McCormick Profit Climbs 11%

June 30 2016 - 8:00AM

Dow Jones News

McCormick & Co., Inc. said profit climbed 11% in the latest

period, as acquisitions and cost-cutting helped boost the

spicemaker's sales.

Chief Executive Lawrence E. Kurzius said the quarter's results

also reflected strong performance in its consumer segment.

"Underpinning our growth is the rise in consumer demand for

healthy flavor and high quality products, and we are meeting this

demand with an expanding portfolio of on-trend products," Mr.

Kurzius said.

For the period ended May 31, consumer segment sales rose 8.3% on

a constant-currency basis, primarily on higher volumes and product

mix, pricing and the impact of acquisitions. During the quarter,

the company acquired Gourmet Garden, a maker of packaged herbs and

spices.

Sales in the industrial segment, on a constant-currency basis,

climbed 2.7%, mainly from higher volume and product mix. Including

currency headwinds, growth in consumer rose by 7% while sales in

the industrial segment fell by 0.7%.

Over all, McCormick posted a profit of $93.8 million, or 73

cents a share, up from $84.3 million, or 65 cents a share, in the

year-earlier quarter. Excluding certain items, the company earned

75 cents. Analysts had expected 74 cents a share, according to a

Thomson Reuters poll.

Sales increased 3.8% to $1.06 billion. The company said that on

a constant-currency basis, sales grew by 6%. Analysts expected

$1.06 billion in revenue.

McCormick in April walked away from making an offer for British

food manufacturer Premier Foods PLC, which rejected a sweetened

takeover bid by McCormick that was worth about $763 million. The

Maryland-based company said then that, having completed due

diligence on Premier Foods, it wouldn't be able to propose an offer

price recommended by Premier Foods and be able to deliver

appropriate returns for McCormick shareholders.

McCormick plans to reduce its costs by $400 million over the

next four years. Mr. Kurzius said Tuesday the company increased its

cost-cutting goal this year to a range of $100 million to $110

million, compared with a prior estimate of $95 million.

McCormick lowered its projected 2016 earnings per share to a

range of $3.63 to $3.70 from a prior range of $3.65 to $3.72 to

reflect one-time charges, but the company backed its adjusted range

of $3.68 to $3.75.

Shares, which have risen 20% so far this year, were inactive in

premarket trading.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

June 30, 2016 07:45 ET (11:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

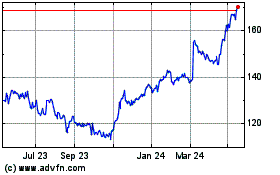

Premier Foods (LSE:PFD)

Historical Stock Chart

From May 2024 to Jun 2024

Premier Foods (LSE:PFD)

Historical Stock Chart

From Jun 2023 to Jun 2024