Safestay PLC Result of Open Offer (1949Y)

September 07 2015 - 2:00AM

UK Regulatory

TIDMSSTY

RNS Number : 1949Y

Safestay PLC

07 September 2015

7 September 2015

Safestay plc

("Safestay" or "the Company" or "the Group")

Result of Open Offer

On 17 August 2015, Safestay (AIM: SSTY), the owner and operator

of a new brand of contemporary hostel, announced the terms of a

Placing and Open Offer to raise up to GBP9.34 million, a new GBP8.5

million debt facility and the issue of New Loan Notes to raise

GBP1.0 million (all before expenses) to finance the proposed

acquisition of a hostel in Edinburgh for GBP14.9 million and for

working capital purposes.

The Placing and Open Offer comprised a firm placing of

13,467,742 new ordinary shares at 62p per share to raise GBP8.35

million (before expenses) and an open offer of 1,603,710 new

ordinary shares at 62p per share to raise up to GBP0.994 million

(before expenses) on the basis of 1 Open Offer Share for every 12

Existing Ordinary Shares held at the Record Date.

The Open Offer closed for acceptances at 11.00 a.m. on 4

September 2015. The Company received valid acceptances in respect

of 264,115 Open Offer Shares under shareholders' Open Offer

Entitlements and 33,081 Open Offer Shares under the Excess

Application Facility. In aggregate, therefore, valid acceptances

were received in respect of 297,196 Open Offer Shares, representing

approximately 18.55 per cent. of the Open Offer Shares available,

and raising GBP0.184 million for the Company (before expenses). As

a result, the Company has raised a total of GBP8.534 million

(before expenses) through the Placing and Open Offer.

All valid applications under the Open Offer have been met in

full, including the Excess Shares applied for under the Excess

Application Facility.

The Proposals are subject to the approval of Shareholders at a

General Meeting to be held at 11.00 a.m. on 9 September 2015 at the

offices of Dechert LLP, 160 Queen Victoria Street, London EC4V

4QQ.

The New Ordinary Shares will on Admission rank pari passu in all

respects with the Existing Ordinary Shares. The New Ordinary Shares

(in uncertificated form) are expected to be credited to CREST

accounts on 10 September 2015 and definitive share certificates for

New Ordinary Shares (in certificated form) are expected to be

despatched to shareholders by 22 September 2015.

Following Admission and in accordance with the Financial Conduct

Authority's Disclosure and Transparency Rules ("DTR"), the

Company's issued share capital will comprise 34,219,134 Ordinary

Shares. The above figure of 34,219,134 Ordinary Shares may be used

by shareholders in the Company as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change in their interest in, the

share capital of the Company under the DTR.

All defined terms in this announcement have the same meaning as

in the Company's admission document dated 17 August 2015.

Larry Lipman, Chairman of Safestay, said:

"As we announced on 17 August 2015, due to the size of the fund

raising we decided to make the Open Offer available to all

shareholders so they could participate if they so wished and to

avoid being diluted. I would like to thank those participating

shareholders for their support especially given it has been such a

volatile period for the stock market."

Enquiries

Safestay Tel: 020 8815 1600

Larry Lipman, Chairman

Colin Stone, Finance Director

Phil Houghton, Chief Executive

Westhouse Securities Tel: 020 7601 6100

Tom Griffiths

Richard Johnson

David Coaten

Novella Tel: 020 3151 7008

Tim Robertson

Ben Heath

For more information visit: www.safestay.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCPKQDDABKDKCK

(END) Dow Jones Newswires

September 07, 2015 02:00 ET (06:00 GMT)

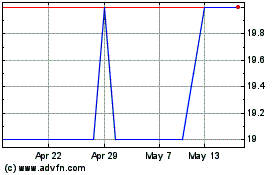

Safestay (LSE:SSTY)

Historical Stock Chart

From Jun 2024 to Jul 2024

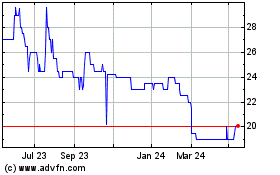

Safestay (LSE:SSTY)

Historical Stock Chart

From Jul 2023 to Jul 2024