TIDMRLE

RNS Number : 0753B

Real Estate Investors PLC

29 September 2022

Real Estate Investors Plc

("REI", the "Company" or the "Group")

Half Year Results

For the six months ended 30 June 2022

STRONG ASSET SALES, REDUCED DEBT AND IMPROVING OCCUPANCY

Real Estate Investors Plc (AIM: RLE), the UK's only

Midlands-focused Real Estate Investment Trust (REIT) with a

portfolio of commercial property across all sectors, is pleased to

report its unaudited half year results for the six-month period

ended 30 June 2022 ("H1 2022").

FINANCIAL

-- 11 assets sold totalling GBP5.7 million (before costs), an

aggregate uplift of 27.9% above year end book value, plus post

period disposals of GBP4.5 million (at near book value) - total

disposals year to date GBP10.2 million. Additional significant

pipeline sales in legals

-- Profit before tax of GBP8.3 million (H1 2021: GBP9 million

profit) includes GBP3.1 million gain on property revaluations (H1

2021: GBP3.3 million gain), GBP1 million profit on sale of

investment property (H1 2021: GBP1.2 million profit) and GBP1.2

million surplus on hedge valuation (H1 2021: GBP716,000

surplus)

-- EPRA** NTA per share of 61p (FY 2021: 58.8p)

-- Revenue of GBP7.2 million (H1 2021: GBP7.8 million) predominantly reduced due to disposals

-- Underlying profit before tax* of GBP2.9 million (H1 2021: GBP3.8 million)

-- EPRA** EPS of 1.64p (H1 2021: 2.1p)

-- The Company will make a fully covered quarterly dividend

payment of 0.8125p per share in respect of Q2 2022

OPERATIONAL

-- Strong rent collection for H1 2022 of 99.36% (adjusted for

monthly and deferred agreements) (H1 2021: 98.53%)

-- GBP190.2 million gross portfolio valuation (after asset

disposals) (FY 2021: GBP190.8 million)

-- On a like for like basis the portfolio valuation has improved

by 2% on 31 December 2021 valuation to GBP187.9 million

-- Completed 56 lease events (including 7 lease renewals)

-- WAULT*** of 4.97 years to break/6.53 years to expiry (FY 2021: 5.03/6.76 years)

-- Contracted rental income of GBP14 million p.a. (H1 2021:

GBP14.7 million p.a.) with reduction due to known lease events and

portfolio disposals in line with strategy

-- Occupancy levels at 85.88% (FY 2021: 85.75%), increased to

86.47% post period, with the potential to rise further

BANKING

-- Disposal proceeds used to pay down GBP5.7 million of debt in H1 2022 including AIB facility

-- Total net debt now GBP75.5 million (FY 2021: GBP79.6 million)

-- As at 30 June 2022, hedge facility has improved by GBP1.2

million for half year to 30 June 2022 and has improved by a further

GBP600,000 as at 1 September 2022

-- 95.2% of Company debt fixed with a weighted average fixed debt duration of 2.3 years

-- Average cost of debt 3.5% (FY 2021: 3.5%)

-- 40.2% Loan to Value (net of cash) (FY 2021: 42.2%)

(management target LTV net of cash 40% or below)

-- GBP8.3 million cash at bank

POST PERIOD ACTIVITY

-- Total sales since period end of GBP4.5 million

-- Additional significant pipeline sales in legals

-- Contracted rental income now GBP13.7 million (allowing for sales)

-- Completed further 28 lease events including 4 lease renewals,

6 break removals and 11 lettings in legals, which have the

potential to improve occupancy to 89.70%

-- Additional GBP2.5 million of debt repaid since period end

Paul Bassi, Chief Executive, commented:

"H1 2022 was a stable period after the challenging years of

Brexit and Covid. Improving occupier demand and sales to a strong

private investor market and overseas buyers will provide the

foundation for rising valuations and improved rental income and

allow us to execute our strategy, whilst remaining open to any

sector consolidation opportunities.

We are mindful of current recessionary concerns, inflation and

rising interest rates. Whilst we are not immune to the effects of

economic downturns, we are well insulated with fixed and reduced

debt, lower LTV, a diverse occupier base plus a healthy WAULT with

growing levels of cash to capitalise on any market opportunities.

Post period lettings will also add to our revenues going forward,

plus the potential for further capital value appreciation.

We remain focused on delivering maximum value to our

shareholders and subject to the ongoing success of the disposals

programme and market conditions, in particular the impact of

economic headwinds on the real estate sector and with due

consideration being given to any downturn, the Board will consider

how best to allocate surplus capital including a capital return to

our shareholders. Alternatively, if the environment for

acquisitions changes markedly by the year end and opportunities

offering significant value start to arise, then we may look to make

opportunistic acquisitions where there is scope to capture material

upside through asset management."

FINANCIAL & OPERATIONAL RESULTS

30 June 2022 30 June 2021

Revenue GBP7.2 million GBP7.8 million

--------------- ---------------

Underlying profit before GBP2.9 million GBP3.8 million

tax*

--------------- ---------------

Contracted rental income GBP14.0 million GBP14.7 million

--------------- ---------------

EPRA EPS** 1.64p 2.13p

--------------- ---------------

Pre-tax profit GBP8.3 million GBP9 million

--------------- ---------------

Dividend per share 1.625p 1.5p

--------------- ---------------

Average cost of debt 3.5% 3.4%

--------------- ---------------

Like for like rental income GBP14.0 million GBP13.9 million

--------------- ---------------

30 June 2022 31 December 2021

Gross property assets GBP190.2 million GBP190.8 million

---------------- ----------------

EPRA NTA per share** 61.0p 58.8p

---------------- ----------------

Like for like capital GBP128.24 psf GBP125.67 psf

value psf

---------------- ----------------

Like for like valuation GBP187.9 million GBP184.1 million

---------------- ----------------

Tenants 239 256

---------------- ----------------

WAULT to break*** 4.97 years 5.03 years

---------------- ----------------

Total ownership (sq ft) 1.47 million 1.5 million sq

sq ft ft

---------------- ----------------

Net assets GBP110.5 million GBP105 million

---------------- ----------------

Loan to value 44.6% 47.4%

---------------- ----------------

Loan to value (net of

cash) 40.2% 42.2%

---------------- ----------------

Definitions

* Underlying profit before tax excludes profit/loss on

revaluation and sale of properties and interest rate swaps

** EPRA = European Public Real Estate Association

*** WAULT = Weighted Average Unexpired Lease Term

Certain of the information contained within this announcement is

deemed by the Company to constitute inside information as

stipulated under the UK version of the EU Market Abuse Regulation

(2014/596) which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018, as amended and supplemented from time to

time.

Enquiries:

Real Estate Investors Plc

Paul Bassi/Marcus Daly +44 (0)121 212 3446

Cenkos Securities (Nominated Adviser)

Katy Birkin/Ben Jeynes +44 (0)20 7397 8900

Liberum (Broker)

Jamie Richards/William King +44 (0)20 3100 2000

Novella Communications

Tim Robertson/Safia Colebrook +44 (0)20 3151 7008

About Real Estate Investors Plc

Real Estate Investors Plc is a publicly quoted, internally

managed property investment company and REIT with a portfolio of

mixed-use commercial property, managed by a highly-experienced

property team with over 100 years of combined experience of

operating in the Midlands property market across all sectors. The

Company's strategy is to invest in well located, real estate assets

in the established and proven markets across the Midlands, with

income and capital growth potential, realisable through active

portfolio management, refurbishment, change of use and lettings.

The portfolio has no material reliance on a single asset or

occupier. On 1st January 2015, the Company converted to a REIT.

Real Estate Investment Trusts are listed property investment

companies or groups not liable to corporation tax on their rental

income or capital gains from their qualifying activities. The

Company aims to deliver capital growth and income enhancement from

its assets, supporting its covered dividend policy. Further

information on the Company can be found at www.reiplc.com .

CHAIRMAN & CHIEF EXECUTIVE'S STATEMENT

In H1 2022, the Company has seen an increase in NTA per share of

3.7% and reports pre-tax profits of GBP8.3 million. The cash inflow

has seen LTV reduce to 40.2% in line with management's objectives.

The lettings and disposals pipelines are strong and the Board

anticipates further increases in NAV by the year end should these

events crystallise.

The portfolio continues to deliver strong rent collection levels

with overall collection for the period standing at 99.36% (adjusted

for monthly and deferred agreements). Current quarter (June -

September) rent collection so far is 99.86%.

During H1 2022, we took advantage of a particularly strong

private investor market, disposing of 11 assets totalling GBP5.7

million (an aggregate uplift of 27.9% on December 2021 valuations).

Since the period end, we have disposed of a further GBP4.5 million

of assets (at near book value) totalling GBP10.2 million for 2022

year to date and have a strong pipeline of disposals in legals

which reflects the difference between market pricing and NAV

valuations and demonstrating the underlying value of our

diversified portfolio.

In line with management's intention to operate the portfolio

with prudent gearing levels, disposal proceeds were used to pay

down GBP5.7 million of debt in H1 2022. Subsequently, our LTV (net

of cash) has reduced to 40.2%. Our average cost of debt has

remained at 3.5% with 95.2% of the Company's debt now fixed (as at

30 June 2022) with a weighted average fixed debt term of 2.3 years.

We are mindful of current recessionary concerns, inflation and

rising interest rates. Whilst we are not immune to the effects of

economic downturns, we are well insulated with fixed and reduced

debt, improved LTV, diverse occupier base, a healthy WAULT and

growing cash balances to capitalise on any market

opportunities.

A more normalised marketplace paved the way for occupiers to

make decisions and this confidence led to significantly increased

leasing activity during the period. This activity has continued

into H2 2022 and enquiries from occupiers is reflected in lettings

on our void space totalling GBP90,701 p.a., plus pipeline lettings

in solicitors' hands totalling GBP685,000 p.a. Subject to market

conditions, this will potentially drive further portfolio capital

values, contributing to a rise in our NAV and rental income,

supporting our covered dividend policy and reducing our gearing

further.

Reflecting the improved occupier activity, our asset management

team completed 56 lease events, leading to a WAULT of 4.97 years to

break and 6.53 years to expiry.

Occupancy as at 30 June 2022 was 85.88% (FY 2021: 85.75%) and is

stable despite the sales of fully let assets. Since the period end,

occupancy has risen to 86.47%. Contracted rental income sits at

GBP14 million p.a. (FY 2021 GBP14.3 million p.a.).

Taking into account the disposals in H1 2022, the portfolio's

property assets have increased by 2% to GBP187.9 million (on a like

for like basis) and we are therefore pleased to report an increase

in our EPRA NTA per share to 61p (FY 2021: 58.8p) up 3.7%. These

valuations do not reflect the post period lettings upside

potential.

As a result of sales and known voids, our revenue has reduced in

the short term to GBP7.2 million (H1 2021: GBP7.8 million) as we

achieve debt reduction and cash generation with underlying profit

before tax to GBP2.9 million (H1 2021: GBP3.8 million). As at 1

July 2022, the hedge facility has improved by GBP1.2 million and

has improved by a further GBP600,000 as at 1 September 2022. The

Board announces a fully covered quarterly dividend for Q2 2022 of

0.8125p per share (Q2 2021: 0.75p per share) to reflect the

operational performance of the business in H1 2022.

The region enjoyed a very successful 2022 Commonwealth Games,

which launched Birmingham onto the global stage and has positively

driven investor and economic activity. The region has been further

boosted by the Chancellor's Growth Plan announcement detailing the

inclusion of the West Midlands in the 38 local combined authorities

that will benefit from 'investment zones'. These zones promise to

offer generous, targeted and time-limited tax cuts for businesses,

backing them to increase productivity and create new jobs,

liberalised planning rules and reforms to increase the speed of

delivering development. This is expected to further encourage and

improve demand from investors and occupiers.

REI continues to benefit from its locality and expects both

investor and occupier demand to remain positive into the

foreseeable future.

CORPORATE STRATEGY

Management continues to remain focused on delivering maximum

value to our shareholders. As stated in our July trading update,

private investor demand has remained high and we have taken

advantage of this by disposing of assets at an aggregate value

above NAV, and we will continue to make further opportunistic

sales.

The disposal proceeds will be used to reduce debt and, subject

to the ongoing success of the disposals programme and market

conditions, in particular the impact of economic headwinds on the

real estate sector and with due consideration being given to any

downturn, the Board will consider how best to utilise excess

capital, including a return of capital to shareholders.

Alternatively, if the environment for acquisitions changes markedly

by the year end and opportunities offering significant value start

to arise, then we may look to make opportunistic acquisitions where

there is scope to capture material upside through asset management.

The Board evaluates the relative merits of these options on an

ongoing basis. The quantum of any return of capital will be set to

ensure that we maintain a prudent loan-to-value ratio and will be

subject to market conditions.

In the meantime, we continue to be alert to market consolidation

within the real estate sector. Management remains open to

evaluating any corporate transaction that is in the best interests

of shareholders.

STRONG PRIVATE INVESTOR MARKETPLACE

We have successfully disposed of GBP5.7 million of assets during

the period at an aggregate uplift of 27.9% above the 31 December

2021 valuation. The income associated with these disposed assets is

GBP424,900 per annum. Mindful of this demand, we have continued to

make sales and can confirm post period disposals as follows:

-- Completed sales of GBP4.5 million

-- Significant pipeline of sales in legals

No acquisitions were made during H1 2022 due to the lack of

suitably priced assets. Management will continue to monitor the

market place for attractive acquisition opportunities.

FINANCE & BANKING

The business remains multi-banked with debt spread across 4

lenders.

Following the proactive decision in 2021 to take advantage of a

low interest rate environment, 95.2% of the Company's debt is now

fixed with an average weighted fixed debt term of 2.3 years and an

average cost of debt of 3.5%.

Our hedge facility has improved by GBP1.2 million for the half

year to 30 June 2022 and has recovered by a further GBP600,000 as

at 1 September 2022. REI has seen a material fall in its swap

liability position. As at 31 December 2021, the swap liability

position was GBP2.1 million. The Company reports that as at 30 June

2022, the unaudited swap liability position had fallen to GBP0.9

million and that as at 31 August 2022, the unaudited liability had

fallen further to GBP0.3 million.

During the period, GBP5.7 million of debt was repaid using the

proceeds from portfolio disposals with a further GBP2.5 million

repaid since 30 June 2022. Debt repayment from the proceeds of

disposals, combined with a gain in the Company's like-for-like

portfolio valuations had supported a reduction in the Company's

loan to value to 40.2% (net of cash). This is in line with the

Company's strategy and management's objective to operate the

business with sensible gearing levels.

The Group has total drawn down debt of GBP83.8 million (FY 2021:

GBP89.4 million) and all banking covenants (which are a combination

of both the measurement of LTV against asset value and interest

cover against rental income) continue to be met with headroom

available and the ability to correct through substitute security or

cash deposits and reduction. The Group has GBP8.3 million cash at

bank.

Management remains committed to a covered dividend policy.

LETTINGS/ASSET MANAGEMENT UPDATE

As renewed occupier confidence gathered pace in 2022, demand

increased leading to 56 lease events being completed, including 7

lease renewals, generating GBP365,000 p.a. of new rental income,

recovering the majority of income lost due to sales during the

period. In particular, we have seen office demand improving, the

sector had previously dominated our voids during and since

Covid.

As a result of asset management activity in H1 2022 our WAULT

was 4.97 years to break and 6.53 years to expiry (FY 2021: 5.03

years to break and 6.76 years to expiry).

Hotel Income Update

Our hotel in West Bromwich, previously let to Premier Inn, was

re-let to Vine Hotels on a new 15-year lease at GBP300,000 p.a.

(above external valuer ERV level at time of letting), with the

intention of operating a Best Western hotel. No rent-free

incentives were given, but the first 3 years are a profit share. We

are pleased to say that Vine secured a rolling annual letting at

100% occupancy that has provided REI with an income in excess of

GBP300,000 p.a.

Post Period Activity

Since the period end, we have:

-- Completed a further 3 lettings, generating GBP90,701 p.a. income

-- We also have approximately GBP685,000 p.a. of lettings in

pipeline legals, which if completed would translate into improved

occupancy to 89.70% and enhanced contracted rental income to

GBP14.3 million p.a.

We anticipate further occupancy improvement in the next few

months which will potentially lead to further capital value

improvement as we secure lettings in line with our ERVs with

improved lease lengths.

These new lettings and the related valuation gain is not

accounted for in our H1 valuation.

During 2022 to date, new tenants within the portfolio include;

Cityfibre Holdings and King & Moffat UK Ltd.

Portfolio Mix

The current sector weightings are:

Sector GBP per annum % by income

Office 5,039,442 36.03

-------------- ------------

Traditional Retail 2,457,794 17.57

-------------- ------------

Discount Retail - Poundland/B&M etc 1,895,350 13.55

-------------- ------------

Other - Hotels (Travelodge), Leisure (The Gym

Group, Luda Bingo), Car parking, AST 1,641,784 11.74

-------------- ------------

Medical and Pharmaceutical - Boots/Holland & Barrett

etc 1,066,599 7.63

-------------- ------------

Restaurant/Bar/Coffee - Costa Coffee, Loungers

etc 793,250 5.67

-------------- ------------

Food Stores - M&S, Aldi, Co-op, Iceland etc 585,690 4.19

-------------- ------------

Financial/Licences/Agency - Lloyds TSB, Santander

UK Plc, Bank of Scotland etc 507,000 3.62

-------------- ------------

Total 13,986,909 100.00

-------------- ------------

Portfolio Summary

Value (GBPm) Area Contracted ERV (GBP) NIY RY Occupancy

(sq ft) Rent (GBP) (%) (%) (%)

Central

Birmingham GBP24,935,000 101,477 GBP1,406,702 GBP1,824,650 5.29% 6.87% 80.17%

---------------- ---------- -------------- -------------- ------ ------ ----------

Other Birmingham GBP24,215,000 172,483 GBP2,012,186 GBP1,994,005 7.80% 7.73% 89.63%

---------------- ---------- -------------- -------------- ------ ------ ----------

West Midlands GBP72,935,000 636,671 GBP5,407,474 GBP6,473,460 6.96% 8.33% 82.68%

---------------- ---------- -------------- -------------- ------ ------ ----------

Other Midlands GBP65,790,000 554,379 GBP5,160,547 GBP5,880,040 7.36% 8.39% 89.42%

---------------- ---------- -------------- -------------- ------ ------ ----------

Other Locations - - - - - - -

---------------- ---------- -------------- -------------- ------ ------ ----------

Land* GBP2,387,320 - - -

---------------- ---------- -------------- -------------- ------ ------ ----------

Total GBP190,262,320 1,465,010 GBP13,986,909 GBP16,172,155 6.90% 7.98% 85.88%

---------------- ---------- -------------- -------------- ------ ------ ----------

* Our land holdings are excluded from the yield

calculations.

ENVIRONMENTAL SOCIAL AND GOVERNANCE

We remain committed to acting responsibly and operating a

sustainable business. Our EPC programme across the portfolio is

progressing in line with the Company's ESG strategy to ensure that

the business is compliant with regulations in April 2023 when all

assets require an EPC rating of 'E' or above. Currently only 0.24%

of the portfolio is below an 'E' (previously reported figure in

March 2022 was 0.84%). Some of our previously non-compliant assets

have been/are being sold.

We intend to expand on our ESG reporting in our full year

results and commit to doing so annually.

DIVID

The Board remains committed to paying a covered dividend,

throughout the period of our sales programme, subject to business

performance. In line with this commitment and to recognise the

operational stability of the business, the Board is pleased to

announce a Q2 2022 fully covered dividend of 0.8125p reflecting a

yield of 9.7% based on a mid-market opening price of 33.50p on 28

September 2022.

The proposed timetable for the dividend, which will be paid as

an ordinary dividend, is as follows:

Ex-dividend date: 6 October 2022

Record date: 7 October 2022

----------------

Dividend payment date: 28 October 2022

----------------

OUTLOOK

With a strong investor and occupier market evidenced by GBP10.2

million disposals year to date and current pipeline lettings of

GBP685,000 p.a. the second half of 2022 has started on a promising

note. We will continue to capitalise on market conditions and

dispose of assets on an opportunistic basis and will utilise

proceeds from disposals to pay down debt and execute our stated

strategy. We have the potential to secure valuation gains, through

new lettings on our void space and further improve the NAV.

The business is well insulated from rising rates due to 95.2%

fixed debt with a weighted average fixed debt term of 2.3 years,

sensible gearing levels and healthy WAULT and our portfolio has the

resilience to withstand economic pressure as demonstrated by our

ability to cope with Brexit, Covid and the financial crisis.

Subject to further disposals in H2 2022 and ongoing market

conditions, in particular the impact of economic headwinds on the

real estate sector and with due consideration being given to any

downturn, the Board will consider how best to allocate surplus

capital including a capital return to our shareholders.

Alternatively, if the environment for acquisitions changes markedly

by the year end and opportunities offering significant value start

to arise, then we may look to make opportunistic acquisitions where

there is scope to capture material upside through asset

management.

In the meantime, we continue to be alert to market consolidation

within the real estate sector. Management remains open to

evaluating any corporate transaction that is in the best interests

of shareholders.

OUR STAKEHOLDERS

Our thanks to our shareholders, advisors, occupiers and staff

for their ongoing support and assistance.

William Wyatt Paul Bassi CBE D.UNIV

Chairman Chief Executive

28 September 2022 28 September 2022

CONSOLIDATED STATEMENT OF

COMPREHENSIVE INCOME

For the 6 months ended 30

June 2022

Six months Six months

to to Year ended

31 December

30 June 2022 30 June 2021 2021

(Unaudited) (Unaudited) (Audited)

Note GBP'000 GBP'000 GBP'000

Revenue 7,165 7,782 15,971

Cost of sales (1,170) (836) (3,329)

------------- ------------- -------------------------------

Gross profit 5,995 6,946 12,642

Administrative expenses (1,483) (1,488) (3,045)

Surplus on sale of investment

properties 1,001 1,157 1,177

Change in fair value of investment

properties 3,149 3,331 4,951

------------- ------------- -------------------------------

Profit from operations 8,662 9,946 15,725

Finance income 26 1 46

Finance costs (1,600) (1,634) (3,235)

Profit on financial liabilities

held at fair value 1,238 716 1,388

------------- ------------- -------------------------------

Profit on ordinary activities

before taxation 8,326 9,029 13,924

Income tax charge - - -

------------- ------------- -------------------------------

Net profit after taxation

and total comprehensive income 8,326 9,029 13,924

------------- ------------- -------------------------------

Basic earnings per share 6 4.64p 5.0p 7.76p

------------- ------------- -------------------------------

Diluted earnings per share 6 4.56p 4.9p 7.64p

------------- ------------- -------------------------------

EPRA earnings per share 6 1.64p 2.1p 3.67p

------------- ------------- -------------------------------

CONSOLIDATED STATEMENT OF CHANGES

IN EQUITY

for the 6 months ended 30 June 2022

Share Share Capital Other Retained Total

Capital Premium Redemption Reserves Earnings

Account Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 31 December 2020 17,938 51,721 749 609 26,657 97,674

Share based payment - - - 75 - 75

Dividends - final 2020 - - - - (2,500) (2,500)

Dividends - interim

2021 - - - - (1,250) (1,250)

-------- ------------------ ----------- --------- --------- --------

Transactions with owners - - - 75 (3,750) (3,675)

-------- ------------------ ----------- --------- --------- --------

Profit for the period

and total comprehensive

income - - - - 9,029 9,029

At 30 June 2021 17,938 51,721 749 684 31,936 103,028

Share based payment - - - 75 - 75

Dividends - interim

2021 - - - - (2,976) (2,976)

-------- ------------------ ----------- --------- --------- --------

Transactions with owners - - - 75 (2,976) (2,901)

-------- ------------------ ----------- --------- --------- --------

Profit for the period

and total comprehensive

income - - - - 4,895 4,895

At 31 December 2021 17,938 51,721 749 759 33,855 105,022

Share based payment - - - 75 - 75

Dividends - final 2021 - - - - (1,457) (1,457)

Dividends - interim

2022 - - - - (1,458) (1,458)

-------- ------------------ ----------- --------- --------- --------

Transactions with owners - - - 75 (2,915) (2,840)

-------- ------------------ ----------- --------- --------- --------

Profit for the period

and total comprehensive

income - - - - 8,326 8,326

At 30 June 2022 17,938 51,721 749 834 39,266 110,508

======== ================== =========== ========= ========= ========

CONSOLIDATED STATEMENT OF FINANCIAL

POSITION

as at 30 June 2022

31 December

30 June 2022 30 June 2021 2021

(Unaudited) (Unaudited) (Audited)

Note GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Investment properties 5 187,875 192,813 188,485

Property, plant and

equipment 4 3 4

187,879 192,816 188,489

------------- -------------------------------- ------------

Current assets

Inventories 2,387 2,380 2,384

Trade and other receivables 3,757 4,798 3,588

Cash and cash equivalents 8,268 9,085 9,836

14,412 16,263 15,808

------------- -------------------------------- ------------

Total assets 202,291 209,079 204,297

============= ================================ ============

Liabilities

Current liabilities

Bank loans 379 3,979 2,479

Trade and other payables 7,078 7,183 7,685

7,457 11,162 10,164

------------- -------------------------------- ------------

Non-current liabilities

Bank loans 83,418 92,071 86,965

Derivative financial

liabilities 908 2,818 2,146

84,326 94,889 89,111

------------- -------------------------------- ------------

Total liabilities 91,783 106,051 99,275

============= ================================ ============

Net assets 110,508 103,028 105,022

============= ================================ ============

Equity

Ordinary share capital 17,938 17,938 17,938

Share premium account 51,721 51,721 51,721

Capital redemption

reserve 749 749 749

Other reserves 834 684 759

Retained earnings 39,266 31,936 33,855

------------- -------------------------------- ------------

Total equity 110,508 103,028 105,022

------------- -------------------------------- ------------

CONSOLIDATED STATEMENT OF CASHFLOWS

for the 6 months ended 30 June 2022

Six months Six months

to to Year ended

30 June 31 December

2022 30 June 2021 2021

(Unaudited) (Unaudited) (Audited)

GBP'000 GBP'000 GBP'000

Cashflows from operating activities

Profit after taxation 8,326 9,029 13,924

Adjustments for:

Depreciation 1 2 2

Surplus on sale of investment

property (1,001) (1,157) (1,177)

Net valuation surplus (3,149) (3,331) (4,951)

Share based payment 75 75 150

Finance income (27) (1) (46)

Finance costs 1,600 1,634 3,235

Surplus on financial liabilities

held at fair value (1,238) (716) (1,388)

(Increase)/decrease in inventories (3) 1,416 1,412

(Increase)/decrease in trade

and other receivables (169) (458) 752

Decrease in trade and other

payables (618) (506) (100)

3,797 5,987 11,813

==================== ================= ========================

Cash flows from investing activities

Purchase of investment properties (723) (228) (955)

Purchase of property, plant

and equipment (1) - (2)

Proceeds from sale of property,

plant and equipment 5,483 9,423 16,119

Interest received 27 1 46

4,786 9,196 15,208

==================== ================= ========================

Cash flow from financing activities

Interest paid (1,600) (1,634) (3,235)

Equity dividends paid (2,904) (3,398) (6,278)

Repayment of bank loans (5,647) (5,304) (11,910)

(10,151) (10,336) (21,423)

==================== ================= ========================

Net (decrease)/increase in cash

and cash equivalents (1,568) 4,847 5,598

Cash and cash equivalents at

beginning of period 9,836 4,238 4,238

Cash and cash equivalents at

end of period 8,268 9,085 9,836

==================== ================= ========================

NOTES TO THE INTERIM FINANCIAL INFORMATION

for the 6 months ended 30 June 2022

1. BASIS OF PREPARATION

Real Estate Investors Plc, a Public Limited Company, is

incorporated and domiciled in the United Kingdom.

The interim financial report for the period ended 30 June 2022

(including the comparatives for the year ended 31 December 2021 and

the period ended 30 June 2021) was approved by the board of

directors on 28 September 2022.

It should be noted that accounting estimates and assumptions are

used in preparation of the interim financial information. Although

these estimates are based on management's best knowledge and

judgement of current events and action, actual results may

ultimately differ from these estimates. The areas involving a

higher degree of judgement or complexity, or areas where

assumptions and estimates are significant to the interim financial

information are set out in note 3 to the interim financial

information.

The interim financial information contained within this

announcement does not constitute statutory accounts within the

meaning of the Companies Act 2006. The full accounts for the year

ended 31 December 2021 received an unqualified report from the

auditor and did not contain a statement under Section 498 of the

Companies Act 2006.

2. ACCOUNTING POLICIES

The interim financial information has been prepared under the

historical cost convention.

The principal accounting policies and methods of computation

adopted to prepare the interim financial information are consistent

with those detailed in the 2021 financial statements approved by

the Board on 21 March 2022.

Some accounting pronouncements which have become effective from

1 January 2022 and have therefore been adopted do not have a

significant impact on the Group's financial results or

position.

3. CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS

Critical accounting estimates and assumptions

The Group makes estimates and assumptions concerning the future.

The resulting accounting estimates will, by definition, seldom

equal actual results. The estimates and assumptions that have a

significant risk of causing a material adjustment to the carrying

amounts of assets and liabilities within the next accounting year

are as follows:

Investment property revaluation

The Group uses the valuations performed by its independent

valuers or the directors as the fair value of its investment

properties. The valuation is based upon assumptions including

future rental income, anticipated maintenance costs, anticipated

purchaser costs and the appropriate discount rate. The valuer and

the directors also make reference to market evidence of transaction

prices for similar properties.

Interest rate swap valuation

The Group carries the interest rate swap as a liability at fair

value through the profit or loss at a valuation. This valuation has

been provided by the Group's bankers.

Critical judgements in applying the Group's accounting

policies

The Group makes critical judgements in applying accounting

policies. The critical judgement that has been made is as

follows:

REIT Status

The Group elected for REIT status with effect from 1 January

2015. As a result, providing certain conditions are met, the

Group's profit from property investment and gains are exempt from

UK corporation tax. In the Directors' opinion the Group have met

these conditions.

4. SEGMENTAL REPORTING

Primary reporting - business segment

The only material business that the Group has is that of

investment in commercial properties. Revenue relates entirely to

rental income from investment properties.

5. INVESTMENT PROPERTIES

The carrying amount of investment properties for the periods

presented in the interim financial information is reconciled as

follows:

GBP'000

Carrying amount at 31 December 2020 197,520

Additions 228

Disposals (8,266)

Revaluation 3,331

-----------------

Carrying amount at 30 June 2021 192,813

Additions 727

Disposals (6,675)

Revaluation 1,620

-----------------

Carrying amount at 31 December 2021 188,485

Additions 723

Disposals (4,482)

Revaluation 3,149

Carrying amount at 30 June 2022 187,875

=================

6. EARNINGS AND NAV PER SHARE

The calculation of the basic earnings per share is based on the

profit attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the period. The

calculation of the diluted earnings per share is based on the basic

earnings per share adjusted to allow for all dilutive potential

ordinary shares.

The calculation of the basic NAV per share is based on the

balance sheet net asset value divided by the weighted average

number of shares in issue during the period. The calculation of the

diluted NAV per share is based on the basic NAV per share adjusted

to allow for all dilutive potential ordinary shares.

The European Public Real Estate Association ("EPRA") earnings

and NAV figures have been included to allow more effective

comparisons to be drawn between the Group and other businesses in

the real estate sector.

EPRA EPS per share

30 June 2022 30 June 2021

Earnings Shares Earnings per share Earnings Shares Earnings per share

GBP'000 No P GBP'000 No P

Basic earnings per share 8,326 179,377,898 4.64 9,029 179,377,898 5.03

Fair value of investment

properties (3,149) (3,331)

Profit on disposal of

investment properties (1,001) (1,157)

Change in fair value of

derivatives (1,238) (716)

EPRA Earnings 2,938 179,377,898 1.64 3,825 179,377,898 2.13

========== ============ =================== ========= ============ ===================

NET ASSET VALUE PER SHARE

The Group has adopted the new EPRA NAV measures which came into

effect for accounting periods starting 1 January 2020. EPRA issued

new best practice recommendations (BPR) for financial guidelines on

its definitions of NAV measures. The new NAV measures as outlined

in the BPR are EPRA net tangible assets (NTA), EPRA net

reinvestment value (NRV) and EPRA net disposal value (NDV).

The Group considered EPRA Net Tangible Assets (NTA) to be the

most relevant NAV measure for the Group and we are now reporting

this as our primary NAV measure, replacing our previously reported

EPRA NAV and EPRA NNNAV per share metrics. EPRA NTA excludes the

intangible assets and the cumulative fair value adjustments for

debt-related derivatives which are unlikely to be realised.

30 June 2022

EPRA NTA EPRA NRV EPRA NDV

GBP'000 GBP'000 GBP'000

Net assets 110,508 110,508 110,508

Fair value of derivatives 908 908 -

Real estate transfer tax - 13,676 -

EPRA NAV 111,416 125,092 110,508

------------ ------------ ------------

Number of ordinary shares issued for diluted and EPRA net assets per share 182,502,063 182,502,063 182,502,063

EPRA NAV per share 61.0p 68.5p 60.5p

============ ============ ============

The adjustments made to get to the EPRA NAV measures above are

as follows:

-- Real estate transfer tax: Gross value of property portfolio

as provided in the Valuation Certificate (i.e. the value prior to

any deduction of purchasers' costs).

-- Fair value of derivatives: Exclude fair value financial

instruments that are used for hedging purposes where the company

has the intention of keeping the hedge position until the end of

the contractual duration.

31 December 2021

EPRA NTA EPRA NRV EPRA NDV

GBP'000 GBP'000 GBP'000

Net assets 105,022 105,022 105,022

Fair value of derivatives 2,146 2,146 -

Real estate transfer tax - 13,127 -

----------------------------------------------------------------------

EPRA NAV 107,168 120,295 105,022

---------------------------------------------------------------------- -------------- ------------ ------------

Number of ordinary shares issued for diluted and EPRA net assets per

share 182,261,263 182,261,263 182,261,263

EPRA NAV per share 58.8p 66.0p 57.6p

====================================================================== ============== ============ ============

30 JUNE 2022 31 DECEMBER 2021

No of Shares No of Shares

Number of ordinary shares issued at end of period 179,377,898 179,377,898

Dilutive impact of options 3,124,705 2,883,365

Number of ordinary shares issued for diluted and EPRA net assets per

share 182,502,063 182,261,263

---------------------------------------------------------------------- -------------- --------------------------

Net assets per ordinary share

Basic 61.6p 58.5p

Diluted 60.5p 57.6p

EPRA NTA 61.0p 58.8p

====================================================================== ============== ==========================

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR ZZGZLRRMGZZM

(END) Dow Jones Newswires

September 29, 2022 02:00 ET (06:00 GMT)

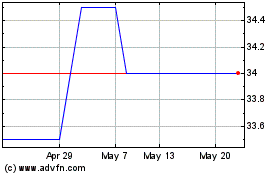

Real Estate Investors (LSE:RLE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Real Estate Investors (LSE:RLE)

Historical Stock Chart

From Nov 2023 to Nov 2024