TIDMSHI

RNS Number : 7851J

SIG PLC

29 April 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 2014/596/EU WHICH IS PART OF DOMESTIC UK

LAW PURSUANT TO THE MARKET ABUSE (AMENDMENT) (EU EXIT) REGULATIONS

(SI 2019/310) ("UK MAR"). UPON THE PUBLICATION OF THIS

ANNOUNCEMENT, THIS INSIDE INFORMATION (AS DEFINED IN UK MAR) IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN.

29 April 2022

SIG plc

Strong start to 2022; significantly increased full year

expectations

SIG plc ("SIG", or "the Group") today issues a trading update

for 1 January 2022 to date ("the period"), in advance of its Annual

General Meeting, which is being held on 12 May 2022.

Key Points

-- Group expected to deliver full year performance significantly ahead of previous expectations

-- Underlying operating margin for 2022 now anticipated to reach 3%

-- Positive free cash flow now forecast in 2022

Trading Summary

The Group has made a strong start to the year, with the Return

to Growth strategy continuing to deliver excellent progress across

the business. In addition to robust demand, we have seen further

impetus to sales and profit as a result of continuing input cost

inflation.

Group sales were 25% up on 2021 for the quarter to 31 March on a

like for like ("LFL") (1) basis. This represented a performance

well ahead of previous expectations, with this momentum continuing

into the month of April to date.

1 January to % GBP'm

31 March LFL

Sales Growth

vs 2021

UK Interiors 26% 162

UK Exteriors 19% 109

UK 23% 271

------------------- ---- ------

France Interiors 10% 51

France Exteriors 21% 106

Germany 20% 105

Poland 63% 55

Benelux 17% 26

Ireland 78% 27

EU 27% 370

------------------- ---- ------

Group 25% 641

------------------- ---- ------

Reported Group sales were 27% up on 2021 for the quarter, with

acquisitions adding 4% to the LFL result referenced above, offset

partially by movements on working days and exchange rates.

Including the acquisitions, the reported UK Interiors growth rate

was 45%.

The overall impact of inflation is estimated to have added c19%

to Group growth over the period, albeit the levels have varied

across the different operating companies. This reflects the

annualisation of input cost inflation experienced in the second

half of 2021, as well as further increases in early 2022 as our

suppliers have passed on steeply increasing energy costs in

manufacturing. There remain some constraints in supply across the

business, but these are continuing to abate, as previously

reported.

Outlook

Given the strong momentum seen through the early part of 2022,

together with increasing visibility on the near-term trading

outlook, the Board now expects the Group to deliver a full year

performance significantly ahead of previous expectations.

Input cost inflation is currently higher than previously

anticipated, as noted above, and expected to remain elevated in the

near term. We expect that the resulting increase in revenue will

more than offset any localised market softening.

In addition, we are confident that we will be able to maintain

and build on the strong margin discipline that has been an

important part of the recent progress made by the Group, with

underlying operating margin for 2022 now expected to reach 3%.

Furthermore, we now expect the Group to be cash generative in

2022.

Steve Francis, Chief Executive, said:

"The first four months have seen markedly stronger growth than

anticipated, driving positive margin momentum across all our

countries of operation. Our decentralised model, with 433 branches

in seven countries providing strong local specialist expertise and

superior stock availability, continues to gain ground and to show

resilience in market conditions that remain challenging. Demand for

our sustainable construction offerings remain strong. The three

acquisitions made during the last 18 months are performing well and

this is an area of increasing strategic focus for us.

"Although it is relatively early in the year, and

notwithstanding the current macro-economic and geo-political

environment, the strength of our recent trading gives us the

confidence that we will now reach our initial margin target of 3%

and return to cash generation this year, ahead of schedule."

1. Like-for-like ("LFL") is defined as sales per working day in

constant currency, excluding completed acquisitions and

disposals.

Contacts

SIG plc +44 (0) 114 285 6300

Steve Francis Chief Executive Officer

Ian Ashton Chief Financial Officer

FTI Consulting +44 (0) 20 3727 1340

Richard Mountain

Peel Hunt LLP - Joint broker to SIG +44 (0) 20 7418 8900

Mike Bell / Charles Batten

Jefferies International Limited - Joint

broker to SIG +44 (0) 20 7029 8000

Ed Matthews / Will Soutar

The person responsible for arranging the release of this

announcement on behalf of the Company is Andrew Watkins, Group

General Counsel & Company Secretary.

Cautionary Statement

This announcement does not constitute an offer of securities by

SIG plc. This announcement may include statements that are, or may

be deemed to be, forward-looking statements. By their nature,

forward-looking statements involve risks and uncertainties because

they relate to events and depend on circumstances that may or may

not occur in the future and may be beyond the Group's ability to

control or predict. Forward-looking statements are not guarantees

of future performance. You are advised to read the section headed

'Principal risks and uncertainties' in the Group's Annual Report

and Accounts for the year ended 31 December 2021 for a further

discussion of the factors that could affect its future performance

and the industry in which it operates. Other than in accordance

with its legal or regulatory obligations, SIG plc does not accept

any obligation to update or revise publicly any forward-looking

statement, whether as a result of new information, future events or

otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUWSKRUWUSUAR

(END) Dow Jones Newswires

April 29, 2022 02:01 ET (06:01 GMT)

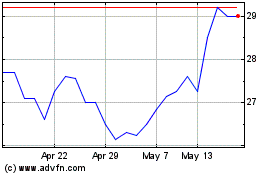

Sig (LSE:SHI)

Historical Stock Chart

From Jun 2024 to Jul 2024

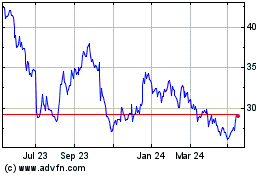

Sig (LSE:SHI)

Historical Stock Chart

From Jul 2023 to Jul 2024