for EUR3.0 million from Equity Point Hostels

("Equity Point"). The consideration will be satisfied from the

Group's cash resources with an initial payment of EUR0.7 million

and then four payments of EUR0.575 million spread over the next

four years. The Board has not completed its appraisal on the fair

value of assets acquired.

10. Business combinations

During the year ended 31 December 2017 the business acquired

a100% interest five new hostels.

Safestay PLC individually acquired three new hostels for a

combined cash consideration of EUR5.9m. Safestay España SLU, a

previously dormant subsidiary of Safestay PLC, acquired a further

two hostels for an additional EUR3m cash consideration.

All hostel acquisitions have been treated as business

combinations as they were operating as a business at the point of

purchase.

On 19th May 2017, the Group's first European hostels were

acquired through a portfolio, hereafter referred to collectively as

"U Hostels":

- U Hostels Albergues Juveniles SL, an entity operating a

228-bed luxury hostel, located in Lisbon, Portugal

- U Places SL, a dormant subsidiary of U Hostels Albergues

Juveniles SL. The entity holds a business licence for the apartment

block situated next to the Madrid hostel.

- Safestay France SAS (formerly U Hostels France SAS), a

subsidiary of U Hostels Albergues Juveniles SL. The company has

access to a development in Montmatre Paris, which, if developed

under current plans as a 250-bed hostel, will join the Safestay

portfolio.

On 30th June 2017, the Group continued its European expansion

through purchases from a further portfolio, hereafter collectively

referred to as "Equity Point".

- Equity Point Lisboa Unipessoal Lda, an entity operating a

150-bed luxury hostel in Lisbon, Portugal

- Equity Point Prague s,r.o, an entity operating a 150 bed

luxury hostel in Prague, Czech Republic.

The business operations of two hostels in Barcelona were

purchased by Safestay España SLU from the same portfolio on 30th

June 2017. The assets and liabilities acquired, translated at

EUR1.14 to the pound are:

GROUP

U Hostels Equity Point

------------- ---------------------

Number of hostels acquired (excluding assets

under development) 1 4

Provisional fair values GBP'000 GBP'000

Property, plant and equipment 467 131

Intangible assets - 401

Current assets 78 78

Cash / (net debt) 386 84

Deferred revenue, trade and other payables (241) (201)

Deferred Tax - (100)

Goodwill 2,207 4,478

Consideration (satisfied by cash) 2,897 4,871

------------- ---------------------

Goodwill recognised on each acquisition reflects the future

growth of the group and represent the first stage in establishing a

pan-European network of Safestay Hostels. All goodwill acquired has

been allocated to a cash generating unit.

The Board reviewed each business on acquisition for its

separately identifiable assets:

1) Brand - the hostels were purchased from two selling entities,

each with a large portfolio of hostels that are continui1ng to

trade under their original brand names. For this reason, management

do not attribute the future earnings to the brands purchased; the

key asset purchased is the future potential of each hostel as

operated under the Safestay management team, and as an extension of

the existing Safestay portfolio.

2) Advanced deposits - each acquisition resulted in the purchase

of advanced deposits taken under previous management that would

result in potential sales whilst under Safestay control. The Board

quantified the value of contracted sales under their original terms

of sale and found the contracts to be immaterial at

acquisition.

3) Property, plant and equipment - the Board reviewed the asset

registers of each entity and performed an impairment of each. The

book value of assets was agreed to represent the fair value of each

asset class.

4) Intangible assets - the Board identified within the business

combination of Safestay España SLU an intangible asset in relation

to a tenancy sublease with a tenant in-situ at acquisition. The

lease terminates in 2031; the amortisation of this intangible asset

is based on a straight- line basis until that date.

The group incurred acquisition costs of GBP155,000 on legal fees

and due diligence costs. These have been charged to operating

exceptional items in the Consolidated Income Statement.

The acquisitions have contributed the following revenue and

operating profits to the Group in the year ended 31 December 2017

from the date of acquisition:

GROUP

U Hostels Equity Point

GBP'000 GBP'000

Revenue 738 1,313

Operating

Profit (66) 116

It is not practicable to identify the related cash flows,

revenue and profit on an annualised basis as the months for which

the businesses have been controlled by Safestay are not indicative

of the annualised figures.

The pre-acquisition trading results are not indicative of the

trading expectation under Safestay's stewardship; the Group

deployed its Property Management System and digital marketing

platform, updated internal processes and undertook a light

re-branding exercise in each new property in the year ended 31

December 2017.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR BDLLFVZFFBBL

(END) Dow Jones Newswires

April 18, 2018 02:00 ET (06:00 GMT)

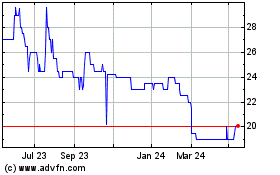

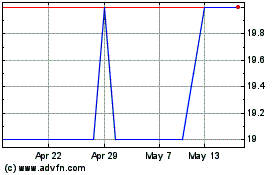

Safestay (LSE:SSTY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Safestay (LSE:SSTY)

Historical Stock Chart

From Jul 2023 to Jul 2024