Secure Property Dev & Inv PLC Conversion of loan to equity in Joint Venture (2867X)

August 26 2022 - 2:00AM

UK Regulatory

TIDMSPDI

RNS Number : 2867X

Secure Property Dev & Inv PLC

26 August 2022

Secure Property Development & Investment PLC/ Index: AIM /

Epic: SPDI / Sector: Real Estate

26 August 2022

Secure Property Development & Investment PLC

('SPDI' or 'the Company')

Conversion of loan to equity in Romanian Logistics Joint

Venture

Secure Property Development and Investment PLC (AIM: SPDI), the

South Eastern European focused property and investment company,

announces that it has signed an agreement to convert EUR2,5m of the

loan it had extended in 2017 to Myrian Nes Ltd ("Myrian Nes"), the

logistics properties owner and developer in Romania ("Olympians

Loan" - for further details see announcement dated 10 October

2017), into a 50% equity stake of a joint venture company ("JV

Company") with Myrian Nes. The objective of this JV Company, which

Myrian Nes is contributing EUR2,5m in equity funds to, is to

develop a portfolio of logistics properties in Romania with a view

of letting them to third party tenants in a market that has very

low vacancy and has shown substantial strength and resilience in

recent years. The remaining part of the Olympians Loan, (being a

total of EUR3,8m as at 31 December 2021 and before the equity

conversion) is being repaid in regular intervals and is expected to

be fully repaid to the Company by the end of 2022 .

Myrian Nes is an established and experienced logistics

properties developer and operator in Romania, having developed more

than 200,000 square meters of such properties, including SPDI's

existing logistics terminal in Bucharest, the Innovations Logistics

Park. Myrian Nes has partnered with several international

institutional property investors in recent years, including GE

Capital ('GEC') and CTP. The partnership with SPDI opens a new

window of opportunity for both partners to exploit synergies in a

property market that they have both been profitably active in for a

long time. SPDI expects to be able to generate further value

through converting part of its loan into an equity stake in such

joint venture, which it expects to soon grow in tandem with the

market demand and the anticipated rental and yield trends.

The transaction complements SPDI's existing logistics properties

position in Romania, the only property type sector not contributed

to Arcona Property Fund (as announced on 28 June 2022), that

includes the 15,000 sqm Innovations Terminal, the cold storage

component of which is fully let to Favorite srl, the Carrefour 3PL

third party service provider, while the ambient component is partly

let to clients including Terra and Chipita. The terminal is

generating an annual net operating income of EUR840,000.

SPDI CEO, Lambros Anagnostopoulos, commented: "The conversion to

equity of part of the loan SPDI extended in 2017 to Myrian Nes,

with a view of investing in the development of a logistics

portfolio, both strengthens the Company's ability to generate

further value for its shareholders and facilitates the eventual

monetisation of such value. Myrian Nes operates in one of Europe's

fastest growing economies in the strategically important South East

corner of the EU, further giving SPDI exposure to the Romanian

property market. Together with the recent closing of Stage 2 of the

Arcona Transaction, that resulted in SPDI owning more than 25% of

Arcona Property Fund N.V. shares, the current transaction

consolidates SPDI's investments into equity positions in third

party managed property companies."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

**ENDS**

For further information please visit www.secure-property.eu or

contact:

Lambros Anagnostopoulos SPDI Tel: +357 22 030783

Rory Murphy Strand Hanson Limited Tel: +44 (0) 20 7409 3494

Ritchie Balmer

Robert Collins

Jon Belliss Novum Securities Limited Tel: +44 (0) 207 399 9400

Catherine Leftley St Brides Partners Ltd Tel: +44 (0) 20 7236 1177

Isabelle Morris

Notes to Editors

Secure Property Development and Investment plc is an AIM listed

property development and investment company focused on the South

East European markets. The Company's strategy is focused on

generating healthy investment returns principally derived from: the

operation of income generating commercial properties and capital

appreciation through investment in high yield real estate assets.

The Company is focused primarily on commercial and industrial

property in populous locations with blue chip tenants on long term

rental contracts. The Company's senior management consists of a

team of executives that possess extensive experience in managing

real estate companies both in the private and the publicly listed

sector, in various European countries.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

CONQELFLLVLLBBB

(END) Dow Jones Newswires

August 26, 2022 02:00 ET (06:00 GMT)

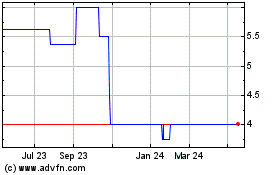

Secure Property Developm... (LSE:SPDI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Secure Property Developm... (LSE:SPDI)

Historical Stock Chart

From Nov 2023 to Nov 2024