TIDMREC

RNS Number : 4463C

Record PLC

16 October 2015

16 OCTOBER 2015

RECORD PLC

SECOND QUARTER TRADING UPDATE

Record plc ("Record" or the "Company"), the specialist currency

manager, announces today that the Group's assets under management

equivalents ("AUME") as at 30(th) September 2015 totalled $53.3

billion (30(th) June 2015: $56.6 billion).

AUME expressed in Sterling as at 30(th) September 2015 totalled

GBP35.2 billion (30(th) June 2015: GBP36.0 billion).

1. AUME composition

AUME expressed in US Dollars decreased by 6% between 30(th) June

2015 and 30(th) September 2015 and decreased by 2% when expressed

in Sterling. The composition of AUME by product was as follows:

AUME $ billion

------------------------------------------------------

30(th) September 30(th) June

2015 2015

--------------------- ----------------- ------------

Dynamic Hedging 8.7 9.3

Passive Hedging 42.1 42.1

Currency for Return 2.3 4.9

--------------------- ----------------- ------------

Cash & Futures 0.2 0.3

--------------------- ----------------- ------------

Total 53.3 56.6

--------------------- ----------------- ------------

2. AUME Movement

Net client AUME flows in the three months to 30(th) September

2015 by product were as follows:

Net client AUME flows - $ billion

--------------------------------------------------------

3 months to 3 months to

30(th) September 30(th) June

2015 2015

--------------------- ------------------ -------------

Dynamic Hedging 0.1 -

Passive Hedging 1.3 0.5

Currency for Return (2.5) 0.1

--------------------- ------------------ -------------

Cash & Futures (0.1) -

--------------------- ------------------ -------------

Total (1.2) 0.6

--------------------- ------------------ -------------

Record had 54 clients at 30(th) September 2015 (30(th) June

2015: 53 clients), which includes three of the six clients whose

mandate was signed in the previous quarter, with the remaining

three clients expected to fund in the current quarter.

The factors other than client flows, which have had an aggregate

impact on AUME during the quarter of -$2.1 billion, were as

follows:

(i) Exchange rate movements: -$2.1bn Exchange rate movements

during the period affect the conversion of non-US Dollar mandate

sizes into US Dollar AUME.

(ii) Movements in global stock and other markets: $0.0bn

Substantially all the Passive and Dynamic Hedging, and some of the

Currency for Return mandates, are linked to stock and other market

levels. Consequently AUME may be affected by movements in these

markets.

3. Investment performance

Our Dynamic Hedging programmes performed as expected for US

clients during the quarter, generating positive returns as the

Dollar strengthened against the weighted basket of currencies in

the programmes. The largest gains came from hedges on the Canadian

and Australian Dollars, as hedge ratios for these currencies

remained high throughout the period. There were some partially

offsetting negative returns from hedging the Euro and Japanese Yen;

however, losses were contained as hedge ratios remained low over

the quarter.

For UK-based Dynamic Hedging clients the programmes also

performed as expected, controlling hedging losses in response to

Sterling weakening against the weighted basket of currencies in the

programmes. Negative returns came from hedging the Euro, US Dollar

and Japanese Yen; however, hedge ratios for all three currencies

fell over the quarter, thus limiting losses.

Investment performance in Record's Active Forward Rate Bias

(FRB) product was negative during the three months to 30(th)

September 2015, and for an ungeared portfolio equated to a return

of -0.46% (three months to 30(th) June 2015: return of

-0.46%). This compares to a -2.80% return in the quarter for the

FTSE Currency FRB10 index (excess return in Sterling). This

variance was mainly the result of differences in the allocations of

these two strategies to some of the weaker performing currencies in

the quarter (mostly Australian Dollar). The FTSE FRB10 Index Fund

continued to track the index closely, on a 1.8x--geared basis.

Record's Emerging Market product investment performance was

negative during the quarter and for an un-geared portfolio equated

to a quarterly return of -6.53% (three months to 30(th) June 2015:

return of -0.70%). This negative performance was mainly

attributable to losses from the Brazilian Real, South African Rand

and Turkish Lira. Annualised performance since inception (30(th)

November 2009) for an un-geared portfolio was +0.26% p.a.

Investment performance in the Multi-Strategy product that uses

the Active FRB strategy was negative during the quarter as gains

from the Value and Momentum strategies were overcome by negative

returns from the Active FRB and Emerging Market components. For an

un-geared portfolio, the return was -0.87% over the quarter (three

months to 30(th) June 2015: return of -0.81%). Annualised

performance since inception (31(st) July 2012) for an un-geared

portfolio is +1.00% p.a.

A version of the Multi-Strategy product which started earlier

this year and uses the FTSE Currency FRB10 index strategy instead

of the Active FRB product, produced negative returns of -0.95% for

an ungeared portfolio during the three months to 30(th) September

2015 (three months to 30(th) June 2015: return of -1.14%).

4. AVERAGE FEE RATES AND PERFORMANCE FEES

During the quarter to 30(th) September 2015, fee rates for all

products remained broadly unchanged from the previous quarter. No

performance fees were earned in the quarter.

5. CHIEF EXECUTIVE'S COMMENT

Chief Executive James Wood-Collins, commenting on business

development, said:

"This quarter continued to demonstrate heightened currency

market volatility, and ongoing debate on the prospects for

divergent monetary policy. These factors have served to maintain

the current high levels of interest shown in currency hedging and

return-seeking products by prospective clients, and to reinforce

the strength in diversity of our products.

"The outflow of $2.8 billion announced on 25(th) August from a

standalone tactical bespoke mandate was a consequence of currency

market movements. Whilst it will detract from revenue, our core

return-seeking strategies' performance and our ability to continue

to build the hedging business remain unaffected.

"It was pleasing to announce, on 29(th) September, Record's

selection for a dynamic hedging mandate, which has now commenced

since quarter-end. As already announced on 1(st) October, just post

quarter end, we were notified by a UK dynamic hedging client of its

intention to terminate the mandate, likely by the end of the

current financial year.

"We continue to make progress in engaging with current and

potential clients across a broad range of currency issues and

geographies and we are hopeful that further progress can be made in

the current financial year."

Record will announce its half year results on 24(th) November

2015 and its third quarter trading update on 22(nd) January

2016.

For further information, please contact:

Record plc Tel: +44 (0) 1753 852 222

James Wood-Collins, Chief Executive Officer

Steve Cullen, Chief Finance Officer

MHP Tel: +44 (0) 20 3128 8100

Nick Denton record@mhpc.com

Ollie Hoare

Jennifer Iveson

Notes to Editors

Record plc

Record is a specialist currency manager and provider of currency

hedging services for institutional clients. Founded in 1983, Record

has established a market leading position as a currency manager.

Specifically, the Group has a leading position in managing Currency

Hedging and Currency for Return for institutional clients.

The Group has three principal product lines:

- Dynamic Hedging, where Record seeks to eliminate the impact of

currency movements on elements of clients' investment portfolios

that are denominated in foreign currencies when these movements are

expected to result in an economic loss to the client, but not to do

so when they are expected to result in an economic gain;

- Passive Hedging, where Record seeks to eliminate fully or

partially the economic impact of currency movements on elements of

clients' investment portfolios that are denominated in foreign

currencies; and

- Currency for Return, in which Record enters into currency

contracts for clients with the objective of generating positive

returns.

Record (LSE: REC) was admitted to trading on the London Stock

Exchange on 3rd December 2007.

This announcement includes information with respect to Record's

financial condition, its results of operations and business,

strategy, plans and objectives. All statements in this document,

other than statements of historical fact, including words such as

"anticipates", "expects", "intends", "plans", "believes", "seeks",

"estimates", "may", "will", "continue", "project" and similar

expressions, are forward-looking statements.

(MORE TO FOLLOW) Dow Jones Newswires

October 16, 2015 02:00 ET (06:00 GMT)

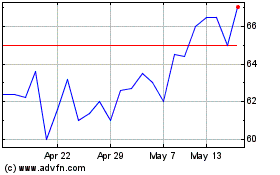

Record (LSE:REC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Record (LSE:REC)

Historical Stock Chart

From Jul 2023 to Jul 2024