TIDMPYX

RNS Number : 1184S

PYX Resources Limited

02 November 2023

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

PYX Resources Limited / EPIC: PYX / Market: Standard / Sector:

Mining

2 November 2023

Pyx Resources Limited

("PYX" or "the Company ")

Q3 2023 Operational Update

61% Increase in Premium Zircon Production and 88% Increase in

Sales

Q3 HIGHLIGHTS

-- Premium Zircon production increased by 61% to 4.0kt (Q3 2022: 2.5kt), its highest to date

-- Sales of Premium Zircon increased 88% in Q3 2023 to 4.2kt (Q3

2022: 2.3kt) driven by demand from China and India

-- Award of the export licence announced on the 17(th) August

2023. The Company had stockpiled 8.2kt of Titanium Dioxide.

-- Successful renewal of 10-year mining and exploration licence

for the Tisma Mineral Sands Project

-- Awarded with the COVID-19 Prevention and Management and Zero

Accident Award 2023 from the Government authorities in

Kalimantan

PYX Resources Ltd (NSX: PYX | LSE: PYX), the world's third

largest publicly listed zircon producer by zircon resources, [1] is

pleased to announce an Operational Update for the three months

ended 30 September 2023 ("Q3 2023").

SUMMARY

Q3 '23 Q3'22 Var YTD'23 YTD'22 Var

Zircon Produced 4.0kt 2.5kt 61% 9.7kt 6.8kt 43%

------- ------ ----- ------- ------- -----

Zircon Sales 4.2kt 2.3kt 88% 9.4kt 6.1kt 54%

------- ------ ----- ------- ------- -----

Value per tonne (USD) 2,116 2,606 -19% 2,012 2,697 -25%

------- ------ ----- ------- ------- -----

Total Mineral Sands Produced 4.9kt 3.5kt 39% 11.7kt 12.7kt -8%

------- ------ ----- ------- ------- -----

Total Mineral Sands Sold 4.2kt 2.5kt 70% 9.4kt 6.4kt 48%

------- ------ ----- ------- ------- -----

The Company has reported a significant increase in Premium

Zircon production of 4,021t in Q3 2023, which is equivalent to a

yearly production rate above 16kt and in line with the PYX's

five-year plan.

Premium Zircon sales experienced robust growth during the period

with an increase of 88% to a sales volume of 4.2kt, mainly to China

and India as the Western economy slows. The Company believes this

growth is a result of the Company's customer-centric approach,

strong relationships with clients, and the ability to deliver

high-quality products that meet their specific needs.

In terms of pricing, Premium Zircon has experienced a remarkable

upward trend. Starting from January 2021 at US$1,400/t,

international pricing (as reported by Bloomberg) steadily increased

throughout the year, reaching US$1,800/t in H2 2021 and US$2,000/t

by January 2022.

This positive trajectory continued into Q2 2023, with the price

reaching US$2,100/t. Since Q3 2022, the price has remained stable

at US$2,200/t, a 64% increase on 2021 prices, defying the

volatility of the market. This exceptional outcome underscores the

imbalanced supply and demand dynamics, and PYX's ability to

capitalize on this favourable market situation.

Commenting on the Company's achievements in Q3 2023, PYX's

Chairman and Chief Executive Officer Oliver Hasler, said:

"I am delighted with our achievements in Q3 2023. The Company

experienced substantial growth in Premium Zircon sales, with a 54%

increase, and a production increase of 43% year-to-date. Our

diversified global client base has allowed us to manage and

minimise risk. This coupled with the quality of our Premium Zircon

has resulted in consistent growth in sales whilst our exceptional

team on site have been instrumental in ensuring maximum

efficiency.

"I am particularly proud of the two awards given to the Company

by the Government authorities in Kalimantan - the Award for the

Prevention and Management of COVID-19 in the Workplace and Zero

Accident Award 2023 - we are passionate about our people and the

safety of our team."

"As we enter the second half of the year, we are optimistic

about our strategic plan and the continued rise of Mineral Sands

prices. We remain well positioned to deliver on our goals and

benefit from the industry's strength."

Licences

The renewal of a 10-year Izin Usaha Pertambangan Operasi

Produksi (IUP-OP, Mining Operation and Production Licence)

exploration and mining licence agreement for the Tisma project,

which PYX has a contractual interest in, represents a significant

milestone for the Company.

The IUP-OP license and newly issued RKAB Operasi Produksi Tahun

2023 (Working Plan and Budget) authorises the Company to extract,

produce, and export 24kt of zircon, 20kt of rutile and 50kt of

ilmenite, ensuring the extraction and production of other

by-products, such as SiO(2) .

This renewal, and access to this licence, solidifies PYX's

position as a leading player in the mineral resources sector and

opens up new opportunities for growth and expansion. The Directors

believe the Tisma project holds immense potential, and this

long-term licence agreement should provide stability and confidence

to maximise its value over the coming years.

Additionally, the Indonesian authorities have outlined the

legislation for Mineral Sands companies to export Ilmenite and

Rutile to international markets, following a change in Indonesian

law. The Ministry of Trade of the Republic of Indonesia, following

the recommendation of the Ministry of Energy and Natural Resources,

has changed the category of Titanium dioxide, with Ilmenite and

Rutile receiving the same classification as Zircon, as a Non-Metal

Commodity.

The new law, issued by the Ministry of Trade under regulation

No. 13, allows for the export of Ilmenite and Rutile as Non-Metal

with a minimum grade of TiO(2) >= 45% for Ilmenite and TiO(2)

>= 90% for Rutile. On 17(th) August 2023 the Company announced

the award of the export licence for Rutile and Ilmenite. PYX

started producing rutile in January 2022 and ilmenite in June 2022,

and by the end of June 2023 it had stockpiled 8.2kt.

Awards

Also, during the period, the Company was delighted to be awarded

with the COVID-19 Prevention and Management and Zero Accident Award

2023 from the Indonesian Ministry of Manpower.

([1]) According to publicly available information as of 30 June

2023

***S***

For more information:

PYX Resources Limited T: +61 2 8823 3132

E: ir@pyxresources.com

WH Ireland Limited (Broker) T: +44 (0)20 7220 1666

Harry Ansell / Katy Mitchell

/ Darshan Patel

------------------------------

St Brides Partners Ltd (Financial E: pyx@stbridespartners.co.uk

PR)

Ana Ribeiro / Isabel de Salis

/ Isabelle Morris

------------------------------

This announcement is authorised for release by Oliver B. Hasler,

Chairman and Chief Executive

Officer.

About PYX Resources

PYX Resources Limited (NSX: PYX | LSE: PYX) is a producer of

premium zircon dual listed on the

National Stock Exchange of Australia and on the Main Market of

the London Stock Exchange. PYX's

key deposits, Mandiri and Tisma, are large-scale, near-surface

open pit deposits both located in the

alluvium-rich region of Central Kalimantan, Indonesia. PYX,

whose Mandiri deposit has been in

production since 2015, is the 3(rd) largest publicly traded

producing mineral sands company by zircon

resources globally. Determined to mine responsibly and invest in

the wider communities where we

operate, PYX is committed to fully developing its Mandiri and

Tisma deposits, with the vision to

consolidate the mineral sands resources in Kalimantan and

explore and acquire mineral sands assets

in Asia and beyond.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This Announcement contains forward-looking statements and

forward-looking information within

the meaning of applicable Australian and UK securities laws,

which are based on expectations,

estimates and projections as of the date of this

Announcement.

This forward-looking information includes, or may be based upon,

without limitation, estimates,

forecasts and statements as to management's expectations with

respect to, among other things, the

timing and amount of funding required to execute the Company's

exploration, development and

business plans, capital and exploration expenditures, the effect

on the Company of any changes to

existing legislation or policy, government regulation of mining

operations, the length of time

required to obtain permits, certifications and approvals, the

success of exploration, development

and mining activities, the geology of the Company's properties,

environmental risks, the availability

of labour, the focus of the Company in the future, demand and

market outlook for precious metals

and the prices thereof, progress in development of mineral

properties, the Company's ability to raise

funding privately or on a public market in the future, the

Company's future growth, results of

operations, performance, and business prospects and

opportunities. Wherever possible, words such

as "anticipate", "believe", "expect", "intend", "may" and

similar expressions have been used to

identify such forward-looking information.

Forward-looking information is based on the opinions and

estimates of management at the date the

information is given, and on information available to management

at such time. Forward looking

information involves significant risks, uncertainties,

assumptions, and other factors that could cause actual results,

performance, or achievements to differ materially from the results

discussed or

implied in the forward-looking information. These factors,

including, but not limited to, fluctuations in currency markets,

fluctuations in commodity prices, the ability of the Company to

access sufficient capital on favourable terms or at all, changes in

national and local government legislation, taxation,

controls, regulations, political or economic developments in

Indonesia and Australia or other

countries in which the Company does business or may carry on

business in the future, operational or technical difficulties in

connection with exploration or development activities, employee

relations, the speculative nature of mineral exploration and

development, obtaining necessary licenses and permits, diminishing

quantities and grades of mineral reserves, contests over title

to

properties, especially title to undeveloped properties, the

inherent risks involved in the exploration and development of

mineral properties, the uncertainties involved in interpreting

drill results and

other geological data, environmental hazards, industrial

accidents, unusual or unexpected

formations, pressures, cave-ins and flooding, limitations of

insurance coverage and the possibility of

project cost overruns or unanticipated costs and expenses, and

should be considered carefully. Many

of these uncertainties and contingencies can affect the

Company's actual results and could cause

actual results to differ materially from those expressed or

implied in any forward-looking statements made by, or on behalf of,

the Company. Prospective investors should not place undue reliance

on

any forward-looking information.

Although the forward-looking information contained in this

Announcement is based upon what

management believes, or believed at the time, to be reasonable

assumptions, the Company cannot assure prospective purchasers that

actual results will be consistent with such forward-looking

information, as there may be other factors that cause results

not to be as anticipated, estimated or

intended, and neither the Company nor any other person assumes

responsibility for the accuracy and completeness of any such

forward-looking information. The Company does not undertake,

and

assumes no obligation, to update or revise any such

forward-looking statements or forward-looking information contained

herein to reflect new events or circumstances, except as may be

required by

law.

No stock exchange, regulation services provider, securities

commission or other regulatory authority

has approved or disapproved the information contained in this

Announcement.

Compliance Statement

The Mandiri mineral sands deposit hosts a 6 Mt Inferred JORC

Resource of zircon. The Company

originally announced this resource in its Prospectus released on

20 February 2020 and confirms that it is not aware of any new

information or data that materially affects the information

included in the

Prospectus. All material assumptions and technical parameters

disclosed in the Prospectus that

underpin the estimates continue to apply and have not materially

changed.

The Tisma mineral sands deposit hosts a 4.5 Mt Inferred JORC

Resource of zircon. The Company

originally announced this resource in its Announcement "PYX

Resources Limited Agrees to Acquire

Tisma Development (HK) Limited, a World-Class, Fully Licensed

Mineral Sands Deposit" on NSX on

13 January 2021 and confirms that it is not aware of any new

information or data that materially

affects the information included in the Announcement. All

material assumptions and technical

parameters disclosed in the Announcement that underpin the

estimates continue to apply and have

not materially changed.

Together the Mandiri and Tisma mineral sand deposits total 10.5

Mt of contained zircon within a

total of 263.5 Mt of heavy mineral sands.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDLFLLBXFLLFBZ

(END) Dow Jones Newswires

November 02, 2023 03:00 ET (07:00 GMT)

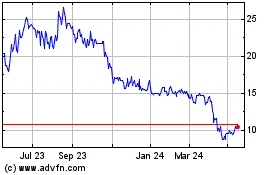

Pyx Resources (LSE:PYX)

Historical Stock Chart

From Nov 2024 to Dec 2024

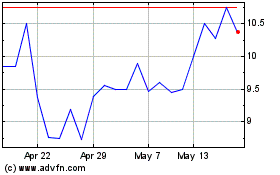

Pyx Resources (LSE:PYX)

Historical Stock Chart

From Dec 2023 to Dec 2024