Regional REIT Limited Appointment of Joint Broker

February 26 2025 - 2:00AM

RNS Regulatory News

RNS Number : 4332Y

Regional REIT Limited

26 February 2025

26 February 2025

Regional

REIT Limited

("Regional REIT", the

"Group" or the

"Company")

Appointment of Joint Broker

Regional REIT is pleased to announce

that Shore Capital has been appointed as Joint Broker and Financial

Adviser to the Company, alongside Peel Hunt, with immediate

effect.

- ENDS -

Enquiries:

|

Regional REIT Limited

|

|

|

Press enquiries through FTI

Consulting

|

|

|

|

|

|

ESR

Europe Private Markets Limited

|

Tel: +44

(0) 203 831 9776

|

|

Investment Adviser to the

Group

|

|

|

Adam Dickinson, Investor Relations,

Regional REIT Limited

|

|

|

|

|

|

ESR

Europe LSPIM Limited

|

Tel: +44

(0) 141 248 4155

|

|

Asset Manager to the

Group

|

|

|

Stephen Inglis

|

|

|

|

|

|

Shore Capital

|

Tel: +44

(0) 20 7408 4050

|

|

Joint Broker and Financial

Adviser

|

|

|

Gillian Martin, Daphne Zhang

(Corporate Advisory)

|

|

|

Ben Canning / Henry Willcocks

(Corporate Broking)

|

|

|

|

|

|

Peel Hunt

|

Tel: +44

(0)20 7418 8900

|

|

Joint Broker and Financial

Adviser

|

|

|

Capel Irwin, Henry Nicholls

(Corporate Advisory)

|

|

|

|

|

|

FTI

Consulting

|

Tel: +44

(0)20 3727 1000

|

|

Financial Communications

|

RegionalREIT@fticonsulting.com

|

|

Dido Laurimore, Giles

Barrie

|

|

About Regional REIT

Regional REIT Limited ("Regional

REIT" or the "Company") and its subsidiaries (the "Group") is

a United Kingdom ("UK") based real estate investment

trust that launched in November 2015. It is managed by ESR

Europe LSPIM Limited, the Asset Manager, and ESR Europe Private

Markets Limited, the Investment Adviser.

Regional REIT's commercial property

portfolio is comprised wholly of income

producing UK assets, predominantly offices located in the

regional centres outside of the M25 motorway. The portfolio is

geographically diversified, with 126 properties, 1,271 units and

780 tenants as at 31 December 2024, with a valuation of

c.£622.5m.

Regional REIT pursues its investment

objective by investing in, actively managing and disposing of

regional Core and Core Plus Property assets. It aims to deliver an

attractive total return to its Shareholders, targeting greater than

10% per annum, with a strong focus on income supported by

additional capital growth prospects.

The Company's shares were admitted

to the Official List of the UK's Financial Conduct

Authority and to trading on the London Stock Exchange on 6 November

2015. For more information, please visit the Group's website

at www.regionalreit.com.

LEI: 549300D8G4NKLRIKBX73

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

APPFLFIDFAIEFIE

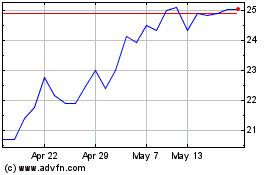

Regional Reit (LSE:RGL)

Historical Stock Chart

From Feb 2025 to Mar 2025

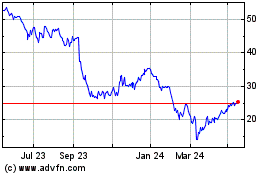

Regional Reit (LSE:RGL)

Historical Stock Chart

From Mar 2024 to Mar 2025