TIDMSQS

RNS Number : 3287Y

SQS Software Quality Systems AG

08 September 2015

SQS Software Quality Systems AG

("SQS" or the "Company")

Results for the six months ended 30 June 2015

Software Quality Systems AG (AIM:SQS.L), the world's largest

specialist supplier of software quality services, today announces

its unaudited results for the six months ended 30 June 2015.

Financial Highlights

-- Total revenue increased by 16.1% to EUR150.3m (H1 2014: EUR129.4m)

o Organic revenue increased by 11.1%

-- Adjusted* Gross profit increased by 9.8% to EUR47.0m (H1 2014: EUR42.8m)

-- Adjusted** PBT increased by 5.6% to EUR9.0m (H1 2014: EUR8.5m)

-- Adjusted*** EPS decreased by 5.6% to EUR0.17 (H1 2014: EUR0.18)

o Due to higher tax rate and minority interests

-- Operating cash outflow**** increased to EUR4.6m (H1 2014: EUR2.6m)

o Reflecting H1 seasonality with increased receivable days

-- Net debt as at 30 June 2015 EUR26.5m (H1 2014: EUR8.9m)

o Reflecting investments in acquired companies, test centre

infrastructure in India and higher receivable days

* no material adjustments in H1 2015, but there were adjustments

for a non-cash amortization of SQS India BFSI acquired order

backlog of EUR1.0m in H1 2014

** adjusted to add back EUR3.1m of IFRS amortisation of client

relationship assets from the SQS India BFSI acquisition, EUR0.6m

acquisition costs for Bitmedia and Trissential and EUR0.03m pro

forma interests on pensions

*** adjusted to add back effects under ** at actual local GAAP

tax rate of 33.8%, less EUR0.8m on minority interests (mainly for

SQS India BFSI)

****incl. a re-allocation of EUR0.6m transaction costs for

acquisitions to cash flow from investment activities due to an IFRS

rule change

Operational Highlights

-- Successful acquisition and integration of Trissential (USA) and Bitmedia (now SQS Italy)

o US revenue going forward at approximately 18% of total

revenue

-- Improving visibility with Managed Services ("MS") revenue

increased 26% to EUR71.9m (H1 2014: EUR57m)

o Record MS order intake of EUR153m (H1 2014: EUR70m) and MS

book to bill ratio of 2.1

o MS revenue now 48% of total revenue with 49 clients (H1 2014:

44%) including 9 new clients

-- Gross margins in strategic segments:

o MS up to 35.9% (H1 2014: 35.7%)

o Specialist Consulting Services up to 34.5% (H1 2014:

32.8%)

o Regular Testing Services down to 26.4% (H1 2014: 33.6%)

-- Regular Testing Services saw reduced margins in some larger

engagements. We have now disengaged from those contracts or reduced

our staffing levels post the period end to cut costs

-- Continued focus on larger client engagements by increasing

annualised revenue per client to EUR769k (2014: EUR634k) and

reducing number of active clients to 385 (2014: 423)

Post Period Highlight

-- Acquisition of Galmont Consulting for up to $22m,

strengthening the Company's US operations and further diversifying

global revenue split

Diederik Vos, Chief Executive Officer of SQS, commented: "The

performance during the first half has further strengthened the

fundamentals of our business and our growth strategy, despite lower

gross margin performance in Regular Testing Services. With MS now

accounting for nearly 50% of revenues and a record order intake,

the company is well placed to continue building on the momentum

achieved to date.

"The addition of Trissential and post period acquisition of

Galmont significantly upscales our US presence in a key market for

SQS. This is expected to underpin further Managed Services and

Specialist Consultancy growth across our key verticals as well as

further diversifying global revenues.

"We are addressing our exposure to margin pressure in some

Regular Testing business by reducing client numbers, overhead costs

and headcount. We will further react, adapt and manage potential

impacts on our clients from continued global economic

uncertainties. For all these reasons we have to be more cautious

and anticipate our profits for the full year to be slightly below

the Board's previous expectations."

Enquiries:

SQS Software Quality Systems AG Tel. +49 (0) 2203 91

54 0

Diederik Vos, Chief Executive Officer

Rene Gawron, Chief Financial Officer

Numis Securities - Nomad and Joint Broker Tel +44 (0) 20 7260

1000

Simon Willis / Jamie Lillywhite / Mark Lander

Westhouse Securities - Joint Broker Tel. +44 (0) 20 7601

6100

Robert Finlay / Antonio Bossi

Walbrook PR - Financial Media and Investor Tel. +44 (0)20 7933

Relations 8780

Paul Cornelius / Sam Allen / Nick Rome sqs@walbrookpr.com

About SQS

SQS is the world's leading specialist in software quality. This

position stems from over 30 years of successful consultancy

operations. SQS consultants provide solutions for all aspects of

quality throughout the whole software product lifecycle driven by a

standardised methodology, offshore automation processes and deep

domain knowledge in various industries. Headquartered in Cologne,

Germany, the company now employs approximately 4,400 staff. SQS has

offices in Germany, UK, US, Australia, Austria, Egypt, Finland,

France, India, Ireland, Italy, Malaysia, the Netherlands, Norway,

Singapore, South Africa, Sweden, Switzerland and UAE. In addition,

SQS maintains a minority stake in a company in Portugal. In 2014,

SQS has generated revenues of EUR268.5 million.

SQS is the first German company to have a primary listing on

AIM, a market operated by the London Stock Exchange. In addition,

SQS shares are also traded on the German Stock Exchange in

Frankfurt am Main.

With over 8,000 completed projects under its belt, SQS has a

strong client base, including half of the DAX 30, nearly a third of

the STOXX 50 and 20 per cent of the FTSE 100 companies. These

include, among others, Allianz, BP, Commerzbank, Daimler, Deutsche

Post, Generali, Meteor, UBS and Volkswagen as well as other

companies from the six key industries on which SQS is focused.

For more information, see www.sqs.com

Chief Executive's Statement

Introduction

During the period under review the Company's fundamentals of

business were further strengthened whilst growing revenue and

profit. We continued to execute our strategy to win larger, longer

term contracts and further diversify the revenue base through the

expansion of our operations in the US.

During the period the Company completed the acquisition of 90%

of the issued share capital of Bit Media S.p.A ("Bitmedia") and the

acquisition of the entire issued share capital of Trissential LLC

("Trissential"). These grew total revenues by 16% to EUR150m during

the period with five months and one month's contributions from

Bitmedia and Trissential respectively. Organic revenue growth of

11% came from contract extensions across the client base assisted

by a favourable foreign exchange rate movements on translating non

Euro revenues. Furthermore, these translational exchange rate

movements helped to fully offset the negative margin impact we had

from Eurozone revenues matched against Indian and Egyptian resource

costs due to the weakening of the Euro in the first half.

As the wider market seems to have slowed down for new software

implementations and outsourcing deals, the Company has recorded the

highest ever order intake for Managed Services ("MS") and added

nine new Managed Services clients. Managed Services revenue

therefore increased by 26.1% to become the largest proportion of

total revenue, at EUR71.9m or 48% of total revenues (H1 2014: 44%).

MS revenue is expected to continue to expand to approximately 50%

of total revenue by the year end. Gross margin from MS slightly

improved to 36% due to the relatively lower costs and

industrialized delivery from our offshore/nearshore service

centres.

Specialist Consultancy Services ("SCS") revenue increased by

0.8% to EUR13.2m to account for approximately 9% of total sales (1H

2014: 10%). The revenue contribution from SCS is expected to

increase above 10% for the full year as Regular Testing Services

revenue continues to decline and we recognise the first six month

revenue contribution from the Trissential acquisition with its

focus on specialist on-site programme management.

Regular Testing Services ("RTS") revenue increased by 6.3% to

EUR50.9m, which accounted for 34% of total revenues (H1 2014: 37%).

This business saw reduced margins in some larger engagements and we

have subsequently disengaged or reduced our staffing levels post

the period end to cut associated costs, which will temporarily

impact our profitability. It is believed RTS is now better aligned

with our delivery structure and our strategic goals to further

reduce the contribution of RTS towards 30% of overall revenue.

Other revenue sources accounted for 9% of total revenue.

Overall, our global revenue mix will be more diversified going

forward. The acquisition of Bitmedia in Italy completed the

Company's expansion across all major European economies. In the US,

Trissential and the post period end acquisition of Galmont, create

a combined annual run rate of approximately $65m across the US

expected to deliver 18% of the Company's total revenues with the

potential to achieve revenues of more than $100m per annum without

further acquisitions.

(MORE TO FOLLOW) Dow Jones Newswires

September 08, 2015 02:00 ET (06:00 GMT)

Cash of EUR18.3m, as part of a net debt position of EUR26.5m,

and net assets of EUR116m as at the period end were in-line with

expectations post exceptional cash payments of EUR15.6m relating to

the two acquisitions and EUR2.4m as a result of the final phase of

the expansion of the Pune facility in India. Receivables also

extended to 84 days (H1 2014: 82 days) reflecting normal

seasonality in the business and the extended payment terms within

the Italian business unit. However, we continue to expect

receivable days to return to more normalised levels during the

second half of the current year to deliver strong cash generation

resulting in a significantly strengthened balance sheet by the end

of the current financial year.

New Business

During the period the Company won a number of high profile

potential Managed Services clients, including one of the world's

leading US hospitality chains, a leading US financial services

group and a retailer based in Europe.

As a result of the expanded US operations, notable client

additions in the US included a tier one bank, a payment processing

company and several other manufacturing and technology

companies.

Market & Industry Overview

The 2015 Nelson Hall market report is yet to be published.

Therefore, 2014 estimates showing 9% growth in Software Testing

Services ("STS") across Europe during 2015, up from 7% in 2014, are

still the most recent. The Company estimates it has once again

achieved market share expansion during the first half of the

current financial year.

Furthermore, the 2014 Nelson Hall research also forecasts a

switch in demand from traditional testing services typically

delivered by system integrators to specialist testing service

vendors.

The 2014 report also discussed the growing delivery requirement

for STS services from India, which is estimated to reach 66% of

total STS spending by 2018. This is clearly a significant market

development, which has many implications for the testing services

industry and was one of the factors in the Company deciding to

invest further in its offshore service centres in India during the

period. The Company is therefore well positioned to capture any

increase in demand for offshore software testing services.

Acquisitions

The acquisition of 90% of the issued share capital Bitmedia for

up to EUR6.07m, announced in February, marked the first of the

recent acquisition activity for the Company. This acquisition

provides entry into the Italian market, and provides a substantial

platform from which to strengthen the Company's services to both

existing and new Italian customers.

The acquisition of Trissential for up to $30.7m, announced in

April, supports the Company's strategy of diversifying its service

portfolio within software and IT quality services and enhancing its

exposure to the significant market opportunities in the US. As

announced, the acquisition approximately quadruples SQS's existing

onsite delivery capability in the US and adds significant exposure

to the active US STS services market, particularly in the North

Central region of the US.

Given the timing of the acquisition, the expected benefits and

scale of operations in the US will only be fully reflected during

the next full year period. However, early indicators suggest

integration is successful and the broader entry into the US market

is expected to be both cost effective and timely for the Group.

Strategy

Over the period, SQS has focussed on delivering higher margin

Managed Services and developing the Company's global presence,

especially in the US.

Global price pressures on testing services, driven by the

slowdown in the global economic growth prospects and increased

competition, has proved that the Company's focus on providing

Managed Services and Specialist Testing Services was resilient for

these business lines and delivered significant growth during the

period. As such, further investment in India capacities ensures SQS

remains well placed to capture higher margin opportunities in the

future.

The Company's three primary service offerings remain MS to meet

the demand of clients seeking efficiency, SCS to meet the demand of

clients seeking transformation and quality and RTS to meet the

demand of more price conscious clients, who tend to be served on a

local basis. Due to the relative operating margins of these

services, the Company remains focussed on growing MS revenues while

managing the costs associated with delivering RTS. Furthermore, RTS

will continue targeting new clients that are likely to provide

greater future value of more than EUR1.5m per annum and to

discontinue those contracts that are not sufficiently profitable.

SCS revenues will however increase as a direct result of the

Trissential acquisition.

Dividend

In accordance with German law, SQS can only pay one dividend in

each financial year. We expect to declare a dividend with our final

results for the year ending 31 December 2015, in line with our

current policy of paying out approximately 30% of adjusted profit

after tax as a dividend.

Employees

Total headcount at the period end had increased by 11.6% to

4,325 (31 Dec 2014: 3,875) with an optional circa 220 contractors

retained during the period. As well as organic expansion, this

increase includes Bitmedia's and Trissential's 296 staff members,

which have been included into the total headcount following the

completion of acquisitions in February and June respectively.

Post Balance Sheet

Post the end of the first half, the Company announced the

acquisition of Galmont for up to $22m. Galmont is a leading

software testing consultancy in the North-Central region of the US,

complementing the Company's strength across the Banking, Financial

Services and Insurance and manufacturing sectors, while bringing

significant new expertise in government and healthcare.

Upon completion of the acquisition, there will be scope to

benefit from further cost synergies and capitalise on cross-selling

opportunities between Trissential's focus on on-site programme

management and Galmont's testing services capabilities.

Outlook

The performance during the first half has further strengthened

the fundamentals of our business and our growth strategy, despite

the lower gross margin performance in Regular Testing Services.

With MS now accounting for nearly 50% of revenues and a record

order intake, the company is well placed to continue building on

the momentum achieved to date.

The addition of Trissential and post period acquisition of

Galmont significantly upscales our US presence in a key market for

SQS. This is expected to underpin further Managed Services and

Specialist Consultancy Services growth across our key verticals as

well as further diversifying global revenues.

We are addressing our exposure to margin pressure in some

Regular Testing Services business by reducing client numbers,

overhead costs and headcount.

We will further react, adapt and manage potential impacts on our

clients from continued global economic uncertainties. For all these

reasons we have to be more cautious and anticipate our profits for

the full year to be slightly below the Board's previous

expectations.

Diederik Vos

Chief Executive Officer

8 September 2015

Financial Review H1 2015

Summary

Revenues grew by 16.1% to EUR150.3m (H1 2014: EUR129.4m),

including a first time consolidation effect for the full period

from new acquisitions Bitmedia (now SQS Italy, consolidated since

February 2015) of EUR4.2m and Trissential (USA, consolidated since

June 2015) of EUR2.4m. Bitmedia contributes mainly to the Managed

Services business unit, Trissential predominantly to Specialist

Consultancy Services. Organic revenue growth with these new

acquisitions was 11.1% compared to H1 2014.

The business units, which represent the accounting segments

according to IFRS 8, are:

-- Managed Services (MS) to meet the demand of clients seeking

efficiency in long-term engagements (between twelve months and up

to five years) of which a growing share (in many cases) is

delivered from nearshore and offshore test centres. This also

includes long term engagements for testing standard software

package products;

-- Specialist Consultancy Services (SCS) to meet the demand of

clients seeking transformation and quality in specialized projects

with skills like SAP, PLM (Product Lifecycle Management), IT

Project and Programme Management, Process Consulting and

Improvement, and Load and Performance Testing as long as these

resources are not active in MS projects; and

-- Regular Testing Services (RTS) to meet the demand of more

price conscious clients in IT projects who tend to be served with a

smaller number of consultants on a more local basis and typically

contracted for a short term period (e.g. three months).

Alongside these major segments we conduct business with

contractors (as far as these have not been included in MS),

training & conferences and software product testing tools

summarized as "Other".

Breakdown by Business Unit

Managed Services (MS)

Revenue in MS, our largest segment and our key strategic focus,

amounted to EUR71.9m in the period (H1 2014: EUR57.0m), an increase

of 26.1% on the prior year, representing a group revenue

contribution of 48%. The increase in revenue predominantly came

from the extension of existing long term managed services

contracts.

Specialist Consultancy Services (SCS)

Our business in this segment saw a moderate increase during the

period of 0.8% to EUR13.2m (H1 2014: EUR13.1m), representing a

group revenue contribution of 9%. Last year, this segment had been

weakened by the use of these specialist consultants in MS

engagements, going forward we expect this segment to contribute

above 10% of group revenues, as the vast majority of Trissential

revenues will add to SCS in H2 2015.

Regular Testing Services (RTS)

(MORE TO FOLLOW) Dow Jones Newswires

September 08, 2015 02:00 ET (06:00 GMT)

This segment grew by 6.3% in revenues to EUR50.9m (H1 2014:

EUR47.9m) on the prior half year period, representing a group

revenue contribution of 34%. Our strategy continues to be to reduce

the share of this segment of our total revenue below 30%, which is

evidenced by the drop of this segment's share of total revenue from

37% in H1 2014 to now 34%.

Other

Revenue in the "Other" segment amounted to EUR14.2m in the

period (H1 2014: EUR11.5m), an increase of 23.5% on the prior H1

period and representing a group revenue contribution of 9%. An

increase in revenues from contractors was the key driver of this

performance.

Margins and Profitability

***Gross profit improved by 9.8% to EUR47.0m (H1 2014:

EUR42.8m), with the gross margin at 31.3% (H1 2014: 33.1%). The

change in the gross margin was mainly influenced by a lower gross

margin from RTS with 26.4% (H1 2014: 33.6%) due to a growing

commoditization and competitive pressure in this market resulting

in lower staff utilization rates, mainly in the UK and Germany. On

the positive side gross margins in MS further improved to 35.9% (H1

2014: 35.7%) due to progress in global delivery and

industrialization, SCS margins went up to 34.5% (H1 2014: 32.8%) as

these specialist consultants were more adequately assigned to

specialist tasks.

Gross margin in the "Other" segment improved to 22.2% (H1 2014:

18.2%) as we increased margins from our contractor business.

Adjusted* profit before tax for the period was EUR9.0m (H1 2014:

EUR8.5m), an increase of 5.6%, with the adjusted profit margin at

6.0% (H1 2014: 6.6%). The profit before taxes was impacted by the

lower gross margin from RTS, only partially offset by lower

overhead costs.

Adjusted** earnings per share are at EUR0.17 (H1 2014: EUR0.18)

due to a higher tax rate under local GAAP and higher minority

interests.

* adjusted to add back EUR3.1m of IFRS amortisation of client

relationship assets from the SQS India BFSI acquisition, EUR0.6m

acquisition costs for Bitmedia and Trissential and EUR0.03m pro

forma interests on pensions

** adjusted to add back effects under * at actual local GAAP tax

rate of 33.8%, less EUR0.8m on minority interests (mainly for SQS

India BFSI)

*** no material adjustments in H1 2015, but there were

adjustments for a non-cash amortization of SQS India BFSI acquired

order backlog of EUR1.0m in H1 2014

Costs

General & Administrative expenses (before effects under *

above) for the period were EUR24.8m (H1 2014: EUR22.1m). This

represents a 0.6% decrease as a percentage of revenue to 16.5% (H1

2014: 17.1%), the absolute growth was due to the first time

consolidation effect of Bitmedia and Trissential (EUR0.9m) and

on-going investment in the build out of the US business

(EUR0.8m).

Sales & Marketing costs for the period were EUR10.9m (H1

2014: EUR10.1m), representing 7.3% of revenues (H1 2014: 7.8%). The

0.5% decrease as a percentage of revenues was due to improved

efficiencies in the sales teams.

Research & Development expense during the period was

slightly up at EUR1.7m (H1 2014: EUR1.4m) representing 1.1% (H1

2014: 1.1%) of revenues. Research and development investment was

mainly focused on the development of our proprietary software

testing tools and PractiQ methodology.

Cash Flow and Financing

Cash flow from operating activities**** was at EUR(4.6)m (H1

2014: EUR(2.6)m). The low operating cash flow results from a

typical seasonality we have seen in all previous first half year

periods, as receivable days and uninvoiced services went up by

EUR10.5m from the last year end due to certain behavioural patterns

of many large clients. Trade payables went down by EUR4.6m in the

period under review. Additionally the market in which Bitmedia

operates generates substantially higher receivable days than the

SQS Group average, an effect which added to the negative first half

operating cash flow. We therefore expect a much improved cash

collection and full profit to cash conversion by the end of the

full year.

****incl. a re-allocation of EUR0.6m transaction costs for

acquisitions to cash flow from investment activities due to an IFRS

rule change

Receivable days (including work in progress) increased by 2 days

to 84 compared with H1 2014.

Cash outflow from investments **** was up to EUR22.1m (H1 2014

EUR4.0m inflow) mainly due to the acquisition of 100% of the share

capital of Bitmedia and Trissential resulting in an outflow of EUR

15.6m and an ongoing investment in the third phase of the building

for our Pune (India) offshore test centre (investment expected to

end during H2 2015). The latter increased the cash outflow for

fixed and intangible assets to EUR6.8m (H1 2014 EUR3.6m

outflow).

Total cash inflow from financing activities was EUR21.5m (H1

2014: 3.3m outflow) reflecting a net increase of finance loans of

EUR18.9m YoY to fund the mentioned investments for acquisitions and

the Pune test centre infrastructure, as well as the increased

working capital requirements due to the seasonality effects of an

H1 period. Additionally dividend payments to SQS and minority

shareholders resulted in an outflow of EUR4.0m (H1 2014: 2.8m).

Balance Sheet

We closed the period with EUR18.3m (30 Jun 2014: EUR17.0m) of

cash and cash equivalents on the balance sheet and borrowings of

EUR44.8m (30 Jun 2014: EUR25.9m). The increase in borrowings was

mainly caused by the cash outflow for acquisitions and the Pune

test centre infrastructure. Cash reserves are increasingly held in

a higher diversity of currencies and offset between cash positions

and debt positions has become less flexible as we seek to exclude

the realization of potential exchange rate risks.

The resulting net debt position at the period end was therefore

EUR26.5m (30 Jun 2014: net debt of EUR8.9m).

The final purchase price allocation with regard to the Bitmedia

and Trissential acquisitions is still pending. Therefore the full

amounts for acquired net assets for Bitmedia (EUR4.7m) and

Trissential (EUR20.2m) have been posted as "goodwill" and will be

allocated to intangible assets and goodwill once the purchase price

allocation will be finalized during H2 2015. For SQS India BFSI

intangible assets for client relationships with a fair value of

EUR9.2m were recognized in the 30 Jun 2015 balance sheet,

reflecting a further amortization of EUR3.1m during the first half

period.

As these amortization charges are non-cash-items and do not

impact the normal business of SQS they are adjusted within the PBT

und EPS reporting.

Taxation

The tax charge of EUR1.3m (H1 2014: EUR1.1m) includes current

tax expenses of EUR3.0m (H1 2014: EUR2.5m) and deferred tax

expenses of EUR(1.7)m (H1 2014: EUR(1.4)m). The tax rate on local

GAAP results was 33.8% (H1 2014: 29.5%), the higher tax rate being

a consequence of a geographically different spread of profits.

Going forward, we expect an actual tax rate of ca. 31%.

Foreign Exchange

Approximately 58% (H1 2014: 53%) of the Group's turnover is

generated in Euros. For the conversion of revenues and costs

generated in local currencies into Euros, the relevant official

average exchange rate for the six-month-period of 2015 was chosen.

For the conversion of the balance sheet items from local currency

into Euros, the official exchange rate as at 30 June 2015 was

used.

Foreign exchange had a EUR0.6m positive translational impact on

earnings for the period. Had the Pound/Swiss Franc/Indian

Rupee/Swedish Krona/US-$/Euro exchange rates remained the same as

in H1 2014, our non-Euro revenues for the period would have been

EUR8.8m lower, the EBIT would have been EUR0.6m lower. These

translational exchange rate movements helped to fully offset the

negative margin impact we had from Eurozone revenues matched

against Indian and Egyptian resource costs due to the weakening of

the Euro in the first half. Thus the net profit impact of forex was

almost nil.

International Financial Reporting Standards (IFRS)

The Interim Consolidated Financial Statements of SQS and its

subsidiary companies ("SQS Group") are prepared in conformity with

all IFRS (International Financial Reporting Standards, formerly

International Accounting Standards) and Interpretations of the IASB

(International Accounting Standards Board) which are to be applied

for those financial statements whose reporting period starts on or

after 1 January 2015.

The SQS Group Consolidated Financial Statements for the six

month period ended 30 Jun 2015 were prepared in accordance with

uniform accounting and valuation principles in Euros.

Rene Gawron

Chief Financial Officer

8 September 2015

Consolidated Income Statement

for the six months ended 30 June 2015

Six months ended 30 Six months ended 30 Year ended 31 December

June 2015 June 2014 2014

(Notes) (unaudited) (unaudited) (audited)

kEUR kEUR kEUR

Revenue 150,254 129,366 268,483

Cost of sales (4) 103,276 87,539 180,908

Gross profit 46,978 41,827 87,575

General and

administrative expenses (4) 28,552 25,527 51,471

Sales and marketing

expenses (4) 10,898 10,098 20,720

Research and development

expenses (4) 1,713 1,448 3,815

------------------------- -------- ----------------------- ------------------------ ------------------------

Profit before tax and

finance costs (EBIT) 5,815 4,754 11,569

(MORE TO FOLLOW) Dow Jones Newswires

September 08, 2015 02:00 ET (06:00 GMT)

Finance income 572 133 974

Finance costs 1,191 1,164 2,417

------------------------- -------- ----------------------- ------------------------ ------------------------

Net finance costs (5) -619 -1,031 -1,443

Profit before taxes

(EBT) 5,196 3,723 10,126

Income tax expense (6) 1,316 1,118 3,266

Profit for the period 3,880 2,605 6,860

Attributable to:

Owners of the parent 3,979 3,155 7,678

Non-controlling

interests (13) -99 -550 -818

Consolidated profit for

the period 3,880 2,605 6,860

Earnings per share,

undiluted (EUR) (7) 0.13 0.10 0.25

Earnings per share,

diluted (EUR) (7) 0.12 0.10 0.24

Adjusted earnings per

share (EUR), for

comparison only (7) 0.17 0.18 0.43

========================= ======== ======================= ======================== ========================

Consolidated Statement of Financial Position

as at 30 June 2015 (IFRS)

30 June 2015 30 June 2014 31 December 2014

(Notes) (unaudited) (unaudited) (audited)

kEUR kEUR kEUR

Current assets

Cash and cash equivalents (14) 18,308 17,024 26,297

Trade receivables 71,319 54,391 57,995

Other receivables 6,574 5,373 3,315

Work in progress 12,089 14,799 7,736

Income tax receivables 1,692 762 730

--------------------------------------------- -------- ------------- ------------- -----------------

109,982 92,349 96,073

Non-current assets

Intangible assets (8) 18,632 20,732 18,470

Goodwill (8) 83,354 55,096 55,836

Property, plant and equipment (9) 12,100 9,807 9,947

Financial assets 32 0 0

Income tax receivables 2,002 2,013 1,483

Deferred tax assets 2,771 2,873 2,174

--------------------------------------------- -------- ------------- ------------- -----------------

118,891 90,521 87,910

Total Assets 228,873 182,870 183,983

============================================= ======== ============= ============= =================

Current liabilities

Bank loans and overdrafts (10) 34,511 14,096 5,463

Finance lease 135 567 306

Trade payables 7,883 6,197 10,763

Other provisions 0 9 0

Income tax accruals 2,768 2,723 2,195

Other current liabilities (11) 42,210 35,129 32,384

--------------------------------------------- -------- ------------- ------------- -----------------

87,507 58,721 51,111

Non-current liabilities

Bank loans (10) 10,310 11,797 11,000

Finance lease 57 147 62

Other provisions 0 5 0

Pension provisions 4,970 2,316 4,625

Deferred tax liabilities 3,759 6,460 4,793

Other non-current liabilities (11) 6,236 572 8,516

--------------------------------------------- -------- ------------- ------------- -----------------

25,332 21,297 28,996

Total Liabilities 112,839 80,018 80,107

============================================= ======== ============= ============= =================

Equity (12)

Share capital 31,301 30,563 30,563

Share premium 55,973 47,153 47,446

Statutory reserves 53 53 53

Other reserves -1,350 -4,524 -3,607

Retained earnings 18,841 18,267 19,213

--------------------------------------------- -------- ------------- ------------- -----------------

Equity attributable to owners of the parent 104,818 91,512 93,668

--------------------------------------------- -------- ------------- ------------- -----------------

Non-controlling interests (13) 11,216 11,340 10,208

--------------------------------------------- -------- ------------- ------------- -----------------

Total Equity 116,034 102,852 103,876

--------------------------------------------- -------- ------------- ------------- -----------------

Equity and Liabilities 228,873 182,870 183,983

============================================= ======== ============= ============= =================

Consolidated Statement of Cash Flows

for the six months ended 30 June 2015 (IFRS)

Six months ended 30 June Six months ended 30 June Year ended 31 December

2015 2014 2014

(Notes) (unaudited) (unaudited) (audited)

kEUR kEUR kEUR

Net cash flow from

operating activities

Profit before taxes 5,196 3,723 10,126

Add back for

Depreciation and

amortisation (4) 6,209 6,294 13,444

Loss on the sale of

property, plant and

equipment 28 132 394

Other non-cash income

not affecting payments 1,289 2,043 -867

Net finance costs (5) 619 1,031 1,443

------------------------- -------- ------------------------- ------------------------- -------------------------

Operating profit before

changes in the net

current assets 13,341 13,223 24,540

(Increase) Decrease in

trade receivables -5,127 1,521 -2,083

(Increase) Decrease in

work in progress and

other receivables -5,384 -9,347 989

(Decrease) Increase in

trade payables -4,643 -2,503 2,064

Decrease in other

provisions 0 0 -14

Increase (Decrease) in

pension provisions 316 -576 725

(Decrease) Increase in

other liabilities and

deferred income -3,750 -4,918 402

------------------------- -------- ------------------------- ------------------------- -------------------------

Cash flow from operating

(MORE TO FOLLOW) Dow Jones Newswires

September 08, 2015 02:00 ET (06:00 GMT)

activities -5,247 -2,600 26,623

Interest payments (5) -619 -598 -1,467

Tax payments (6) -3,065 -2,480 -5,594

------------------------- -------- ------------------------- ------------------------- -------------------------

Net cash flow from

operating activities -8,931 -5,678 19,562

Cash flow from

investment activities

Purchase of intangible

assets -4,152 -2,162 -5,625

Purchase of property,

plant and equipment -2,666 -1,413 -2,331

Purchase of net assets

of acquired companies -14,603 7,524 7,524

Interest received (5) -40 21 477

------------------------- -------- ------------------------- ------------------------- -------------------------

Net cash flow from

investment activities -21,461 3,970 45

Cash flow from financing

activities

Dividends paid -3,973 -2,751 -2,751

Capital increase 0 0 0

Proceeds from

non-controlling

interests on the

exercise of stock

options 194 117 205

Payments for the

acquisition of non

controlling interests -425 0 -1,800

Dividends paid to non

controlling interests 0 0 -658

Repayment of finance

loans (10) -6,457 -6,237 -8,068

Increase of finance

loans (10) 32,291 12,530 4,930

Increase of finance

lease 0 541 0

Redemption of finance

lease contracts -176 -889 -694

------------------------- -------- ------------------------- ------------------------- -------------------------

Net cash flow from

financing activities 21,454 3,311 -8,836

Change in the level of

funds affecting

payments -8,938 1,603 10,771

Changes in cash and cash

equivalents due to

exchange rate movements 949 173 278

------------------------- -------- ------------------------- ------------------------- -------------------------

Cash and cash

equivalents

at the beginning of the

period 26,297 15,248 15,248

------------------------- -------- ------------------------- ------------------------- -------------------------

Cash and cash

equivalents

at the end of the period 18,308 17,024 26,297

========================= ======== ========================= ========================= =========================

Consolidated Statement of Changes in Equity

for the six months ended 30 June 2015 (IFRS)

Attributed to equity owners of the parent Non Total

--------------------------------------------------------------------------------------

cash

Share Share Statutory Other flow Translation Retained Total controlling equity

capital premium reserves reserves hedge of foreign earnings interest

reserve operations

EURk EURk EURk EURk EURk EURk EURk EURk EURk EURk

1 January 2014

(audited) 30,563 46,882 53 -1,693 -479 -3,905 17,863 89,284 72 89,356

================= ======== ======== ========== ========= ======== ============ ========= ======== ============ ========

Dividends paid -2,751 -2,751 -2,751

Transactions

with owners of

the parent -2,751 -2,751 -2,751

Business

combinations 11,564 11,564

Capital increase

by

non-controlling

interests 117 117

Share-based

payments 271 271 271

Profit for the

period 3,155 3,155 -550 2,605

Exchange

differences on

translating

foreign

operations 1,473 1,473 137 1,610

Gains arising

from cash flow

hedges 80 80 80

----------------- -------- -------- ---------- --------- -------- ------------ --------- -------- ------------ --------

Total

comprehensive

income 80 1,473 3,155 4,708 -413 4,295

----------------- -------- -------- ---------- --------- -------- ------------ --------- -------- ------------ --------

30 June 2014

(unaudited) 30,563 47,153 53 -1,693 -399 -2,432 18,267 91,512 11,340 102,852

================= ======== ======== ========== ========= ======== ============ ========= ======== ============ ========

Dividends paid -658 -658

Transactions

with owners of

the parent -658 -658

Capital increase

against cash 205 205

Acquisition of

non-controlling

interests -1,268 -1,268 -649 -1,917

Share-based

payments 293 293 293

Profit for the

period 4,523 4,523 -268 4,255

Exchange

differences on

translating

foreign

operations 887 887 238 1,125

Re-measurement

gains on

defined benefit

plans -2,309 -2,309 -2,309

Gains arising

from cash flow

hedges 30 30 30

----------------- -------- -------- ---------- --------- -------- ------------ --------- -------- ------------ --------

Total

comprehensive

income 30 887 2,214 3,131 -30 3,101

----------------- -------- -------- ---------- --------- -------- ------------ --------- -------- ------------ --------

31 December 2014

(audited) 30,563 47,446 53 -1,693 -369 -1,545 19,213 93,668 10,208 103,876

================= ======== ======== ========== ========= ======== ============ ========= ======== ============ ========

Dividends paid -3,973 -3,973 -3,973

Transactions

with owners of

the parent -3,973 -3,973 -3,973

Business

combinations 0 248 248

Acquisition of

subsidiary 0 0

Capital increase 738 8,088 8,826 194 9,020

Acquisition of

non-controlling

interests -378 -378 -47 -425

(MORE TO FOLLOW) Dow Jones Newswires

September 08, 2015 02:00 ET (06:00 GMT)

Share-based

payments 439 439 439

Profit for the

period 3,979 3,979 -99 3,880

Exchange

differences on

translating

foreign

operations 2,322 2,322 712 3,034

Gains arising

from cash flow

hedges -65 -65 -65

----------------- -------- -------- ---------- --------- -------- ------------ --------- -------- ------------ --------

Total

comprehensive

income -65 2,322 3,979 6,236 613 6,849

----------------- -------- -------- ---------- --------- -------- ------------ --------- -------- ------------ --------

30 June 2015

(unaudited) 31,301 55,973 53 -1,693 -434 777 18,841 104,818 11,216 116,034

================= ======== ======== ========== ========= ======== ============ ========= ======== ============ ========

Notes to the interim consolidated financial statements

(unaudited)

1. Summary of Significant Accounting Policies

Basis of preparation and statement of compliance

The Interim Consolidated Financial Statements of SQS and its

subsidiaries ("SQS Group") are prepared in conformity with all IFRS

Standards (International Financial Reporting Standards) and

Interpretations of the IASB (International Accounting Standards

Board) which are mandatory at 30 June 2015. The interim reports are

published in an abbreviated form according to IAS 34. The Interim

Consolidated Financial Statements have neither been audited nor

reviewed.

The accounting policies applied preparing the Interim

Consolidated Financial Statements 2015 are consistent with those

used for the Consolidated Financial Statements at 31 December

2014.

The Financial Information has been prepared on a historical cost

basis. The Financial Information is presented in Euros and amounts

are rounded to the nearest thousand (EURk) except when otherwise

indicated. Negative amounts are presented in parentheses.

The interim consolidated financial statements do not include all

information and disclosures required in the annual financial

statements, and should be read in conjunction with the Group's

annual financial statements as at 31 December 2014.

Basis of consolidation

As at 30 June 2015, the Company held interests in the share

capital of more than 50 % of the following undertakings (all of

those subsidiaries have been consolidated):

Consolidated companies Country of Six month Six month Year ended

incorporation ended 30 ended 30 31 December

June 2015 June 2014 2014

----------- ----------- -------------

Share of Share of Share of

capital capital capital

% % %

SQS Group Limited, London UK 100.0 100.0 100.0

SQS Software Quality Systems

(Ireland) Ltd., Dublin Ireland 100.0 100.0 100.0

SQS Nederland BV, Utrecht The Netherlands 95.1 95.1 95.1

SQS GesmbH, Vienna Austria 100.0 100.0 100.0

SQS Software Quality Systems

(Schweiz) AG, Zurich Switzerland 100.0 100.0 100.0

SQS Group Management Consulting

GmbH, Vienna Austria 100.0 100.0 100.0

SQS Group Management Consulting

GmbH, Munich Germany 100.0 100.0 100.0

SQS Egypt S.A.E, Cairo Egypt 100.0 100.0 100.0

SQS Software Quality Systems

Nordic AB, Kista Sweden 100.0 100.0 100.0

SQS Software Quality Systems

Sweden AB, Kista Sweden 100.0 100.0 100.0

SQS Software Quality Systems

Norway AS, Oslo Norway 100.0 100.0 100.0

SQS Software Quality Systems

Finland OY, Espoo Finland 100.0 100.0 100.0

SQS India Infosytems Private

Limited, Pune India 75.0 75.0 75.0

SQS France SASU, Paris France 100.0 100.0 100.0

SQS USA Inc., Naperville

(Illinois) USA 100.0 100.0 100.0

Trissential LLC, Wisconsin USA 100.0 0.0 0.0

SQS India BFSI Limited

(former: Thinksoft Global

Services Limited), Chennai India 54.56 53.35 54.89

SQS Software Quality Systems

Italia S.p.A., Rome Italy 90.0 0.0 0.0

--------------------------------- ----------------- ----------- ----------- -------------

SQS AG holds 15% of the shares of SQS Portugal Lda with a book

value of EUR nil (previous year EUR nil).

SQS-Group applied the amendment to IAS 19 retrospectively since

1 January 2015. This amendment had no significant impact on the

interim consolidated financial statements of the SQS Group. For

more information, see Note 2 'Summary of Significant Accounting

Policies' to the annual Consolidated Financial Statements for the

year 2014.

Use of estimates

The preparation of the Interim Financial Statements requires the

disclosure of assumptions and estimates made by management, which

have an effect on the amount and the presentation of revenues,

expenses, assets and liabilities shown in the other comprehensive

income or profit or loss, in the statement of financial position as

well as any contingent items.

The main estimates and judgements of the management of SQS refer

to:

-- the useful life of intangible assets and property, plant and equipment,

-- the criteria regarding the capitalisation of development costs,

-- the recoverability of deferred taxes on tax losses carried forward,

-- the stage of completion of work in progress regarding fixed price contracts,

-- the discount rate, future salary increases, mortality rates,

future pension increases and future employee contributions

regarding the valuation of defined benefit obligations,

-- the inputs such as risk free rate, expected share volatility

and expected dividends as well as expected forfeiture rate for the

measurement of the share-based-payments.

There have been no changes in estimates compared to the year

2014.

2. Segmental reporting

Based on the organizational structure and the different services

rendered, SQS Group operates the following segments:

-- Managed Services (MS) to meet the demand of clients seeking

efficiency in long-term engagements (between six months up to five

years) of which a growing share (in many cases) is delivered from

nearshore and offshore test centres. This also includes long term

engagements for testing standard software package products,

-- Specialist Consultancy Services (SCS) to meet the demand of

clients seeking transformation and quality in specialized projects

with skills like SAP, PLM (Product Lifecycle Management), Process

Consulting and Improvement, and Load and Performance Testing as

long as these resources are not active in MS projects,

-- Regular Testing Services (RTS) to meet the demand of more

price conscious clients who tend to be served on a more local basis

and are typically contracted for a short term (e.g. three

months).

Beside these major business activities there is the business

with contractors (as far as these have not been included in MS),

training & conferences and software testing tools. Each of

these minor operating segments represents less than 10 % of the

Group's revenues and the Group's profit. Thus, all these other

segments are presented as "Other".

The group management board consisting of CEO (Chief Executive

Officer), CFO (Chief Financial Officer) and CMO (Chief Market

Officer) monitors the results of the operating segments separately

in order to allocate resources and to assess the performance of

each segment. Segment performance is evaluated based on gross

profit.

Non-profit centres represent important functions such as Project

Management, Marketing, Finance & Administration, IT, Human

Resources and Sales Support.

The non-profit centres are not allocated to the operating

segments as they provide general services to the whole group. Their

costs are shown under 'Non-allocated costs'.

The assets and liabilities relating to the operating segments

are not reported separately to the Group Management Board. Finance

costs and income taxes are managed on a group basis. Therefore they

are not allocated to operating segments.

(MORE TO FOLLOW) Dow Jones Newswires

September 08, 2015 02:00 ET (06:00 GMT)

The following tables present revenue and profit information

regarding the SQS Group's reportable segments for the interim

periods ended 30 June 2015 and 30 June 2014 and for the year ended

31 December 2014, respectively.

Six month ended MS SCS RTS Other Total

30 June 2015 (unaudited)

EURk EURk EURk EURk EURk

Revenues 71,948 13,209 50,895 14,202 150,254

Segment profit (gross

profit) 25,830 4,558 13,437 3,153 46,978

Non-allocated costs (41,163)

EBIT 5,815

Financial result (619)

Taxes on income (1,316)

Result for the period 3,880

--------------------------- ------- ------- ------- ------- ---------

Six month ended MS SCS RTS Other Total

30 June 2014 (unaudited)

EURk EURk EURk EURk EURk

Revenues 56,958 13,099 47,852 11,457 129,366

Segment profit 20,325 4,291 16,094 2,081 42,791

Amortisation of order

backlog (964)

Gross profit 41,827

Non-allocated costs (37,073)

EBIT 4,754

Financial result (1,031)

Taxes on income (1,118)

Result for the period 2,605

--------------------------- ------- ------- ------- ------- ---------

Year ended 31 MS SCS RTS Other Total

December 2014 (audited)

EURk EURk EURk EURk EURk

Revenues 120,527 20,673 102,055 25,228 268,483

Segment profit (Gross

profit) 44,354 7,277 32,964 4,960 89,555

Non-allocated costs (77,986)

EBIT 11,569

Financial result (1,443)

Taxes on income (3,266)

Result for the period 6,860

-------------------------- -------- ------- -------- ------- ---------

3. Business combinations

SQS Group acquired in the reporting period shares of SQS Italia

and Trissential.

SQS Italia

On 30 January 2015 SQS acquired 90% of the voting rights and

shares of SQS Italia (SQS Italia SpA, formerly Bit Media SpA), for

a cash consideration of EUR6.07m. The Managing Director of SQS

Italia has retained 10% of the shares and stays with SQS as

managing Director of SQS Italia. With regard to the remaining 10%

of shares the parties have agreed a call option in favour of SQS

and a put option in favour of the vendor. Any party may exercise

its respective option at any time between the 3rd and 5th

anniversary of completion of the acquisition. The value of the

remaining shares will be determined with reference to Bit Media's

latest audited profit after tax at that time.

SQS Italia is an Italian joint stock company, based in Rome. The

acquisition of SQS Italy gives SQS entry into the Italian market,

and provides a solid and substantial platform from which to

strengthen our service to the existing Italian customers of SQS

Italia and to expand further into the region through the cross

selling of services. SQS Italia had been focused on the public

sector. In addition, SQS expect to develop the Banking, Financial

Services and Insurance ("BFSI") business. There are also a number

of synergies across the two organisations that may result in cost

savings and improved efficiencies including providing the existing

SQS Italia business with access to SQS's lower cost offshore

testing resources.

The acquisition has been accounted for using the acquisition

method at the acquisition date of 1 February 2015. With regard to

the put option SQS Group accounted for 100% of the shares of SQS

Italia.

Trissential

On 30 April 2015 SQS Group acquired the entire voting rights and

the entire issued share capital of Trissential LLC, Wisconsin USA

(Trissential) for a maximum consideration of US$30.7m. The purchase

price is partly due in cash and partly in new SQS shares. Pursuant

to the terms of the Acquisition, SQS has paid to the vendors of

Trissential a cash component of the initial consideration of

US$11m, funded by new credit facility. The share component of the

initial consideration comprising 737,804 new Ordinary Shares,

equating to US$6.7m, are issued in line with German law on 15 June

2015. A further US$3mof consideration will be payable, subject to

any indemnity claims, in 330,361 SQS shares, between 18 and 24

months from this date, being the completion date of the

Acquisition, and an earn-out consideration to be satisfied in cash

and shares of SQS AG of up to US$10m, payable subject to the

achievement of certain performance-related targets over next three

years.

Trissential is a leading IT project, programme and portfolio

management consultancy in the Mid-West region of the United States,

with a presence in Minneapolis, Milwaukee and Chicago. Trissential

operates across four principal sectors, with a strong alignment to

SQS's existing strength in manufacturing, while adding significant

expertise in retail, energy and healthcare. The Acquisition

provides SQS with a substantial and stable revenue platform,

supporting SQS's strategy of diversifying its geographic revenue

split by materially enhancing its operations in the US.

The acquisition has been accounted for using the acquisition

method at the acquisition date of 1 June 2015.

Assets acquired and liabilities assumed

The fair value of the identifiable assets and liabilities of SQS

Italia and Trissential as at the acquisition date were

provisionally determined as follows:

Provisional fair value recognised SQS Italia Trissential

on acquisition date

---------------------------------------------- ------------ -------------------------------

EURk EURk

Cash 992 488

Trade receivables - current 5,149 3,048

Other receivables- current 647 196

Work-in-Process 1,995 305

Tax receivables 445 0

---------------------------------------------- ------------ -------------------------------

Total current assets 9,228 4,037

---------------------------------------------- ------------ -------------------------------

Intangible assets 176 1

Tangible fixed assets 137 113

Financial assets 32 0

Other non-current receivables 0 10

---------------------------------------------- ------------ -------------------------------

Total non-current assets 345 124

---------------------------------------------- ------------ -------------------------------

TOTAL ASSETS 9,573 4,161

---------------------------------------------- ------------ -------------------------------

Bank loans and overdrafts 2,211 0

Other provisions 1,273 1,094

Trade payables 1,401 361

Other current liabilities 1,022 184

Deferred income 30 0

---------------------------------------------- ------------ -------------------------------

Total current liabilities 5,937 1,639

---------------------------------------------- ------------ -------------------------------

Bank loans 310 0

Other non-current liabilities 1,092 0

Non-current liabilities 1,402 0

---------------------------------------------- ------------ -------------------------------

TOTAL LIABILITIES 7,339 1,639

---------------------------------------------- ------------ -------------------------------

Total identifiable net assets at

fair value 2,234 2,522

---------------------------------------------- ------------ -------------------------------

Provisional Goodwill arising on acquisition 4,734 20,195

---------------------------------------------- ------------ -------------------------------

(MORE TO FOLLOW) Dow Jones Newswires

September 08, 2015 02:00 ET (06:00 GMT)

Purchase consideration transferred 6,968 23,127

---------------------------------------------- ------------ -------------------------------

Analysis of cash flows on acquisition:

SQS Italia Trissential

----------------------------------- ----------- ------------

EURk EURk

----------------------------------- ----------- ------------

Cash acquired with the subsidiary 992 488

----------------------------------- ----------- ------------

Cash paid 6,074 10,009

----------------------------------- ----------- ------------

Net cash outflow on acquisition 5,082 9,521

----------------------------------- ----------- ------------

Further considerations

SQS Italia Trissential

-------------------------------------- ----------- ------------

EURk EURk

-------------------------------------- ----------- ------------

Capital increase (737,804 shares) 6,096

-------------------------------------- ----------- ------------

Consideration subject to indemnity

claims 2,828

-------------------------------------- ----------- ------------

Conditional liability

SQS Italia: option

Trissential: Earn out consideration 894 4,195

-------------------------------------- ----------- ------------

The value of the SQS Italia put-option is calculated based on

the expected profit after taxes of SQS Italia for the year

preceding the option exercise.

The capital increase regarding Trissential has been done based

on an agreed share price by transferring 737,804 new SQS AG

shares.

The consideration subject to indemnity claims regarding

Trissential is due after a period of two years. The fulfilment

shall be done by transferring a maximum 330,361 new shares of SQS

AG.

The Earn out consideration regarding Trissential is calculated

based on the expected profit of the acquired company for the 36

months following the closing date. This consideration will consist

of cash and an equity portion. The parties agreed a minimum payment

of zero and a maximum payment of US$10m. This amount will be

determined by a minimum and a maximum 36months result.

The provisional goodwills of EUR4,734k and EUR20,195k reflect

the acquired work force as well as expected synergies arising from

the acquisition. The Goodwill is allocated to each of the acquired

entities which are considered to be separate cash generating units.

As the purchase price allocations are not completed yet, the

goodwills are expected to be reduced after having identified and

valued the intangible assets and order backlog of the acquired

entities.

None of the provisional goodwill recognised are expected to be

deductible for income tax purposes.

With regard to the acquired receivables Management expects that

all of the amount will be collected.

SQS Italia has been fully consolidated since 1 February 2015.

Trissential has been fully consolidated since 1 June 2015. For both

acquisitions the fair value of SQS' equity interest in the two

acquired companies has been provisionally recognised.

For the period beginning with the acquisition date until 30 June

2015 the acquired companies recognised the following amounts:

SQS Italia Trissential

------------ ----------- ------------

EURk EURk

------------ ----------- ------------

Revenue 4,207 2,355

------------ ----------- ------------

Net profit 278 197

------------ ----------- ------------

If the acquisition had taken place at the beginning of the year,

revenue and the profit from continuing operations would have

recognised the following amounts:

SQS Italia Trissential

------------ ----------- ------------

EURk EURk

------------ ----------- ------------

Revenue 5,011 14,052

------------ ----------- ------------

Net profit 285 463

------------ ----------- ------------

Transaction costs of EUR599k have been recognised in the

administrative expenses as well as the operating cash flow.

4. Expenses

The Consolidated Income Statement presents expenses according to

function. Additional information regarding the origin of these

expenses by type of cost is provided below:

Cost of material

Cost of material included in the cost of sales in the interim

period ended 30 June 2015 amounted to EUR12,069k (at mid-year 2014:

EUR10,135k). Cost of material mainly relates to the procurement of

external services such as contracted software test engineers. In

addition, certain project-related or internally used hardware and

software is shown under cost of material.

Employee benefits expenses

Six month Six month Year ended

ended 30 ended 30 31 December

June 2015 June 2014 2014

(unaudited) (unaudited) (audited)

EURk EURk EURk

Wages and salaries 87,921 74,199 149,501

Social security contributions 11,409 9,353 18,497

Expenses for retirement benefits 1,871 1,214 2,950

Total 101,201 84,766 170,948

---------------------------------------- ------------- --- ------------- --- -------------

The expenses for retirement benefits include current service

costs from defined benefit plans and expenses for defined

contribution plans.

Amortisation and depreciation

Amortisation and depreciation charged in the interim period

ended 30 June 2015 amounted to EUR6,209k (at mid-year 2014:

EUR6,294k). Of this, EUR1,204k (at mid-year 2014: EUR1,039k) was

attributable to the amortisation of development costs and EUR3,138k

to customer relationships regarding SQS India BFSI.

5. Net finance costs

The net finance costs are comprised as follows:

Six month Six month Year ended

ended 30 ended 30 31 December

June 2015 June 2014 2014

(unaudited) (unaudited) (audited)

EURk EURk EURk

Interest income 100 21 477

Exchange rate gains 472 112 497

---------------------------- ------------- --- ------------- --- -------------

Total finance income 572 133 974

---------------------------- ------------- --- ------------- --- -------------

Interest expense (649) (628) (1,527)

Exchange rate losses (542) (536) (890)

---------------------------- ------------- --- ------------- --- -------------

Total finance costs (1,191) (1,164) (2,417)

---------------------------- ------------- --- ------------- --- -------------

Net finance costs (619) (1,031) (1,443)

---------------------------- ------------- --- ------------- --- -------------

Finance income mainly results from fixed deposit

investments.

Interest expense relates to interest on bank liabilities and

finance lease liabilities.

Finance income and costs are stated after foreign exchange rate

gains and losses.

6. Taxes on earnings

The line item includes current tax expenses in the amount of

EUR3,009k (at mid-year 2014: EUR2,483k) and deferred tax income in

the amount of EUR(1,693)k (at mid-year 2014 deferred tax income:

EUR(1,365)k).

7. Earnings per share

The earnings per share presented in accordance with IAS 33 are

shown in the following table:

Six month Six month Year ended

ended 30 ended 30 31 December

June 2015 June 2014 2014

(unaudited) (unaudited) (audited)

Profit for the year attributable

to owners of the parent,

EURk 3,979 3,155 7,678

---------------------------------------- ------------- --- ------------- --- -------------

Diluted profit for the year,

EURk 3,979 3,155 7,678

---------------------------------------- ------------- --- ------------- --- -------------

Weighted average number of

shares in issue, undiluted 30,623,823 30,562,679 30,562,679

---------------------------------------- ------------- --- ------------- --- -------------

Weighted average number of

shares in issue, diluted 32,975,701 32,564,115 32,662,295

---------------------------------------- ------------- --- ------------- --- -------------

Undiluted profit per share,

EUR 0.13 0.10 0.25

(MORE TO FOLLOW) Dow Jones Newswires

September 08, 2015 02:00 ET (06:00 GMT)

---------------------------------------- ------------- --- ------------- --- -------------

Diluted profit per share,

EUR 0.12 0.10 0.24

---------------------------------------- ------------- --- ------------- --- -------------

Adjusted profit per share

(optional), EUR 0.17 0.18 0.43

---------------------------------------- ------------- --- ------------- --- -------------

Undiluted profit per share is calculated by dividing the profit

for the six month period attributable to owners of the parent by

the weighted average number of shares in issue during the six month

period ended 30 June 2015: 30,623,823 (at mid-year 2014:

30,562,679).

Diluted profit per share is determined by dividing the profit

for the six month period attributable to owners of the parent by

the weighted average number of shares in issue plus any share

equivalents which would lead to a dilution.

Adjusted profit per share is calculated by adjusting the profit

before tax for current taxes, transaction costs regarding the

acquisitions of SQS Italia and Trissential, amortised costs of

acquired customer relationships as part of the business combination

SQS India BFSI, interest expenses on pensions and minority effects.

This adjusted profit after tax divided by the weighted average

number of shares in issue during the six month period ended 30 June

2015: 30,623,823 shares, (at mid-year 2014: 30,562,679 shares)

shows adjusted earnings per share of EUR0.17 (at mid-year 2014:

EUR0.18).

8. Intangible assets

The composition of this item is as follows:

Book values Six month Six month Year ended

ended 30 ended 30 31 December

June 2015 June 2014 2014

(unaudited) (unaudited) (audited)

EURk EURk EURk

Goodwill 83,354 55,096 55,836

Development costs of software 4,005 2,761 3,408

Acquired Software 3,148 1,266 1,325

Other development costs 2,260 2,175 2,365

Acquired customer relationships 9,220 13,548 11,372

Order backlog 0 982 0

Total 101,986 75,828 74,306

--------------------------------------- ------------- --- ------------- --- -------------

Development costs were capitalised in the interim period ended

30 June 2015 in the amount of EUR1,627k (at mid-year 2014:

EUR1,290k). They are amortised over a period of 36 months. The

other development costs mainly relate to the methodology 'PractiQ',

used by SQS to provide Managed Services. The estimated useful life

of these intangible assets covers a period of five years.

The customer relationships were acquired within the business

combination of SQS India BFSI. The customer relationships will be

amortised over the expected useful life of three years.

The amortisation of development costs is shown in the research

and development expenses. The amortisation of software and

remaining intangible assets is allocated to the functional costs by

an allocation key.

9. Property, plant and equipment

The development of property, plant and equipment of the SQS

Group is presented as follows:

Book values Six month Six month Year ended

ended 30 ended 30 31 December

June 2015 June 2014 2014

(unaudited) (unaudited) (audited)

EURk EURk EURk

Freehold land and buildings 5,548 5,422 5,418

Office and business equipment 4,151 4,349 3,783

Construction in progress 2,401 36 746

Total 12,100 9,807 9,947

------------------------------------- ------------- --- ------------- --- -------------

10. Bank loans and overdrafts

The finance liabilities are comprised as follows:

Six month Six month Year ended

ended 30 ended 30 31 December

June 2015 June 2014 2014

(unaudited) (unaudited) (audited)

EURk EURk EURk

Bank overdrafts and other

short-term bank loans 34,511 14,096 5,463

----------------------------------- ------------- --- ------------- --- -------------

Bank loans with maturity

between one and five years 10,310 11,797 11,000

----------------------------------- ------------- --- ------------- --- -------------

Total bank liabilities 44,821 25,893 16,463

of these, secured 28,147 22,073 12,256

----------------------------------- ------------- --- ------------- --- -------------

For SQS AG and some subsidiaries bank overdraft agreements are

in place.

11. Other current and non-current liabilities

The item is comprised as follows:

Six month Six month Year ended

ended 30 ended 30 31 December

June 2015 June 2014 2014

(unaudited) (unaudited) (audited)

EURk EURk EURk

Personnel liabilities (leave,

bonus claims) 12,905 12,122 15,616

Purchase obligations from

SQS India 10,613 6,812 7,978

Purchase obligations from

SQS USA 4,111 0 0

Sales tax and value-added

tax liabilities 7,234 5,330 7,959

Liabilities in regard to

social security 3,418 2,290 2,918

Outstanding invoices 3,416 2,330 2,407

Put Option SQS Italia 894 0 0

Grated rebates and discounts 415 1,135 208

Liabilities for employees'

travelling expenses 870 618 766

Liabilities against former

shareholders of SQS Italia 683 0 0

Interest swap (fair value) 390 572 538

Deferred income 783 915 457

Remaining other liabilities 2,714 3,577 2,053

Total 48,446 35,701 40,900

------------------------------------- ------------- --- ------------- --- -------------

The remaining other liabilities comprise trade accruals and

other items due in short term. Their carrying amounts are

considered to be reasonable approximation of fair value.

12. Equity

SQS is listed on the AIM market in London and traded on the Open

Market in Frankfurt (Main).

The development of equity is presented in the Consolidated

Statement of Changes in Equity.

Subscribed Capital

The subscribed capital amounts to EUR31,300,483 (at 31 December

2014: EUR30,562,679) and is divided into 31,300,483 (at 31 December

2014: 30,562,679) individual registered shares with an arithmetical

share in the share capital of EUR1 each. Each share entitles the

holder to one right to vote. No preference shares have been issued.

The capital is fully paid up.

The movements in the subscribed capital are as follows:

Individual Nominal value

shares

--------------------------------------------- ----------- --------------

Number EUR

--------------------------------------------- ----------- --------------

As at 31 December 2014 30,562,679 30,592,679

--------------------------------------------- ----------- --------------

Capital increase against contribution

in kind for the acquisition of Trissential

LLC (Entry of 30 April 2015) 737,804 737,804

--------------------------------------------- ----------- --------------

As at 30 June 2015 31,300,483 31,300,483

--------------------------------------------- ----------- --------------

SQS had no shares in its ownership as at 30 June 2015.

Conditional Capital

(MORE TO FOLLOW) Dow Jones Newswires

September 08, 2015 02:00 ET (06:00 GMT)

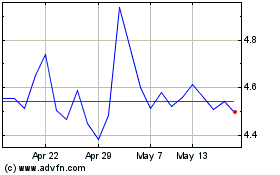

-1x Square (LSE:SQS)

Historical Stock Chart

From Jun 2024 to Jul 2024

-1x Square (LSE:SQS)

Historical Stock Chart

From Jul 2023 to Jul 2024